A significant proportion of major infrastructure projects suffer from excessive financial overruns. Typically, such project financial failures arise as project budgets are not estimated appropriately at the project preparatory stage. Using appropriate project financial projections could avoid or mitigate financial failures by ensuring that best practice financial risk analysis practices are adopted and pursued. Project financial policy frameworks, practices, and procedures should promote accuracy and confidence in projections for infrastructure projects. This will ensure that the initial project design and associated budget allocation recognizes pertinent construction, implementation, and policy risks facing projects, and the complete project delivery. To ensure effective project financial policy certainty frameworks and their implementation, this policy brief identifies the significant challenges within current financial risk analysis practices and procedures when allocating a project budget. The policy brief recommends major changes in the structures, strategies, systems, and behaviors of governmental risk analysis and risk management policies. These changes will achieve project financial certainty via financial risk analysis for robust infrastructure investments and enhance the fundamental criteria of the T20 program.

Challenge

A significant proportion of major infrastructure projects suffer from excessive financial overruns. Typically, such project financial failures arise from a failure to establish a proper and realistic project budget at the project preparatory stage. To avoid project financial failures, governments should develop proper financial risk analysis policies, procedures, and practices.

Project financial failures create project delivery delays (or cancellations), and parties face major legal challenges to achieve financial redressal for the disadvantaged parties. Delays and the related legal costs add to the financial burden of project delivery. Furthermore, should these complications compound, the project may not be delivered, delivery could be inconsistent with the fundamental project objectives, and these could lead to time and cost overruns and impact quality. Depending on the weaknesses in risk frameworks, vital projects may not receive approval because of a lack of availability of investment finance.

Aligning and enhancing the availability of finance for projects facilitates decisionmaking to approve projects. It also secures improvements and advanced employment opportunities created by the enhanced transfer of knowledge and learning. Improvements in financial risk analysis policies will also create the need for continual advanced education and training at the MSc level (and above) within indigent communities. Such educational attainment will create new career opportunities for the local population.

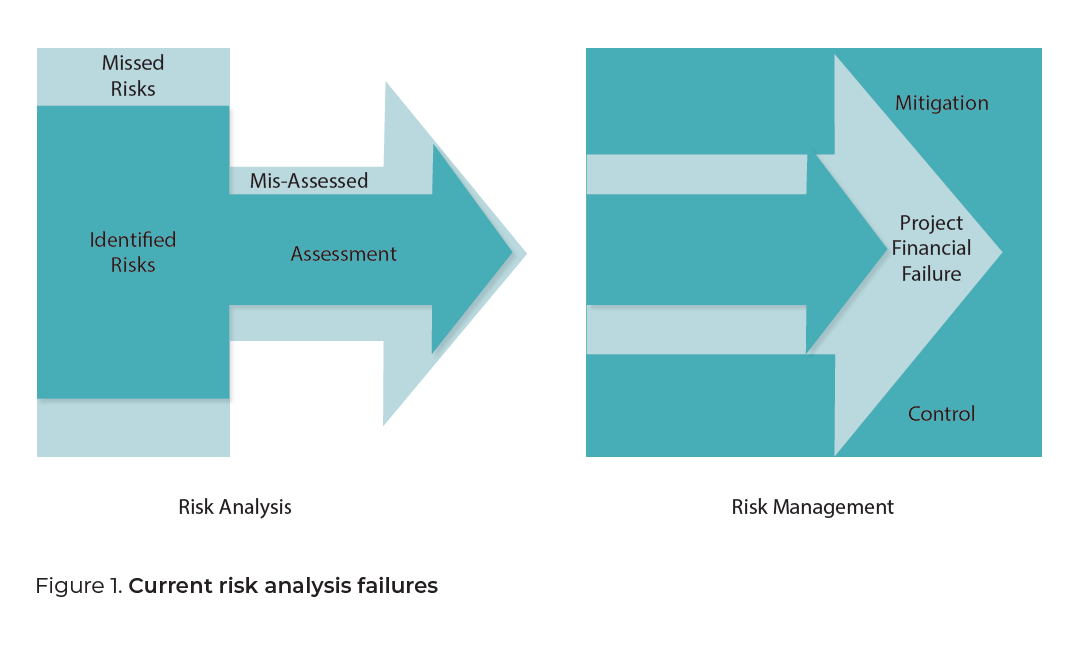

This challenge is manifest in inadequate financial budgets for major infrastructure projects.[1] These initial project budgets fail to reflect the true risk register (a comprehensive list of events that may affect the attainment of satisfactory project delivery). Therefore, they do not reflect the true costs of full project implementation. These are failures in risk analyses, both in the identification and assessment of these risks.

Figure 1 below illustrates the risk analysis failures that inexorably lead to project financial failure. The challenge is to amend governmental policies, practices, and procedures to avoid such failures in the future.

The risk register frequently fails to identify the full range of associated and relevant risks, and those that are identified suffer from the inadequate assessment of the quantum and probability of the risks (Eaton 2008a). It is, therefore, imperative to improve financial risk analyses of project budgets. Ascertaining risks is typically undertaken by external professionals, who lack local knowledge, and the relocation of practices and procedures to a different environment is typically misunderstood (Eaton et al. 2007). Utilizing locally trained professionals will enhance the social and cultural affinity of project proposals.

If a risk is not identified and assessed (i.e., a risk analysis), it cannot be risk-managed, as, by definition, it is unknown. Risk analysis methods often do not clarify whether the risk is fixed or variable. Political approval of a project is a fixed risk, while ground conditions and bad weather are examples of variable risks, and depending on the source, the risks can have a differential impact. The quantum of variable risks is more difficult to assess and these risks are frequently assessed as though they are fixed risks. The inadequate identification or assessment of any component will cause a potential project to fail because of the financial risks.

Another issue with risk management is the failure of risk analyses to recognize that each risk may affect stakeholders in different ways. Current practices do not provide risk registers for specific stakeholders. The challenge is, therefore, to ensure that risk analyses are undertaken so that effective and efficient risk management can be achieved. By using methods that register all the stakeholders involved, project budgets will be more certain, and robust infrastructure investments can be assured.

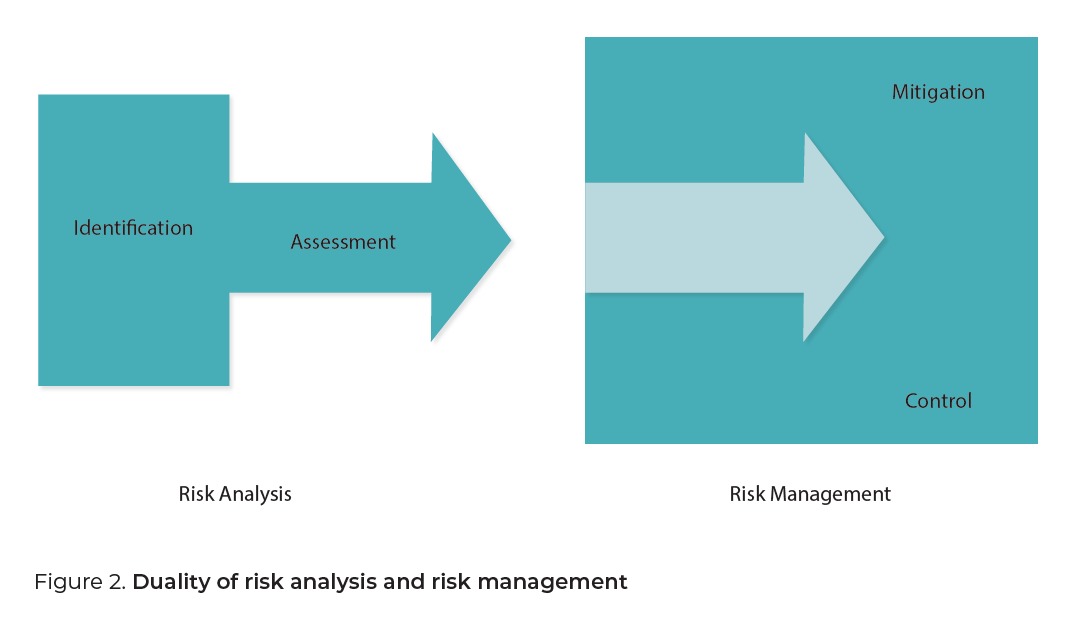

Figure 2 illustrates the changes in risk analyses from the proposed amendments to governmental policies, practices, and procedures. Risk identification and assessment mirror risk management. However, effective risk management is impossible if the risk analysis is incomplete or fails to deal comprehensively with each of the four components below (Akbiyikli, Dikmen, and Eaton 2011a).

Project risk analyses consist of four inter-related components:

- Identification of risks or potential events (internal or external) that may adversely affect project delivery if they occur;

- Quantum assessment of the impact of these risks;

- Probability of occurrence assessment of each risk;4. I dentification of affected stakeholders for each risk.

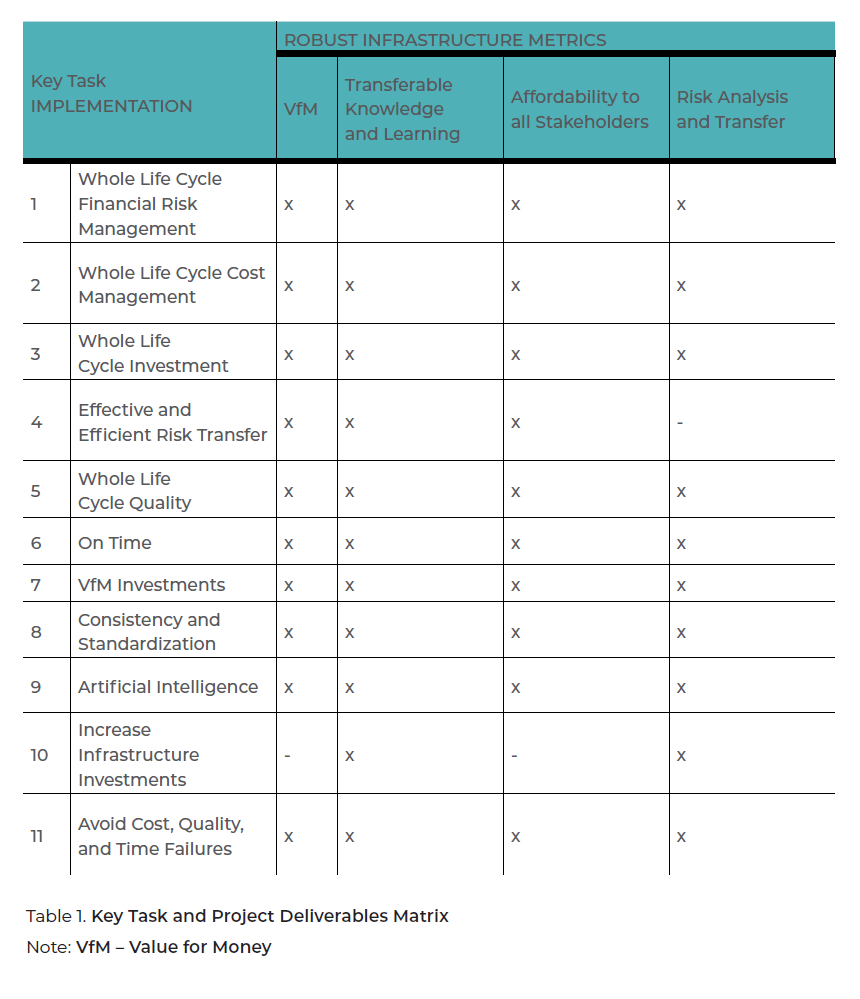

The proposed governmental policy amendments will be evaluated by metrics aligned with robust infrastructure investments (Sundaraj and Eaton 2011):

- The investment provides value for money (VfM): The true investment cost (based on resolving the above-stated issues) provides adequate VfM.

- The project provides transferability of knowledge and learning: Project knowledge, learning, and best practices can be captured and disseminated to other projects and stakeholders.

- The investment provides affordability for all stakeholders: The true investment cost is available without causing financial distress to any stakeholder.

- The project incorporates appropriate risk analysis and transfer: Risk transfer (and hence financial risk liability) should be to the party best able to manage each risk (total transfer to or avoidance by any stakeholder does not achieve VfM).

This demonstrates that a holistic and fundamentally enhanced financial risk analysis and management policy that combines all four of the inter-related risk components and is assessed based on the four robust infrastructure investment metrics is required. As current risk analyses and risk management practices are heavily focused on economic and technology factors, the risk analysis policy change should be based on the broader analysis to include social, cultural, legal, economic, environmental, political, and technological factors (SCLEEPT; Eaton et al. 2006). This will ensure that all the appropriate factors and the inter-connectedness of these SCLEEPT factors are included. The priority is, therefore, to achieve project financial certainty through improved financial analyses for robust infrastructure investments.

Proposal

Project financial certainty (defined as the initial project budget allocation that is sufficient for project completion) can be achieved by applying the proposed financial risk analysis techniques from the inception of the project. This will create an effective and efficient allocation of the necessary resources to achieve successful project completion.

Key objective: Achieving project financial certainty via improved financial analysis for robust infrastructure investment.

Key tasks:

- Whole life cycle financial risk analysis

- Whole life cycle cost management

- Whole life cycle financial affordability for investments

- An effective and efficient risk transfer

- Whole life cycle quality targets

- Timely project delivery

- Value for money infrastructure investments

- Systems consistency and standardization

- Implementation of actionable and artificial intelligence

- Increases in infrastructure investments

- Avoiding cost, quality, and time failures

1. Whole life cycle financial risk analysis: A process that effectively provides exogenous and endogenous risk analysis and management (modified from Eaton 1994). The whole life cycle for a project runs from the project idea through development, construction, operation, and remediation and only finishes with a post-project review. The whole life cycle must be considered as an operation, and remediation costs may be many multiples of the basic construction costs.[2] Small investments in increased capital costs can be highly beneficial in reducing overall operation and remediation costs.

Training and procedures are required so that the personnel undertaking the risk analysis and risk management record the potential deficiencies of each stage. They can also make explicit records of the presumptions and assumptions of the processes being undertaken.

2. Whole life cycle cost management: Robust infrastructure investment requires that the whole life cycle of the investment project is considered in the initial evaluation. Poor decision making at an early stage can have disastrous consequences in the long run. Cost-in-use is a critical component of establishing project financial certainty (Akbiyikli and Eaton 2006).

3. Whole life cycle financial affordability for investments: All stakeholders need to be assured that their costs associated with the project will remain affordable over the whole life cycle (Akbiyikli, Eaton, and Dikmen 2010). If a stakeholder is unable to meet the necessary financial commitments, then project viability is jeopardized. Thus, risk analyses should be conducted separately for each stakeholder.[3]

4. Effective and efficient risk transfer: A fundamental principle of risk management is that every risk should be owned by the stakeholder who is best able to manage that risk. Frequently, contracts are established whereby risks are transferred to a stakeholder who cannot manage the risk. In such situations, the risk owner can only accept the risk by increasing their price for participating in the project. Infrastructure contracts, therefore, need to ensure that appropriate risk transfer is achieved[4] (Eaton and O’Connor 2002b; Eaton 2008b; Akbiyikli, Dikmen, and Eaton 2011b)[5].

5. Whole life cycle quality targets: Robust infrastructure investment considers the whole life cycle of the investment project in the initial evaluation (Eaton and Akbiyikli 2005). Poor decision-making in relation to selecting the appropriate level of quality at an early stage of the project can have disastrous consequences in the long run. Costin-use is a critical component of establishing project financial certainty (Akbiyikli and Eaton 2011).

6. Achieving timely project delivery: Authorizing an appropriate initial infrastructure project budget will avoid delays associated with applying for and receiving the authorization for additional project funds. It will also permit project managers to focus on project delivery rather than attempting to control project finance pressures.

7. Achieving value for money infrastructure investments: Finance is a scarce resource, and it is a governmental priority that investments should offer good value (Eaton and O’Connor 2002a; Eaton et al. 2006, 2007). VfM project opportunities will then encourage private investors to provide funds for projects, subject to resolving investment deterrents as identified below.

8. Achieving systems consistency and standardization: Systemic changes and standardization of procedures and practices should occur at a national and governmental level. This includes, for example, increased openness, clarity and simplification of the rules, clear investment strategies, improved investment security, improved risk analyses, and relevant risk transfers. This will improve project financial certainty and encourage private investors to engage with the government on future projects. Such consistency and standardization will also encourage additional developers and contractors to engage with governmental activities, increasing the bidding competition. Appropriate risk transfer will also encourage additional developers and contractors as their overall financial exposure will be reduced to acceptable and practical levels.

9. Achieving increases in infrastructure investments: Infrastructure investment opportunities can be enhanced by improvements in the development of a country’s systems, structures, strategies, and behaviors. The standardization of practices will enhance the availability of external funds associated with individual or institutional investors. The lack of standardization of practices is detrimental to investment by local and private institutions. A lack of certainty in policies and procedures creates unnecessary “hesitation of fund owners.”

Infrastructure bottlenecks can be addressed by training additional qualified professionals. This can be achieved by applying global standards that establish vocational competency standardization—for example, the Turkish government’s INTES program.

10. Achieving the implementation of actionable and artificial intelligence: After regenerating/improving systems consistency and achieving standardization of policies and practices, AI (Artificial Intelligence; El Sawalhi, Eaton, and Rustom 2007, 2008; Dikmen et al. 2009) can be implemented. This could include monitoring data management (Beran et al. 2011), achieving zero defects, simplified processing, and secure data sharing for investors. Implementing actionable intelligent services (Eaton et al. 2002b; Eaton, Dikmen, and Akbiyikli 2018) for simplified actions/processes—such as budget virements, avoiding management inaction, and disabling inappropriate management actions and methods—should also be included.

11. Avoiding cost, quality, and time failures in infrastructure delivery: The improvements and changes illustrated above will enhance the national reputation of being a good potential infrastructure partner. The changes will lead to improved delivery of infrastructure projects with improved project financial certainty. This should avoid project failures and minimize the cost and time for the delivery of projects while enhancing the quality of the projects.

The following risk management tools are recommended for implementing the policy brief recommendations: SCLEEPT factors (Eaton et al. 2006), Monte Carlo Simulations, MERAs (Multiple Estimate Range Analyses), and MaxiMax, MiniMax, MaxiMin, and MiniMin budget estimates to complement the LRRNE (long-run risk-neutral estimate) of current infrastructure investments. [6]

Proposal Summary

The key tasks and the infrastructure deliverables are summarized in the table below.

Relevance to the G20 Task Force 3

The effective and efficient utilization of scarce financial resources is imperative for the improvement of all aspects of human society. Achieving effective and efficient project financial certainty will benefit all capital investments and can be subsequently applied to operational budgets.

This policy brief will mediate in achieving the governmental targets as follows:

- Improvement in the health and longevity of the population

- Establishment of more than 15 years of education

- Improvement in community standards of living

- Timely and measurable impact on sustainability

- Timely and measurable impact on reducing the rate/level of pollution

- Large impact on education and knowledge

- A positive multiplier on real gross national fixed assets that affect income/capita

- Increased involvement/improved role of the private sector

- Improvement in real estate valuation systems

- Improvement in new climate economics

- Improvements or innovations in Infratech systems and standardization

- Implementation of actionable and artificial intelligence

Conclusion

All of the stated key objectives can only be delivered when a holistic financial risk analysis and management practice is implemented. This analysis should cover SCLEEPT factors (Eaton et al. 2006). Current risk analyses and risk management practices are heavily focused on economic and technology factors. Other factors and the inter-connectedness of SCLEEPT factors are largely ignored.

Determining the quantum and probability of (variable) risks can be managed using the implementation of Monte Carlo, MERA, and MaxiMax, MiniMax, MaxiMin, and MiniMin budget estimates to complement the LRRNE of current infrastructure investments. Therefore, to achieve project financial certainty via financial risk analysis, it is necessary to incorporate SCLEEPT factors, computer simulation, MERA, and AI systems into robust risk management processes and procedures.

The deliverables from these proposed changes can form policy guidance and establish practices and procedures for risk analyses. This will lead to effective and efficient financial risk management, ensuring project financial certainty for robust infrastructure investments. Such practices and procedures should be consolidated into postgraduate training packages for construction, property, finance, and investment professionals (Eaton 2002a, 2002b).

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat

References

Akbiyikli, Rıfat, and David Eaton. 2006. “Whole-Life Cycle Costing (WLCC) Framework Proposal for PFI Road Projects.” Symposium on Sustainability and Value Through Construction Procurement, CIB W092, November 29–December 2, 2006. Salford.

Akbiyikli, Rıfat, Seyyit Ümit Dikmen, and David Eaton. 2011a. “Financing Road Projects by Private Finance Initiative: Current Practice in the UK with a Case Study.” Transport 26(2): 208–215. Vilnius, Lithuania. https://doi.org/10.3846/16484142.2011.589426.

Akbiyikli, Rıfat, Seyyit Ümit Dikmen, and David Eaton. 2011b. “Private Finance Initiative (PFI) for Road Projects in the UK: Current Practice with a Case Study.” Traffic and Transportation Journal 23(3): 215–223. PROMET, Zagreb, Croatia. https://doi.org/10.7307/ptt.v23i3.125.

Akbiyikli, Rıfat, and David Eaton. 2011. “A Conceptual Framework for Operation and Maintenance Management in PFI Road Projects in the UK.” Journal of Civil Engineering and Management JCEM Vilnius Lithuania.

Beran, Václav, Petr Dlask, David Eaton, E. Hromalda, and O. Zindulka. 2011. “Mapping of Synchronous Activities through Virtual Management Momentum Simulation.” Construction Innovation. 11(2): 190–211. https://doi.org/10.1108/14714171111124167.

Dikmen, Seyyit Ümit, O. Ates, Rıfat Akbiyikli, and M. Sonmez. 2009. “A Review of Utilization of Soft Computing Methods in Construction Management.” In Managing IT in Construction/Managing Construction for Tomorrow, edited by Attila Dikbas, Esin Ergen, Heyecan Giritli, 703–710. London: CRC Press. https://doi.org/10.1201/9781482266665.

Eaton, David. 1994. “Interpretive and Modelling Problems of Risk and Uncertainty in Bidding Techniques.” In Computing in Civil Engineering, edited by Khalil Khozeimeh, 2038–2045. New York, NY: ASCE.

Eaton, David. 2002a. “Benchmarking.” In Best Value in Construction, edited by John Kelly, Roy Morledge, and Sara J. Wilkinson, 59–76. Oxford, UK: Wiley Blackwell.

Eaton, David. 2002b. “Innovation and Change for Property and Construction.” Post Graduate Masters’ Training Package. EPSRC/University of Salford.

Eaton, David. 2008a. “Creating an Accurate Risk Register Encompassing Lucid Tender Requirements and Its Importance in Construction Competition.” Marcus Evans, Prague.

Eaton, David. 2008b. “Tunnel Vision on Risk Assessment. Going Underground. Journal of Specialist Underground Constructors and Trenchless Technology.

Eaton, David, and Rıfat Akbiyikli. 2005. “Risk Identification and the Impact on PFI/PPP Project Success.” CIB W92 International Symposium on Procurement Systems. Las Vegas, NV: Vol. 1, 271–277.

Eaton, David, and Charmaine O’Connor. 2002a. “PFI/DBFO: Roads to the Future? Do These Schemes Present Value for Money?” The Journal of Structured Finance 7, no. 4 (Winter): 50–67. https://doi.org/10.3905/jsf.2002.320266.

Eaton, David, and Charmaine O’Connor. 2002b. “PFI/DBFO: Roads to the Future? Do PFI/DBFO Schemes Provide Acceptable Risk Transfer?” The Journal of Structured Finance 8, no. 1 (Spring): 53–62. https://doi.org/10.3905/jsf.2002.320273.

Eaton, David, Seyyit Ümit Dikmen, and Rifat Akbiyikli. 2018. “Controlling the Cost of Risk Management by Utilising a Phase Portrait Methodology,” Transport 33(2): 315–321. http://dx.doi.org/10.3846/16484142.2016.1183228.

Eaton, David, et al. 2002. “Using Cognitive Mapping to Assess the Critical Success Factors in Private Finance Initiative Projects.” Jornados de Gestao Cientifica, Portugal.

Eaton, David, Rıfat Akbiyikli, Teresa de Lemos, Louis Gunnigan, Rana Ozen Kutanis, Martin Casensky, Josef Ladra et al. 2006. “Evaluating National Cultural Characteristics to Improve Major Infrastructure Projects.” 5th International Conference on Advanced Engineering (AED 06) June, Prague, Czech Republic.

Eaton, David, Rifat Akbiyikli, Teresa de Lemos, Louis Gunnigan, Rana Ozen Kutanis, Martin Casensky, Josef Ladra et al. 2007. “An Examination of the Suitability of a UK PFI Model within the Czech Republic, the Republic of Ireland, Palestine (Gaza-West Bank) Portugal and Turkey.” Construction Innovation 7(1): 122–142. https://doi.org/10.1108/14714170710721331

El Sawalhi, Nabil, David Eaton, and Rifat Rustom. 2007. “Establishing Relative Weights for Contractor Pre-Qualification Criteria in a Pre-Qualification Evaluation Model.” The 7th International Postgraduate Research Conference, Manchester. http://hdl.handle.net/20.500.12358/26441.

El Sawalhi, Nabil, David Eaton, and Rifat Rustom. 2008. “Forecasting Contractor Performance Using a Neural Network and Genetic Algorithm.” Construction Innovation 8(4): 280–298. https://doi.org/10.1108/14714170810912662.

Morris, Peter W. G., and George H. Hough. 1987. The Anatomy of Major Projects: A Study of the Reality of Project Management. Chichester, UK: John Wiley & Sons Ltd.

Sundaraj, Gerald, and David Eaton. 2011. “The Anticipated Robustness factors in a PFI Project Environment from the Granting Authority’s Perspective.” In Proceedings of the 27th Annual ARCOM Conference, edited by C. Egbu and E. C. W. Lou, 775–784. September 5–7, 2011. Bristol, UK: ARCOM.

Appendix

[1] . For example, the UK HS2 rail project budget has risen from GBP 32B to a reported budget in excess of GBP 100B as of 2020, with extremely limited construction being executed. Completion was initially forecast for 2020 and is now not expected before 2035. See also, Morris and Hough (1987).

[2] . Calder Hall Nuclear Power Plant decommissioning costs (remediation) are estimated as being 100 times the original construction cost. Remediation was not considered when the UK Atomic Energy Agency initially developed the project. This is considered as a significant financial risk analysis failure by the PB authors.

[3] . If a project is operated based on users paying a fee for use, then the operational time scale should be evaluated to ensure that the fee will be affordable for the entire project duration. As an example, in Portugal, the Tagus Toll Bridge fee was fixed by the concession operator. The public felt the toll increases were unacceptable, and a prolonged protest, known as Buzinao, meant that the central government was forced to intervene. The central government negotiated a financial settlement to avoid future toll increases, and this was an unanticipated government cost.

[4] . In a UK PFI (Private Finance Initiative) prison project, the UK government tried to transfer the occupancy risks to the concession owner via contract conditions. All the potential bidders for this project rejected this condition and declined to submit a bid. The UK government had to retender the project, and this caused a delay of 12 months and consequential cost increases to the project budget.

[5] . Terotechnology—the appropriate selection of materials—can have a significant effect on the whole life cycle cost management of a project and will have a significant effect on project financial certainty.

[6] . It is not possible to define and describe these tools further within the word limit of this submission.