The COVID-19 pandemic has brought significant additional challenges to the financing of Sustainable Development Goal (SDG) initiatives by the private financial sector. Investors are likely to require relevant and accurate metrics to ensure that SDG-related financing effectively delivers investors and companies the optimum contribution while minimising the risk of default. An SDG-environmental, social and governance (ESG) taxonomy of SDG-related projects at the company level would bring clarity for investors in evaluating companies’ SDG contributions. The taxonomy should consist of a clear guideline on the operationalisation and prioritisation of SDGs at the organisational level so organisations can optimise their resources to achieve the relevant SDGs indicators and thus leverage companies’ contributions.

Challenge

Achieving the SDGs requires a joint effort from multiple stakeholders, including the private sector, which plays an essential role in ensuring that assets are used for activities that contribute to sustainable development.

The private financial sector is expected to significantly contribute to SDG financing efforts through public-private (blended) SDG programmes or through the financing of private sector initiatives or projects that contribute to achieving the SDGs. These initiatives are broadly related to ESG investments that integrate ESG considerations into investments. The Group of 20 has recognised the role of ESG investment in SDG financing, as reported in several of the 2021 Think 20 (T20) policy briefs (for example, Machado et al., 2021). SDGs have also been formally acknowledged as a framing for the outcomes that are expected to result from ESG investments (PRI, 2020).

Despite the heightened attention to the SDGs in ESG investments, current initiatives and projects are not yet at the rate and scale required to support the achievement of the SDGs in 2030 (UN, 2022). The potential for private SDG financing remains largely unrealised, and this situation has been exacerbated by the COVID-19 pandemic (IMF, 2021). The pandemic has brought additional challenges for ESG investments due to the heightened business uncertainty and additional operational risks for businesses. As a result, ESG investors have become more prudent in allocating investments, which might affect future ESG investments related to attaining the SDGs. To ensure that investments hold both a business case and optimum contribution to the SDGs, investors need relevant and reliable data for investment analysis.

The quality of ESG data related to SDGs has been of concern (Widyawati et al., 2021). The main sources of ESG information are sustainability reports published by companies, which are then subsequently processed by ESG rating agencies or investors’ in-house ESG analysts into numerical data that form the ESG data for financial analysis. However, the heterogeneity of sustainability reporting guidelines as well as the variety of ESG rating frameworks means that there are issues related to the reliability and comparability of ESG data. Consequently, there are also no standardised guidelines on reporting companies’ SDG contributions as they relate to ESG data.

A report on SDG contributions should ideally present the outcomes of companies’ strategic integration of SDGs. Strategic integration implies that a company can optimally utilise its resources, capabilities and networks to contribute to the achievement of the SDGs as well as achieve its commercial goals. However, strategic integration is challenging as companies struggle to translate SDGs targets into organisational-level and operational-level indicators (Bebbington and Unerman, 2020). Reports on a company’s SDGs contributions are often of low quality with a lack of quantitative indicators and targets, as well lack of assessment of the company’s potential and actual contribution to the SDGs (Hummel and Szekely, 2022). Consequently, the reports provide little meaningful data and incentives for ESG investors that would like to link their investment with the achievement of the SDGs.

Proposal

Further work is needed to develop data and metrics to accurately assess private sector SDG contributions. The credibility of ESG investments is closely linked with the availability of high-quality ESG data. ESG data should be accurate and reliable as well as relevant and meaningful to ensure that ESG investments can deliver the financial, societal and/or environmental values expected by the ESG investors. With high-quality ESG data, investors are able to properly identify, monitor and evaluate the impact of their investment. Therefore, high-quality ESG data is crucial for the legitimacy and acceleration of ESG investments, including ESG investment linked to the achievement of SDGs.

Building upon previous 2021 T20 Policy Briefs by Machado et al. (2021) as well as Lopez and Serrate (2021), this policy brief proposes an SDG-ESG taxonomy to clarify and create a formal link between ESG investments and the achievement of the SDG goals that is also recognised by SDG stakeholders, including governments, businesses, investors and non-governmental organisations. An SDG-ESG taxonomy would facilitate the strategic integration of SDGs within business operations to leverage the contribution of the private sector, including the private financing of SDG-related initiatives. An SDG-ESG taxonomy of SDG-related projects at the company level would provide clarity to investors who seek to evaluate companies’ SDG contributions.

As the world starts to recover from the COVID-19 pandemic, there is also a need to align the COVID-19 recovery with long-term SDG outcomes. This includes refocusing public and private investments towards SDGs-related projects. The refocusing needs collaborative efforts from multiple stakeholders involved along with the G20 to serve as key advocates to ensure highly effective coordinated efforts. The G20 provides legitimacy to the refocusing effort, while the Sustainable Finance Working Group (SFWG) of the G20 Finance Track Workstream led by the United Nations Development Programme (UNDP) could be a discussion platform between major public and private financing actors in developing an ESG-SDGs taxonomy.

ESG AND SDG

The Independent Group of Scientists appointed by the Secretary-General of the UN (2019) has identified economic and financial levers as central levers for the achievement of the SDGs in 2030. The levers include the urgency of the transformation of international financial systems to accelerate private investments to achieve the SDGs. It is estimated that more than US$400 trillion in private capital is required to achieve the SDGs in 2030, which will be channelled through banking systems, institutional investors and capital markets to complement public financing initiatives.

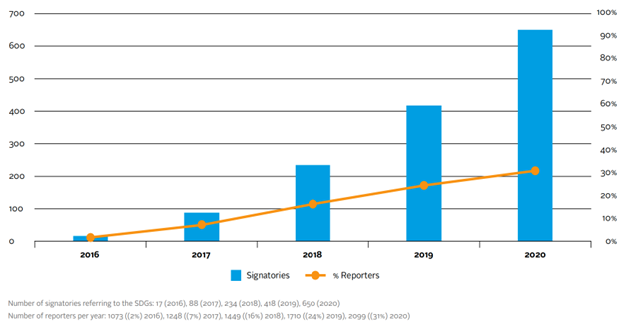

Given the scale of the investments required, there is now increased attention towards the SDGs within the international financial systems. The Principles for Responsible Investment (PRI) initiative, a UN-supported international network for ESG investors, has recorded an increasing uptake of SDGs in the context of ESG investment, as shown in Figure 1. PRI (2020) recognises the SDGs as “the global goals for society and all its stakeholders – including investors.” In addition, aligning ESG investments with SDG outcomes creates a virtuous cycle that positively affects the portfolio performance as well as the resilience of the financial systems, provided that the ESG risks and opportunities associated with the SDG-aligned outcomes are properly assessed and integrated into investment decision making. A properly aligned ESG investment would also be able to provide a multistakeholder return in the form of a positive impact on the stakeholders.

A five-part framework designed by PRI (2020) for SDG-aligned ESG investment includes two main steps: 1) the identification of investment outcomes and 2) the identification of clear investment policies and targets. To appropriately carry out these analyses, investors need relevant and reliable data regarding the SDG contributions of the investees, including companies.

Figure 1: Number of signatories (and percentage of reporters) mentioning SDGs in reporting to the PRI for 2016-2020

Source: PRI (2020)

Another common form of SDG financing involving the private sector is blended financing. Blended financing involves collaboration between development organisations such as the UN, development finance institutions such as the World Bank (WB) and the Asian Development Bank (ADB) and private financial institutions such as institutional investors and mutual funds. The OECD (2018) suggests that the availability of a common language and common interpretation of measurements of development results, including for SDGs, is a key success factor for blended financing.

Data on companies’ SDG contributions are generally based on self-assessment reports that form part of corporate sustainability reporting. However, the information disclosed within the reports varies based on the sustainability reporting requirements in their relevant jurisdictions, as there is currently no international generally accepted sustainability reporting standard (IOSCO, 2021). The reporting standards landscape consists of multiple standards that claim to serve different audiences and/or for different purposes. Major standards include the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Integrated Reporting (<IR>) and Task Force on Climate-Related Financial Disclosure (TCFD). Following the establishment of the International Sustainability Standards Board (ISSB), which includes a merger of the institutions behind the SASB and <IR>, a new set of standards is expected to emerge soon that builds upon the two standards (IFRS, 2022).

As a consequence of the diversity in reporting standards and practices, data on the SDG contributions of corporations suffer from similar data quality issues as the ESG ratings, as discussed above. Commentators have argued that SDG reporting is mainly symbolic and superficial as there is a lack of integration of SDG indicators in a measurable, accountable and assessable manner, as well as a lack of adequate monitoring and assessment systems in place (Heras-Saizarbitoria et al., 2022). One of the main issues is the challenge of operationalising the macro level of SDG indicators at the organisational level (Bebbington and Unerman, 2020).

Concurrently, different ESG rating providers present different frameworks of metrics and assessment frameworks to capture companies’ SDG contributions. There is also no standardised definition and score yet on what can be considered SDG-ESG investments. As a consequence, the inclusion of SDGs outcomes as part of ESG investment analysis is challenging and even inaccurate, which means the expected SDGs impact might not be realised.

This policy brief argues that a multistakeholders framework in the form of an SDG-ESG taxonomy to assess corporations’ contributions to the SDGs based on the ESG metrics is crucial, particularly to unlock the full potential of international financial systems to finance SDG efforts. Such a taxonomy could become the main reference point for the operationalisation of the SDGs at the corporate level. Subsequently, the taxonomy could be a guideline (i.e., a common language) for private sectors, public sectors or the blended financing participants in assessing SDGs outcomes at the company level.

DEVELOPING AN SDG-ESG TAXONOMY

The G20 platform could facilitate the development of the taxonomy with the UNDP at the forefront of the development process. The development of SDG-ESG taxonomy should consider the following principle:

- Global goals with national context

Considering that the SDGs are global goals, the development of an SDG-ESG taxonomy needs to be coordinated at a global level but implemented with the national context in mind. The G20, through the SWFG, would be in an optimal position to coordinate the development process considering its breadth of stakeholder representation. The global effort is expected to set up the foundation of the taxonomy, including the conceptual framework of the taxonomy as well as the core content of the taxonomy. Subsequently, and similar to the approach proposed by Machado et al. (2021), such a taxonomy could be ratified and fine-tuned at the national level. The foundation would be adopted by each nation with national-level content that considers national SDG targets, priorities and processes, as well as the economic landscape and nature of the financial systems in the country.

- Avoid “reinventing the wheel.”

Multiple ideas and frameworks regarding enabling private finance for achieving the SDGs have been proposed. The development of an SDG-ESG taxonomy should build upon this effort and avoid “reinventing the wheel” to avoid confusion and information overload as well as to make the process more resource-effective. Major development organisations have attempted multiple proposals to align SDGs efforts with the private sector. One of the major contributors is the UNDP. For instance, an initial effort to create a prototype of SDGs taxonomy related to financing has also been made by the UNDP (2020). The prototype focuses on the identification of environmental targets of SDGs to facilitate blended finance in the context of China. The prototype indicates the feasibility of the SDG-ESG alignment. However, more effort would be necessary to improve on and expand its applicability internationally and in other countries. In addition, a complete SDG-ESG taxonomy should include all SDGs targets. The OECD and UNDP (2020) have also proposed several recommendations to align the mobilisation of private financial sources with SDG targets, including improvement of transparency and accountability of data and expanding the scope of ESG factors to include SDG impact. Such recommendations would need to be translated into an SDG-ESG taxonomy as a practical and applicable framework.

- Supportive Infrastructure

The development of an SDG-ESG taxonomy should also include the identification of supporting infrastructure that can facilitate and promote the implementation. National governments play an important role in building this infrastructure as they have the authority to design incentives and regulatory frameworks and provide a coordination platform for its monitoring and evaluation. Furthermore, and following the proposed approach of Machado et al. (2021), the taxonomy should become binding within national jurisdictions. A clear and binding legal framework would discourage companies from so-called “cherry-picking” or even “SDG-washing” (i.e., superficial engagement with SDGs) (Heras-Saizarbitoria et al., 2022). To ensure implementation, there needs to be assurance requirements, either voluntary using market pressures or via mandatory regulation. Stakeholder involvement also plays an important role in creating and maintaining relevant infrastructure. For example, the accounting profession would need to create systems and ensure the availability of skilled professionals able to assure reports using the taxonomy.

- Stakeholders Involvement

As an organisation with considerably extensive initiatives and resources on SDGs, including SDG financing, The UNDP could play an important role at the forefront of the development of the taxonomy. Nevertheless, multiple stakeholders should be involved in all stages of the development of the SDG-ESG taxonomy. This is to ensure the legitimacy of the process and the taxonomy, as well as ensuring the relevance and quality of the taxonomy. The involvement should include knowledge-sharing and collective action between relevant stakeholders during and after the development of the taxonomy (UNDP, 2020). The stakeholders involved should come both from the public and private sectors. Public sector stakeholders include government, development institutions, multinational development banks and non-governmental organisations. Private sector stakeholders include stakeholders who play important roles in the financial markets and affect financing decisions at a corporate level, such as accounting and finance professions, institutional investors, financial institutions and financial markets authorities.

CONTENT OF AN SDG-ESG TAXONOMY

The development process of the taxonomy should ensure that the content of the SDG-ESG taxonomy should enable the operationalisation and prioritisation of the SDGs.

- Operationalisation of SDGs

The ESG-SDGs taxonomy should comprise the agreed operationalisation of SDGs at the organisational level. This means deconstruction of the 169 SDGs targets and the 230 associated macro-level indicators into ESG indicators applicable and assessable at the organisational level. The deconstruction should consider the scope of control of organisations. The indicators at the organisational level should reflect the expected organisation’s SDG contribution considering the breadth as well as the limitation of resources and influence of an organisation.

This process should involve scrutinising each goal and its indicators to define the role expected of the private sector in its achievement, bearing in mind the potential trade-off between goals. Inventarisation of currently available alignment between SDGs and sustainability-related indicators should then take places, such as alignment between sustainability reporting standards and ESG rating indicators with SDG indicators. A crucial part of the process is a discussion between the stakeholders to achieve commonly agreed aligned indicators. This would also include agreed data sources, types of data, as well as data measurement methods for the aligned ESG indicators. At the heart of the operationalisation is the description of how the ESG corporate-level indicators affect the macro-level indicators, as well as a clear indication of how the ESG data would be linked to or aggregated to national SDG indicators as evidence of the connection.

- Prioritisation of SDGs

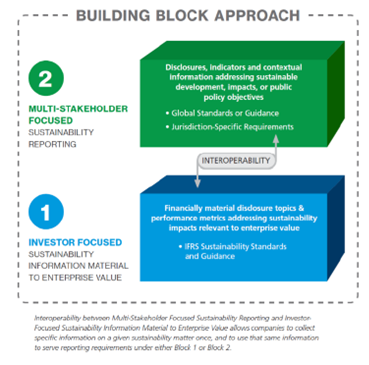

In addition, a framework for the prioritisation of companies’ SDG contributions should be included in the SDG-ESG taxonomy. We argue that the prioritisation framework should adopt the concept of double materiality, which is applied by the European Union (2021) in its Corporate Sustainability Reporting Directive (CSRD). The double materiality concept suggests that companies should prioritise ESG factors based on two criteria (or building blocks), as shown in Figure 2.

Figure 2: The building blocks approach of double materiality

Source: IOSCO (2021)

Block 2 involves an outward-looking materiality assessment based on the most significant impact of companies’ operations on the environment and society. Adopting this outward-looking lens enables companies to identify the SDG topic associated with their operations. In the context of SDG-ESG taxonomy, the assessment should also be influenced by the specific SDGs targets assigned to the company or the industry by the national jurisdiction. The designation should be developed with consideration of the main business operations and location(s) of the company or the industry. Block 1 is the main foundation for building a business case for SDGs for the company. Block 1 involves an inward-looking materiality assessment based on the ESG risks and opportunities that would significantly affect the enterprise value creation. This assessment would facilitate the companies in realising the importance and further guide the integration of ESG factors (and consequently relevant SDGs indicators) into the companies’ business strategy and value creation process. By applying the double materiality lenses, companies’ resources could be properly allocated to the material factors (i.e., material SDGs indicators). The double materiality concepts would allow companies to prioritise the SDGs both most relevant to their operations and most impactful to their stakeholders.

References

Bebbington, J., & Unerman, J. (2020). Advancing research into accounting and the UN Sustainable Development Goals. Accounting, Auditing & Accountability Journal, 33(7), 1657-1670. https://doi.org/10.1108/AAAJ-05-2020-4556

Boffo, R. & Patalano, R., (2020), ESG investing: Practices, progress and challenges, OECD, https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf

European Union. (2021). Questions and Answers: Corporate Sustainability Reporting Directive proposal, https://ec.europa.eu/commission/presscorner/detail/en/QANDA_21_1806

Heras-Saizarbitoria, I., Urbieta, L., & Boiral, O. (2022). Organizations’ engagement with sustainable development goals: From cherry-picking to SDG-washing? Corporate Social Responsibility and Environmental Management, 29(2), 316–328. https://doi.org/10.1002/csr.2202

Independent Group of Scientists appointed by the Secretary-General, (2019), “Global Sustainable Development Report 2019: The Future Is Now–Science for Achieving Sustainable Development”. https://sustainabledevelopment.un.org/content/documents/24797GSDR_report_2019.pdf

International Organization of Securities Commissions (IOSCO), “Report on Sustainability-related Issuer Disclosures”, June 2021, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD678.pdf

International Financial Reporting Standards (IFRS), “ISSB communicates plans to build on SASB’s industry-based Standards and leverage SASB’s industry-based approach to standards development”, 31 March 2022, https://www.ifrs.org/news-and-events/news/2022/03/issb-communicates-plans-to-build-on-sasbs-industry-based-standards/

International Monetary Fund (IMF), “A Post-Pandemic Assessment of the Sustainable Development Goals”, April 2021, https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2021/04/27/A-Post-Pandemic-Assessment-of-the-Sustainable-Development-Goals-460076

Machado, M., Chiodi, L., Costoya V. & Ramon, C., (2021), “ESG20: Standardisation to Foster Public-Private Collaboration Towards the 2030 Agenda”, Policy Brief T20 Task Force 5-2030 Agenda and Development Cooperation, T20 Italy, https://www.t20italy.org/2021/09/21/esg20-standardisation-to-foster-public-private-collaboration-towards-the-2030-agenda/

Lopez, C. & Serrate J. S., (2021), “Ensuring ESG Impact: Four Actionable Recommendations for a Dependable Path”, Policy Brief T20 Task Force 9-International Finance, T20 Italy, https://www.t20italy.org/2021/08/31/ensuring-esg-impact-four-actionable-recommendations-for-a-dependable-path/

OECD & UNDP, “Framework for SDG Aligned Finance”, November 2020, https://www.oecd.org/development/financing-sustainable-development/Framework-for-SDG-Aligned-Finance-OECD-UNDP.pdf

OECD, “Making Blended Finance Work for the Sustainable Development Goals”, January 2018 ,https://www.oecd.org/dac/making-blended-finance-work-for-the-sustainable-development-goals-9789264288768-en.htm

Principles for Responsible Investment (PRI), “Investing with SDG Outcomes: a Five-Part Framework”, 2020, https://www.unpri.org/download?ac=10795

Widyawati, L., Daugaard, D., & Linnenluecke, M., (2021), “Corporate Sustainability Reporting: Aligning the Sustainable Development Goals, Planetary Boundaries, and ESG Rating Frameworks”, Working Paper.

United Nations (UN) Inter-agency Task Force of Financing for Development, “Sustainable investing and private sector efforts and initiatives on environmental, social and governance (ESG) factors”, April 2022, https://developmentfinance.un.org/sustainable-investing-and-private-sector-efforts-and-initiatives-environmental-social-and-governance

UNDP, “Technical Report on SDG Finance Taxonomy (China), June 2020, https://www.cn.undp.org/content/china/en/home/library/poverty/technical-report-on-sdg-finance-taxonomy.html

Hummel, K., & Szekely, M. (2022). Disclosure on the sustainable development goals–evidence from Europe. Accounting in Europe, 19(1),152-189. https://www.tandfonline.com/doi/full/10.1080/17449480.2021.1894347