Despite ongoing efforts, there continues to be a significant investment gap in building energy efficiency (BEE). Given the limited public resources, targeted green finance instruments can help bridge this gap. However, mainstreaming green finance is fraught with several challenges, including the lack of a global taxonomy and incoherent policy guidance. In this policy brief, we first propose improving national BEE standards, especially in the developing members of the G20, and to reduce differences between the national and global standards, which can significantly contribute to establishing a global taxonomy of green finance for BEE. Next, we propose a more focused and progressive implementation of the G20 Tokyo Declaration with systemic policy action, aligning fiscal and financial policy priorities with low-carbon energy transition goals that can catalyze the development of green finance.

Challenge

Achieving climate change goals necessitates a significant improvement in building energy efficiency (BEE), which lags due to lack of finance. Buildings account for 31% of global final energy consumption and around one-third of direct and indirect carbon dioxide emissions (IEA 2019). To meet the Paris Agreement’s 1.5°C benchmark, global emissions from buildings need to be reduced by half by 2030. Achieving this goal requires an 80% cut in emissions below 2010 levels by 2050, mostly through increased energy efficiency (IPCC 2018). Investing in energy efficiency for existing buildings and establishing higher energy efficiency standards for new ones can significantly reduce energy consumption and cut down carbon emissions. These benefits are particularly significant in countries exposed to extreme weather conditions, such as those in the Gulf Region (e.g., UNECE 2018; UNEP FI and IPEEC 2019).[1] However, financing energy efficiency investments is a challenge for many households and small business owners. They often do not have the financial capacity to cover the initial costs, even though future energy savings can significantly contribute to the recovery of the initial investment. G20 countries must mobilize private finance by leveraging scarce public finance to address the multi-trillion-dollar investment gap.

Green finance has tremendous potential to bridge the investment gap. However, without a global taxonomy and coherent policy guidance, this potential will remain unfulfilled (Anbumozhi et al. 2018). A comprehensive global taxonomy to classify energy efficiency investments according to the shades of “green” and “brown” does not currently exist at the G20 level (Bak et al. 2017). Creating such a global taxonomy is difficult in the absence of local BEE standards, especially for developing G20 members, or in the presence of significant differences in standards across G20 members. Apart from bridging the financing gap, specific green finance instruments such as mortgages, in general, appear to be less risky[2] and create many positive externalities for the environment and society. Yet, such positive attributes are currently not incorporated in the pricing of green finance instruments in many G20 countries because fiscal, financial, and energy policies do not adequately incentivize reflecting the “true cost” of conventional financing programs. The net consequence is that green finance instruments are artificially priced at a higher level and are generally not widely accessible, thereby leading to underinvestment in green assets.

Proposal

Proposal I

Bridging local energy efficiency standards for buildings with global standards can significantly contribute to the development of a global taxonomy of green assets.

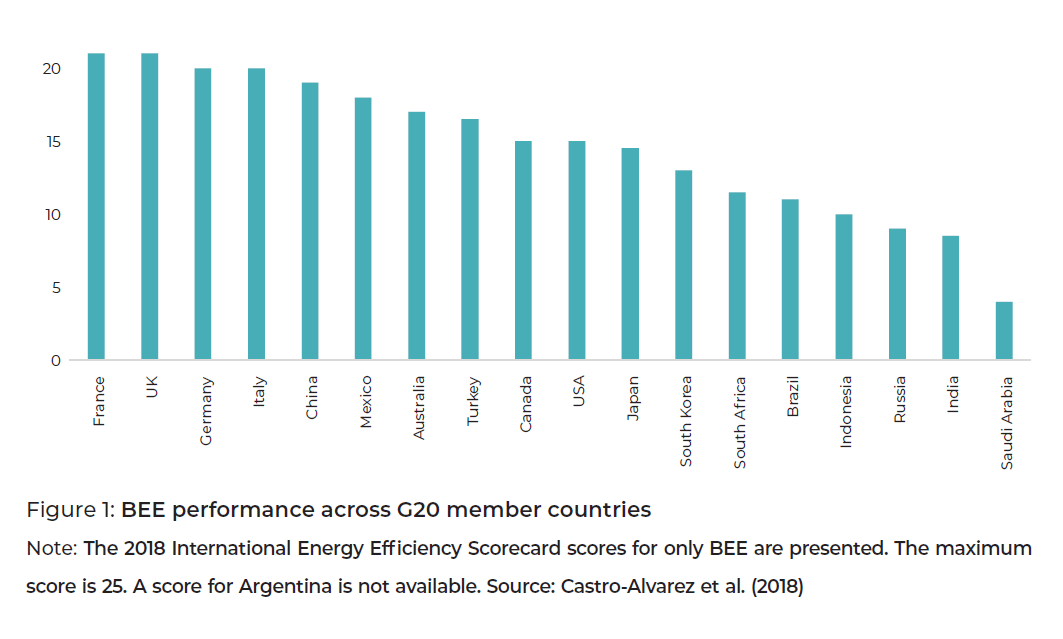

Given their different physical locations and local climate conditions, some variations in local BEE standards across G20 members is expected. However, the absence of local BEE standards or their sharp divergence from global standards would hinder efforts to establish a global taxonomy of green assets. Without a global taxonomy, it would be challenging to correctly price local assets in global markets. With the establishment of the International Partnership for Energy Efficiency Corporation (IPEEC) in 2009, the G20 members have already taken substantial steps toward establishing BEE standards, both locally and globally. The IPEEC provided many platforms for discussions and studies to support its members to develop energy efficiency standards. Many G20 countries have already implemented various policies to improve BEE. However, some developing G20 members still do not have specific building standards and procedures in place, while the existing BEE standards vary across countries in scope, targets, and investments. Figure 1 presents the level of BEE performance of G20 member countries. The figure indicates substantial differences in the scores across the G20 countries and highlights the need for further work to improve national BEE standards and harmonize the sharp contrasts. France and Germany, in the EU, are among the few G20 members with long-term strategies for the retrofitting of existing buildings (Climate Transparency 2019). Emerging G20 economies, such as Russia, India, and Saudi Arabia, follow a relatively weaker implementation of retrofitting standards and monitoring mechanisms for new net-zero buildings.

This lack of harmonized and universal standards limits the comparison of local building assets globally, and thus, impedes the efforts to mobilize private investments, both local and international, for the financing of domestic energy efficiency projects, especially in developing G20 member countries. With the ending of the IPEEC’s operations in 2019 and the establishment of the Energy Efficiency Hub (EEH), a platform for global collaboration on energy efficiency, the focus should be on a higher mandate. While supporting the establishment and improvement of BEE standards in member countries, the EEH should also lead the efforts toward establishing universal standards for BEE that would significantly contribute to the global taxonomy of green assets.

Proposal II

A systematic policy approach to leadership for mainstreaming green finance is required among regulatory agencies both locally and globally.

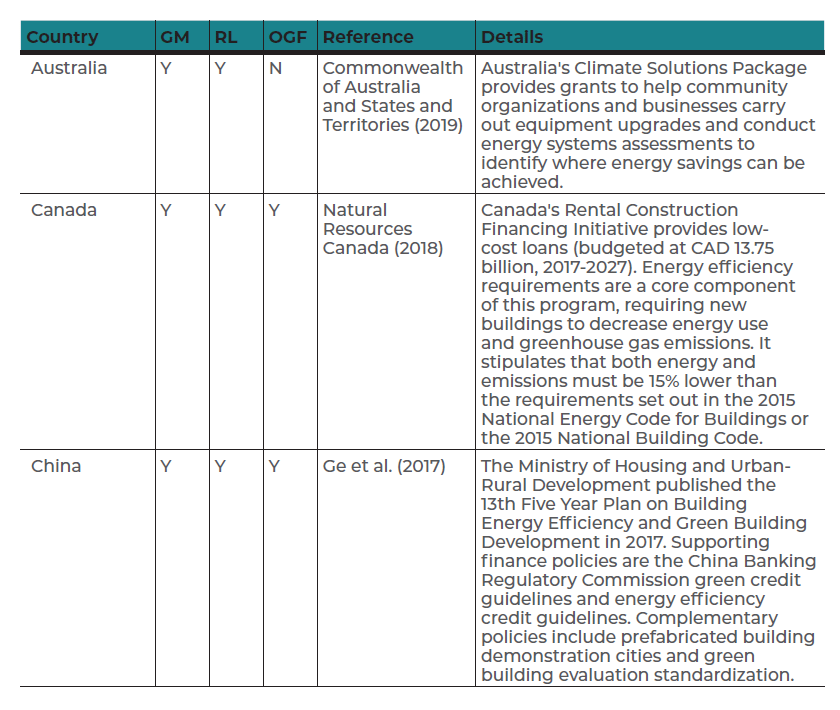

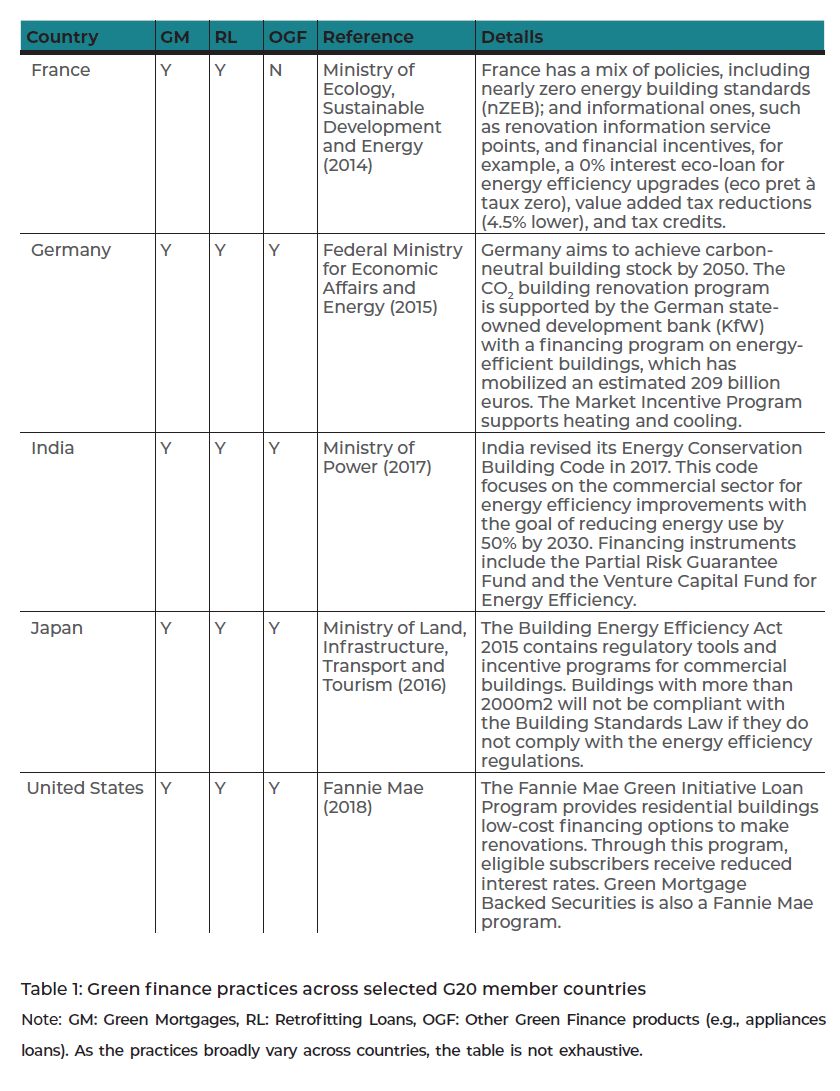

Green finance instruments have the potential to accelerate the transition to a lowcarbon economy. Recognizing this fact, the G20 has already taken initial action, including forming the Energy Efficiency Finance Task Group (EEFTG), one of nine dedicated task groups under the IPEEC to promote collaboration in financing energy efficiency. The EEFTG has already interacted with many G20 governments and the financial industry in raising awareness among many public and private entities, although the desired impact is yet to be achieved. A quick survey of the current practices implemented among G20 members shows that green financial products primarily for BEE appear to be available despite significant limitations in coverage. The scope of these instruments, their availability in practice, and their effectiveness significantly vary across countries. Table 1 presents some of the widely used green finance instruments for BEE, such as green mortgages, retrofitting loans, and other loans (e.g., appliances), for selected G20 members. For instance, acting as a pioneer, the EU implemented several financing schemes, including the recent Energy Efficient Mortgages Action Plan (EeMAP 2018) initiative that has been put into action as a joint effort of several private financial institutions and regulatory bodies. However, the initiative is currently in the pilot stage with limited accessibility.

Moreover, a systemic approach in government policy is crucial to mainstream green finance for BEE, where fiscal and financial policies should complement each other. However, most of the policy actions aiming to bolster the spread of green finance among G20 members seem to be partial and uncoordinated. Covering the interest cost of green loans, providing guarantee coverage for green mortgages, and allowing deduction of interest payments from tax returns are some of the general policies implemented among G20 countries. Specifically, Saudi Arabia has recently provided zero-interest and partially subsidized loans for the deployment of more energyefficient cooling systems for buildings. China has also provided subsidies for energyefficient appliances and new buildings to increase the economic incentives for energy efficiency improvement. In the United States, the Federal Housing Authority’s (FHA) Energy Efficient Mortgage program enables homeowners to finance the cost of adding energy efficiency features to new or existing houses as part of an FHA-insured home purchase or refinancing mortgage. Although these policies have spurred the development of green finance to certain levels, they are far from being capable of mainstreaming green finance that can address the multi-trillion-dollar investment gap.

Some G20 members, such as Germany and Japan, however, offer relatively better practices that are close to being systemic. Such a systemic approach sets a new direction for financing BEE by enhancing coordination between fiscal, financial, and energy policies. This coordinated approach ensures the coherent alignment of policies and incentives to catalyze more private resources toward BEE investments. We briefly describe two successful case studies from Japan and Germany.

Some G20 members, such as Germany and Japan, however, offer relatively better practices that are close to being systemic. Such a systemic approach sets a new direction for financing BEE by enhancing coordination between fiscal, financial, and energy policies. This coordinated approach ensures the coherent alignment of policies and incentives to catalyze more private resources toward BEE investments. We briefly describe two successful case studies from Japan and Germany.

Japan

The building sector is a significantly growing end-user of energy in Japan. Japan’s basic Energy Conservation Law, which has been revised multiple times, forms the cornerstone of BEE. The Energy Conservation Law involves establishing progressive standards and targets as well as the introduction of market-based business models such as Energy Service Companies. Japan’s experience demonstrates how regulations, information and labeling programs, and financial incentives have worked in conjunction with each other to achieve energy efficiency and climate goals. For example, the Japanese government provides financial assistance for the construction of zero-energy houses, low-interest rates for retrofitting energy-efficient housing, and tax deductions for new net-zero emission buildings. Assessment and tracking are also done through programs such as the Comprehensive Assessment System for Built Environment Efficiency, a rating system that includes environmental indicators for buildings.

Germany

Germany aims to reduce its energy use by 30% by 2020. Financial incentives form a vital part of the strategy to achieve this target. The Climate Action Program 2020 includes a number of detailed plans, such as the National Action Plan for Energy Efficiency and the Energy Efficiency Strategy for Buildings. Buildings have received particular attention as they account for up to 30% of Germany’s greenhouse gas emissions. The German state-owned development bank (KfW) and the Federal Office for Economic Affairs and Export Control play a prominent role in providing finance and information, especially to households. During 2014–2019, the KfW financed over 75% of all new residential dwellings in Germany. The KfW also funds the initial purchase of an energy-efficient building, the retrofitting of existing buildings, and solar thermal installations and combined heat and power plants. The main instrument of the KfW is the provision of low-interest loans; however, in some instances, specific grants are also provided. The financial incentives are embedded in a broader legal and regulatory framework at the federal level. Voluntary actions, certificate programs, and campaigns to build awareness have also sought to change individual behavior and reinforce the financial incentives provided. The Climate Action Program 2030 further enhanced these incentives, including a tax break for energy-efficient buildings and upgrades.

As the EEH assumes the role of the IPEEC with a broader institutional scope, a similar body to the EEFTG of the IPEEC can be established under EEH. The new body can take a leadership role in close cooperation with other relevant international institutions, such as the United Nations Environment Programme Finance Initiative (UNEP FI), the International Monetary Fund (IMF), and the World Bank, in promoting the construction of a more systemic approach to mainstreaming green finance across the G20 member countries.

Proposal III

Policymakers can enhance liquidity in the market by providing clear guidance and incentives on the use of green bonds.

Liquidity needs for the required large-scale investment into BEE can be supported via private sources such as the green bond market. According to the recent IMF report (IMF 2019), there is growing appetite for these bonds among institutional investors (e.g., pension and sovereign wealth funds). While the global green bond market is currently small, it has been experiencing high growth rates in some countries. Many developed G20 member countries have already utilized some of these resources, albeit minimally. According to the most recent data on bond issuance, the share of total green bond issuance is less than one percent of the USD 100 trillion worth global bond market. At the global level, green bond issuance is dominated by a few G20 members. About half of the green bond global issuance is utilized by the US, China, and France.[3] Similarly, green bond holding is also highly concentrated among institutional investors (e.g., sovereign wealth funds, pension funds, and insurance companies), who hold more than three-quarters of green bonds globally.

Bond issuance is, however, a complicated process and can be costly for issuers. Government programs can target the reduction of some of these costs. According to Climate Bonds Initiative’s recent data,[4] several local and central G20 governments provide various support programs. For instance, China and Japan offer subsidy schemes covering issuance and interest costs; the European Central Bank and the Central Bank of Brazil provide preferential risk weighting for banks’ holdings of green bonds; the US government implements a bond guarantee scheme to enhance the risk profiles of green bonds.[5] While subsidy programs guide and incentivize potential issuers, bond guarantee programs can also significantly mitigate risks, especially for international investors who plan to invest in developing G20 countries. By providing appropriate incentives, government policy can address the liquidity needs of local financial institutions from international markets by issuing green bonds (i.e., mortgage-backed securities). However, for effective implementation, bond support programs should also be part of the systemic approaches discussed above. For instance, while fiscal policy supports the supply of green bonds, by lowering the cost of issuance and easing the process, monetary policy should incentivize green bond demand by providing the necessary incentives to the financial sector for the purchase of these green bonds.

Key Recommendations

- Bridging local energy efficiency standards for buildings with global standards can significantly contribute to the development of a global taxonomy of green assets. The absence of local BEE standards or their sharp divergence from global standards hinders efforts to establish a global taxonomy. Creating a global taxonomy is a crucial step toward the development of green finance instruments, particularly for the classification, pricing, and securitization of financial instruments for BEE globally. The EEH should play a more active role in achieving these goals.

- A systematic policy approach is needed among regulatory agencies both at the domestic and the global scale to lead the initiative to mainstream green finance. Active collaboration and coordination between local fiscal, financial, and regulatory agencies are essential to offer appropriate incentives and support for the development of green finance and to facilitate its access. In contrast, international cooperation can reinforce national policy responses by creating the necessary foundation to improve global capital allocation toward green assets. The EEFTG, under the EEH, should take on a more active role in mainstreaming green finance.

- Providing policy guidance and incentives for green bond issuance can significantly contribute to the liquidity needs of the domestic financial sector. Given the increasing appetite for green assets among both international and local investors (e.g., pension and sovereign wealth funds), providing policy guidance and incentives for green bond issuance can significantly contribute to the liquidity needs of the local financial sector, especially for developing G20 members.

Concluding remarks

The proposals in our policy brief aim to contribute to the efforts in designing a global taxonomy of green assets and mainstreaming green finance. Achieving the former requires G20 members to reduce the sharp differences between national and global BEE standards. In tackling the latter, G20 countries should advance policy guidance by following a systemic approach in mainstreaming green finance to increase investment into BEE, and address the liquidity demands for the supply of green financial products. These actions will broaden the supply and improve the access to green financial instruments, enabling a larger population of households and firms to invest in BEE. This can bring about a significant reduction in carbon emissions.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

An, Xudong, and Gary Pivo. 2020. Green Buildings in Commercial Mortgage‐Backed Securities: The Effects of LEED and Energy Star Certification on Default Risk and Loan Terms. Real Estate Economics, 48 (1): 7–42.

Anbumozhi, Venkatachalam, Kaliappa Kalirajan, and Fukunari Kimura. 2018. Financing for Low-Carbon Energy Transition: Unlocking the Potential of Private Finance. Book, Springer, Singapore

Bak, Céline, Amar Bhattacharya, Ottmar Edenhofer, and Brigitte Knopf 2017. Towards a Comprehensive Approach to Climate Policy, Sustainable Infrastructure, and Finance. G20 Insights, Berlin.

Castro-Alvarez, Fernando, Shruti Vaidyanathan, Hannah Bastian, and Jen King. 2018. The 2018 International Energy Efficiency Scorecard. American Council for an Energy-Efficient Economy. Climate Transparency. 2019. Brown to Green: The G20 Transition Towards a Net-zero Emissions Economy. Climate Transparency, Berlin.

Commonwealth of Australia and States and Territories. 2019. Energy Efficiency: NCC 2022 and Beyond Scoping Study. Report by Australia Building Codes Board.

EeMAP (Energy Efficient Mortgages Action Plan). 2018. Creating an Energy Efficient Mortgage for Europe: Towards a New Market Standard. EU Energy Efficient Mortgages Initiative.

Fannie Mae. 2018. Multi-family Green Bond Impact Report 2012–2018. Fannie Mae Report.

Federal Ministry for Economic Affairs and Energy. 2015. Energy Efficiency Strategy for Buildings: Methods for achieving a virtually climate-neutral building stock. Federal Ministry for Economic Affairs and Energy Germany.

Ge, Jing, Wei Feng, Nan Zhou, Mark Levine, and Carolyn Szum. 2017. Accelerating Energy Efficiency in China’s Existing Commercial Buildings. Energy Analysis and Environmental Impacts Division, Lawrence Berkeley National Laboratory.

IEA (International Energy Agency). 2019. World Energy Outlook 2019. International Energy Agency, Paris.

IFC (International Finance Corporation). 2018. Creating Green Bond Markets—Insights, Innovations and Tools from Emerging Markets. Report by the IFC/ Sustainable Banking Network and the Climate Bonds Initiative.

IMF (International Monetary Fund). 2019. Global Financial Stability Report: Vulnerabilities in a Maturing Credit Cycle. International Monetary Fund, Washington, DC.

IMT (Institute for Market Transformation). 2013. Home Energy Efficiency and Mortgage Risks. Research Paper by the Institute for Market Transformation, Washington, DC.

IPCC (Intergovernmental Panel on Climate Change). 2018. Global Warming of 1.5 ºC. The Intergovernmental Panel on Climate Change, Report.

IRENA (International Renewable Energy Agency). 2020. Green Bonds. International Renewable Energy Agency, Report.

Ministry of Ecology, Sustainable Development and Energy. 2014. Energy efficiency action plan for France 2014. Directorate General for Energy and Climate, Ministry of Ecology, Sustainable Development and Energy.

Ministry of Land, Infrastructure, Transport and Tourism. 2016. Overview of the Act on the Improvement of Energy Consumption Performance of Buildings (Building Energy Efficiency Act). Report.

Ministry of Power. 2017. Energy Conservation Building Code 2017. Bureau of Energy Efficiency, Ministry of Power, Government of India.

Natural Resources Canada. 2018. Canada’s Buildings Strategy Update. Energy and Mines Ministers’ Conference.

Pelizzon, Loriana, and Max Riedel. 2017. Creating an Energy-Efficient Mortgage for Europe: Review of the Impact of Energy Efficiency on the Probability of Default. EeMAP project: Research Center SAFE, Goethe University, Frankfurt.

UNEP FI (United Nations Environment Programme Finance Initiative) and IPEEC (International Partnership on Energy Efficiency Cooperation). 2019. G20 Energy Efficiency Finance and Investment Stock Take Report. UNEP Finance Initiative and International Partnership for Energy Efficiency Cooperation.

UNECE (United Nations Economic Commission for Europe). 2018. Mapping of Existing Energy Efficiency Standards and Technologies in Buildings in the UNECE Region. United Nations Economic Commission for Europe, Geneva.

Appendix

[1] . For instance, according to World Energy Outlook 2019 (IEA 2019), Saudi Arabia, the US, and Australia have the highest building energy usage, and in turn, the highest emissions per capita.

[2] . Some recent studies (e.g., An and Pivo 2020; Pelizzon and Riedel 2017; IMT 2013) show that green assets (e.g., green mortgages and energy retrofit loans for more energy-efficient buildings) are usually less risky (i.e., they have relatively lower default rates) compared to their conventional alternatives.

[3] . Authors’ calculations from Bloomberg and similar figures are also available in IRENA (2020).

[4] . The Climate Bonds Initiative is a private platform that focuses on enhancing the standards of the global green bond market by working with several private and public institutions. https://www.climatebonds. net/policy/data/download

[5] . Comprehensive policy design and different practices are presented in a recent joint report by the World Bank and the Climate Bonds Initiative (IFC 2018).