Challenge

Proposal

Since the first G20 summit in 2008, G20 leaders have given growing support to reforming international taxation by addressing national tax base erosion, corporate profit shifting, and deficiencies in the tax policy and administration of developing countries. In 2012, several transatlantic scandals exposing the tax avoidance practices of Starbucks, Amazon, Apple and Google thrust international tax cooperation to the top of the global agenda. This prompted a seismic shift in the G20’s approach to global fiscal law and relations.

At the Los Cabos Summit in 2012, the G20 leaders stressed the need to prevent base erosion and profit shifting, and tasked the Organisation for Economic Co-operation and Development with developing and implementing a new international taxation agenda known as the Inclusive Framework on Base Erosion and Profit Shifting. The framework currently boasts 125 members, representing 95% of global gross domestic product.

Conclusions

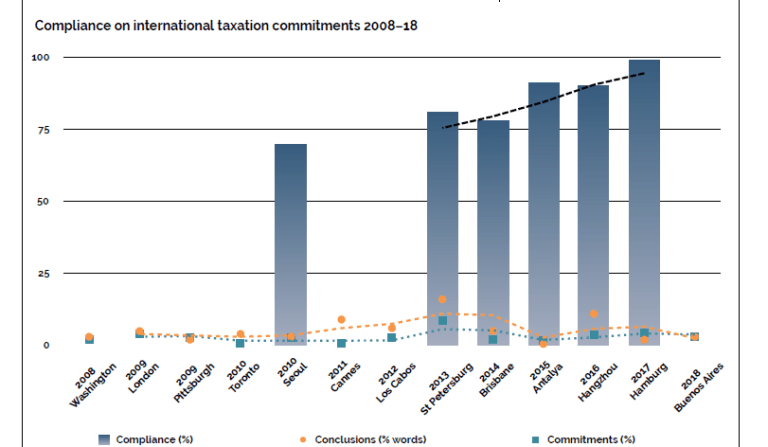

International taxation has been a regular feature of G20 deliberation since the summit’s start in 2008, although its proportional weight of communiqué conclusions at each summit has been inconsistent. Leaders have dedicated about 11,060 words to tax in their summit outcome documents, comprising 6% of their conclusions. The number of words has increased, although irregularly. An average of 5.2% of words per summit referred to international taxation. It peaked at the St Petersburg Summit in 2013 at 4,450 words (15.8%), followed by the Hangzhou Summit in 2016 at 1,720 words (10.6%) and the 2011 Cannes Summit at 1,210 words (8.6%). The lowest came at the Antalya Summit in 2015 with 65 (0.5%).

Commitments

In all, G20 leaders have made 85 collective, politically binding, future-oriented commitments on international taxation, or 3.5% of the total on all subjects. They made their first tax commitment at the 2008 Washington Summit, pledging to work with the OECD and address the lack of transparency in global tax governance owing to the failure of information sharing. At Los Cabos in 2012, leaders tasked the OECD with addressing BEPS and the digital economy.

In 2013, the OECD issued the Action Plan on Base Erosion and Profit Shifting, containing 15 action items to improve global tax cooperation, covering the compulsory spontaneous exchange of tax rulings, a new multilateral instrument, mandatory disclosure rules for aggressive tax planning and a new dispute resolution mechanism.

At St Petersburg in 2013, G20 leaders committed to the automatic exchange of information as the new global standard, and reaffirmed their full support of the OECD’s work. In 2014 at Brisbane, leaders welcomed significant progress on the action plan.

The G20 reaffirmed its previous commitments at the Antalya Summit in 2015. At Hangzhou in 2016, leaders committed to achieving a global fair and modern tax system, pledging support for a timely, consistent and widespread implementation of the BEPS package.

They reaffirmed these objectives again at Hamburg in 2017, adding that they would undertake defensive measures against non-cooperative jurisdictions with insufficient tax compliance. At the 2018 summit in Buenos Aires, G20 leaders reiterated their commitment to work together to create a modern international taxation system, support BEPS, tackle the tax implications of the digital economy and use defensive measures against jurisdictions that do not meet transparency standards.

Compliance

The G20 Research Group has assessed 11 of the 85 commitments on tax for compliance by G20 members. They average 85%, well over the 71% average across all subjects. Compliance has varied widely but generally risen. The highest compliance of 100%, came twice: with the 2013 commitment to stimulate pro-growth structural reforms and reform labour markets using appropriate tax regimes, and with the 2017 commitment to implement BEPS packages. The lowest compliance resulted from the commitments to build sustainable revenue bases by improving developing country tax administration in 2010 at 58%, tackle tax avoidance and aggressive tax planning in 2013 at 68%, and work with developing countries to build their tax administration capacity in 2014 at 70%.

Causes

The number of commitments on tax at each summit strongly and positively coincides with members’ subsequent compliance with those commitments. The three summits with the most tax commitments – St Petersburg in 2013, Hangzhou in 2016 and Hamburg in 2017 – averaged 90% compliance, higher than the overall tax average of 85%. These summits had over 20% higher compliance than the three summits with the fewest tax commitments, namely Seoul in 2010, Brisbane in 2014 and Antalya in 2015, with their average of 60%.

Corrections

At Osaka, G20 leaders could increase compliance with their tax commitments by making more such commitments.

They could also pledge enhanced support for monitoring and enforcing compliance through AEOI, greater tax policy harmonisation, the inclusion of developing countries through the multilateral BEPS instrument and more robust sanctioning of non-compliant regimes.

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of the Global Solutions Initiative. This article was originally published in G20 Japan: The 2019 Osaka Summit by GT Media Group and the G20 Research Group, 2019. View the original article.