The IMF estimates that State-Owned Enterprise (SOE) assets totalled US$45 trillion in 2018, close to 50% of the global GDP, and calculated the debt of the largest SOEs to be US$ 7.4 trillion. Clearly, SOEs have a direct bearing on the global economy. The most systemically important SOEs are the State-Owned Multinational Enterprises (SOMNEs) since they are focused on cross-border financing and business. A global framework for regulating SOMNEs is needed, one that defines SOMNEs clearly, enforces transparency and ownership of business accounts, maps cross-border financial interlinkages, and requires regular exercises on financial stability.

Challenge

SOMNEs are deeply entrenched in the international financial and trading system. Their operations impact global supply chains, capital flows and macroeconomic policy. Yet, there is no universal framework for governing multinational SOEs. The mismanagement of SOMNEs can be a major risk to the global economy and may spawn a global financial crisis.

Proposal

Since SOMNEs have a direct bearing on the global economy, particularly financial stability, it is natural that efforts to design universal rules for their governance should be led by the G20. Without globally accepted prudential norms, SOMNEs may prove to be a systemic risk for the international financial system.

The G20 can create a framework that helps:

- Identify a SOMNE

- Documents cross-border linkages and systemic risks for each SOMNE

- Ensures that SOMNE activities are monitored regularly

Data on SOMNEs is limited, but since they operate in the same marketplace as private enterprise, they should be subjected to similar rules on transparency as multinational corporations.

A good starting point is to use the regulations and standards that exist for SOEs. As per an IMF report, the share of SOE assets amongst the world’s 2,000 largest firms is nearly 20%; at US$ 45 trillion in 2018, these account for 50% of global GDP (IMF 2020). The same report estimates the debt of the largest SOEs to be US$ 7.4 trillion. SOEs are present across the developed and developing economies. Some of the largest and most vibrant SOEs can be found in Germany, France, Norway, Italy, China, India, Brazil, Malaysia, Indonesia, and Saudi Arabia. They are spread across sectors such as finance, utilities, energy, transport, and communication in both developed and developing countries.

Chinese SOEs are always under the scanner for potential cross-border systemic risks given the scale of the enterprises and their interlinkages with the global economy. There are nearly 150,000 SOEs in China, accounting for nearly US$ 22 trillion in assets, many of them with international business operations. Sovereign Wealth Funds (SWFs) are another form of SOMNEs whose financial sustainability can have serious implications for the global economy. In October 2008, the SWFs voluntarily published the ‘Santiago Principles’ to guide “transparency, governance, accountability, and prudent investment practices” )International Forum of Sovereign Wealth Funds 2008). Yet, concerns about SWFs’ systemic risks remain due to the sheer size and scale of their presence. A PIIE report estimated that the assets under management of 37 SWFs it examined in 2008 was nearly US$2.6 trillion, but by 2019 the scale had reached 64 SWFs with assets worth US$ 8.1 trillion (Maire et al. 2021). SWFs have also been withdrawing their assets to tide over fiscal deficits due to COVID-19 and the drop in oil prices, both of which may have implications for the global economy.

DEFINING A STATE-OWNED MULTINATIONAL ENTERPRISE

A first step for regulating SOMNEs is to have a globally accepted definition for them. This is difficult because there is yet no global definition for SOEs either. Nevertheless, some international institutions and plurilateral initiatives have attempted recently to define SOEs. For instance, the Trans-Pacific Partnership (TPP) defines an SOE as:

An enterprise that is principally engaged in commercial activities in which a party (government):

- directly owns more than 50% of the share capital

- controls, through ownership interests, the exercise of more than 50% of the voting rights, or

- holds the power to appoint a majority of members of the board of directors or any other equivalent management body

The IMF defines a public corporation as “entities that are controlled directly or indirectly by the government” with the following criteria to measure government control:

- ownership of the majority of the voting interest

- control of the board or other governing body

- control of the appointment and removal of key personnel

- control of key committees of the entity

- ownership of golden shares and options

- capacity to change regulation

- control by a dominant public sector customer or group of public sector customers, and

- control attached to borrowing from the government

The World Bank defines the public sector as consisting of the following types of institutions:

- Central governments and their departments

- Political subdivisions such as states, province and municipalities

- Central banks

- Autonomous institutions, such as financial and non-financial corporations, commercial and development banks, railways, utilities, etc., where:

— The budget of the institution is subject to the approval of the government of the reporting country; or

— The government owns more than 50% of the voting stock or more than half of the members of the board of directors are government representatives, or

— In case of default, the state would become liable for the debt of the institution.

A global definition for SOMNEs can be produced by using the TPP, IMF and World Bank definitions of public-sector companies as the base and adding select extra indicators that represent their multinational nature. For instance, a definition for SOMNEs can be created by adding the following attributes:

- Share of revenue earned from foreign operations (to identify SOMNEs by their international business operations).

- Share of assets and liabilities attributed to foreign entities (to identify SOMNEs by their global investors and cross-border acquisitions).

With such a universal definition, it will become easier to identify SOMNEs as well as their geographic concentration, sovereign affiliation, market integration, and supply chain dependencies.

DISCLOSURE OF DATA BY STATE-OWNED MULTINATIONAL ENTERPRISES

Transparency and disclosure are not new pursuits but the quest for better data and surveillance has become even more critical given the weakening fiscal situation of many nations. Experts have warned how external borrowing by state-owned (or guaranteed) enterprises has increased drastically but the reporting has not kept pace (Pazarbasioglu et al. 2021).

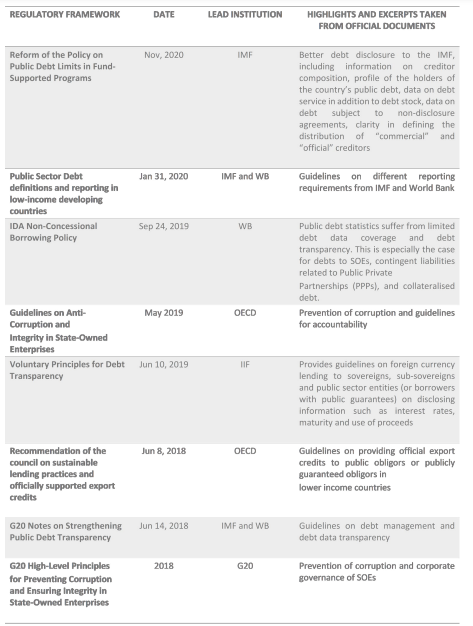

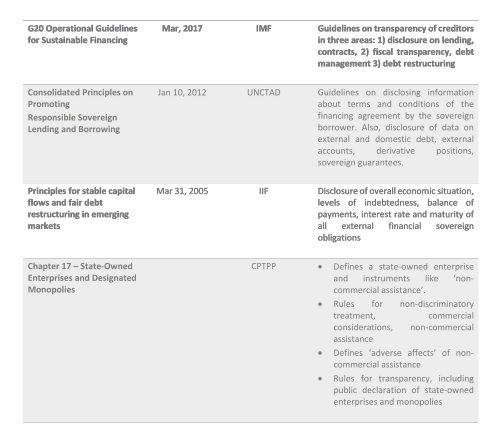

Existing initiatives on disclosure requirements for SOEs are usually motivated by the following:

- For corporate governance: These include guidelines and initiatives that focus on curbing corruption and improving corporate governance to ensure firm-level resilience and stability

- These guidelines typically are applicable for national, subnational and even local SOEs.

- For systemically important financial institutions: These include the guidelines and initiatives undertaken by public and private banks after the trans-Atlantic crisis of 2008 on ‘Systemically Important Financial Institutions (SIFIs)’, particularly the work done by the Financial Stability Board, IMF, and Bank of International Settlements in upgrading standards for disclosure and resiliency.

Since disclosure norms for publicly-listed SOEs, particularly those in the financial services, are clearly established and enforced by financial market regulators, the focus of this proposal is on the non-listed, government-supported SOMNEs.

The World Bank and IMF have established regulations for disclosing data on debt but none specifically for SOEs (or SOMNEs). The guidelines in place today treat official (bilateral and multilateral) and private SOMNEs alike. In the wake of the pandemic and the work being done by the IMF and World Bank to assist nations with economic recovery, there is a renewed focus on debt disclosure. Therefore, the time is ripe to establish specific regulations for disclosure of information for SOMNEs. It will help G20-led initiatives such as the Debt Service Suspension Initiative (DSSI), which is working on developing a ‘common framework’ between lenders from Paris Club and Non-Paris Club nations to provide debt relief to the most vulnerable nations.

The G20 can craft guidelines for:

- Disclosure of cross-border operations by SOMNEs (for instance, foreign currency-denominated financing by SOMNEs to private or public firms for project financing for infrastructure).

- Disclosure of credit given or taken by SOMNEs (e.g. lenders or borrowers).

The Voluntary Principles for Debt Transparency published by the Institute for International Finance is a good framework to build on. It provides guidelines on foreign currency lending to sovereigns, sub-sovereigns and public sector entities (or borrowers with public guarantees) on disclosing information such as interest rates, maturity and use of proceeds.

Any such guideline for SOMNEs will have to be preceded by guidelines that accurately distinguish sovereign lenders and borrowers from truly private lenders. The World Bank International Debt Statistics 2021 estimates that the total external debt stock of low-income countries eligible for DSSI was US$ 744 billion in 2019. Of this, lending from private creditors to DSSI-eligible countries was US$ 102 billion (WB 2021). The World Bank Debtor Reporting System requires the borrowing nation to report the name of the creditor nation and crediting institution extending the loan for public and publicly guaranteed loan commitments. It is a methodology described in the System of National Accounts (SNA 2008) and the IMF Balance of Payments manual (BPM6).

Yet, SOEs seem to find loopholes. For instance, the World Bank Debtor Reporting System (DRS) Manual (WB 2020) designates all commercial banks as public if they are debtors but private if they are creditors, as a result of which crediting commercial banks are outside the scope of debt data reporting. This needs to change. Experts from the Bruegel have highlighted how the misclassification of banks has contributed to the slow uptake of G20’s DSSI (Bery, Herrero, and Weil 2021). A report by the Group of Thirty underlined the importance of disclosure by highlighting how some nations are under-reporting their public borrowing and foreign currency exposure by borrowing through their SOEs (for instance, state-backed oil companies) (Group of Thirty 2020).

So far, the risks posed by SOEs have remained within national boundaries. For instance, PIIE expert reported that SOEs in China defaulted on 80 bonds worth nearly US$ 15 billion due to fiscal constraints and the government’s “gradual phaseout of government guarantees on state firm liabilities” (Huang 2021). The report explained the cross-border implications for these defaults were likely to be limited since foreign investors hold little in China’s corporate bond market. Similarly, the case of Mozambique is most readily cited to illustrate how debt can be ‘hidden’ despite guidelines on debt transparency. As per the IMF, Mozambique did not disclose to it two state-backed guarantees worth US$ 1.15 billion (9% of GDP in 2015) provided to SOEs registered as private enterprises. Since the SOEs were designated as private enterprises and money was directly transferred to contractors, data on the loans never made it to the disclosures (IMF 2018). When the loans were eventually discovered, the revelation jolted the financial markets, leading to a sharp spike in bond yields.

REQUIRING SOMNES TO USE LEIS FOR ALL CROSS-BORDER FINANCIAL TRANSACTIONS

Finally, how effectively SOMNEs can be regulated globally will depend on the enforcement mechanism. What is eventually needed is ‘real-time’ enforcement and to avoid any dependence on self-reporting by SOEs.

The Legal Entity Identifier (LEI), mandated by the G20 and overseen by the Global Legal Entity Identifier Foundation, can be made mandatory for all cross-border financial transactions undertaken by SOMNEs. With LEI tracking, Beneficial Ownership information will also become possible, which can help trace and monitor the SOMNEs’ activities. Since the central banks are usually responsible for regulating cross-border financial transactions, they can enforce the use of LEIs on cross-border credit related transactions on both the lender and the borrower. A related proposal to the G20 on creating a global framework for Beneficial Ownership written by policy experts is in the public domain (Vaidyanathan et al.).

APPENDIX

REFERENCES

Bery, S., A. García-Herrero, and P. Weil, “How is the G20 tackling debt problems in the poorest countries?”, Bruegel Blog, 25 February 2021 https://www.bruegel.org/2021/02/how-is-the-g20-tackling-debt-problems-of-the-poorest-countries/

Group of Thirty, “Sovereign Debt and Financing for Recovery”, 2020 https://group30.org/images/uploads/publications/G30_Sovereign_Debt_and_Financing_for_Recovery_after_the_COVID-19_ Shock_1.pdf

Huang T., Rising SOE defaults alarm investors but could benefit the Chinese economy, Peterson Institute for International Economics (PIIE), 2 February 2021 https://www.piie.com/blogs/china-economic-watch/rising-soe-defaults-alarm-investors-could-benefit-chinese-economy#:~:text=State%20firm%20 defaults%20suddenly%20increased,end%20 to%20implicit%20state%20guarantees

International Forum of Sovereign Wealth Funds, “Santiago Principles”, 2008 https://www.ifswf.org/santiago-principles-landing/santiago-principles#:~:text=The%20Santiago%20Principles%20consists%20of,deeper%20understanding%20of%20SWF%20activities.

International Monetary Fund (IMF), “G20 notes on strengthening public debt transparency”, 2018, p. 15 https://www.imf.org/external/np/g20/pdf/2018/072718.pdf

International Monetary Fund (IMF), State Owned Enterprises: The Other Government, chapter 3, p. 49

Maire, J., A. Mazare, and E. Truman, “Sovereign Wealth Funds Are Growing More Slowly, and Governance Issues Remain”, Peterson Institute for International Economics (PIIE), 2021, retrieved 23 April 2021 from https://www.piie.com/sites/default/files/documents/pb21-3.pdf

Pazarbasioglu, C. and C. Reinhart, “Key to Resolving Covid’s global Debt Crunch: Transparency”, Bloomberg, 8 March 2021, retrieved 23 April 2021 from https://www.bloombergquint.com/gadfly/imf-world-bank-need-transparency-on-covid-s-global-debt-crunch

Vaidyanathan K.N., A. Mathur, and P. Modak, “A global framework for tracing Beneficial Ownership”, G20 Insights Platform, 23 June 2018 https://www.g20-insights.org/policy_briefs/a-global-framework-for-tracing-beneficial-ownership/

World Bank, “International Debt Statistics”, 2021, p. vii https://openknowledge.worldbank.org/bitstream/handle/10986/34588/9781464816109.pdf

World Bank, “Debtor Reporting System Manual”, 2000, p. 9 https://databank.worldbank.org/data/download/debt/DRS%20Manual%202013.pdf