The speed of digitalisation is accelerating, but not everywhere at the same pace. Widening digital divides, between and within countries, may disproportionally harm local small and medium sized enterprises (SMEs) in digitally lagging host markets. Without proper policies, these actors, important for their local economies, could be denied access, dismissed from or downgraded in their participation in digitalised global value chains (GVCs). This policy brief reviews the literature and analyses entrepreneur-level, national-level and international trade-dyadic data to provide 11 evidence-based policy recommendations aimed at enhancing GVC inclusivity through (1) supra-national level alignment, (2) country-level policy adjustments and (3) firm-level interventions to stimulate digital entrepreneurship among SMEs.

Challenge

At the end of 2021, global trade hit a record high of US$28.5 trillion. The United Nations Conference on Trade and Development (UNCTAD) reported that all major trading economies saw imports and exports rise above pre-pandemic levels in the fourth quarter of 2021, with trade in goods increasing more strongly in the developing world than in developed countries. Despite the growth, international trade relationships remain in flux due to geopolitical shifts like the United States-China decoupling, the rise in protectionism, the Russia-Ukraine war and the supply chain aftermath of the COVID-19 global health crisis. Underneath these trade volume fluctuations are dramatic structural changes in terms of the rise in dominance of GVCs and digital transformations in trade.

Emergence of GVCs

GVCs are global production and distribution systems, which bring together diverse constellations of economic actors through an increasingly complex regime of global corporate governance, widespread outsourcing of productive functions and new international divisions of labour.[1],[2],[3] Through GVCs, countries trade more than products; they trade know-how and make things together. Imports of goods and services matter as much as exports to successful GVCs.[4] Today, the Organization for Economic Co-operation and Development (OECD) (n.d.) estimates that trade resulting from GVCs accounts for 70 percent of total global trade, while the rest comes from traditional trade, which is the export of final goods and services produced locally.[5] The growth of GVCs is the outcome of a two-centuries-long globalisation process of unbundling production from consumption, in two separate waves.[6] While the first wave primarily lowered the costs of moving products – not those of moving ideas – the industrial activities remained clustered in the developed economies (e.g., the global north). The second wave of innovations in the area of information and communication technology (ICT) also lowered the costs of moving ideas. This accelerated the fragmentation of production by allowing firms to turn their attention to overseas markets in search of discounted costs of input, helping them save a substantial amount of overhead along the way. This practice is known as offshoring. Developing and low-wage economies (e.g. the global south) began to catch up economically when the offshoring of production stages moved to them and it effectively shifted jobs overseas. To ensure that the offshored stages meshed seamlessly with those left onshore, rich-nation firms sent their marketing, managerial and technical know-how along with the production stages that had been moved offshore. As a consequence, the second unbundling – sometimes called the “global value chain revolution” – redrew the international boundaries of knowledge. The status of GVCs in the world is monitored and documented by the UNCTAD-Eora GVC database.[7]

Table 1: Types of GVCs, impact of GVC digitalisation and GVC inclusivity risks

| GVC type | Predominant GVC governance mode | Orchestrating / lead firms | Impact of GVC digitalisation | SME risk in GVC inclusion | ||

| Diversion | Dismissal | Downgrading | ||||

| Contractual | Nestle, Cargill, Nike, Adidas, Levi-Strauss, Uniqlo, Shein, WalMart | Efficiency | H | H | L |

| Relational | Toyota, Ford, Mercedes, SONY, Philips, Asus | Innovation | L | H | H |

| Network | Uber, Grab, Traveloka, Amazon, Shopee | New markets | L | L | L |

| Note: * studies on the global apparel chains (Gereffi 1994; 1999) consumer electronics chains (Kenney and Florida, 1994) and footwear (Schmitz, 1995, 1999; Kaplinsky, 1998). ** Other examples are the global production network (GPN) and industrial chains like medicinal plants (Pauls and Franz, 2013), logistics (Coe, 2014), marine transport and passenger aviation (H Yeung, 2016; Niewiadomski, 2017), tourism (Christian, 2016), investment funds (Dörry, 2015), offshore services (Kleibert, 2016) and renewable energy (Baker and Sovacool, 2016) *** Coviell, Kano and Leisch (2017); 3D printing (Gress and Kalafsky, 2015; Rehnberg and Ponte, 2018) overlapping forces of digitalisation (Foster and Graham, 2017), e-commerce (Li et al., 2019) and technological platforms (Langley and Leyshon, 2017; Humphrey et al., 2018). Based on: Kano, Tsang and Yeung (2020). Global value chains: A review of the multi-disciplinary literature. Journal of international business studies, 51(4), 577-622. | ||||||

The first two rows of Table 1 show the different types of GVCs in agriculture/commodities (Type I), as well as the industrial/manufacturing (Type II) or international production networks (IPNs) that main GVC governance modes are predominant in managing the inter-firm relationships: contractual and relational respectively.

Digital transformation of GVCs

The next projected stage of unbundling – which involves workers in one nation providing services in another nation – is rapidly becoming a common practice through the widespread adoption of digital technologies. Already, pre-COVID-19 in 2018, the World Trade Organization (WTO) announced that global trade had entered a new era, in which a series of innovations that leveraged the internet could have a major impact on trade costs and international trade, and the emergence of a new type of GVC, the digital platforms (see row 3 in Table 1). The Internet of Things (IoT), artificial intelligence (AI), 3D printing and Blockchain have the potential to profoundly transform the way we trade, who trades and what is traded.[8] Digitalisation (including services) will further increase the scale, scope and speed of global trade. It allows firms to bring new products and services to a larger number of digitally connected customers across the world. It also enables firms, notably smaller ones, to use new and innovative digital tools to overcome barriers to growth, helping facilitate payments, enabling collaboration, avoiding investment in fixed assets through the use of cloud-based services and using alternative funding mechanisms such as crowdfunding.[9]

Digital trade as defined by the OECD[10] is based o growing consensus that it encompasses digitally enabled transactions of trade in goods and services that can either be digitally or physically delivered, involving consumers, firms and governments. That is, while all forms of digital trade are enabled by digital technologies, not all digital trade is digitally delivered. For instance, digital trade also involves digitally enabled but physically delivered trade in goods and services such as the purchase of a book through an online marketplace, or booking a stay in an apartment through a matching application. Underpinning digital trade is the movement of data. Data is not only a means of production, but it is also an asset that can itself be traded, and a means through which GVCs are organised and services delivered. It also underpins physical trade less directly by enabling the implementation of trade facilitation. Data is also at the core of new and rapidly growing service supply models such as cloud computing, the IoT and additive manufacturing.[11]

In a recent policy brief, the Asian Development Bank urged countries to facilitate the digital transformation of global trade by making it more seamless and securing greater transparency. Two major impediments need to be dealt with: the lack of global standards and protocols to drive interoperability and the lack of legislation recognising digital trade documents.[12]

The issue at play then, becomes whether ICT and digital technologies advancement could mediate the “north-south” divide. Early indication suggests that the adoption of ICT may play an important role in helping developing countries chip into the GVCs by virtue of lower monitoring costs borne by northern firms in their southern markets, thus encouraging more investments and trade.[13] The WTO estimates that on average, between now and 2030, global trade growth will be 2-percentage-points per annum higher as a result of digital technologies. Furthermore, developing countries’ trade growth will be 2.5-percentage-points per annum higher and the increase in their share of global trade will be more pronounced the faster they can catch up technologically.[14]

The right section of Table 1 shows the impact GVC digitalisation has on the agricultural and commodity GVCs and how that is different from the other two GVC types, industrial chains/GPNs and the digital platform relationships. In these Agrichains, digitalisation helps to make the contractual forms of GVC governance to be more agile and market-efficient. Whereas in industrial GVCs, digitalisation of the chain relationships does not only benefit agility and efficiency, but also innovation and knowledge creation. Finally, the networked GVCs owe their entire existence to digital technologies and create new competitive dynamics and easier access to international markets.

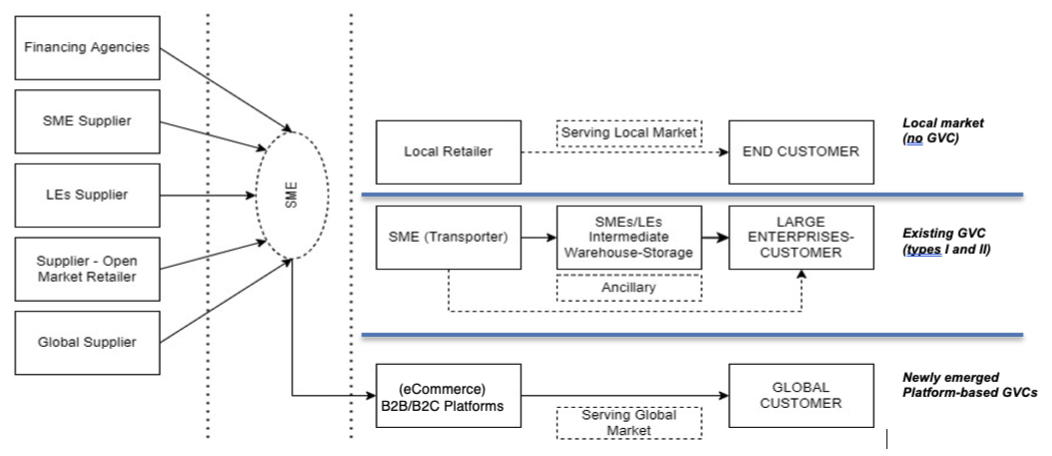

(eCommerce) B2B/B2C Platforms

Figure 1: SMEs and existing and new GVC relationships

Adapted from: Thakkar and Deshmukh (2008)

Trade sustainability multipliers from GVC inclusivity

It has been widely argued that international trade and investment promote economic growth for both developed and developing countries worldwide. GVCs have further spurred investment and the spread of industrial and high-value-added activities in various countries, and it has been proven to promote instead of substitute trade. The share of GVC-related jobs in total employment in a country can get as high as 56 percent (Taiwan, China 2013), but for many countries in the sample, the levels of GVC-related jobs were around 25 percent for advanced economies and 19 percent for emerging economies. [15]. Hence, [host] countries have been supportive to host GVCs with the prospect of receiving various benefits including, among other benefits, the economic multiplier effect of the investment and production activities in the form of GDP, employment and tax revenues, strengthening the domestic value chains as well as the transfer of knowledge and technology.

Despite the proven economic benefits at each involved host country’s aggregate level in the past, we argue that moving forward, the speed by which GVCs digitalise may affect the composition and inclusion of local SMEs.

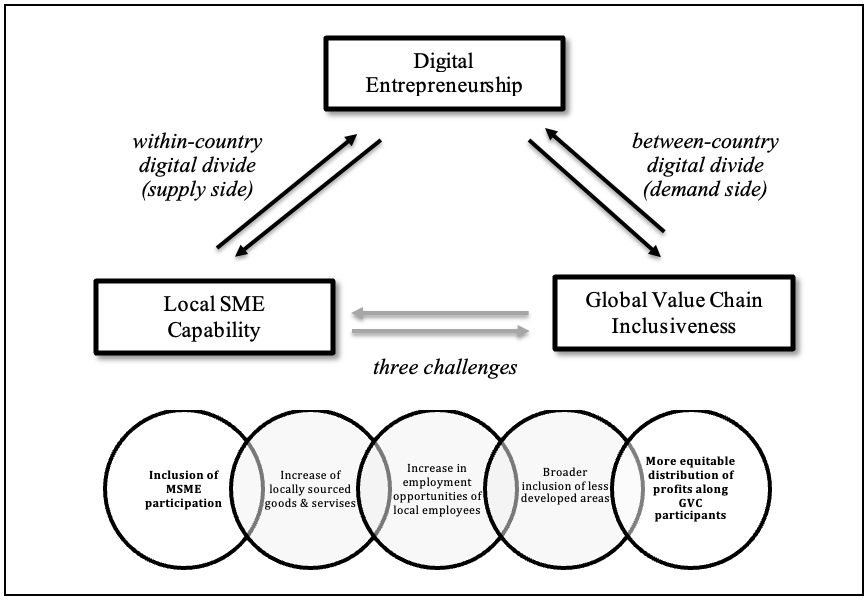

We define GVC inclusivity in two dimensions. The first dimension is the percentage of SMEs participating in one or more GVCs. While micro, small and medium enterprises (MSMEs) have great potential in playing an important role in GVCs by providing inputs and materials to larger companies that make products that are exported, research has shown that many countries’ GVC-adopting SMEs remain few and far between.[16] Other studies echo the low degree of local SME participation in GVCs, including the low rates of labour force localisation by Chinese firms in Africa[17] and Kyrgyzstan.[18] According to Indonesia’s Cooperatives and SMEs Ministry, only 6.3 percent of Indonesia’s MSMEs participate in GVCs, the lowest share in Southeast Asia.[19]

The second dimension of GVC inclusivity is the value local SMEs are contributing to the GVCs. There have been calls for more equitable distribution of GVC profits. When GVCs finally become more inclusive, the distribution of profits along the supply chains is expected to get more equitable and less exploitative.[20] Studies in the agriculture industry, for example, have shown SMEs have suffered unequal distribution of margins along production chains in Kenya and Uganda[21], Vietnam[22] and Colombia[23]; and the electronics industry in the US, Japan, Korea and China.[24] A further indication that GVCs have a long way to go in terms of inclusivity is the low percentage of goods and services sourced locally.

With the entrance of GVCs into lesser-developed economies, multinational companies (MNCs) that orchestrate these movements create both opportunities and threats to local SMEs and entrepreneurs. On the one hand, MNCs procure supplies from local companies and reversely downstream local businesses use MNCs’ products and services as inputs. Highly skilled and educated workers and developed and industrialised provinces of the country disproportionally benefit from the GVCs. On the other hand, GVC-orchestrating MNCs intensify competition for good locations, scarce resources and talented workers. Local SMEs and entrepreneurs struggle with the intensified competition.[25] Especially when GVCs are not inclusive, lower-skilled labourers and less-developed provinces are unable to capture the business opportunities. By making GVCs more inclusive and increasing the local SME participation, favourable trade sustainability multiplier effects are to be achieved. Research has indicated the potential of following three trade sustainability multiplier effects by creating more inclusive GVCs:

- Increase local sourcing; there is a direct correlation between GVC participation and upstream specialisation and levels of local sourcing in Sub-Saharan Africa and Vietnam.[26] Similarly, the OECD found that that GVC exports from countries like Morocco and Tunisia still have low levels of local procurement.[27]

- Increase local employment; more inclusive GVCs can lead to more opportunities for local employees with lower levels of education and skills. Firms that employ skilled workers are more likely to participate in GVCs.[28] Local sourcing, including employment, is lower in nations with lower education spending.[29]

- Wider geographic spreading of economic activities; GVC inclusion is needed because most GVC participants are located in developed areas. In Indonesia, Karawang International Industrial City in Java has become the most popular industrial estate for multinational companies to invest in, compared with the Special Economic Zones (SEZs) outside Java.[30] In addition, it has been noted that investment realisation in SEZs has been modest.

Characterising the impact GVC digitalisation allows us to hypothesise its effect on SMEs excluded from GVC infrastructure. We have identified three types of risks: (1) diversion risks of an SME not getting access to a GVC system, (2) dismissal risks of a GVC-embedded SME getting excluded from its participation in a GVC system and (3) downgrading risks of an SME getting assigned to low value-added activities in the GVC system.

Finally, if GVCs remain low on inclusivity, local legitimacy in the long term may be difficult to maintain. As a result, the governments of host countries may feel obliged to pursue protectionist policies aimed at shielding local businesses or workers from foreign competition, resulting in anti-competitive behaviour and anti-trade or anti-globalization sentiment.[31],[32] GVCs are a powerful driver of productivity growth, job creation and increased living standards.[33]

Proposal

Figure 1 visualises our thesis that stimulating digital entrepreneurship can keep or make GVCs more inclusive while retaining their international competitiveness. It argues that the capacity for SMEs to get access to and benefit from GVCs can be increased through their digital entrepreneurial capabilities. To test this assumption we gathered fresh data from in-depth interviews with 685 digital entrepreneurs in ASEAN-6 countries – Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. We measured the entrepreneurs’ adoption of digital technologies in their business models and their business model experimentation activity, and we found that digital entrepreneurship not only makes a firm more agile and perform better, but it also gains better access to international markets and its export performance improves.[34]

Building SME capability for digital entrepreneurship is related to two parts of the digital divide. As the digital divide is defined as the gap between those who do and do not have access to computers and the internet, we need to distinguish between the within-country digital divide of individuals, households, businesses and geographic areas at different socioeconomic levels in one nation, from the between-countries digital divide, and how this directly affects the way GVCs are designed with implications for GVC inclusiveness. Closing the divide on this level unlocks the potential of moving ideas around the globe.

Figure 1: Digital entrepreneurship ecosystems bridging two types of digital divide

Source: Authors

Within-country digital divide

At the national level, a digital entrepreneurship ecosystem is a country’s physical and digital conditions for SMEs and entrepreneurs to start, grow and thrive. The method we developed encompasses four pillars for the general framework conditions (i.e. cultural and informal institutions, formal institutions, regulation and taxation, market conditions and physical infrastructure) and their associated digital counterparts. Specifically, each framework condition can be digitalised with a suitable measure of a corresponding digital context obtained by variables that reflect the digitalisation of each specific framework condition. Consequently, two versions of each framework condition appear in the index: a non-digitalised version and a digitalised one. In addition to the general framework conditions, we also measured the “systemic” framework conditions, which are the resource-related conditions with a direct effect on the entrepreneurial dynamic in a given country or region. In practical terms, businesses require a range of different resources (i.e. human capital, knowledge creation and dissemination, finance and networking and support) in order to scale up successfully. These resources are not substitutable against one another. Therefore, the systemic framework conditions have to come together to help coproduce the system outcomes.

Our purpose-developed Asian Index for Digital Entrepreneurship Systems (AIDES) database profiles the digital entrepreneurship ecosystems of 21 Asian countries, benchmarked against 92 other countries. AIDES uses the Penalty of Bottleneck algorithm to pinpoint key bottlenecks that hold back the performance of the digital entrepreneurship system in each country. AIDES also includes policy portfolio optimisation analysis, which helps policymakers selectively target policy actions that are most likely to improve the performance of their countries’ digital entrepreneurship systems. An example of a digital entrepreneurship system (DES) for European countries has been published on the European Union portal[35]. Exhibit 1 shows the variance in the AIDES of the G20 member states, ranging from India (AIDES score of 19.6 out of 100) to the USA (79.7). Exhibit 2 compares Germany’s and Indonesia’s DES ecosystems.

Between-country digital divide

The projected 2-percent boost to global trade due to increased digitalisation, as estimated by the WTO, is the average across all international trading relationships. The boost is expected to be higher in international trade relationships where both countries possess equally well-developed digital entrepreneurial ecosystems. The challenges and opportunities in international trade relationships with lower or unequal levels of digital entrepreneurship are very different.

Our analyses of the international trade relationship portfolio of G20 members show that: the five economies that are in the lead for digital entrepreneurship conditions (the US, the United Kingdom, Germany, Canada and Australia) have a highly diverse set of major trade relationships in terms of digital entrepreneurship development. On average, six of their top 10 trading partners are countries that are either equally leading or following digital entrepreneurship development. With around four of their top 10 top relationships those catching up, laggards or tailenders, their ecosystems have a digital edge. For the 11 G20 members that are catchers-up, laggards or tailenders, the situation is different as a large majority of their main trading relationships are further digitally advanced (see Exhibit 3).

Recommendations

In a world of trade with rapidly digitalising GVCs, local SMEs run the risk of getting blocked, excluded or downgraded when they cannot adopt digital technologies fast enough and gain sufficient capabilities. Our policy recommendations are steered in two directions to improve GVC inclusivity through digital entrepreneurship.

- The first direction is to encourage new entrepreneurs to embrace digital technologies to participate in cross-border trade through either direct exports, trading platforms or by joining newly emerged (platform-based) GVCs;

- The second direction is to encourage firms, including SMEs – regardless of their location and owner’s gender – to adopt end-to-end digital technology (systems) to improve their human resource capacity, business processes as well as product competitiveness, thereby qualifying them to be involved in the existing GVCs, and minimising the risk of diversion, dismissal or downgrading SME involvement in GVCs;

Both help to close the within- and between-country digital divide. The step-wise process we recommend is multi-level:

Supra-national level

- Mainstreaming and bringing the digital economy to be the top of the global agenda. The world’s digital economy performs better when more economies develop higher digital economy capabilities, as reflected by their (combined) AIDES scores.

- Addressing security of online transactions

- Cooperation on transaction security, including banking cooperation, ensuring payment collection and preventing scamming.

- Addressing the sufficient conditions that allow digitalisation and digital entrepreneurship to serve as an enabler for trade to flourish

- Continue the trade facilitation agenda, including trading across borders.

- Continue the facilitation for cross-border businesspeople and service mobility.

Country level (policy)

- Identifying digital trading partners.

- Utilising the AIDES methodology to give countries the possibility to find relevant benchmarks by identifying the most digitally advanced trading partners.

- Identifying strengths and weaknesses in a country’s digital framework conditions for entrepreneurship.

- Use the AIDES index to identify or conduct peer comparisons with selected peers.

- Identify relative strengths and weaknesses of self and peers.

- For identified weaknesses in self, study peer’s strengths and identify best practices.

- Form task forces to adopt and implement peer best practices to address weaknesses.

- Identifying the most significant areas to improve by strengthening the country’s digital framework conditions for entrepreneurship.

- Strengthen digital infrastructure, especially in less-developed provinces/regions.

- Strengthen teaching of digital capabilities, with special attention towards female, older and lower education entrepreneurs.

- Insert digital technology for business into school curriculums, especially in entrepreneurship subjects and courses.

- Strengthen accessibility of digital infrastructure, for example by improving the competition and competition policy in the ICT sectors (for cheaper and better services of ICT provision).

- Getting on par with digital trade partners and forging digital trade relationships with key strategic partners.

- For the seven G20 member states that are leaders or followers.

- For the 11 G20 member states that are catchers-up, laggards or tailenders.

- Adopting a regional entrepreneurial ecosystem approach to SME and entrepreneurship policy.

- Nurture regional communities of entrepreneurs and support organisations.

- Emphasise experimentation with digital advances to support innovative business models.

- Facilitate experience exchange and collaboration with peers.

- Support new venture accelerators.

Firm-level intervention

- Building SMEs’ capability for digital entrepreneurship.

- Support digital technology adoption by entrepreneurs by strengthening the reach and openness of the country’s digital infrastructure.

- Provide a mass, country-wide digital technology course.

- Provide free online learning resources on digital technology for SMEs and entrepreneurs.

- Supporting community-level initiatives

- Support digital technology adoption by communities of entrepreneurs.

- Involve business and social communities to accelerate digital technology adoption including socialisation and training of trainers programmes.

- Gaining international market access.

- Short-term: Support digital technology adoption for exporting SMEs with the potential to expand their export markets (SME internationalisation challenges are not only at the pre-export stage i.e., to create exporters, but also at the post-export stage – to avoid sporadic or one-off exporters).

- Short-term: Support digital technology adoption for SMEs with the potential to export (based on product quality, licenses and permits readiness or initial contact with potential foreign buyers).

- Support SME engagement with cross-border digital platforms (e.g., two-sided market platforms), mainly through education on how to offer their products and services through cross-border platforms.

References

ADB (2021) Enabling the Digital Transformation of Global Trade in the New Normal. Policy Brief https://development.asia/policy-brief/enabling-digital-transformation-global-trade-new-normal

Amendolagine, V., Presbitero, A. F., Rabellotti, R., & Sanfilippo, M. (2019). Local sourcing in developing countries: The role of foreign direct investments and global value chains. World Development, 113, 73-88

Amendolagine, V., Presbitero, A. F., Rabellotti, R., & Sanfilippo, M. (2019). Local sourcing in developing countries: The role of foreign direct investments and global value chains. World Development, 113, 73-88

Autio, E., Szerb, L., Komlósi, E.and Tiszberger, M., EIDES 2020 – The European Index of Digital Entrepreneurship Systems, Nepelski, D. (editor), EUR 30250 EN, Publications Office of the European Union, Luxembourg, 2020, ISBN 978-92-76-19444-6, doi:10.2760/150797, JRC120727

Autio, Erkko, Kun Fu, Willem Smit, Anang Muftiadi, Chiraphol Chiyachantana, Pattarawan Prasarnphanich, Phạm Minh Quyên, Raymund Habaradas, Cynthia Castillejos Petalcorin, Yothin Jinjarak, Donghyun Park (2022) Digital Technologies, Business Model Experimentation, and Entrepreneurial Firm Performance. ADB Working Paper.

Baldwin, R. (2018). The great convergence. In The Great Convergence. Harvard University Press.

Basco, S., & Mestieri, M. (2013, October 5). ICT and global supply chains. VOX, CEPR Policy Portal. https://voxeu.org/article/ict-and-global-supply-chains

Bekkers, E., Koopman, R., Sabbadini, G., & Teh, R. (2021). Chapter 1: The impact of digital technologies on developing countries’ trade. In Smeets, M. (ed.) Adapting to the digital trade era: challenges and opportunities. World Trade Organization. https://www.wto.org/english/res_e/ booksp_e/adtera_e.pdf

Cieślik, A., Michałek, J. J., & Szczygielski, K. (2019). What matters for firms? participation in Global Value Chains in Central and East European countries?. Equilibrium. Quarterly Journal of Economics and Economic Policy, 14(3), 481-502.

Dedrick, J., Kraemer, K. L., & Linden, G. (2010). Who profits from innovation in global value chains?: a study of the iPod and notebook PCs. Industrial and corporate change, 19(1), 81-116

French, H.W. (2014). China’s second continent: How a million migrants are building a new empire in Africa. Vintage.

García-Cardona, J. (2016). Value-added initiatives: Distributional impacts on the global value chain for Colombia’s coffee (Doctoral dissertation, University of Sussex).

Gereffi, Gary (1994) ‘The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production networks’, in Gary Gereffi and Miguel Korzeniewicz (eds) Commodity Chains and Global Capitalism, Westport, CT: Praeger, pp. 95–122.

Gereffi, Gary John Humphrey & Timothy Sturgeon (2005) The governance of global value chains, Review of International Political Economy, 12:1, 78-104, DOI: 10.1080/09692290500049805

Held, D., & McGrew, A. (2007). Globalization/anti-globalization: Beyond the great divide. Polity.

Jenkins, R. (2004). Globalization, production, employment, and poverty: debates and evidence. Journal of International Development, 16(1), 1-12.

Kano, L., Tsang, E. W., & Yeung, H. W. C. (2020). Global value chains: A review of the multi-disciplinary literature. Journal of international business studies, 51(4), 577-622.

López González, J. and M. Jouanjean (2017), “Digital Trade: Developing a Framework for Analysis”, OECD Trade Policy Papers, No. 205, OECD Publishing, Paris, https://doi.org/10.1787/524c8c83-en

Masroor, N., & Asim, M. (2019). SMEs in the contemporary era of global competition. Procedia Computer Science, 158, 632-641.

Ministry of Cooperatives and SMEs of Indonesia. (2021). TARGET KEMENKOPUKM: EKSPOR KUMKM TANGGUH DAN MASUK RANTAI PASOK GLOBAL. Retrieved from https://kemenkopukm.go.id/read/target-kemenkopukm-ekspor-kumkm-tangguh-dan-masuk-rantai-pasok-global

Ministry of Industry of Indonesia. (2015). Kemenperin Berikan Penghargaan Kawasan Industri Tahun 2015. Retrieved from https://kemenperin.go.id/artikel/13907/Kemenperin-Berikan-Penghargaan-Kawasan-Industri-Tahun-2015

Mogilevskii, R. (2019). Kyrgyzstan and the Belt and Road Initiative. The University of Central Asia.

Nguyen, V. K., Chu, H. L., & To, L. H. (2015). Vietnam tea industry-an analysis from value chain approach.

OECD (n.d) “Key Topic: Digital Trade – The impact of digitalization on trade” https://www.oecd.org/trade/topics/digital-trade/

OECD. (2018). Making global value chains more inclusive in the MED region: The role of MNE-SME linkages. https://www.oecd.org/mena/competitiveness/BN-Making-global-value-chains-more-inclusive-Beirut-042018.pdf

OECD. (n.d.). Global value chains and trade – OECD. https://www.oecd.org/trade/topics/global-value-chains-and-trade/

Shively, G., Jagger, P., Sserunkuuma, D., Arinaitwe, A., & Chibwana, C. (2010). Profits and margins along Uganda’s charcoal value chain. International Forestry Review, 12(3), 270-283.

Takaaki Kizu, Stefan Kühn, and Christian Viegelahn (2016) “Linking Jobs in Global Supply Chains to Demand,” ILO (International Labour Organization) Research Paper, Geneva, 15.

Thakkar, J., Kanda, A. and Deshmukh, S.G. (2008), “Evaluation of buyer‐supplier relationships using an integrated mathematical approach of interpretive structural modeling (ISM) and graph theoretic matrix: The case study of Indian automotive SMEs”, Journal of Manufacturing Technology Management, Vol. 19 No. 1, pp. 92-124.

UNCTAD (2013), Global Value Chains and Development: Investment and Value-Added Trade in the Global Economy: a preliminary analysis. United Nations Publication UNCTAD/DIAE/2012/1

UNCTAD Global Update Report (February 2022) https://unctad.org/webflyer/global-trade-update-february-2022

Urata, S. (2021). Enhancing SME Participation in Global Value Chains: Determinants, Challenges, and Policy Recommendations. Asian Development Bank Institute.

Van Dijk, M. P. (2008). Global Value Chains: Some Examples and Resulting Issues.

World Bank. (n.d.). Global Value Chains. https://www.worldbank.org/en/topic/global-value-chains/

World Bank. (n.d.). Global Value Chains. https://www.worldbank.org/en/topic/global-value-chains/

WTO (2018). World Trade Report 2018: The future of world trade. How digital technologies are transforming global commerce. https://www.wto.org/english/res_e/publications_e/wtr18_e.htm

WTO (2021). WTO Chairs Programme: Adapting to the digital trade era: challenges and opportunities Edited by Maarten Smeets

Appendix

Exhibit 1: G20 and digital entrepreneurship ecosystems

| G20 member | AIDES | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | Total trading (‘000 USD) | % top 10 | |

| Leaders | United States of America | 79.7 | 75.1 | 78.7 | 100 | 62.9 | 67.7 | 87.8 | 95.7 | 100 | 2,267,279,740 | 76.01 |

| United Kingdom | 69.0 | 81.0 | 81.8 | 95.8 | 44.1 | 62.5 | 73.5 | 82.9 | 77.9 | 648,042,125 | 67.59 | |

| Germany | 64.7 | 73.9 | 83.9 | 79.1 | 59 | 57.7 | 75.1 | 54.4 | 62.4 | 1,182,618,477 | 62.88 | |

| Canada | 62.7 | 77.4 | 59.9 | 69.3 | 39.9 | 83.2 | 69.4 | 62.9 | 81.0 | 446,670,635 | 88.92 | |

| Australia | 61.3 | 68.7 | 74.7 | 64.6 | 43.0 | 76.2 | 57.5 | 64.9 | 68.8 | 203,133,402 | 76.44 | |

| Followers | Republic of Korea | 54.1 | 55.6 | 40.7 | 70.3 | 61.3 | 66.4 | 50.4 | 50.7 | 61.6 | 419,686,849 | 76.08 |

| France | 50.3 | 54.7 | 47.5 | 63.1 | 41.7 | 42.9 | 63.3 | 51.6 | 57.2 | 649,409,445 | 73.97 | |

| Catchers-up | Saudi Arabia | 40.7 | 72.9 | 48.1 | 42.6 | 28.1 | 49.5 | 31.7 | 32.2 | 38.5 | 105,760,593 | 64.71 |

| Italy | 39.7 | 30.2 | 29.4 | 60.3 | 41.2 | 42.1 | 45.1 | 38.6 | 43.7 | 476,203,708 | 63.64 | |

| China | 35.3 | 25.6 | 33.4 | 61.1 | 51.4 | 32.0 | 27.6 | 39.2 | 30.3 | 1,324,075,322 | 63.85 | |

| Laggards | Russian Federation | 33.4 | 28.0 | 19.9 | 47.8 | 52.2 | 33.0 | 36.1 | 31.1 | 35 | 216,028,809 | 65.91 |

| Turkey | 26.9 | 30.9 | 22.7 | 36.3 | 36.7 | 19.1 | 24.5 | 29.8 | 26.3 | 193,277,567 | 62.92 | |

| South Africa | 24.5 | 16.2 | 29.8 | 21.5 | 23.9 | 23.0 | 23.2 | 36 | 29.9 | 84,070,611 | 62.71 | |

| Brazil | 22.7 | 20.0 | 12.4 | 31.5 | 24.4 | 20.1 | 25.0 | 29.3 | 27.5 | 174,912,331 | 70.15 | |

| Argentina | 22.2 | 28.1 | 12.2 | 28.8 | 20.1 | 27.8 | 25.0 | 18.4 | 25.2 | 56,706,909 | 79.59 | |

| Mexico | 20.8 | 17.7 | 17.9 | 22.3 | 28.5 | 18.9 | 21.8 | 19.6 | 24.2 | 413,687,092 | 90.44 | |

| Indonesia | 20.4 | 10.4 | 22.1 | 14.7 | 24 | 29.0 | 22.3 | 22.0 | 30.4 | 164,131,298 | 84.86 | |

| India | 19.6 | 5.3 | 26.4 | 19.8 | 32.4 | 23.1 | 20.8 | 20.1 | 23.0 | 371,662,430 | 61.58 |

Source: AIDES data 2021 for G20 member states

Exhibit 2: Comparison of Germany’s and Indonesia’s DES

| Indonesia Germany |

Exhibit 3: Portfolio analysis of international trading relationships

| Host G20 countries (number) | Percentage of import value of top 10 trading relationships* | High digital disadvantage** | High digital advantage** |

| Leaders (5) | 62.9 – 88.9 | 0-2 | 3-8 |

| Followers (2) | 74.0 – 76.1 | 2-3 | 0-4 |

| Catchers-up (3) | 63.6 – 64.7 | 4-7 | 0-1 |

| Laggards (7) | 62.9 – 84.9 | 5-8 | 0 |

| Tailenders (1) | 61.6 | 8 | 0 |

| *Note: below the Pareto optimum of 80 percent ** A digital disadvantage in a trading relationship is considered when the host country has DES score that is 15 points lower. A digital advantage in a trading relationship means that the host country has 15 DES points higher than the host country. | |||

Exhibit 4: Portfolio examples of a DES laggard and a DES leader

| Indonesia |

| DES INDONESIA Weighted DES top trading partners |

| Germany |

| Weighted DES top trading partners DES GERMANY |

- Gereffi, Gary (1994) ‘The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production networks’, in Gary Gereffi and Miguel Korzeniewicz (eds) Commodity Chains and Global Capitalism, Westport, CT: Praeger, pp. 95–122. ↑

- Gary Gereffi, John Humphrey & Timothy Sturgeon (2005) The governance of global value chains, Review of International Political Economy, 12:1, 78-104, DOI: 10.1080/09692290500049805 ↑

- For a recent review on the literature: Kano, L., Tsang, E. W., & Yeung, H. W. C. (2020). Global value chains: A review of the multi-disciplinary literature. Journal of international business studies, 51(4), 577-622. ↑

- World Bank. (n.d.). Global Value Chains. https://www.worldbank.org/en/topic/global-value-chains/ ↑

- OECD. (n.d.). Global value chains and trade – OECD. https://www.oecd.org/trade/topics/global-value-chains-and-trade/ ↑

- Baldwin, R. (2018). The great convergence. In The Great Convergence. Harvard University Press. ↑

- UNCTAD (2013), Global Value Chains and Development: Investment and Value-Added Trade in the Global Economy: a preliminary analysis. United Nations Publication UNCTAD/DIAE/2012/1 ↑

- WTO (2018). World Trade Report 2018: The future of world trade. How digital technologies are transforming global commerce. https://www.wto.org/english/res_e/publications_e/wtr18_e.htm ↑

- WTO (2021). WTO Chairs Programme: Adapting to the digital trade era: challenges and opportunities Edited by Maarten Smeets ↑

- López González, J. and M. Jouanjean (2017), “Digital Trade: Developing a Framework for Analysis”, OECD Trade Policy Papers, No. 205, OECD Publishing, Paris, https://doi.org/10.1787/524c8c83-en ↑

- OECD (n.d) “Key Topic: Digital Trade – The impact of digitalisation on trade” https://www.oecd.org/trade/topics/digital-trade/ ↑

- ADB (2021) Enabling the Digital Transformation of Global Trade in the New Normal. Policy Brief https://development.asia/policy-brief/enabling-digital-transformation-global-trade-new-normal ↑

- Basco, S., & Mestieri, M. (2013, October 5). ICT and global supply chains. VOX, CEPR Policy Portal. https://voxeu.org/article/ict-and-global-supply-chains ↑

- Bekkers, E., Koopman, R., Sabbadini, G., & Teh, R. (2021). Chapter 1: The impact of digital technologies on developing countries’ trade. In Smeets, M. (ed.) Adapting to the digital trade era: challenges and opportunities. World Trade Organization. https://www.wto.org/english/res_e/ booksp_e/adtera_e.pdf ↑

- Takaaki Kizu, Stefan Kühn, and Christian Viegelahn (2016) “Linking Jobs in Global Supply Chains to Demand,” ILO (International Labour Organization) Research Paper, Geneva, 15. ↑

- Urata, S. (2021). Enhancing SME Participation in Global Value Chains: Determinants, Challenges, and Policy Recommendations. Asian Development Bank Institute. ↑

- French, H.W. (2014). China’s second continent: How a million migrants are building a new empire in Africa. Vintage. ↑

- Mogilevskii, R. (2019). Kyrgyzstan and the Belt and Road Initiative. University of Central Asia. ↑

- Ministry of Cooperatives and SMEs of Indonesia. (2021). TARGET KEMENKOPUKM: EKSPOR KUMKM TANGGUH DAN MASUK RANTAI PASOK GLOBAL. Retrieved from https://kemenkopukm.go.id/read/target-kemenkopukm-ekspor-kumkm-tangguh-dan-masuk-rantai-pasok-global ↑

- Van Dijk, M. P. (2008). Global Value Chains: Some Examples and Resulting Issues. ↑

- Shively, G., Jagger, P., Sserunkuuma, D., Arinaitwe, A., & Chibwana, C. (2010). Profits and margins along Uganda’s charcoal value chain. International Forestry Review, 12(3), 270-283. ↑

- Nguyen, V. K., Chu, H. L., & To, L. H. (2015). Vietnam tea industry-an analysis from value chain approach. ↑

- García-Cardona, J. (2016). Value-added initiatives: Distributional impacts on the global value chain for Colombia’s coffee (Doctoral dissertation, University of Sussex). ↑

- Dedrick, J., Kraemer, K. L., & Linden, G. (2010). Who profits from innovation in global value chains?: a study of the iPod and notebook PCs. Industrial and corporate change, 19(1), 81-116 ↑

- Masroor, N., & Asim, M. (2019). SMEs in the contemporary era of global competition. Procedia Computer Science, 158, 632-641. ↑

- Amendolagine, V., Presbitero, A. F., Rabellotti, R., & Sanfilippo, M. (2019). Local sourcing in developing countries: The role of foreign direct investments and global value chains. World Development, 113, 73-88 ↑

- OECD. (2018). Making global value chains more inclusive in the MED region: The role of MNE-SME linkages. https://www.oecd.org/mena/competitiveness/BN-Making-global-value-chains-more-inclusive-Beirut-042018.pdf ↑

- Cieślik, A., Michałek, J. J., & Szczygielski, K. (2019). What matters for firms? participation in Global Value Chains in Central and East European countries?. Equilibrium. Quarterly Journal of Economics and Economic Policy, 14(3), 481-502. ↑

- Amendolagine, V., Presbitero, A. F., Rabellotti, R., & Sanfilippo, M. (2019). Local sourcing in developing countries: The role of foreign direct investments and global value chains. World Development, 113, 73-88 ↑

- Ministry of Industry of Indonesia. (2015). Kemenperin Berikan Penghargaan Kawasan Industri Tahun 2015. Retrieved from https://kemenperin.go.id/artikel/13907/Kemenperin-Berikan-Penghargaan-Kawasan-Industri-Tahun-2015 ↑

- Jenkins, R. (2004). Globalization, production, employment and poverty: debates and evidence. Journal of International Development, 16(1), 1-12. ↑

- Held, D., & McGrew, A. (2007). Globalization/anti-globalization: Beyond the great divide. Polity. ↑

- World Bank. (n.d.). Global Value Chains. https://www.worldbank.org/en/topic/global-value-chains/ ↑

- Autio, Erkko, Kun Fu, Willem Smit, Anang Muftiadi, Chiraphol Chiyachantana, Pattarawan Prasarnphanich, Phạm Minh Quyên, Raymund Habaradas, Cynthia Castillejos Petalcorin, Yothin Jinjarak, Donghyun Park (2022) Digital Technologies, Business Model Experimentation, and Entrepreneurial Firm Performance. ADB Working Paper. ↑

- Autio, E., Szerb, L., Komlósi, E.and Tiszberger, M., EIDES 2020 – The European Index of Digital Entrepreneurship Systems, Nepelski, D. (editor), EUR 30250 EN, Publications Office of the European Union, Luxembourg, 2020, ISBN 978-92-76-19444-6, doi:10.2760/150797, JRC120727 ↑