This policy brief explores how African countries can leverage digitalization and ICTs to further their goal of industrialization. With increasing digitization of global manufacturing, there is a risk that opportunities for African countries to industrialize will erode. The world economy is already undergoing a trend where historically labour-intensive production is being “reshored” to “smart” factories in developed and emerging economies. This policy brief explores strategies for enhancing African economies’ manufacturing capabilities, especially in the traditional labour-intensive sectors through leveraging Information and Communication Technologies (ICTs).

Challenge

Industrialization is pivotal to Africa’s long-term development and broadening and deepening the manufacturing sector will build more resilient economies. Africa is endowed with vast resources – in agriculture, mining, and maritime resources, as well as a youthful labor force, which if properly harnessed, can stimulate a resource-based industrialization strategy (ECA and African Union, 2013). Historically, industrial development has been key to sustained, inclusive and job-rich development due to the high productivity growth, labor intensity, productivity spillovers and forward and backward linkages that the industrial sector has with the rest of the economy (ECA, 2015; Signé and Johnson, 2018).

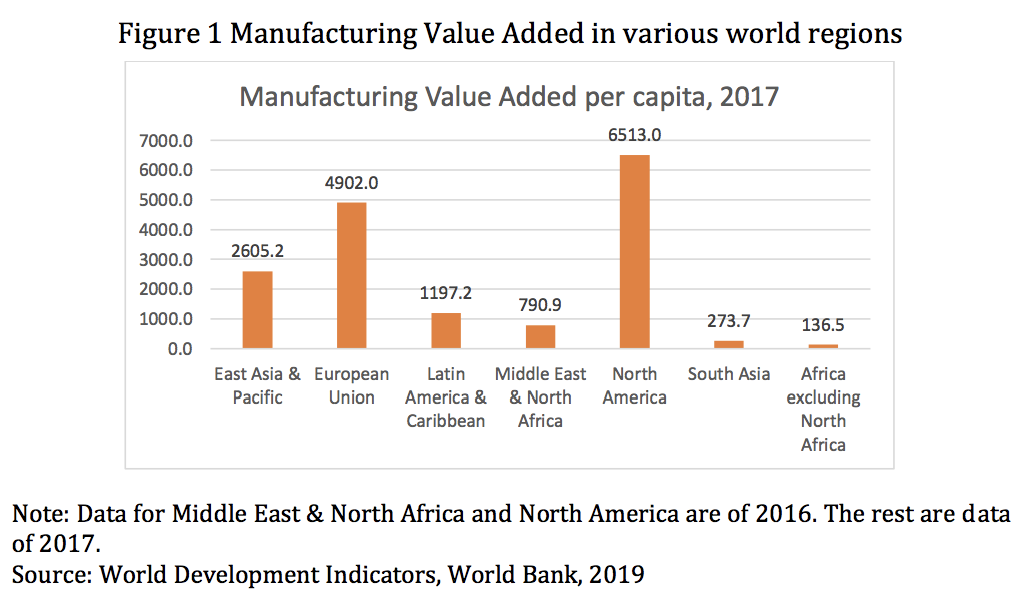

Notwithstanding these virtues of industrialization, the story of Africa is one of de-industrialization overall, with the share of manufacturing in GDP hovering around 10% for most countries while falling in some (Banga and te Velde, 2018). It appears African countries have, until now, failed to capitalize on the opportunities to industrialize, especially in light of the rising labor costs in advanced countries, and in many emerging Asian economies, in particular, China. The contrast with East Asia, which is often cited as a development model for Africa, could not be starker. Manufacturing value added in East Asia and developing Asia is much higher than in Africa (Figure 1).

Given its labor abundance, Africa needs to diversify into the export of low value manufactures and services and integrate into global value chains (1). This however requires enhanced productivity in the relevant sectors. The challenge for industrialization in Africa is how to leverage digitalization and information technologies to drive competitiveness of African manufacturing, and industrial development more generally. Digitalization of the economy is often viewed as being associated with the large-scale introduction of labor-saving technologies, requiring appropriate skills development for the labor-force (and general citizenry) across the region, in order to take advantage of digitalization. This, however, cannot be the focus for Africa, especially given the youth employment challenge in the region. There is need to leverage ICT technologies to support growth of productive sectors, especially those industrial sectors with high labor-intensity and strong backward and forward linkages. In addition to African manufacturers directly benefiting from the use of digital technologies, African governments can also use such technologies in public administration to enhance service delivery to (directly or indirectly) support the continent’s industrialization.

Cutting-edge digital technologies such as automation are increasingly eroding the comparative advantage of low labor cost regions, including Africa. This thus requires African countries to embrace these technologies to enhance their competitiveness in producing manufactures. Indeed, erosion is already happening to some extent with the rise of ‘re-shoring’ in advanced economies as it becomes cheaper for such economies to produce manufactures domestically with the adoption of labor-saving technologies (Banga and te Velde, 2018). For now, African countries still have the opportunity to grow their market share in the global market for manufactured goods, as automation and re-shoring have not yet affected some sub-sectors of manufacturing. That notwithstanding, there is need for African countries to adopt digitization and ICTs in manufacturing processes in order to reap the efficiency and productivity gains that come with these technologies, allowing African producers to at least keep pace with global developments, and thus maintain their competitive edge against reshoring. Indeed, ICT innovations, such as M-Pesa in Kenya, could easily be adapted to support industrialization efforts in the continent. This is important as services are increasingly becoming a key and integral component of manufacturing (Hoekman, 2018). In the longer term, the high level of concentration and barriers to entry in the global market for digital services is likely to increase the cost of these to African and other manufacturers (2).

Opportunities

There are opportunities available to African countries to develop their industrial sectors. These include: active industrial policies on manufacturing (3); investment in infrastructure and human capital (4); and digitization and ICTs. While these are all essential, we focus below on “digitization and ICTs”.

Digitization and ICTs

Beyond efforts to help African manufacturers to better access digital inputs, African Governments can also use digital technologies to enhance public administration’s support for industrialization. Digitization can help enhance the efficiency and productivity of services associated with manufacturing, including customs administration, general logistics, etc, thereby enhancing industrial development. In particular, digitization of customs administration can help improve customs efficiency, reduce trade costs and thus promote greater intra-African trade (particularly in the context of the African Continental Free Trade Area (AfCFTA)), which, in turn, would support greater industrial development on the continent. There are a number of digital innovations in customs administration and related trade barriers that can reduce trade costs, including costs of customs clearance and trade document preparation (United Nations, 2017). One such innovation is electronic single windows, which have proven to be a cost-effective intervention to reduce trade costs in Africa (see e.g. African Alliance for Electronic Commerce, 2013).

The benefits of ICTs and e-commerce, however, do not materialize automatically or smoothly – the returns to e-commerce differ significantly across different economies and industries, depending on their ability to adapt to the digital economy. Further, the 4th industrial revolution could yield greater inequality, particularly in its potential to disrupt labor markets. As automation substitutes for labor across the entire economy, the net displacement of workers by machines might exacerbate the gap between returns to capital and returns to labor. On the other hand, it is also possible that the displacement of workers by technology will, in aggregate, result in a net increase in safe jobs. Regardless of which of the two scenarios is likely to emerge, major disruptions to labor markets in terms of the growth in wholly new occupations require new ways of organizing and coordinating work, new skills requirements in all jobs and new tools to augment workers’ capabilities” (World Economic Forum, 2016) .

We cannot foresee at this point which scenario is likely to emerge, and history suggests that the outcome is likely to be some combination of the two. It is in this milieu that carefully planned industrial and HRD skills policy should be crafted and calibrated to ensure a just transition into the 4th industrial economy.

At the regional level and particularly in the AfCFTA context, reductions in trade costs are forecast to have substantial positive impacts on intra-African trade, and thus welfare across the continent (Mevel and Karingi, 2013; DepetrisChauvin and others, 2016; Valensisi, Lisinge and Karingi, 2016). Given the high share of manufactures in intra-African trade, reductions in trade costs resulting from digitization should promote industrialization in Africa (5). In addition, providing African manufacturers an opportunity to export within the African market could provide a springboard to global markets. In particular, integration into regional value chains tends to support greater integration into global value chains (and potentially capture higher value-added activities, which tend to provide better employment prospects and have greater effects on output – see ECA, 2015) than trade integration with the rest of the world. This is because international value chains are mostly regional (International Trade Centre, 2017). Further, African markets tend to be less standardsintensive than non-African export markets meaning that African manufacturers are more likely to be able to export to such markets, providing opportunities for learning and thus quality and productivity enhancements (see for instance, Bigsten and others, cited from Collier, 2007). Therefore, technology enabled intra-African trade can help raise productivity of African firms, positioning them to compete globally.

Using digitization to reduce non-tariff barriers to trade (NTBs) should boost intra-African trade in manufactures. Full implementation of the AfCFTA is itself expected to have significant positive impacts on the continent’s industrialization (ECA, African Union and African Development Bank, 2017). Yet currently, implementation of paperless trade measures (trade facilitation using digital technology) in Africa remains very limited (United Nations, 2017). This suggests further measures are needed in this regard. Intra-African ecommerce strategies can also help to boost intra-African trade, especially since e-commerce is relatively under-developed in Africa (see UNCTAD B2C ecommerce index 2017).

Proposal

We ask African and G20 leaders to take urgent and decisive action to harness digital technologies to support Africa’s industrialization.

A. African countries should adopt active industrial policies and urgently use a range of industrial policy tools to support African manufacturers’ access to digital services to strengthen their businesses, with financial and technical support from G20 countries.

In order for digitization and other ICTs to augment manufacturing competitiveness in Africa, African countries need to pursue a range of different active industrial policies to strengthen manufacturing sectors. Such policies include developing and building ICT backbone infrastructure, including fiber and submarine cables; developing appropriate technical skills, achieving better financing for digitalization (through attracting private investment in the sector (6) and supplementing this through the use of public funds where appropriate (7)), taxes and incentives, boosting firm capabilities, the development of national innovation systems and related ICT infrastructure, and facilitating integration (both backward and forward) (8) of digital service providers into global value chains (Banga and te Velde, 2018). G20 countries can provide financial and technical support to Africa to institute these policy reforms and to implement the relevant programs.

B. Africa and G20 countries should establish a framework for ensuring that the transformative impact of technology is directed towards the SDGs

In the current global economy, characterized by a huge digital divide and dominance of multinational companies (MNCs) in global value chains, appropriate and strategic industrial policies by African countries are needed to reap the benefits of digital economy for structural transformation and to ensure that the transformative impact of technology is directed towards the SDGs. The framework should emphasize the impact of digitalization on industrial development that integrate a rethinking of governments on the education system, labor markets and governance dimension of the digital economy. One of the other key policy questions confronting African policy makers is the extent to which investments made in education and vocational training are preparing citizens for the digital economy, and how governments and other stakeholders can assist citizens to manage the transition. The challenge is compounded by the failure to generate sufficient formal sector jobs for the young which is fueled by scarcity of fiscal resources, with many African countries experiencing high levels of debts, limiting their capacity to borrow. The framework should include building data and cloud computing infrastructure, enhancing digital skills as well as financial and technical co-operation, technology transfer and flexible approaches to intellectual property that balance incentives for innovation with the public interest of broader access to technology.

Also, the digitalization strategy for manufacturing sectors should address the governance challenges; these include supporting the adoption of legal frameworks in Africa providing for both ownership of data and sharing it at the regional level (9) , supporting the upgrading of regional digital infrastructure and developing anti-trust policies to address the challenges posed by large global tech firms. Finally, African countries should also regulate the cross-border supply of digital services and prioritize liberalization of intra-African trade in digital services through AfCFTA negotiations.

C. Continuous improvement of processes in manufacturing, management and supporting business practices, with financial and technical support from G20 countries.

Africa’s trade and investment relationships with G20 economies can be leveraged to enhance quality of products and to raise productivity and thus global competitiveness of African manufacturers. African firms and producers can potentially benefit, in terms of productivity and managerial process improvements, from FDI spill-overs and from adopting and, where necessary, adapting managerial approaches – such as KAIZEN – that have been perfected elsewhere. The efficacy of these initiatives has been proven in many African economies, especially in selected sectors such as autos, leather and textiles. In addition, IT use may also address the deficiencies in various managerial skills. Another challenge in Africa is the lack of opportunities for the disadvantaged groups (low income families, women entrepreneurs etc.) who do not have adequate formal training. The “embedded” knowledge in technologies, such as the use of mobile payments which helps in preparing the proper bookkeeping without the formal knowledge of accounting, can be very helpful to disadvantaged groups and small and micro enterprises.

D. G20 countries should provide financial and technical support for African countries to use advanced technologies to improve their customs and tax administrations, intra-African trade by implementing paperless trade reforms and facilitating intra-African e-commerce.

Tax administrations in Africa can leverage new technologies to mobilize additional resources by allowing automatic electronic exchange of invoices used at import and export to ensure that they have not been re-invoiced (a common practice – see ECA, 2018; Hakelberg, 2018; Monkam and others, 2018). In addition, broader digitalization of tax and customs administration can allow data to be more easily analyzed by automated risk models to identify cases that carry a high risk of tax evasion or unlawful tax avoidance. This can also help countries to more easily analyze patterns in accounting and firms’ transactions, helping them to identify which legal tax avoidance techniques are most commonly used, so that they may close the associated loopholes. African countries should try to access country-by-country MNC reports by requiring that the corporations operating in their territories file their country-by-country reports locally.

The WTO Trade Facilitation Agreement offers an opportunity for African member countries to mobilize financial and technical support for trade facilitation measures such as paperless trade reforms and the digitalization of customs administration. This is because the Agreement provides for countries to designate trade facilitation (including digital trade facilitation) measures that they will only implement upon receipt of financial and technical support from rich (G20) countries. Yet so far, only 19 out of 47 African countries that are members have notified the measures for which they will require technical and financial support. As such, African countries may need to be more proactive in notifying such measures (WTO, 2019a and 2019b). G20 countries should also work with African countries that are not WTO members to support the implementation of similar reforms. Furthermore, G20 countries should provide financial and technical support to the remainder of the AfCFTA negotiations and ratification. However, due to concerns among some African countries around conflicts of interest for technical support provided so far to the negotiations, G20 countries may do well to provide such support through institutions that African countries know and trust, for instance, the African Development Bank, UNECA, etc.

To boost intra-African e-commerce, the following tools could be considered: ecommerce readiness assessment and strategy formulation; ICT infrastructure and services; trade logistics and trade facilitation; payment solutions; legal and regulatory frameworks; knowledge and skills development; and access to financing for digital entrepreneurs. At the same time, it is important to consider changes in tax policy to ensure that e-commerce does not undermine tax collection that is used for the domestic spending on industrial policies needed to achieve industrialization.

References

• African Alliance for Electronic Commerce. 2013. Guidelines for Single Window Implementation in Africa. Dakar: African Alliance for Electronic Commerce.

• Banga and Te Velde (2018). DIGITALISATION AND THE FUTURE OF MANUFACTURING IN AFRICA. Available from https://set.odi.org/wpcontent/uploads/2018/03/SET_Digitalisation-and-future-of-Africanmanufacturing_Final.pdf. Accessed 14 and 15 January 2019.

• COLLIER, P. (2007). The bottom billion: why the poorest countries are failing and what can be done about it. Oxford, Oxford University Press.

• Conde, Carlos, Philipp Heinrigs and Anthony O’Sullivan. (2015). “Tapping the Potential of Global Value Chains for Africa.” The African Competitiveness Report 2015. OECD. Paris.

• Depetris-Chauvin, Nicolas, M. Priscilla Ramos and Guido Porto (2016). “Trade, growth, and welfare impacts of the CFTA in Africa”. Available from https://editorialexpress.com/cgibin/conference/download.cgi?db_name=CSAE201 7&paper_id=749.

• ECA and African Union (2013). Making the Most of Africa’s Commodities: Industrializing for Growth, Jobs and Economic Transformation Economic Report on Africa 2013. ECA: Addis Ababa.

• ECA (2013). Building trade capacities for Africa’s transformation: A critical review of aid for trade. ECA: Addis Ababa.

• ECA and African Union (2014). Dynamic Industrial Policy in Africa: Innovative Institutions, Effective Processes and Flexible Mechanisms Economic Report on Africa 2014. ECA: Addis Ababa.

• ECA (2015). Economic Report on Africa 2015: Industrializing through Trade. ECA: Addis Ababa.

• ECA (2016). Transformative Industrial Policy for Africa. ECA: Addis Ababa.

• ECA (2017). EXPANDING AND STRENGTHENING local entrepreneurship for structural transformation in Africa. ECA: Addis Ababa.

• ECA (2018). Base Erosion and Profit Shifting in Africa: Reforms to facilitate improved taxation of multinational enterprises. ECA: Addis Ababa.

• ECA, African Union and African Development Bank (2017). Assessing Regional Integration in Africa VIII: BRINGING THE CONTINENTAL FREE TRADE AREA ABOUT. ECA: Addis Ababa.

• The Global Competitiveness Report 2017–2018.

• Hakelberg, Lukas (2018). Their hands untied but still imprisoned? National tax policy under the automatic exchange of information. Presentation made at the conference Paradise Lost? Inequality and Tax Justice held in Lima, 13 to 14 June 2018.

• International Trade Centre. (2017). “Promoting SME Competitiveness in Africa. International Trade Centre: Geneva.

• Mayer, J (2018) Digitalization and industrialization: friends or foes? UNCTAD Research Paper No. 25 UNCTAD/SER.RP/2018/7.

• Mckinsey Global Institute. (2016). Lions on the Move II: Realizing the Potential of Africa’s Economies.

• Mevel, S. and Karingi, S. (2013). TOWARDS A CONTINENTAL FREE TRADE AREA IN AFRICA: A CGE MODELLING ASSESSMENT WITH A FOCUS ON AGRICULTURE. In Cheong, D., Jansen, M. and Peters, R (eds.). Shared Harvests: Agriculture, Trade, and Employment. International Labour Office and United Nations Conference on Trade and Development.

• Monkam, Nara, Ibrahim, Gamal, Davis, William and von Haldenwang, Christian (2018). Tax Transparency and Exchange of Information (EOI): Priorities for Africa. Available from https://t20argentina.org/wp-content/uploads/2018/07/TF5-5.2- Taxation.pdf. Accessed 15 January 2019.

• Signé, L. and Johnson C. (2018). “The Potential of Manufacturing and Industrialization in Africa.” The Brookings Institution. New York.

• United Nations (2017). Trade Facilitation and Paperless Trade Implementation Global Report 2017. Available from https://www.unescap.org/sites/default/files/Global%20Report%20Final_26%20O ct%202017.pdf. Accessed 14 January 2019.

• United Nations Conference on Trade and Development (2019). Merchandise: Intratrade and extra-trade of country groups by product, annual. Available from http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx. Accessed 15 January 2019.

• United Nations Economic Commission for Europe. Not dated. Retrieved from http://www.unece.org/fileadmin/DAM/cefact/single_window/draft_160905.pdf.

• Valensisi, G., Lisinge, R. and Karingi, S. (2016). The trade facilitation agreement and Africa’s regional integration. Canadian Journal of Development Studies / Revue canadienne d’études du développement, 37:2, 239-259, DOI: 10.1080/02255189.2016.1131672

• WTO (2019a). Members and Observers. Available from https://www.wto.org/english/thewto_e/whatis_e/tif_e/org6_e.htm. Accessed 15 January 2019. • WTO (2019b). Notifications list. Available from https://www.tfadatabase.org/notifications/list?notificationtype=c. Accessed 15 January 2019.