The COVID-19 pandemic has led many countries to initiate unprecedented economic recovery packages. G20 policy makers tackling the health crisis, which is far from over, have also been encouraged to prioritise strategies which help to mitigate another looming crisis of climate change. Among the policy interventions that support climate change mitigation, promoting investments in labour intensive green infrastructure, establishing a private financing catalysing facility, and designing ambitious carbon pricing schemes are found to boost economic recovery in the short and medium term. In this sense, this policy brief recommends that ministries of finance, energy, and economy accelerate the deployment of these three risk mitigation mechanisms as part of stimulus packages to achieve long-term sustainability goals.

Challenge

The developing, emerging and advanced economies of the world have been structurally transformed by the COVID-19 crisis. The cumulative economic and financial impacts were estimated to be much worse than that of the 2008 global financial meltdown (Engstroem et al. 2020).

As countries around the world rush to repair their battered economies, G20 leaders must decide what type of economic recovery they want to promote. Will they choose policy measures that reinforce old economic structures, particularly those which will further lock-in carbon intensive development? Or will they see COVID-19 as a once-in-a-generation opportunity to build in a better future that significantly improves sustainability outcomes? As this brief will argue, polices that support low-carbon transition are crucial to ensure an economically resilient future, especially for the G20’s large developing countries.

Moreover, resetting policy measures during the pandemic is critical for three reasons. First, developing and emerging economies need to resume the battle against climate change that was interrupted by the COVID-19 pandemic. Heat waves, droughts, floods, and cyclones have become more intense and frequent in developing countries. Recent research has found that impacts of climate change on agriculture, tourism, energy demand, and labour productivity will collectively result in the loss of about 8-11% of the world’s combined annual economic growth by the end of the century (IPCC 2017). Second, stimulus policies combined with appropriate skill development programmes generated more jobs in low-carbon sectors such as renewable energy and resource efficient and services development. For example, Garrett-Peltier (2017) and Engstroem (2020) found that every US$ 1 million spent on renewable energy created 7.5 full time jobs and every US$ 1 million spent on energy efficiency created 7.2 full time jobs, which is significantly more than the 2.7 jobs generated from the same investment in fossil fuels in the 2008 financial stimulus packages. Third, policies that support internalising externalities such as carbon pricing can strengthen the long-term competitiveness of industries in emerging markets that cater to the needs of advanced economies, which increasingly demand low-carbon products (WEF 2020). Setting the right policies would also ensure foreign direct investments from the growing number of multinational companies that have made public commitments to move toward a Net Zero future (ETC 2020). However, the economic recovery measures announced by several developing and emerging G20 economies are not well harmonised to combat climate change and achieve co-benefits such as job creation and social inclusion (Vivid Economics 2021). Placing these countries onto a low-carbon green growth pathway requires coordinated risk mitigation policies and investment enablers.

Proposal

The global pathway to meet Paris Agreement targets by 2030 and net zero emissions by 2050 requires all governments to significantly strengthen and then successfully implement their energy, climate, economic and fiscal policies. At the first Summit in the aftermath of the 2008 financial crisis, the leaders of the G20 countries promised to use fiscal measures to stimulate consumer demand in green products and services as well as the rapid recovery of the global economy, especially as conventional policy appears to have reached its limit in many countries. The G20 Energy and Environmental Ministers’ meetings held in Germany (2017), Japan (2019) and Saudi Arabia (2020) also agreed to undertake necessary policy reforms to mobilise private capital for lowcarbon energy transition. Leading G20 economies have announced economic stimulus packages that will pump approximately US$ 3.7 trillion directly into sectors that have a large and lasting impact on carbon emissions and nature, namely agriculture, forestry, industry, waste and energy and transport. However, the Greenness of Stimulus Index (GSI) shows that developing G20 economies have so far largely failed to harness the opportunity (Vivid Economics 2021). Packages in parts of Europe, South Korea and Canada offer more promise for low-carbon green growth. Regardless of economic structure or past performance in meeting climate stabilisation goals, each country can steer its recovery and stimulus packages to support low-carbon green growth with the following three clear sets of policy tools.

DESIGN AND IMPLEMENT INVESTMENTS THAT BRING IMMEDIATE DEVELOPMENTAL CO-BENEFITS

The quality, content and strength of the stimulus investments will determine both socio-economic and environmental outcomes for decades to come. Developing countries have a unique opportunity to design recovery packages that create the right jobs and build a better future. The right investments will need to be fast, labour intensive in the short run, and have higher multiplier co-benefits in the long run. Investments with these characteristics include low-carbon energy infrastructure such as renewable assets, building energy efficiency, smart transport, innovations in green technologies, urban waste management, and restoration of degraded forests. Implementing investment decisions on those assets will maximise cobenefits in at least three major ways: boosting demand, creating jobs for the local work force and maximising pollution prevention (Anbumozhi, Kalirajan, and Kimura 2018).

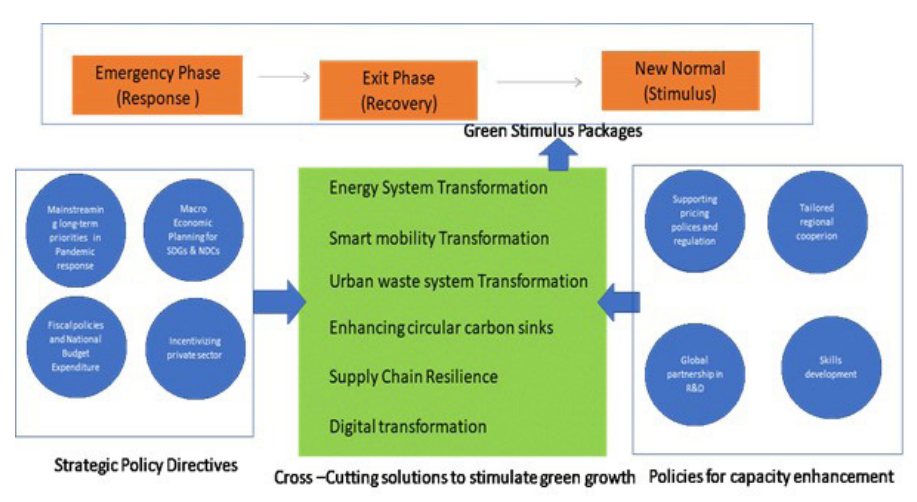

Fig 1 An outlook for integrating long-term low-carbon green growth objectives in pandemic Recovery and Stimulus packages

A well-articulated low-carbon green growth strategy, as shown in Figure 1, designed to harness emerging digital technologies and principles of circular economy, with strategic policy directives for inclusive growth and capacity building has the potential to bring tangible long-term benefits. In this regard, the South Korean stimulus packages place emphasis on green and digital investments. Japan, the European Union, and China’s long-term decarbonisation strategies or Net Zero emission targets also provide helpful guidance. Nevertheless, the differences between G20 country stimulus packages reflect the immediate green technology solutions that are available to them, their commitment to Paris Climate Agreement and existing fiscal space. But there are challenges and trade-offs in aligning short term stimulus measures with long-term sustainability goals. In countries with inadequate or less ambitious climate mitigation targets and financing polices, new short-term investments are likely to reinforce unsustainable trajectories. Almost all developing countries within the G20 entered the pandemic emergency phase still producing significant carbon emissions, air and water pollution. Many countries also lack sectoral targets to absorb targeted technology interventions. As a result, the recovery packages announced during the exit phase risk reinforcing a status quo that significantly tilted towards negative environmental outcomes, amplifying climate risks in the medium term. But challenges common to both developed and developing countries include the required behavioural changes by households and affordability of new low-carbon technologies (Cable 2016). For developing countries, the challenges are that stimulus packages should have balanced implementation of climate change adaptation and emissions reductions measures, while improving economic growth and poverty reduction.

UPSCALE BANKABLE PROJECTS WITH THE ESTABLISHMENT OF A LOW-CARBON FINANCE CATALYSING FACILITY

Economic recovery and stimulus packages are to be implemented in an ecosystem in which several large-scale low-carbon infrastructure investments in developing countries have already been cancelled or postponed due to the pandemic (Anbumozhi 2021). Governments can assess these projects and get them restarted, which will help to reduce cost overruns from interruptions in project implementation. But there are also many smaller-scale projects that have strong multiplier co-benefit effects in terms of local economic growth, employment, and climate payoffs, and can be implemented fast. Nevertheless, two fundamental and persistent gaps exist as barriers to the quantity and quality of low-carbon investment needed. First, countries are often unable to transform the tremendous developmental needs and climate change mitigation opportunities into a concrete pipeline of bankable projects, due to the inherent complexities of infrastructure investment such as its long-term nature, interconnectedness, social impacts, and positive and negative externalities, as well as policy and institutional impediments (Bhattacharya et al. 2020). Second, despite the large pool of available savings, mobilising long-term finance at reasonable cost to match the risks of the project cycle and ensuring that finance is well-aligned with Nationally Determined Contributions (NDC) targets remains a widespread challenge (Chen et al. 2020).

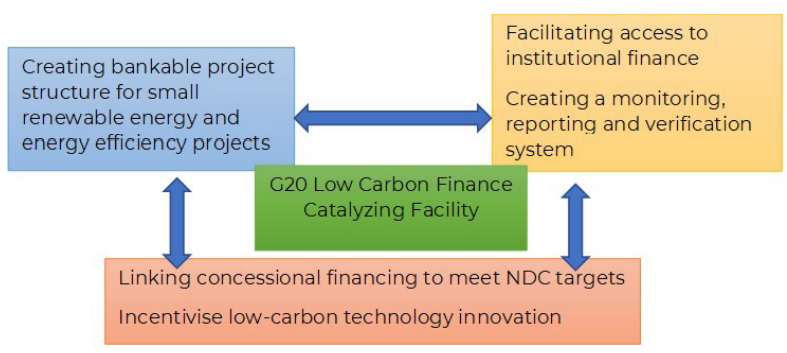

Fig. 2 Basic Rationale and Principles for the low-carbon financing facility

Tackling these two challenges will require concerted efforts to strengthen the upstream investment policy and institutional frameworks, design projects based on low-carbon green growth criteria, and develop better platforms for project preparation. Developing an innovative financing structure such as a Low-carbon Finance Catalysing Facility (LCFCF) will help to mobilise all pools of finance, especially private finance including long-term institutional investors.

Once established, a G20 level Low-Carbon Finance Catalysing facility such as that in Figure 2 could have the following objectives (i) directly catalyse a pool of small scale bankable low-carbon projects (ii) assist low-carbon investors in creating financially viable portfolio of projects that meet the NDC targets and SDG goals (iii) strengthen national low-carbon green growth policies, allowing gradual reduction on national level fiscal burdens, (iv) concessional sovereign risk and development finance to mitigate project risk and (v) access private finance. In contrast to common infrastructure finance approaches, establishment of a LCFCF will also mitigate risk and act as an investment enabler for small-scale, high-risk projects.

ENHANCING TAX POLICY FRAMEWORKS AND BAILOUT CONDITIONS TO INCENTIVISE LOW-CARBON GREEN GROWTH

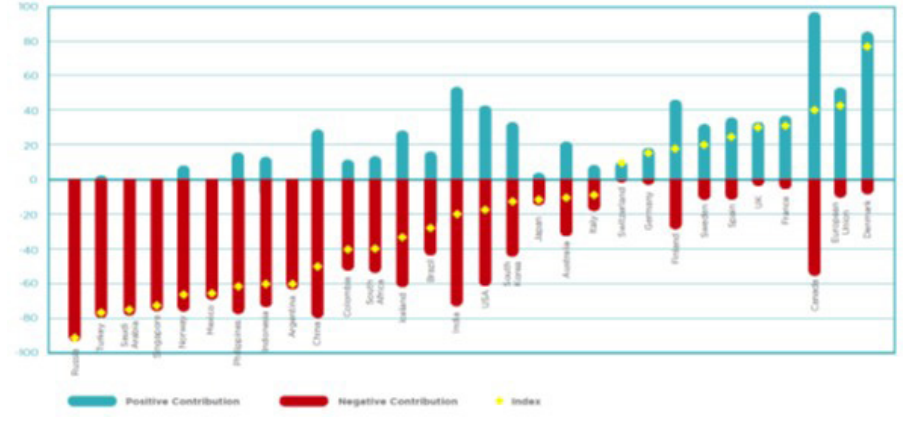

There are complex methodological issues in assessing the impact of stimulus spending on climate change mitigation, job generation and achieving social inclusion. An ongoing exercise by Vivid Economics (2021) assesses the greenness of stimulus flows into key economic sectors of G20 countries. The latest results available are presented in Figure 3 below.

Fig. 3 Green index of stimulus packages

Source: Vivid Economics, 2021

Despite the methodological issues in measuring the impacts, effective tax policy reforms are necessary and should be an integral part of green stimulus programmes in response to the COVID-19 crisis (Agarwala 2020). Advanced G20 countries are characterised by low growth, surplus savings and limitation with stronger monetary policy and expansionary fiscal action. (LSE 2020) On the other hand, developing countries face a much more complex and challenging fiscal situation (Victor 2020). There has also been a rapid erosion of fiscal space and foreign exchange reserves in several developing and emerging economies since the outbreak of pandemic. The COVID-19 crisis has therefore underscored the importance of implementing

effective carbon tax reforms as a source of new revenue streams and of implementing bailout programmes for green industries.

Carbon price reforms, new fiscal regulations and well-designed bailout conditions can be a powerful way of tilting incentives towards low-carbon green growth (IIPP 2019). Carbon pricing and the phasing out of pervasive fossil fuel subsidies can be critical components in a package of climate policies needed to restore growth and decarbonise the economic system (IEA 2020). Fuel subsidy reforms are an important complement to carbon pricing or a substitute if political economy factors prevent carbon tax and can be particularly timely and effective in times of financial crisis (Bowen 2015). By ensuring fossil fuel prices reflect both supply and environmental costs, carbon tax measures also reduce the risk of locking-in carbon-intensive capital (Rosenbloom et al. 2020). Carbon pricing can take the form of carbon taxes, which charge the carbon content of fuel supply, or emissions trading systems (ETS), where firms need permits to cover their emissions. In ETS, the government controls the supply of allowances, and trading establishes the allowance price. Fuel excise taxes, which are economically like carbon taxes, should also part of the support policy framework during the pandemic recovery.

Bailout conditions are also timely and helpful during the recovery stage when significant numbers of jobs are at stake (OECD 2012). They can save jobs and accelerate ecorestructuring of erstwhile brown industries. But implementing them will need to consider existing status of financial and banking system. Strengthening the financial systems to support pandemic recovery and low-carbon green growth is necessary. To mitigate the risks of financial instability, governments, central banks, regulators, and the commercial banking industry need to transform financial risk management practices, improve the transformation and disclosure of climate risks and enable the stakeholders to make informed decisions. In this regard, economic ministries are required to work with Network of Central Banks and supervisors for Greening the Financial Systems (NGFS).

It would be appropriate for some advanced countries within the G20 to focus on fiscal neutrality in the stimulus example using the additional funds to reduce distortionary taxes. Other developing and emerging economies with large funding needs can use the carbon tax revenues to support low-carbon infrastructure investments that are labour intensive. To meet the Net Zero targets by 2030, World Bank (2020) and IEA (2021) estimated a carbon tax in the range of US$ 90-110/t CO2. Nevertheless, from the developing G20 economies perspectives, it will be important to use part of the additional revenues from such a carbon tax to also alleviate the distributional consequences of hard tax reforms, which may particularly affect Small and Medium Enterprises (SMEs) and low-income households. In any event, the world was on an unsustainable and climate vulnerable path before the pandemic crisis and the recovery must avoid the dangers and fragilities of the past, not only with respect to environment and planetary boundaries, and with increasingly inequitable growth and a lack of social cohesion. There can be no going back to the old normal by the G20, if the above three interconnected actions are taken up during the pandemic recovery phase.

REFERENCES

Agarwala S., (2020), What policies for green ing the crisis response and economic recovery? Lesson learnt from past green stimulus measures and implications for the COV ID-19 crisis, Paris, Organisation for Economic Co-operation and Development (OECD)

Anbumozhi V., (2021), Mobilizing Private Finance for Low-Carbon Energy Transition in Financing Clean Energy in Developing Asia, Asian Development Bank https://www.adb.org/sites/default/files/publication/706641/financing-clean-energy-developing-asia.pdf

Anbumozhi V., K. Kalirajan, and F. Kimura, (2018), Financing for Low Carbon Energy Transition, Springer https://www.springer.com/gp/book/9789811085819

Bhattacharya A., C. Contras Casado, and M. Jeong, (2019), Attributes and Framework for Sustainable Infrastructure, Consultation Report, Global Economy and Development at Brookings, International Development Group

Bowen A., (2015), Carbon Pricing: How best to use the revenue, Policy Brief, Grantham Research Institute

Cable, (2016). Why Governments Won’t Invest, Centre for Economic Performance, Special Paper no. 33 http://www.industry-forum.org/wp-content/uploads/2016/04/Why-governments-wont-invest.pdf

Chen Z., G. Marin, D. Popp, and F. Vona, (2020), “Green stimulus in a Post Pandemic Recovery; the Role of Skills for a Resilient Recovery”, Environmental and Resource Economics, vol. 76, pp. 789-810

Energy Transitions Commission (ETC), (2020), Delivering Net Zero Economy, Energy Transition Commission https://www.energy-transitions.org/wp-content/uploads/2020/09/Making-Mission-Possible-Full-Report.pdf

Engström G. et al., (2020), “What Policies Address Both Coronavirus Crisis and the Climate Crisis”, Environmental and Resource Economics, vol. 76, pp. 789-810

Garrett -Peltier H., (2017), “Green Versus Brown. Comparing the Impact of Employment Impact of Energy Efficiency, Renewable Energy and Fossil Fuel using an Input-Output model”, Economic Modelling, vol. 61, pp. 439-447

International Energy Agency (IEA), (2020), Sustainable Recovery, Paris, International Energy Agency

International Energy Agency (IEA), (2021), Net Zero by 2050. A Roadmap for the Global Energy Sector, Paris, International Energy Agency

Institute for Innovation and Public Purpose (IIPP), (2019), A Mission Oriented UK Industrial Strategy, Institute for Innovation and Public Purpose, London

International Panel on Climate Change (IPCC), (2017), Special Report on Global Warming of 1.5 0C, International Panel on Climate Change https://www.ipcc.ch/sr15/

London School of Economics (LSE), (2020), Investing in a just transition- a global project, London School of Economics, London

Organisation for Economic Co-operation and Development (OECD), (2012), The jobs potential of a shift towards a low carbon economy, OECD Green Growth Papers, No 2012/01, Paris, OECD Publishing

Rosenbloom D., J. Markard, F.W. Geels, and L. Fuenfschilling, (2020), “Why carbon pricing is not sufficient to mitigate climate change and how sustainability transition policy can help”, PNAS, vol 117, no. 16, pp. 8664-68

Victor D.G., (2020), Building Back Better: Why Europe must lead a global green recovery, Brookings

Vivid Economics, (2021), Greenness of Stimulus Index https://www.vivideconomics.com/wp-content/uploads/2021/02/Greennes-of-Stimulus-Index-5th-EditionFINAL-VERSION-09.02.21.pdf

World Bank, (2020), State and Trends of Carbon Pricing, Washington DC, World Bank

World Economic Forum (WEF), (2020), Nature Risk Rising, Why the crisis Engulfing Nature Matters for Business and Economy, Geneva, World Economy Forum