G20 leaders should re-affirm that the International Monetary Fund (IMF) is a central pillar in a well-functioning multilateral system striving to achieve peace, stability, and the Sustainable Development Goals (SDGs). The IMF will need to be adequately resourced in order to achieve These goals. And, an effective and legitimate IMF will need to significantly reform its governance, expand and improve its toolkit, and better cooperate with other actors in the global system in order to maintain financial stability and achieve sustainable development.

Challenge

A decade after the global financial crisis, the world economy continues to be on fragile footing. While global growth is gradually recovering in many parts of the world, deep vulnerabilities remain in the global monetary and financial system at a period when support for multi-lateral institutions is very low in some countries. During these times, the IMF lacks the resources and governance capacity to effectively play its role in preventing and mitigating financial instability.

Proposal

1. Re-affirm that the IMF is an important pillar of the multilateral system striving for peace, stability, and sustainable development. Financial stability is a necessary underpinning of a world economy seeking to fulfill the SDGs and the IMF can help the multilateral system ‘deliver as one’ in the process. Article 1 of the IMF’s Articles of Agreement states that the IMF should strive to “i) To promote international monetary cooperation through a permanent institution which provides the machinery for consultation and collaboration on international monetary problems, and (ii) To facilitate the expansion and balanced growth of international trade, and to contribute thereby to the promotion and maintenance of high levels of employment and real income and to the development of the productive resources of all members as primary objectives of economic policy (IMF, 2016).” There is no other global multilateral body that can provide these public goods.

Since the global financial crisis, a number of other actors have emerged that provide liquidity and balance of payments support in the world economy. A number of advanced economy central banks provided bilateral swap lines to certain countries in the aftermath of the financial crisis, as did some central banks from emerging market and developing economies (CFR, 2019). However, such liquidity has been unpredictable, uncertain, and asymmetric in distribution—especially for emerging market and developing countries. Regional Financial Arrangements (RFAs) and other development finance institutions (DFI) have also become stronger and more prevalent, but there are gaps in the scale and coverage of these actors, as well as in their relative costs.

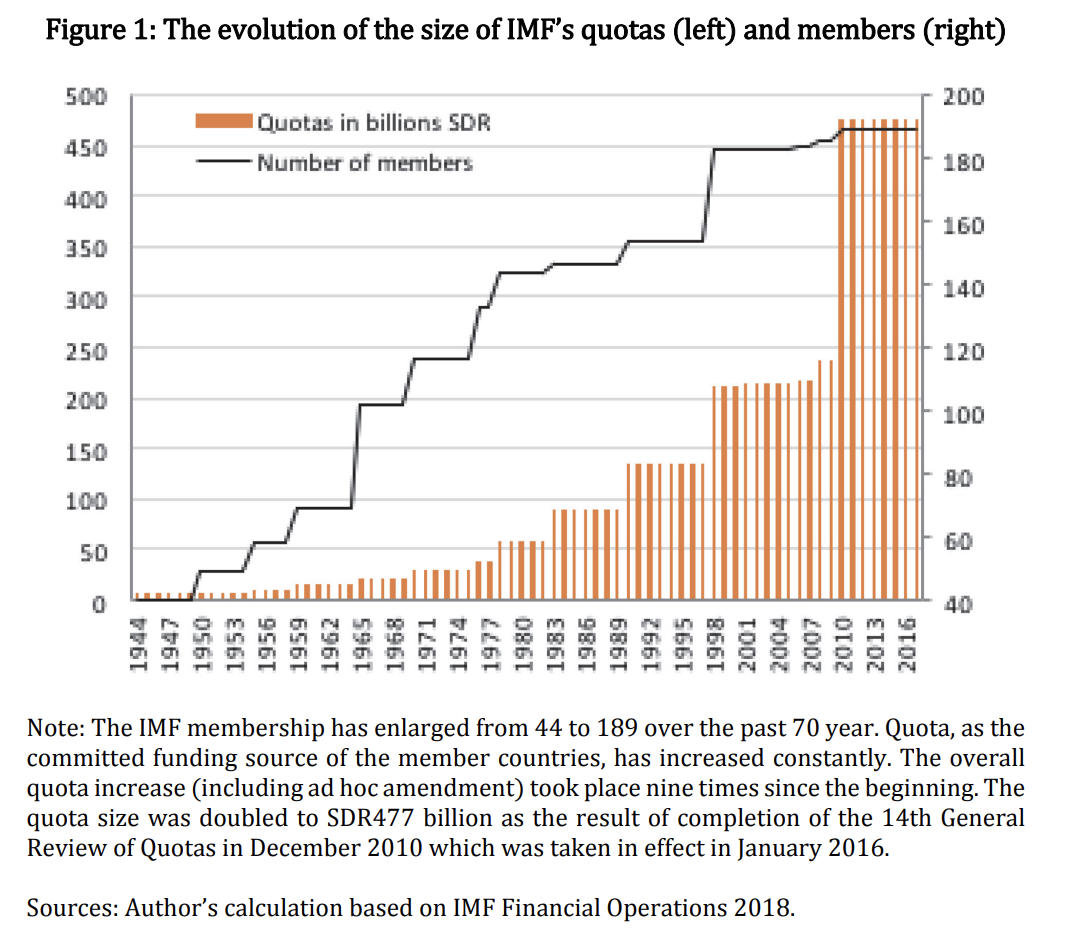

2. Scale the IMF’s capacity to prevent and mitigate financial instability and meet the needs of the member countries. Quota-based increases should form the core of IMF resource mobilization, though quota increases have lagged far behind the increase in the magnitude of capital flows and volatility. Of the quota reviews completed to date, few have ended without increase in quotas, and the average increase has been 50.4 percent since the first time increase in 1959. Only one—completed in 2010 in the aftermath of the global financial crisis—reached a 100 percent overall increase in the wake of crisis and after 13 years of no increase in quotas at all (Mohan and Kapur, 2015).

At the very least, it is important to ensure that the IMF’s current lending capacity is maintained. More than half of the IMF’s resource envelope is at risk in the near future, as the -“Bilateral Loans and Note Purchase Agreements” are due to expire by the end of 2020 and the ‘New Arrangements to Borrow’ by late 2022. In the absence of an increase in quota resources, the loss of these borrowed resources will undermine the IMF’s capacity to respond adequately to potential liquidity needs and countries’ confidence on the IMF.

At the same time, it will also be timely to provide alternatives on how to complement IMF resources, in addition to exploring the renewal of current borrowed resources. Creative alternatives that should be considered are broadening the role and use of Special Drawing Rights (SDRs) as an instrument of international policy cooperation, and in this regard to its more active use as a reserve currency, including through sizable and more frequent SDR allocations over the longer run (G-24, 2018; Ocampo, 2018).

3. Reform IMF governance to reflect 21st Century realities. Key to the effectiveness and legitimacy of the IMF will be to:

• Deepen the voice and governance reforms in the IMF. There continues to be a need to address the gap between quota shares in the IMF and the output weights of member countries in the world economy–and the quota formula that links shares and voting. Subsequent realignment of quota shares should also protect the quota shares and voice of all countries eligible for the Poverty Reduction and Growth Trust (PRGT) and small developing states (see Mohan and Kapur 2015).

• Establish an open merit-based selection of the Managing Director of the IMF. The longstanding tradition of the IMF being directed by a European and the World Bank by a citizen of the United States of America is outdated and contributes to a lack of legitimacy associated with these essential multilateral institutions. There are a number of established and highly qualified individuals across the globe that should be recruited and considered in an open and merit-based fashion.

4. Expand and improve the IMF toolkit for stability and growth. The uneven use and perceived stigma of the IMF’s toolkit underscores the need to revisit the design of its existing instruments. Countries have in essence relied more on self-insurance through accumulating reserves, exchange rate flexibility, and capital flow management measures to navigate continued instabilities in the aftermath of the crisis. Four key areas of improvement in the toolkit are as follows:

• Advance surveillance and advice on capital account liberalization and the use of capital flow management measures. The IMF Institutional View on capital flows has been a major step in the right direction but the IMF still needs to improve in three areas:

- acknowledge that capital flow management measures should be standard parts of the toolkit for emerging market and developing economies in their quest to prevent and adjust to the harmful impacts of volatile capital flows—rather than a reluctant last resort in times of major instabilities. The academic literature and work of the IMF confirms that capital flow management measures can be effective and that capital account liberalization is often associated with banking crises (IMF 2018a; Ocampo, 2018; Jeanne et al, 2012; Gallagher, 2015; Ostry et al, 2012).

- Increase examination of the spillover impacts of advanced economy policies as push factors of volatile capital flows and encourage advanced economies to take such spillovers into account. Accompanying T-20 policy briefs document the spillover impacts of advanced economy policies on capital flows in Asia and confirm the current literature showing that advanced economy policies can have negative capital flow spillovers in emerging market and developing economies (Ogawa and Shimizu, 2019; Agenor and Pereira da Silva, 2018; EPG, 2018). Meanwhile, since the magnitude of the impact depends on individual economic conditions, it is important to promote timely disclosure of economic information, not only by the IMF but also by RFAs.

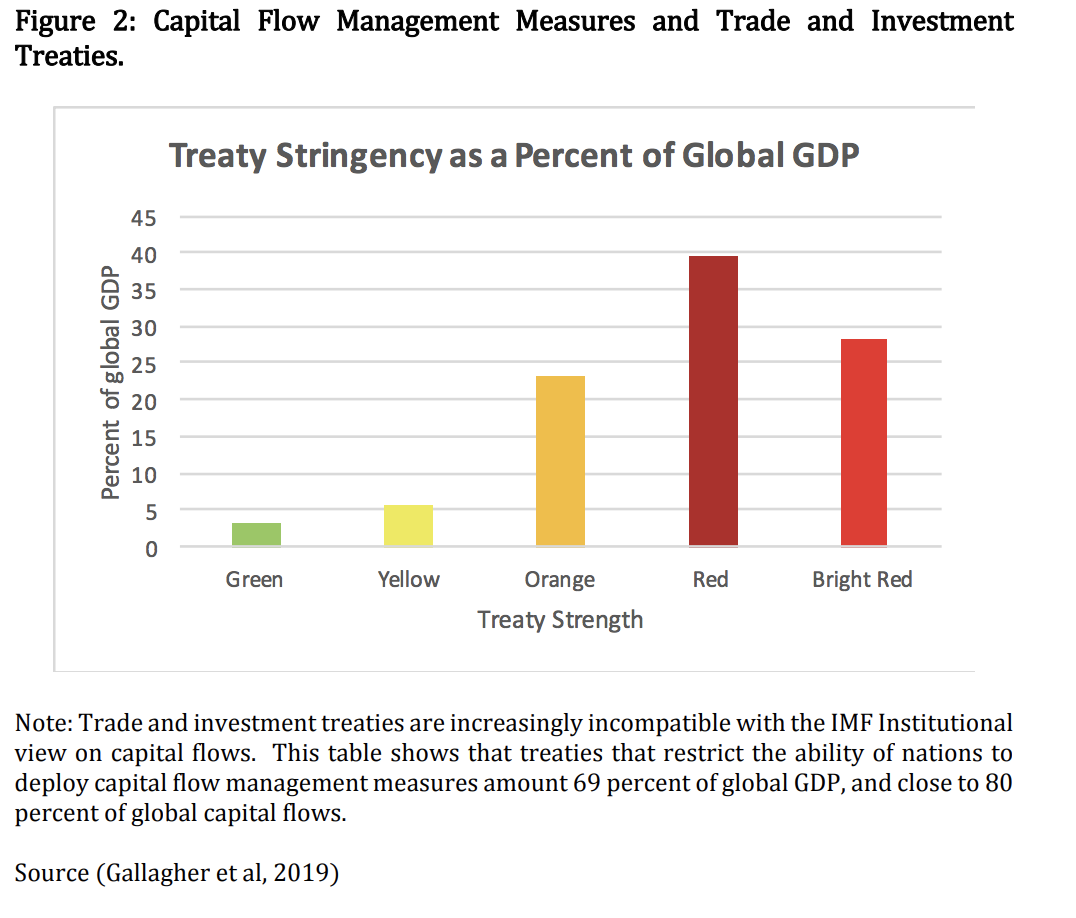

- create mechanisms for greater international policy coordination on managing capital flows across regions and between emerging market and developing countries and advanced economies. Moreover, the IMF should work to ensure that the trade and investment regime also allows ample policy space for national efforts and international cooperation on capital flow management. Such treaties increasingly restrict the ability of such coordination. The IMF has recognized that “these agreements in many cases do not provide appropriate safeguards or proper sequencing of liberalization, and could thus benefit from reform to include these protections (IMF 2012, 8; Gallagher et al, 2019, see appendix).

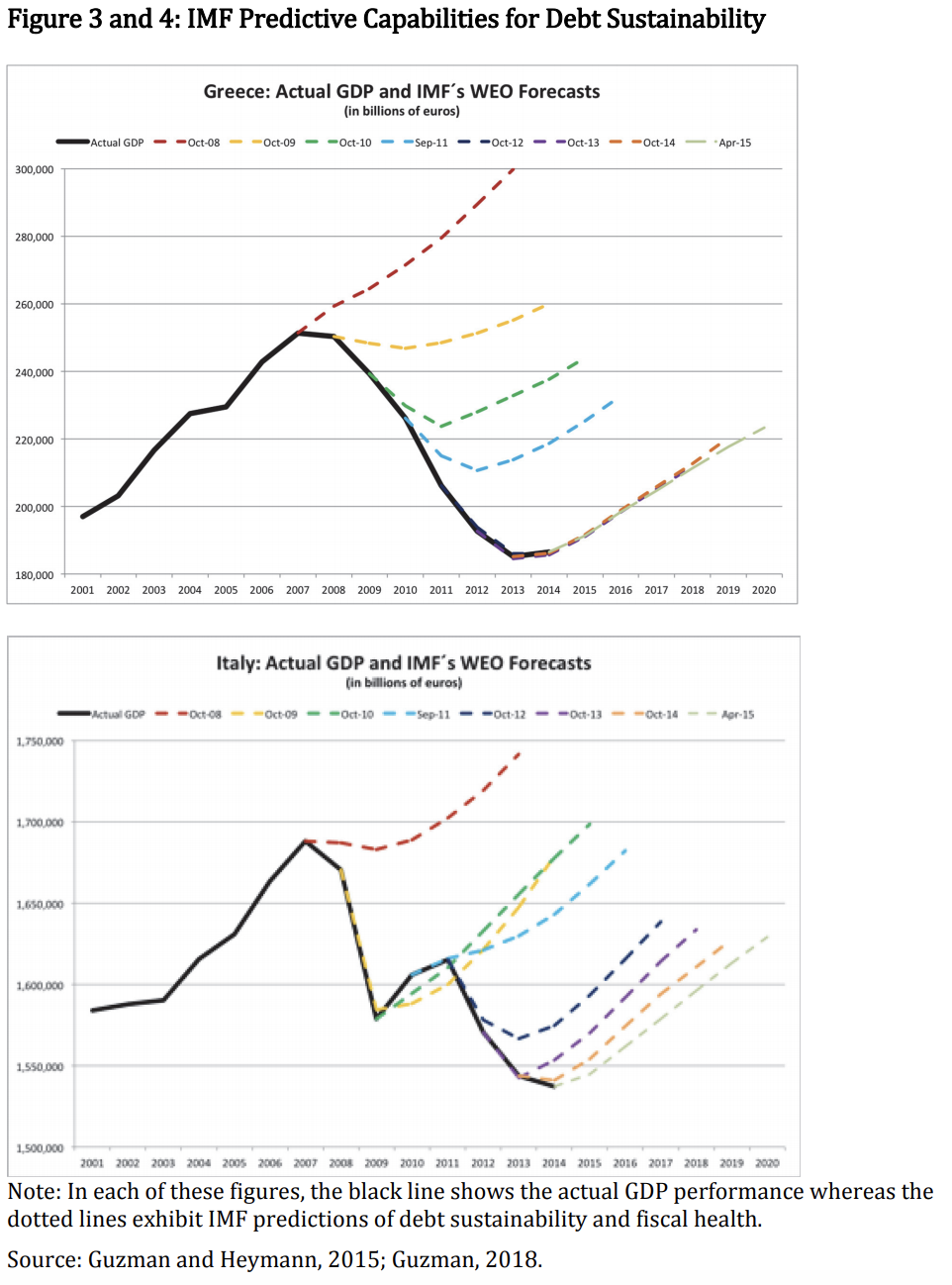

• Improve surveillance, data, and advice on debt sustainability. Members of the IMF should share their data on external debts in an open and transparent manner as specified under the IMF-World Bank Debt Sustainability Framework and Debtor Reporting System. What is more, IMF staff will need to rework their modeling approaches to estimating debt sustainability in the design as the IMF has a long history of erroneous projections on debt sustainability that lead to extended use of IMF facilities and decreases in host country welfare (Guzman, 2019, see appendix; EPG, 2018).

• Boost the level of access for liquidity support and address the absence of a precautionary instrument for low-income countries (LICs) at the IMF. The IMF’s low-income country (LIC) facilities have undergone reforms since 2009, with over half of all LICs with a facility or instrument in place on average in any given year. However, unlike other emerging market and developing economies, the LICs lack a precautionary instrument, have trouble accessing some facilities because of little flexibility built into those facilities and lack adequate options for fragile economies (Sayeh, 2019; G-24, 2018).

• Align conditionality policies with the SDGs. Despite recognized improvements in the number of conditionalities explicitly required in IMF programs, in addition to spending ‘floors’ for social programs, IMF conditionalities still carry a stigma because of their pro-cyclical nature and social impacts. While the academic literature on the impacts of IMF programs on economic growth is somewhat mixed, there is overwhelming evidence in the literature that IMF conditionality is correlated with worsening inequality, social and educational spending, health systems, and environmental quality (IMF, 2018b; Kentikelenis et al, 2016). The IMF should coordinate with development finance institutions to design counter-cyclical components to IMF programs and should devise a ‘social protection tool’ to mitigate the unintended consequences of IMF programs and help calibrate IMF programs to the SDGs (Ortiz, 2018).

• Cooperate with other actors in the global financial safety net, including advanced economy Central Banks and Regional Financial Arrangements. Bi-lateral swap arrangements and RFAs now have resources that far exceed those of the IMF (Kring and Gallagher, 2019). However, the IMF, with its broad membership, remains the global multilateral body that provides predictability to liquidity needs in the global economy. Echoing G20 principles, the IMF should work with central banks and RFAs in a manner that respects the roles, independence and decision-making processes of each institution, taking into account regional specificities in a flexible manner (G20, 2011; EPG, 2018). These institutions should cooperate closely during crises mitigation while allowing for complementarity and diversity of approaches to governance, surveillance, program design, and conditionality over the longer run.

References

• Agenor, Pierre Richard and Luis Pereira da Silva, (2018). Financial spillovers, spillbacks, and the scope for international macroprudential policy coordination, Bank for International Settlements. https://www.bis.org/publ/bppdf/bispap97.pdf

• Aizong XIONG (2019), Adequacy of and Possible Options for Supplementing IMF Resources, Workshop of the T-20 Task Force on the International Financial Architecture, Boston University Global Development Policy Center, February 28, 2019.

• Council on Foreign Relations, CFR (2019), The Spread of Central Bank Swap Lines Since 2007 New York: Council on Foreign Relations, https://www.cfr.org/interactives/central-bank-currency-swaps-since-financialcrisis?cid=otr-marketing_use-currency_swaps#!/central-bank-currency-swapssince-financial-crisis?cid=otr-marketing_use-currency_swaps.

• Eminent Persons Group (EPG), (2018), Making the Global Financial System Work for All, G-20 Eminent Persons Group, https://www.globalfinancialgovernance.org/assets/pdf/G20EPGFull%20Report.pdf

• G20 (2011), G20 Principles for Cooperation between the IMF and Regional Financing Arrangements http://www.g20.utoronto.ca/2011/2011-financeprinciples-111015-en.pdf

• G-24 (2018), Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development, Washington, IMF: https://www.imf.org/en/News/Articles/2018/04/20/intergovernmental-groupof-twenty-four-on-international-monetary-affairs-and-development

• Gallagher, Kevin P (2015), Ruling Capital: Emerging Markets and the Reregulation of Cross Border Finance, Ithaca, Cornell University Press.

• Gallagher, Kevin P., Sarah Sklar, and Rachel Thrasher (2019), Policy Space for Managing Capital Flows in Trade and Investment Treaties: An Empirical Approach, G-24 Working Paper, Washington, G-24 Secretariat.

• Guzman, M. and Heymann, D., 2015. The IMF debt sustainability analysis: issues and problems. Journal of Globalization and Development, 6(2), pp.387-404.

• Guzman, M., 2018. The Elements of Sovereign Debt Sustainability Analysis. Centre for International Governance Innovation Paper No. 196. https://www.cigionline.org/sites/default/files/documents/Paper%20No.196 web.pdf

• Kentikelenis, A., T. Stubbs, and L. King. 2016. “IMF Conditionality and Development Policy Space, 1985-2014,” Review of International Political Economy. 23(4).

• International Monetary Fund (2012), Liberalizing Capital Flows and Managing Outflows, Washington, IMF. https://www.imf.org/external/np/pp/eng/2012/031312.pdf

• International Monetary Fund (2016), Articles of Agreement of the International Monetary Fund, 2016 edition, Washington: International Monetary Fund https://www.imf.org/external/pubs/ft/aa/index.htm.

• International Monetary Fund (2018a), The IMF’s Institutional View on Capital Flows in Practice, Washington: International Monetary Fund, https://www.imf.org/external/np/g20/pdf/2018/073018.pdf

• International Monetary Fund (2018b), Structural Conditionality in IMF-Supported Programs – Evaluation Update, Washington: International Monetary Fund https://ieo.imf.org/en/our-work/evaluation-reports/Updates/StructuralConditionality-in-IMF-Supported-Programs-Eval

• Jeanne, Olivier, Arvind Subramanian, and John Williamson. (2012). Who Needs an Open Capital Account? Washington, DC: Peterson Institute for International Economics.

• Kring, William and Kevin P. Gallagher (2019), Strengthening the Foundations? Alternative Institutions for Finance and Development, Development and Change, Volume50, Issue1 Special Issue: Beyond Bretton Woods: Complementarity and Competition in the International Economic Order, January 2019, Pages 3-23

• Mohan, Rakesh and Maneesh Kapur (2015), Emerging Powers and Global Economic Governance: Whither the IMF? Washington, International Monetary Fund. https://www.imf.org/external/pubs/ft/wp/2015/wp15219.pdf

• Ocampo, Jose Antonio (2018), Resetting the International Monetary (non) System, New York, Oxford University Press.

• Ogawa, Eiji and Junko Shimizu (2019), Capital Flows and International Financial Architecture, T-20 Policy Brief, Japan.

• Ortiz, Isabel (2018) The Case for Universal Social Protection, Finance & Development, December 2018, Vol. 55, No. 4 https://www.imf.org/external/pubs/ft/fandd/2018/12/case-for-universal-socialprotection-ortiz.htm

• Ostry, J.D., Ghosh, A.R., Habermeier, K., Chamon, M., Qureshi, M.S. and Reinhardt, D.B.S. (2010). Managing Capital Inflows: the role of Controls. IMF staff position note. Washington, D.C.: International Monetary Fund, pp. 33-64.

• Rey, H (2015): “Dilemma not trilemma: the global financial cycle and monetary policy independence”, NBER Working Papers, no 21162, May.

• Sayah, Antoinette (2019), Improving the IMF’s Low-Income Country Toolkit, Workshop of the T-20 Task Force on the International Financial Architecture, Boston University Global Development Policy Center, February 28, 2019.

Appendix