The world will need to see some US$ 20 trillion in capital expenditure on lowcarbon energy supply and in energy efficiency to meet the Paris Agreement targets. Given the large scale of the investment required to decouple carbon emissions from economic growth, it will have to rely largely on mobilizing private capital. The G20 has taken initial steps to formulate a climate agenda to be financed by private capital, but more needs to be done. Four interrelated solutions: a low-carbon transition fund, a financial performance warranty program, best low-carbon regulations and a high-quality infrastructure program are proposed as an action plan for G20 to accelerate a private sector-led climate mitigation agenda at the global level.

Challenge

Decoupling economic growth from carbon emission is crucial yet remains as an universal challenge. With carbon-intensive growth models, the developing and emerging economies of Asia, Africa and Latin America face greater challenge than developed regions. Following the Nationally Determined Contribution (NDC) targets under the Paris Agreement framework, policymakers are now more determined in advancing viable and scalable climate mitigation actions. Centered on the innovation and dissemination of low-carbon energy technologies, this transition requires about US$ 20 trillion from 2016 to 2030 (UNEP 2017, IEA, 2017).

There are several reasons for leveraging the private finance is needed to accelerate climate mitigation actions. First, advanced countries have not yet agreed on any clear plans for meeting their commitment to provide US$100 billion annually by 2020 for achieving the NDC targets by developing countries. Second, as current estimates indicate, more than US$100 billion per year is needed to meet the climate change challenges that include not only investments in renewable energy, but also energy efficiency and other strategies like deployment of clean coal and carbon capturing and storage technologies at a scale required as well as adapting to climate change (Limaye, 2011; Newcomb and Satdelemen, 2015). Third, government budgets of both advanced and emerging economies are often constrained by the financial debts and austerity policies, with little clarity on about when and how public financial flows will be scaled up to meet the Paris targets set for 2030 (Anbumozhi, Kalirajan and Kimura, 2018).

For private banks and institutional investors, NDCs proposes a new financing model to adhere, in order to deliver clean and green growth to their shareholders. The opportunities to combine climate change mitigation with socio-economic needs of new infrastructure is indeed a new opportunity for responsible wealth creation. For the private sector, the Paris Agreement has been referred to as, a purchase order from 2030 for joint actions with governments (Wolf et al, 2016). Given the opportunities, the question is how to direct the large and increasing private investments towards climate change mitigation. As the major private sector actors are bound by fiduciary duty to maximize the shareholder values of current assets, the existing regulatory pathways may slow the emergency of and deployment of low-carbon energy technologies at the scale required (Kalirajan t al, 2016). However, G20 policy makers could work on at least three regulatory factors that can unleash the potential of private finance, towards low-carbon transition. First, private financial institutions operate in a market environment where the prices for the commodity they replace, such as fossil fuels are volatile and where prices for the externalities they produce such as emissions are still very low. Markets for high carbon–based inputs will be subject to downward pressure (Hongo and Anbumozhi, 2015). Second, private investors in a low- carbon economy operate a capital –intensive business model because the foundational capital stocks are still being established (ACMF, 2017). As a result, pioneering investors need to balance intensely competing demand for capital within the firms. Third, lowcarbon technology providers are often called upon to provide cost effective innovative solutions with long lived assets which are subject to swings in commodity prices, under reduced competitive pressures due to fiscal and public finance subsidies to high-carbon investments (Simon and Chengui, 2015). Therefore, seizing the opportunities offered by the private sector will very much depend on the G2O’s efforts in designing risk mitigants and investment enhancers. This will require policy interventions to consider the range of available channels to change preferences, structures, and risk appetites of private investment.

Proposal

Globally, mobilizing the private finance needed faces with simultaneous challenges such as development of various co-benefit technological systems and investment models and related adjustments of regulations supporting the free trade (Anbumozhi, Kalirajan and Kimura, 2018). Such systemic change is unlikely to proceed smoothly without a proactive coordination at the G20 level. Therefore, four interrelated private financing solutions are recommended as an action agenda for the G20: establishment of a low-carbon transition fund (LCTF), that can broaden and deepen the risk bearing capacity of the private sector; formulation of a finance performance warranty program which would target low carbon technology providers, that includes an insurance and performance guarantee; the best regulations for a low-carbon economy program, that engages an independent third party to assess the effectiveness of new investment grade policies to spur private finance action domestically; and a quality infrastructure program, that evaluate new energy infrastructure proposals in terms of their net carbon impacts and incorporates conditionalities that spur private investment.

(a) A G20 Low-Carbon Transition Fund

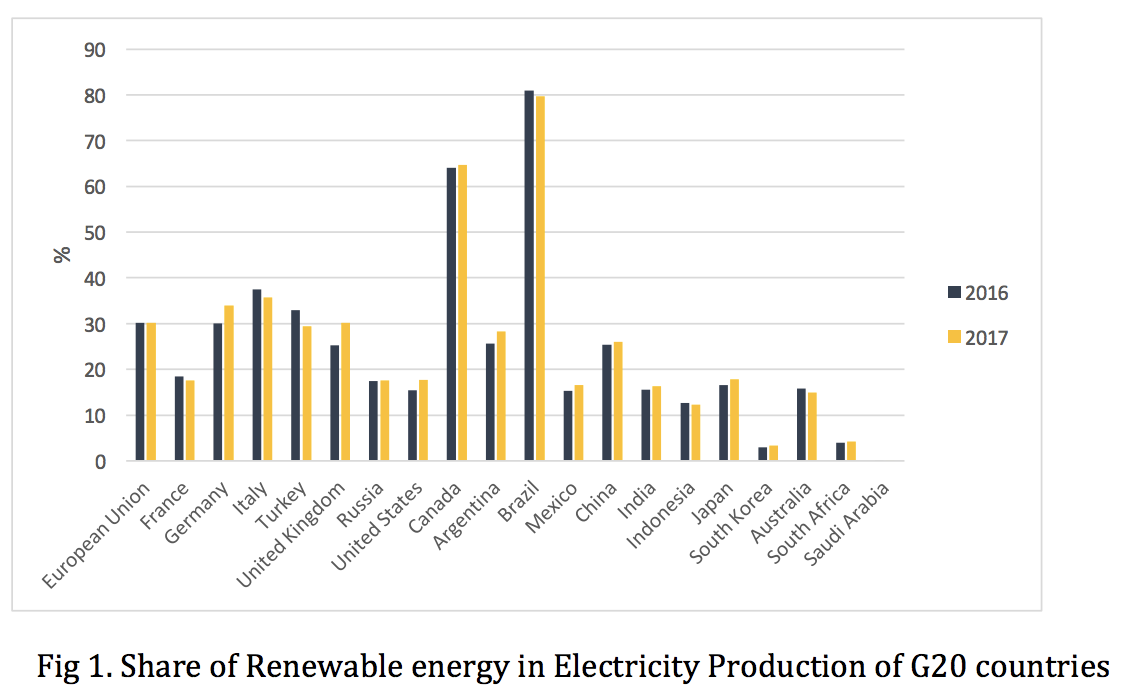

Rationale: These carbon emission reduction targets expressed as Nationally Determined Contributions (NDC), agreed as a part of global agreement in Paris on reducing emissions imposes structural changes needed in energy system, that varies from country to country (Fig 1) and delinked from the financial systems. Existing capital markets for low-carbon projects are relatively thin in most of the emerging economies, making the project finance slow and costly (Arent et al, 2017). Thin capital markets are also slowing the deployment of low-carbon technology solutions that can contribute to NDC targets (Sachs et al, 2019). Regulators do not provide substantial market signal to upscale lowcarbon investments. In order to accelerate the deployment of low-carbon technologies to meet the Paris Agreement goals, a G20 Low-Carbon Transition Fund (LCTF) fund will be established.

Discussion: This G20 LCTF will be financed by unwinding fiscal and public finance subsidies currently provided to conventional energy sectors. This fund would enable the investors in low-carbon assets, which will underpin the NDC targets to monetize the carbon credits and thus to increase their financial resilience. The value of the fund would be proportional to existing fossil fuel subsidies in G20 economies and would be established to operate until 2030 during which period prices on carbon will be advanced and/or significant reductions in emission permits will be achieved through cap and trade systems. The low-carbon project developers would apply for G20 accreditation as NDC target achiever in the funds based on (i) Financial innovations as evidenced by certification and credit for transferring carbon credits; (ii) Being a guarantee in good standing; and (iii) Qualifying as an innovative enterprise in terms of revenues and job creation.

Once accredited under the G20 fund, the low-carbon project developers could apply for loans to finance projects delivering carbon emission reductions that meet NDC targets. Investors would be entitled to implement the projects across the countries. These projects would also be considered for eligibility under bilateral offset trading mechanisms. The loans would be converted into grants at pre-established carbon price, if carbon reductions for projects proposed by emission reduction providers were realized before the planned completion date. A third party will certify the proposed and actual carbon reductions. Investors applying for accreditation as emission reduction providers would be encouraged to engage early with NDC target achievers.

This G20 transition fund would serve to deepen capital stocks among lowcarbon project developers, thereby enabling them to scale up and invest profits to expand deployment of low-carbon technologies, employ more people and expand international trade. They would also serve to build stronger policy ties between officials responsible for fiscal policy programs and those responsible for NDC domains by requiring good standing in investment funding as a criterion for project developers. The appropriation for the funds would be assured through the retirement by 2030 of subsidies to fossil fuel industries.

(b) Financial Performance Warranty Program

Rationale: Public sector actors seeking climate mitigation projects cannot bear the full risks for technical and business performance. As a result, contractual agreements with project proponents may result in risk down loading to lowcarbon project developers, whose balance sheet are still forming, or the exclusion of such investments together (Venugopal and Srivastava, 2012). G20 financial markets have not received sufficiently concentrated market signals to build or acquire lending and underwriting experience for low-carbon investment (Robins and Choudhry, 2015). Performance insurance underwriting capacity exists for other risky sectors such as mining, oil and gas – but market signals have not triggered a spill over of this capacity to lowcarbon energy sectors.

Discussion: The G20 finance performance warranty program would target manufacturers of low-carbon technology whose customers, such as engineering procurement and construction companies and public procurement actors, require insurance to warranty technology availability and performance. Investments in new low-carbon technologies require enhancing entrepreneurial talents and pose new kind of risks that strongly influence the investment returns (Jones, Vicky and Jonson, 2016). Transfer of these risks to the insurance market, through a performance warranty program, will improve the project cash flows, thereby supporting investments and new business models.

For low-carbon technologies manufacturers, a performance warranty program can help to free up the capital. The G20 insurance warranty to be provided will allow them to secure more favourable financing terms, particularly to raise the capital or receive debt that covers the risks when their technology does not perform. This performance warranty program may be extended to further insurance coverage that pays compensation directly to low-carbon technology customers, where their performance is dependent on the manufacturers staying in business due to its use of the manufacturer’s proprietary technology. This insurance coverage provides guarantee against the manufacturers becoming insolvent or being unable to fix a technological issue that led to a shortfall in performance. A performance warranty program would allow entrepreneurs to obtain funding for low-carbon projects more easily and give all the stakeholders a greater reliability in project planning. Eventually, this scheme could significantly increase the project’s rating and improve the overall financing eco-systems during the process. The freed-up capital from concluding the insurance can be used for other investment in technology development and low-carbon market growth.

This G20 – wide program would target the formation of a critical mass of risk underwriting opportunities to attract private sector underwriters to warranty the performance and availability of innovations and investments being procured by the public and private sector buyers. It would be deployed in 2020 to coincide with the start of a full 10-year life cycle cost accounting until 2030 for low-carbon infrastructure procurement.

The overarching goal for G20 central banks would be to enable the formation of a low-carbon risk underwriting market. The market signals to kick-start such performance warranty or insurance market would come from the accreditation of low-carbon projects under the G20 LCTF. This warranty program would be overseen by an independent agency or by a private sector marketplace operator. The administrator under a management contract would retain the market operator for several years up to 2030. The management contract, established through a transparent process, would combine variable compensation based on the value of underwriting and the number of underwriting firms participating in the market, with fixed fees for communication and engagement with low-carbon energy project proponents including cities and municipalities.

(c)Best Regulations for Upscaling Low-Carbon Investments

Rationale: Academia, civil society and non-profit organizations in the emerging economies of the G20 do not have enough opportunity to become aware of how investments in climate mitigation are being catalysed to achieve the Paris Agreement commitments. Many regulators are not structured to accommodate low-carbon solutions. Innovative investors are successfully deploying their low-carbon energy projects in global markets that have low regulatory burdens. Innovative low-carbon investors have low-regulatory engagement, but they are knowledgeable of regulations and policies that enable the deployment of their investments in international markets (Stadelmann, Castri and Michelowa, 2017). Provision of articles in the Paris Agreement will lead to increasing international cooperation and a greater need for regulatory harmonization (Anbumozhi and Yao, 2015). The best G20 regulation program would enable countries to request a third-party assessment of the potentials within their country of international policies and regulations that have enabled commercial deployment of low-carbon technology.

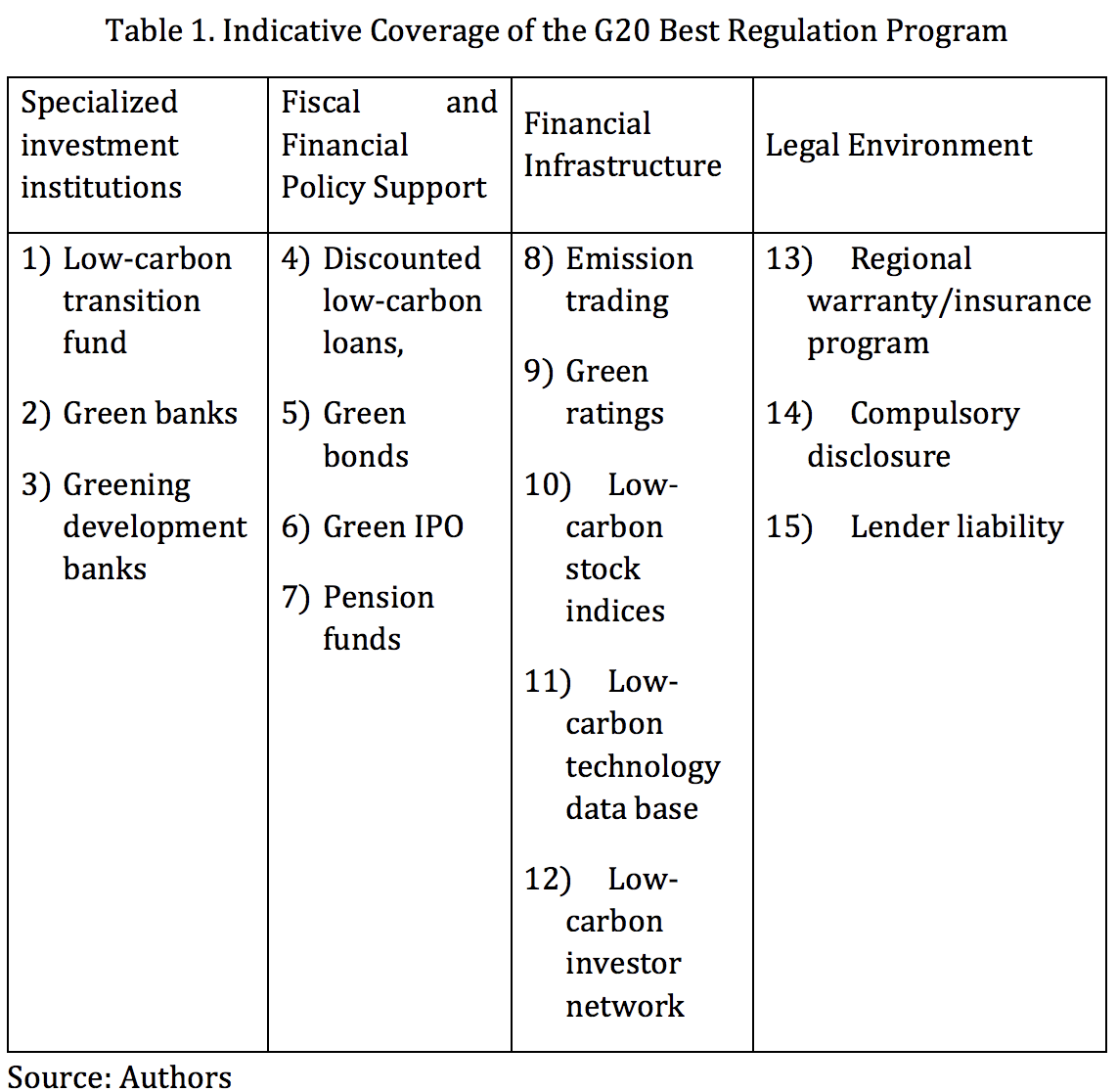

Discussion: The intent of this best regulation program would be to recruit academia and non-profit sectors to assess the effectiveness of current G20 policy and regulations to determine and prioritize reforms that has potential to spur low-carbon investments across the sectors and countries. Their reports and guidelines would be made public and would serve as evidence to determined and prioritize reforms. The scope of the guidelines is as shown in Table 1. Guided by the NDC targets and drawing on international best practices and experiences, this basic framework could include 15 specific regulations, clearly delineating the responsibilities of various government agencies and market entities under the four categories of institution building, policy support, financial infrastructure and legal environment.

This program could be established for an initial period of five years up to 2023 to coincide with the NDC implementation review. Following the second year of operation, a report on sub-sovereign jurisdiction for the best G20 regulations on low-carbon investment would be submitted to the G20 summit to be held in 2023. In parallel, and operational review of the permit approval and regulatory process would be undertaken to assess the impact of various investment processes on the take up low-carbon investments. The review could also consider structural impediments such as costs, delays and current investment status.

(d) High Quality Infrastructure Program

Rationale: Infrastructure procurement criteria have so for assessed one-time capital expenditure only, with no requirement to consider the cost of future carbon emissions and NDC targets to be achieved by 2030, and other operating costs or cost-effective alternatives, even though the World Trade Organization’s government procurement program allows for such criteria (IFC, 2016). With very few exceptions, infrastructure investments have been unsuccessful in integrating their low-carbon innovations into public infrastructure projects (Anbumozhi and Kawai, 2015). Taking up investment decisions within low-carbon infrastructure would be a vehicle to ensure that spill over benefits of high-quality infrastructure are realized from investments.

Discussion: Under the high-quality infrastructure procurement, the G20 will adopt a three stages approach to evaluate new infrastructure programs. First, full economic life cycle cost assessment would be carried out considering operating costs, social benefits and the impact on NDC targets. Many requests for proposals under infrastructure procurement agreements in the G20 consider upfront costs. Second, a full carbon cost assessment, accounting for embodied, operational, end of life sequestered carbon emissions would be undertaken. This approach would result in cost-effective infrastructure decisions, a lower carbon footprint by 2030, increased economic productivity and financial innovation spillover effects. The carbon content of future infrastructure projects would be evaluated in at least four forms; (i) embodied – from material production, construction process and waste, (ii) operational – from functional use of a project over its useful life, (iii) end of life – from decommissioning, reuse, recycling and or disposal, and (iv) sequestered – for examples, through restoration and enhancement of natural features. Third, the best available low-carbon infrastructure solutions – an assessment that requires the project proponents and investors to carry out an analysis of whether the needs associated with the infrastructure project can be met through high tech cost- innovative means or conventional approaches.

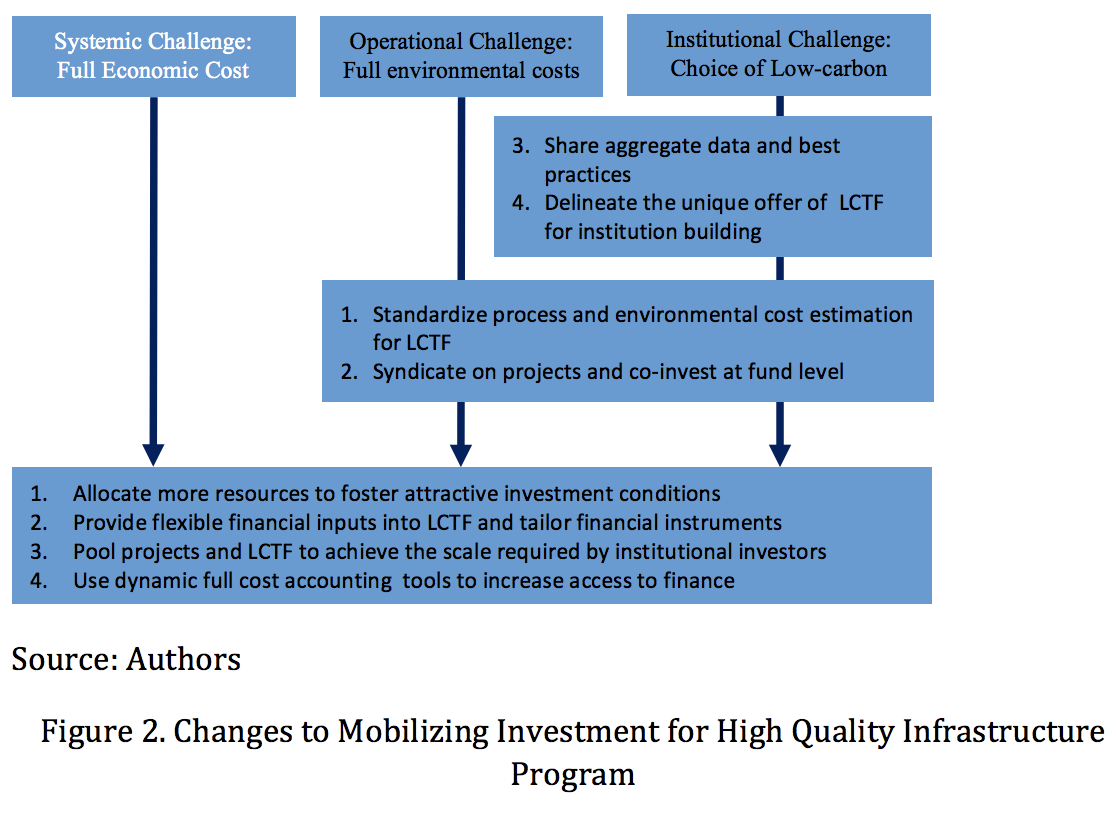

Fig 2. summarizes this three steps process in the context of the proposed G20 low-carbon transition fund (LCTF), and the platform methods to execute the program. Navigating the complex requirements of high -quality infrastructure will be a daunting task for private sector actors. Developing dynamic full cost accounting tools could increase the access to finance. Standardizing common or at least similar process and transaction documents for LCTF will decrease the transaction cost of environmental full cost accounting. Sharing knowledge about best practices in mobilizing private investment among different funding mechanisms will be helpful in identifying the low-carbon energy solutions. Collective action and a sense of partnership among the financial institutions will be necessary to scale up projects to qualify for LCTF.

Conclusion

The G20 unites a group of countries with very distinct energy mixes and widely diverging NDC commitments made. As opportunities to raise capital from the public is limited, which means that low-carbon project developers in G20 countries must rely on private financing. Continuing the current low level of investment equilibrium will create structural impediments to achieving NDC targets. The four interrelated policies proposed here provide an important setting for coordinated action. The G20 can complement and add coherence to this framework by entitling national development banks and multilateral development banks to implement these initiatives. If this is designed appropriately, with a clear long-term institutional mandate, then such an approach can ensure continuity and commitment by the G20, that would go beyond the changing agendas set by each revolving presidency.

REFERENCES

• ACMF (2017). ASEAN Green Bond Standards, ASEAN Capital Market Forum, Kuala Lumphur.

• Anbumozhi V and M Kawai (2015). Towards a Low-carbon Asia: Challenges of Economic Development in Anbumozhi M Kawai and B Lohani (Eds). Managing the Transition to a Low-carbon Economy, Asian development Bank Institute, Tokyo. Pp11-44

• Anbumozhi V and X Yao (2015). Serenpidity of Low Carbon Energy System and the Scope of Regional Cooperation in V Anbumozhi, K. Kalirajan, F Kimura and X Yao (Eds), Investing in Low-Carbon Energy Systems, Springer 1-27

• Anbumozhi, V. K. Kalijaran,., and F Kimura, (eds.) (2018). Financing for Low-carbon Energy Transition: Unlocking the Potential of Private Capital. Jakarta: Economic Research Institute for ASEAN and East Asia.

• Arent, D., Arndt, C., Miller, M., Tarp, F., and Zinaman, O. (eds.) (2017). The Political Economy of Clean Energy Transition. Oxford, UK: Oxford University Press.

• Hongo T and V Anbumozhi (2015). Reforms for Private Finance toward Green Growth in Asia in Managing the Transition to a Low Carbon Economy, Asian Development Bank, Manila – Asian Development Bank Institute, Tokyo.

• IEA (2017). World Energy Investment 2017. International Energy Agency, Paris.

• IFC (2016). How Banks can Seize Opportunities In climate and Green Investment, International Finance Corporation, Washington DC • Jones M, Vicky and D Jonson (2016). Recent Developments in the Asian Green Bond Markets.

• Kalirajan K, V. Anbumozhi and F Kimura (2016). The Hard Choices that Asia Must Make in V. Anbumozhi, K. Kalirajan, F Kimura and X Yao (Eds). Investing in Lowcarbon Energy Systems: Implications for Regional Cooperation, Springer

• Limaye C L (2011). Scaling up Energy Efficiency: The case for a Super ESCO, Journal of Energy Efficiency , 22(1): 17-28

• NewCombe, K and Satdelman, M (2015). Game changer or complement? The potential of public finance for covering risks and facilitating low carbon investments in developing countries, Cambridge

• Robins N and R Choudhury (2015). Building a Sustainable Financial Systems to Serve India’s Developmental Needs. UNEP inquiry into the Design of Sustainable Financial Systems, Geneva and Federation of Indian Chambers of Commerce and Industry, New Delhi.

• Sachs F J, W W Thye, N Yoshino and F T Hesary (2019). Why is Green Finance Important, ADBI Working Paper Series, No 917, Asian Development Bank Institute, Tokyo.

• Simon Z and Z Chenghui (2015). Greening China’s Financial System: Synthesis Report, Institute for Sustainable Development, Winnipeg and Research Centre of the State Council, Beijing

• Stadelmann C , R Castri and K Michaelowa (2011). Is there a leverage paradox in climate finance?, Cambridge

• UNEP (2017). The Emissions Gap Report 2017. United Nations Environment Program, Nairobi.

• Venugopal and Srivastava (2012). Moving the fulcrum; a primier on public financing instruments used to leverage private capital, World Resources Institute, Washington DC

• Wolf P, C Kohl, T Rinke, L Stuff, M Theisling and C Weigelmeir (2016). Financing Renewable Energy Investments in Indonesia, German Development Institute, Bonn.