The G20 Quality Infrastructure Investment (QII) Principles agreed in 2019 confirmed that ecosystem, biodiversity and climate considerations should be incorporated into infrastructure investing. Nevertheless, integration of environmental factors especially related to biodiversity into infrastructure investment remains inadequate, while infrastructure development continues to put natural capital and critical ecosystems at risk. This is due to insufficient government guidance and regulation, non-standardised requirements and metrics, lack of investor capacity to evaluate biodiversity, environmental data deficiency and lack of clarity regarding environmental impacts on investment performance. Considering infrastructure’s central role in recovery plans for the COVID-19 crisis, we must focus on policies and requirements for integrating environmental criteria in investments that support a nature-positive recovery. G20 policy guidance is key to strengthening the sustainability of infrastructure investments at the scale and speed needed. Building on the QII Principles, we therefore propose a policy-level harmonisation of international standards to promote net gain for nature. We propose regulatory reforms to create market-driven implementation of environmental criteria in infrastructure investments. Furthermore, we recommend standardised and comparable biodiversity impact disclosure to promote adoption of sustainable practices in a post-COVID-19 world.

Challenge

Human activity has transformed natural ecosystems on most of the planet (Ellis et al., 2010). This has contributed to biodiversity loss that has already exceeded planetary boundaries, undermined sustainable development, caused permanent loss and degradation, whilst edging nearer to tipping points of catastrophic magnitude (Newbold et al., 2016). According to the Dasgupta review, “biodiversity is declining faster than at any time in human history”. The review showcases that between 1992 and 2014, produced capital doubled per capita, and human capital increased by 17 per cent per capita, but natural capital declined by 40 per cent per person (Dasgupta, 2021). By some estimates, wildlife populations have declined by more than 70 per cent since the 1970s (WWF, 2020); and more than a million species are at risk of extinction within decades (IPBES, 2019). Between 1997 and 2011, the world lost an estimated $4-20 trillion per year in ecosystem services owing to land-cover change and $6-11 trillion per year from land degradation (Costanza et al., 2014). Action to halt and reverse biodiversity loss to maintain these essential services needs to be scaled up dramatically and urgently in concert with climate action.

Despite growing social and political attention to nature loss, awareness of biodiversity risk in the infrastructure sector lags climate awareness by at least a decade. As a result, infrastructure development continues to not only destroy and degrade natural capital and the critical services it provides, but undervalues its enormous potential benefits for infrastructure, communities and economies. To overcome the time gap, the financial world should support the upcoming “super year for nature” being driven by global climate change and the biodiversity negotiations. In particular, the post-2020 framework of the Convention on Biological Diversity (CBD) offers an important opportunity to address the interactions between climate change, infrastructure and biodiversity and revise targets accordingly by better

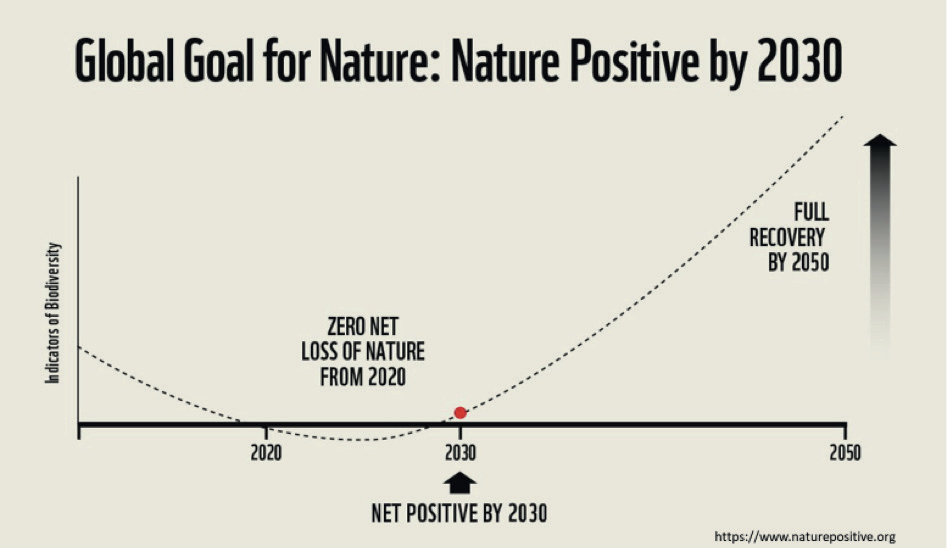

Figure 1: Proposed 2030 Goal for Convention on Biological Diversity

aligning these with the Paris Agreement and the Sustainable Development Goals. The CBD post-2020 framework should propose a global goal for nature to be achieved by 2050 on biodiversity net gain (see Figure 1). This biodiversity-positive goal was endorsed by G7 leaders in the 2030 Nature Compact adopted at their June 2021 summit, which explicitly included commitment to “tasking our Finance and other relevant Ministries to work together to identify ways to account for nature in economic and financial planning and decision-making: we encourage other countries and non-state actors to follow suit and consider the footprint of economic activity on biodiversity”(G7, 2021).

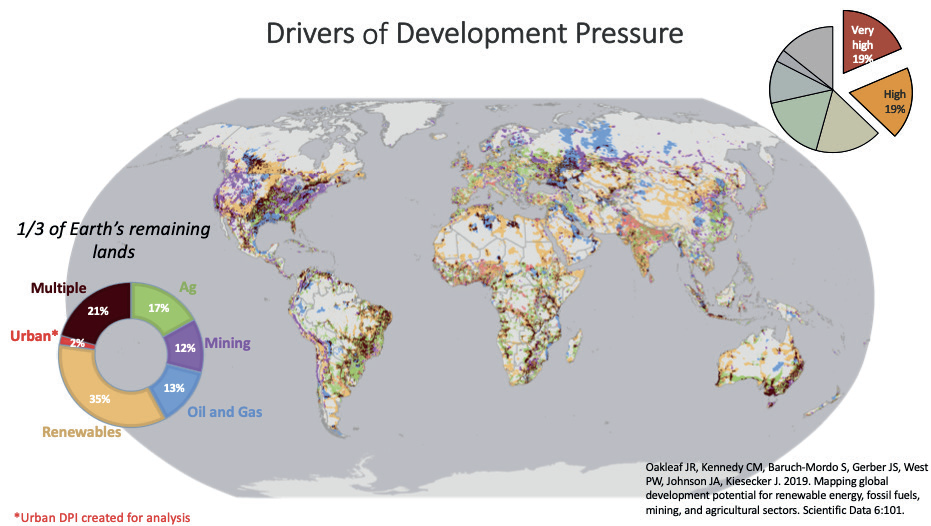

The post-COVID-19 era also poses a unique momentum to invest in nature-positive economic recovery packages, creating roadmaps that address the most important drivers of nature loss to build a nature-positive future. Future development will compound these outcomes without fundamental changes (see Figure 2). The Global Infrastructure Outlook estimates that $94 trillion in infrastructure needs to be built by 2040. Energy infrastructure and roads are identified as the two most significant growth areas (G20 and Oxford Economics, 2017); both have particularly large fragmentation effects on natural habitat that can have significant indirect impacts for biodiversity beyond the direct footprint of projects (Alamgir et al., 2017; Hilty et al., 2020). Ninety-five per cent of Amazon deforestation, for example, is within 5 km of a road (Barber et al., 2014), and dams and other infrastructure have fragmented most of the world’s rivers, affecting aquatic species migration kilometres upand downstream. Only one third of long rivers remain free flowing, severely disrupting the natural services that they provide (Grill et al., 2019). Degraded ecosystems also undermine the benefits that natural capital provides to infrastructure (Mander et al., 2017; Mandle et al., 2016; Wolanski, 2006), such as mitigating increasingly frequent landslides through soil stabilisation provided by intact vegetation (Spiker and Gorijan, 2003).

Figure 2 (Oakleaf et al., 2019)

Many emerging infrastructure sustainability standards include environmental criteria related to CO2 emissions, pollution, biodiversity, resource use and land-use change (Bennon and Sharma, 2018), but these standards have had very limited or only regional uptake to date. This is because most are not mandatory and many are new (Nofal, 2021), but also due to the multiplicity of standards (Hove et al., 2020), insufficient government guidance and regulation, weak technical capacities, non-standardised requirements and metrics, lack of investor capacity to evaluate biodiversity (WWF and B Capital Partners, 2019), environmental data deficiency and lack of clarity on impacts of environmental factors on investment performance (Oliver Wyman and WWF, 2020). Lack of mandatory disclosure standards also reduces awareness and accountability and can make attention to environmental criteria less salient.

Spending on infrastructure will be a key response to the economic shock caused by the COVID-19 pandemic.1 However, only a small share of the recovery spending to date is supporting environmentally friendly industries or sustainable infrastructure (Vivid Economics and Natural History Museum, 2020), despite studies demonstrating that spending on measures targeting good environmental outcomes can produce more growth than business-as-usual investments (Batini et al., 2021).

Previous T20 recommendations on infrastructure have focused on creating the right policy and institutional framework for delivering sustainability (Bhattacharya et al., 2019). Given the central role of both infrastructure and biodiversity in the post-COVID recovery and the growing scientific and political understanding of the need to prevent further ecosystem decline, more explicit policies and requirements are needed for integrating environmental criteria related to ecosystems, biodiversity and climate at the upstream planning phase in investments to support a nature-positive recovery (Nofal, 2021). Progress is especially critical for emerging markets and developing countries and cities, which are expected to see the most infrastructure investment and where environmental data to evaluate nature-based solutions and ecosystem services is most often lacking. The urgency for action is even greater given the long lag time between the structuring, planning, design, procurement and construction of infrastructure projects; realising the results of this much-needed transition can take even longer (Depietri and McPhearson, 2017).

Environmental criteria for sustainable infrastructure typically comprise greenhouse gas emissions, climate risk and resilience, disaster risk reduction, biodiversity, pollution, resource efficiency and water use/efficiency (IDB, 2020). While all components are critical, this brief focuses on biodiversity criteria as being the least applied and generally perceived as the most challenging component to measure (Credit Suisse, 2021).

Proposal

1. HARMONISE STANDARDS AND METRICS AROUND THE “NET GAIN” PRINCIPLE

The QII Principles adopted by the G20 in 2019 state: “Both positive and negative impacts of infrastructure projects on ecosystems, biodiversity, climate, weather and the use of resources should be internalized by incorporating these environmental considerations over the entire process of infrastructure investment”. Building on this concept, we propose a policy-level harmonisation of international standards for the use of biodiversity criteria in investment decisions. Several harmonisation and alignment initiatives are underway, but there is an urgent need to define clear and shared principles, establish a worldwide consensus on the most significant biodiversity criteria and use these shared principles to implement consistent biodiversity-positive regulations across countries.

There are many indications that investors would welcome more robust policy guidance on environmental performance expectations. Investors support the promotion of a common understanding of environmental criteria in infrastructure. They are generally aware that integrating environmental factors overall can help manage risk and improve investment performance (Sloan et al., 2019). In a recent G20/OECD survey, many investors stated that it would be useful for governments to develop guidance on which elements are most important, and whether there are common or shared elements of environmental, social and corporate governance (ESG) criteria in infrastructure. Investors also note many private sector initiatives on ESG across asset classes, investment products and financial instruments (such as green bonds) (OECD, 2020).

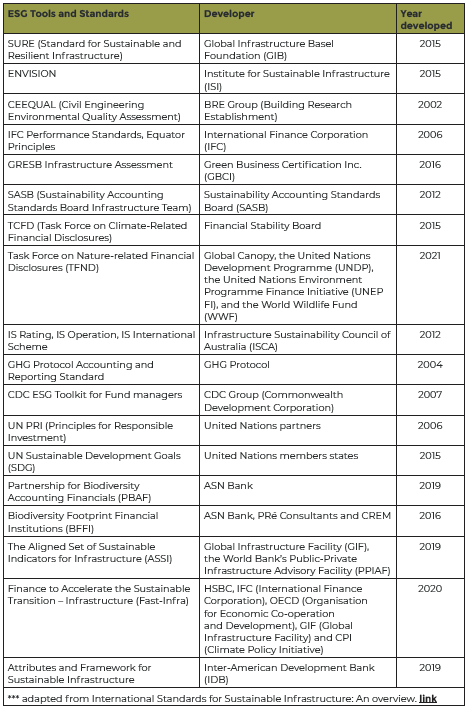

Various tools, standards and frameworks for sustainable infrastructure have been developed that include environmental components, benchmarks or indicators (see Table). Unfortunately, this has led to confusion about the performance indicators that really matter. What is needed is clear government endorsement from an entity with a focus on infrastructure finance, like the G20. The Aligned Set of Sustainable Indicators for Infrastructure initiative of the Public-Private Infrastructure Advisory Facility (PPIAF) is working across four leading infrastructure standards (SuRe, Envision, ISCA, CEEQUAL) and is designed to apply worldwide, including in low-income countries (IDB, 2020). Its preliminary list of indicators includes 12 in the field of environment overall, two of which focus on biodiversity (species and land use) (PPIAF, 2020). Another initiative led by the international finance community aims to build on this effort by developing a sustainable infrastructure label that provides consistency regarding the quality and sustainability of assets via assessment (using any of the sustainability standard platforms in the market) of 14 core criteria against four dimensions of sustainability environmental, social, governance, and adaptation and resilience. The FAST Infra (Finance to Accelerate the Sustainable Transition Infrastructure) initiative label is designed to increase financing potential in emerging markets, and in turn to motivate governments to design more projects with sustainability criteria at their core, and encourage developers to maintain high environmental, social and resiliency standards at all stages of the infrastructure lifecycle (Widge, 2021).

Table: Partial list of infrastructure tools and standards on environment

While these standards all identify multiple factors related to infrastructure project planning, siting and operations that can affect a project’s biodiversity impacts, the single most significant driver of biodiversity loss in most cases is the land-use change and degradation caused by incursions and fragmentation of natural habitat (IPBES, 2019). We therefore suggest that averting this loss driver be addressed through upstream planning at a national/ subnational level that is guided by a net gain or “biodiversity positive” goal. This is consistent with the proposed Global Goal for Nature in the CBD (“net positive by 2030” see Figure 1) and the 2030 Nature Compact adopted by the G7 heads of state in their June 2021 summit (G7, 2021). This should be the overarching principle adopted by G20 nations in their approach to sustainable infrastructure. We also recommend that this principle be backed up by specific, measurable, time-bound goals defining ambitious levels of biodiversity gain at a national level.

Biodiversity-positive infrastructure is inherently land-sparing, avoiding urban sprawl and maximising use of already degraded lands. It means that no loss of irreplaceable sites essential for biodiversity conservation be permitted. Linear infrastructure and transportation corridors must be designed to avoid impacts to intact natural ecosystems avoiding habitat fragmentation and corridors for wildlife movement and ecological adaptation to climate change. Construction should be avoided in areas important for the persistence of biodiversity or having high ecosystem service value. The development of physical infrastructure should seek to complement or strengthen, rather than replace, nature’s ability to provide services such as water supply and purification, flood control and carbon sequestration. Nature-based solutions for infrastructure can often deliver the needed services and natureand biodiversity-positive outcomes and should be prioritised when possible (United Nations Environment Programme, 2021).

The concept of biodiversity “net” gain acknowledges that some loss or degradation of nature in the near term is an inevitable result of humanity’s ongoing demand for food, energy, materials and transport, and to address different stages of development (Díaz et al., 2020; Maron et al., 2019). However, the magnitude of these losses should be systematically assessed when infrastructure projects are designed and robust efforts should be made to implement a scientifically informed mitigation hierarchy (Milner-Gulland et al., 2021) that avoids areas that are significant for biodiversity, limits other losses to nature and compensates for unavoidable losses through ecological restoration (Locke et al., 2021)

The EU process to develop a shared taxonomy for biodiversity-positive investments is also vital to assess whether projects are truly sustainable; it will reportedly include disclosure requirements on healthy ecosystems criteria.2 We recommend that all types of projects be evaluated for their impacts on land use and be required to avoid critical habitat3 and high ecosystem service value areas and compensate for impacts to other natural habitat through application of the mitigation hierarchy, in accordance with Recommendation #1.

– Recommendation #1: The G20 should endorse: (a) the principle of net gain of ecosystem extent and condition; and (b) avoidance of destruction of high-value ecosystem service and biodiversity areas in its QII guidance. The G20 should also encourage countries to mandate policies and apply incentives that will ensure net gain for nature from infrastructure development over the long term.

2. SET CLEAR GUIDANCE FOR TRANSPARENCY AND DISCLOSURE REGARDING IMPACTS AND FINANCE

Transparency is essential to encourage attention and accountability to environmental standards and to ensure that infrastructure finance is aligned with better environmental outcomes. The QII Principles have recognised this, calling for improved disclosure of environmental information to better understand risk and to enable the use of green finance instruments (G20, 2019).

Even in the case of public development finance institutions that have adopted environmental performance standards, data to attest to their successful implementation is lacking. In addition, a recent Credit Suisse report finds that 91 per cent of investors do not have measurable biodiversity-linked targets and 72 per cent have not assessed their investments’ impact on biodiversity. However, as many as 55 per cent of investors believe biodiversity loss needs to be addressed in the next 24 months (Credit Suisse, 2021). Financial institutions need to establish portfolio-wide systems to monitor and measure the environmental impacts of their investments, particularly related to biodiversity (Portfolio Earth, 2020).

The recently formed Task Force on Nature-related Financial Disclosures aims to integrate biodiversity risk and impact analysis and reporting within investment decisions and develop common reporting frameworks, but it has only just begun its work. In the meantime, financial institutions should audit and publicly report on their current implementation of biodiversity and environmental standards that they have already adopted, such as the widelyaccepted International Finance Corporation (IFC) Performance Standard 6, and the performance of clients on these standards, including successful fulfilment of mitigation and offsetting obligations.

Another relevant initiative is the Partnership for Biodiversity Accounting Financials (PBAF) a partnership of 21 financial institutions that work together to explore the opportunities and challenges surrounding the assessment and disclosure of the impact on biodiversity associated with their loans and investments. The PBAF partners are cooperating in the development of a set of harmonised principles underlying biodiversity impact assessment. The ASN Bank in the Netherlands, in another example, applies the Biodiversity Footprint Financial Institutions (BFFI) method, which can calculate both the negative and the positive impact of an investment portfolio on biodiversity and provides guidance how to assess biodiversity-positive investments (CREM and PRé Sustainability, 2019). BFFI defines biodiversity positive investments as: investments in interventions resulting in net biodiversity conservation gain, either through averted loss and/or degradation of biodiversity and improving protection status, or through positive management actions (restoration, enhancement) that improve biodiversity condition (Partnership for Biodiversity Accounting Financials, 2020). G20 governments should provide policy support for these frameworks by imposing compliance standards for incorporating biodiversity-related risk analyses into public and private investment processes (Deutz et al., 2020).

– Recommendation #2: The G20 should reinforce its call on financial institutions to improve disclosure of environment-related information without further delay by requiring reporting on compliance with currently-adopted ESG standards such as the IFC Performance Standards. In the medium term, G20 should endorse the development and use of a common framework and metrics for financial reporting that will permit financial institutions to better understand the biodiversity impacts from their investments and enhance the positive and avoid the harmful impacts, including by conducting “stress tests” for balance sheet exposure to nature-related risk.

3. IMPROVE THE INTERNATIONAL AND NATIONAL ENABLING POLICY AND DATA ENVIRONMENT

In the global space several positive developments are afoot to create enabling conditions for policy and investment perspectives to shift from doing no harm to net gain for nature. The New Planet Summit for Biodiversity,4 held in Paris on 11 January 2021 under the leadership of President Macron, gathered an impressive number of political leaders and CEOs who pledged to reverse the destruction of nature for reducing the risk of future pandemics, and highlighted that protecting biodiversity and fighting climate change are two sides of the same coin. This was preceded by the Leaders’ Pledge for Nature, signed by 84 Heads of State and Heads of Government, at the UN Biodiversity Summit in 2020, reflecting the growing recognition and political salience of commitments to addressing the drivers of biodiversity loss.5 The Leaders’ Summit on Climate convened by US President Biden in April 2021 brought together 40 world leaders who, in addition to making significant new climate pledges, featured the theme of nature-based solutions, with concrete announcements by countries to end deforestation and the loss of wetlands, and to restore marine and terrestrial ecosystems. This year is often called the “super year” for nature, with the anticipated conclusion of a new Global Biodiversity Framework in Kunming, China as well as the UN Climate Conference in Glasgow, UK that will emphasise the role of nature-based climate solutions. In particular, the post-2020 Global Biodiversity Framework poses a great opportunity for a global goal on net gain for nature, which would promote a paradigm shift towards a nature positive future.

However, national policies need to be adopted to create a favourable regulatory environment for these political pledges, and to create incentives for market-driven implementation of environmental criteria in infrastructure investments. The G20 is in a strategic position to align with the above-mentioned global environmental initiatives with a strong leadership stance and supporting governments to integrate a net gain for nature approach into infrastructure investments and financing.

In this context, governments should focus on:

Biodiversity-positive regulations to support net gain: Chief among these is a national environmental policy explicitly requiring net gain outcomes for climate and biodiversity. While tacit support for a regulatory regime on climate mitigation is now nearly universal, biodiversity lags in both awareness and, more importantly, deployment of measures to address this risk in the infrastructure and finance sectors. As in the climate arena, effective and persistent leadership will be required to address this gap.

Improving biodiversity data availability to guide priority setting: One of the most significant barriers to adoption of environmental criteria is the lack of data and information to perform impact analyses (Sloan et al., 2019). Project-based environmental impact assessments are ineffective in stemming biodiversity loss, since they do not include assessment of cumulative impacts or ecological network effects. Governments need to identify, assess and publicise areas that are important for biodiversity and ecosystem services, including critical habitat for plants and animals, water source protection areas and natural areas important for climate mitigation and disaster risk reduction. Governments must also create meaningful incentives to both avoid and mitigate impacts to these public goods, including explicit regulatory requirements to avoid areas most essential for biodiversity habitat and ecosystem service values in infrastructure development. While these important natural ecosystems normally include formal protected areas, protected areas do not cover all habitats critical to preserve biodiversity, water and climate mitigation and adaptation needs. Governments should develop cross-sectoral, long-term, climate-aware spatial plans to establish a transparent baseline for infrastructure development.

Prioritising and investing in nature-based infrastructure: Using nature-based systems such as forests, wetlands, mangroves, soils and floodplains to complement grey infrastructure in providing service provision is a highly cost-effective and climate-resilient approach that provides multiple benefits. Supportive national and subnational policies to evaluate, procure and protect nature-based infrastructure are lacking in most countries. Proactive government policies can help speed adoption by identifying natural infrastructure opportunities in regional and sectoral planning processes and preferencing implementation where feasible (Browder et al., 2019).

Focusing on institutional incentives for biodiversity net gain: In collaboration with the private sector, governments can drive the implementation of regulatory or voluntary incentives that address market failures where firms lack information or simply fail to address externalities. Robust, market-oriented institutional frameworks ensure the selection of, and incentivise private-sector investment in, sustainable infrastructure (Bhattacharya et al., 2019). They do this through the upstream integration of the policies, planning, legislation, regulations and organisational capacities that will feature throughout a decades-long project cycle, which extends from project inception to decommissioning of some form. Incentives should aim to encourage the private sector to incorporate environmental considerations into investments and operations in such a way that project developers and financiers continually seek the least-cost method (Casey et al., 2006).

– Recommendation #3: The G20 should encourage member countries to establish net gain policies and supporting regulations for national-level implementation that include the collection and publication of environmental data to enhance upstream planning, create appropriate incentives, incorporate nature-based solutions and help streamline efforts by project developers and investors to integrate environmental criteria in decision making.

CONCLUSION

Like nothing else, the COVID-19 pandemic has created a sense of urgency around maintaining a healthier balance between humans and nature. As we all become increasingly aware of environmental changes we will have a better foundation for understanding the costs attached to disrupting this delicate balance. Acting on this information is key to building a more sustainable and resilient future that benefits everyone.

Infrastructure has been a long-standing agenda item for the G20. The G20 Quality Infrastructure Investment Principles include references to sustainability and the environment, confirming that ecosystem, biodiversity and climate considerations should be incorporated into infrastructure investments. Nevertheless, there continues to be inadequate integration of environmental factors -especially those related to biodiversity-into infrastructure investment considerations. Additional G20 policy guidance regarding mandatory requirements and harmonised principles for environmentally sustainable infrastructure, the improvement of national enabling environments and greater transparency are urgently needed to strengthen the sustainability of investments at the scale and speed that is necessary for a nature-positive recovery.

NOTES

1 See, for example, US Government (2021), “FACT SHEET: The American Jobs Plan”, https:// www.whitehouse.gov/briefing-room/statements-releases/2021/03/31/fact-sheet-the-american-jobs-plan/; EU Commission (2021a), “Recovery Plan for Europe”, https://ec.europa.eu/info/ strategy/recovery-plan-europe_en; EU Commission (2021b),”NextGenerationEU: European Commission Endorses Spain’s €69.5 Billion Recovery and Resilience Plan”, https://ec.europa. eu/commission/presscorner/detail/en/IP_21_2987; UNEP (2021), “Are We Building Back Better? Evidence from 2020 and Pathways for Inclusive Green Recovery Spending”, March 10, https:// www.unep.org/resources/publication/are-we-building-back-better-evidence-2020-andpathways-inclusive-green; B. Nofal (2021), “A Global Partnership for Infrastructure Sustainability”, in ReCoupling, Global Solutions Journal, Vol. 7; OECD (2020), “Green Infrastructure in the Decade for Delivery”, https://www.oecd-ilibrary.org/sites/bddc18e1-en/index.html?itemId=/ content/component/bddc18e1-en; Oxford University, “Global Recovery Observatory”, https:// recovery.smithschool.ox.ac.uk/tracking/.

2 See https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en.

3 Critical habitats are areas with high biodiversity value, including (i) habitat of significant importance to Critically Endangered and/or Endangered species; (ii) habitat of significant importance to endemic and/or restricted-range species; (iii) habitat supporting globally significant concentrations of migratory species and/or congregatory species; (iv) highly threatened and/or unique ecosystems; and/or (v) areas associated with key evolutionary processes (see, for example, IFC Performance Standard 6).

4 https://www.oneplanetsummit.fr/en.

5 See, for example, Leaders’ Pledge para. 7: “We commit to mainstreaming biodiversity into relevant sectoral and cross-sectoral policies at all levels, including in key sectors such as food production, agriculture, fisheries and forestry, energy, tourism, infrastructure and extractive industries, trade and supply chains, and into those key international agreements and processes which hold levers for change, including the G7, G20, WTO, WHO, FAO, and UNFCCC and UNCCD. We will do this by ensuring that across the whole of government, policies, decisions and investments account for the value of nature and biodiversity, promote biodiversity conservation, restoration, sustainable use and the access to genetic resources and the fair and equitable sharing of benefits arising from their utilization”, https://www.leaderspledgefornature.org/.

REFERENCES

Alamgir, M.; M. J. Campbell; S. Sloan; M. Goosem; G. R. Clements, M. I. Mahmoud; and W. F. Laurance (2017), “Economic, Socio-Political and Environmental Risks of Road Development in the Tropics”, in Current Biology, Vol. 27, No. 20, pp. R1130-R1140, https://doi.org/10.1016/j.cub.2017.08.067

Barber, C. P.; M. A. Cochrane; C. M. Souza; and W. F. Laurance (2014), “Roads, Deforestation, and the Mitigating Effect of Protected Areas in the Amazon”, in Biological Conservation, Vol. 177, pp. 203-209, https://doi.org/10.1016/j.biocon.2014.07.004

Batini, N.; M. D. Serio; M. Fragetta; G. Melina; and A. Waldron (2021), “Build Back Better Multipliers”, in IMF Working Papers

Bennon, M.; and R. Sharma, (2018), State of the Practice: Sustainability Standards for Infrastructure Investors, www.guggenheiminvestments.com/guggenheiminvestments/media/pdf/wwf-infrastructure-full-report-2018.pdf

Bhattacharya, A.; L. Krueger; B. Nofal; K. Gallagher; and M. Jeong (2019), “Policy and Institutional Framework for Delivering on Sustainable Infrastructure”, in T20 Task Force on Economic Effects of Infrastructure Investment and Its Financing, T20 Japan, https://t20japan.org/wp-content/uploads/2019/05/t20-japan-tf4-10-policy-institutional-framework-delivering-sustainable-infrastructure.pdf

Browder, G.; S. Ozment; I. R. Bescos; T. Gartner; and G.-M. Lange (2019), Integrating Green and Gray: Creating Next Generation Infrastructure, Washington DC, World Bank and World Resources Institute, https://www.wri.org/research/integrating-green-and-gray-creatingnext-generation-infrastructure

Casey, F.; S. Vickerman; C. Hummon; and B. Taylor (2006), Incentives for Biodiversity Conservation

Costanza, R.; R. D. Groot; P. Sutton; S. van der Ploeg; S. J. Anderson; I. Kubiszewski; S. Farber; and R. K. Turner (2014), “Changes in the Global Value of Ecosystem Services”, in Global Environmental Change, Vol. 26, pp. 152-158, https://doi.org/10.1016/j.gloenvcha.2014.04.002

Credit Suisse (2021), Unearthing Investor Action on Biodiversity

CREM; and PRé Sustainability (2019), Positive Impacts in the Biodiversity Footprint Financial Institutions, Dutch Ministry of Agriculture, Nature and Food Quality and The Netherlands Enterprise Agency

Dasgupta, P. (2021), The Economics of Biodiversity: The Dasgupta Review, HM Treasury

Depietri, Y.; and T. McPhearson (2017), “Nature-Based Solutions to Climate Change Adaptation in Urban Areas, Linkages between Science, Policy and Practice”, in Theory and Practice of Urban Sustainability Transitions, pp. 91-109, https://doi.org/10.1007/978-3-31956091-5_6

Deutz, A.; G. M. Heal; R. Niu; E. Swanson; T. Townshend; Z. Li; A. Delmar; A. Meghji, S. A. Sethi; and J. Tobin de la Puente (2020), Financing Nature: Closing the Biodiversity Finance Gap

Díaz, S.; N. Zafra-Calvo; A. Purvis; P. H. Verburg; D. Obura; P. Leadley; R. Chaplin-Kramer; L. D. Meester, E. Dulloo, E., B. Martín-López et al. (2020), “Set Ambitious Goals for Biodiversity and Sustainability”, in Science, Vol. 370, No. 6515, pp. 411-413, https://doi.org/10.1126/science.abe1530

Ellis, E. C.; K. K. Goldewijk; S. Siebert; D. Lightman; and N. Ramankutty (2010), “Anthropogenic Transformation of the Biomes, 1700 to 2000”, in Global Ecology and Biogeography, Vol. 19, No. 5, pp. 589-606, https://doi.org/10.1111/j.1466-8238.2010.00540.x

Compact

G20 (2019), G20 Principles for Quality Infrastructure Investment

G20; and Oxford Economics (2017), Global Infrastructure Outlook: Infrastructure Investment Needs 50 Countries, 7 sectors to 2040

Grill, G.; B. Lehner; M. Thieme; B. Geenen; D. Tickner; F. Antonelli; S. Babu; P. Borrelli; L. Cheng; H. Crochetiere et al. (2019), “Mapping the World’s Free-Flowing Rivers”, in Nature, Vol. 569, No. 7755, pp. 215-221, https://doi.org/10.1038/s41586-019-1111-9

Hilty, J.; G. L. Worboys; A. Keeley; S. Woodley; B. J. Lausche; H. Locke; M. Carr; I. Pulsford; J. Pittock; J. W. White et al. (2020), Guidelines for Conserving Connectivity through Ecological Networks and Corridors, https://doi.org/10.2305/iucn.ch.2020.pag.30.en

Hove, A.; X. Liu; T. Stubhan; N. K. Fuerst; G. L. Downing; and Global Infrastructure Basel Foundation (2020), International Standards for Sustainable Infrastructure: An Overview

IDB (2020), MDB Infrastructure Cooperation Platform: A Common Set of Aligned Sustainable Infrastructure Indicators

IPBES. (2019). Summary for Policymakers of the Global Assessment Report on Biodiversity and Ecosystem Services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services, https://doi.org/10.5281/zenodo.3553579

Locke, H.; J. Röckstrom; P. Bakker; M. Bapna; M. Gough; J. Hilty; M. Lambertini; J. Morris; C. M. Rodriguez; C. Samper et al. (2021), A Nature Positive World: The Global Goal for Nature

Mander, M.; G. Jewitt; J. Dini; J. Glenday; J. Blignaut; C. Hughes; C. Marais; K. Maze; B. van der Waal; and A. Mills (2017), “Modelling Potential Hydrological Returns from Investing in Ecological Infrastructure: Case Studies from the Baviaanskloof-Tsitsikamma and uMngeni Catchments, South Africa”, in Ecosystem Services, Vol. 27, pp. 261-271, https://doi.org/10.1016/j.ecoser.2017.03.003

Mandle, L.; R. Griffin; J. Goldstein; R. Avecedo-Daunas; A. Camhi; M. Lemay; E. Rauer; and V. Peterson (2016), Natural Capital and Roads: Managing Dependencies and Impacts on Ecosystem Services for Sustainable Road Investments, Inter-American Development Bank

Maron, M.; J. S. Simmonds; J. E. M. Watson; L. J. Sonter; L. Bennun; V. F. Griffiths; F. Quétier; A. von Hase; S. Edwards; H. Rainey et al. (2019), “Global No Net Loss of Natural Ecosystems”, in Nature Ecology & Evolution, pp. 1-4, https://doi.org/10.1038/s41559-019-1067-z

Milner-Gulland, E. J.; P. Addison; W. N. S. Arlidge; J. Baker; H. Booth; T. Brooks; J. W. Bull; M. J. Burgass; J. Ekstrom; S. O. S. E. zu Ermgassen et al. (2021), “Four Steps for the Earth: Mainstreaming the Post-2020 Global Biodiversity Framework”, in One Earth, Vol. 4, No. 1, pp. 75-87, https://doi.org/10.1016/j.oneear.2020.12.011

Newbold, T.; L. N. Hudson; A. P. Arnell; S. Contu; A. D. Palma; S. Ferrier; S. L. L. Hill; A. J. Hoskins; I. Lysenko; H. R. P. Phillips et al. (2016), “Has Land Use Pushed Terrestrial Biodiversity Beyond the Planetary Boundary? A Global Assessment”, in Science, Vol. 353, No. 6296, pp. 288-291, https://doi.org/10.1126/science.aaf2201

Nofal, B. (2021), “A Global Partnership for Infrastructure Sustainability”, in ReCoupling, Global Solutions Journal, Vol. 7

Oakleaf, J. R.; C. M. Kennedy; S. Baruch-Mordo; J. S. Gerber; P. C. West; J. A. Johnson; and J. Kiesecker (2019), “Mapping Global Development Potential for Renewable Energy, Fossil Fuels, Mining and Agriculture Sectors”, in Scientific Data, Vol. 6, No. 1, p. 101, https://doi.org/10.1038/s41597-019-0084-8

OECD (2020), G20/OECD Report on the Collaboration with Institutional Investors and Asset Managers on Infrastructure: Investor Proposals and the Way Forward

Oliver Wyman; and WWF (2020), Incorporating Sustainability into Infrastructure: How climate and Nature-Related Factors Are Applied in the Investment Process

Partnership for Biodiversity Accounting Financials (2020), Paving the Way Towards a Harmonised Biodiversity Accounting Approach for the Financial Sector

Portfolio Earth (2020), Bankrolling Extinction: The Banking Sector’s Role in the Global Biodiversity Crisis, p. 61

Public-Private Infrastructure Advisory Facility (PPIAF) (2020), Promoting Sustainable Infrastructure through an Aligned Set of Sustainability Indicators (ASSI). Draft for Discussion

Sloan, W.; K. Wright; J. Crowe; J. Daudon; and L. Hanson (2019), Valuing Sustainability in Infrastructure Investments: Market Status, Barriers and Opportunities, pp. 1-42

Spiker, E. C.; and P. Gorijan (2003), National Landslide Hazards Mitigation Strategy, a Framework for Loss Reduction, US Geological Survey

United Nations Environment Programme (2021), International Good Practice Principles for Sustainable Infrastructure Nairobi

Vivid Economics; and Natural History Museum (2020), The Urgency of Biodiversity Action

Widge, V. (2021), Climate Policy Initiative, https://www.climatepolicyinitiative.org/consultation-announcement-fast-infra-sustainable-infrastructure-labelling-system/

Wolanski, E. (2006), Thematic Paper: Synthesis of the Protective Functions of Coastal Forests and Trees against Natural Hazards”, in Coastal Protection in the Aftermath of the Indian Ocean Tsunami: What Role for Forests and Trees, pp. 157-179

WWF (2020), Living Planet Report, https://livingplanet.panda.org/en-US/what-isthe-living-planet-index

WWF; and B Capital Partners (2019), Guidance Note: Integrating ESG Factors into Financial Models for Infrastructure Investments