The demographic transition has been one of the greatest phenomena affecting development worldwide and its effects on gender equity are undeniable. Lower fertility and ageing populations create both challenges and opportunities for gender equity, while women still face obstacles towards labour, financial and digital inclusion. G20 countries are at very different stages of the process, yet most have birth rates below replacement levels and population is ageing. Adopting a comprehensive and intersectional approach to women’s economic empowerment that contemplates ageand gender-specific rights, priorities and needs is crucial to both fulfilling women’s rights and facing the challenges associated with demographic.

Challenge

The demographic transition has been one of the greatest phenomena affecting development around the world: it has transformed the structure of societies. Demographic change can affect and be affected by gender relations through different channels.

Demographic transitions are triggered by a decline in mortality while fertility remains high, sparking a process of natural increase that leads to an increasing dependency ratio and population growth. Then, fertility falls; augmenting adult cohorts before ageing takes place. This critical period is called the window of demographic opportunity or dividend, with dependency rates at their lowest. As time advances, fertility remains low and population ages, increasing dependency ratios.

For development benefits to materialize during the transition, drops in fertility must converge among different socioeconomic strata; new cohorts need to be educated to be productive; and employment opportunities must exist, especially for women and youngsters. Fulfilling these requirements can lead countries to profit from the demographic bonus and eventually lengthen it. The implications of the transition on women remain less analysed. While the process can certainly bring improvements in female status, the connection is not straightforward.

The fertility decline can bring health benefits for women and their families. As parents have fewer children, they have more time and money available to invest in the ones they have. This translates into better health and educational status for each child (Dyson, 2010).

Lower fertility is also associated with reduced care responsibilities, which traditionally fall on women. By women’s increased reproductive choice and later fertility, reduced and planned childbearing and childrearing relax constraints on women’s time and allow them to pursue activities such as employment and education (McNay, 2005). Nonetheless, women do not necessarily reach decent work opportunities and the unequal gender distribution of unpaid work creates a double burden of work. In advanced economies like Japan, Spain, Korea and Italy, difficulties to reconcile work and caring contribute to very low birth rates.

Declining fertility can provoke adverse gender consequences. Major transformations in family arrangements imply that marriage rates decrease while divorce rates, out-of-wedlock childbearing and single-parent families increase. Moreover, low fertility can trigger coercive policies and societal pressure to limit women’s reproductive rights. In societies with son preferences, families may give up girls for adoption, use gender-selection technologies or carry out sex-selective abortions, leading to a demographic masculinization with undetermined effects (Guilmoto, 2009). State regulations become critical to provide adequate protection for women and children in these cases.

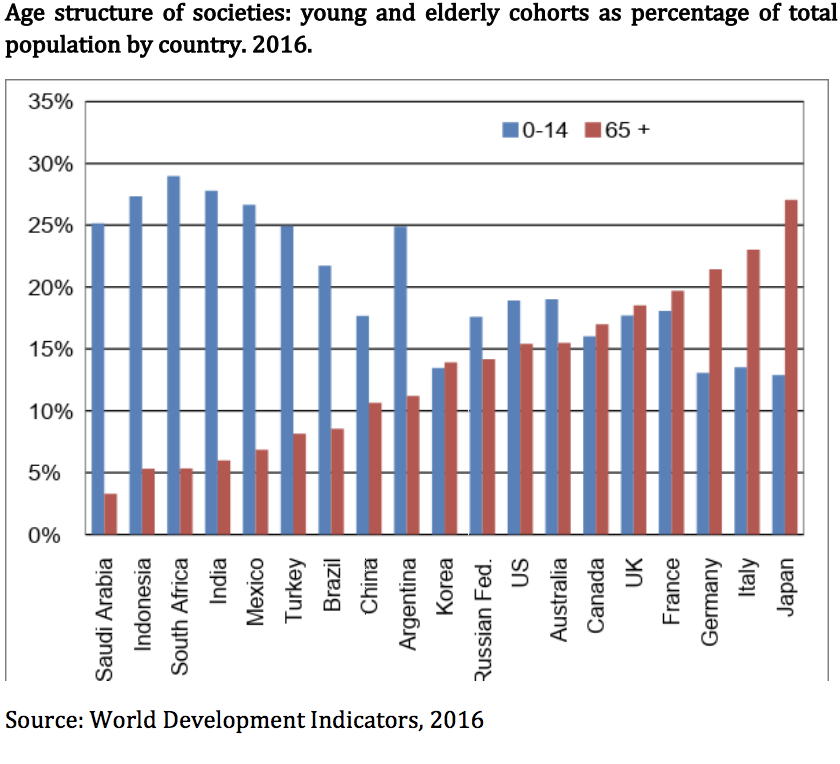

Ageing also impacts gender relations. People live more healthy years and can be economically active for longer. Yet increases in longevity also boost care demand, which affects women’s burden of unpaid work. Moreover, ageing, a falling family size and differential life expectancies by gender can be problematic for older women, especially due to gender gaps in labour participation, social security and savings. Typically, older women display higher poverty rates than men.

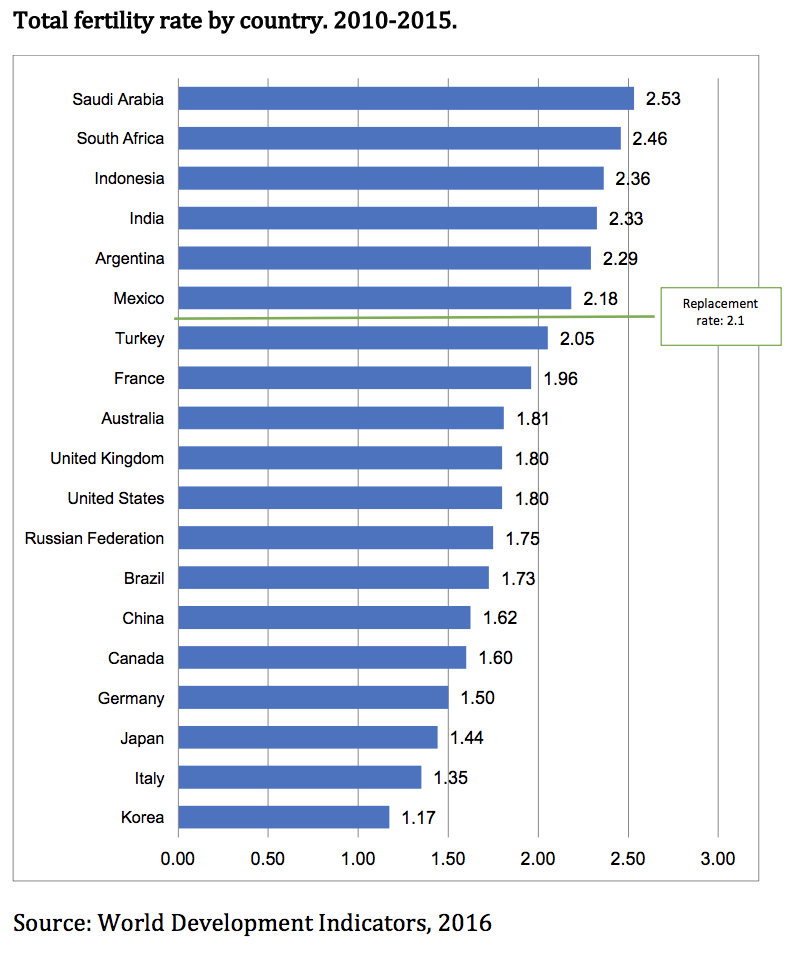

While G20 countries are at very different stages of the demographic transition, most societies experience below-replacement fertility levels, which bring rapid ageing and population decline in the long run. As the G20 represents 86% of the global economy and two-thirds of the world population, it holds a huge role in leveraging the demographic transition to reduce gender gaps, promote women’s economic empowerment and foster inclusive and sustainable development.

Proposal

The demographic transition is an inevitable phenomenon that will, sooner or later, affect all societies, going from high birth and death rates to a severe decline in both (Dyson, 2010). This process has been a key factor underneath the transformation of gender relations and women’s empowerment during the last century (Davis & Van de Oever, 1982; Dyson, 2010), as it impacted on women’s working and education opportunities, care responsibilities and health, among others. Given impending demographic change, a life-course approach to gender equity becomes critical to both fulfilling women’s rights and facing the challenges associated with this transition.

G20 countries are at very different stages of the transition. Europe, Oceania, North America and some Latin American countries have already achieved an ageing population, with average birth rates almost as low as death rates. Africa, Middle East, Asia and other Latin American countries are still in the midst of the process, with natural increase happening at a decreasing rate (Dyson, 2010)1.

At different stages, the demographic transition creates diverse challenges and opportunities for gender relations and for women’s labour, financial and digital inclusion. This section will present policy recommendations in these fields to promote gender equity and women’s rights.

Cross-cutting policies

While there are policies that help to specifically address labour, financial and digital equity from a gendered and demographic perspective, several crosscutting initiatives can contribute to the three goals.

First, social norms create gender roles and stereotypes that shape behaviours since childhood. These constructions are internalised by men and women and affect their decision making and opportunities throughout their lives. No policy is gender neutral: social norms are embedded in institutions and technologies, and these biases must be considered to avoid compounding existing inequalities. A gendered analysis of the demographic transition stresses the need to confront these norms. Gender norms limit women’s agency and perpetuate the sexual division of labour, which needs to be addressed in coming generations. To fulfil women’s rights, it is crucial to design policies and campaigns that bust discriminatory norms and promote equality of opportunities between men and women, through displaying more egalitarian gender roles.

Second, it is paramount to design social protection systems that guarantee decent standards of living over the life cycle, accounting for gender and age considerations. Typically, older women receive lower pensions than men, compounded by obstacles to work, discriminatory laws and lack of knowledge of their rights (Samuels et al, 2018). Women also depict higher levels of poverty and unemployment throughout their lives, especially when they have children. Therefore, social protection floors should guarantee access to health, education and income security, by providing universal childhood grants, unemployment insurance and universal pension coverage. Additionally, it is necessary to socialize the cost of care and ensure universal access to quality care over the life-cycle. These policies can potentially alleviate poverty, promote quality livelihoods and foster development.

Comprehensive reproductive health services are associated with lower maternal mortality, lower adolescent pregnancies and fewer unsafe abortions. Improved access to sexual education and to sexual and reproductive healthcare can enable women and girls to make their own informed decisions regarding marriage and childbearing. Reproductive empowerment enables economic empowerment, and recognizing this is key in the context of the demographic transition and for women’s health and rights.

Third, collecting and analysing gender- and age-disaggregated data along the life cycle is crucial to interrogate evolving and intersecting inequalities and to design, deliver and evaluate policies tailored to the specific needs of different groups, such as youth, women in reproductive age and the elderly. Engendering data and policy systems will assist in diagnosing the current position and setting a coordinated plan for change. By taking this gender-lens approach, barriers can come into sharp focus and appropriate initiatives be identified, implemented and tracked, setting a framework for success. Impact evaluations become also imperative to better understand the link between gender equity and the demographic transition.

Labour inclusion

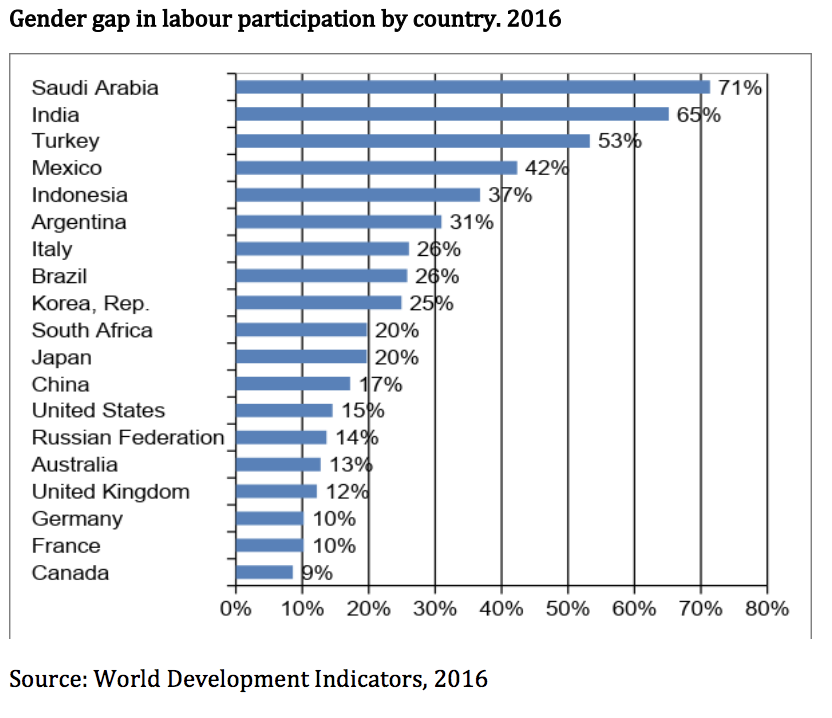

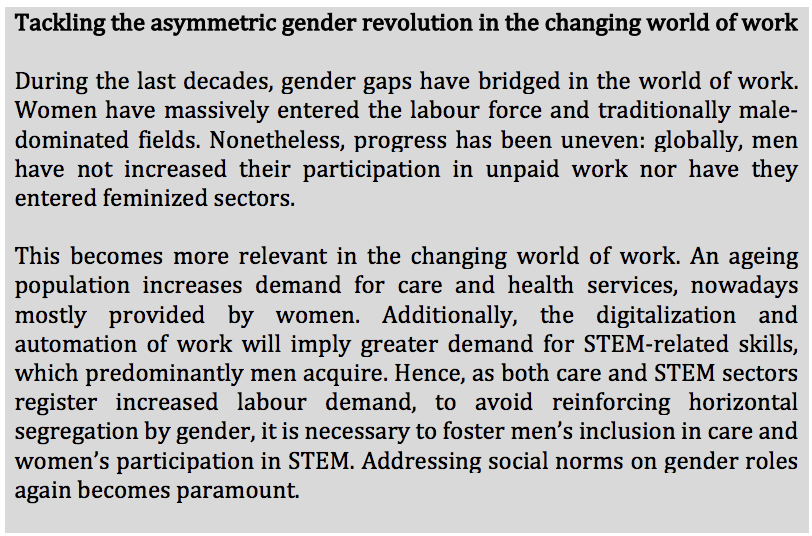

The burden of care and domestic unpaid work is one of the main deterrents for women’s labour participation. As described above, the transition’s effect is twofold: declining fertility diminishes the burden of care, yet an ageing population increases care demand. Additionally, the unequal gender distribution of paid and unpaid work may further decrease birth rates.

The recognition, reduction, redistribution and representation of unpaid care work is critical for women’s economic empowerment (Gammage et al, 2018) and to profit from the demographic bonus, requiring an integrated set of policies. First, initiatives must recognize the social and economic value of care, by promoting measurement of time use and providing compensation through social protection. Second, reducing the burden of care is possible by developing quality, affordable and accessible care infrastructure for children, the sick and the elderly, as well as by implementing time-and-labour-saving equipment to reduce workloads. To redistribute unpaid work between women, men and the State, providing universal high-quality care services and advancing coverage and length of paternity leaves is essential. Finally, it is necessary to support carers and promote their representation in collectives, the policy environment and the labour market. Raising awareness of and seeking to shift norms around the gendered division of care must underpin this 4R approach. Additionally, there is a need to generate further knowledge about intersecting inequalities (gender, age, ethnicity) and to use these insights to inform policy development, monitoring and evaluation.

While reduced care responsibilities free women’s time to participate in the labour market, decent work and education opportunities are far from guaranteed. Women have lower access to paid work across the life course and higher likelihood of being in low-paid or informal work, resulting in low lifetime savings and higher economic insecurity.

Active labour market policies are vital to foster skill acquisition and improve women’s employability (Díaz Langou et al, 2018). These initiatives need to mainstream gender and contemplate age-specific needs to address the barriers that women face, such as care work. Training programmes can help the youth get their first job and re-skill older women, while preventing the reproduction of horizontal segregation, especially in a changing world of work. Additionally, as gender biases hamper gender labour equity, encouraging gender-neutral job advertisements and blind recruitment processes can foster women’s employment.

Furthermore, women also perform most paid care and domestic work: these are highly feminized sectors with high informality. States must design strategies to monitor informality and promote workers’ registration. Creating non-contributory basic pillars for pensions and cash transfers can help reduce the costs of formalization for low-skill jobs.

In a context of increasing life expectancies, women tend to live longer than men on average, and so account for the majority of older persons, shift known as the ‘feminization of ageing’ (Greengross, 2015). Hence, women are in the labour market for longer healthy years. Gender-and-age-based discrimination at the workplace can be widespread, due to stereotypes are that older workers are less productive, less physically capable and slow to learn or adapt to change (UNFPA and HelpAge International, 2012). The un-recognition and undervaluation of older women’s contribution leaves them unsupported by policy – with many falling through the gap in initiatives aimed at supporting women (ignoring age) and older people (ignoring gender)2.

These trends will become more acute given ageing populations worldwide, including G20 countries. Adopting a comprehensive and intersectional approach to women’s economic empowerment which fully responds to the rights, priorities and needs of older women requires specific, tailored policy responses.

Older women’s income security needs to be strengthened by ensuring access to comprehensive social protection (including universal pensions), assets, property and financial services, and supporting their labour participation. Creating decent paid work and supporting entry into high-value and highreturn economic sectors through skills (re)development, life-long learning and tackling barriers to (re)entry –including discrimination– are critical.

Financial inclusion

Meaningful financial inclusion is vital to tackle poverty and inequality and to stimulate inclusive and sustainable economic growth and development (Suri and Jack 2016; Allen et al 2016; ADB 2018). For these effects to materialize, enhancing financial literacy and access to financial services such as credit, loans, savings and payments from banks and formal providers, especially for women, is paramount.

Limited financial inclusion is a global problem that affects women disproportionately. The gender gap is clear: 72% of men and 65% of women worldwide have access to an account (Trivelli et al, 2018). Men are 65% of bank customers, hold 75% of deposits and manage 80% of total loans (Global Banking Alliance for Women, 2018). In developing countries, 70% of womenowned small- and medium-sized enterprises are underserved by financial institutions (UN Foundation and Bank of NYC Mellon, 2018). This situation worsens for older women, who may have limited knowledge of financial products and lack income security.

Women’s financial inclusion can nurture development by enabling their economic autonomy and better resource management within households, which could in turn foster savings, smooth consumption, facilitate business opportunities and provide income security (Trivelli et al, 2018). A potential two-way relationship between financial and labour inclusion could create a virtuous cycle that can bolster the global economy. Policies need to consider women’s special needs at different ages3.

First, providing digital IDs for all and guaranteeing data privacy is essential to promote access to the financial system. This is a bigger challenge for developing countries. In India, an initiative fostering account ownership through biometric ID cards helped significantly reduce the gender gap in account ownership (Demirgüç-Kunt et al, 2018).

Second, interventions must foster women’s access to financial services and also reduce usage costs. No-cost, basic financial instruments that can be easily accessed (e.g. through mobile phones) can serve this purpose. The intersection of financial and digital inclusion is critical: digital solutions can address barriers such as elder women’s mobility, restrictions on women’s freedom of movement or interactions with men outside their family (World Bank, 2018). Additionally, governments can provide incentives for usage granting discounts when paying with electronic means or by making government cash transfers through the financial system, especially those for women recipients. Financial education is imperative in this context, as lack of familiarity and knowledge about the financial system can hamper usage, particularly for the elderly.

Additionally, financial inclusion can boost profit from the youth bulge for countries in the demographic window of opportunity. Using affirmative action to target young entrepreneurs could assist in improving labour market inclusion in addition to financial inclusion. Financial literacy should be part of schools curricula to close the gap in new generations and to allow early financial inclusion.

Finally, due to lower earnings and higher participation in unpaid work, women usually face difficulties to build credit records, save and raise collateral. Governments must abolish all laws that hinder women’s property and inheritance rights and promote non-discriminatory legal systems. Moreover, allowing alternative sources of collateral, such as movable assets, and credit records based on non-financial information can contribute to women’s financial inclusion. Fostering income security throughout the life course can also contribute to building collateral and encourage savings.

Digital inclusion

Participation in the digital world is essential to improve livelihoods, foster social integration and develop one’s potential and opportunities. Nonetheless, digital gaps persist. Around the world, women fall behind in access to information and communication technologies (ICTs): 250 million fewer women than men use the internet and 200 fewer women have access to a mobile phone (Equals Global Partnership). The elderly also lag behind in technology access, literacy and usage. The intersection of these divides exposes older women to higher vulnerability.

Digital inclusion can potentially provide services such as health-care, education and employment matching for all. Therefore, the digital gender divide could worsen gender inequalities in several fields and these are likely to grow due to the increasing omnipresence of technologies in the digital age. Digital gaps can turn into welfare gaps unless governments address the barriers that the digitally excluded face.

Fertility decline can have a positive effect on young women’s education. Thus, digital literacy must be included in schools’ curricula to bridge digital gaps since early ages. In this vein, government must devote resources to develop stronger gender-sensitive initiatives in STEM. Older women should not be left behind, for they are the most disadvantaged in using ICTs: initiatives to acquire digital skills must consider age-specific needs. Digital education must also contemplate the risks for sexual harassment, stereotyping and exploitation that new technologies allow with expanded access.

More jobs are set to become digitally-mediated (e.g. crowdwork, gig economy) and there is an urgent need to ensure equal access to economic opportunities and quality work in the digital economy. Evidence shows that the gig economy – consisting of digital platforms that connect workers to service providers – is growing fast globally particularly in feminized sectors. In the European Union, on-demand household services are set to be the fastest growing gig economy sector, with revenues projected to expand at roughly 50% yearly through 2025 (Vaughn and Davario, 2016; Hawksworth and Vaughn, 2014). Gig economy jobs may provide workers with more flexibility and freedom to choose the place and time to work, allowing for better balance between work and family4.

Nonetheless, while the gig economy exhibits some new features, on the whole it represents the continuation (even deepening) of long-standing structural, gendered inequalities existing in ‘traditional’ labour markets. Significant gender divides in participation, earnings and retention prevail, as well as sectorial segregation. Additionally, marginalised groups – e.g. those experiencing intersecting inequalities based on gender, race, age or class – are concentrated in the lowest paying forms of gig work. Public policies must guarantee access to social protection and labour rights for gig workers, especially women and the elderly, to ensure decent livelihoods.

Policymakers also consider the gig economy as an option to support access to jobs, particularly among youth given the high rates of unemployment. This draws attention to the pressing need to ensure that digital jobs are open and accessible to all, as well as providing decent working opportunities. Additionally, it is critical not to lose sight of the elderly. Older women are set to stay longer in labour market as populations age, and may face a double exclusion due to a lack of appropriate skills or access to adequate digital infrastructure, and due to gendered digital divides. (Re)training older people is needed, as is ensuring a gendered and life course approach which takes the specific needs of people of all ages into account in policy focused on the digital economy, which will span economic, labour, technology and social policy domains.

1 See appendix for country-level demographic information

2 Adapted from Samuels et al (2018)

3 Recommendations based on Trivelli et al (2018)

4 Adapted from Hunt and Samman (2019)

References

• ADB. 2018. “Financial Inclusion in the Digital Economy,” Asian Development Bank. https://www.adb.org/sites/default/files/publication/200001/financial -inclusion-digital-economy.pdf

• Allen, F., Demirgüç-Kunt, A., Klapper, L., & Martinez Peria, M. S. (2016). The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. Journal of Financial Intermediation, 27, 1-30.

• Davis, K. and P. van den Oever (1982) ‘Demographic foundations of new sex roles’, Population and Development Review, 8(3): 495–511.

• Demirgüç-Kunt et al (2018). The Global Findex Database Measuring Financial Inclusion and the Fintech Revolution

• Diaz Langou, G. et al (2018). Achieving “25 by 25”: Actions to make Women’s Labour Inclusion a G20 Priority. Gender Economic Equity Taskforce. T20 Argentina.

• Dyson, T. (2010). Population and Development. The Demographic Transition. London and New York: Zed Books.

• Equals Global Partnership. https://www.equals.org/

• Gammage, S. et al (2018). The Imperative of Addressing Care Needs for G20 countries. Gender Economic Equity Taskforce. T20 & W20 Argentina.

• Gasparini et al (2015). Bridging gender gaps? The rise and deceleration of female labour force participation in Latin America. La Plata: CEDLAS

• Greengross, S. (2015) ‘Understanding ageing and gender’, in Age International (ed.), Facing the facts: the truth about ageing and development. Age International

• Guilmoto, C. Z. (2009). The sex ratio transition in Asia. Population and Development Review, 35(3), 519-549.

• Global Banking Alliance for Women (2017). La Oportunidad de la Banca Mujer. Retrieved from: http://www.gbaforwomen.org/download/laoportunidad-de-labanca-mujer/

• Hunt, A., and Samman, E. (2019). Gender and the gig economy. Critical steps for evidence-based policy. ODI. Retrieved from: https://www.odi.org/publications/11272-gender-and-gig-economy-critical-steps-evidence-based-policy

• Lloyd, C. B. (1994) ‘Investing in the next generation: the implications of high fertility at the level of the family’, in R. H. Cassen (ed.), Population and Development: Old Debates, New Conclusions, New Brunswick, NJ, and Oxford: Transaction Publishers.

• McNay, K. (2005). The implications of the demographic transition for women, girls and gender equality: A review of developing country evidence. Progress in Development Studies, 5(2), 115–134.

• Samuels, F. et al (2018). Between work and care. Older women’s economic empowerment. Overseas Development Institute (ODI). Retrieved from: https://www.odi.org/sites/odi.org.uk/files/resourcedocuments/12509.pdf

• Suri, T., & Jack, W. (2016). The Long-Run Poverty and Gender Impacts of Mobile Money. Science, 354(6317), 1288-1292. •

Trivelli, C. et al, 2018. Financial inclusión for women: a way forward. Gender Economic Equity Taskforce. T20 & W20 Argentina

• UNFPA and HelpAge International (2012) Ageing in the twenty-first century: a celebration and a challenge. UNFPA and HelpAge International

• United Nations Foundation and Bank of Ney York City Mellon (2018). Powering Potential: Increasing Women’s Access to Financial Products and Services. Retrieved from: https://www.bnymellon.com/_globalassets/pdf/our-thinking/powering-potential.pdf

• Vaughan, R. and Davario, R. (2016). Assessing the size and presence of the collaborative economy in Europe. Brussels: European Commission Retrieved from: https://publications.europa.eu/en/publication-detail/- /publication/2acb7619-b544-11e7-837e-01aa75ed71a1/language-en

• World Bank, 2018. Women, Business and the Law

Appendix

G20 countries: stage in the demographic transition and gender gaps

As mentioned above, G20 countries are at different stages of the demographic transition. This section describes the current process for different groups of countries and displays graphs and data for this, together with illustrations on gender gaps.

Advanced, developed economies with high human development have already transited the transformation of their population structure, migration apart. These societies currently have small young cohorts and a large old population, while many countries have birth rates below the replacement level and high dependency rates. Reforming care towards the elderly without neglecting childcare results a key policy implication for countries going through this stage, like Japan, Korea and the Mediterranean countries.

Many Western, high-income countries with high human development experience low aggregate fertility but no convergence among different socioeconomic strata. This situation leads to large gender gaps in labour force participation and employment, urging for investment in social protection and care regimes. The cases of Latin America high-income countries are the clearest examples. In Chile, Uruguay and Argentina, women’s labor force participation has increased on average, yet for lower income groups it has remained almost stagnant for the last 15 years (Gasparini et all, 2015).

In middle-income countries, with considerably high level of human development, such as Latin America or East Asia, fertility has declined near the replacement rates, yet countries still experience population growth, to a varying degree. The process of urbanization is advanced, yet still going, and social protection and care systems need to be developed.

Finally, some societies are still experiencing a process of high fertility, which leads to fast population growth, called population momentum, and a youth boom. These countries are mostly located in Sub-Saharan Africa and, while many have already started the mortality decline, in others mortality has almost stagnated due to the high incidence of infectious diseases and low life expectancy.