The phenomenon of rapid population aging is threatening not only economic stability but also the social security of every nation across the world, including in the Group of 20 (G20). The COVID-19 pandemic has unquestionably added an additional threat. To deal with these threats, policy solutions are proposed for the development of comprehensive social welfare frameworks for aged and ageing societies, promoting social protection and preventing longevity poverty. Two main policy proposals include integrating age-inclusive and long-term care in national insurance coverage and developing a sustainable pension system that minimises old-age poverty and equally distributes a financial burden across generations.

Challenge

Many countries in the G20 have already entered or are entering an ageing society at different demographic stages (see classification in Appendix, Table A1). While the rapid demographic transition has been a challenge, the COVID-19 pandemic has posed a new threat to the world’s economy and has heavily affected the older population. Low immunity, possible comorbidities and financial vulnerability have pushed older people into the most at-risk category. Among G20 members, the population aged 65 and above made up the majority of COVID-19 deaths, except for in Indonesia and India.

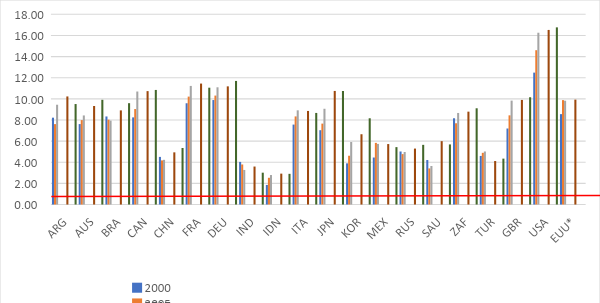

The average current health expenditure (CHE) for G20 members was 8.35 percent of gross domestic product in 2019. Although the increasing trend has been evident in most members, not all countries allocate a significant amount of their spending on health. The comparison indicates that most countries, whose health expenditure is less than the G20 CHE average, are either young societies or in the middle-income group with a relatively younger population (Figure 1). According to the World Health Organization (2021a), health spending in lower-income countries was financed primarily by out-of-pocket spending (OOPS), while government spending dominated in high-income countries. Over the past 20 years, government spending has witnessed an increase in health expenditure in upper-middle-income countries.

Figure 1. Current health expenditure (% of GDP)

*Note: EU data extracted from the World Development Indicators, World Bank, and not available for 2019.

ARG = Argentina; AUS = Australia; BRA = Brazil; CAN = Canada; CHE = current health expenditure; CHN = China, DEU = Germany; EUU = European Union; FRA = France; G20 = Group of Twenty; GBR = the United Kingdom; GDP = gross domestic product; IND = India; IDN = Indonesia; ITA = Italy; JPN = Japan; KOR = Republic of Korea; MEX = Mexico; RUS = Russia; SAU = Saudi Arabia; TUR = Turkey; USA = the United States of America; ZAF = South Africa

Source: Global Health Expenditure Database, World Health Organization (2021).

To examine people’s access to quality health services, our survey indicates that most G20 countries offer universal health coverage (UHC) and/or free health insurance, except Indonesia and the United States. Despite the coverage with premiums, the US’ Medicaid provides comprehensive coverage for older citizens. With the largest share sponsored by the US federal and state governments, the US’ OOPS is lower than many G20 countries. Usually, higher life expectancy is associated with a higher UHC service coverage index (SCI)[1] score. This reflects the essential role of the health and social protection systems throughout people’s life course.

For sustainable social protection and pension schemes, finances must come from government expenditure, private expenditure and investment. According to the Organization for Economic Co-operation and Development’s (OECD) projection (OECD, 2021a), countries entering an aged society tend to allocate more public expenditure on pensions. Despite having a relatively smaller allocated amount, Korea’s public pension expenditure shows rapid expansion as the pension system matures. This implies that growing pension expenditures are driven by demographic change. It is evident that public expenditure on pensions is highly correlated with a country’s income level. Young and developing economies need to prepare fiscal space to avoid the related challenges.

Proposal

In response to the combined impact of the COVID-19 pandemic and demographic change on social welfare systems, this policy brief proposes two main policy proposals.

Proposal 1: Integrate age-inclusive coverage and long-term care in UHC or national insurance coverage

To build up an age-inclusive UHC scheme, an extension and improved targeting of benefit packages and financial protection are required to meet older people’s health and long-term care needs, especially for those in the poorest and most vulnerable segments. The first proposal is to integrate age-inclusive coverage and long-term care in a country’s existing UHC or national insurance coverage. According to the WHO (2021b), UHC means that all individuals and communities receive the health services they need without suffering financial hardship. Integrating age-care services in the UHC is essential to respond to the increasing ageing population in the G20. Although most G20 countries have implemented UHC schemes, age-inclusive coverage is not yet common. Besides accessibility and affordability, UHC scheme should incorporate important elements of age-care treatments and long-term care (LTC) that respond to the need of an older population. All governments should ensure effective mechanisms and quality services in the long-term care sector and its facilities as preparation for possible pandemics in the future and protection for vulnerable groups.

An LTC system, according to the WHO (2021b), should be constituted in the existing health and social care systems of a country. The key driver is efforts to expand the already available healthcare models and services by including wider coverages of functional ability and treatments that are centred around a person’s needs. The integration should be done seamlessly to ensure non-fragmented care delivery to people in need. In parallel, COVID-19 does not only highlight the urgency to protect vulnerable groups but also brings into focus the scarcity of resources mismatched to demands for health care and social safety nets. Government officials and countries must review their existing health and social care systems to evaluate adequacy and identify gaps in structuring integrated and people-centred care services. Better resource allocation is required to establish a comprehensive LTC-integrated UHC scheme that protects older people.

A number of principles are recommended to strengthen the LTC-integrated UHC framework for older people. First, the LTC system must be developed to cover the whole range of operable elements, from information systems to service delivery. These include access to healthcare information and knowledge, performance monitoring, quality of age-care services, delivery timeliness and innovation and research, among other elements. The LTC should incorporate the principles of affordability, equitability, accessibility, upholding human rights and dignity and person-centredness. Second, the LTC systems must consider chronic and complex needs related to functional ability and underlying diseases that are common among older people. For example, the Japanese Cabinet approved dementia to be included in healthcare measures in the Guideline of Measures for Aging Society. Other common diseases, e.g. heart attack, high blood pressure and diabetes, should be included while developing the age-inclusive UHC in a national healthcare system. Third, the accessibility to hospitals and adequate labour force of care workers and caregivers ensure sufficient and quality age-care delivery to older people, particularly in emergency cases. Although care may be provided by public and private sectors, civil society and family members, the government must play an active role in overall responsibilities and effective coordination to mobilise resources towards a well-functioning system.

The UHC-SCI indicates that there is room for improvement in the UHC scheme or national insurance coverage of the G20 members (Table A2). The countries should develop the LTC based on the needs of older people rather than the structure of the service. Given differences in country characteristics, e.g., available resources, income levels, cultural, political and socioeconomic profiles, each country should tailor a framework of their integrated long-term care systems in their existing UHC or national insurance schemes based on these differences. Nonetheless, regardless of this diversity, specific standards and principles underlying long-term care must be universal across systems (WHO 2021b). The framework should standardise the LTC scheme for definition, packages of services and key factors that help promote sustainability and equitability of health and social care systems. Moreover, the LTC should be mainstreamed through primary health care. For example, countries with more developed health systems should utilise the existing healthcare infrastructure to strengthen their LTC system towards sustainable and inclusive long-term care provision. By leveraging a wide variety of well-developed health and social care services, the LTC can be improved to cover home-, community- and facility-based care for older people as well as upgrading support for and training of caregivers/care workers. On the other hand, countries with maturing health systems can leverage their experience in primary healthcare knowledge to further develop their existing UHC or national health insurance schemes by exploring the possibility of mainstreaming LTC into its primary healthcare provision. This is a developing process to enhance the primary healthcare coverage for noncommunicable diseases, which are common in older people. In sum, diversity must be utterly considered to establish effective, sustainable and inclusive long-term care provision to be integrated into the UHC scheme. A suitable framework and strategy design must be tailored to a country’s characteristics, while the common ground of standards and principles must be universal and upheld.

Proposal 2: Develop a sustainable pension system that minimises old-age poverty and equally distributes a financial burden across generations

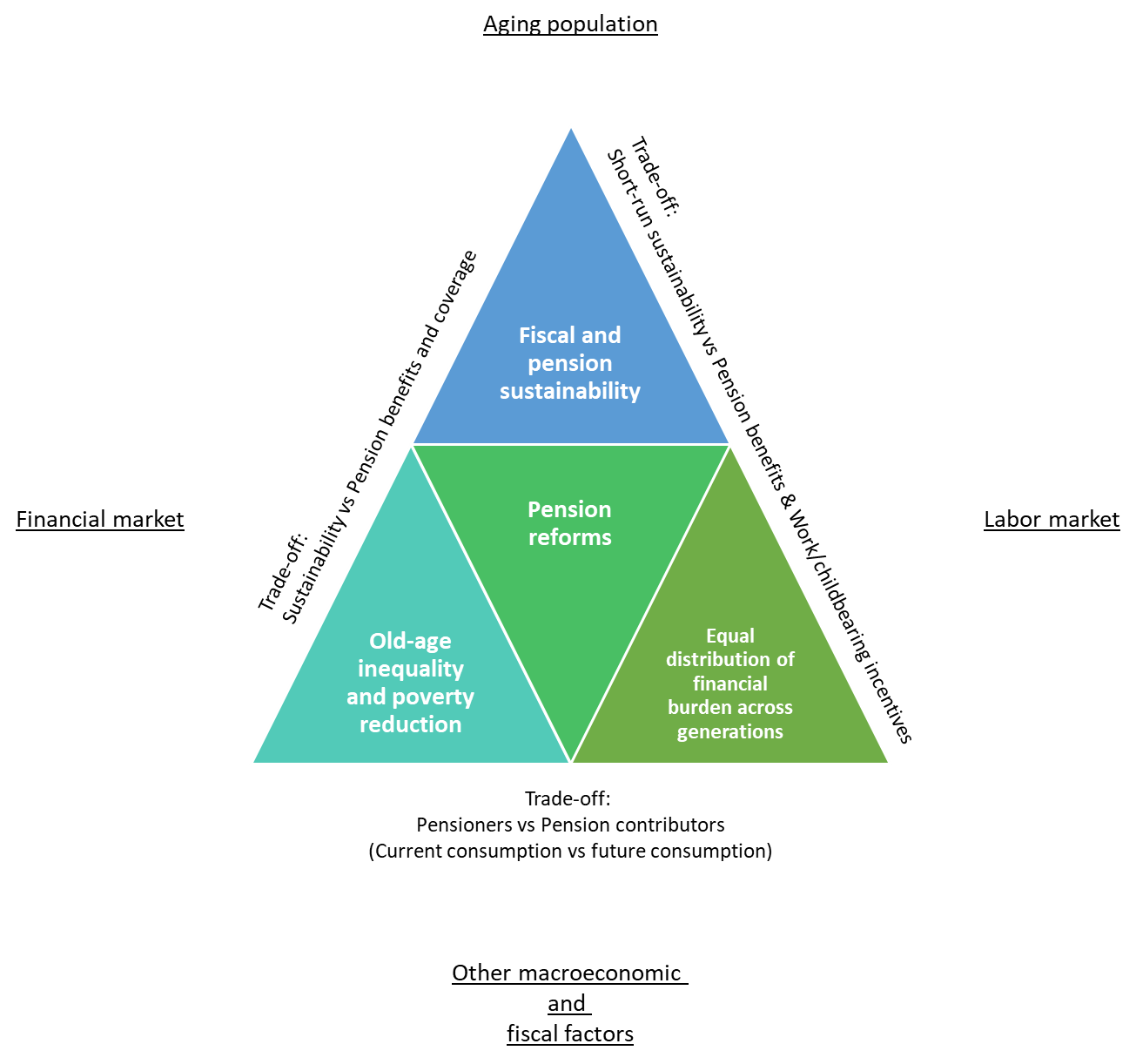

An ageing population pressures fiscal balance and a pension system’s sustainability, particularly regarding health and social protection expenditure (Korwatanasakul, Sirivunnabood and Majoe, 2021). Thus, structural reforms for a sustainable government budget and pension system become necessary. Generally, structural reforms go beyond the reform of a pension system, covering the broader issues of social equity (e.g. gender, informal workers, workers with low economic status and intergeneration), financial inclusion, labour force participation, formalisation and other macroeconomic and fiscal factors. Developing a sustainable pension system that minimises old-age poverty and equally distributes a financial burden across generations must integrate four extensive policy areas: a pension system, a labour market, a financial market and key macroeconomic factors. Policymakers must fundamentally address the trinity of challenges (e.g. Bazzana, 2020; OECD, 2019) (Figure 2).

Figure 2. Trinity of pension reform challenges

Note: Underlined texts represent factors influencing the development of a sustainable pension system that minimises old-age poverty and equally distributes a financial burden across generations.

Source: Authors.

Fiscal and pension sustainability

Rapid demographic transitions raise pension costs, especially among the advanced G20 economies, as the pool of pensioners grows faster than the pool of pension contributors. Policymakers can respond to the challenge through three broad strategies, including adjusting overall pension schemes, slowing down the growth of pensioners and boosting the number of pension contributors. Implementing these policies will affect pensioners and pension contributors; policymakers should consider factors such as current and future economic conditions, the stage of demographic transition and the welfare of pensioners and pension contributors. Figure 2 shows the trade-offs between fiscal and pension sustainability and pension benefits and coverage, together with working and childbearing incentives.

Adjusting overall pension schemes: Evidence shows that although defined contribution (DC) pension schemes could put the burden of saving and investing for retirement on pension contributors, adopting DC pension schemes over defined benefit (DB) pension schemes will help maintain fiscal sustainability. A study found that, on average, countries without DC plans show a lower private savings level than countries with the plans (Amaglobeli, Dabla-Norris and Gaspar, 2020). Moreover, policymakers may opt to target the size of pension benefits by modifying the benefit calculation formulas or reducing pension schemes’ generosity, possibly affecting pensioners’ welfare. Accelerating the shift from DB to DC pension schemes and the overall pension reforms has become crucial since most advanced G20 economies are under fiscal pressure from their ageing populations.

Containing the growth of pensioners: To slow down the flow of pensioners, policymakers can change key parameters of a pension system, such as a statutory retirement age and eligibility rules, by adjusting the retirement age to life expectancy, enabling flexible retirement age and reversing the trend of early retirement. According to Cipriani (2018) and Bazzana (2020), allowing flexible retirement age yields more sustainable pension schemes. The success of this policy proposal depends on the labour market condition and its policies. Policymakers should encourage older workers to remain in the labour market by providing sufficient financial incentives, guaranteeing decent work and offering skill-development programmes based on the labour market demand. Moreover, it is necessary to minimise barriers to the employment of older workers, such as discrimination against senior workers, mandatory retirement age and lack of flexible work arrangements, through dialogues and consultations with public and private employers. Policy measures that reduce early-retired pension benefits and eliminate early retirement schemes possibly help limit the growth of pensioners.

Increasing the pool of pension contributors: Expanding pension coverage also heavily relies on labour market policies, particularly those targeting the expansion of labour force participation of women, youth and migrants. The inclusion of these workers helps increase the number of pension contributors. Youth labour force participation implies early participation in pension schemes, positively affecting fiscal and pension sustainability and their pension benefits. Youth employment allows workers to plan their long-term investments more efficiently and effectively and, in turn, avoid inequality and poverty after retirement. In general, policies addressing discrimination against sex, age and race are crucial in encouraging labour force participation. In addition, similar to older workers, policymakers should offer long-life skill development programmes to women, youth and migrants to acquire the necessary skills for the labour market. Policymakers must also recognise gendered structures in economies and mainstream gender into policies to facilitate women at work and reduce their unpaid burdens outside the labour market (Korwatanasakul, 2020).

Old-age inequality and poverty reduction

Policymakers must ensure all older people’s welfare and guarantee pension benefits covering a decent minimum cost of living. As discussed, the pension reforms, such as those reducing the size of pension benefits, could jeopardise pensioners’ welfare and put them at risk of old-age poverty. Therefore, the reforms should also consider income protection for workers with low earnings and savings during their careers.

Old-age inequality is another emerging concern when a country does not provide pension coverage and basic pension benefits to its citizens. This challenge is evident in the emerging G20 economies (OECD, 2021b). Policymakers face a trade-off between pension coverage (old-age inequality) and pension benefits (old-age poverty) since expanding the coverage to all older people, including those with low socioeconomic status, e.g., informal workers, comes with the cost of declining pension benefits.

Reducing informality: Evidence, particularly in the developing G20 countries (e.g., OECD, 2021a; Arza, 2019; Wang and Huang, 2021), suggests that workers in informal sectors have limited access to social security, social services and no access to contributory social security benefits or inadequate pension benefits and accumulated savings. Reducing informal employment will improve pension coverage, benefits and sustainability (OECD, 2019). Korwatanasakul (2021) found that schooling-related policies help improve informal workers’ welfare and mobility to the formal sector. In contrast, policies regarding working experience, such as on-the-job training programmes, help workers who inevitably remain in the informal sector earn more wages and, in turn, become less vulnerable.

Strengthening social/safety net pensions: Governments can expand pension coverage and guarantee sufficient pension benefits by offering noncontributory pensions (or social/safety net pensions) to older people suffering from old-age inequality and poverty. The noncontributory pensions do not link to past contributions, and income is not the factor to include people in the pension schemes. However, this policy raises concerns about the financial sustainability of the pension schemes and the overall fiscal balance, reflecting the trade-off between fiscal and pension sustainability and old-age inequality and poverty reduction.

Considering the adverse effects of pension generosity on personal savings: In connection with the previous measure, policymakers should also consider the negative effects of overly generous public pension schemes (e.g. average pension spending per pension) on both public and private savings, particularly among older cohorts (Amaglobeli, Dabla-Norris and Gaspar, 2020). Due to pension coverage expansion and high pension benefits, generating pension plans inflate government spending, particularly in counties with a low tax base. They also reduce individuals’ investment incentives. Financial market development plays a vital role in stimulating early-age private investment and a long-term financial strategy for retirement, particularly among emerging G20 economies with less-developed financial markets. To increase savings and financial investment, governments can offer tax incentives, support various financial products and promote financial and digital literacy at an early age and among older people.

Introducing automatic adjustment mechanisms to pension schemes: According to the OECD (2021b) and Kudrna, Tran and Woodland (2022), automatic adjustment mechanisms (AAMs), such as a means-tested pension system, act as a fiscal stabiliser and a pension benefit redistributor. AAMs adjust pension parameters or benefits based on individual socioeconomic status and macroeconomic indicators, including demographic, financial and economic conditions. Therefore, they can mitigate the rising pension costs while redistributing pension benefits within and across generations to those in need. In other words, AAMs simultaneously tackle the trinity of pension reform challenges.

Equal distribution of financial burden across generations

An unfair distribution of pension burden across generations puts economic pressure on the working-age population, affecting their work and childbearing incentives (Cigno, 1993; Guinnane, 2011; Fenge and Scheubel, 2017). It, in turn, aggravates fiscal and pension sustainability due to less pension contributions per person and a smaller pool of pension contributors. Hence, ensuring a fair sharing of burdens across generations does not only promote long-run fiscal and pension sustainability, but also guarantees younger people’s current and future consumptions.

Implementing income redistribution: Policymakers can reduce inequality across generations through income redistribution programmes, such as property tax and the introduction of AAMs in pension schemes.

Boosting financial and economic conditions: An uncertain economic outlook, together with financial fluctuation and an underdeveloped labour market, negatively affects retirement funds and a working-age population’s work and childbearing incentives. It also affects their migrating decisions for a better country to work and live in and prevents foreign high-skilled labour from immigrating to a country, signalling a reduction of current and potential pension contributors. Therefore, policies that can boost financial and economic conditions will indirectly help ensure an equal distribution of financial burden across generations and overcome the trinity of pension reform challenges. Governments, for example, can promote productivity and financial stability to stimulate market confidence and economic security for younger generations.

References

David Amaglobeli, Era Dabla-Norris, and Vitor Gaspar, “Getting Older but Not Poorer”, in Finance & Development, Vol. 57, No. 1 (March 2020), p. 30-34

Camila Arza, “Basic Old-Age Protection in Latin America: Noncontributory Pensions, Coverage Expansion Strategies, and Aging Patterns across Countries”, in Population and Development Review, Vol. 45, No. S1 (December 2019), p. 23-45

Davide Bazzana, “Ageing Population and Pension System Sustainability: Reforms and Redistributive Implications”, in Economia Politica, Vol. 37 (October 2020), p. 971-992

Alessandro Cigno, “Intergenerational Transfers without Altruism. Family, Market, and State”, in European Journal of Political Economy, Vol. 9, No. 4 (November 1993), p. 505–518.

Giam Pietro Cipriani, “Aging, Retirement, and Pay-As-You-Go Pensions”, in Macroeconomic Dynamics, Vol. 22, No. 5 (June 2016), p. 1173–1183

Gabriel Demombynes, Damien B. C. M. De Walque, Paul Michael Gubbins, Beatriz Piedad Urdinola, and Jeremy Henri Maurice Veillard, “COVID-19 Age-Mortality Curves for 2020 Are Flatter in Developing Countries Using Both Official Death Counts and Excess Death”, in Policy Research Working Paper, Vol. 9807 (October 2021)

Robert Fenge and Beatrice Scheubel, “Pensions and Fertility: Back to the Roots”, in Journal of Population Economics, Vol. 30, No. 1 (January 2017), p. 93-139

Timothy W. Guinnane, “ The Historical Fertility Transition: A Guide for Economists”, in Journal of Economic Literature, Vol. 49, No. 3 (September 2011), p. 589-614.

Upalat Korwatanasakul, “Determinants, Wage Inequality, and Occupational Risk Exposure of Informal Workers: A Comprehensive Analysis with the Case Study of Thailand”, in PIER Discussion Paper, Vol. 160 (Septembeer 2021)

Upalat Korwatanasakul, “How Can Trade Liberalization Boost Women’s Employment and Well-Being? An Analysis of The Thai Labor Market”, in Asia Pathways: The Blog of the ADBI, 17 August 2020, https://www.asiapathways-adbi.org/2020/08/how-trade-liberalization-boost-women-employment-well-being-thai-labor-market/

Upalat Korwatanasakul, Pitchaya Sirivunnabood, and Adam Majoe, “Demographic Transition and Its Impacts on Fiscal Sustainability in East and Southeast Asia”, in Sang-Chul Park, Naohiro Ogawa, Chul Ju Kim, Pitchaya Sirivunnabood, and Thai-Ha Le (eds), Demographic Transition and Its Impacts in Asia and Europe, Tokyo, Asian Development Bank Institute, 2021, p. 9-39

George Kudrna, Chung Tran, and Alan Woodland, “Sustainable and Equitable Pensions with Means Testing in Aging Economies”, in European Economic Review, Vol. 141 (January 2022)

Organization for Economic Co-Operation and Development (OECD), Fiscal Challenges and Inclusive Growth in Ageing Societies, Paris, OECD, 2019

Organization for Economic Co-Operation and Development (OECD), Pensions at a Glance 2021, Paris, OECD, 2021a

Organization for Economic Co-Operation and Development (OECD), Pension Markets in Focus 2021, Paris, OECD, 2021b

Huan Wang and Jianyuan Huang, “How Can China’s Recent Pension Reform Reduce Pension Inequality?”, in Journal of Aging & Social Policy, (May 2021)

World Bank, World Development Indicators Database,

https://databank.worldbank.org/source/world-development-indicators extracted on 2 February 2022.

World Health Organization, Global Health Expenditure Database, https://apps.who.int/nha/database extracted on 2 February 2022.

World Health Organization (WHO), Global Expenditure on Health: Public Spending on the Rise?, Geneva, WHO, 2021a

World Health Organization (WHO), Framework for Countries to Achieve an Integrated Continuum of Long-Term Care, Geneva, WHO, 2021b

World Health Organization (WHO) and the World Bank, Tracking Universal Health Coverage, 2021 Global Monitoring Report (Conference Edition), Geneva, WHO, 2021

Appendix

Table A1. Share of population aged 65 and above and its share of official COVID-19 deaths in the G20, 2020

| % of Population ages 65 and above | % COVID-19 deaths of population ages 65 and above | |

|---|---|---|

| Japan* | 28.4 | 94 |

| Italy | 23.3 | 92 |

| Germany | 21.7 | 93 |

| European Union | 20.8 | n/a |

| France | 20.8 | 91 |

| United Kingdom | 18.7 | 90 |

| Canada | 18.1 | 94 |

| United States | 16.6 | 81 |

| Australia** | 16.2 | 93 |

| Republic of Korea | 15.8 | n/a |

| Russian Federation | 15.5 | n/a |

| China | 12.0 | n/a |

| Argentina | 11.4 | 76 |

| Brazil | 9.6 | 68 |

| Turkey | 9.0 | 73 |

| Mexico | 7.6 | 49 |

| India | 6.6 | 41 |

| Indonesia | 6.3 | 29 |

| South Africa | 5.5 | 42 |

| Saudi Arabia | 3.5 | n/a |

Note: According to the World Health Organization’s criteria, 7 percent and more is an aging society, 14 percent and more is an aged society and 21 percent and more is a super aged society.

G20 = Group of Twenty

*Japan’s data based on age 60 and above, assessed from https://covid19.mhlw.go.jp/en/

**Australia’s data based on age 60 and above, assessed from https://www.health.gov.au/health-alerts/covid-19/case-numbers-and-statistics#cases-and-deaths-by-age-and-sex

Source: World Development Indicators, World Bank (2021) and Demombynes et al. (2021).

Table A2. Selected G20’s UHC SCI, 2021

| Country | Non-elevated blood pressure | Mean fasting plasma glucose | Hospital bed density | Health worker density | International Health Regulations core capacity index | Service Capacity & Access |

|---|---|---|---|---|---|---|

| Argentina | 20 | ≥80 | ≥80 | ≥80 | 61 | ≥80 |

| Australia | 51 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Brazil | 25 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Canada | 63 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| China | 55 | 72 | ≥80 | ≥80 | ≥80 | ≥80 |

| France | 51 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Germany | 51 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| India | 48 | ≥80 | 29 | 38 | 78 | 44 |

| Indonesia | 33 | ≥80 | 65 | 31 | 73 | 53 |

| Italy | 43 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Japan | 48 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Korea, Rep. | 56 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| Mexico | 47 | 76 | 54 | ≥80 | ≥80 | 76 |

| Russian Federation | 26 | 79 | ≥80 | ≥80 | ≥80 | ≥80 |

| Saudi Arabia | 46 | 35 | ≥80 | ≥80 | 75 | ≥80 |

| South Africa | 27 | 68 | ≥80 | 74 | 70 | ≥80 |

| Turkey | 46 | ≥80 | ≥80 | ≥80 | 77 | ≥80 |

| United Kingdom | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 | ≥80 |

| United States | 47 | 73 | ≥80 | ≥80 | ≥80 | ≥80 |

Note 1 : G20 = Group of 20; UHC = universal health coverage

Note 2: The UHC-SCI determines service coverage related to aged care based on the UHC SCI sub-indices. The performance score is from 0 – 100.

Source: World Health Organization and the World Bank (2021).

- The higher the SCI value, the better access and quality the health service. ↑