Infrastructure investments have been accorded high priority within the Group of 20 (G20). In 2019, quality infrastructure principles were endorsed as a way to raise the level and quality of public and private infrastructure finance around the globe. However, the onset of the COVID-19 pandemic has worsened the external debt situation of the emerging markets and developing economies (EMDEs), which are struggling with high inflation and recession. This has accentuated macro-economic fragilities in lower- and middle-income countries (LMICs) to a point that makes pre-pandemic infrastructure investment trajectories largely infeasible. Mobilising financial resources domestically and from external sources, for instance through multilateral development banks (MDBs) is important but only an integrated medium-term new infrastructure development vision could bring fresh perspectives. This policy brief explores how a “new narrative” on infrastructure finance could emerge within the G20. It argues that the focus on endless infrastructure creation instead of maintenance, adaptation and distributional impacts often dilutes the infrastructure-sustainable development synergies.

Challenge

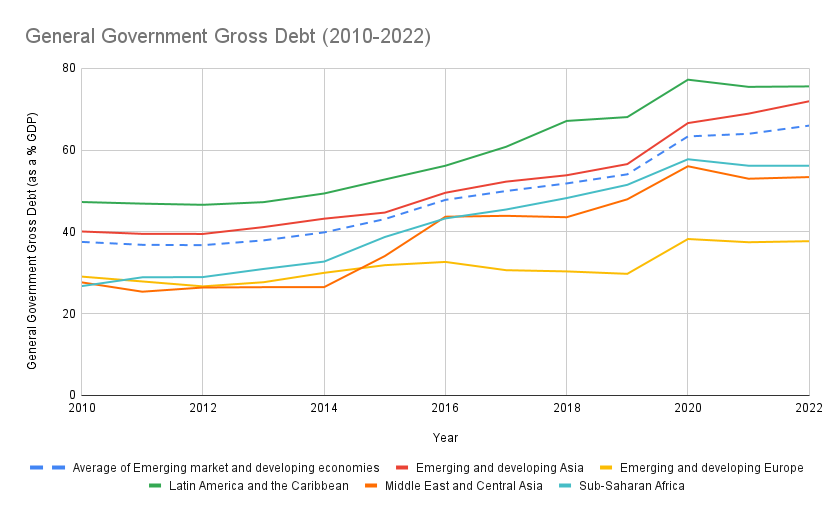

Even before COVID-19 pandemic, debt touched record levels for many developing countries. At the end of 2019, government debt as a percentage of GDP was 54 percent (Figure 1). The COVID-19 related recession and economic policy responses by governments further led to accumulation of sovereign debt and expanded the list of EMDEs in debt distress. The average total debt burden among the low- and middle-income countries (LMICs) increased by approximately 9 percent of GDP in 2020 compared with an average of 1.9 percent of GDP over the previous decade (World Bank, 2022). This high debt burden is unlikely to fall in the future as it is part of large fiscal programmes and exists in a period where government revenues are collapsing.

Figure 1: General government gross debt in EMDEs (percentage of GDP), 2010-2022

Source: IMF, World Economic Outlook Database.

Sovereign debt crises are costly for sustained growth. High levels of sovereign debt can result in high interest rates raising borrowing costs for firms and households thereby dampening economic activity in an economy. Restoration of the “business-as-usual” monetary policy stance in advanced economies as the crisis exerts pressure on borrowing costs and exchange rates leads to capital outflows from emerging markets and exacerbates debt sustainability concerns. Furthermore, in case of default, the economic performance of a country might collapse. Every year a country remains in default, its GDP growth reduces by 1–1.5 per cent (Borensztein and Panizza, 2009).

In terms of social costs, high debt reduces a government’s ability to spend on social safety nets and public goods, worsening inequality. For instance, the current crisis and the trends in financing for sustainable development are exacerbating the limited fiscal space faced by many LMICs, leaving less money to spend on development projects (IMF, 2020; IMF, 2021). The prospects of a slow recovery places further pressure on government budgets, even as the immediate effects of the pandemic subside. Countries with a significant debt build-up are forced to sacrifice future growth, jobs and opportunities with a dire impact on the youth, informal sectors, social capital and innovation capacities. Additionally, fiscally constrained economies are less resilient to economic shocks (Augustin et al. 2022). The consequences go much beyond the fragile nations. For instance, the global development of a circular economy depends on macroeconomic transformations across global supply chains that span across all the nations.

With high levels of public debt and additional pressures induced by the pandemic on all major sources of development finance, LMICs are struggling to finance new and existing infrastructures (OECD, 2020). However, the demand for infrastructure in EMDEs and its correlation with economic growth and employment creation necessitates more funding for resilient and inclusive recovery. Of the current infrastructure financing gap of approximately US$2.5 trillion annually, around 75 percent is made up of infrastructure investments in developing markets (UNCTAD, 2020). If no mechanism is found to address the narrowed fiscal space, then economies will operate at low equilibrium. Therefore, resolution of the debt gridlock is crucial for building a sustainable, inclusive and resilient growth trajectory in the post-COVID period.

Proposal

Factors that could prompt infrastructure development in G20 countries in a different way include:

1. Maintenance of infrastructure

All infrastructure assets are subject to gradual wear or tear. Although maintenance is needed to mitigate the effects of ageing and offset the loss in asset value associated with it, many countries do not make it a priority as it warrants. Subjecting maintenance activities to budget cuts in the short term may lead to greater costs in later years. When maintenance is low, vital infrastructure assets such as power plants, highways connecting major cities or international airports are more fragile and exposed to hazards and disasters. The temporary or permanent closure of strategic assets bears significant fiscal costs, both direct (the need to repair or rebuild the asset) and indirect (negative impact on economic activity, hence on tax revenues). Furthermore, without strong public investment management practices, the urgency surrounding replacement or rebuilding may lead to ill-designed and ill-advised infrastructure, hence perpetuating the fiscal costs of not maintaining the assets in the first place (Blazey et al, 2020). The costs of delaying or avoiding maintenance spending can cause user, human and ecological costs.

Additionally, the need to achieve the Sustainable Development Goals (SDGs) in line with the climate targets of the Paris Agreement is greater than ever, further strengthening governments’ and private investors’ focus on planning, designing, building, operating and maintaining sustainable infrastructure as a comprehensive strategy. Annual maintenance spending varying between 1 and 3 percentage points of GDP will be needed to reach the SDGs in key infrastructure sectors by 2030 (Rozenberg and Fay, 2019). For advanced economies, it entails that maintenance of investments in ageing infrastructure can no longer be deferred. In particular, modernisation of aged infrastructure and wider implementation of preventive maintenance (PM) and predictive maintenance (PdM) approaches could lead to future reduction of maintenance costs, also by enhancing energy efficiency and the use of ecologically friendly technologies (D20 Statement, 2021). In emerging markets, this includes investments in new infrastructure but not compromising on the maintenance of existing social infrastructures.

Preventive maintenance is the routine maintenance of equipment and assets in order to keep them running and prevent any expensive unplanned downtime from unexpected equipment failure. A successful maintenance strategy requires planning and scheduling maintenance of equipment before a problem occurs. On the other hand, predictive maintenance techniques are designed to help determine the condition of in-service equipment to estimate when maintenance should be performed. This approach promises cost savings over routine or time-based preventive maintenance, because tasks are performed only when warranted. More standardised design and construction processes also create the opportunity to save on long term maintenance due to similar replacement parts and equipment being used (Fransen et al. 2018). Identification of maintenance requirements and costs leading up to the investment decision helps identify the revenue sources and capabilities needed to ensure that infrastructure assets will deliver public services as expected.

Sustainable access to funding for maintenance also needs to be ensured. Some of the methods involve (Blazey et al, 2020):

User charges: In circumstances when infrastructure is operated in a commercial environment, revenues from user charges may provide funding for the operator to carry out maintenance. For example, where a toll road is operated through a public-private partnership, the private partner may be contractually responsible for upkeep of the road using the revenue generated from tolls. In other cases, potential sources of revenues through user charges may remain an option available to a government. This is relevant for sub-national governments that might not have existing funding sources to support the upkeep of roads, though it requires the capacity to collect fees and to forecast user demand for the services.

Auxiliary business activities: Infrastructure assets often include land and other asset categories that are connected to but not directly used in providing the core services delivered by an infrastructure asset. By way of example, airport entities earn concession revenues from food and beverage services, duty-free sales, car parking, airport hotels and so on. Commercial business practices for auxiliary business activities apply to a range of infrastructure assets, including seaports, railways and motorways, although the percentage of revenues generated is typically lower than achieved at airports. Revenue from auxiliary activities does not directly relate to or contribute to maintenance expenses, but by increasing the overall returns from infrastructure assets, it creates potential for increased funding for maintenance.

National wealth funds: The wealth of a fund is the net value of a portfolio of publicly owned assets and the manager is charged with the responsibility to achieve specified results. These goals provide incentives for the asset manager to consider maintenance to maximise the portfolio value of the assets through the optimised operation of the assets.

Holding companies: A number of countries have established holding companies to own and govern a portfolio of infrastructure assets at arm’s length from the government. As with national wealth funds, the holding company aims to maximise the value of its asset portfolio. The companies can define the use of dividends, including reinvestment into businesses.

2. Developing a supply of high quality bankable infrastructure projects

Given the magnitude of the infrastructure funding gap, the G20 must adopt a new collaborative approach to crowd-in private capital in order to harness the large pool of private savings looking for long-term investment. The quantity of dry powder available and level of interest in emerging markets presents a great opportunity for governments to tap into the pot of funding available. The biggest constraint to unlocking private finance is the shortage of well-structured, bankable project pipelines. Therefore, there is a need to develop a supply of bankable infrastructure projects that are aligned with the SDGs, including climate change. This would include coming up with a clear pipeline of greenfield and brownfield projects via asset recycling, to offer them as an investable asset class for long-term investors like pension funds, insurance companies and infrastructure funds (KPMG, 2020).

Upstream project preparation serves as a critical first step in making infrastructure projects bankable, i.e. having infrastructure projects prepared up to a stage where risk is appropriately allocated between the public and private sector such that institutional investors are willing to engage. This will promote robust pipelines of high-quality, sustainable and bankable infrastructure projects that are commercially attractive to institutional investors.

The design of the project pipeline would need to include on a systematic basis SDG parameters and metrics that are aligned with developing investment practices among both conventional and impact institutional investors. There is a growing need to incorporate environmental, social and governance (ESG) criteria in infrastructure projects as investors will insist on higher levels of compliance with respect to ESG indicators in the years to come, especially in emerging markets. For EMDE governments, incorporating and reporting on ESG considerations throughout the infrastructure project lifecycle not only sends an important signal to the market – which has increasingly embraced ESG as a key factor in investment decision-making – but also, at the asset-level, makes infrastructure programmes and projects more resilient and sustainable over the long-term. Sustainable infrastructure that is informed by ESG factors is more capable of withstanding external shocks – such as the effects of climate change and other hazards – optimising value for money for both end-users and investors over the asset lifecycle. EMDEs must deepen ESG and climate-related reporting standards and ensure that their approach to sustainability is aligned to the broader market. Likewise, institutional investors must adopt and adhere to sustainability frameworks to ensure that ESG factors are rigorously analysed to facilitate more informed due diligence processes and investment decisions. (Swiss re Institute, 2020).

In efforts to bring more bankable infrastructure projects to market, EMDE governments areincreasingly turning to project preparation facilities (PPFs) housed in MDBs. PPFs provide support at each stage of the infrastructure project lifecycle – from planning to selection, pre-feasibility through feasibility, design, choice of procurement, structuring and contract development to financial closing. PPFs enhance the enabling environment for infrastructure project preparation in EMDEs by developing standardised bidding frameworks, procurement documents and concession agreements. Such heavy lifting by PPFs at the upstream project development stage can optimise the conditions and overall bankability of infrastructure projects in ways that account for the unique operating environments of EMDEs while still meeting the investment preferences and risk profiles that private lenders and financiers desire.

3. Convergence of social, physical and digital infrastructure investment

The COVID-19 pandemic has forcefully demonstrated that the composition of infrastructure in most countries is not properly balanced. In the United States there is more investment in roads and energy than in health care, and within the health sector, not enough for preparedness. A second lesson from the pandemic is that it has revealed deep structural inequalities in income, services and other opportunities within rural and urban populations. The idea of “infrastructure for distribution”, i.e. justifying and designing infrastructure to help address the structural inequalities. These include the location, scale, cost and operations of infrastructure so that its benefits accrue to the people who need it most. Programmes such as slum upgrading or bustee improvement are more likely to deliver benefits to the poorest in our societies.

The pandemic calls for increased spending to address certain priorities, such as digital connectivity, health care, welfare, pandemic-proofing of public services and infrastructure such as transportation. However, these infrastructure systems must be connected in a way that creates a seamless flow of services to society. Hence, achieving convergence between the physical, social and digital infrastructures is a novel way of harnessing existing infrastructure to achieve sustainability and resilience.

The digital economy is emerging to become one of the most important growth drivers and an indispensable part of the modern economy. Despite the rising importance of the digital economy, the financing gap in digital infrastructure in Asia is growing significantly, which is predicted to reach US$512 billion by 2040. Financing gaps are still prevalent in the LMICs. More than 50 percent of the digital infrastructure investment gap will be in Asia by 2040, with a potentially adverse impact on economic growth. Digital infrastructure development (both soft and hard) is the foundation of the digital economy. It has to be aligned with different maturity levels, where digital availability, access, appetite and abilities should be considered holistically.

The benefits of a strong digital infrastructure would spill over directly to hard infrastructure. Network Rail in the United Kindgom was looking for a way to reduce rail downtime and maintenance costs in its network. In response, it installed sensors around 64,000 assets on its rails and switched infrastructure with an artificial intelligence-driven big data platform to analyse incoming data to predict failures of physical assets in advance. This has enabled accurate scheduling and budgeting for “just-in-time” maintenance, thereby reducing in-service failures and unplanned maintenance. The reduction in unplanned maintenance and site visits has cut costs by 30 percent, leading to high return on investment. Having achieved a 500 percent return on digital investment, this initiative indicates potential for attracting investors.

In regard to digital infrastructure improving social infrastructural outcomes, the San Antonio Water System (SAWS) in the United States is an interesting example. The Clean Water Act of 1972 seeks to eliminate sewer overflows, usually caused by blockages or excess storm water. SAWS work crews have used a pipe cleaning schedule based on historical information at over 800 sites, costing US$1.2 million annually. However, they lacked real-time information about actual flow restrictions implying that overflows still occur. In response to this persistent problem, SAWS piloted a digital system to obtain real-time network information at 10 high-frequency cleaning sites. Iridium satellite-connected sensor networks were embedded in manhole covers. Digital applications were implemented to process and analyse water level data, display and alert management. The crews were directed to clean based on measured water levels. This provides useful insights for water supply planning and sewage systems, especially in urban areas (AIIB, 2020a).

4. Financing

Financing for infrastructure, given the supply side constraints, require innovative solutions such as creating aggregation platforms and optimal utilisation of existing sources of finance. Borrowing for infrastructure will remain an indispensable element of the financing mix. However, attracting investors requires investing better, which is all about the prioritisation of investments and avoiding poor choices. The viability of infrastructure projects can be enhanced by a sound and flexible economic environment that militates against a build-up of macroeconomic stress and imbalances due to higher infrastructure investment rates. While policies may vary by country, prescriptions include averting large exchange rate misalignments, filtering out unnecessary trade protectionist measures (both tariff and non-tariff) that would increase the cost of imported inputs and hence the total project costs, putting fiscal frameworks in place for investing more counter-cyclically and increasing public savings to make space for more investment, as well as promoting a sound financial sector to encourage private savings. The last measure would also allow investors to finance themselves in local currencies thus removing the foreign exchange risk, which can be substantial for many Asian countries and which act as a deterrent to more infrastructure investments.

Local currency financing will become important to reduce fiscal costs of currency mismatches in project financing as well as in context of higher risk profiles in EMDEs vis-à-vis foreign financiers. Strengthening domestic government bond markets would improve efficiency in debt financing and strengthen the reliability of long-term interest rate benchmarks for infrastructure projects. Additionally, policies and regulations for domestic markets would need to be reinforced. Therefore, deepening long-term local currency markets should be an active policy action.

The COVID-19 pandemic has brought into focus the struggle EMDE governments face in obtaining and maintaining an investment-grade sovereign rating. However, the strategic use of credit enhancement products can help mobilise private capital by de-risking investments. Domestic institutional investors (pension funds and insurance companies) are generally well below their potential to support a long-term infrastructure finance agenda. There is a strong case to support both policymakers and investors developing the conditions for a greater mobilisation of resources into infrastructure sectors while maintaining prudent investment strategies. Depending on the country, strengthening the pension and insurance sectors through reviewing investment regulations and supporting investor consortiums for greater capacity and economies of scale in investment strategies is needed. Scaling-up tools for reducing project risks as well as blended finance solutions for sustainable infrastructure will be critical.

The provision of risk mitigation tools, including the use of credit enhancement products, optimises the risk-return profile for institutional investors and enhances the overall affordability and bankability of infrastructure assets. Against the backdrop of the COVID-19 pandemic where public budgets for countries are severely constrained, the provision of credit enhancements not only mitigates risks to investors but also provides a pathway to enhance the overall affordability of infrastructure assets – thereby helping EMDEs make more efficient and cost-effective investments in needed infrastructure. Risk mitigation instruments such as guarantees are particularly well suited for mobilising resources because they enable MDBs and development finance institutions (DFIs) to strategically de-risk investments while crowding in private investment. The strategic use of guarantees – largely offered by MDBs in the form of partial credit guarantees and partial risk guarantees – can provide lower borrowing costs and longer loan tenors to borrowers, and cover potential payment-related, counterparty, regulatory and political risks, among others (Swiss Re Institute, 2020).

One way of raising financing for infrastructure can be aggregation platforms. Infrastructure pipelines in EMDEs primarily comprise individual smaller volume transactions that are not ideally suited to institutional investors in search of long-term, investment-grade assets with large ticket sizes. Aggregation platforms, which securitise several smaller and/or below-investment grade assets into a single, pooled vehicle, can improve the risk-return profile and overall financial attractiveness to the institutional investors. Over the short-term, EMDE governments can package existing, brownfield infrastructure projects on a domestic or regional scale. Likewise, over the longer-term, EMDEs can warehouse greenfield assets in existing vehicles and aggregate them over time so that the revenue flows from greenfield and brownfield assets can be pooled.

Bond finance can be leveraged as a financing instrument for infrastructure projects. The advantage of project bonds as a means of debt financing is the flexibility that they offer in structuring the issue. They could have flexible or fixed interest rates and released in tranches that could be issued in different currencies and for different tenors (AIIB, 2020b), hence a preferred way for investors. Additionally, there is untapped potential in public funds (e.g. social security funds) that could be greater contributors to long-term financing given their, generally, long-term liabilities. These interventions could help governments in handling potential political pressures during the post-COVID-19 phase to use long-term investors to fund growing fiscal and investment needs under non-commercial terms.

5. Regional and Sectoral Cooperation

Existing initiatives at the national level like the Global Infrastructure Hub, the Blue Dot Framework and now the Build Back Better Group of seven (G7) process, are repackaging old concepts and surfing on trendy ones but do not provide fresh thinking. The focus should instead be on coordination at the regional and sectoral level, integrating all components of infrastructure. Lessons from India can be taken in this regard. The PM Gati Shakti Initiative – National Master Plan for Multi-modal Connectivity, essentially a digital platform to bring 16 ministries including railways and roadways together for integrated planning and coordinated implementation of infrastructure connectivity projects, can be conceptualised in other G20 member countries. The multi-modal connectivity will provide integrated and seamless connectivity for the movement of people, goods and services from one mode of transportation to another. It will facilitate the last mile connectivity and also reduce travel time for the people.

References

Asian Infrastructure Investment Bank (AIIB), Digital Infrastructure Sector Analysis: Market analysis and technical studies, 10 January 2020a, https://www.aiib.org/en/policies-strategies/operational-policies/digital-infrastructure-strategy/.content/_download/Full-DISA-Report_final-with-Appendix-2020-01-10.pdf.

D20 – Long-Term Investors Club, Statement of the Heads of the Institutions of the D20 – Long-Term Investors Club, Rome, 23 September 2021, http://www.d20-ltic.org/images/D20_Statements/D20_Statement_2021_Rome_-_final_.pdf

Lieve Fransen, Gino del Bufalo and Edoardo Reviglio, Report of the High-Level Task Force on Investing in Social Infrastructure in Europe, Discussion Paper 074, January 2018, https://ec.europa.eu/info/sites/default/files/economy-finance/dp074_en.pdf

OECD, Roadmap to Infrastructure as an Asset Class, 2018, https://www.oecd.org/g20/roadmap_to_infrastructure_as_an_asset_class_argentina_presidency_1_0.pdf

UNCTAD, World Investment Report 2020: International Production Beyond the Pandemic, USA, 2020, https://unctad.org/system/files/official-document/wir2020_en.pdf

World Bank, World Development Report 2022: Finance for an Equitable Recovery, 2022, https://openknowledge.worldbank.org/bitstream/handle/10986/36883/9781464817304.pdf

IMF, “Confronting the crisis: priorities for the global economy”, 2020, https://www.imf.org/en/News/Articles/2020/04/07/sp040920-SMs2020-Curtain-Raiser.

IMF , “The IMF’s response to COVID-19”, 2021 https://www.imf.org/en/About/FAQ/imf-response-to-covid-19.

Eduardo Borensztein and Ugo Panizza, The Costs of Sovereign Default, IMF Staff Papers, 2009, https://www.imf.org/external/pubs/ft/wp/2008/wp08238.pdf

OECD, The impact of the coronavirus (COVID-19) crisis on development finance, June 2020, https://read.oecd-ilibrary.org/view/?ref=134_134569-xn1go1i113&title=The-impact-of-the-coronavirus-(COVID-19)-crisis-on-development-finance

KPMG, Pandemic and the future of infrastructure as an asset class, May 2020, https://assets.kpmg/content/dam/kpmg/sg/pdf/2020/06/pandemic-and-the-future-of-infrastructure-as-an-asset-class-062020.pdf

Asian Infrastructure Investment Bank (AIIB), ASIAN INFRASTRUCTURE FINANCE 2020: Investing Better, Investing More, 2020b, https://www.aiib.org/en/news-events/asian-infrastructure-finance/2020/_common/pdf/AIIB_AIF2020_16April2020.pdf

World Bank, Infrastructure financing in times of COVID-19: A driver of recovery, 2020, https://thedocs.worldbank.org/en/doc/424911600887428587-0130022020/original/InfrastructurefinancingintimesofCOVID19Adriverofrecovery.pdf

Swiss Re Institute, Closing the Infrastructure Gap, 2020, https://www.swissre.com/dam/jcr:3f5e2757-f08b-4fb2-8805-fdc479dd7c20/swiss-re-institute-publication-closing-the-infrastructure-gap-2021.pdf

Blazey,A., Gonguet,F., and Stokoe, P., “Maintaining and Managing Public Infrastructure Assets”, 2020, https://www.elibrary.imf.org/view/books/071/28328-9781513511818-en/ch014.xml