COVID-19 has complicated plans to achieve the Sustainable Development Goals (SDGs) by 2030. As we are witnessing a proliferation of recovery initiatives by governments and international financial institutions, we need to ensure that additional resources align with larger environmental and sustainability goals. Cities and local authorities have a key role to play, as they have a unique capacity to implement and monitor sustainable policies at the local level with immediate feedback loops. For this reason, policy-makers must be equipped with tools that allow them to assess the impact of their budgets and COVID-19 relief schemes on the 2030 Agenda. The G20 can play a central role in setting standards for reporting on such data for both domestic and development cooperation funding.

Challenge

Three key challenges emerge as developing countries seek to recover from the COVID-19induced recession. First, their governments, especially those with limited (or expensive) access to private capital markets, need access to more official financing to reverse the fall in investment, education and the environment that is occurring. Advanced economies provided trillions of direct and indirect fiscal support to bolster domestic economic recovery efforts, equivalent to 28% of their GDP (IMF, 2021). During the pandemic they have largely borrowed on private capital markets to finance their activities, taking advantage of historically low interest rates. Some 36 emerging and developing economies, however, had their creditworthiness downgraded in 2020 as a consequence of the recession and, as they face rising risk premia and interest rates, they have less fiscal space to respond.1 They have spent just 7% and 2% of GDP respectively on recovery actions. Only two countries in sub-Saharan Africa accessed the international bond market (Fitch, 2020). Second, new channels are needed to provide financing for local authorities’ investment plans and implementation of activities that support the Sustainable Development Goals (SDGs). Third, a transparent way to track spending and financing is needed to permit dialogue, sharing of knowledge and innovations, and mutually reinforcing accountability at global, national and local levels.

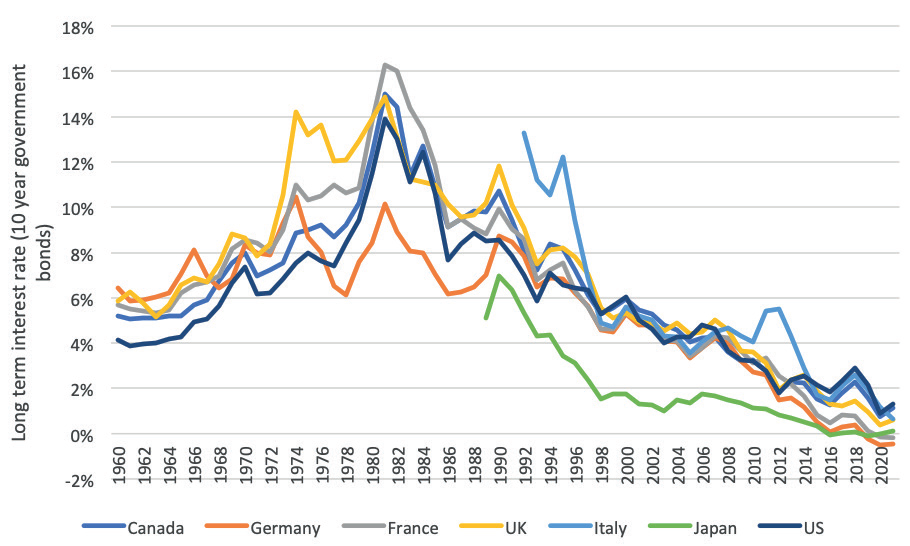

The year 2021 presents an opportunity to reset and realign global, national and local priorities in the wake of COVID-19. It is an opportune time because (i) global interest rates are at historically low levels, making this the right time to scale up investment (see Figure 1); (ii) growth multipliers of public spending are high, given the large cyclical downturn associated with the COVID-19 lockdowns; and (iii) there is an urgent need to put in place transformative shifts in each country, especially to address climate change, improve biodiversity conservation and achieve inclusive economic growth so that business and governments alike embrace the SDGs as the “North Star” to guide their recovery strategies.

Figure 1: Long-term interest rates in the G7, 1960-2021

Source: OECD Stat (2021) and OECD (2021)

Proposal

MOBILIZE GREATER VOLUMES OF IFI RESOURCES

International financial institutions (IFIs) can access global capital markets and offer sovereign loans at low interest rates and long maturities. They can assist countries with grants and technical support to improve their institutional and policy settings to maximize the impact of investments. They have long-term relationships with client countries, reinforced by a strong field presence and a cooperative governance structure that limits the risk of sudden stops of capital. They perform due diligence on public investments to ensure sound projects and avoid insolvency.

Each IFI has a suite of instruments at its disposal that can be used to scale up financing. G20 ministers have already signalled support for a new Special Drawing Rights (SDR) allocation of $650 billion to be distributed to every country in the world based on its IMF quota share (G20, 2021). In aggregate, developing countries would get $224 billion, with low-income countries receiving $13 billion, significant in absolute terms but small in terms of overall need. Thus, there have been concurrent calls for developing mechanisms to permit countries with surplus reserves to on-lend to those who need them most. One such mechanism already exists, the IMF’s Poverty Reduction and Growth Trust (PRGT), that could be strengthened with additional resources. However, most middle-income countries (MICs) do not have access to this facility, so it would be desirable to create other mechanisms that MICs can draw upon. The IMF staff proposal to develop a Resiliency and Sustainability Trust with broader country coverage than the PRGT is a move in the right direction. UNECA and PIMCO have launched a Liquidity and Sustainability Facility, a “repo” market initially for African sovereign debt that could be underpinned by SDRs from one or more countries (UNECA, 2021). Greater liquidity would reduce sovereign interest rates and also help crowd in additional private investment on the continent.

SDRs are most useful to help finance the short-term cyclical recovery of the next two years. Beyond that, there is need for a ramped up level of development finance for the coming decade, much of which could be channelled through multilateral development banks (MDBs). The MDBs already have substantial room to expand their lending by changing the way they account for callable capital and by optimizing their balance sheets through changes in management’s prudential guidelines. Humphrey (2020) and Settimo (2017) find that the major MDBs have around $750 million in additional lending headroom, even maintaining their AAA rating, and considerably more (up to $1.5 trillion) if they are prepared to risk a downgrade to AA+. However, such a move would require approval from shareholders, hence may be seen as a less viable option.

Additionally, MDB lending can be boosted through recapitalizations. The World Bank and Inter-American Development Bank are particularly constrained in their ability to significantly expand their sustainable lending levels above current volumes. The G20 has indicated support for an accelerated IDA20 replenishment cycle, moving it up one year to the end of 2021, to permit remaining IDA19 balances to be committed this year (G20, 2021). But it has been silent on the topic of core capital to back additional non-concessional lending. They have instead called on MDBs to optimize their balance sheets and to mobilize private capital by using guarantees and by developing platforms for co-financing in specific sectors. They can disburse and potentially turn over assets at a faster rate than at present.

DEVELOP LOCAL GOVERNMENT ACCESS TO FINANCIAL RESOURCES

Cities and subnational governments will be central to a successful reset that reverses the setbacks to SDG progress resulting from the COVID-19 pandemic. Cities are the engines of economic growth, accounting for 80% of global GDP. They also generate more than 70% of the world’s greenhouse gas emissions, and urban dwellers are responsible for more than two-thirds of global energy consumption. As a result, estimates suggest that 65% of the SDG agenda is dependent upon subnational leadership and investments (Cities Alliance, 2015; SDSN 2015; SDSN and Brabant Center for Sustainable Development 2019).

Local governments have been bearing the brunt of the social and economic impact of COVID-19. Estimates from the World Bank and UN agencies suggest that local governments stand to lose between 15% to 25% of their revenues in 2021 due to the crisis (Wahba et al., 2020).

Mayors and local policymakers are determined and eager to lead a transformational recovery, one that results in more inclusive, just, and sustainable cities consistent with the SDGs. An increasing number of local governments are adopting SDG strategies as the blueprint for their recovery. The “C40 Mayors Agenda for a Green and Just Recovery”, for example, emphasizes specific measures to deliver an equitable and sustainable recovery (C40 Cities Climate Leadership Group, 2020).

Their financing options, however, are limited. Two major barriers exist: access to finance and project readiness. Only 5% of the $20.5 trillion in COVID-19 relief and stimulus packages is committed to cities, and the sovereign lending model of the MDBs makes it difficult for municipalities and local governments to access financing directly (Lonsdale, Negreiros and Yang, 2020). The MDBs have done a bit better in partnering with cities to increase their investment prospects and project pipeline, through efforts such as the World Bank and EIB’s City Climate Finance Gap Fund, which provides technical assistance and targeted finance, and the World Bank’s City Creditworthiness initiative, which helps cities strengthen their fiscal rating and improve the potential for attracting private investment.

Yet the activities and financing of the MDBs in relation to subnational governments are proportionately meagre when compared with the potential they demonstrate for accelerating global progress on the SDGs. As they did during the acute phase of the crisis, local leaders will continue to form the front lines of the recovery, without the resources and support necessary to maximize that promise. The public demand for an inclusive and equitable recovery provides an opportunity to transform and elevate the engagement of the MDBs and set the stage for a substantial increase in their focus and resources.

The G20 should encourage MDBs to expand lending to cities and consider innovative mechanisms such as pooled city financing to mitigate risk.

A NEW TOOL TO TRACK AND ALIGN FINANCE AND SPENDING TO SUPPORT THE SDGS AT NATIONAL AND LOCAL LEVELS

Mobilizing additional financing is not enough; the new funds must be aligned and tracked to ensure they contribute to the wider 2030 Agenda. The SDGs are a natural framework through which to filter new investments to assess the sustainability of short-term recovery schemes. The goals represent a shared definition of what connotes sustainable and inclusive investments, and their universal nature means they can be applied to both domestic and international financial flows at national and sub-national levels.

One means of tracking SDG action is the Voluntary National Review (VNR) and the Voluntary Local Review (VLR), where national and sub-national governments respectively report on progress towards the SDG targets at their particular level. While national governments report their VNRs as part of the official follow-up processes at the UN, VLRs are an innovation that local governments have created and pursued primarily for their own benefit (Pipa and Bouchet, 2020). These reviews focus on localizing the SDG targets and tracking local progress, highlighting local policy interventions that have catalysed progress.

Nonetheless, neither of these schemes generally tracks funding towards the various goals, nor provides a means for governments to indicate the degree to which their budgets are aligned with the SDGs. This is where a complementary financial tracking system comes in, assessing ex ante how much of the total spending would go towards the achievement of SDG targets and allowing for ex post monitoring of the largest impact per unit of finance in a world of finite budgets if used in tandem with an SDG results framework.

The novelty of such a tool lies in its ability to verify whether current funding streams contribute to the wider 2030 Agenda, both in terms of dollars spent and potential impact. This information is particularly relevant for policy-makers in that it allows them to orient public spending towards programmes with greater SDG impact or reallocate resources to areas where the locality is furthest from the SDG targets. Such a tool becomes especially valuable at this time when large incremental public investments are being contemplated by developing countries using borrowed funds from official institutions. A tracking tool would build transparency and accountability into the process. It provides a mechanism to communicate to civil society the areas where new investments will bring benefits in terms of sustainable, inclusive and just recovery and growth.

Such a tool would need to adjust to varying contexts, able to track funding at both the national and local level under a variety of governing arrangements, local capacity and data availability. Given the proximity to their citizens and the immediate feedback loops regarding their success in addressing local priorities, local governments are well positioned to serve as a living laboratory to refine this approach. To serve such purpose, there are some core principles any tool should include.

1. The ability to categorize spending by sector/policy area: Tool users will need enough detail on government budget data to be able to classify spending decisions into various SDG related categories. This can be done by linking spending allocations to specific policy areas (e.g. green/digital transition), or specific targets/intervention fields (e.g. renewables, R&D) The more specific the categorization, the greater the tool’s ability to measure the real impact of investments on the SDGs. Many institutions and governments are already starting to do this the European Union (EU), for example, has been using its own methodologies to monitor climate and biodiversity-related expenditures (IEEP, 2020), based on the intervention fields set out in EU regulations, and it is exploring the possibility of developing an SDG expenditure tracking methodology for the EU budget (European Commission, 2020). While the level of technical capacity and transparency needed to do this is already present in most G20 countries, as demonstrated by the EU institutions’ monitoring of the sustainability of its Recovery and Resilience Plans’ budget (European Commission, 2021), developing countries might need technical support to implement such budgeting efforts.

2. The ability to identify the geographical level of spending: Given that the achievement of the SDGs is hyper-local, the tool must be able to identify what spending is happening at the national, regional and local level in order to be able to accurately identify which funds are generating impact.

3. The ability to track government spending decisions: Some level of budget transparency is required to implement any such tool. Budget information must be accessible and timely, allowing users to see allocations as well as disbursements in order to assess where spending is going. Such measures are in place in G20 countries, but broader work on addressing corruption and improving public financial management will be required for implementation in developing countries.

Figure 2: Relative contribution of Sardinia ERDF and ESF 2014-2020 to the SDGs

Source: Cavalli et al. (forthcoming)

Tracking tools are already moving from concepts to pilots. A case in point is a tool that has been developed and tested by Fondazione Eni Enrico Mattei (FEEM) and the Autonomous Region of Sardinia (RAS). Taking advantage of the detailed budget categorization available in various EU investment funds,2 the tool identifies how EU funds contribute to the various SDG targets in Sardinia (Cavalli et al., forthcoming). By assigning each intervention or investment a coefficient, weighting how much it contributes to the each of the SDGs’ 169 targets, the researchers were able to assess how aligned the EU investment funds were with the SDGs and which goals were most targeted. They found that in Sardinia around 65 to 70% of the EU investment funds analysed went towards SDG related outcomes, with the largest contributions to Goal 9 (infrastructure), 13 (climate), 1 (poverty) and 8 (decent work and economic growth), as shown in Figure 2.

THE APPLICATION OF THE FEEM/RAS SDG TRACKING TOOL IN SARDINIA

The FEEM and RAS approach (Cavalli et al., 2020) relies on creating weighted matrices to evaluate the direct and indirect impacts of each investment on the 169 SDG targets.

Given the ambiguity of some targets, the team first conducted a thorough literature review to ensure correct interpretation. For example, only 94 of the 169 targets are focused on country-level outcomes, and only 37 of these are quantified and measurable (Kharas, McArthur and Rasmussen, 2018). The team looked at the proposed indicators and developed proxy targets where specific metrics were not specified, giving them a concrete meaning within the EU’s institutional, social and economic context.

Second, the team created a 169 x n matrix, with one column for each intervention or investment field in the budget. For each intervention, the team assessed whether it had an impact on each of the 169 SDG targets. The impact could be classified as none, indirect or direct for each target and intervention combination. For example, investments in solar energy would have a direct impact on Target 7.2 “Increase substantially the share of renewable energy in the global energy mix by 2030”, whereas R&D investments would have an indirect impact (Figure 3).

Third, the team created a second matrix that took into account the magnitude (very low, low, medium and high) and the orientation (positive or negative) of the impacts. An intervention was given a positive orientation if it contributed to the attainment of a target and a negative one if it hampered progress. Location-specific characteristics were considered in weighting the magnitude of intervention impacts. For example, in Sardinia, investments in the protection of natural sites were considered to have a high magnitude impact on Target 14.2 “sustainably manage and protect marine and coastal ecosystems”.

Finally, the two matrices were multiplied together to create a final weighted matrix that captured each intervention’s direct/indirect effect and scale/direction of impact on the 169 targets. To get the average impact per goal, the team took the average score across all targets comprising that goal for a given intervention. They also added up the respective impacts on each goal to understand how each intervention impacted the SDGs writ large.

Figure 3: Example of the first 169 x n matrix, showing the impact (none, indirect or direct) of each intervention or investment on the 169 SDG targets

Source: Cavalli et al. (2020)

Tools like the above matrix represent a necessary addition to the international toolbox, allowing users to both track and align finance and spending to support the SDGs at the national and local levels. Successful application will provide a baseline that should inform and guide local policy-makers during future budget processes and allocations. The scale-up of similar tools could be particularly significant at a time when the international community is contemplating a big push of additional finance for COVID-19 recovery, green infrastructure and the 2030 Agenda.

WHAT THE G20 SHOULD DO

There are three core tasks for the G20 to take up in pursuit of these proposals.

First, the three core G20 working groups that work on various elements of sustainable finance (the International Financial Architecture Working Group, the Development Working Group and the new Sustainable Finance Working Group) should develop a common view on how finance links to SDG results at national, regional and local levels by drawing lessons from the use of innovative tools; the EU experience applying a common classification system for sustainable economic activities and the above-referenced Sardinia case study are good examples. The working groups should reach out to low-income and middle-income countries to identify pilots in different country circumstances to test these tools.

The working groups should encourage all financing partners, notably the IMF, the World Bank and other IFIs, to develop and use such tools when any incremental financing is proposed, including in the macroeconomic programmes agreed to in IMF arrangements and World Bank budget support operations. In so doing, the microeconomics of project activities and the macroeconomics of aggregate budget and financing envelopes can be more closely linked, potentially providing an empirical basis for G20 shareholders to support more ambitious medium-term lending programmes by the MDBs and other development finance institutions, including those that expand financing for sub-national governments. A good first step would be to undertake a review and analysis of the scope of activity under way across the MDBs that supports sub-national and city governments, identifying opportunities for greater MDB leadership.

Second, the G20 should encourage each member state to report on how COVID-19 recovery programmes align with the SDGs within their own economies (leading by example). It should encourage the use of and share experiences with alternative tracking tools. For example, in addition to the matrix tool piloted in Sardinia by FEEM and RAS, the three G20 finance orking groups should build an inventory of other tracking tools that could be scaled up. In addition, the G20 finance working groups should work towards a standardized reporting effort for G20 countries to report on the SDG impact of domestic recovery funds. Such standards should provide a way to link local reporting to national figures.

Third, the three working groups should request similar reports as to how G20 countries contribute to developing countries’ strategies for reaching the SDGs. Tools are being developed to help with such reports; the OECD launched the SDG Financing Lab in 2017, using machine learning to map official development flows onto the SDGs (OECD, 2017). The SDG Financing Lab is a first step, but it is not institutionalized. Most G20 countries subscribe to the OECD Creditor Reporting System that includes sector tags, but this data is not timely and does not account for the co-benefits that spending on one SDG has on the achievement of other SDGs. All official financing should be linked to an SDG outcome through a tracking tool.

These activities would build on the important leadership of the G20 in the Debt Service Sustainability Initiative (DSSI) in 2020 and would ensure that incremental resources provided to developing countries by G20 members contribute towards sustainable, green, inclusive investments, aligned with the wider global agenda. G20 actions are critical because their economies, together, represent the overwhelming majority of the global economy and population, because they include the world’s largest providers of development cooperation finance, and because they are the major shareholders of the multilateral development finance system.

NOTES

1 See Fitch, Moody’s, and S&P Press Releases, accessed 28 January 2021.

2 The team looked at the contribution of the EU European Structural and Investment (ESI) Funds to the SDGs, specifically looking at the impact of two pools of funding: the European Regional Development Fund (ERDF) and the European Social Fund (ESF). ESI funds aim to strengthen EU economic, social and territorial cohesion and reduce development disparities across the region.

REFERENCES

C40 Cities Climate Leadership Group (2020). C40 Mayors’ Agenda for a Green and Just Recovery. New York, C40, https://www.c40knowledgehub.org/s/article/C40-Mayors-Agenda-for-a-Greenand-Just-Recovery?language=en_US, accessed 12 July 2021

Cavalli L, Sandro S, Alibegovic M, Arras F, Cocco G, Farnia L, Manca E, Mulas LF, Onnis M, Ortu S, Romani IG, Testa M (2020). The Contribution of the European Cohesion Policy to the 2030 Agenda: an Application to the Autonomous Re gion of Sardinia, in Fondazione Eni Enrico Mattei Working Paper, no. 11, https://www.feem.it/en/publications/feemworking-papers-note-di-lavoro-series/the-contribution-of-the-european-cohesion-policy-to-the-2030-agenda-an-application-to-the-autonomous-region-of-sardinia/, accessed 12 July 2021

Cavalli L, Sandro S, Alibegovic M, Arras F, Cocco G, Farnia L, Manca E, Mulas LF, Onnis M, Ortu S, Romani IG, Testa M (forthcoming). Localizing the 2030 Agenda 2030 at regional level through the European Cohesion policy: An application to the region of Sardinia, in International Conference for Sustainable Development 2021

Cities Alliance (2015). Sustainable Development Goals and Habitat III: Opportunities for a Successful New Urban Agenda, in Cities Alliance Discussion Paper, no. 3, https://www.citiesalliance.org/sites/default/files/Opportunities%20for%20the%20New%20Urban%20Agenda.pdf, accessed 12 July 2021

European Commission (2020). Delivering on the UN’s Sustainable Development Goals – a comprehensive approach – staff working document (SWD 400 final), Brussels, 11 November, https://ec.europa.eu/info/sites/info/files/delivering_on_uns_sustainable_development_goals_staff_working_document_en.pdf, accessed 12 July 2021

European Commision (2021). European Parliament resolution of 10 June 2021 on the views of Parliament on the ongoing assessment by the Commission and the Council of the national recovery and resilience plans (2738(RSP)), 10 June, https://www.europarl.europa.eu/doceo/document/TA-9-2021-0288_EN.pdf, accessed 12 July 2021

Fitch (2020). Debt markets re-open for sub-Saharan issuers. Fitch Wire, 19 November, https://www.fitchratings.com/research/sovereigns/debt-markets-reopen-for-sub-saharan-issuers-29-11-2020, accessed 12 July 2021

Fitch (2021). Soverign Ratings Press Releases. FitchRatings, accessed 28 January, https://www.fitchratings.com/search/?expanded=racs&filter.sector=Sovereigns&filter.country=Cape%20Verde&dateValue=allAvailable&sort=recency

G20 (2021). Second G20 finance ministers and Central Bank governors meeting, Rome, 7 April, https://www.g20.org/wp-content/uploads/2021/04/Communique-Second-G20-Finance-Ministersand-Central-Bank-Governors-Meeting-7April-2021.pdf, accessed 12 July 2021

Humphrey C (2020). All hands on deck. ODI Briefing Paper, April, https://www.odi.org/publications/16832-all-hands-deck-how-scale-multilateral-financing-face-coronavirus-crisis, accessed 12 July 2021

IEEP (Institute for European Environmental Policy) (2020). Documenting climate mainstreaming in the EU budget – making the system more transparent, stringent and comprehensive (PE 654.166), Brussels, May, https://www.europarl.europa.eu/RegData/etudes/STUD/2020/654166/IPOL_STU(2020)654166_EN.pdf, accessed 12 July 2021

IMF (International Monetary Fund) (2021). Fiscal Monitor April 2021, Washington, D.C., IMF, Figure 1.7, p. 10, https://www.imf.org/en/Publications/FM/Issues/2021/03/29/fiscal-monitor-april-2021, accessed 12 July 2021

Kharas H, McArthur J, Rasmussen K (2018). How many people will the world leave behind? Brookings Global Economy and Development Working Paper, no. 123, https://www.brookings.edu/research/how-many-people-will-the-world-leavebehind/, accessed 12 July 2021

Lonsdale A, Negreiros P, Yang K (2020). Urban climate finance in the wake of COVID-19, London, Cities Climate Finance Leadership Alliance. https://www.citiesclimatefinance.org/wp-content/uploads/2020/12/Urban-Climate-Financein-the-Wake-of-COVID-19.pdf accessed 12 July 2021

Moody’s (2021). Sovereign & Supranational Ratings Press Releases. Moody’s, accessed 28 January, https://www.moodys.com/researchandratings/market-segment/sovereign-supranational/-/005005?tb=0&ol=-1&lang=en&type=Rating_Action

OECD (Organisation for Economic Co-operation and Development) (2017). The SDG financing lab. https://sdg-financing-lab.oecd.org/?country=Korea&distribution=providers&sdg=12 accessed 12 July 2021

OECD Stat (2021). Long-term interst rates (indicator). Accesssed 1 June,

https://data.oecd.org/interest/long-terminterest-rates.htm#indicator-chart

OECD (2021). Main Economic Indicators, Volume 2021, Issue 6. Paris, OECD.

https://www.oecd-ilibrary.org/economics/main-economic-indicators_22195009

Pipa T, Bouchet M (2020). Next generation urban planning: Enabling sustainable development at the local level through volunatary local reviews (VLRs). Washington, D.C., Brookings Institution. https://www.brookings.edu/research/next-generation-urban-planning-enabling-sustainable-development-at-the-local-level-through-voluntary-local-reviews-vlrs/

S&P (2021). Sovereign Ratings Press Releases. S&P Global, accessed 28 January, https://disclosure.spglobal.com/ratings/en/regulatory/press-releases

SDSN (Sustainable Development Solutions Network) (2015). Getting Started with the Sustainable Development Goals. A Guide to Stakeholders. New York and Paris, Sustainable Development Solutions Network. https://sdg.guide/, accessed 12 July 2021

SDSN (Sustainable Development Solutions Network) and the Brabant Center for Sustainable Development (2019). The 2019 SDG Index and Dashboards Report for European Cities (prototype version), Tilburg, the Netherlands, Brabant Centre for Sustainable Development

https://s3.amazonaws.com/sustainabledevelopment.report/2019/2019_sdg_index_euro_cities.pdf, accessed 12 July 2021

Settimo R (2017). Towards a more efficient use of multilateral development banks’ capital. Banca D’Italia Occasional Papers, No 393. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3056276 accessed 12 July 2021

UNECA (2021) ECA launches LSF, a vehicle for debt management and fiscal sustainability. UNECA Press Release, 23 March, https://www.uneca.org/stories/eca-launches-lsf%2C-a-vehicle-for-debt-management-and-fiscal-sustainability, accessed 12 July 2021

Wahba S, Sharif MM, Mizutori M, Sorkin L (2020). Cities are on the front lines of COVID-19. World Bank Sustainable Cities Blog, 12 May, https://blogs.worldbank.org/sustainablecities/cities-are-front-linescovid-19, accessed 12 July 2021