In this policy brief, we recommend the institution of a Global Universal Basic Income (GUBI). We define this as a periodic payment unconditionally delivered to all individuals worldwide, without means-test or work requirement, paid in cash or other appropriate form. It should be funded through a tax on financial transactions, a wealth tax levied on the top 1% of the global wealth distribution, and a carbon tax. The GUBI provides an automatic safety net against sudden systemic shocks like COVID-19. It should be managed by a United Nations (UN) agency. A GUBI helps create global citizenship, foster global social cohesion, and regain trust and legitimacy toward international institutions such as the Group of 20 (G20).

Challenge

Despite sustained growth in global average income, there is widespread discontent with existing political institutions in many countries. According to the Edelman Trust Barometer (2020), which gathers information from 27 countries, four out of five respondents state that the governmental system is not working for them. In Western countries, discontent has taken various forms, including a surge in anti-establishment parties who often embrace nativism and xenophobia in their political agenda. This has led to a retreat in multilateralism in global governance, and to the widespread use of despicable rhetoric in political discourse. Global institutions, including the G20, the International Monetary Fund (IMF), the World Bank, and the World Trade Organization (WTO), suffer from a perceived lack of legitimacy. They are often portrayed as embodying the interests of rich countries at the expense of poor countries and of perpetuating the interests of multinational companies at the expense of local business. These trends are worrying, and if not thwarted may even lead to institutional failures and collapse. Furthermore, three critical global challenges cannot be confronted without major transformations in global institutions: migratory pressures, climate change, and global health challenges, such as the COVID-19 pandemic. The economic disruptions of such threats can bring the global economy to a halt. Retreating within national borders is neither desirable nor effective as these threats become reality.

Social cohesion has been conceptualized as the capacity of a community to express mutual solidarity. This implicitly applies to the national level. We believe that it is the correct time to re-think and re-propose the notion of social cohesion at the global level. The notion of global citizenship should be theoretically founded, politically constructed (Gellner and Breuilly 1983), and instruments to maintain it should be created. The proposal of a GUBI should be understood as an instrument toward crafting global citizenship. The proposal that we outline below includes three components: the global tax systems that will fund GUBI, the transfers delivered and their administrative capacities, and the global institutions that will govern and regulate the process. This will include both the global tax system and the administrative and policy machinery for the delivery and monitoring of implementing a monetary transfer system. A GUBI is also a way to re-establish trust in global institutions such as the G20, increasing their legitimacy.

Proposal

1. Foundations of GUBI

1.1 What is a GUBI?

According to the Basic Income Earth Network, a Universal Basic Income (UBI) is a periodic cash payment unconditionally delivered to all on an individual basis, without means-test or work requirement (Straubhaar 2018). Basic income has the following five characteristics:

- Periodic: it is paid at regular intervals (for instance every month), rather than as a one-off sum;

- Cash payment: it is paid in an appropriate medium of exchange, typically money, allowing the recipients freedom to decide how to use it. It is not paid either in kind (such as food or services) or in vouchers for a specific use;

- Individual: it is paid on an individual basis rather than, for instance, to households;

- Universal: it is paid to all, without a means-test;

- Unconditional: it is paid under any circumstances, regardless of the recipient’s condition in the labor market. In particular, it is not conditional to being unemployed, or performing a specific sort of work, such as public utility work (BIEN 2020).

A GUBI is a UBI extended to all citizens of the world.

We argue that a GUBI can be justified on philosophical, political, social, and economic grounds.

1.2 Philosophical foundations

A common philosophical argument for a UBI, inspired by Paine’s (2000) and Meade’s (1995) proposals for a social dividend, invokes the idea that the unequal distribution of wealth should be compensated by a public distribution of unearned income. Since benefits flow from commonly owned natural resources, they should be distributed equally (Steiner 1994; Van Parijs 1997). Van Parijs and Vanderborght (2015) argue that UBI can be extended to the world society to become a GUBI.

Moreover, there is wide consensus in justice theories and within the general public that everyone should have the means to live a dignified life. A GUBI would provide a building block to attain this goal, although the income level at which this goal can be achieved is the subject of political deliberation. A GUBI would provide income support without means-testing. Means-testing is costly and many people who have the right to receive the benefit are left out either because of the complexity of the means-testing process, or because of its social stigma (Atkinson 2015). Ultimately, the main difference between means-tested income support and a UBI is that the latter avoids payment delays, provides greater insurance that support will be received, and avoids the stigma of requesting assistance. UBI´s ideal is a universal benefit financed by progressive, targeted taxes. When UBI is combined with an income tax, the means-testing procedures only target the well-off population of net taxpayers.

1.3 Political foundations

In a world experiencing mounting global challenges, such as climate change, epidemics, economic insecurity, wars and migration, global cooperation and coordination have never been as necessary as today. However, the current myopic response implies further national retrenchment and protectionism. This nationalist turn may not be accidental. It could signal a basic failure of the democratic nation state in coping with systemic challenges, and could evolve into a breakdown of democratic systems, as demonstrated by the spread of “illiberal democracies” (Zakaria 1997). We argue that a GUBI would be a powerful instrument to revert this trend, improving social cohesion and global governance. It would mold a global collective sense of identity in individuals worldwide, regardless of their conditions or provenance. Granting a universal right to a dignified life would endorse the view that nobody should be left behind on the global scale. It would include citizens in the benefits of a global society and grant them a minimum level of resources to pursue their life plans. We argue that this new sense of global inclusion, engendered by a GUBI, will reverberate into increased support and legitimacy for global institutions such as the G20. GUBI would be a way to tangibly show the possibility of solidarity beyond national realms and which benefits individuals directly. This development would strengthen cosmopolitan citizenship, which should pave the way for increased support for international cooperation. For this to happen, GUBI must be presented as a truly global policy, rather than the conjunction of national policies.

1.4 Social foundations

At the basis of the current crisis of legitimacy of political institutions stands the widespread perception held by individuals that “the system is not working for them,” that is, political institutions are not capable of managing the increased global insecurity. Insecurity mainly refers to the economic domain, as the effects of the 2008 Great Recession are still felt by large sectors of the population. The effects of the global economic disruption triggered by the coronavirus pandemic will probably prove to be worse. However, insecurity also refers to the social and political domain, as the rolling back of the welfare state in Western countries led to reduced social insurance for the very people who most needed it (Nolan and Valuenzela 2019; OECD 2011). A UBI would help address the perception of having been “left behind” at the national level. A GUBI would permit enfranchisement of people at the global level.

1.5 Economic foundations

A GUBI would also be justified on economic grounds. Development economics argues that one of the reasons for under-development and persistence of poverty is the lack of capital (or credit) to fund entrepreneurial activities. A GUBI is a way to empower individuals economically and give them tools to break out of the poverty trap.

In countries utilizing unemployment subsidies, a UBI is a way to prevent unemployed workers from falling into a poverty trap. They can avoid disproportionately high levels of taxation when a job is accepted. A UBI is particularly effective under the irregular work contracts brought about by digitalization (Atkinson 2015).

1.6 GUBI as the way forward toward global (or human) citizenship

Marshall (1963) distinguished three types of citizenship. Civil citizenship concerns individual freedom, liberty of movement, freedom of speech, thought and faith, and the right to property and justice. Political citizenship concerns the right to participate in the exercise of political power, either as a voter or as a candidate in elections. Finally, social citizenship concerns the right to a minimum level of economic welfare and security. For Marshall, modern citizenship is the way in which communities tame market forces and allow for basic forms of equality. The state is its architect. We need global thrust in this direction since nation states alone can no longer guarantee these basic forms of equality.

We draw two lessons from Marshall’s analysis of the emergence of citizenship in England. First, citizenship has been constructed in all the three domains. Before the Middle Ages, citizenship was virtually non-existent for most people under all the three domains, and gradually developed upon social struggle. Citizenship does not exist in natural form; rather it is the result of a political and social process. Second, the three domains of citizenship have developed sequentially rather than jointly, with progress in the social domain being delayed compared to the other two domains.

We believe that in the case of global citizenship, starting with social citizenship, and reframing civil and political citizenship in the process, is a reasonable way forward. Instituting a GUBI is consonant with Marshall’s definition of social citizenship, as it would grant every individual in each society at a given moment the material set of resources that is necessary to lead a dignified life. While Marshall thought at the nation-state level, we propose considering this at the level of the global human village.

2. Funding a GUBI

This brief’s purpose is not to compute an optimal form of taxation. Rather, we want to make two points. First, it is important that funding comes from global taxation because this is functional to fostering a sense of global citizenship. This would not be the case if GUBI was seen as a form of aid from rich to poor countries. Second, global taxation at mild tax rates would suffice to fund a substantial GUBI.

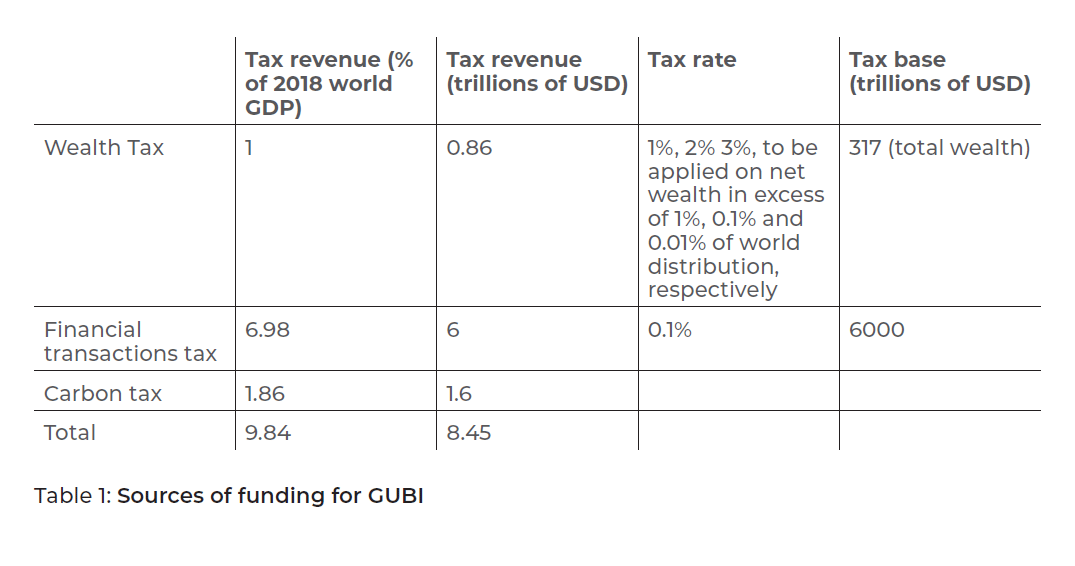

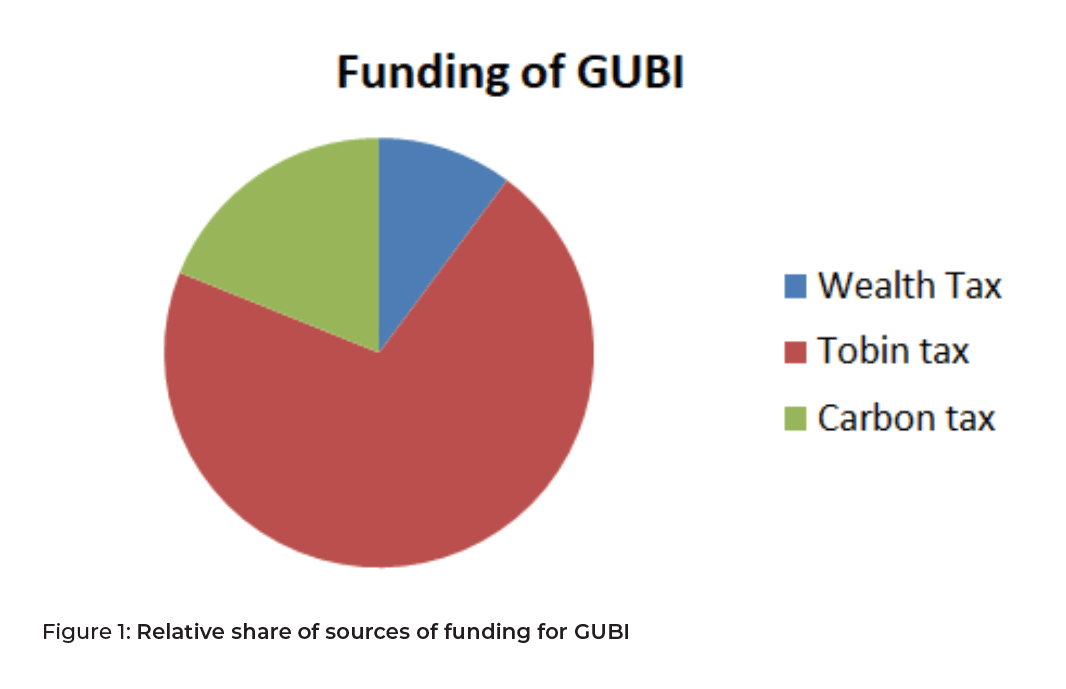

We do suggest possible sources of funding and their projected revenues. The tax we propose would combat global public bads and negative externalities: climate change, financial and economic instability, and extreme wealth concentration. Both the wealth tax and the Tobin tax are clearly progressive in targeting people at the top of the wealth distribution.

- Global wealth tax. A wealth tax is an annual tax levied on the net wealth that a household (or an individual) owns above an exemption threshold. Net wealth includes all assets (financial and non-financial) and all debts, valued at their prevailing market prices. Proposals for a wealth tax have been recently made by Landais, Saez and Zucman (2020) for the European Union (EU) as a way to fund debt emitted to face the COVID-19 pandemic, and globally by Piketty (2018) and Oxfam (Pearce 2019). Landais, Saez, and Zucman (2020) propose marginal tax rates of 1%, 2%, and 3% for net wealth above €2 million (close to the top 1% threshold for wealth), €8 million (close to the wealth top 0.1% threshold), and €1 billion, respectively. This would raise 1.05% of EU Gross Domestic Product (GDP) in revenues each year, accounting for evasion and avoidance responses. The levy would be higher in countries with larger wealth concentration than the EU. A wealth tax with the same structure would raise around 1.8% of US GDP (Saez and Zucman 2019). We make the prudent assumption that a progressive global wealth tax would contribute revenues close to 1% of world GDP.

- Carbon tax: According to Jacob et al. (2016), a global system of carbon taxation could raise around USD 1.6 trillion per year between 2020 and 2030, that is, around 1.86% of current GDP. As the transition toward a decarbonized world proceeds throughout the century, this carbon tax revenue would inexorably decrease, and other sources of funding would need to be substituted. A carbon tax may be regressive, in that it may weigh more on the poorest of the population. In that case, compensatory transfers should be undertaken to overturn the regressive character of the carbon tax (Schwerhoff et al. 2017; Klenert et al. 2018).

- Tobin tax: A conservative estimate of the world’s financial transactions is around $12 quadrillions. Taxing these transactions at the rate of 0.1%, and assuming it would reach only half of this volume of transactions due to either elusion or evasion, would generate around 7% of the global GDP as revenue. A tax rate of 0.1% is a cautious figure, as the EU is currently discussing levying a 0.2% tax on financial transactions (Funke, Meyer and Trebesch 2020). However, we do not have a clear idea of the tax base’s elasticity. It could be that other forms of taxation, such as a digital tax, may be used to complement the revenues from a GUBI.

As detailed in Table 1, the overall financial capacity would be around 9.84% of world GDP.

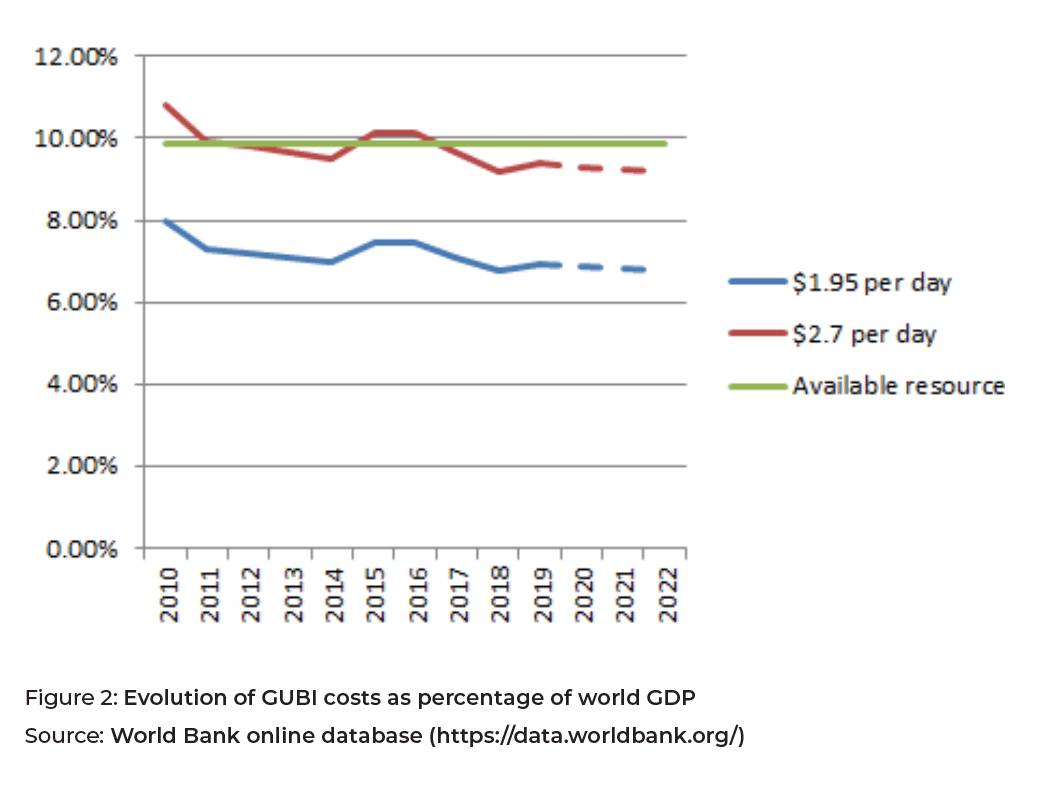

3. Costs of a GUBI

As a first and basic estimation of a GUBI, our target is that every citizen in the world receives enough to overcome the absolute poverty threshold. This is conventionally set at $1.95 per day for 365 days a year. Without adjusting this sum for Purchasing Power Parity (PPP), the GUBI would be equivalent to around 6.3% of world GDP. Adjusting for PPP, the GUBI would cost around 3.12% of world GDP. Van Parijs (In Press) discusses the use of PPP adjustments. He argues against the use of PPP for assessments of inter- and intra-national inequality but is in favor of its use for poverty assessments and transnational redistributive schemes for reasons of political feasibility. Not adjusting for PPP, as we do in the continuation, provides larger support to people from poor countries.

Administrative costs should be included in the computation of the costs of GUBI. We believe that it is important that the GUBI is managed by a specifically created UN agency. The World Bank, the IMF, and regional banks should also be involved for the purpose of collecting revenues and administering the benefit. GUBI should not be seen as a form of aid from rich countries to poor countries, but as a global dividend to which citizens around the world are entitled. For this reason, it is important that the benefit is managed by a global institution. Since the GUBI can rely on existing institutions, the marginal administrative costs are contained. A prudent estimate is that they amount to 0.5% of the global GDP.

The revenue capacity examined in Section 2 would then be more than sufficient to finance a GUBI set at the poverty threshold of $1.95. In fact, a prudent estimate is that the GUBI could be set at a level of $2.7 and still be below the available financial resources. Figure 2 shows the evolution of GUBI as a percentage of GDP for these two thresholds.

4. Conclusions and relevance to the G20

In this policy brief, we have advocated for the establishment of a GUBI, sketched out its costs, and suggested ways to raise global revenues to fund it. In the Appendix we provide a roadmap whereby the GUBI may be established and discuss some open questions. We favor the idea that the GUBI may be integrated by additional schemes of UBI in richer countries to make it a significant policy tool in rich as well as poor countries.

The establishment of global social citizenship is an ambitious endeavor that must rest upon global institutions. The G20 is one of the most effective global institutions, thus it is a natural arena to discuss this topic. Countries belonging to the G20 would be natural candidates to start the process. A GUBI helps create global citizenship, fosters global social cohesion, and rebuilds trust and legitimacy toward international institutions such as the G20.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Atkinson, Anthony B. 2015. Inequality: What Can Be Done? Cambridge: Harvard

University Press. https://doi.org/10.4159/9780674287013.

Basic Income European Network (BIEN). 2020. The Basic Income Earth Network’s

Definition of Basic Income since the GA 2016. BIEN website, PDF. https://basicincome.org/wp-content/uploads/2020/07/Basic-Income-definition-longer-explanation-1.pdf

Edelman. 2020. “2020 Edelman Trust Barometer.” Edelman webpage. Last updated

January 19, 2020. https://www.edelman.com/trustbarometer.

Collier, Paul. 2020. “Social Cohesion and the State: What Can the G20 Do To Improve

Social Cohesion and Trigger Responsibility in Business and Politics?” Keynote speech

Global Solutions Summit, held online. Video. https://www.global-solutions-initiative.org/global-table/social-cohesion-through-business-and-politics.

Funke, Manuel, Josefin Meyer and Christoph Trebesch. 2020. “The German-French

Proposal For a European Financial Transaction Tax – International Comparison and

Policy Recommendations.” In German, Kieler Beiträge zur Wirtschaftspolitik, 24.

Garton Ash, Timothy and Antonia Zimmermann. 2020. “In Crisis, Europeans Support

Radical Positions.” Eupinions Brief, May 6, 2020. https://eupinions.eu/de/text/in-crisiseuropeans-support-radical-positions.

Gellner, Ernest and John Breuilly. 1983. Nations and Nationalism: New Perspectives

on the Past, 1st ed. Ithaca: Cornell University Press.

Jacob, Michael, Claudine Chen, Sabine Fuss, Annika Marxen, Narasimha D. Rao and

Ottmar Edenhofer. 2016. “Carbon Pricing Revenues Could Close Infrastructure Access

Gaps.” World Development 84: 254-65. https://doi.org/10.1016/j.worlddev.2016.03.001.

Klenert, David, Linus Mattauch, Emmanuel Combet, Ottmar Edenhofer, Cameron

Hepburn, Ryan Rafaty and Nicolas Stern. 2018. “Making Carbon Pricing Work For

Citizens.” Nature Climate Change 8: 669-77. https://doi.org/10.1038/s41558-018-0201-2.

Landais, Camille, Emmanuel Saez and Gabriel Zucman. 2020. “A Progressive

European Wealth Tax To Fund the European COVID Response.” Article on Vox EU

website. Last updated April 3, 2020. https://voxeu.org/article/progressive-europeanwealth-

tax-fund-european-covid-response.

Marshall, T. H. (1963). Citizenship and social class. Sociology at the Crossroads, 79.

Meade, James E. 1995. Full Employment Regained? (Vol. 61). Cambridge: Cambridge

University Press.

Nolan, Brian and Luis Valenzuela. 2019. “Inequality and its discontents.” Oxford

Review of Economic Policy 35 no. 3: 396-430. https://doi.org/10.1093/oxrep/grz016.

OECD. 2011. Divided We Stand: Why Inequality Keeps Rising. Paris: OECD Publishing.

Paine, Thomas 2000. Paine: Political Writings, edited by Bruce Kuklick. Cambridge:

Cambridge University Press.

Pearce, Oliver. 2019. “Why Taxing Wealth More Effectively Can Help To Reduce

Inequality and Poverty.” Oxfam blog. Last updated August 22, 2019. https://viewsvoices.oxfam.org.uk/2019/08/why-taxing-wealth-more-effectively-can-help-toreduce-inequality-and-poverty.

Piketty, Thomas. 2018. “Capital In the 21st Century.” In Inequality in the 21st Century,

edited by David Grusky and Jasmine Hill, 43-8). New York: Routledge. https://doi.org/10.4324/9780429499821-9.

Saez, Emmanuel and Gabriel Zucman. 2019. “Progressive Wealth Taxation.” Brookings

Papers on Economic Activity, Fall 2019, edited by Janice Eberly and James Stock. https://www.brookings.edu/bpea-articles/progressive-wealth-taxation.

Schwerhoff, Gregor, Thang Dao Nguyen, Ottmar Edenhofer, Gianluca Grimalda,

Michael Jakob, David Klenert and Jan Siegmeier. 2017. “Policy Options For a Socially

Balanced Climate Policy. Economics: The Open-Access, Open-Assessment E-Journal

11 no. 2017-20: 1-11. https://doi.org/10.5018/economics-ejournal.ja.2017-20.

Steiner, Hillel, 1994, An Essay on Rights, Oxford: Wiley-Blackwell.Straubhaar, Thomas.

2018. “Universal Basic Income – New Answer to New Questions for the German

Welfare State in the 21st Century.” CesIfo Forum 19 no. 3: 3-9.

Van Parijs, Phillipe. 1997. Real Freedom For All: What (If Anything) Can Justify

Capitalism? Oxford Political Theory. London: Clarenden Press. https://doi.org/10.1093/0198293577.001.0001.

Van Parijs, Phillipe and Yannick Vanderborght. 2015. “Basic Income In a Globalized

Economy.” In Inclusive Growth, Development and Welfare Policy: A Critical

Assessment, edited by Reza Hasmath, 229-48. New York: Routledge.

Van Parijs, Phillipe and Yannick Vanderborght. 2017. Basic Income: A Radical Proposal

For a Free Society and a Sane Economy. Boston: Harvard University Press. https://doi.org/10.4159/9780674978072.

Van Parijs, Phillipe. In Press. “What Kind of Inequalities Should Economists Address?”

in Rethinking Inequality Policy, edited by Olivier Blanchard, and Dani Rodrik.

Cambridge: MIT Press.

Zakaria, Fareed. 1997. “The Rise of Illiberal Democracy.” Foreign Affairs 76 no. 6: 22-43.

https://doi.org/10.2307/20048274.