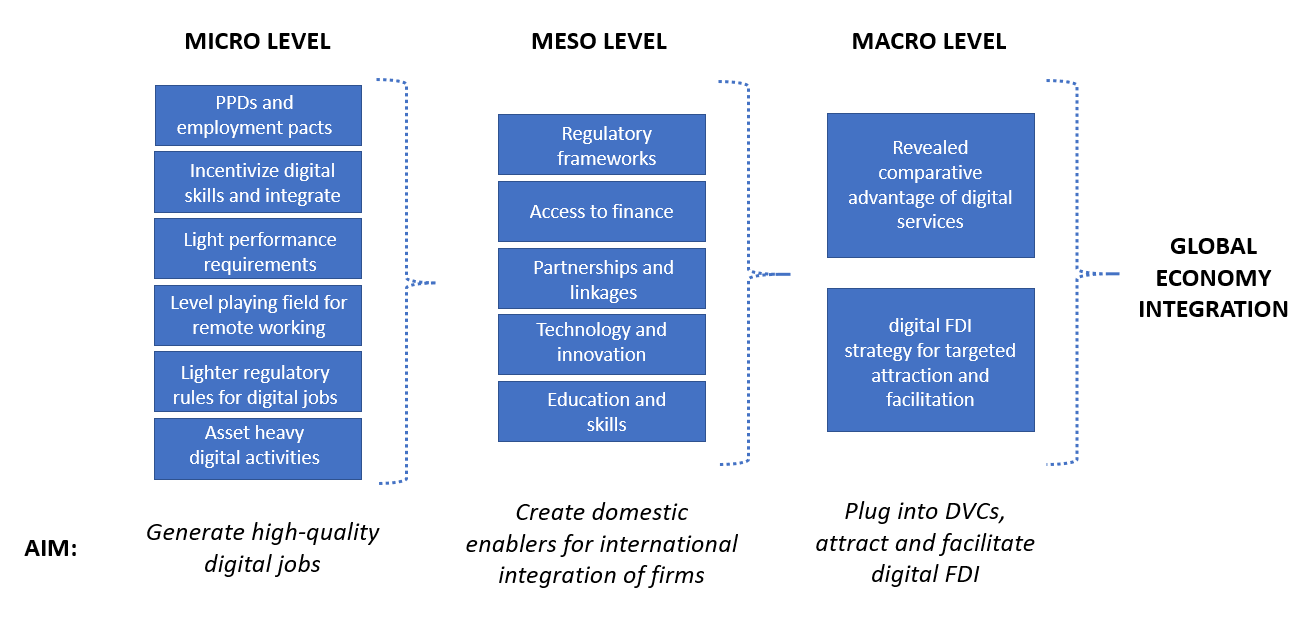

Global value chains (GVCs) are increasingly becoming digital value chains (DVCs) as firms adopt digital solutions to boost efficiency, resiliency, and elasticity of operations. Policy makers want to help firms plug into DVCs to seize new opportunities, not be left behind, and create high-quality jobs. But how? The solution lies in a digital value chain strategy that combines three levels. The macro level focuses on integration into the global economy; the meso on creating a domestic environment to support integration; and the micro on generating quality digital jobs to feed into this domestic environment. This brief suggests specific policy maker actions at each level.

Challenge

As the world struggles to emerge from the COVID-19 pandemic, G20 policy makers face three inter-connected challenges.

First, the rapid acceleration of digitalization as firms seek to grow efficiency, resiliency, and elasticity of operations (CGI, 2021; Dilyard et al., 2021; Nanry et al., 2015; Zhan, 2021a). This creates new opportunities for firms to plug into value chains through digital means; in other words, plug into digital value chains (DVCs). At the same time, rapid digitization risks leaving some firms behind—known as digital laggards—that will be unable to plug into new DVC opportunities or receive cross-border investment in the digital economy, known as digital FDI (Stephenson et al., 2021a). This could potentially exacerbate growing inequality. Rapid digitization also puts pressure on certain professional services jobs that were thought to be immune from outsourcing and automation (Baldwin 2019).

Second, the rapid evolution of new technologies means that technology development is outpacing policy (Sotelo and Fan, 2020). This risks creating domestic business environments that are not oriented to—or supportive of—firms plugging into new DVC opportunities or receiving digital FDI.

Third, providing certain cross-border digital services can be “asset light”, meaning a large capital investment in a foreign market may not be needed, limiting job creation through this channel (UNCTAD 2017). In addition, there is a secondary risk that jobs that are created may be relatively low quality (e.g., food delivery) rather than high quality (e.g., computer engineering).

Figure 1. Three challenges presented by digital value chains

Yet quality employment is key to long-term sustainable development and social stability.

G20 policy makers want to help their firms plug into DVCs to seize new opportunities and not be left behind. But how? And how to do so in an inclusive manner so that all groups stand to benefit, young and old, men and women, skilled and low-skilled, urban and rural? And especially, how to do so in a way that creates quality jobs, the key to sustainable growth and social stability?

Proposal

The solution is for policy makers to adopt an integrated “digital value chain strategy” at the macro, meso, and micro levels.

Figure 2. Three levels of an integrated digital value chain strategy

The macro level focuses on integration into the global economy; the meso level on creating a domestic environment to support such integration; and the micro level on generating quality digital jobs to feed into this domestic environment. At each level, there are specific, concrete actions that policy makers can take.

The policy brief will consider each level in turn.

The macro level: How to identify digital value chain opportunities

At the macro level, policy makers can identify sectors or digital activities where they are relatively competitive, and support their firms to plug into these sectors or activities through digital means; in other words, plug into DVCs.

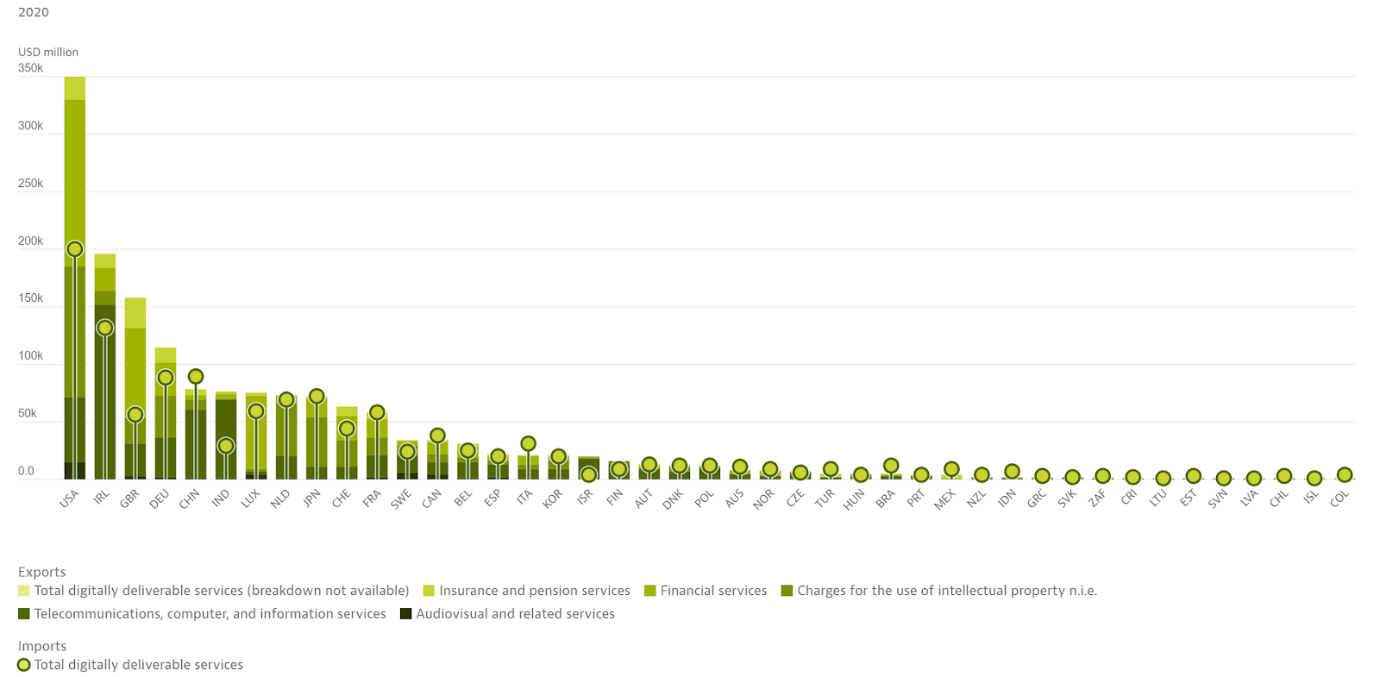

To do so, they can use a revealed comparative advantage approach applied to digital services (Deardorff, 2017; Stephenson, 2021; UNCTAD, 2017; van der Marel, 2020). Policy makers can look at the sectors where their digital services exports as a share of total services exports are relatively high, for instance through using the indicator Digitally-deliverable services as a share of commercial services trade within the OECD’s Going Digital Toolkit (OECD, 2022) (see Figure 3). Policy makers can benchmark their economies against other, comparable economies and see whether they export relatively more digital services as a function of total services exports than comparable economies. Comparability can be based on size, economic production profile, and markets served, among others.

Figure 3. Digitally-deliverable services as a share of commercial services trade

Source: OECD, Going Digital Toolkit (2022)

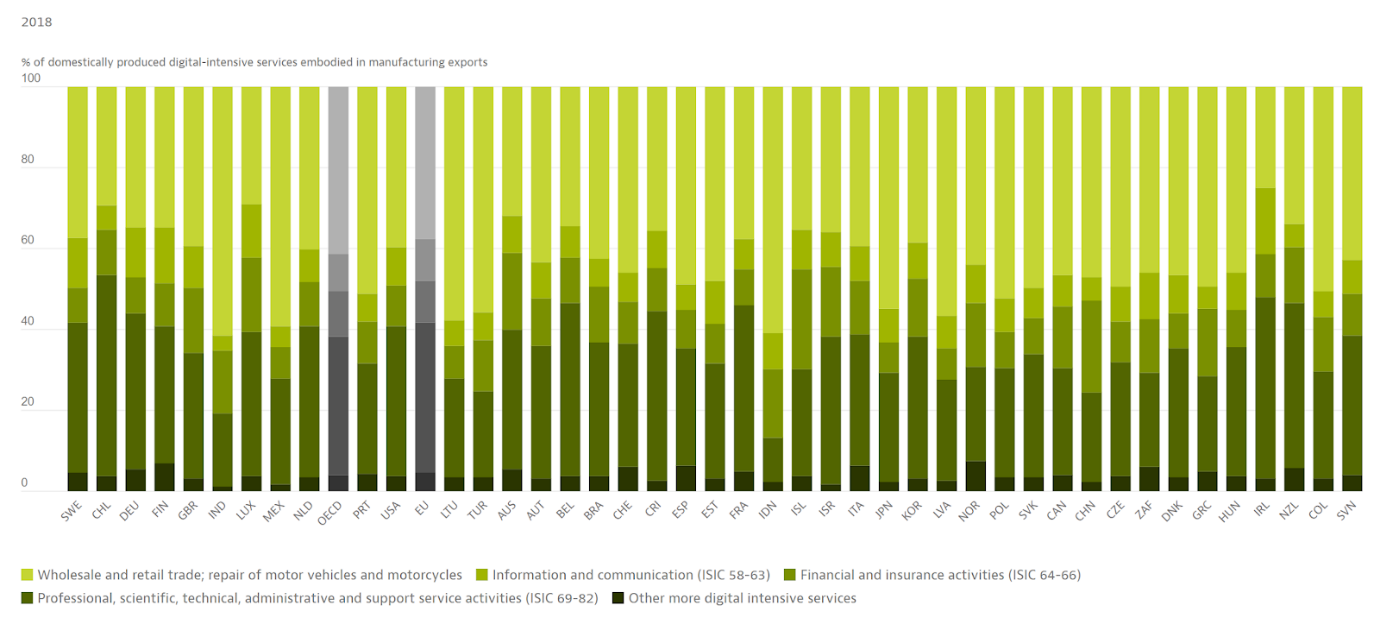

In addition, besides direct service exports, manufactured exports can also have a significant digital services component embodied in these exports. Policymakers can therefore apply the same approach to manufactured exports: identify manufactured exports with a high level of digital intensity in their production; benchmark against comparable economies; and support the production and exports of these manufactured goods. Another indicator can help, the Digital-intensive services value added embodied in manufacturing exports, as a percentage of manufacturing export value, also within the OECD Going Digital Toolkit (see Figure 4).

Figure 4. Digital-intensive services value added embodied in manufacturing exports, as a percentage of manufacturing export value

Source: OECD, Going Digital Toolkit (2022)

At the same time, policy makers can identify digital services where they may wish to grow capacity and competitiveness, and adopt a targeted digital FDI strategy to attract and facilitate FDI into those activities, thus growing capacity both directly and through spillovers (Stephenson, 2020; Stephenson et al., 2021a). While six sectors have been identified as especially important for digital FDI, these kinds of investments can take place in any sector given the increasing importance of digitalization across all activities in an economy (Stephenson et al., 2021).

The meso level: How to support firms to plug into digital value chain opportunities

At the meso level, policy makers can work in five areas to help their firms plug into DVC opportunities and attract digital FDI (Zhan and Meloni, 2021).

Design regulatory frameworks to ensure they support new digital opportunities

The digital landscape is constantly evolving, and it is difficult for policy makers to know exactly the right regulatory choice in every case. However, certain approaches will work better regardless of the specific technology or sector. This includes creating an open, inclusive, non-discriminatory, stable, transparent, and predictable legal and regulatory environment. In addition, the lightest regulatory framework possible, consistent with achieving the intended goals, is preferrable, as is one that sets the overall objectives but does not necessarily prescribe how to reach these objectives, given that there are often many paths to the same destination, including many that may not yet have been discovered. To start, regulatory frameworks developed and rolled out before the growth in the digital economy should be revisited to ensure they do not inadvertently hamper new opportunities through not addressing—or even limiting—new digital activities.

Ensure access to finance

Inadequate access to finance remains a major obstacle for many aspiring entrepreneurs who require a variety of financial services, including accessing credit, equity, and guarantees. However, digital entrepreneurs face additional entry costs. Access to finance to develop and adopt digital solutions should therefore be prioritized.

Foster partnerships and linkages

Partnerships and linkages between foreign and domestic firms are also one of the most effective channels for the latter to access DVCs. In addition, these linkages often generate spillovers in terms of access to know-how, technology, and business processes. Information on foreign digital markets is an important ingredient to foster partnerships and linkages, but so are digital supplier development programs, international regulatory coherence, interoperability of technology, and cross-border data flows. Sustainability reporting by domestic firms will also become increasingly critical as foreign firms seek to operate sustainably cross their (digital) supply chains.

Support technology exchanges and innovation

Policymakers should ensure that regulations promote innovation, rather than hinder the introduction of new digital products and business models. This can take place through encouraging technology development centers and clusters; promoting transition to digital manufacturing through integration of artificial intelligence (AI), internet of things (IoT), big data, blockchain, and broadband connections; and strengthening the links and synergies between technology and applied research.

Promote relevant education and skills

Digital entrepreneurs need specific knowledge and skills that go beyond those of traditional entrepreneurs. There are a number of concrete steps that can be taken to provide domestic firms with training and tools to embrace digital solutions, which will be outlined in more detail below, in discussion of actions at the micro level.

Together, these are five horizontal enablers that can help generate a pipeline of digital trade and investment-ready domestic firms, capable of plugging into DVCs and attracting digital FDI (Zhan and Meloni, 2021). Importantly, policy makers may need to provide additional support to certain groups for them to develop sufficient capacity to plug into DVCs.

The micro level: How to help create quality digital jobs that can be used to plug into digital value chains

At the micro level, policy makers can adopt six specific measures to help increase the number of quality jobs that can plug into DVCs. Having a domestic workforce with the right digital skills is also sure to attract greater digital FDI, as a right-skilled workforce was identified as the most important overall locational determinant for digital FDI when surveying investors (Stephenson, 2020). It also can help address concerns of inequality and how this can partly be addressed through new digital opportunities.

Hold public-private dialogues to identify employers’ digital-skill needs and develop “employment pacts”

Employers are best placed to determine the digital skills needed today and especially tomorrow, given the accelerating speed of technological change. Policy makers should therefore hold regular public-private dialogues to ask employers to identify the digital skills they need. Significantly, “employment pacts” can link these public-private efforts, thereby making them both more credible and more effective. Employment pacts are agreements whereby employers guarantee to provide a job if a worker acquires the requisite digital skills through certification or training. Together, this would help address the information asymmetry-based market failure between digital skills being imparted and digital skills needed to succeed in the workforce.

Incentivize digital skills and support their integration into training and curricula

The digital skills identified then need to be integrated into training and curricula, both within educational institutions and within firms, and they should especially be incentivized in corporate training. For instance, 100 percent of expenditures on training could be deducted from corporate taxes, especially training that is portable to other firms (as opposed to company-specific), thereby creating value for society and the economy beyond the firm. Broad development of digital skills is one tool that can help combat inequality, as it makes new digital opportunities realizable across society, and therefore it is in the interest of society to incentivize digital skills’ rapid and broad provision.

Adopt “light” performance requirements to support digital skills

Another way to encourage growth of digital skills is through “light” performance requirements. In other words, training a small percentage of employees in digital skills is made a condition of entry and establishment—or continued operation—by a foreign firm in the host economy (Buzdugan and Tuselmann, 2018; Cherif and Hasanov, 2019; Moran, 2015). Performance requirements are often considered ineffective because a firm would rather not enter the market than be forced to hire (or train) unqualified or low-skilled employees. However, making performance requirements “light”—in that only a small percentage of the total firm labor force is required to be trained—is not likely to dissuade investment, while it can import and impart these skills as a demonstration effect, thereby gradually being absorbed across the firm and through spillovers into the rest of the economy. In contrast, a “heavy” approach, for instance requiring all employees to receive significant digital training as condition of market entry, is likely to prove counterproductive.

Ensure a level playing field between remote and office-based employment when providing commensurate work

One of the realizations from the experience of COVID-19 is that many jobs can be done—in whole or in part—remotely. This opens up a whole new gamut of digital activities, as people provide digital services or goods through digital transactions remotely. However, the workplace—both norms and codes—may not support remote digital activities in the same way as in-person, physical activities. As a result, there should be a stocktaking to ensure that there is a level playing between remote and office-based professional activities, when the outputs are commensurate. This can create a large new potential labour pool—those who might not have joined (full or part time) the labour force but now do through working remotely—which can help the economy plug into DVCs.

Consider lighter regulatory rules for jobs in digital activities

The digital economy is changing rapidly, and it is hard to know what are the best regulations, both to protect people and not to stifle growth and innovation. For these reasons, it may be warranted—in the short term—to provide lighter regulatory rules for jobs in digital activities. The rationale is to help these jobs grow, provide a solid base of evidence as to what regulatory systems may be needed, and only then adopt these regulations. A parallel can be drawn between this approach and regulatory sandboxes, which create a space to trial new approaches before regulatory rules are determined, or, similarly, special economic zones, which create a parallel regulatory framework to help grow certain industries, with an expectation that regulations will adapt and follow once they are needed.

Focus on growing digital activities that are relatively asset heavy rather than asset lite

Finally, different types of digital activities have different job intensities. In other words, for a given level of investment, some digital activities produce a low number of jobs, a mid-level number of jobs, and relatively high-level number of jobs. One way to proxy this can be the asset intensity of investments into digital activities, ranging from asset heavy to asset light (UNCTAD 2017). In other words, do these activities require a significant capital expenditure or not. If the aim is to generate digital jobs, policies can focus on promoting and facilitating investment into asset-heavy activities, when it is not possible to directly determine whether a digital activity will be job-intensive or not.

Conclusion

All policy makers want to help their firms plug into new DVC opportunities, and especially create high-quality jobs in the digital economy. This policy brief has argued that to do so, policy makers can adopt an integrated “digital value chain strategy” at the macro, meso, and micro levels.

The macro level looks outward and seeks to help integrate a country into the global economy; the meso level looks inward and seeks to create domestic conditions that will help with such integration; and the micro level considers specific measures that are needed to boost the job intensity and skills in the digital economy.

Critically, each of these three levels needs to feed into the next: the creation of quality jobs with the right digital skills can supply the workforce for a competitive domestic business environment; and a competitive domestic business environment creates the capacity for firms to plug into international digital trade opportunities and also attract digital FDI.

The contribution of the policy brief has been to outline very practical actions and measures that G20 policy makers can consider adopting at each of the three levels, thereby providing a pragmatic, operational menu of options.

At the macro level, policy makers can use revealed comparative advantage applied to digital services and digital-intensive services in manufacturing, as well as a digital FDI attraction and facilitation strategy (Stephenson 2020; Stephenson et al., 2021a). At the meso level, they can use five horizontal elements to create a competitive domestic business environment. At the micro level, they can use six specific measures to boost the job creation and job intensity of digital trade and investment.

The G20 is the right forum to help grow inclusive DVCs for both economic and political reasons.

Economically, many firms from G20 economies have either the capacity or the potential to integrate DVCs. Such integration can then generate economic growth that will benefit both G20 economies directly and non-G20 economies through secondary effects.

Politically, technology-driven growth has become a significant source of tension between G20 economies, generating growing techno-national competition. This is leading to increased export controls and investment screening, both inward and outward (Evenett and Fritz, 2021). Yet technology holds the potential to help achieve the Sustainable Development Goals (SDGs) (Stephenson et al., 2021b).

As a result, developing and implementing a transparent agenda on integrating DVCs and attracting digital FDI can both keep open—and help expand—these channels for sustainable, inclusive, job-generating growth.

References

Alalawneh, Mustafa, and Azizun Nessa. “The Impact of Foreign Direct Investment on Unemployment: Panel Data Approach.” (2020). http://webmail.khazar.org/handle/20.500.12323/4792

Baldwin, Richard. The globotics upheaval: Globalization, robotics, and the future of work. Oxford University Press, 2019. https://global.oup.com/ushe/product/the-globotics-upheaval-9780197518618

Bernard, Bjorn, “How elasticity leads to excellence in supply chain execution”, 20 April 2021, EY, https://www.ey.com/en_gl/alliances/how-elasticity-leads-to-excellence-in-supply-chain-execution

Buzdugan, S., and Heinz Tuselmann. «Making the Most of FDI for Development: ‘New’ Industrial Policy and FDI Deepening for Industrial Upgrading.” Transnational Corporations 25, no. 1 (2018): 1-21. https://e-space.mmu.ac.uk/620266/

CGI, “Getting unstuck: Accelerating results from digital transformation”, 2021, https://www.us.cgi.com/hubfs/US%20-%20DVC%20-%20Campaign%20-%20Q4FY21/CGI_Viewpoint_Digital%20Value%20Chain.pdf

Cherif, Reda, and Fuad Hasanov. The return of the policy that shall not be named: Principles of industrial policy. International Monetary Fund, 2019. https://www.imf.org/-/media/Files/Publications/WP/2019/WPIEA2019074.ashx

Deardorff, Alan V. “5 Comparative advantage in digital trade.” In Simon J. Evenett (ed.) Cloth for wine? The relevance of Ricardo’s comparative advantage in the 21st century. CEPR Press, 2017. https://www.alexandria.unisg.ch/253123/1/’Cloth_for_Wine.pdf’.pdf#page=44

Dilyard, John, Shasha Zhao, and Jacqueline Jing You. “Digital innovation and Industry 4.0 for global value chain resilience: Lessons learned and ways forward.” Thunderbird International Business Review 63, no. 5 (2021): 577-584. https://onlinelibrary.wiley.com/doi/abs/10.1002/tie.22229

Estrin, Saul. “Foreign direct investment and employment in transition economies.” IZA World of Labor (2017), https://wol.iza.org/uploads/articles/330/pdfs/foreign-direct-investment-and-employment-in-transition-economies.pdf?v=1

Evenett, Simon J. and Johannes Fritz. “Advancing Sustainable Development with FDI Why Policy Must Be Reset”, June 2021, The 27th Global Trade Alert Report. https://www.globaltradealert.org/reports/75

Landesmann, Michael A., and Roman Stöllinger. “Structural change, trade and global production networks: An ‘appropriate industrial policy’for peripheral and catching-up economies.” Structural Change and Economic Dynamics 48 (2019): 7-23. https://www.sciencedirect.com/science/article/abs/pii/S0954349X17302382?via%3Dihub

Lehnert, Kevin, Mamoun Benmamoun, and Hongxin Zhao. “FDI inflow and human development: analysis of FDI’s impact on host countries’ social welfare and infrastructure.” Thunderbird International Business Review 55, no. 3 (2013): 285-298. https://onlinelibrary.wiley.com/doi/epdf/10.1002/tie.21544

Mayer, Jörg. “Development strategies for middle‐income countries in a digital world—Insights from modern trade economics.” The World Economy 44, no. 9 (2021): 2515-2546. https://onlinelibrary.wiley.com/doi/abs/10.1111/twec.13158

Mkombe, Dadirai, Adane Hirpa Tufa, Arega D. Alene, Julius Manda, Shiferaw Feleke, Tahirou Abdoulaye, and Victor Manyong. “The effects of foreign direct investment on youth unemployment in the Southern African Development Community.” Development Southern Africa 38, no. 6 (2021): 863-878. https://www.tandfonline.com/doi/full/10.1080/0376835X.2020.1796598

Moran, Theodore. 2015. “The Role of Industrial Policy as a Development Tool: New Evidence from the Globalization of Trade-and-Investment.” CGD Policy Paper 071. Washington DC: Center for Global Development. http://www.cgdev.org/publication/role-industrial-policy-development-tool-new-evidenceglobalization-trade-and-investment

Nanry, John, Subu Narayanan, and Louis Rassey. “Digitizing the value chain.” McKinsey Quarterly 3, no. 1, 2015. https://www.mckinsey.com.br/~/media/McKinsey/Business%20Functions/Operations/Our%20Insights/Digitizing%20the%20value%20chain/Digitizing%20the%20value%20chain.pdf

Oliveira, Luis, Afonso Fleury, and Maria Tereza Fleury. “Digital power: Value chain upgrading in an age of digitization.” International Business Review (2021): 101850. https://www.sciencedirect.com/science/article/abs/pii/S0969593121000573

Organisation for Economic Co-operation and Development (OECD). “Doing Digital Toolkit”, 2022,

https://goingdigital.oecd.org/, Accessed 16 April 2022.

Organisation for Economic Co-operation and Development (OECD). “How Good is Your Job? Measuring and Assessing Job Quality”, February 2016, https://www.oecd.org/sdd/labour-stats/Job-quality-OECD.pdf

Sotelo J. and Z. Fan, “Mapping TradeTech: Trade in the Fourth Industrial Revolution”, World Economic Forum, December 2020 http://www3.weforum.org/docs/WEF_ Mapping_TradeTech_2020.pdf

Stephenson, Matthew. “Digital FDI: Policies, Regulations and Measures to Attract FDI in the Digital Economy.” World Economic Forum White Paper, September 2020. https://www3.weforum.org/docs/WEF_Digital_FDI_2020.pdf

Stephenson, Matthew. “The OFDI policy path and the product space,” Columbia FDI Perspectives No. 311, August 9, 2021, https://ccsi.columbia.edu/sites/default/files/content/docs/fdi%20perspectives/No%20311%20-%20Stephenson%20-%20FINAL.pdf

Stephenson, Matthew, Lorraine Eden, Michael Kende, Fukunari Kimura, Karl P. Sauvant, Niraja Srinivasan, Lucia Tajoli, and James Zhan, “Leveraging Digital FDI for Capacity and Competitiveness: How to be SMART”, T20 policy brief, September 2021a, https://www.t20italy.org/2021/09/08/leveraging-digital-fdi-for-capacity-and-competitiveness-how-to-be-smart/

Stephenson, Matthew, Iza Lejarraga, Kira Matus, Yacob Mulugetta, Masaru Yarime, and James Zhan,

“SusTech Solutions: Enabling New Technologies to Drive Sustainable Development”, September 2021b

UNCTAD (United Nations Conference on Trade and Development) (2017). World investment report 2017: investment and the digital economy. https://investmentpolicy.unctad.org/publications/174/world-investment-report-2017—investment-andthe-digital-economy

van der Marel, Erik, Sources of comparative advantage in data-related services, EUI RSCAS, 2020/30, Global Governance Programme-393, [Global Economics]

Retrieved from Cadmus, European University Institute Research Repository, 2020,

https://cadmus.eui.eu/bitstream/handle/1814/66987/RSCAS%202020_30.pdf?sequence=1&isAllowed=y

World Bank Group (2016). World development report 2016: digital dividends. World Bank Publications. https://www.worldbank.org/en/publication/wdr2016

Zhan, James. “GVC transformation and a new investment landscape in the 2020s: driving forces, directions, and a forward-looking research and policy agenda.” Journal of International Business Policy 4 (2021a), 206–220. https://link.springer.com/article/10.1057/s42214-020-00088-0

Zhan, James and Massimo Meloni, “Born Green via Digital: Increasing MSMEs’ Competitiveness and Sustainability”, UNCTAD, 2021.