The collapse of supply chains and the dramatic shift in aggregate demand due to COVID-19 increased the significance of the strategic resilience of infrastructures as well as the importance of their being agile and flexible in order to address local-specific needs, especially during times of distress. Most importantly, it indicated that an infrastructure is not a remote enabler of economic activities but an integral part of the vital value chains of businesses and households, and thus immediately linked with the welfare of the citizens. Shifting the proximity of infrastructures closer to the value chain of businesses and households opens a window of opportunity to explore how digital technology tools can create significant improvements in the decision-making, financing and governance/agency efficiency of infrastructure projects. This policy paper identifies the challenges and opportunities of these three areas by introducing the concept of “digitally enhanced infrastructures”, reflects on the promise and organisational challenges associated with these infrastructures, briefly explores the ways in which they can neutralise the acute policy effects of the dichotomy between developed and developing regions, and provides practical recommendations to improve the existing infrastructures regime.

Challenge

A general observation is that operating units with an existing digital layer in their value chains and business models were more efficient in absorbing the supply chain and demand shocks of the COVID-19 distress. The subsequent acceleration of digitally enabled operational solutions not only imposes a significant challenge in the operation of existing infrastructures (usually identified as the need to add a digital layer to existing “bricks and mortar” facilities), it also opens a wide window of opportunity in: (1) improving decision-making processes around the location, size, tailor-made idiosyncratic characteristics and usage of infrastructures, by leveraging data pooling and analytics capabilities, (2) lifting financial frictions in the aggregation and allocation of capital using investment platforms, crowd-funding platforms and FinTech enabling solutions and (3) improving the efficiency of governance structures including contracting, monitoring and coordination/agency mechanisms. The challenge can be addressed in the three lines of engagement outlined above by following a “technology neutral” approach but it is by no means “governance neutral”. Requirements of privacy, social inclusion, accountability and transparency require optimal organisational structures with checks and balances that blend the potential of both public-sector and private stakeholders.

Proposal

THE BIG PICTURE

The impact of the COVID-19 pandemic on usage patterns of various types of infrastructure, as well as the accelerating adoption of digital technologies across industries, challenged established perceptions of the proximity of infrastructures to the value chains of industries, businesses, and households. This topological shift compels us to reassess the value of infrastructures in the economy from mere “enablers” and “facilitators” that exist somewhere “out there” to an organic element that affects economic efficiency at an arm’s-length distance. Infrastructures are no longer just “bricks and mortar” projects. First, they are living organisations that merge with our day-to-day operations in an interactive manner that disrupts their legacy value proposition. Second, the value of an infrastructure does not derive merely from its efficiency in isolation, but from its blending with other infrastructures in the value chain and in the development process, including inter alia supply chains and the healthcare, financial and educational systems. In a new situation, the infrastructure transforms into a platform on which existing services are digitally updated and new ones are created. This enables a wide range of network effects to drive new business models and platform strategies for creating and distributing value (OECD, 2018).

We believe that the infrastructures of Industry 4.0 should reflect the nature of the economic and social challenges of Industry 4.0, as well as expectations of it. What distinguishes the infrastructures of the current industrial era from the previous one is the transition from a mentality that infrastructures reflect massive needs that are more or less homogeneous to a mentality of customisation. The concept of customisation is not limited to the logic of glocalisation of best practices but also reflects new opportunities created by information technologies to identify the needs of users on the personal or small community level. From a political economy point of view, digital technologies provide an excellent opportunity to refocus on tailor-made solutions that advance the role of communities as the end-users of infrastructure networks (United Nations, 2019).

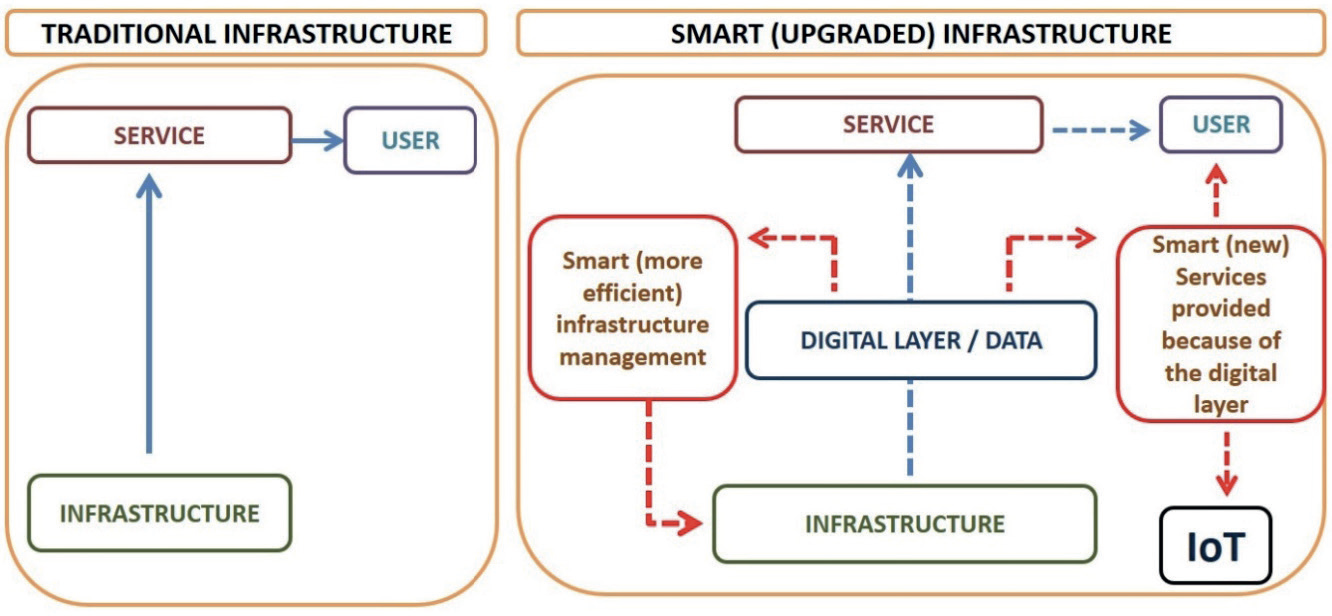

Figure 1: The idea of smart/exponential infrastructure

The digital layer approach that we propose for G20 is instrumental, not merely in improving the services that existing physical and social infrastructures provide, but also in augmenting their linkages with other infrastructure systems in dense and smart networks. Elements of data analytics, data storage, enhanced connectivity, augmented reality, machine learning, hyper-performance computing and distributed ledgers transform the infrastructure stack by enabling the digital layer to improve the coordination and density of supply and value chains. This reduces networking costs, transaction costs, replication costs, transportation costs, tracking costs and verification costs. It is worth noting that taking transaction-related costs as the basis of infrastructure analysis means that we do not need significantly different economic models compared to previous industrial eras we need only a wider approach.

BUILDING “THE INFRASTRUCTURE” FOR SMART INFRASTRUCTURES

Though the economic logic is not sharply different, the transition from Industry 3.0 to Industry 4.0 infrastructures requires a new enabling basis that will streamline the process from inception to implementation. Institutional certainty (endorsement by stakeholders) and legal certainty (endorsement by the regulatory environment) are sine qua non requirements. They are necessary conditions for a frictionless transition to the new paradigm of infrastructure development, but, we believe, they are by no means sufficient. We need a new infrastructure for infrastructures.

Infrastructures of the previous industrial eras reflected, from a methodological point of view, an understanding that value chains were comparatively stable, just like the economic equilibria. The winner was determined by achieving the appropriate economies of scope and scale. Because the moving averages were slow, the value fluctuation of infrastructures was relatively inactive (accounting depreciation rules aside). The challenge was to identify the project with the greatest impact (often determined in terms of actual size) and to identify the appropriate financial structure to fund its implementation. Moving averages now shift exponentially rather than linearly. Agility is more important than size, transient strategic advantage is a more appropriate business target than the creation of stable competitive advantage, and NPV (Net present value) and IRR (Internal rate of return) calculations of financial value provide unreliable metrics, thus real options valuation methods are preferred. In this environment, even the selection of a project in the first place is a challenging task. This helps to explain why, in areas where there is an abundance of capital and a real need for infrastructure projects, the demand side is very thin.

In an environment like this, the selection of an agile, future-proof, strategy-relevant, value-enhancing, community-reinforcing, network-oriented infrastructure project requires a different decision-making mechanism and a technologically relevant information, governance and financing infrastructure in place to support this mechanism all the way on. We suggest three major facilitating improvements:

Data infrastructures that will inform the decision-making process

Data analytics emerges as a crucial component for decision making. The abundance of data generation allows us to improve the precision of economic planning at a level of granularity that is unprecedented. Predictive and, most importantly, prescriptive analytics can inform the path of infrastructure decision makers, reduce uncertainty, increase the predictability of future cash flows and spot shifts in usage in real time. Most importantly, they can determine (1) the magnitude of the infrastructure needed in a region, (2) the auxiliary infrastructures in the grid and (3) the specificities required to maximise the value of the project for the local communities, taking into consideration the idiosyncratic characteristics of the regional environments. The authors believe that uncertainty management along with idiosyncratic specifications recognition is a crucial first step for any future infrastructure project undertaking. Similarly, data pooling and analytics is a critical facilitator for the acceleration of vital infrastructure in both developed and developing regions.

Data management, however, itself requires a trusted infrastructure. Cloud computing, along with more localised solutions like edge computing, is a necessary infrastructure for the collection of infrastructure data. It is important, though, to make sure that these data concentrations are considered as data for the public good. This leads us to state a preference for dedicated organisational entities comprising both publicand private-sector stakeholders that will be accountable for the integrity, security, use and re-use of data in a way that respects the privacy of the data generators and ensures the inclusion and sustainability of the communities. The data pooling, as well as their use, will be part of the value chain of infrastructure project building, running and aiming for constant improvements both of the operational efficiency of the projects and the maximisation of the end-user experience. Other types of risks will be identified and managed as part of an integrated approach to data management (such as strategic, operational, compliance, cyber). These data will not be used for monetisation by anybody without the consent of the generators.

Crowd-funding and investment platforms for infrastructure project acceleration

As mentioned earlier, financial metrics in a rapidly changing financial environment and value chains require dynamic rather than static methods of valuation. This can be achieved with real options valuation methods and financial instruments for capital accumulation and risk sharing that improve liquidity, accelerate the accumulation of capital and improve the agility in the capital structure balance of equity and debt. Digital finance solutions can play an instrumental role in this direction. The tokenisation of value, the simplicity of issuing and trading infrastructure securities (both equity-like and bond-like) and RegTech solutions that can allow the supervisory authorities to monitor the transactions through embedded supervision mechanisms open up new horizons of opportunities (Solms, 2020; Chenqi Mou, 2021).

Crowd-funding platforms are expected to play a significant role in a FinTech-empowered era of financial intermediation that infrastructure developers and local communities cannot ignore. Aggregation of capital for specific projects, even in the most remote and disadvantaged areas, can be easily designed and implemented by crowd-funding platforms (Oneplanetcrowd, Convergence Finance, Citizenergy, etc.), reaching audiences and pools of capital available for development infrastructures (Nika Pranata, 2020). This neutralises the impediment facing certain communities to generate crowd-funding if they lack the necessary crowd. Despite the wider perception that FinTech and blockchain-based finance will

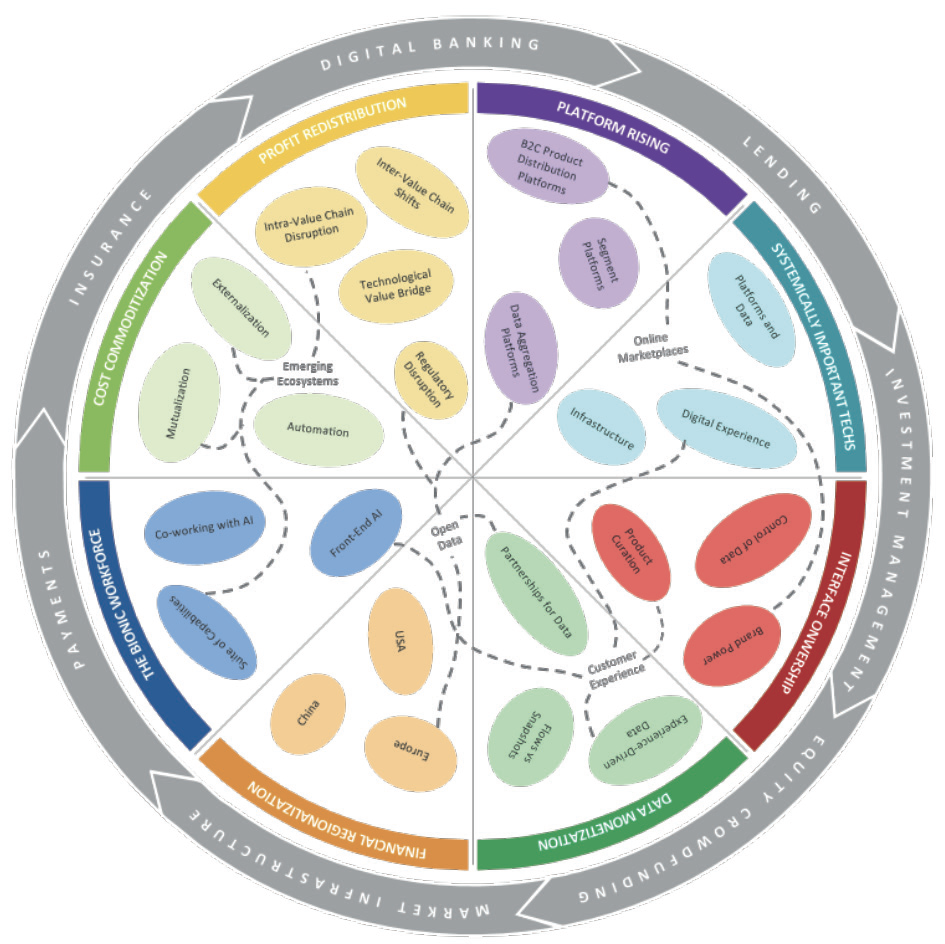

Fig. 2: Beyond FinTech: A pragmatic assessment of disruptive potential in financial services (World Economic Forum, 2017)

bring us to an era of financial disintermediation, we believe that recent technological developments will instead create a new era of financial intermediation, much more favourable for strategic and infrastructure projects. Mainstreaming unbanked populations into the formal banking sector and enabling cost-effective access to essential financial services using mobile banking platforms in developing countries are both commendable. We also believe that FinTech tools will improve the operational efficiency of development banks as well as the coordination of these banks with other financial intermediaries and stakeholders (PwC, 2016).

Investment platforms are another strategic tool that strategic project developers and local communities can leverage in creating robust infrastructure networks. One of the major impediments to the demand side, both in developing and developed regions, was that many projects, despite their major economic and social significance, fell below the investment thresholds of many development and reconstruction banks. The EU, in its EFSI and InvestEU Programmes, has developed the investment platforms instrument to solve the problem of low thresholds by aggregating two or more regional or thematic smaller infrastructure projects under one “umbrella” (Maria João Ribeirinho, 2020). This allowed streamlining, simplification and cost efficiency for project initiation. We believe that the design of special purpose vehicles like investment platforms along with crowd-funding and FinTech tools can create a new era of agile public-private partnerships (PPPs) much more relevant to the requirements of the infrastructures of Industry 4.0 and a significant facilitator for cross-border projects, as this scheme bypasses significant impediments in current design and implementation practices. Moreover, financing smart digital infrastructure through smarter ways of local resource mobilisation could also unleash new sources of funding and enhance marketability of innovative financing instruments. This includes novel ways of revenue generation such as the idea of the Non-Fare Revenue Box of urban metro rail systems (e.g., the Delhi Metro), which typically include commercial use of land in the station and converting railway stations as multi-purpose activity centres including shopping malls. Likewise, by adopting the land value capture (LVC) method, underdeveloped (or under-used) land around urban infrastructure such as roads, bridges and highways can be leveraged for additional resource generation. Municipal bonds, often packaged as social impact bonds and/or blended finance products, can be effectively integrated into local digital layer creation. The presence of a digital model of the infrastructure complex (such as digital twins) can improve the effectiveness and prevalence of using the LVC method.

Again, similarly to the case of data infrastructures mentioned above, a major issue to be resolved is the governance and ownership structure of these platforms. In the case of investment platforms, the governance and accountability setting is straightforward as it replicates traditional synergetic functions. But in the case of crowd-funding platforms a regulatory environment that ensures investor protection, capital channelling processes and anti-money laundering requirements is of paramount importance, especially due to the cross-border nature of these platforms (Gasparro, 2015). The authors believe that infrastructure-dedicated crowd-funding platforms are necessary to augment the financing operations of development banks, commercial banks, qualified private investors and also private individuals who want to fund a project that inspires them in the regions they care about most.

Coordination and agency mechanisms for infrastructures

The leveraging of data-empowered decision-making instruments and innovative financing tools requires also a technologically relevant approach in the facilitation of coordination between the stakeholders as well as the reduction of the possibility of market failures due to agency problems. Digital tools enable the removal of inefficiencies occurring in contracting, monitoring and verification costs and incentives alignment. We find that an innovative approach in accelerating the development of enhanced infrastructure projects requires us to reconsider legacy models of PPPs.

One of our major beliefs is that, while we realise the disruptive force of the enhanced infrastructures, we do not believe that a fundamentally new economics is needed to address the challenge. We only need to think, “What is new?” As new financing tools can improve the channelling of capital and the capital structures, so can digitally enhanced agency and contracting models such as PPPs that employ smart contracts, Ricardian contracts and oracle technological solutions improve transparency, integrity and efficiency through the automation of verification procedures and reduction of monitoring and tracking costs (Savian, 2020). This requires an enabling regulatory framework that will encourage innovative design of PPPs in the spirit of “technological neutrality” that is already employed in other areas of economic activity (ElGohary, 2020).

ROBUST ECONOMICS FOR SMART INFRASTRUCTURES

Our approach to digitally enhanced infrastructures brings us into an emerging field of infrastructure economics where the main question is how exponential technologies can transform the major models of supply, demand, financing and coordination/agency of infrastructure projects and affect decision making, preferences and incentives in the interaction of communities, investors and governments (McKinsey, 2018).

By shifting the interest of architectural design of infrastructures from a model and mindset that advances the significance of location (centralisation approach) to a model that advances the significance of the network and the proximity of the infrastructure to the value chain of industries, firms and households (decentralisation approach), we bypass longstanding obstacles to infrastructure project implementation, such as: (1) the problem of boosting effective demand, (2) the problem of mobilising adequate funding, (3) the problem of linking cross-border projects, (4) the problem of achieving transparent coordination and (5) most importantly, we make significant steps in neutralising the dichotomy of infrastructure building in developing and developed economies or regions.

The last point is critical. Our team comprises a diverse group of people from Africa, Asia and Europe, and a major challenge we spotted from the beginning was the extent to which the approach of digitally enhanced infrastructures neutralises the effects of the persistent dichotomy between developed and developing countries/regions in developing and enhancing access to infrastructure services, and makes infrastructure an opportunity for convergence of technological standards, regulations, engineering manuals and ex-post engagement procedures that ensure compatibility, interoperability and seamless interlinking of supply and value chains. These issues, alongside the homogenisation of financing operations, PPP design and data management procedures, are strategic in shifting the supply curve.

However, supply-side instruments are not enough in reaching a desirable equilibrium. Demand-side instruments are equally important. There are two challenges associated with the demand side. First is the requirement for remote communities to have a clear understanding of the technological options of new types of infrastructures. Demand for digitally enhanced infrastructures requires operational understanding of the new value proposition and digital literacy that can be locally developed through a coordination of business, government and educational institutions. Second, we face the challenge of accelerating the transition from notional to effective demand. Wherever we have a strong understanding of the need for enhanced infrastructures, we do not have adequate willingness to pay for them. The solution to this problem can be a coordinated action that blends innovative financing instruments, as described above, with clear strategies that prioritise the development of enhanced infrastructures as short/mid-term targets rather than long-term plans.

WHAT COMES NEXT: THREE POLICY RECOMMENDATIONS

Following our analysis, we advocate for the formation of a dedicated interdisciplinary team within the G20, with support from multilateral development institutions (GIH, World Bank, OECD, etc.) to coordinate efforts and reflect a digital dimension in the Quality Infrastructure

Investment framework. We propose the following policy recommendation as concrete and immediate steps to capitalise on the technological opportunities provided by digital instruments as well as the momentum generated by the pandemic:

1) The design of a governance framework that will enable and accelerate the implementation of organisational entities comprising accountable public and private stakeholders for the development of data pooling and data analytics infrastructures that will improve the decision-making process in infrastructure development from the inception to implementation.

2) The articulation of governance, ownership, operational and regulatory requirements for the creation and management of crowd-funding and investment platforms, leveraging FinTech and RegTech instruments, as well as their blending with existing development banks and other financial intermediaries to support the capital aggregation procedure for infrastructure projects irrespective of their location and size.

3) The adoption of an approach of “technological neutrality” in the design of coordination and agency mechanisms among infrastructure stakeholders in an attempt to leverage the upscale of digital technology instruments in improving the operational and cost efficiency of trusted governance, contracting, monitoring and verification mechanisms.

REFERENCES

Chenqi Mou, W.-T. T. (2021), Game-Theoretic Analysis on CBDC Adoption

ElGohary, A. M. (2020), “Public-Private Partnerships (PPPs) in Smart Infrastructure Projects: The Role of Stakeholders”, in HBRC Journal, Vol. 16, No. 1, pp. 317-333

Gasparro, K. (2015), Funding Municipal Infrastructure: Integrating Project Finance and Crowdfunding

Maria João Ribeirinho, J. M. (2020), The Next Normal in Construction, McKinsey

McKinsey (2018), Future-Proofing Infrastructure in a Fast-Changing World

Nika Pranata, N. F. (2020). Crowdfunding for Infrastructure Project Financing: Lesson Learned for Asian Countries

OECD (2018), “Digitalisation, Business Models and Value Creation”, in Tax Chal lenges Arising from Digitalisation – Interim Report 2018: Inclusive Framework on BEPS, Paris, OECD Publishing

PwC (2016), Financial Services Technology 2020 and Beyond: Embracing Disruption

Savian, C. (2020), “Do We Need Blockchain in Construction?”, in AEC Business, 29 April, https://aec-business.com/do-weneed-blockchain-in-construction/

Solms, J. v. (2020), “Integrating Regulatory Technology (RegTech) into the Digital Transformation of a Bank Treasury”, in Journal of Banking Regulation, Vol. 22, pp. 152-168

United Nations (2019), Digital Economy Report Value Creation and Capture: Implications for Developing Countries