In recent years, the challenge of industrial subsidies distorting global trade has moved to the forefront of international trade debates, including G20 discussions of World Trade Organization (WTO) reform. It is implicitly assumed that subsidies benefit the domestic economy of the subsidizing country and harm foreign competitors by tilting the playing field in the subsidizer’s favour (Draper et al., 2020).

This perspective neglects an important domestic property of industrial subsidies: they are discriminatory not only between domestic and foreign companies but also within the domestic economy. Some companies are subsidized, while others are not but pay taxes that finance the subsidies for others. While some subsidies may prove to be welfare-enhancing, for example pharmaceutical research into COVID-19 vaccines, distortions may arise some companies gain, others lose, even in the same industry.

This policy brief first outlines the potential effects of domestic subsidies on domestic welfare through an overview of the empirical evidence, thereby providing a clearer picture of the domestic net welfare effects of industrial subsidies in G20 countries. Such evidence will broaden G20 members’ perspectives by showing that in subsidizing domestic companies, they mostly support special interests rather than increasing domestic welfare. We then propose that G20 members use this evidence as grounds for establishing a framework for smart monitoring of subsidies to enable members to distinguish between overall welfare-enhancing and welfare-distortive subsidies. This monitoring framework can be used to reduce international conflicts that typically arise when domestic subsidies drive changes in international market share in favour of the subsidized domestic firms, or when they result in global excess capacity.

Challenge

Industrial subsidies have become a major tool of economic policy-making, leading in some cases to potentially destructive ‘races to the bottom’ and negative international economic spillovers. Currently, international frameworks for containing and managing these spillovers are partial and imperfect. The challenge is to convince the largest subsidizers to properly evaluate the harmful effects that subsidies can have on their own economies and thereby incentivize them to cooperate internationally to reduce harmful subsidies.

Much empirical work indicates that industrial subsidies distort welfare and provide little consistent benefit to the domestic economy. The argument is straightforward: subsidies distort relative prices and, therefore, the allocation of factors, goods and services.1 They also are typically granted to companies and sectors that are politically well connected, often the losers from structural change that have lower opportunity costs of lobbying than successful companies. This argument is often neglected, and the policies that are then applied cause international conflicts.

Studies by Bernini and Pellegrini (2011) and Criscuolo et al. (2019) find that subsidies to firms in economically disadvantaged regions increase employment and investment, but they find no effect on total factor productivity. Studying Korea’s Heavy and Chemical Industry Push (1973-1979) with new empirical tools, Lane (2020) finds that the targeted sectors experienced strong expansion and generated lower output prices. This benefitted downstream domestic industries that profited from the lower prices. However, domestic upstream industries shrank through increasing import competition that was part of the policy. Barwick et al. (2019) evaluate the welfare effect of China’s shipbuilding policy (2005-2015).2 They find that overall, the welfare effect is negligible and that welfare distortions occurred.3

Whereas in the textbook case of vertical industrial subsidies governments can identify sectors that would benefit the most from production subsidies, in practice governments often do not have the knowledge or capacity to “pick the winners”. For example, Baldwin and Robert-Nicoud (2007) demonstrate that governments tend to pick inefficient industries (sunset industries) as opposed to sunrise industries, as sectors that are unprofitable stand to gain from lobbying. In sum, subsidies that do not address positive externalities have the potential to distort allocation and reduce overall domestic economic welfare.

While empirical papers find mixed effects of subsidies on the domestic economy without clear evidence that domestic welfare is enhanced, there are two central objections to subsidies based on epistemological considerations and political economy. First, governments face the inescapable epistemological fact that the future is uncertain, thus they cannot be sure which industries or firms to support to increase efficiency. While private investors face the same problem, their incentives are more directly motivated and disciplined by market outcomes, and the risks to domestic welfare of failed private investment bets are significantly smaller than for failed government bets on a larger scale. In fact, industrial subsidies are often motivated by national pride (Grossman, 1990), geopolitical objectives or national security.4 In these cases, governments regularly place economic welfare considerations second or third.5

Second, there are distinct international and domestic components regarding the political economy of subsidies. At the international level, subsidy programs that generate large-scale negative spillover effects are a perennial source of trade tensions and have recently become a highly contested issue (Bown & Hillman, 2019). This is particularly true for some of the largest G20 members. For example, the USA, the European Union and Japan have called for reform of industrial subsidies that cause global excess capacity, both in the WTO and beyond (Gao, 2021). These members released a series of joint statements in 2019 and 2020 under the banner of Trilateral Cooperation outlining a reform package that, while it was presented as a general reform, implicitly targets China’s system (McDonagh & Draper, 2020). China in turn has released its own WTO reform proposal that seeks to expand non-actionable subsidies and provides special and differential treatment to developing countries (Gao, 2021).6 It is clear that domestic subsidy programmes can generate not only negative impacts on domestic welfare but also international tensions, adding a further motivation for devising better policy.

Domestically, the problem with political capture is that industrial policy will turn into rents. While it is true that these issues theoretically are not insurmountable (Rodrik, 2019), the concerns have merit, and it is important to take them seriously in order to dissect the discourse around industrial policy. As the examples presented by Baldwin and Robert-Nicoud (2007) as well as Barwick et al. (2019) show, most of the firms that were supported were inefficient, as entry subsidies attracted firms with higher production costs. Political rent-seeking can also incentivize selective measurement of the effects of a subsidy to hide costs while publicizing gains. It can also be observed that domestic welfare distortions of subsidies may not be evident in all categories. A subsidy that leads to a drop in output costs, but in a situation dominated by high-cost producers, can be misleading in the absence of production cost data. Standardization of the categories used in evaluations of subsidies made by governments would be helpful here.

Even without domestic distortions, the political economy of subsidies creates a sort of prisoner’s dilemma. Without subsidies, all countries may be better off, as long as other countries do not grant subsidies to their firms. However, since mutual trust is limited, most countries want to create an advantage for their enterprises in international competition; yet when all countries grant subsidies, they may all lose, at least relative to a no-subsidy equilibrium. However, if domestic distortions are not considered, it appears logical to grant subsidies, since if other countries do not subsidize then the granting country’s own welfare may rise. And if other countries subsidize, the granting country’s own welfare is less negatively impacted through negative spillovers.

However, when taking into account domestic distortions, subsidies lose their economic appeal as the gains for subsidized firms are (over-)compensated by losses for taxpayers and other firms. Yet this rationale is very difficult to sell politically. In addition, as welfare losses arising from foreign subsidies are visible whereas welfare losses owing to one’s own subsidies are not, it seems politically highly unattractive to stop domestic subsidies.

Proposal

Since countries are incentivized to challenge their trading partners’ subsidies that harm their own industries, the weight of evidence calls for more domestic transparency and a proper monitoring system that allows governments to calculate the net effects of subsidies at home, and to use them for negotiations about subsidy control abroad. The G20 could act as a catalyser, in that members mutually agree to evaluate their domestic subsidies with respect to domestic distortions in a transparent process aiming at reciprocal reduction of subsidies that have been proven to be welfare-distorting at home (without the need to discuss welfare problems abroad that are caused by these subsidies).

COMMITMENT TO STANDARDIZED SUBSIDY EVALUATION

Accordingly, firstly, we call for a commitment to a standardized process of subsidy evaluation, ideally using several indicators. This will help to more systematically uncover where societal costs occur and to counter political capture related to rent-seeking. We propose reproducing an analytical framework drawing on best practices currently in use,7 such as the Organisation for Economic Co-operation and Development’s (OECD) well-known framework for analysing agriculture subsidies (Box 1), the Australian Productivity Commission’s mandate and the Kiel Institute for World Economics’ (an independent initiative) methodology. The framework’s design could be negotiated by a G20 appointed task force. G20 members could then unilaterally establish such frameworks according to the agreed design. It may well be adequate to combine these approaches or to use them in parallel.8

The OECD framework

The OECD data places subsidies paid at the domestic level into a broader analytical framework that includes the prevalence of relevant trade and domestic measures, as well as agricultural subsidies (Box 1) (OECD, 2021).

Box 1: Definition of terms in OECD agricultural support database

- Market price support (MPS) is measured by the gap between domestic and world prices and is an estimate of the benefit transferred to producers from consumers and taxpayers, owing to import restrictions (an export restriction is reflected as “negative support”, essentially a tax on producers).

- Direct payments (DP) are direct transfers from taxpayers to agricultural producers based on output, input use, and area/animal numbers/revenue/income (AARI), for which production is required (P) or not required (NP).

- Total producer support estimate (PSE) is the annual value of gross transfers from consumers and taxpayers to agricultural producers. It is also expressed as a percentage of gross farm receipts. PSE is agricultural support regardless of its objectives, nature and impacts on farm production and farm income.

- General services to the sector (GSSE) refers to the annual gross monetary transfers value that creates enabling conditions for the agricultural sector by developing services, institutions and infrastructure. GSSE includes support to research and development, extension, inspection and quality control, infrastructure and public stockholding (OECD, 2018).

- Total support estimate expressed as a per cent of GDP (% TSE) includes all the above plus some consumer transfers that are not summarized here.

This offers important insights into the role of covered countries’ net government policies in promoting, or hindering, their agricultural sectors’ competitiveness. This framework yields a rich set of insights into the net support received by covered countries’ agricultural sectors,9 producing some interesting results: for example, both India and Argentina effectively tax their farmers.

The Australian Productivity Commission

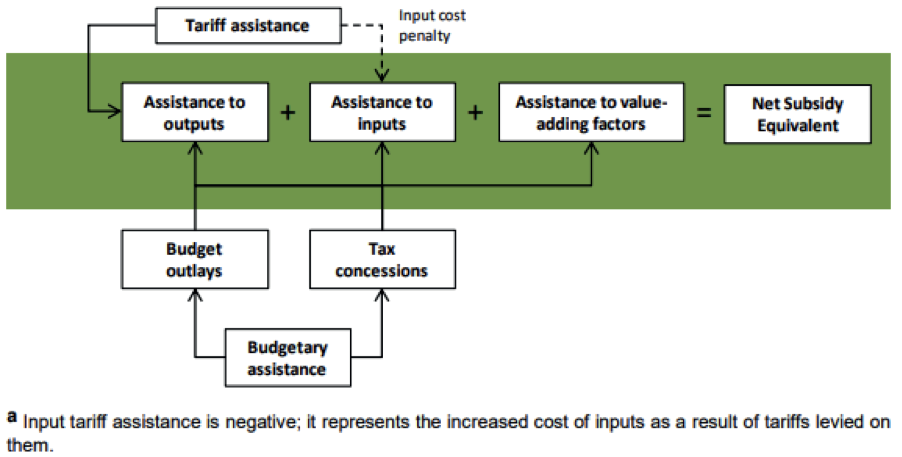

Figure 1: Budgetary and Tariff Assistance in Trade and Assistance

Box 2: Australian Productivity Commission Assistance Calculation Methodology

- Budgetary assistance: this includes subsidies and tax concessions and focuses on measures that can be readily and consistently quantified on an annual basis. The Commission notes that this means some support measures which are difficult to estimate are therefore not included, such as regulations that advantage a business or industry, or government procurement preferences.

- Output tariff assistance: import tariffs increase the price of imported goods on the domestic market. This allows domestic producers a rent-seeking opportunity, as they can increase prices by the amount of the tariff applied to foreign competitors. This effect is captured by output assistance.

- Input cost penalty: import tariffs also result in a cost penalty for Australian firms importing goods used as inputs, although tariff concessions may be available, which the Commission takes into account when calculating final cost penalty.

- Net subsidy equivalent: output assistance (import tariffs plus budgetary assistance) minus input cost penalties equals net tariff assistance.

Through the production of annual reports, the Productivity Commission estimates Australian Commonwealth government assistance to industry under the umbrella of its Trade and Assistance Review. The methodology is set out in Figure 1 and Box 2, showing particularly the differences in the effects of subsidies and tariffs on input and output respectively.

They also examine recent developments in assistance in various sectors of the economy and discuss recent international policy developments affecting Australia’s trade. In their latest report they found that Australian industry received more than AUD12.5 billion in net assistance from the Australian government in 2018-19, mostly concentrated on services firms, followed by manufacturing and primary production.10

There are two points to note regarding data in the Trade and Assistance Review report. Firstly, it refers to federal-level data and does not capture sub-federal state and territory governments’ assistance, which the report notes has historically been substantial. Secondly, measures of assistance are for manufacturing, primary production and mining sectors, but not for services sectors, which as the report notes comprise more than 80 per cent of the Australian economy. Thus the available data only partially captures the extent of domestic distortions.

The Kiel Subsidy Robot

For the last twenty years, the Kiel Institute for the World Economy has documented subsidies paid in Germany. To assess the welfare effects of individual subsidies, Boss et al. (2011) as well as Laaser and Rosenschon (2018) proposed the so-called Kiel Subsidy Robot, which applies a number of criteria to judge the potential welfare effects of a subsidy:

- potential distortion (-); –potential negative side effects (-); –alternatives (?); –infrastructure potential (+); –potential pretence of knowledge,11 leading to resource misallocations (-); –adjustment subsidy (?), for example subsidies to harness structural change (they often become permanent subsidies);

- rescue subsidy (-), for example for textile firms competing with companies from Asia; –contradictory subsidies (-): an example is a subsidy for energy-intensive sectors, while at the same time carbon emissions are taxed;

- grotesque subsidies (-): an example is a subsidy only paid to please the electorate before an election; and

- inevitable subsidy (+), for example pension payments after the privatization of a company.

Taken together, these criteria can justify a red light, yellow light or green light for each subsidy; in very unclear cases, Laaser and Rosenschon (2018) propose an orange light. It is then a political decision whether or not the Kiel Subsidy Robot has consequences, for example, in the case of a red light.

ADDITIONAL CONSIDERATIONS: OWNERSHIP AND MULTIPLE POLICY OBJECTIVES

Secondly, as illustrated by Barwick, Kalouptsidi and Zahur’s (2019) study on the welfare effect of China’s shipbuilding policy, the efficiency and welfare effects of subsidies in a given sector could differ depending on the ownership types of the firms involved. In the shipbuilding industry in China, for example, most of the firms enjoying subsidies are state owned enterprises (SOEs), and they typically have lower efficiency levels compared with private firms. It would be interesting to further segregate welfare effects according to the ownership types of the firms receiving the subsidies to enable better discussions on welfare effects at the domestic level, as well as potential cross-border spillovers.

Thirdly, while welfare effect analysis is useful in most cases, we recognize that such arguments may be less persuasive to the extent that a government places its priority on something other than economic welfare. Indeed, if the primary goal of a government is to develop strategic autonomy or to prop up or even strengthen SOEs for use as tools for policy implementation, welfare costs or benefits will tend to be less of a concern when formulating or evaluating such policies. This problem could be further exacerbated if the senior executives of such firms are political appointees who value political goals more than economic goals. However, we believe that even in such cases, it could still be useful to highlight the welfare effects in order to facilitate informed debate.

CONCLUSIONS

According to the empirical literature on the domestic welfare effect of subsidies, it is unlikely that government subsidies to domestic companies are welfare-enhancing. While they benefit the supported industries, and they can plug market failures and be successful in increasing market share, they tend to distort welfare and their overall effects remain contested. This evidence gives reason to rethink the practice of subsidizing domestic companies. Instead of “beggar-thy-neighbour”, there is the risk of “beggar-thyself” in addition to creating international trade tensions. Unfortunately, the domestic welfare effects are not captured by existing international regulatory frameworks such as that of the WTO, which only focus on negative spillover effects in third countries. By highlighting the domestic welfare effects, our brief provides arguments to convince governments to rethink and reform their own industrial policies towards resolving market failures in their own interest. We hope that the G20 members can agree to a set of predefined principles to measure domestic subsidy effects, drawing on the practical examples provided above.

NOTES

1 An exception is the case of research and development (R&D) subsidies. While they are subsidies, they are directed to remedy a market failure, as research activities create publicly available knowledge, which can be regarded as a public good. Without the subsidy, an under-provision of R&D is to be feared. Therefore, we do not consider R&D subsidies in this policy brief.

2 Shipbuilding was marked as an industry that needed special oversight and support in two of China’s five-year plans: the 11th (2006-2010) and 12th (2011-2015).

3 This is not to say that there are no international distortions. Kalouptsidi (2018) found that while subsidies in China’s shipbuilding sector (2005-2010) reduced shipbuilding costs, they increased its market share and pushed out Japanese production; this shows the negative international consequences of domestic subsidies.

4 https://www.wsj.com/articles/chinas-rise-drives-a-u-s-experiment-in-industrial-policy11615381230.

5 Evenett (2020) shows for the sub-national level that even if subsidies are officially labelled as “geopolitical”, political economy considerations as described in the next two paragraphs often dominate the outcome.

6 China’s Proposal on WTO Reform, WT/GC/W/773, 13 May 2019. See also Draper et al. (2020).

7 Those chosen are generally highly regarded by economists that follow the subsidies policy debate. No doubt more could be referenced, but this is a brief and we have to be selective.

8 It seems preferable to have several options instead of a one-size-fits-all solution, as it is also politically easier to agree on such a scheme.

9 OECD countries plus select non-OECD members.

10 Productivity Commission, Trade and Assistance Review, 2018-19, available at https://www.pc.gov.au/research/ongoing/trade-assistance/2018-19

11 This phrase describes the problem that central state actors sometimes claim to know future trends better than those private actors who interact with many individuals to learn about preferences and additionally spend their own money for future-oriented investment.

REFERENCES

Baldwin, RE, Robert-Nicoud F (2007). Entry and asymmetric lobbying: why governments pick losers. Journal of the European Economic Association 5(5): 1064-1093

Barwick PJ, Kalouptsidi M, Zahur NB (2019). China’s industrial policy: An empirical evaluation. Working Paper No. w26075. Cambridge, MA: National Bureau of Economic Research

Bernini C, Pellegrini G (2011). How are growth and productivity in private firms affected by public subsidy? Evidence from a regional policy. Regional Science and Urban Economics 41(3): 253-265

Bown CP, Hillman JA (2019). WTO’ing a Resolution to the China subsidy problem. Journal of International Economic Law 22(4): 557-578

Boss A et al. (2011). Die Kieler Subvention sampel. Kiel Policy Brief No 11. Kiel Institute for the World Economy: Kiel

Criscuolo C, Martin R, Overman HG, Van Reenen J (2019). Some causal effects of an industrial policy. American Economic Review 109(1):48-85

Draper P, Freytag A, Gao H, McDonagh N, Evenett S (2020). Industrial Subsidies as a Major Policy Response since the Global Financial Crises: Consequences and Remedies. T20 Policy Brief. Riyadh: T20 Saudi Arabia

Evenett S (2020). Economic statecraft: is there a sub-national dimension? evidence from United States-China rivalry. World Trade Review. Volume 20 – Special Issue 2 – May, 220-237

Gao H (2021). WTO Reform: A China Round? Proceedings of the 114th American Society of International Law Annual Meeting, 23-32. DOI: https://doi.org/10.1017/amp.2021.4

Grossman, M G (1990). Promoting New industrial activities: a survey of recent arguments and evidence. OECD Economic Studies 14:87-126

Kalouptsidi M (2018). Detection and impact of industrial subsidies: the case of Chinese shipbuilding. The Review of Economic Studies 85(2):1111-1158

Laaser, CF, Rosenschon A (2018). Kieler Subventionsbericht und die Kieler Subventions-ampel: Finanzhilfen des Bundes und Steuervergünstigungen bis 2017 – eine Aktualisierung, Kieler Beiträge zur Wirtschaftspolitik, No 14. Kiel Institute for the World Economy: Kiel

Lane N (2020). The new empirics of industrial policy. Journal of Industry, Competition and Trade 20(2):209-234

McDonagh N, Draper P (2020). Industrial Subsidies, State-Owned Enterprises and WTO Reform: Prospects for Cooperation? Adelaide: Institute for International Trade

OECD (2021) Agricultural Policy Monitoring and Evaluation 2021: Addressing the Challenges Facing Food Systems, OECD Publishing, Paris, https://doi.org/10.1787/2d810e01-en

Rodrik, D. (2019). Where are we in the economics of industrial policies? https://voxdev.org/topic/public-economics/where-are-we-economics-industrial-policies [accessed 23 April 2021]