Financing the sustainable energy transition remains a global challenge, especially for developing countries with higher reliance on hard-to-abate and legacy fossil fuel-based industrial sectors. Understanding the unique environmental, social, and corporate governance (ESG) challenges facing developing countries constitutes a compelling starting point for addressing climate finance issues. A first step is developing a global ESG framework based on more inclusive and sustainable energy transition concepts, such as the Circular Carbon Economy (CCE). Active cooperation between developed and developing nations in local capacity building, economic and operational knowledge transfers, fiscal transfers from Annex I to non-Annex countries, local carbon pricing mechanisms and utilisation of innovative green financial instruments can significantly foster sustainable energy transitions.

Challenge

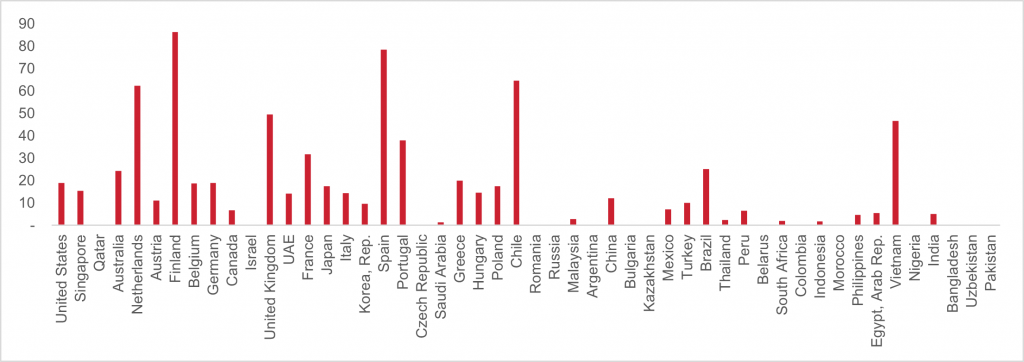

Financing the sustainable energy transition continues to be a global challenge given the massive investment needs associated. Projections provided by different institutions (e.g., OECD, World Bank and UN Environment, 2018)[1], indicate that trillions of dollars in investment are needed annually to meet the 2030 United Nations Sustainable Development Goals (SDGs) and fulfill the Paris Agreement climate ambitions. The scale of these investments is beyond the current public finance capabilities and illustrates the critical need for involving private finance to attain the necessary levels. The investment gaps are notably significant for developing and least-developed nations. For instance, according to the Bloomberg Transition Investment data, annual renewable energy (RE) investment per million tons of carbon dioxide is significantly less in developing economies (Figure 1).

Notes: Numbers are averages between 2019-21. Countries are ordered based on average per capita income, and Chile is the median. The top-50 emitting countries, accounting for more than 90 percent of global carbon dioxide emissions, are displayed in the figure.

Figure 1: Renewable energy investment, $/Mt CO2

Source: Authors’ calculation from Bloomberg Transition Investment and the World Bank data.

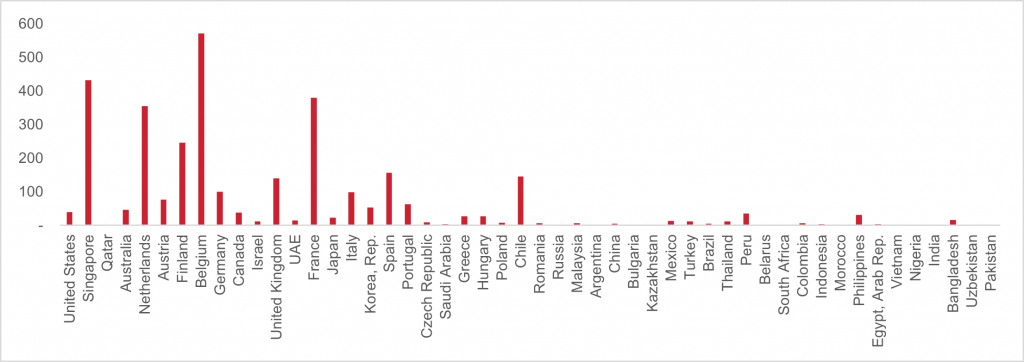

Despite their unprecedented size, conventional private financial instruments have not provided the required funds. These instruments do not account for many risks and opportunities associated with sustainable energy transitions and instead focus on short-term financial return maximisation.[2] There is a growing consensus that scaling up environmental, social, and corporate governance (ESG) finance is key to raising sufficient funds for the investment needs of the sustainable energy transition (OECD, 2018). However, with the current global practice, the ESG funds concentrate in certain developed economies (Figure 2 below), whereas the developing countries’ access to these funds is limited.

Notes: Numbers are averages between 2018-2021. Countries are sorted based on average per capita income, and Chile is the median. Sustainable debt includes green loans and bonds and sustainability-linked bonds and loans. The top-50 emitting countries, accounting for more than 90 percent of global carbon dioxide emissions, are displayed.

Figure 2: ESG finance flows, $/Mt CO2

Source: Authors’ calculation from Bloomberg BNEF and the World Bank data.

With its long-term focus, ESG has become the new and widely accepted investment norm and a critical necessity, rather than an option or a luxury, for delivering the financing needs of the sustainable energy transition. Without globally and regionally aligned ESG guidelines, varying ESG definitions, classifications and reporting systems have emerged. Such diverging views on its definition and classification create bottlenecks for mainstreaming ESG-based financial investments. The International Financial Reporting Standards Foundation is working to develop a baseline global reporting standard building on the Task Force on Climate-related Financial Disclosures (TCFD) framework, which Group of 20 (G20) leaders welcomed in 2021 (G20 Italian Presidency, 2021). However, a globally recognised taxonomy that can speak to the needs of both developed and developing nations is yet to be established.

Proposal

Proposal 1:

The global standards for ESG should consider emission challenges across the globe throughout the value-chains of all sectors. A global ESG framework should incorporate more flexible and holistic energy transition concepts, such as the Circular Carbon Economy (CCE) framework. Using the CCE, countries can develop transition strategies based on their strengths and local specificities while still being able to raise ESG funds for the investment needs of the transition process (Yilmaz & Luomi, 2022).

Building on the circular economy concept (i.e., reduce, recycle and reuse), the CCE adds a fourth R for “remove” and focuses on energy and emissions flows instead of materials. The CCE approach embraces all mitigation technologies (e.g., renewable energy, carbon capture, utilisation and storage (CCUS), clean hydrogen) and activities (e.g., energy efficiency, fuel switching, and natural carbon sinks). It mainly focuses on preventing GHGs from reaching the atmosphere instead of prioritising certain mitigation technologies (e.g., (CCE Guide, 2020), (Williams, 2019); (McDonough, 2016); among others[3]). As a technology-agnostic approach, the CCE provides additional flexibility for hard-to-abate sectors and thus, promises a more inclusive transition process that is particularly important for many developing countries.

Rationale:

Despite efforts to standardise the definition of ESG, a globally harmonised ESG taxonomy is still missing. The current ESG guidelines, practiced globally, generally follow more restrictive definitions of the sustainable energy transition, emphasising renewable energy and electrification. However, this approach ignores various realities facing developing countries, such as a more carbon-intensive legacy industry structure, energy access inequality and technology shortcomings, which hinder the efforts to bridge the transition finance gaps. The consequent lack of harmonisation impedes the flow of capital into sustainable energy-transition projects, especially in developing countries, where investment is needed the most. The recent global political developments and the increasing concerns around energy security and the security of supply have raised new dimensions in a continuing discussion. For instance, the European Union has opened a recent debate around including gas and nuclear in the list of clean technologies that could be considered green under the emerging ESG guidelines (Abnett, 2022).

How one defines sustainable energy transition significantly matters for the definition of the ESG guidelines, and this issue will become increasingly important as actors worldwide seek to harmonise related frameworks. Of relevance for many developing economies, current ESG taxonomies largely fail to explicitly include many emission-management technologies that are important for the carbon-intensive sectors in achieving cost-effective net-zero pathways. A more inclusive definition of the sustainable energy transition that can address country- and sector-specific issues could help deliver broader ESG frameworks and bolster efforts toward forming a robust global governance framework underpinning ESG. Such inclusivity could benefit both countries currently seen as incumbents in the sustainable energy transition and those whose prominent sectors are deemed hard to abate, including heavy transport and industry.

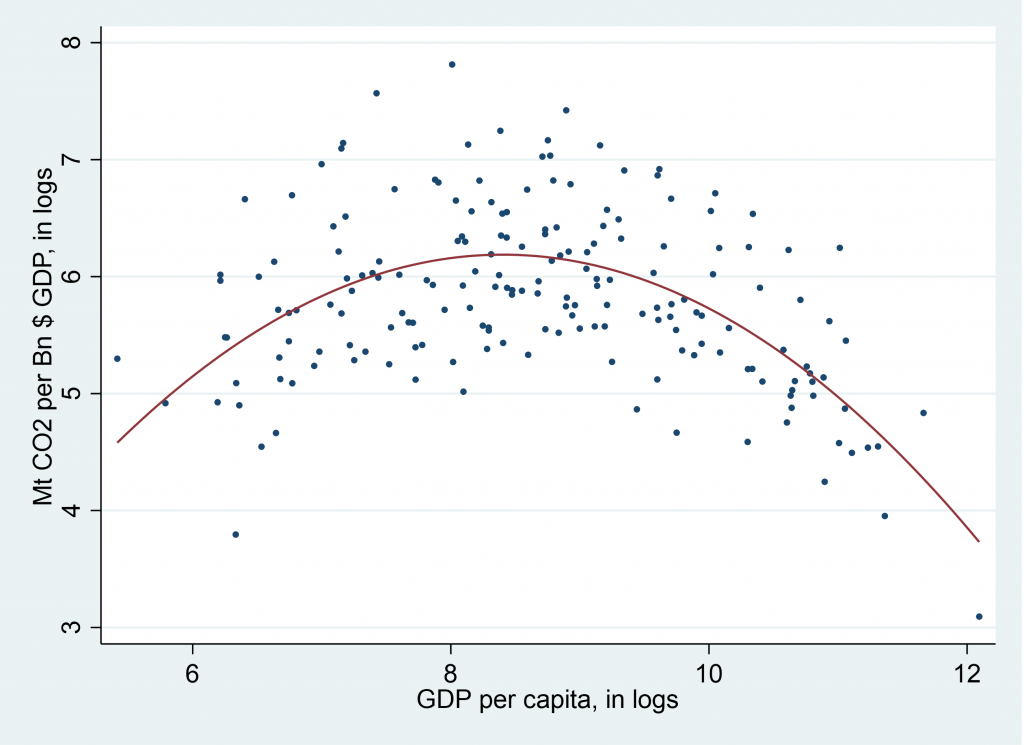

Developing and least-developed countries have structural difficulties committing to such low-carbon policies. Consequently, the “pioneering” policies towards a carbon-neutral future cannot be automatically transposed in the context of developing countries. The global division of labour has disproportionately endowed these countries with carbon-intensive, hard-to-abate sectors. Many developed countries have already moved their carbon-intensive industries to the developing economies via foreign direct investment (FDI) following the early climate agreement of the Kyoto Protocol (UNFCCC, 1998). These developed countries have also worked to decarbonise their energy consumption by increasing investments in renewable energy installations and low-carbon fossil fuels like gas. Therefore, the current stage of their economies is better situated to meet the current global ESG requirements. Given their development needs, developing countries, where hard-to-abate sectors are disproportionately concentrated, emerge at a structural disadvantage. For instance, according to Figure 3 below, the well-known Kuznets curve shows that many developing economies have more CO2-intensive output production processes (Kuznets, 1955). Carbon capture and storage (CCS) and hydrogen have been identified as one of the seven key pillars for a successful transition, especially in the carbon-intensive sectors according to the International Energy Agency (IEA). The other key pillars identified are energy efficiency, behavioural changes, electrification, renewables and bioenergy (IEA, 2021). According to the IEA report, it is estimated that nearly US$1.3 trillion in CCS capital investment will be needed to scale the technology to 5,600 Mtpa[4] by 2050 from its current level of 40 Mtpa. Despite its key role in decarbonising hard-to-abate sectors, CCS (or CCUS) technologies are not explicitly and widely recognised in many global ESG guidelines, which impedes the flow of ESG capital into the relevant projects (Global CCS Institute, 2020). Similarly, newly emerging technologies, such as different types of hydrogen (e.g., blue), are not widely included in the current ESG guidelines, despite some analyses suggesting they could meet up to 30 percent of the final global energy demand by 2050 (BloombergNEF, 2020).

Notes: Numbers are averages between 2019-2020. All 187 countries with available data are included in the figure.

Figure 3: Relation between countries’ output CO2 intensity and income

Source: Authors’ calculation from World Bank data.

Decarbonisation pathways for hard-to-abate sectors need time to mature and scale. Developed countries with access to technology, finance, and institutional capacity and depth possess the capability to navigate such pathways. Maintaining high levels of state capacity is critical to successfully developing and executing the transition technologies to achieve climate ambitions. Effective policy and market interventions can create incentive-compatible mechanisms where actors can converge on a low-carbon national strategy roadmap in developed countries through technology transfer. In turn, markets can often fund investments in line with these low-carbon strategy roadmaps.

While efforts to harmonise ESG guidelines and concepts globally are accelerating, ensuring its inclusiveness in the developing world’s realities is necessary. One way to achieve this can be done by adopting ESG guidelines and more inclusive and flexible transition concepts, such as the CCE Framework, which also incorporates carbon management technologies (e.g., CCUS), fuel switching, and energy efficiency in addition to the mainstream mitigation options (e.g., RE). Countries like India have used the CEE framework as part of their ESG strategy, focusing on decarbonisation with the electricity utility company NTPC using CCUS for its power generation operations (Carbon Clean, 2021) and Tata Steel using it for decarbonisation efforts towards steel production (FE Bureau, 2021).

Proposal 2:

Ensure local legal ESG infrastructure development and alignment to global standards via knowledge sharing and capacity building. This will become critical for a successful energy transition. Energy transitions does not only require financing but also access to technologies that will enable the energy transition.

Rationale:

Time and again, modern human history has shown that significant successes in global policy adoption build on securing wide-range support from countries and on voluntary participation. Such a participatory framework needs to be underpinned by a robust international regime, where the expectations and interests of stakeholders converge. This is even more important for frameworks such as ESG, which, when standardised globally, may not provide a level playing field for all countries equally as the more developed countries may be at an advantage compared with developing countries. This can be bridged to some extent by ensuring alignment, knowledge sharing and capacity building to ensure that the developed countries can build their capacities and capabilities at a pace to absorb financing and the new energy transition supportive technologies.

Capacity building in local ESG infrastructure goes hand in hand with the sustainability of such reforms. Most decarbonisation pathways imply a considerable redistribution of local resources. For instance, reallocating land use in a developing country may mean relocating herding and agricultural groups. Changes in labour legislation may shave away the already slim profits of small-medium enterprises. These states, however, have little in their toolkit (financial or otherwise) to address the negative implications that such a redistribution ESG reform may entail. As a result, committing to these pathways may appear politically untenable. Transferring knowledge and capacity to these countries is foundational for ESG infrastructure to subscribe to global standards. As elaborated in Proposals 3 and 4, it attracts increased levels of global capital to finance this transition.

Proposal 3:

Annex I countries should fulfill the annual global climate fund commitments, and the fund should be more active in catalysing the flow of other private ESG funds towards non-annex parties, especially those with more urgent needs. International financial organisations (e.g., World Bank) and multilateral investment guarantee agencies (e.g., Multilateral Investment Guarantee Agency (MIGA)) should take a more active role in assessing country-level investment needs and risks and providing hedging mechanisms for private investors.

Rationale:

As the world moves towards carbon neutrality, stakeholders in the sustainable energy transition are increasingly focusing on policies and regulatory frameworks to ensure greater acceptability and increased attraction for investment to flow into new technologies and innovations required to help support the evolution and development of the process. For these investments to continue to flow, it is essential to have the enabling environment, especially the necessary finance – e.g., ESG – to accommodate more inclusive sustainable energy transition approaches (e.g., the CCE) to accommodate the structural changes and differences across the countries. This convergence on harmonisation of ESG taxonomy is vital for various loci of capital, such as sovereign wealth funds, hedge funds, green/brownfield investments, etc., to optimise global investments towards the transition. Also, as elucidated in Proposal 2, local knowledge transfer is critical in ensuring the adoption and application of such capital towards sustainable energy-transition projects. A systematic assessment of country-specific investment needs and risks will encourage higher levels of much-needed global investment to be channeled to non-annex countries.

An effective channeling of finance can also address the stranded assets problem in non-Annex countries via cost-effective transfer of technologies such as CCUS. This circular approach will also keep these industries competitive in a carbon-priced future. External anchoring of funding for such projects can also provide an institutional overview of the success of these policies enabling sharing of best practices and education of stakeholders by knowledge sharing.

Proposal 4:

Encouraging local governments to support the sustainable energy-transition process with incentives and guarantees and ensuring the appropriateness of the local business environment to lower the hurdles to issuing appropriate green financial instruments. Local carbon pricing mechanisms should be activated and integrated with the global markets.

Rationale:

Securing buy-in from global and local critical stakeholders into net-zero goals requires political support and the promise of a satisfactory rate of return. The inherent uncertainties need political goodwill to encourage investments in a carbon-constrained area. A supportive stance by a local government can address many potential issues early and effectively.

The “effectiveness multiplier” of high-quality local governance is more than what initially meets the eye. In addition to financial guarantees, such oversight is critical for creating a productive business environment. Innovative financing schemes, and the complex contracts they imply, will inevitably challenge the existing legal framework in developing countries. Maintaining a healthy dialogue among stakeholders will allow early intervention in potential disputes and conflicts, fostering an even favorable investment climate. Local governments’ support also engenders stakeholders’ trust, facilitating further knowledge transfer and higher quality investments in their respective localities.

Initiating local carbon pricing mechanisms and integrating them into global markets are key policy steps to secure sustained benefits for developing countries in an ESG-guided future. The pricing mechanism will motivate the effective allocation of resources in a developing economy. Transparency and accountability required to execute carbon pricing also create significant positive externalities for the business environment in these countries. These policy steps are likely to raise various challenges for the manufacturing, services and agricultural sectors of respective countries at the beginning. Economic history suggests that the longer-term benefits of attaining a competitive position in the global economy often dwarf the shorter-term adjustment pains. Still, the pains of structural adjustment (incorporation of carbon pricing in this case) are front-loaded, potentially translating into political opposition with veto power. Innovative financial instruments, which ease these pains (spreading them over time), appear as key catalysers for moving towards an ESG-guided future.

Additional sources of financing, including multilateral development banks, international financial institutes, and philanthropic avenues, should be encouraged for the energy-transition technologies (Dingus, et al., 2020).

Conclusion

The sustainable energy transition is currently underway and requires massive finance globally to be successful. However, most of the available finance (e.g., ESG) for climate adaptation, mitigation and emissions control is currently more skewed towards developed countries, with developing and the least-developed ones having to clamour for climate finance at international fora.

ESG frameworks should consider the disparity between income levels and development levels across developed and developing economies to ensure that the technology required for the energy transition is affordable for the purchasing power of the developing countries. Energy transition should work to ensure that developing countries are not pushed into energy poverty due to the energy transition or high energy prices due to the transition.

A globally accepted ESG framework with a more holistic transition approach can better unlock the global ESG finance potential while allowing the distribution of the funds towards the countries and projects where they are needed the most. Globally harmonised ESG frameworks would help reduce the multiplicity of reporting requirements, provide a cost-effective mechanism that provides low compliance costs, and ensure that small and medium enterprises in developing and least developed countries are not burdened with such non-tariff barriers. Grassroots political support, financed by ESG frameworks, would support countries to move faster towards achieving net-zero ambitions. Incorporating more flexible transition frameworks, like the CCE, would help ensure that developing countries are provided with the requisite tools to make the transition a success.

References

Abnett, K. (2022, 2 2). EU proposes rules to label some gas and nuclear investments as green. Retrieved from Reuters: https://www.reuters.com/business/sustainable-business/eu-proposes-rules-label-some-gas-nuclear-investments-green-2022-02-02/

BloombergNEF. (2020, March 30). Hydrogen Economy Outlook: Key Messages. Retrieved from Bloomberg NEF: https://data.bloomberglp.com/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf

Carbon Clean. (2021, August 11). NTPC selects Carbon Clean and Green Power International to set up 20 TPD CO₂ capture plant in India. Retrieved from Carbon Clean: https://www.carbonclean.com/media-center/news/ntpc-selects-carbon-clean-and-gpipl-to-set-up-20-tpd-capture-plant

CCE Guide. (2020, August). https://www.cceguide.org/guide/. Retrieved from CCE Guide: https://www.cceguide.org/guide/

Cling, J.-P., Ali Marouani, M., Razadindrakto, M., Robillard, A.-S., and Roubaud, F. (2009). The distributive impact of Vietnam’s accession to the WTO. Retrieved from Economie Internationale, CEPII research center, issue 118, pages 43-71.: https://ideas.repec.org/a/cii/cepiei/2009-2tb.html

Dingus, D., Bennett, D., Cardini, A., Matovich, I., Ridge, N., and Roychoudhury, J. (2020, September). Leveraging Private Philanthropy Towards Achieving the SDGs. Retrieved from https://www.t20saudiarabia.org.sa: https://www.t20saudiarabia.org.sa/en/briefs/Pages/Policy-Brief.aspx?pb=TF7_PB10

FE Bureau. (2021, September 15). Tata Steel commissions carbon capture and reuse plant to promote circular carbon economy. Retrieved from Financial Express: https://www.financialexpress.com/industry/tata-steel-commissions-carbon-capture-and-reuse-plant-to-promote-circular-carbon-economy/2330257/

G20 Italian Presidency. (2021, November 18). G20 Rome Leaders’ Declaration. Retrieved from Global Partnership for Financial Inclusion (GPFI): https://www.gpfi.org/sites/gpfi/files/7_G20 percent20Rome percent20Leaders percent27 percent20Declaration.pdf

Grigoriadis, I. (2006). Turkey’s Accession to the European Union. Retrieved from The SAIS Review of International Affairs, Vol. 26, No. 1 (Winter-Spring 2006), pp. 147-160: https://www.jstor.org/stable/26999305

IEA. (2021, May). Net Zero by 2050 – A Roadmap for the Global Energy Sector. Retrieved from International Energy Agency: https://www.iea.org/reports/net-zero-by-2050

IFC. (2016, November 07). Climate Investment Opportunities Total $23 Trillion in Emerging Markets by 2030, Says Report. Retrieved from International Finance Corporation: https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=17382

IRENA. (2019). Transforming the energy system – and holding the line on the rise of global temperatures. Retrieved from IRENA: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Transforming_the_energy_system_2019.pdf

Kuznets, S. (1955, March). Economic Growth and Income Inequality. Retrieved from JSTOR: https://www.jstor.org/stable/1811581?seq=1

McDonough, W. (2016). Carbon is not the enemy. Nature, 349–351.

OECD. (2018, November 28). Financing Climate Futures: Rethinking Infrastructure. Retrieved from OECD: https://www.oecd.org/env/cc/climate-futures/

OECD. (n.d.). List of Annex I Countries. Retrieved from OECD: https://www.oecd.org/env/cc/listofannexicountries.htm

Schoenmaker, D. (2017, November 09). From Risk to Opportunity: A Framework for Sustainable Finance. Retrieved from Social Science Research Network (SSRN): https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3066210

The New Climate Economy. (2016). The Sustainable Infrastructure Imperative. Retrieved from The New Climate Economy: https://newclimateeconomy.report/2016/

UNFCCC. (1998). Kyoto Protocol – Targets for the first commitment period. Retrieved from United Nations Climate Change: https://unfccc.int/process-and-meetings/the-kyoto-protocol/what-is-the-kyoto-protocol/kyoto-protocol-targets-for-the-first-commitment-period

Williams, E. (2019, November 07). Achieving Climate Goals by Closing the Loop in a Circular Carbon Economy. Retrieved from KAPSARC: https://www.kapsarc.org/wp-content/uploads/2019/11/Achieving-Climate-Goals-by-Closing-the-Loop-in-a-Circular-Carbon-Economy.pdf

Yilmaz, F., and Luomi, M. (2022). Scaling up ESG Finance in the Gulf: A Perspective from Saudi Arabia; The NYUAD Transition Investment Lab Annual Report 2022 (forthcoming). Abu Dhabi, United Arab Emirates: NYU Abu Dhabi, Mubadala Investment Company and Al Maskari Holding.

Global CCS Institute (2020) “Environmental, Social and Governance Assessments and CCS” Report

- Different estimates are available from various international institutions, but they agree that the investment needs are unprecedented. For instance, (IRENA, 2019) predicts total investment needs of around US$110 trillion dollars to meet the stated goals by 2050. The OECD, the United Nations and the World Bank Group (OECD, 2018) predict that annual investments of $6.9 trillion are needed until 2030. The (IFC, 2016) points out that emerging markets will require climate-smart investments of around $23 trillion dollars through 2030. The (The New Climate Economy, 2016) estimates that $90 trillion dollars in investments is necessary before 2030. ↑

- For a more detailed discussion on the traditional finance and the development of sustainable finance, see Table 2 in (Schoenmaker, 2017). ↑

- For a more detailed background on the CCE concept, see the dedicated website: https://www.cceguide.org/guide/ ↑

- Mtpa – Million tons per annum ↑