With the limited success of the Addis Ababa Action Agenda (AAAA), financing the United Nations Sustainable Development Goals (SDGs) has proved to be a major bottleneck. Blended finance as an instrument was highlighted in the AAAA as a modality to enhance resource mobilisation from the private sector and was also underlined in the Group of 20 (G20) Osaka Declaration. Recently, the G20 High-Level Principles on Sustainability-Related Financial Instruments were endorsed in 2021, including the adoption of the G20 Sustainable Finance Roadmap; and Indonesia has committed to working in 2022 towards G20 Principles on Scaling-up Private and Blended Finance. This policy brief proposes specific G20 level action to strengthen ongoing efforts and bring in desired convergence for blended finance with a focus on localisation.

Challenge

With limited success of the Addis Ababa Action Agenda (AAAA), challenges remain in terms of mobilisation of resources, their alignment to the United Nations Sustainable Development Goals (SDGs), and the Paris Climate on climate change, and in creating development impact. The AAAA highlighted challenges to domestic resource mobilisation and curbing illicit financial flows. According to the UNCTAD (2014) and Chaturvedi, et al. (2019), the estimates of financing needs are very large since external and domestic public finance are insufficient to meet the estimated US$2.5 trillion annual SDG financing gaps in developing countries. The Organisation for Economic Cooperation and Development (OECD) (2021) shows that this gap climbed to $3.7 trillion in 2020 owing to the COVID-19 pandemic, a 50 percent increase over pre-pandemic years. The United Nation Conference on Trade and Development (UNCTAD) and International Monetary Fund (IMF) projections suggest that the SDG financing gap could even further increase to USD 4.3 trillion per year from 2020 to 2025, which would be a considerable increase to previous estimates (UNCTAD, 2022).

Financing the SDGs through new partnerships, including with the private sector, has emerged under various templates, including impact finance, green finance and blended finance. The G20, under the presidency of Saudi Arabia developed a multi-year Financing for Sustainable Development Framework for the Sherpa track and Italy in 2021 followed with multi-year G20 Sustainable Finance Roadmap (G20-SFR) for the finance track. However, efforts by development partners, international financial institutions (IFIs), development financial institutions (DFIs) as well as national governments are yet to attain scale due to divergences in conceptualising objectives and strategies. We note the complex incentives for actors beyond governments (and international organisations) to participate in the process.

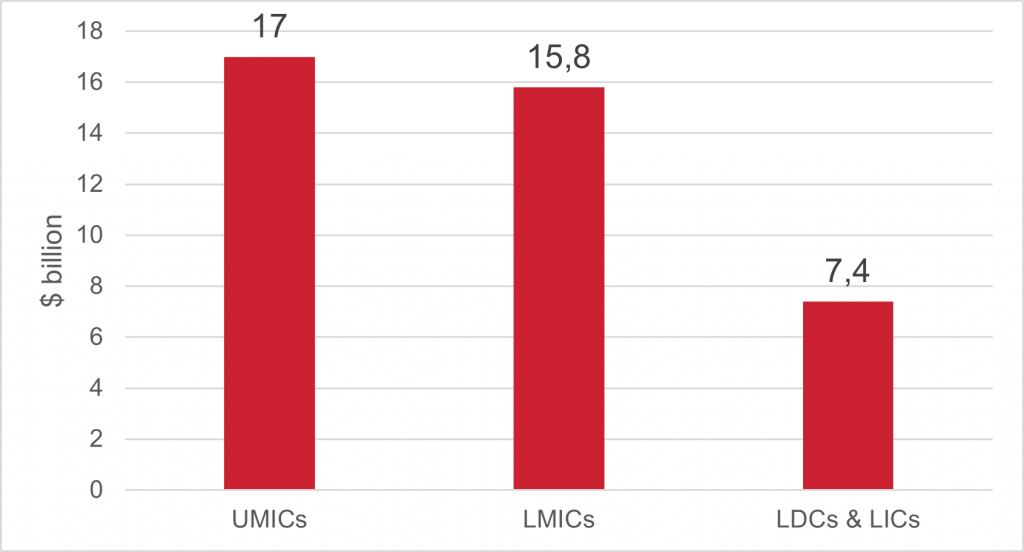

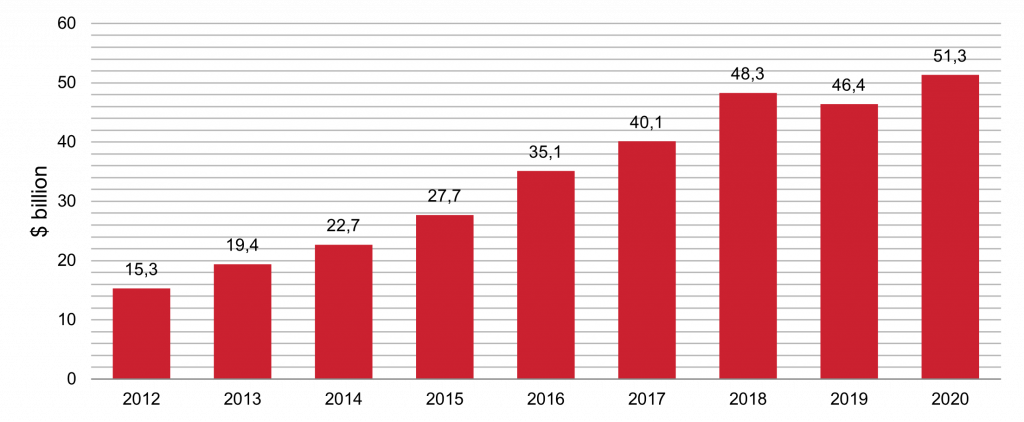

Blended finance has increased since the AAAA. While no universally agreed definition of blended finance exists, blended finance is understood as the strategic use of development finance for the mobilization of additional finance towards sustainable development in developing countries (OECD, 2018). The potential of blended finance as a mobilising factor has been recognised and private finance towards developing countries has grown steadily between 2012-2018, but this growth has not been sufficient enough, and in fact has dropped by 4% in 2019 and overall amounted to USD 51 billion in 2020, its peak to date (OECD, 2022). Furthermore, monitoring and transparency of blended finance is still limited, which makes its developmental impact unknown (IDFC, 2019 and Attridge and Engen, 2019). On average, USD 7 billion per year was mobilised for LDCs in 2018-20., Least-developed countries (LDCs) continued to receive the lowest share of private finance mobilised by ODF[2] during 2018-20 (Figure 1) and the requirements for a broad spectrum of developing countries remain poorly identified. A lack of blended-finance deals in LDCs is a barrier to private capital mobilisation at the project level. Key bottlenecks to blended finance in creating an enabling environment can be classified as macroeconomic, governance, regulatory, market and both real and perceived risks, while barriers at the project level include operational and contract risks, difficulties in pipeline conceptualisation and project preparation, small deal sizes, untested business models and gaps in information and data (UN, 2019). Pandemic-related risk aversion and uncertainty have hindered private risk-taking in the short term, and absorptive capacity issues in countries may continue to impact blended-financing deals (UN, 2022)

Figure 1: Average Private finance mobilised by ODF during 2018-20 ($ billion) by income groups

Source: OECD (2021)

Private finance mobilised by ODF interventions has seen an increase over the years, as estimated by the OECD (Figure 2). From 2018 to 2020, the private sector contributed an average of $46 billion per year to developing countries’ sustainable development, with only 10 percent going to LDCs and 7 percent going to social sectors critical to LDCs and the SDGs. Around 56 percent of blended finance transactions go to projects in the energy and banking sectors, with only 7 percent going to social initiatives.

Figure 2: Private Finance Mobilised by Official Development Finance Interventions

Source: OECD (2021)

Proposal

The SDG financing gap outlined in the challenges will not be fulfilled by official development assistance (ODA)[3] alone, as this resource currently totals around $178.9 billion per annum (based on preliminary data for the year 2021 by OECD). This is equivalent to 0.33% of Development Assistance Committee (DAC) donor’s combined gross national income (GNI) of and much below the UN target of 0.7% ODA to GNI.

In principle, blended finance can help increase private investment in SDGs, reduce risks for private investors and improve developmental impacts by linking financing to the SDGs (Berensmann, 2021). Recognising the importance of blended finance, Indonesia launched the Tri Hita Karana (THK) Roadmap for Blended Finance in 2018. It is a multi-stakeholder effort that has sought to develop a narrative for a shared blended-finance value system that can contribute to effective coordination. Blended finance can be scaled up by giving the public partners greater equity roles, pooling resources in a blended-finance fund, giving non-concessional loans priority in order to mobilise private capital and utilising the public development bank (PDB) network (UN, 2022). More specifically, keeping in view the existing bottlenecks in blended finance mentioned in the challenges, G20 nations must consolidate their work on SDG financing.

a) G20 Finance track and Sherpa track need to work together on SDG financing

The idea of blended finance is less understood nationally in several developing and emerging economies due to weaker direct involvement of the private sector in development (Taskin, et al., 2020). Often private sector participation in SDGs is received with scepticism and cynicism on various grounds. Despite a welcome focus on green finance and impact finance, convergence is missing. For the G20 to act now, we need a very different approach towards inspiring more effective strategies and mobilising relevant actors for wider partnerships and crowding in additional resources, ideally through blended finance.

First, to streamline additional finances for SDGs including private sector participation (under various templates), the Finance track and the Sherpa track of the G20 need to work very closely together to bring the finance and development communities together. We note that the special drawing rights (SDR) allocation by the International Monetary Fund (IMF) in 2021 was just over $15 billion for LDCs, while the small island developing states (SIDS) received just over $9 billion, which accounts for 2.3 percent and 1.3 percent, respectively, of the total SDR allocation. In this context, additional efforts are required to reallocate SDRs to the countries that are in the greatest need, including with a view on the climate crisis. Increased SDR allocation to countries will help them in improving the balance of payment situation, which in turn will help in the reduction of country risk and thus, the cost of domestic borrowing. This would result in an improved ability of the nations to access and leverage private financing (ECLAC-ECA, 2022). The Finance track should therefore state an expression of support for a far more ambitious agenda of international financial flows to developing countries and LDCs and SIDS, while the Sherpa track should underscore political support for aligning financing with the SDGs and the global mitigation and adaptation goals on climate change with development partnership initiatives in third countries, as well as specific national initiatives. This would help advance Art. 2.1c of the Paris Agreement and contribute to complementarities and scale.

The SDGs also offer enormous potential to harness the business sector’s skills and resources. NITI Aayog (Apex public policy think tank of the Government of India) and the United States Agency for International Development (2022) pointed out that blended finance addresses the following main barriers for private investors: i) an investment opportunity with a high perceived risk ii) poor risk-adjusted returns compared with comparable investments. In order to attract, deploy and scale blended finance effectively, developing countries and LDCs need additional insights and guidance on how to scale blended finance. EIC Accelerator of Europe, which is aimed at supporting national small and medium enterprises (SMEs) and incentivising them to develop internally, provides an instance of blended finance.

b) G20-SFWG needs to streamline localisation of blended finance

Under Italy’s G20 presidency in 2021, the G20 Sustainable Finance Working Group (SFWG) was established with the objective of scaling up sustainable finance in line with the 2030 Agenda and the Paris Agreement goals. With the SFWG’s goal of advancing international work to help scale up private and public sustainable finance and the adoption of the G20-SFR, more efforts should be made to guide local initiatives by multilateral development banks (MDBs) and DFIs to further expedite the implementation of the 2030 Agenda. Focus Area 4 of the SFWG realises the importance of MDBs and other IFIs in mobilising private finance, however, specific templates for localisation of financing efforts and partnerships should be further streamlined.

MDBs provide financial resources to developing countries for promoting socio-economic development. The UN (2021) suggests that around 450 public development banks (PDBs) exist globally, at sub-national, national, sub-regional, regional and multilateral levels. In 75 middle-income countries, there are 236 PDBs with assets ranging from $2 million to $2 trillion. They have only been marginally involved in blended finance to date. Local knowledge and expertise of national and sub-regional development banks should be leveraged for blended finance, while global expertise should be shared with them to help build capacity. According to UNCTAD (2018), MDBs’ conservative loan approach and narrow capital base impede their ability to scale up lending significantly. Attridge and Engen (2019) pointed out that for every dollar invested by MDBs and DFIs, private finance mobilisation amounts to $0.37 in low-income countries (LICs), $1.06 in lower-middle-income countries (LMICs), and $0.65 in upper-middle-income countries (UMICs).

The Global Taskforce of Local and Regional Governments in partnership with the United Nations Development Programme (UNDP) and UN-Habitat developed a five-part “Roadmap for Localising the SDGs: Implementation and Monitoring at Subnational Level”, vis. Awareness-Raising, Advocacy, Implementation, Monitoring and Where Do We Go From Here (the way forward) to guide stakeholders in the process of SDG localisation. It is essential for the G20 to further the cause of localising the 2030 Agenda and for G20 members to actively employ skills and resources at the local level.

The UN, which has shaped the debate through efforts like the Sustainable Stock Exchanges (SSEs), Principles of Responsible Investment (PRI) and the Global Compact, can help align financial markets with the SDGs. At the local level, the financing gap can be filled by establishing an SDG bond market, which could begin with green bonds and then expand to blue or social bonds (Dembele, Schwarz, Horrocks, 2021). Sovereign bonds play a crucial role in financing the SDGs in emerging markets as government-issued bonds, often issues with the help of public development banks, are significant sources of outside financing.

Successful implementation of SDGs requires the collaboration of multiple levels of government to collaborate (UN General Assembly, 2015 and UN, 2018). We may recount the lessons learned from the implementation of the Millennium Development Goals (MDGs), where the lack of local and regional skills and resources was identified as a barrier to reaching targeted communities (UNDP and World Bank, 2016). While SDGs are global, their success is closely tied to the responsibilities of local and regional governments, particularly their role in providing services such as education, health, waste management and other basic services and hence partnerships for blended finance need to have a clear focus on localisation of development.

References

Samantha Attridge and Lars Engen, Blended Finance in the Poorest Countries: The Need for a Better Approach, London, Overseas Development Institute (ODI), 2019 (ODI Report), p. 11, https://cdn.odi.org/media/documents/12666.pdf

Kathrin Berensmann, How Can the G20 Support Innovative Mechanisms to Mobilise Financial Resources for LDCs in a Post-Pandemic World?, Istituto Affari Internazionali (IAI), 2021 (IAI Papers 21/49), para. 3, p. 6, https://www.iai.it/sites/default/files/iaip2149.pdf

Sachin Chaturvedi, Homi Kharas, Mustafisur Rehman and Imme Scholz, Sustainable Financing for Development, 2019, T20 Japan 2019, https://www.global-solutions-initiative.org/wp-content/uploads/g20-insights-uploads/2019/05/t20-japan-tf1-7-sustainable-financing-for-development-1.pdf.

Economic Commission for Latin America and the Caribbean – Economic Commission for Africa (ECLAC-EC), Special Drawing Rights (SDRs) and the COVID-19 crisis, UN, April 2022, p7, https://repositorio.cepal.org/bitstream/handle/11362/47856/1/S2200199_en.pdf .

Global Taskforce of Local and Regional Governments, UNDP, and UN-Habitat, Roadmap for Localising the SDGs: Implementation and Monitoring at Subnational Level, Barcelona, 2016, https://sustainabledevelopment.un.org/content/documents/commitments/818_11195_commitment_ROADMAP%20LOCALISING%20SDGS.pdf

IDFC, Blended Finance: A Brief Overview, October 2019, https://www.idfc.org/wp-content/uploads/2019/10/blended-finance-a-brief-overview-october-2019_final.pdf.

NITI Aayog, United States Agency for International Development (USAID) and SAMRIDH Healthcare Blended Finance Facility. Reimagining Healthcare in India through Blended Finance, 2022, para 5, p. 4, https://www.niti.gov.in/sites/default/files/2022-02/AIM-NITI-IPE-whitepaper-on-Blended-Financing.pdf.

OECD, Amounts mobilised from the private sector by official development finance interventions in 2018-19– Highlights, Paris, August 2021, https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/mobilisation.htm.

United Nations (UN), Inter-agency Task Force on Financing for Development, Financing for Sustainable Development Report 2019, New York, 2019, para 2, p. 88, https://developmentfinance.un.org/fsdr2019 .

United Nations (UN), Inter-agency Task Force on Financing for Development, Financing for Sustainable Development Report 2021, New York, 2021, para 2, p. 89 https://developmentfinance.un.org/sites/developmentfinance.un.org/files/FSDR_2021.pdf

United Nations (UN), Inter-agency Task Force on Financing for Development, Financing for Sustainable Development Report 2022, New York, 2022, para 2, p. 85 https://developmentfinance.un.org/fsdr2022

United Nations, Working Together: Integration, Institutions and the Sustainable Development Goals, World Public Sector Report 2018, UN, New York, 2018, https://publicadministration.un.org/publications/content/PDFs/World%20Public%20Sector%20Report2018.pdf

United Nations Conference on Trade and Development (UNCTAD), World Investment Report 2014, Investing in the SDGs: An Action Plan, New York and Geneva, 2014, para 2, p. 140 https://unctad.org/system/files/official-document/wir2014_en.pdf

United Nations Conference on Trade and Development (UNCTAD), Scaling up Finance for the Sustainable Development Goals: Experimenting with Models of Multilateral Development Banking, New York and Geneva, 2018, https://unctad.org/system/files/official-document/gdsecidc2017d4_en.pdf

United Nations Conference on Trade and Development (UNCTAD), Financing for development: Mobilizing sustainable development finance beyond COVID-19, New York and Geneva, 2022. https://unctad.org/system/files/official-document/tdb_efd5d2_en.pdf

UNDP and World Bank Group, Transitioning from the MDGs to the SDGs, New York and Washington, 2016, https://www.undp.org/sites/g/files/zskgke326/files/publications/Transitioning%20from%20the%20MDGs%20to%20the%20SDGs.pdf

UN General Assembly (UNGA), Transforming our world: the 2030 Agenda for Sustainable Development (A/RES/70/1), 21 October 2015, para. 45, https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf

- He was with Research and Information System for Developing Countries till February 2022 ↑

- Official Development Finance (ODF) is measured as the inflow of resources to recipient countries and it includes i) bilateral official development assistance (ODA), ii) grants and concessional and non-concessional development lending by multilateral financial institutions, and iii) Other Official Flows for development purposes (including refinancing Loans) which have too low a Grant Element to qualify as ODA (OECD). ↑

- Official development assistance (ODA) flows to countries and territories on the DAC List of ODA Recipients and to multilateral development institutions are i. provided by official agencies, including state and local governments, or by their executive agencies; and ii. Concessional (i.e. grants and soft loans) and administered with the promotion of the economic development and welfare of developing countries as the main objective. (OECD) ↑