The Group of 20 (G20) countries are experiencing or starting to experience the impacts of demographic change on their economies. The reduced working population in the G20’s aging societies necessitates a social transition to maintain labor productivity and fiscal sustainability. Given this situation, this policy brief recommends four proposals to tackle the demographic challenges on the economy: 1) improve productivity through enhanced labor participation and investment in human capital; 2) Invest in education to prepare future generations; 3) strengthen fiscal frameworks to prepare young societies to deal with the demographic transition; and 4) develop comprehensive reform for public pension and healthcare schemes in the light of demographic changes.

Challenge

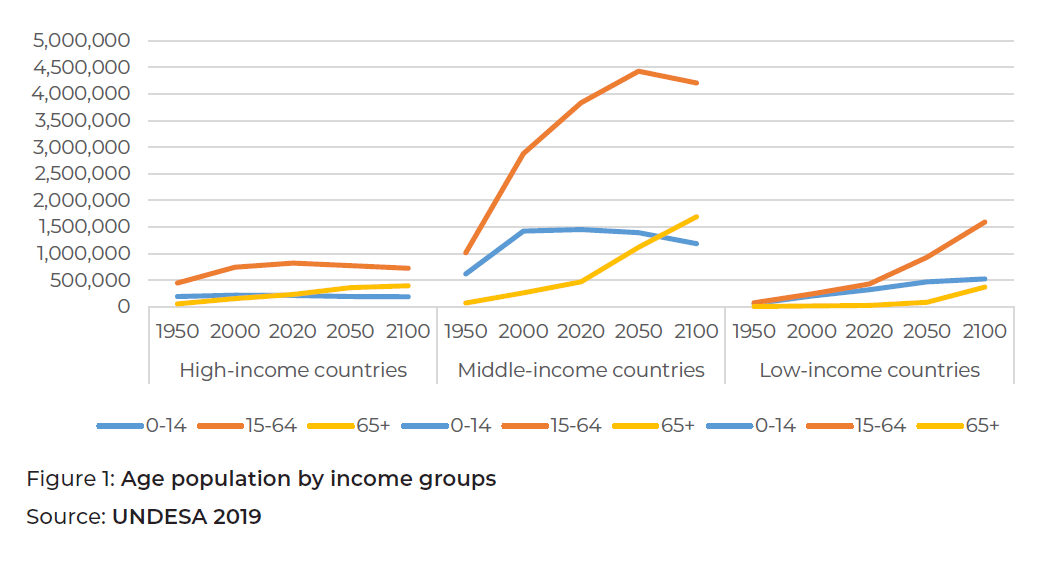

Demographic change is a critical issue that affects the social and economic aspects of global societies. A reduction in the working population in aging societies requires a social transition. This includes greater female labor participation, effective labor migration, and skill development and knowledge enhancement for youths to maintain labor productivity. The United Nations (UN) Department of Economics and Social Affairs (UNDESA 2019) demonstrated the demographic challenges that will arise in the next 30 years. The working population will decrease in high-income and middle-income economies, while low-income economies will experience steady growth in the working population (see Figure 1).

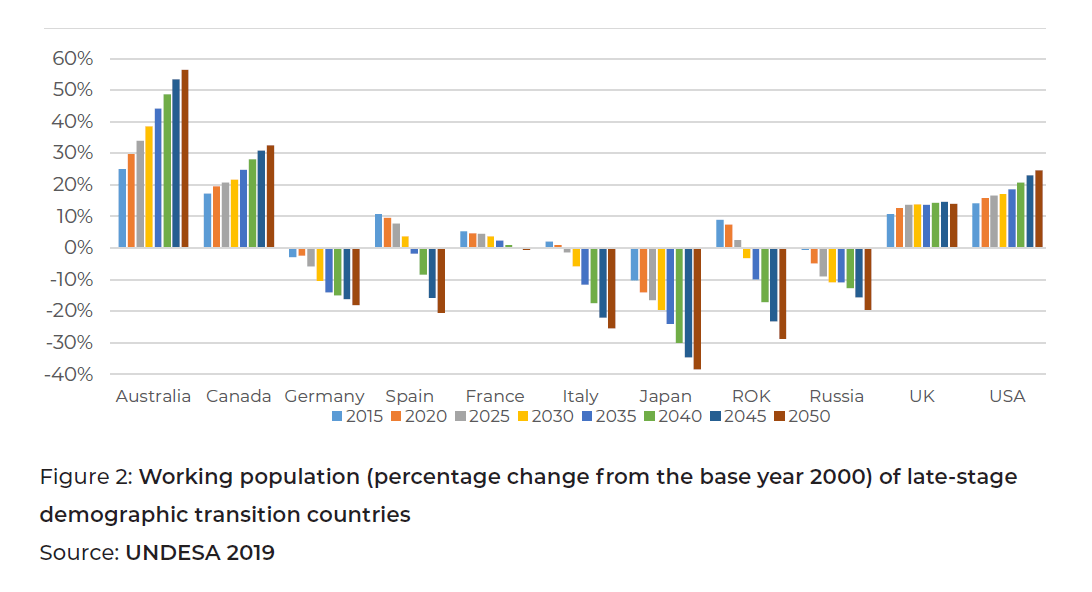

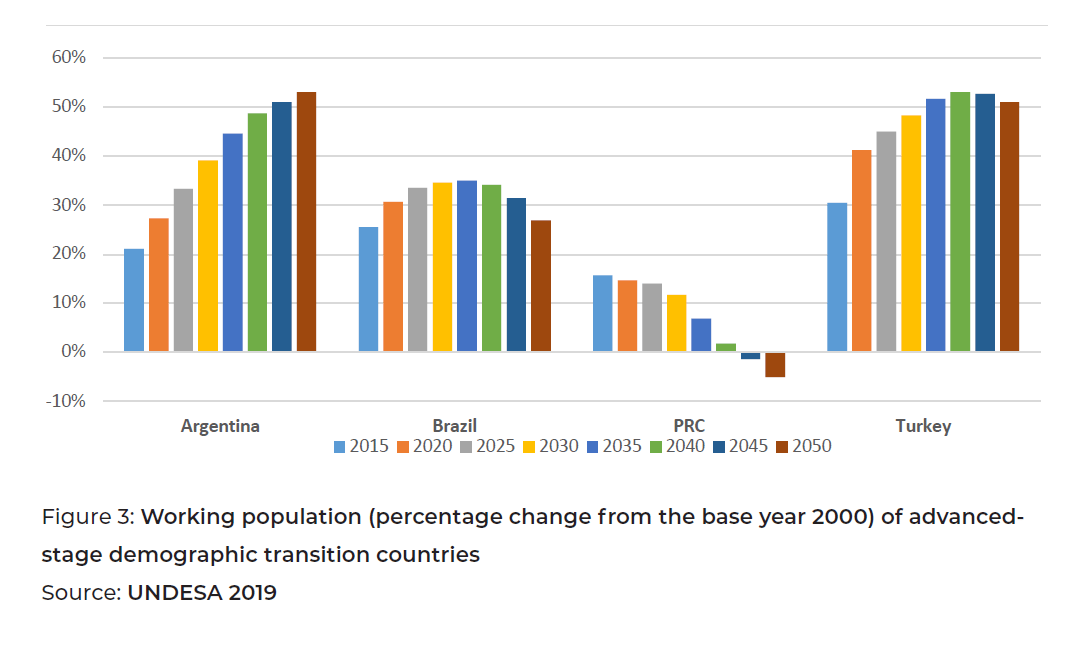

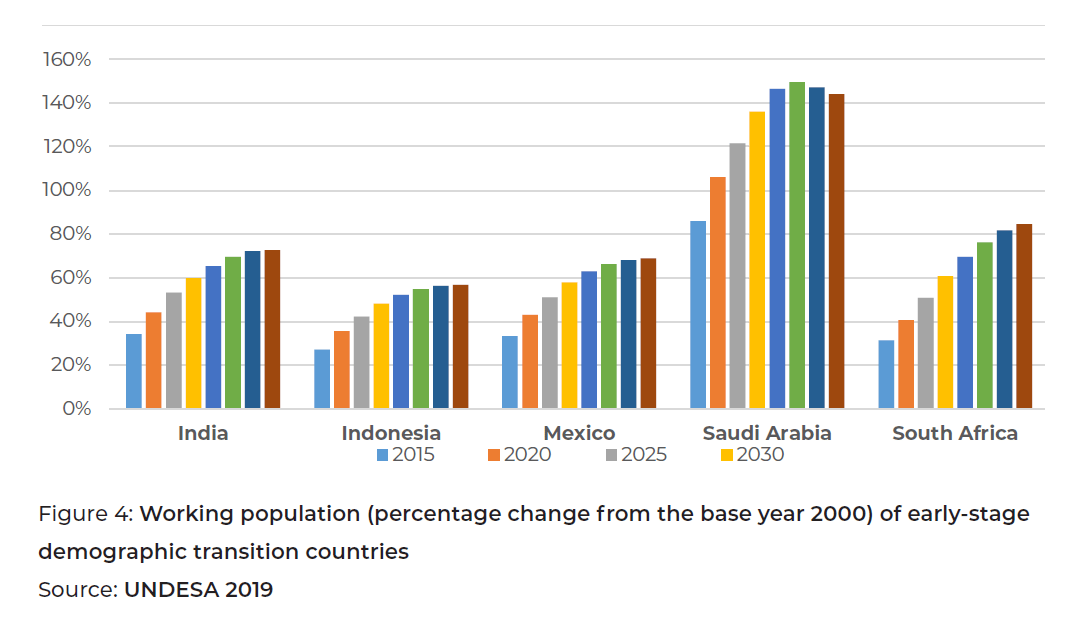

In light of this challenge, many economies in the G20 have been experiencing or have started to experience the impacts. IMF (2019) categorizes the G20 economies into three groups according to the stages of demographic transition: late stage of demographic transition, advanced stage of demographic transition, and early stage of demographic transition. Figure 2 and Figure 3 illustrate that many economies in the G20 have entered the aged/aging status since 2000. However, some G20 members with a younger population still reap demographic benefits as their working population increases (see Figure 4).

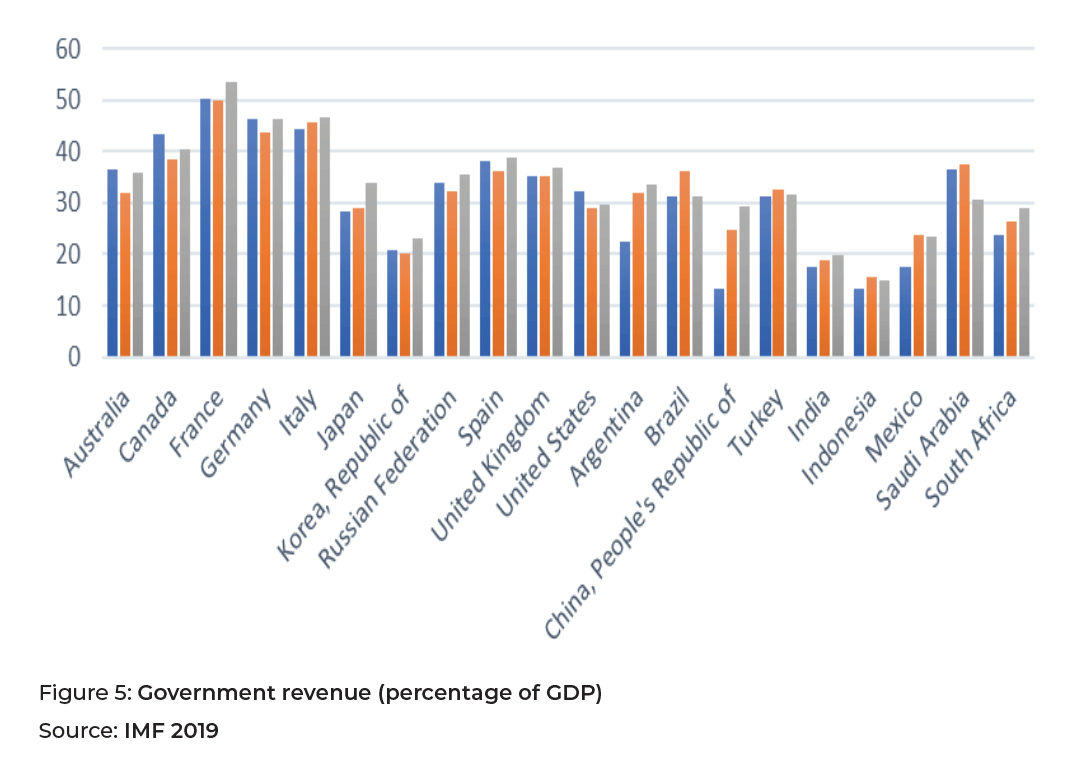

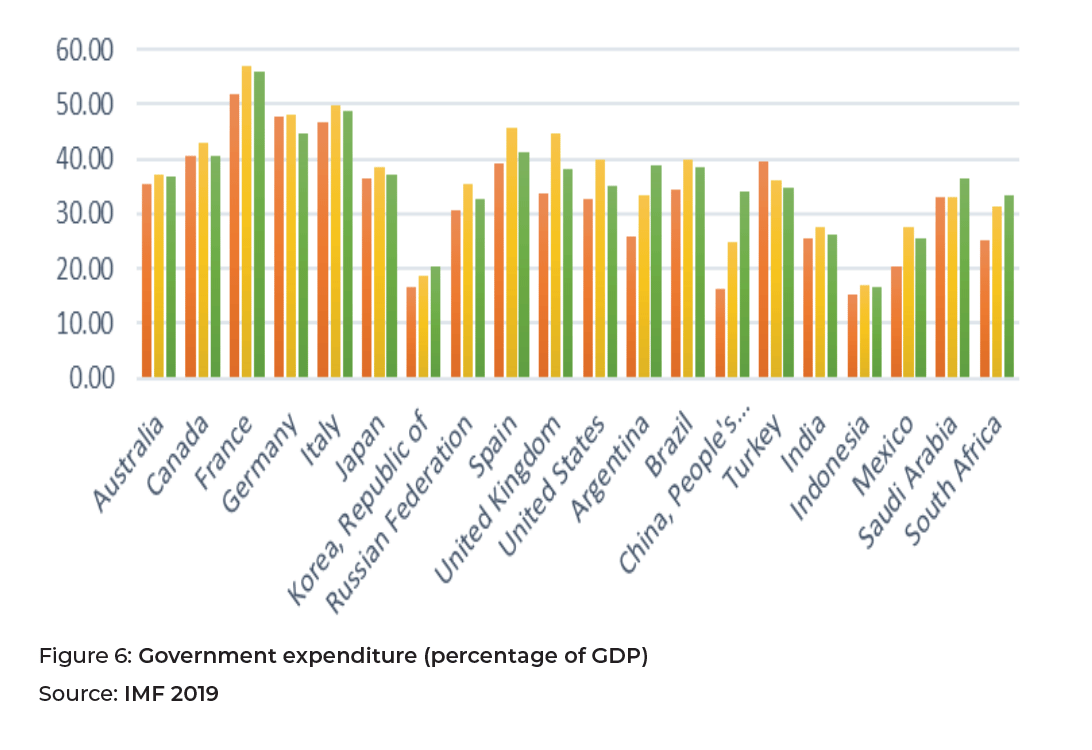

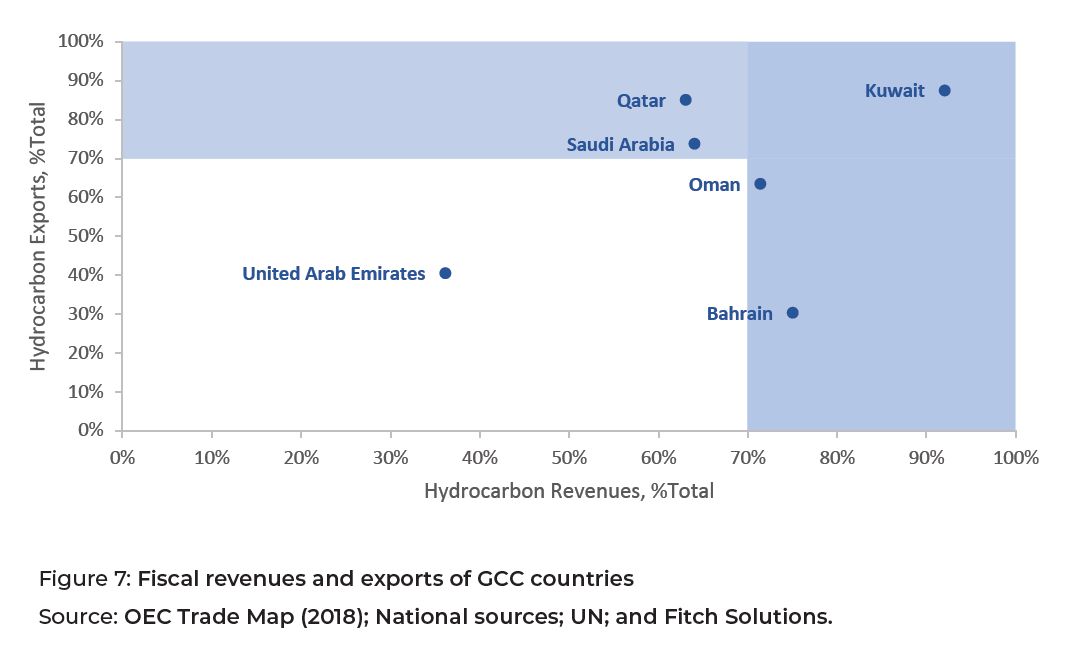

Although population aging has multifaceted impacts on an economy, the main challenge is how to balance fiscal revenue against increasing fiscal burdens from social security and pension systems and rising healthcare expenditures. Figures 5 and 6 illustrate the ratio of government revenue and government expenditure as a percentage of gross domestic product (GDP), respectively. Although most G20 member countries gained an increase in government revenue, many experienced a rise in government expenditure during this time. For Gulf Cooperation Council (GCC) countries, government revenue is closely tied to oil export revenue and is sensitive to external shocks. This is evident in the 2020 oil supply shock in conjunction with a contraction in global demand due to the COVID-19 pandemic. Figure 7 illustrates the GCC countries’ sensitivity to oil revenue as a percentage of exports and total government revenues.

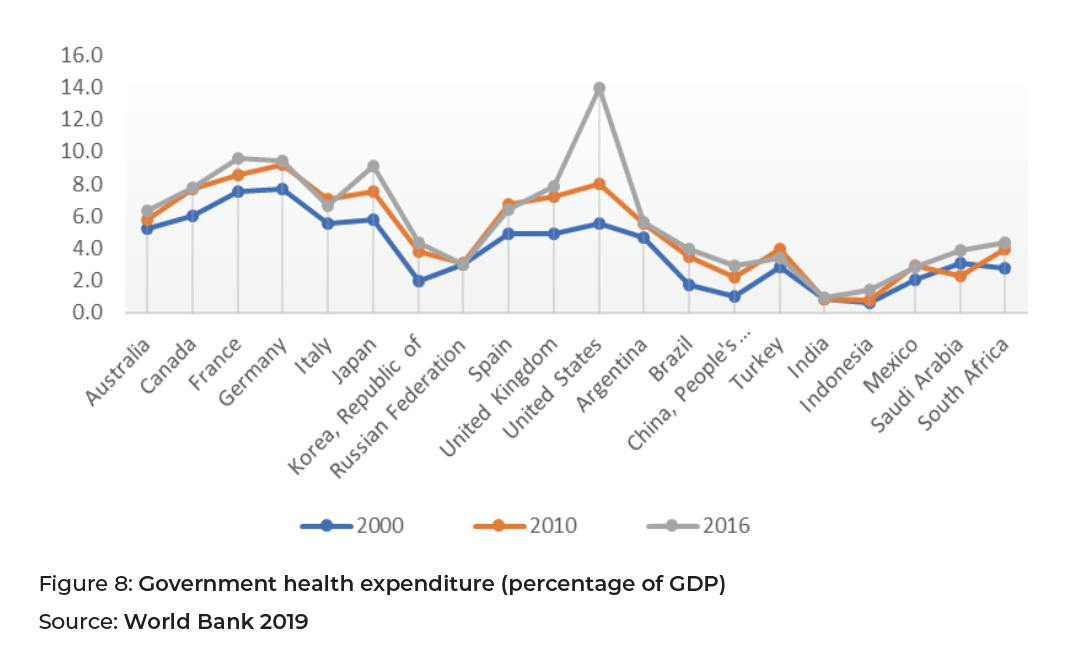

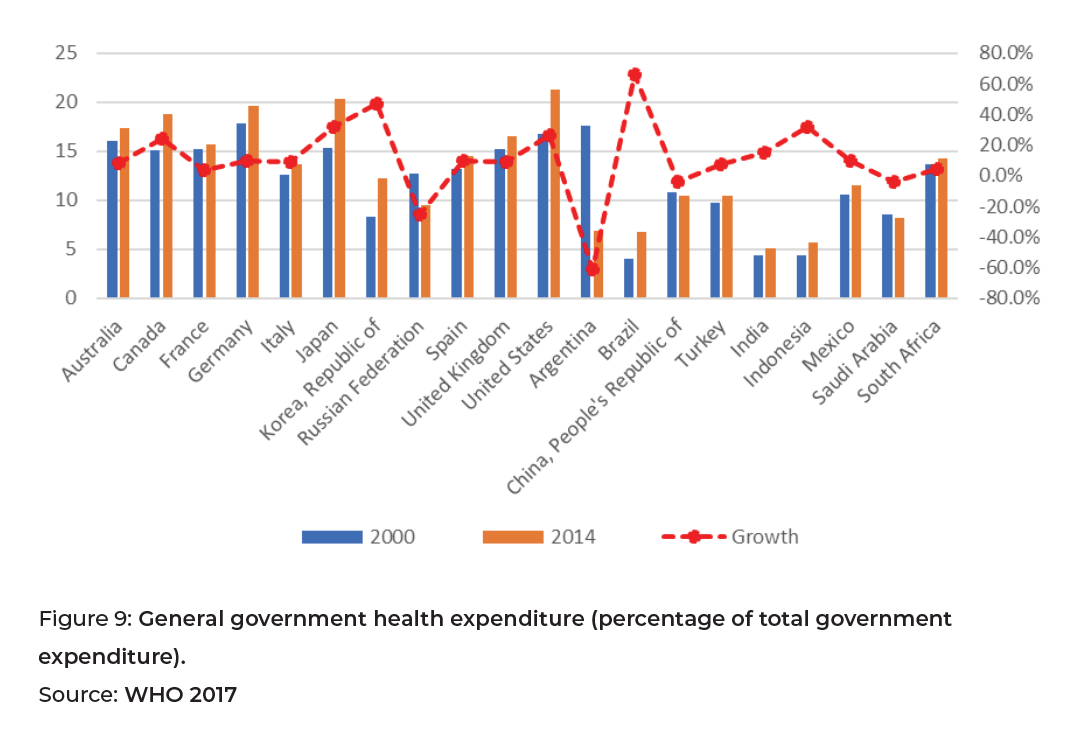

Figure 8 illustrates the government health expenditure as a percentage of GDP in the G20 member countries. An increasing trend was observed in most G20 countries, while Figure 9 presents the growth of government health expenditure as a percentage of total government expenditure in many G20 countries.

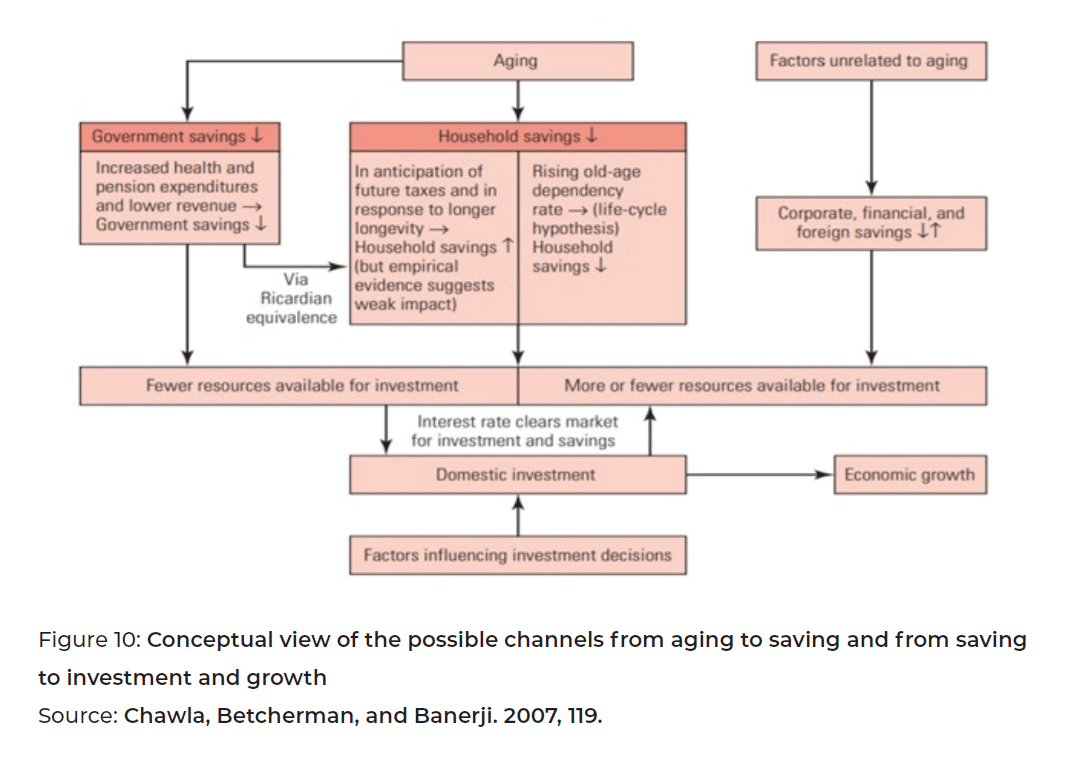

Different economic and financial implications are derived based on varied savings and investment behaviors due to the stage of demographic transition. Figure 10 explains the relationships between demographic changes, the balance of payments, savings, investments, and growth. Once a society becomes aging, there is a tendency for household savings to reduce and for government savings to fall due to an increase in health and pension expenditures. This could impact total domestic consumption as the aging population increases, and thus, possibly slowdown investment and productivity growth.

The different stages of demographic change across the G20 economies require a set of customized policy frameworks tailored to specific characteristics of each group to ensure and manage the fiscal sustainability. The global challenge of COVID-19 and subsequent economic contraction will, in many ways, aggravate the challenge to promote fiscal sustainability in a time of demographic change. The most nuanced analyses of the economic, social, and political impacts can be found within the Think 20 (T20) COVID-19 taskforce policy papers. G20 members can look to the policy approaches of other countries to address the challenge of an aging population, while also looking to promote economically feasible approaches.

Proposal

To address and prepare for the impacts of demographic change, four policy recommendations are proposed based on the different stages of demographic transition in G20 members to ensure fiscal sustainability.

Improve Productivity

To maximize potential gains from demographic dividends and mitigate the possible impact from a shrinking working population, productivity must be raised. Two main approaches are proposed to boost economic productivity. The first approach involves enhancing labor participation in the labor market. This can be achieved through labor market reform measures, including an increase in female participation, the extension of the retirement age, and accommodative migration policies for demanded-skill shortages. The second approach includes investing in human capital and education for a quality labor force or higher labor productivity. Lifelong education and training programs should be offered to working and aging populations to overcome the barriers to productivity caused by innovation and rapid technological advances.

Boosting labor force participation and productivity also includes increasing access to financial services, so that wages can be used in a broader sense for national economic growth.

In Saudi Arabia, the potential of increasing female labor force participation and female access to financial products can have a large effect on long-term financial stability and planning for lower and middle-income families. Vision 2030 has a direct target of increasing homeownership to 70% among citizens. The mortgage industry is growing in Saudi Arabia, and with it, more young people will have to access loans to buy their first homes. According to a report on financial inclusion by the King Khalid Foundation, nearly 7 million Saudis do not have bank accounts, and women make up 60% of the “unbanked” population (2018). The acceleration of women’s employment may be a key factor that will increase first home purchases for young Saudis. Working women will expand the market size of potential mortgage borrowers, either on their own or as part of dual-income families. As more women are employed, they qualify for loans, and they create demand for new financial products, such as mortgages, which strengthens the position of local banks listed on the Saudi stock exchange, Tadawul. Bank stocks on the Tadawul are also strengthened by incoming foreign investment as a result of emerging market index inclusion. Social policies that target women’s economic empowerment (employment and access to financial products) can also be a powerful growth multiplier. According to projections by HSBC (Aybek 2019), there is the potential for USD $150 billion of growth in mortgage loans in Saudi Arabia over the next five years, and as much as USD $78 billion could come from first-time buyers, with women accounting for as much as 40% of first-time buyers.

Sometimes the “sweet spot” in economic development policy requires simple policy adjustments, which in turn, create noticeable impacts. World Bank economists, Elena Ianchovichina and Danny Leipziger, argue for combining gender-enhanced growth diagnostics to identify solutions based on policies that are good for women’s economic empowerment (2019). These will simultaneously create positive growth effects in the overall economy. There is often a misinformed bias that policies that remove obstacles to women’s participation in the labor market will harm their male counterparts. However, there is a body of literature that disproves this and demonstrates the positive gains at both the household and country levels.

Invest in Education

Achieving economic growth requires investment in formal and technical education to prepare future generations for work. Investing in youths with a focus on productivity, entrepreneurship, and innovation will be key to job creation. In GCC countries, many strategic visions speak to the commitment to education in relation to job growth. They focus on the need for diversified economic growth and educational opportunities in both classroom settings and on-the-job internships. It is important to ensure that the education system is closely aligned with the skills that future workers will need to be successful in the future job market.

Crucial skills required for the future labor market include: i) critical thinking; ii) emotional intelligence; and iii) flexibility. While many parts of the world still focus on teaching to prepare youths to pass an exam, a greater emphasis on “soft skills” is required. Critical thinking and emotional intelligence will be necessary as jobs that require these skills are much less susceptible to automation (Barbieri et al. 2019). Flexibility and adaptability will become more important for future workers as workers are predicted to not only change jobs more often but also change careers much more frequently than in the current labor environment (Gallup 2017). It is important, therefore, to introduce these three skills as early as possible in the education system. In the COVID-19 era, communities around the globe are struggling to find ways to adapt to education at a distance, and the T20 COVID-19 taskforce provides a wealth of views on how to move from the present challenges to building education systems that can prepare youths for the workforce.

In 2018, Saudi Arabia introduced philosophy into its secondary education system, which is an attempt to nurture the critical thinking aspects of its population from an early age. This is compatible with the Saudi Vision 2030 goal of transitioning to a knowledge economy, which reaps the economic benefits of a highly educated workforce. Oman also seeks this transition in its Vision 2040. This is a step in the right direction in a region where education is often regarded as overly focused on rote learning (Oxford Business Group 2018), which will not prepare students adequately for the future labor market. Emotional intelligence and flexibility are soft skills that are more difficult to nurture, but education systems need to be devised in ways to introduce these concepts into national curricula. A focus on group learning and teamwork over rote learning and standardized testing could go a long way to improving these skills, and adequately prepare youths for the future of work.

Strengthen Fiscal Framework

Given the implications of demographic changes on fiscal sustainability, G20 governments must strengthen fiscal frameworks in response to or in preparation for possible impacts caused by population aging in both the short- and medium-term. In principle, how countries address the demographic impacts depends on the fiscal space available to implement their government revenues and benefit programs. This task will be especially important as the international community seeks to find ways to stabilize markets and create options for reconstruction in the post-COVID-19 era. Social behavior and its values of redistribution and intergenerational equity are also a factor in the context of financing individual and family consumption, particularly in older age (UNDESA 2019).

Tax systems should be modified to compensate for fiscal imbalances while not putting too much burden on the taxpayers. Generally, tax revenue is closely linked to employment, and declining employment rates can put pressure on public finance. According to the Organisation for Economic Co-operation and Development (OECD 2019), to cope with increasing pensions, healthcare costs, and other expenditures, tax revenue would have to increase by between 4.5% to 11.5% of GDP by 2060 to keep debt at current levels in G20 countries. A tax system should be designed to finance additional older age spending and manage any shortfalls in revenue while ensuring a fair burden-sharing across generations. Proposals are made for increasing tax revenue through raising the effective retirement age and enhancing the labor force via female participation, adjusting benefits, or increasing other (tax or non-tax) public revenues. Implementation of these measures could balance the fiscal budget and may also alleviate adverse macroeconomic impacts of population aging.

One option is to shift from individual income tax to consumption taxes. Income tax is usually levied on the working population base while consumption taxes, such as VAT, have a larger base of population/taxpayers, which entails fewer negative-side effects. Japan, for example, has imposed a 10% VAT since September 2019, up from 8%. Additionally, a promotion toward environmental taxation, including carbon taxes, could raise substantial government revenue without compromising efficiency. For example, countries could consider imposing taxes to price carbon emissions on transport. An idea of reviewing inheritance taxes has also been introduced, not only to improve government revenue but also to mitigate income and wealth inequality.

For economies with a younger population, creating fiscal space in preparation for the impact of population aging on their fiscal balance is necessary. This can be achieved by improving the revenue-generating capacity of tax and social security systems. To enhance this capacity of tax, enhancing formality will help improve the tax base; for example, avoiding high labor tax rates on low-paid workers and incentivizing workers to join the formal sector. Together, improvements in tax administration with targeted audits, user-friendly/digital registration, and the use of indirect methods to ascertain tax liability will lead to higher tax revenues (OECD 2019).

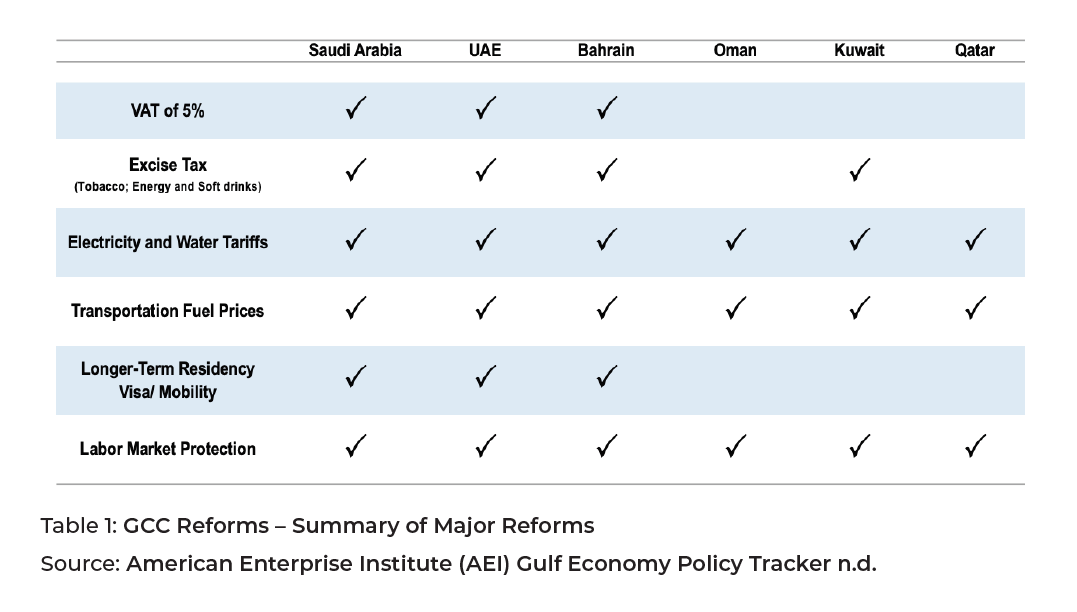

In economies, such as Saudi Arabia, which are attempting to diversify from hydrocarbon reliance, the fiscal balance will require alternative sources of government revenue. Simultaneously boosting private sector productivity and growth will require human capital investment and access to finance, and legal institutions that allow entrepreneurs and firms to fail and try again. Across the GCC countries, since 2015, we have seen movement on the implementation of a value-added tax of 5%; the reduction of energy, fuel, and water subsidies; and new excise taxes (Young 2019; see table 1). Simultaneously, GCC governments have expanded protections for nationals within the labor market. They have secured jobs in certain sectors for citizens only, while expanding some provisions of immigration policy to attract highly skilled workers and potential investors.

Additionally, public spending should be reviewed and improved in a way to stabilize public debt and ensure efficiency. Reducing and removing regressive expenditures, such as VAT exemptions, are proposed. Priority should be placed to either cut or eliminate inefficient government expenditures. These include public subsidies that do not bring in economic or social benefits, growth, and inclusiveness. There is no one bullet solution for tax design. The tax system should be designed and customized subject to each economy’s characteristics and demographic stage. Some changes in tax design may have more impact and be more politically feasible if done earlier than later (OECD 2019). Although some G20 members have not yet reached the stage of rapid aging/aged population, early tax reforms can help to prepare the countries for possible fiscal pressures. Consequently, economies with younger populations should expand fiscal space by establishing effective tax systems and a thorough review of public spending.

Comprehensive Reform of Public Pension, Social Security, and Healthcare Schemes

A comprehensive reform of public pensions, social security, and healthcare schemes is required to address the short- and medium-term impact on fiscal sustainability as well as the long-term impact on worker welfare after retirement. More importantly, the design of pension schemes needs to address the triple challenges of ensuring fiscal sustainability, providing adequate incomes in retirement, and guaranteeing intergenerational fairness (OECD 2019). For comprehensive reform, many parameters of public pension design should be included. These include contribution periods and rates, benefits packages and coverages, replacement rates, flexibility to combine work and pensions, and pension-scheme options. Complex modeling to compute appropriate levels of contribution and compulsory government subsidy should be developed, and macroeconomic indexation can be considered, among other options. In addition, considering possible demographic impacts, governments may want to consider indexing the statutory age at retirement by socioeconomic status. As mentioned, raising the effective retirement age as life expectancy increases can promote fiscal sustainability, not just by expanding the government revenue base, but also by widening the period of contribution for retirement pension systems. The better-educated and higher-income groups that enjoy longer life expectancy can expect to pay contributions and receive pensions later, compared to the less educated and lower-income populations.

To avoid an excessive burden on younger generations, effective pension contribution rates should be computed along with promoting private savings to ensure wealth at retirement age. To manage longevity risks, public pension systems should adopt timely information on mortality and life expectancy to determine appropriate rates of contribution. A comprehensive evaluation of demographic developments and pension schemes can help governments manage public finances more effectively. Moreover, many approaches are proposed to incentivize individuals to save more to avoid poverty or guarantee wealth at old age and manage risk in private saving schemes. Automatic enrollment systems tend to be an efficient option to enhance participation, where individuals are automatically signed up to a pension plan but have the flexibility of opting out. Employers are, however, required to contribute to make this system work. Financial incentives are also important to minimize opt-out rates. Tax incentives and government subsidies, such as matching contributions or fixed nominal subsidies, can also help boost participation in retirement savings. Another proposal should include the annuitization of accumulated assets for the pay-out phase during retirement age. This can help limit longevity risks, particularly if individuals rely intensively on those assets to finance their retirement.

Additionally, according to SDG 3, promoting lifelong health and preventive care to maintain the maximum functional capacity of individuals can improve health and well-being. An idea of healthy aging can indirectly improve fiscal sustainability by containing healthcare costs in government expenditure. Promoting healthier lifestyles is required within and beyond the health sector. For example, adjusting lifestyles toward physical and cognitive exercise as well as providing equitable access to disease prevention, treatment, and rehabilitation for all stages of life. Other policies can be implemented to prevent harmful activities to health or associated illness, such as alcohol prevention policies via taxation and other regulations. Furthermore, health and long-term care systems should be aligned to provide age-appropriate integrated care and maintain the intrinsic capacity of aged/aging populations.

Younger economies should consider these proposed measures that are appropriate for their demographic stage and socioeconomic status by tailoring their policy design for their social security and pension systems. The customized policy framework will balance both the need to support the vulnerable and fiscal sustainability in the future.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

American Enterprise Institute (AEI). n.d. Gulf Economic Policy Tracker, Database.

Accessed February 20, 2020. https://www.aei.org/multimedia/gulf-economic-policy-tracker.

Barbieri, Laura, Chiara Mussida, Mariacristina Piva, and Marco Vivarelli. 2019. “Testing

the Employment Impact of Automation, Robots, and AI: A Survey and Some Methodological

Issues.” Accessed December 12, 2019. http://ftp.iza.org/dp12612.pdf.

Chawla, Mukesh, Gordon Betcherman, and Arup Banerji. 2007. “From Red to Grey:

The Third Transition of Aging Populations in Eastern Europe and Former Soviet

Union.” Washington, DC: World Bank Publication.

Gallup. 2017. “How Millennials Want to Work and Live.” Accessed January 8, 2020.

https://www.gallup.com/workplace/238073/millennials-work-live.aspx.

Ianchovichina, Elena, and Danny Leipziger. 2019. “Combining Growth and Gender

Diagnostics for the Benefit of Both.” Policy Research Working Paper No. 8847. Washington,

DC: World Bank. Accessed February 20, 2020. https://openknowledge.worldbank.org/handle/10986/31672.

International Monetary Fund. 2019. “Fiscal Monitors (October 2019).” DataMapper,

IMF. Accessed February 10, 2020. https://www.imf.org/external/datamapper/datasets/FM/1.

Islamov, Aybek. 2019. “Age of Mortgage.” HSBC Global Research. CFAKing Khalid

Foundation. 2018. “Financial Inclusion in Saudi Arabia: Reaching the Financially

Excluded.” Accessed February 20, 2020. https://kkf.org.sa/media/ipuh5olx/2-financial-inclusion-in-saudi-arabia-2018.pdf.

Organisation for Economic Co-operation and Development (OECD). 2019. “Fiscal

Challenges and Inclusive Growth in Ageing Societies, Paris.” Accessed February 3,

2020. https://www.mof.go.jp/english/international_policy/convention/g20/annex3_2.pdf.

Organization of Economic Complexity (OEC), “Export Data” for six GCC states, (2018),

accessed August 17, 2020.

https://oec.world/en/visualize/tree_map/hs92/export/bhr/all/show/2018.

https://oec.world/en/visualize/tree_map/hs92/export/kwt/all/show/2018.

https://oec.world/en/visualize/tree_map/hs92/export/omn/all/show/2018.

https://oec.world/en/visualize/tree_map/hs92/export/qat/all/show/2018.

https://oec.world/en/visualize/tree_map/hs92/export/sau/all/show/2018.

https://oec.world/en/visualize/tree_map/hs92/export/are/all/show/2018.

Oxford Business Group. 2018. The Report: Saudi Arabia, 2018. Accessed June 25, 2019.

https://oxfordbusinessgroup.com/saudi-arabia-2018.

United Nations Department of Economics and Social Affairs (UNDESA), Population

Division. n.d. “World Population Prospects 2019.” Accessed February 10, 2020. https://population.un.org/wpp/Download/Standard/Population.

United Nations Department of Economics and Social Affairs (UNDESA), Population

Division. 2019. “World Population Ageing 2019: Highlights.” New York: United Nations

Publications. Accessed February 10, 2020. https://www.un.org/en/development/desa/population/publications/pdf/ageing/WorldPopulationAgeing2019-Highlights.pdf.

World Bank. 2019. “Current Health Expenditure (percent of GDP).” World Bank Open

Data. Accessed February 10, 2020. https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS.

World Health Organization. 2017. “Current Expenditure on Health by General Government

and Compulsory Schemes (Percent of Current Expenditure On Health).” Global

Health Observatory data repository. Accessed February 10, 2020. https://apps.who.int/gho/data/view.main.HS05v?lang=en.

Young, Karen E. 2019 “Mapping Economic Diversification Across the GCC.” American

Enterprise Institute, Policy Paper, September 2019. https://www.aei.org/research-products/report/mapping-economic-diversification-across-the-gulf-cooperation-council.