Challenge

Proposal

Money laundering, terrorist financing and corruption have been a constant presence on the G20 agenda since the first summit in Washington DC in 2008. Leaders recognised that laundering the proceeds of crime and terrorist funds was a global phenomenon that required a concerted collaborative response. It estimated that between 3% and 5% of global gross domestic product is laundered annually, or between $800 trillion and $1.5 trillion.

This allows organised criminal networks, corrupt politicians, terrorists and war criminals to continue to traffic drugs, humans, wildlife and arms and to commit atrocities that harm human lives, economic growth, development, peace and security.

Conclusions

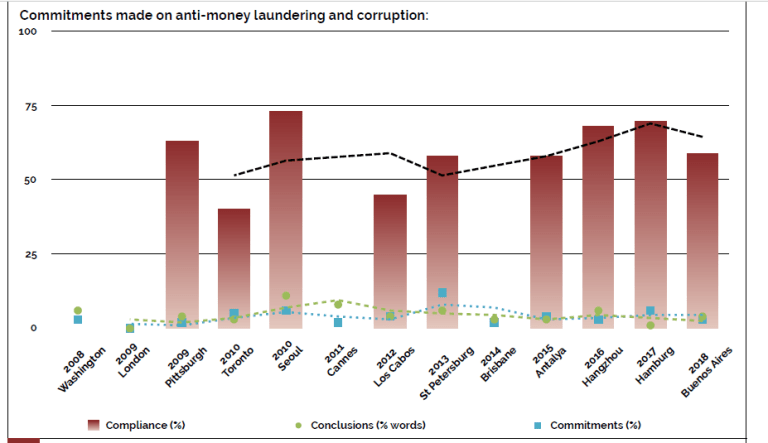

Since the Washington Summit, leaders have continued to set the global agenda, tasking international bodies, particularly the Financial Action Task Force (FATF), the International Monetary Fund and the World Bank, and other multilateral organisations, to lead efforts in developing measures to fight money laundering, terrorist financing and corruption. Words associated with anti-money laundering, combating the financing of terrorism, crime and corruption have been referenced at G20 summits more than 8,500 times for an average of 5% per summit. More than 100 paragraphs have been dedicated to these issues, appearing in 25 documents.

AML/CFT (anti-money laundering and countering financing of terrorism) and corruption featured most prominently

at the 2010 Seoul Summit with 1,799 words, followed by the 2013 St Petersburg Summit with 1,779 words, 2011 Cannes Summit with 1,143 words and the 2016 Hangzhou Summit with 896 words. The Seoul Summit focused especially on developing a global anti-corruption response through the Anti-Corruption Action Plan and initiatives on politically exposed persons, such as denial of entry of corrupt politicians, mutual legal assistance for asset recovery, public-sector transparency and the development of public-private partnerships.

The 2011 Cannes Summit continued to support the work of the Anti-Corruption Working Group, also focusing on tax evasion and addressing the need to tackle transparency in beneficial ownership of corporate structures. In 2013, the St Petersburg Summit placed special attention to tax crimes and renewed focus on bribery and corruption.

The 2016 Hangzhou Summit highlighted the need to step up measures to combat corruption, through corporate and public-sector transparency and asset recovery via the World Bank’s Stolen Asset Recovery Initiative. It also addressed unintended consequences of complying with measures on anti-money laundering and countering terrorist financing, such as de-risking in correspondent banking and remittance issuers.

Commitments

Since 2008, G20 leaders have made 115 commitments on anti-money laundering and corruption. There were three each at Washington in 2008, Pittsburgh in 2009 and Toronto in 2010. This number tripled to nine at the 2010 Seoul Summit, decreased to five at Cannes in 2011, and increased to seven at Los Cabos in 2012. There was a peak of 33 commitments made at St Petersburg in 2013. The number plunged to four each at the 2014 Brisbane and 2015 Antalya summits, and increased to seven at Hangzhou in 2016. It soared to 32 at Hamburg in 2017 and dropped to five at Buenos Aires in 2018.

Compliance

The G20 Research Group has assessed nine of these 115 commitments for compliance by G20 members. It found average compliance of 60%. The highest compliance came from the United Kingdom, European Union, Brazil and Canada. The lowest compliance came from Japan, Saudi Arabia and Turkey.

Corrections

To increase this low level of compliance, G20 leaders can consider including several catalysts – text embedded in the commitment that provides direction for its implementation. They should:

- Continue to refer to the FATF as the global standard-setter in this field;

- Add a one-year timetable to commitments, as with the commitment on virtual assets;

- Encourage innovative ways of linking initiatives on AML/CFT to corruption and to the Sustainable Development Goals as a priority in the G20 agenda, perhaps through the use of new technology;

- Make commitments that are specific, measurable, achievable or attainable, relevant and time-bound (in other words, follow the SMART – specific, measurable, appropriate, realistic, timely – formula); and

- Promote domestic or regional implementation of commitments with the offer of technical assistance to non-G20 countries or FATF-style regional bodies.

Given the FATF’s recently extended mandate, G20 leaders should also highlight that adequate resourcing is key.

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of the Global Solutions Initiative. This article was originally published in G20 Japan: The 2019 Osaka Summit by GT Media Group and the G20 Research Group, 2019. View the original article.