Energy transformation towards 100% renewable energy is economically inevitable, and socially and environmentally desirable, yet it may produce negative signals in outdated statistics as fossil trade diminishes and the sector shrinks. This paradoxon should be addressed in a joint report by, e.g., IRENA, IMF, OECD, andthe World Bank, and the Task Force on Climate-Related Financial Disclosures.

Fossil fuel extraction and commodity trade will end, and fossil asset values erode. The industry’s role in capital formation, international trade, economic activity (GDP), and government revenue will decline. New energy systems, based on efficiency, renewables, storage, and smart management are cheaper to build, run and maintain. Growth of electricity use stimulates innovation, value creation, and growth in consumer rent, as renewable energy technologies harvest free environmental flows that are not traded and often for self-consumption. Total utility will grow while trade, GDP and the tax base may shrink. Reports should inform G20 Leaders, Ministers of Finance and Central Bank Governors on the true costs and benefits, and alert them to misleading signals.

Challenge

The current shift from fossil energy resources to “green” energy — renewable energy plus storage in smart grids, many with electric vehicles providing grid services — is now a global phenomenon (IEA 2016; IRENA 2017b). For economic reasons, this energy transformation (or Energiewende) has become self-sustaining and self-accelerating where it is underway, and self-replicating in an increasing number of countries and regions, including in poor areas or remote locations not served yet by a power grid.

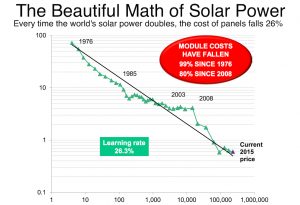

The main reason for this boom in green energy is the decreasing cost for key energy technologies and equipment, especially wind turbines, solar panels (see image below), storage and smart energy management systems. They no longer need the subsidies that in the past helped them mature, and are now able to compete with heavily subsidized fossil and nuclear energy. The cost reductions result from technology learning (Rubin et alii 2015) that is projected to continue for years to come. The costs of fossil energy, by contrast, tend to rise, even before the true costs including external costs are calculated. The currently low-to-medium world market prices for fossil energy commodities cannot hide the trend that with easy-to-access areas already exploited, these resources are getting ever more difficult and expensive to extract and bring to market; costs of extraction are rising while prices fall.

Source: Randall (2016b).

The urgency of climate change and its impacts — global overheating, glaciers melting, extreme weather events, desertification, ocean acidification and sea-level rise leading to flooding of coastal areas and low-land river plains — is increasing. The environmental and social costs of fossil energy use have moved from economics textbooks onto front pages and news channels.

Financial analysts at Trucost conclude that the highest external damages (so-called externalities) are caused by coal-fired power in Eastern Asia and Northern America and are estimated at US$ 453 billion per annum and US$ 317 billion, respectively. These consist of the damage impacts of GHG emissions, health costs and other damage due to air pollution. “In both instances, these social costs exceeded the production value of the sector” (Trucost 2013). An IMF study by Coady et alii (2015) estimated global externalities (and subsidies) to be $5.3 trillion.

Policy-makers are already responding by removing subsidies and privileges for the fossil industries and by placing “a price on carbon” through taxes, emission trading in “carbon markets”, changing liability regimes or (environmental and health) regulation (Burck et alii 2016; Roehrkasten et alii 2016). The overall objective, agreed to in the Paris Agreement, is to make “financial flows consistent with global long-term climate goals” (Obergassel et alii 2016; Hansen et alii 2017). Coordinated action by the G20 (or a majority group in the G20) on carbon pricing and subsidy reform would accelerate the energy transformation, which is in any case inevitable (Kraemer 2016a; Röhrkasten et alii 2016).

The fossil energy industries are reaching the end of their historical cycle and losing their social licence to operate (Carney 2015). Bankruptcies of major coal companies signal a trend that is spreading to the oil and gas industry, a trend that is increasing investor risk in an industry with low prospects of long-term recovery.

The result may be a denial of capital as institutional investors pull out of the industries, as they are being asked to do by activist investors and the growing divestment movement, and as they are being nudged to do by ever more stringent risk-disclosure requirements. The total value of the “fossil bubble” currently being deflated may be as high as $33 trillion (Ryan 2016), much of that on paper only, and much owned by governments or government-owned companies (Cust et alii 2017).

The shrinking of the fossil energy industry overshadows the parallel decline of the much smaller nuclear power industry. Devoid of economic justification, it cannot compete without massive subsidies and privileges, and these are increasingly difficult to hide. This industry will probably not die, but shrink to what it can be without being economically competitive: a military technology with marginal relevance to the energy economy.

In an economically rational world, the overall effect would be simple: in ever larger parts of the world, new investment would go into renewable smart energy, and progressively, capital would be withheld from the fossil and nuclear industries. Industry momentum and other factors explain why some investment is currently still flowing into old energy, but that is likely to be temporary. Because it is based on sound economics, this shift is not only unstoppable but also transformational (Kraemer 2016b).

Energy sector and economic models will reflect this transformational dynamic better once the new realities are factored in (Pollitt & Mercure 2017). Perhaps one day, a new set of economic indicators will be accepted as a more suitable guide to policy evaluation and decision-making (Stiglitz et alii 2009). In the end of a transformation, the winner takes all; essentially, the whole market will shift to renewable energy, similar to the way motor cars replaced horses in transport 100 years ago.

In the short to medium term, investment in the renewable energy sector is likely to increase rapidly, partly displacing investment no longer needed in the fossil and nuclear sectors, partly to reach people in areas not currently served by a power grid (off-grid power). Because of the small investment volumes – with lots starting as low as US$500.00 – the latter might appear in economic statistics as consumptive expenditure by households, but should be regarded as capital investment in long-life energy conversion equipment.

Beneficial as it is, energy transformation may look bad through the lense of the statistics most commonly used to guide economic, fiscal, monetary and trade policy. Therein lies the risk of misguiding policy-makers into protecting the incumbent industries, their privileges and subsidies, and thus to slow down the energy transformation instead of accelerating it for maximum benefit.

Proposal

Implications of the Unstoppable Shift out of Fossil Energy Resources

Impact on Export, Trade and Import of various Resources and Materials

This energy transformation will have significant and potentially disruptive impacts in other areas, notably capital formation and deployment, trade, finance and investment, growth and tax revenue and the ability of companies and countries to service debt. This disruption should be anticipated and prepared for, so that negative effects can be mitigated and risks of contagion can be contained. The disruptions are balanced by a range of obvious benefits resulting from this energy transformation (Jakob & Steckel 2016; Helgenberger & Jänicke 2017). Simply put, there is an ongoing shift from trading chemical energy commodities for consumption to trading durable equipment for the conversion of (kinetic) energy in free environmental flows into electricity.

The old fossil energy systems mine coal and extract oil and gas, which are stocks of preserved energy, from sites where they occur and uses an extensive and expensive global processing and long-distance transport infrastructure to bring derivative products to market for consumption. The energy itself is traded in chemical form as a commodity. Once a site is exhausted of its resources, the industry moves on, progressing from locations that are easy and cheap to work on to those that are more difficult and expensive. Although technical innovation may obscure it at times, the operational costs of the fossil energy system rise over time (Lovins et alii 2005; summarized and updated in Lovins 2012).

In contrast, the new renewable energy systems harvest environmental flow resources, which are near ubiquitous so that the energy, often in the physical form of electricity, does not have to be transported over long distances. Many technologies are suitable for deployment at small-scale, which creates the option of self-supply for many users, which then produce the energy they consume and become “prosumers”. In such cases, the energy itself is no longer traded. Once a site has been developed for harvesting renewable energy flows, it can be used theoretically in perpetuity, even if physical structures and equipment must be replaced from time to time in practice. In consequence, the new energy systems tend to get cheaper over time, especially as equipment prices fall.

Overall, this results in lower trade volumes, both in total and in terms of international trade. The main fossil energy producing countries will have declining exports, and the importing countries will save on their fossil energy import bill. This overall phenomenon can be broken down into three components:

- Substitution effect: Import substitution can result from fracking for fossil oil and methane gas (in North America) or, more importantly, from the growth of renewables (everywhere), where new technologies reduce the market share of fossil fuels;

- Quantity effect: in consequence, the volume (or mass) of internationally traded fossil energy commodities declines;

- Price effect: with lower demand and thus increased competition in the fossil energy industries, the revenue per unit of volume or mass declines; the value of trade declines faster than the volume of trade. This combines with rising costs of extraction to erode profits even faster.

These three components will persist because they are underpinned by changes in the economics of energy systems, which have resulted in renewable energy being cheaper than fossil (or nuclear) energy (Randall 2016a+b; Sussams & Leaton 2017). The old and the new energy systems still require large capital investment in infrastructure and equipment, but the composition of raw materials used is likely to change over time (cf. Angerer et alii 2016). Even if technologies evolve and the long-term evolution of the energy system is uncertain, one can surmise that there may be a shift from ferrous metals that dominate the manufacture of equipment for coal, oil and fossil methane industries to more non-ferrous metals and other elements used in to manufacture renewable energy, storage and ICT equipment for smart energy systems.

The decline of the fossil energy industry will leave behind “stranded assets”, what economists call investments that have become worthless. Some of these are real assets that have been built by the industry, other are merely valuations of fossil energy stocks found in the ground that have made their way into balance sheets before being extracted. In G20, the focus has been on stranded financial assets, and the systemic risks to the world’s financial system caused by the consequences of climate change, and contagion or “domino effects” that could rip through the global markets. The concerns about stranded assets should go beyond financial assets which can be written off, and the resulting insolvencies which can be managed with existing legal and regulatory instruments. Stranded assets also include:

- Stranded industries, which are a well-known consequence from earlier changes in technologies and industrial patterns. Industrial brownfield sites may look ugly, but in populated and especially urban areas imaginative policies can turn them into opportunities. Stranded industries present social, economic and fiscal challenges. When large companies close, unemployment rises, and tax revenue goes down when demand for social services go up.

- Stranded infrastructure, some of it over long distances, is in a class of its own, especially in remote areas. Industrial installations, pipelines, ports, railroads and roads, off-shore platforms or trans-shipment terminals stay behind and the scrap value is often not enough to merit the dismantling of the infrastructure. The blights stay for decades if not forever.

- Stranded legacies are the result of company insolvencies that in effect dump the long-term cost of decommissioning, dismantling, clean-up and reclamation on the state and future tax-payers. The experience in many industries from mining to nuclear power plants shows that the accounting rules and the obligations to make provisions or accruals for legacy costs are not enforced, and that in too many cases the clean-up does not happen.

Some of the stranded assets are in the form of redundant equipment that can be recycled and thus provide materials that otherwise would come from the mining industry. They can be used in the wider economy, including in building the new energy industry, although there will be a need also for new resources in a changing composition to enter the technosphere (Angerer et alii 2016). The current overcapacity in the steel sector is already a concern for investors and even governments, to the point that the G20 leaders meeting in Hangzhou, China, in September 2016 addressed the issue in their final declaration (G20 2016, para. 31).

There may be also significant growth in down-stream trade in renewable energy, including fuels from (renewable) power-to-gas and power-to-liquid conversion processes. There is furthermore a potential for (small or incremental) increases in international trade in electricity and renewable-power-derived fuels, where interconnections exist and temporal, geographic differences in the availability of natural environmental energy flows make such trade advantageous (e.g. Parikh et alii 2017). However, the overall impact of the shift from the old fossil energy to smart renewable systems will lead to the decline and cessation of (bulk) fossil energy commodity trade and a reduction in trade value and volume. These reductions will likely not be compensated by net increases in trade in other raw materials and manufactured goods in the energy sector, although other sectors may grow as a result of the energy transformation and the potential for innovation it provides.

Impact on Investment, the Economy (GDP), Tax Revenue and Subsidies

Furthermore, not only the “total cost of ownership” as the sum of capital costs and operational expenses over the lifetime, but the total capital needs of the new energy system may well be significantly lower than those of the old energy system. “Every time the world’s solar power doubles, the cost of panels falls by 26%” (Randall 2016b), by far above average effect of technology learning (Rubin et alii 2015). This resulted in the phenomenon that global solar investment in 2016 fell by 32% compared to the year before, while the capacity of new installations rose by 20% (BNEF 2017). The corresponding effect for on-shore wind is not as high, but at 19% is still above average. Technology learning in storage technology seems to replicate the downward cost trajectory of solar power (AECOM Australia 2015; Lazard 2016). Judging from the reports about new findings in material research laboratories, it can be assumed that the trend will continue for at least another 5 to 7 years before technology learning may settle at a more average pace.

New configurations of equipment using low-voltage, direct-current (LVDC) technology are not only cheaper to build but also much more energy efficient to run. They can provide low-cost modern and smart energy in areas that are not currently served by the power grid, at a technical complexity like that in motorcycle maintenance and smartphone applications. With such installations mushrooming in rural areas with no grid or unreliable grids, large-scale investment for central power stations and regional or national grids may no longer be required. The investment needs of the new energy system can be shouldered by individual households and microcredit institutions (Vinci et alii 2017).

In consequence, there is a reduced need for central coordination of the electricity system and accordingly a lower need for the deployment of large (aggregated) capital. Indeed, capital formation may shift, at least partly, from large aggregators (e.g. stock markets, funds, governments) to individuals, households, microcredit institutions or mutual savings banks serving local communities (Morris & Jungjohann 2016). The lower overall capital needs of the new energy industry imply reduced opportunities for large capital accumulation and deployment. A Ministerial Roundtable at IRENA’s 7th Assembly in Abu Dhabi on 17 January 2017, discussed ways to improve access to electricity and gain substantial socioeconomic benefits through off-grid renewable energy. The discussion highlighted “the importance of unlocking asset-based financing for rural consumers and levering on microcredit delivery” and “the importance of innovative financing tools, including provision of guarantees for de-risking private sector investments and local currency loans” (IRENA 2017a).

It follows that not only international trade, overall trade, value of the energy system and capital needs decline, but that business volume may also be greatly reduced, due to both the reduced cost of the industry and its products and services, and a rising share of self-supply that is neither a commercial business nor taxable. Economic activity (as measured by GDP) would be smaller compared to the business-as-usual scenario. The decline may or may not be masked by initial investment in new energy.

Tax bases are also likely to shrink, because of lower capital values employed and lower volumes and values of energy bought and sold. This effect should be roughly in line with the decline in GDP, except that the impact on public finance would be mitigated by phasing out subsidies for the fossil energy industries and a lower overall need for public funding to deal with the external environmental and social costs, the “externalities” imposed by the fossil energy industries on the public.

The value of subsidies (in 2012) was estimated to be Euro 57 billion per annum for Germany, of which 90% is linked to the energy system and climate damage (Köder & Burger, 2017). The OECD (2015) estimates that direct subsidies to the energy sector account for hundreds of billions per year. Including “external costs” as an expression of social and environmental damage to current and future generations caused by the fossil energy sector, “the total value of global subsidies”, has been estimated by the IMF to be $5.3 trillion (Coady et alii 2015). G20 countries provide roughtly US$444 billion per year in subsidies for the production of fossil fuels (Bast et alii 2015). The phasing out of subsidies for the fossil energy sector is called for also by institutional investors (Actiam et alii 2017).

Co-Benefits of Energy Transformation, Value Creation from Electrification and an Economic Paradox

Despite the reductions in cost, value, trade, economic activity and tax revenue from the energy sector that can be expected, the energy transformation is likely to be beneficial for the wider economy and society in ways that are often difficult to quantify and are not reflected in economic statistics (Helgenberger & Jänicke 2017). This is not only because the money saved on energy supply can go to other and potentially better uses but also for the following reasons:

- The total value of damages caused by the industry will diminish; the external cost in the form of, for example, an overheated planet and a legacy of radioactive waste that needs to be kept safe and managed for thousands of future generations, will stop rising;

- There are many co-benefits of the energy transformation aside from climate change mitigation, for example in the areas of pollution control and environment, conservation and protection of habitats, in economic and fiscal, social, ethics and governance, foreign affairs and security policy;

- The shift towards electricity as the main energy carrier will help in the creation of additional value beyond what was possible with the chemical and thermal energy from fossil resources.

Electricity is a noble, physical form of energy, more physically valuable than the equivalent chemical energy contained in fossil fuels, more versatile and suitable for use in advanced systems. The physical value of electricity, its exergy, translates into properties that increase its economic value for end users. It can be transformed quite easily into other forms of energy—movement, light and heat. Electricity also enables modern information and communication technology (ICT), which is at the heart of the transformations or “digital disruptions” (Khare et alii 2017) that improve efficiencies at many levels.

The cost of extracting, processing and bringing fossil energies to market, plus profits, determine the lower bounds of prices consumers pay (absent consumer subsidies). Those prices tend to rise as fossil fuels become more difficult to extract. Renewable energies, especially solar and wind energy, rely on the harvest of free environmental flows; their costs are determined largely by the capital expenditure for photovoltaic equipment and wind turbines (plus grid investment in some areas), divided by the respective life-time output of electricity (in kWh). These costs tend to come down over time. Paradoxically, the energy with lower physical value has higher costs and prices, and the physically superior electricity is getting cheaper.

The demise of fossil fuels and the rise of renewable electricity together produce an apparent paradox in economic development, to the benefit of end users. In return for lower total energy costs they obtain a more valuable form of energy that allows them to create additional value in manifold ways. There is a very large additional “consumer rent” they can enjoy. The value of this rent is difficult to estimate, and it is likely that a large part of it will be enjoyed in ways that are not captured by economic statistics or subject to taxation. Well-being (and perhaps happiness) may rise but not be reflected in GDP growth or an increase in tax revenue.

Summary and Recommendation

The energy transformation is building an energy economy that serves the needs of people, current and future, and the planet much better than the old energy system. Some or even many of the benefits are not reflected in traditional economic indicators and statistics, which therefore give false signals to policy evaluators and decision-makers.

With the Task Force on Climate-Related Financial Disclosures (TFCD) of the Financial Stability Board (FSB), the Ministers of Finance and Central Bank Governors of the G20 already have a mechanism in place to investigate the implications of the energy transformation for the wider economy, notably:

- Impact on the extractive sectors, both fossil (coal, oil, gas) and minerals and metals, including companies and underground assets in government-owned and privately held companies;

- Commodity trade patterns and financial flows, balances of trade and payment;

- Investment needs and time horizons, including for small smart energy systems that constitute durable investments but may look like “consumption” because of their small lot-size;

- Changes in the level and distribution of economic activity, including the likely growth of energy self-supply, peer-to-peer trading in the platform economy;

- Resulting changes in the statistics covering trade, investment, capital stock, GDP, etc.;

- Resulting changes in the tax bases and future government revenue streams.

In addition, the G20 should request a report from a group of international organisations, notably IRENA, IMF, OECD, and the World Bank, on the wider economic implication and the true costs and benefits of the energy transformation.

Implementation Overview

The Task Force on Climate-Related Financial Disclosures (TFCD) of the Financial Stability Board (FSB) is given a broader mandate to investigate and report on the wider implications of energy transformation, and to make recommendations for additions and changes in international statistics.

In 2018, the International Renewable Energy Agency (IRENA), the International Monetary Fund (IMF), the Organisazion for Economic Cooperation and Development (OECD) and the World Bank submit to the G20 Leaders, the G20 Ministers of Finance and Central Bank Govenors, and the G20 Ministers of Climate and Energy their joint report on the wider economic implication and the true costs and benefits of the energy transformation.

From 2019, the TFCD reports annually through the G20 Finance Track as well as G20 Ministers of Climate and Energy. Energy Sector Transformation becomes a standard item on the agenda of the G20 Leaders meeting in summit.

Existing Policies and Monitoring

Financial Stablity Board (FSB) Task Force on Climate-related Financial Disclosures (TCFD)

Sustainable Development Goal (SDG) nos.:

7 “Ensure access to affordable, reliable, sustainable and modern energy for all”

9 “Building resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation”, and

12 “Ensure sustainable consumption and production patterns” (including material consumption and resource husbandry)

Progress towards the Sustainable Development Goals is reviewed by the High-Level Political Forum on Sustainable Development in annual conferences.

Resources

“Beyond GDP – Measuring Progress, True Wealth, and Well-Being”: The European Commission maintains a web site with a repository of relevant news, studies, and policy papers at http://ec.europa.eu/environment/beyond_gdp/index_en.html

The NetGreen Network for Green Economy Indicators maintains a blog with opinions and information about current developments at http://netgreen-project.eu/blog

References

Actiam et alii (2017). Statement: G20 governments must lead in phasing out subsidies and public finance for fossil fuels – to accelerate green investment and reduce climate risk. Retrieved from https://www.actiam.nl/nl/verantwoord/Documents/Klimaat/170214_Statement_G20_governments_must_lead_in_phasing_out_subsidies_and_public.pdf

AECOM Australia (2015). Energy Storage Study. A Storage Market Review and Recommendations for Funding and Knowledge Sharing Priorities. Sydney, NSW: AECOM Australia.

Angerer, G., P. Buchholz, J. Gutzmer, C. Hagelüken, P. Herzig, R. Littke, R. K. Thauer and F.-W. Wellmer (2016). Rohstoffe für die Energieversorgung der Zukunft: Geologie – Märkte – Umwelteinflüsse. München: acatech, Deutsche Akademie der Technikwissenschaften.

Bast, E., Doukas, A., Pickard, S., van der Burg, L., & Whitley, S. (2015). Empty promises: G20 subsidies to oil, gas and coal production. London: Overseas Development Institute (ODI).

BNEF. (2017). Global Trends in Clean Energy Investment. Bloomberg New Energy Finance (BNEF) (Ed.) (pp. 45). Retrieved from https://about.bnef.com/clean-energy-investment/

Burck, J., N. Höhne, M. Hagemann, S. Gonzales-Zuñiga, G. Leipold, F. Marten, H. Schindler, S. Barnard and S. Nakhooda (2016). Brown to Green – Assessing the G20 Transition to a Low-Carbon Economy. Berlin, DE: Climate Transparency.

Carney, M. (2015). Breaking the Tragedy of the Horizon — Climate Change and Financial Stability.” Speech at Lloyds of London on 29 September 2015. London, UK, Bank of England.

Coady, D., Parry, I., Sears, L., & Shang, B. (2015). How Large Are Global Energy Subsidies. IMF Working Paper WP/15/105. Washington DC: International Monetary Fund (IMF).

Cust, J., Manley, D., & Cecchinato, G. (2017). Unburnable Wealth of Nations. Finance & Development, 54(1), 46-49.

G20 (2016). G20 Leaders’ Communiqué: Hangzhou Summit, 5 September 2016. Retrieved from http://www.g20.utoronto.ca/2016/160905-communique.html

Hansen, G., Eckstein, D., Weischer, L., & Bals, C. (2017). Shifting the Trillions – The Role of the G20 in Making Financial Flows Consistent with Global Long-Term Climate Goals. Bonn, DE: Germanwatch.

Helgenberger, S., & Jänicke, M. (2017, forthcoming). Mobilising the co-benefits of climate change mitigation: Connecting opportunities with interests. Potsdam, DE: Institute for Advanced Sustainability Studies (IASS).

IEA (2016). World Energy Investment 2016. Paris: IEA – International Energy Agency.

IRENA (2017a). Ministerial Roundtable, Catalysing off-grid renewable energy deployment – Towards universal electricity access and the attainment of SDGs. Retrieved from www.irena.org/menu/index.aspx?mnu=Subcat&PriMenuID=30&CatID=79&SubcatID=3820

IRENA (2017b). REthinking Energy 2017 – Accelerating the Global Energy Transformation. Abu Dhabi: International Renewable Energy Agency (IRENA).

Jakob, M., & Steckel, J. C. (2016). Implications of Climate Change Mitigation for Sustainable Development. Environmental Research Letters, 11(10). DOI: https://doi.org/10.1088/1748-9326/11/10/104010

Khare, A., Schatz, R., & Steward, B. (Eds.). (2017). Phantom ex machina: Digital disruption’s role in business model transformation. Cham, New York, Heidelberg, Berlin etc.: Springer.

Köder, L., & Burger, A. (2017). Umweltschädliche Subventionen in Deutschland. Aktualisierte Ausgabe 2016. Berlin: Umwetlbundesamt (UBA).

Kraemer, R. A. (2016a). Energy in the G20 Finance Track. G20 Energy Transformation during the German Presidency (Vol. 86). Waterloo, ON: Center for International Governance Innovation (CIGI). Retrieved from https://www.cigionline.org/sites/default/files/pb_no.86web.pdf

Kraemer, R. A. (2016b). Twins of 1713: Energy Security and Sustainability in Germany. In R. Looney (Ed.), Handbook of Transitions to Energy and Climate Security (pp. 413-429). London etc.: Routledge.

Lazard (2016). Lazard’s Levelized Cost of Storage – Version 2.0. New York, NY: Lazard.

Lovins, A. B. (2012). A Farewell to Fossil Fuels. Answering the Energy Challenge. Foreign Affairs, 91(2), 134-146.

Lovins, A. B., Datta, E. K., Bustnes, O.-E., Koomey, J. G., & Glasgow, N. J. (2005). Winning the Oil Endgame. Innovation for Profits, Jobs, and Security. Snowmass, CO: Rocky Mountain Institute.

Morris, C., & Jungjohann, A. (2016). Energy Democracy – Germany’s Energiewende to Renewables: Palgrave Macmillan.

Obergassel, W., Arens, C., Hermwille, L., Kreibich, N., Mersmann, F., Ott, H E., & Wang-Helmreich, H. (2015+2016): Phoenix from the ashes – an analysis of the Paris Agreement to the United Nations Framework Convention on Climate Change. Part I: Environmental Law & Management, 27 (2015), p. 243-262. Part II: Environmental Law & Management, 28 (2016), p. 3-12.

OECD (2015). OECD companion to the inventory of support measures for Fossil Fuels 2015. Paris: OECD.

Parikh, K., Parikh, J., Ghosh, P., Puri, R., Saini, V. K., Behera, A., & Das, A. D. (2017). Economic Benefits from Nepal-India Electricity Trade – South Asia Regional Initiative for Energy Integration (Executive Summary). New Delhi: Integrated Research and Action for Development (IRADe).

Pollitt, H., & Mercure, J.-F. (2017). The role of money and the financial sector in energy-economy models used for assessing climate and energy policy. Climate Policy. DOI: http://dx.doi.org/10.1080/14693062.2016.1277685

Randall, T. (2016a). Wind and Solar Are Crushing Fossil Fuels. Record clean energy investment outpaces gas and coal 2 to 1. (6 April 2016). Retrieved from www.bloomberg.com/news/articles/2016-04-06/wind-and-solar-are-crushing-fossil-fuels

Randall, T. (2016b). The World Nears Peak Fossil Fuels for Electricity. Coal and gas will begin their terminal decline in less than a decade, according to a new BNEF analysis. (13 June 2016). Retrieved from https://www.bloomberg.com/news/articles/2016-06-13/we-ve-almost-reached-peak-fossil-fuels-for-electricity

Röhrkasten, S., Kraemer, R. A., Quitzow, R., Renn, O., & Thielges, S. (2016). An Ambitious Energy Agenda for the G20 (5/2016). Potsdam: Institute for Advanced Sustainability Studies (IASS). Retrieved from http://www.iass-potsdam.de/en/content/ambitious-energy-agenda-g20

Roehrkasten, S., Thielges, S., & Quitzow, R. (Eds.). (2016). Sustainable Energy in the G20 – Prospects for a Global Energy Transition. Potsdam, DE: Institute for Advanced Sustainability Studies (IASS). Retrieved from http://www.iass-potsdam.de/sites/default/files/files/iass_study_dec2016_en_sustainableenergyg20_0.pdf

Rubin, E. S., Azevedo, I. M. L., Jaramillo, P., & Yeh, S. (2015). A review of learning rates for electricity supply technologies. Energy Policy, 86, 198-218. DOI: http://dx.doi.org/10.1016/j.enpol.2015.06.011

Ryan, J. (2016). Fossil Fuel Industry Risks Losing $33 Trillion to Climate Change. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2016-07-11/fossil-fuel-industry-risks-losing-33-trillion-to-climate-change

Stiglitz, J. E., Sen, A., & Fitoussi, J.-P. (2009). Report of the Commission on the Measurement of Economic Performance and Social Progress (pp. 292). Retrieved from http://www.communityindicators.net/system/publication_pdfs/9/original/Stiglitz_Sen_Fitoussi_2009.pdf

Sussams, L., & Leaton, J. (2017). Expect the Unexpected: The Disruptive Power of Low-carbon Technology. London, UK: Grantham Institute at Imperial College London.

Trucost (2013). Natural Capital at Risk: The Top 100 Externalities of Business. London: Trucost.

Vinci, S., Nagpal, D., & Parajuli, B. (2017). Accelerating Off-Grid Renewable Energy – Key Findings and Recommendations from IOREC 2016. Abu Dhabi: International Renewable Energy Agency.