Central Bank Digital Currencies (CBDC) are rapidly gaining ground, with all Group of 20 (G20) nations researching or adopting such technologies. This policy brief identifies how the G20 can play a central role in driving an integrated multiple CBDC (mCBDC) model built upon a wholesale CBDC architecture, with a G20-managed common bridging platform. The brief describes how domestic policies on governance and exchange rules can be unbundled in the mCBDC design. The brief further describes how these technologies can unleash global trade and outlines a series of domestic principles that promote inclusive economic development. In addition, for commodities and bulk trade scenarios, wholesale CBDC solutions can leverage two-tier CBDC architecture to bring efficiency, compliance and other benefits to settlement and trade finance among businesses.

Challenge

International trade cooperation has been under growing strain since the turn of the 21st century. Overall, Group of 20 (G20) economies have implemented 154 new trade and trade-related measures. Despite these efforts, there has been a global economic slowdown with decreasing economic growth. The G20 should consider ways to overcome the payment constraints and the dominance of foreign exchange that limit economic integration and intra-G20 trade. One innovative way of promoting economic integration and intra-G20, developing and emerging economies trade is through Central Bank Digital Currencies (CBDC) that offer a radical departure from traditional economic and monetary policies, bringing new ideas to reimagine the global economic structure. These views were recognised by the Group of Seven (G7) in 2021 after outlining public policy principles for retail CBDCs (see Appendix). In addition, every G20 nation is researching, testing or about to launch a CBDC focusing on national monetary policies. The G20 needs to move away from uniquely national protocols when using digital currencies and adopt a common system of protocols that can be interoperable and allow for cross-border trade.

The G20 has prioritised enhancing cross-border payments, recognising the inherent weaknesses of the current international financial system infrastructure (Bank for International Settlements, 2021a). A standard international SWIFT-based transaction takes three days to complete, and the costs escalate depending on the number of banks involved in the transaction chain between the sender and the receiver (Perekaz24, 2021). CBDCs offer a solution to address the efficiency and cost challenges that plague the traditional finance industry. However, while all G20 nations are investigating CBDCs, the focus is on domestic issues and uses cases with limited interest in cross-border payments (Bank for International Settlements, 2021a).

Recognsing this limitation, some countries have established collaborative CBDC projects to enable cross-border trade. For instance, Project Dunbar has developed prototypes for international settlements using a multiple CBDC (mCBDC) model, bringing together Australia, Malaysia, Singapore, South Africa and the Bank for International Settlements’ Innovation Hub (Bank for International Settlements, 2022). Similarly, Project Jura explores the transfer of euro and Swiss franc wholesale CBDCs using tokenised asset and foreign exchange trades (BIS Innovation Hub et al., 2021). These projects provide some insights into developing an mCBDC model that promotes currency interoperability.

The CBDC mechanism has emerged as a system supportive of the general public and the wholesale trader. The currency is issued to the public, and the system infrastructure provides a platform for daily transactions. While the Retail CBDC model may limit intermediary involvement and securely reduce transaction costs, thus improving financial inclusion, it might still encounter challenges in boosting cross-border trade as faced by the traditional payment networks. The Wholesale CBDC is issued to financial institutions. They carry reserve deposits with a central bank, which is the central counterparty for cross-border payments. The Wholesale CBDC is typically used for high-value transactions performed by financial institutions (Bank for International Settlements, 2021b). In addition, asset tokenisation offers central banks another mechanism to digitally represent a currency on either a distributed or centralised ledger that can be traded using electronic financial wallets (Organisation for Economic Cooperation and Development, 2021). With the range of technologies and models available, central banks require guidance to identify appropriate models that advance international trade, interoperability, financial inclusion and security.

MCBDC platforms have great potential to address international trade settlement weaknesses. However, central banks have a deep interest in maintaining total control over the CBDC system and are hesitant to implement an mCBDC arrangement, with ownership distributed across the central bank network (Lam & Wei, 2021). Central banks are also concerned about losing domestic control of monetary policy. Allowing a foreign digital currency within a country’s borders may result in consumers changing their preference for the foreign currency. The domestic currency then becomes underutilised. The central bank, thereafter, has less control over domestic prices (Lam & Wei, 2021).

Given the current economic climate, G20 countries need to adopt radical measures to transform society to break out of the current economic hardships characterised by experiences of poverty, inequality, unemployment, weak trading networks and limited foreign investment brought on by the global financial crisis and the pandemic. MCBDC arrangements offer a radical option to reimagine the global financial landscape. However, central banks will need to balance the need to drive economic growth with their concerns about sovereignty and ownership.

Proposal

Financial integration in the G20 using integrated CBDC settlement platforms could become central in international finance and benefit economic growth through risk-sharing, improvements in efficiency allocation, and reductions in macroeconomic volatility and transaction costs. With the emergence of national CBDCs, and trade and investment ecosystems developing within G20 developing and emerging economies, the G20 should seek to promote interoperability and common standards to ensure seamless international exchanges. Such standards can create more open systems that allow for a level playing field for all stakeholders in the new system.

To promote international exchanges and boost trade and investment, these CBDCs need to be designed from the onset with the international dimension in mind. This design is necessary to avoid replicating existing slow, expensive and inefficient trading that characterises the current financial system underpinning international trade and investment. This policy brief identifies the guidelines for the G20 to promote the interoperability of G20 CBDCs needed to facilitate seamless international trade.

Recommendation 1: The G20 must implement an adapted BIS integrated mCBDC model based on an unbundled technology stack

MCBDC arrangements offer potential solutions that could reduce the cost of international transactions and improve the efficiencies in exchange. As of 2022, a few projects have shown such benefits that could inform a set of guidelines needed by the G20 to boost trade in developing and emerging economies. For example, the M-bridge introduced between China, Hong Kong, Thailand and the United Arab Emirates was based on distributed ledger technology to allow real-time international payment. The pilot project was also constructed to allow countries control over privacy, liquidity management and compliance with domestic regulations (Nolens, 2021).

The Bank for International Settlements (BIS) has identified three mCBDC models countries could adopt. These were described as compatible, interlinked and integrated models. The integrated model is based on a single multicurrency system with several CBDCs on-boarded to the model. In this model, participants agree to the rules of exchange and the shared underlying technical infrastructure. The model does require an increase in governance and controls inherent to the system, and participants need to relinquish a level of control over the governance arrangements, technical infrastructure and overall system oversight, as the group shares these functions. Despite these arrangements, the models do support efficiency gains as additional currencies are brought on board (Auer et al., 2021).

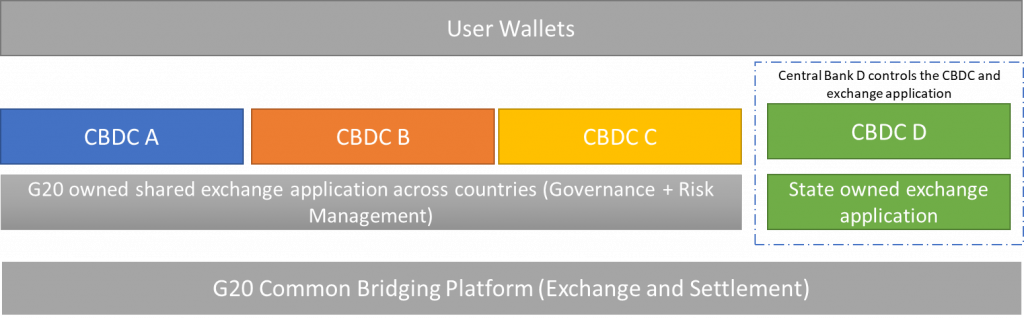

An adapted integrated model may be optimal for G20 nations, given the reduced complexity of onboarding several currencies into the platform. The degree of adaptation may depend on the level of integration required by G20 nations. The BIS integrated model will provide G20 nations with a basis to adopt a common technical infrastructure and platform. The G20 must define a common governance framework that underpins the shared platform. The Monetary Authority of Singapore has considered the challenge of relinquishing control and has proposed unbundling the technology stack by separating the exchange application from the shared platform. This model will allow each country control over the application, while the group of nations (the G20 in this instance) would manage the shared platform. Each nation can then manage the application by introducing domestic controls, while the platform includes the interface of exchange, which concentrates on the bare minimum requirements for cross-border payments (Hartley, 2021). The multicurrency common settlement platform will allow countries to pay each other directly without costly intermediary correspondent banks included in the chain (Bank for International Settlements, 2022).

Figure 1 – Unbundling the technology stack, Source: Hartley (2021)

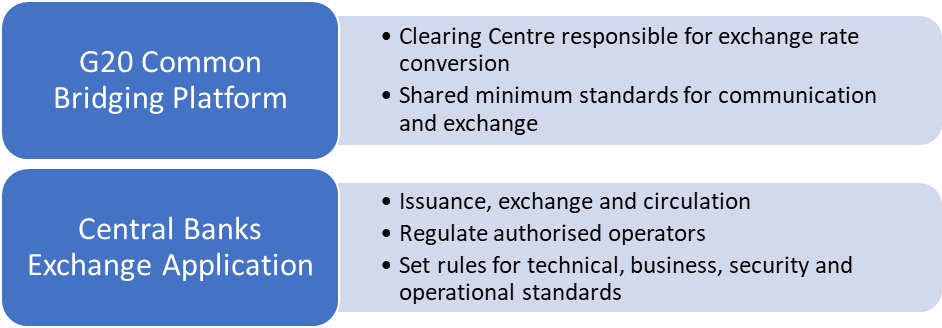

Recommendation 2: Share the regulatory and governance powers between the G20 common platform and affiliated central banks

The integrated mCBDC model increases the shared control over governance, with all participants needing to abide by a single rulebook and governance arrangements, which informs the structure of the shared ledger. The mCBDC model will need to introduce a set of common standards to ensure that a nation’s CBDC can connect to other external systems. The ISO20022 standard provides the common language for CBDCs. This standard also provides the basis for mCBDC interoperability (Bank for International Settlements, 2022; ISO20022, n.d.).

The mCBDC governance model must share responsibilities between the central bank and the G20 common platform. The model will allow the central bank to maintain control and authority over its monetary policy, while the G20 common bridging platform will act as a clearing centre for cross-border transactions. The bridging platform will need to manage exchange rate conversion, define communication protocols and set the minimum standards for exchange (Auer et al., 2021).

As adopted in China, the central bank requires the power to plan, organise and supervise its payment systems and financial infrastructure. Its supervisory role will include monitoring CBDC issuance, exchange and circulation within its borders to address potential money-laundering, regulating authorised operators and commercial institutions, and defining the technical, business, security and operational standards. These standards will supersede the minimum operational standards set by the G20 common bridging platform (Auer et al., 2021; Wang, 2022). This approach allows central banks a degree of autonomy over national monetary policy, providing greater confidence in system resilience and national security.

Figure 2 – Division of responsibilities between the G20 common bridging platform and central banks

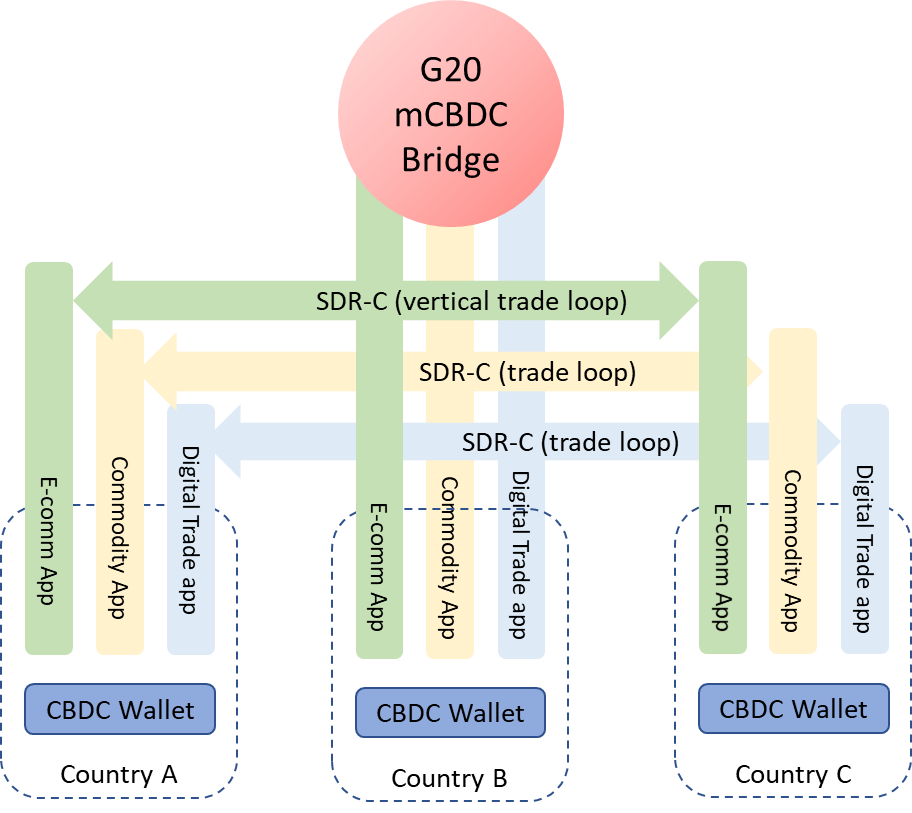

Recommendation 3: The G20 must endorse the vertical stack design to enable a cross-border trade settlement system

Global trade involves complex processes involving importers and exporters for commodities and goods, e-commerce platforms, service providers, financial institutions, customs, logistics, related regulators etc. However, they can be classified into various vertical ecosystems based on their industry, region, type of business and other factors. For example, commodities trading is a specialised vertical ecosystem that depends heavily on trade finance, logistics and customs. In contrast, copyrights, digital rights and patents consist of different stakeholders familiar with the country’s laws, relevant international treaties, etc. In the case of commodity and bulk trade between cross-border businesses, a two-tier wholesale CBDC could benefit trading parties in areas of settlement, compliance and industry-specific trade finance when adequate trust can be established among supply chain parties. To succeed in promoting trade using CBDCs, we need to strategically prioritise regions, industries and sets of stakeholders, iteratively expanding across the economy when introducing innovations of such magnitude. This approach cultivates trust among industry trading partners, banks and the central bank. It reduces settlement risks and facilitates trade finance, as the traders take advantage of the CBDC arrangements. The approach strengthens the supply chain finance for upstream and downstream parties within the selected industry, leveraging the trust in the industry.

A typical use case for a commodities trade vertical application would be the small and medium businesses in China’s Zhejiang province that today import a non-standard commodity product called plastic beads. These businesses, for example, could use such an app to purchase them from the platform collectively. With smaller down payments, collaborating banks will issue a “special drawing rights on commodity” (SDRC) that can be traded on the smart-contract-based blockchain platform. The SDRC will reduce the financing pressure and costs for the importer and ensure the exporter gets paid if the importer changes their mind due to unforeseen reasons, which is typical in today’s individual company-based case (Harrison & Xiao, 2019). The SDRC can be bought and sold on the platform in a country’s CBDC. The G20 common bridging platform and the proposed central bank-owned exchange application will provide all the necessary regulatory enforcement using smart contract technology. A standard interface to the mCBDC bridge will be developed to integrate the regulator’s requirements.

Other industry or trade-specific vertical application stacks can be developed based on different international organisation rules, such as the Uniform Custom and Practice (eUCP), the Wolrd Trade Organisation (WTO) or the World Intellectual Property Organisation (WIPO). These organisations can leverage the integrated retail CBDC as a basic service and provide more advanced services, such as trade finance, settlement based on SDRC etc. The G20’s endorsement of the vertical stack design will accelerate the national adoption of CBDCs developed using smart contract technology, boosting G20 cross-border trade.

Figure 3 – Vertical trade application interface with the G20 mCBDC common bridging platform

Recommendation 4: The G20 must endorse a set of inclusive economic development principles for the mCBDC design

Assuming that the integrated mCBDC model is applied, one must still consider who is affected by the change in the financial system within the national context. It is recommended that the CBDC model operates parallel to the current traditional exchange processes. However, implementing the CBDC model introduces several ecosystems based on broad public-private collaboration. As an extension of the public sector, this implementation requires that the central bank carry out certain functions while providing a framework for the private sector to integrate into the new financial architecture.

Expanding on the public policy principles endorsed by the G7 in 2021 for CBDCs, the G20 must act to promote the inclusive economic development of all countries participating in the mCBDC. These principles should include but not be limited to the following:

Foster financial inclusion

In 2021, the G7 endorsed the need for the CBDC model to contribute to financial inclusion and enhance access to payment services, particularly among the financially excluded population (G7, 2021). In addition to limiting intermediaries to decrease costs, the offline wallet transaction capability can allow the CBDC to be used where there is no internet access, broadening potential usage. Creating circumstances that make digital transactions appealing to the financially excluded community can expand financial inclusion opportunities (Ozili, 2021). The G20 can drive financial inclusion by promoting knowledge and technology sharing among affiliated central banks. By sharing the open-source software for central bank-issued wallets that enable offline transactions, all countries will be in a position to offer financially affordable services to their consumers.

Promote payment platform interoperability and data privacy

The CBDC may also form the backbone of future cross-border payment systems that integrate digital identities and data governance, as well as privacy standards. With the central bank holding end-user CBDC accounts, it takes responsibility for the know-your-customer (KYC) and anti-money laundering (AML) checks. An integrated digital identity may streamline the verification process supporting the central bank when conducting these checks (Christensen, 2021). With the central bank taking responsibility for these checks, no other parties need access to the identity data as they place their trust in the central bank’s verification. By centrally integrating the KYC and AML checks into the system, non-bank entities have an opportunity to offer financial services without the need to secure an expensive banking license.

By centralising this role, trust is integrated into the financial system and is shared among all systems that connect to the CBDC infrastructure, thereby unlocking new opportunities in other ecosystems, including supply chains, health care, security, retail and e-commerce (Central Bank Digital Currencies Working Group, 2020). Although the CBDC will integrate identity data, the system should be developed to limit unnecessary access to identity data. Third parties that don’t need access to the data should not have the opportunity to retrieve the end-user’s data. Furthermore, these systems need to be designed to ensure that all access and usage of identity data is done transparently.

Promote carbon neutrality

In 2021, the G7 endorsed energy efficiency when managing global financial transactions (G7, 2021). Achieving a net-zero financial system requires procuring renewable energy-based power to support the digital processing of transactions that pass through country CBDCs, the exchange application and the G20 common platform. Transaction encryption supported by distributed ledger technology does consume substantial power, as experienced in cryptocurrency mining. Fossil fuel-based energy consumption will increase the financial system’s carbon footprint (Smith, 2021). While CBDCs need not mine transactions to demonstrate proof of work, it is crucial to prioritise sustainability to ensure that new financial systems do not also harm the ecological balance of society. The G20 can endorse using renewable energy power generation to power mCBDC and country CBDC services to mitigate against any harmful effects on the climate.

Catalyse digital economy innovations

In 2021, the G7 supported using the CBDC to catalyse future innovation and promote interoperability for future payment solutions (G7, 2021). By redesigning the global financial architecture, the CBDC can be used as a launchpad for future innovations that accelerate global economic growth. The innovation provides novel ways for Central Banks to interact directly with consumers when adjusting monetary policy. For example, Central Banks could opt to disintermediate the credit supply by engaging directly with consumers through CBDC wallets (Bloomberg, 2022). Alternatively, one might expect the tokenised-based currency to signal a shift away from cash, which offers new opportunities for the country to consider (De Galhau, 2021). Such innovations must be managed to be inclusive and benefit all consumers. The G20 can again support knowledge, innovation and technology-sharing among countries affiliated with its mCBDC platform. Sharing knowledge will allow all consumers an equal opportunity to benefit from new applications of the CBDC.

References

Auer, R., & Böhme, R. (2020). The Technology of Retail Central Bank Digital Currency. BIS Quarterly Review. https://www.bis.org/publ/qtrpdf/r_qt2003j.pdf

Auer, R., Haene, P., & Holden, H. (2021). Multi-CBDC Arrangements and the Future of Cross-Border Payments (No. 115; BIS Papers, Issue 115). https://www.bis.org/publ/bppdf/bispap115.pdf

Bank for International Settlements. (2020). Central bank digital currencies: foundational principles and core features (Issue 1). https://www.bis.org/publ/othp33.pdf

Bank for International Settlements. (2021a). Central bank digital currencies for cross-border payments Report to the G20 (Issue July). https://www.bis.org/publ/othp38.pdf

Bank for International Settlements. (2021b). III. CBDCs: an opportunity for the monetary system. In BIS Annual Economic Report. Bank for International Settlements. https://www.bis.org/publ/arpdf/ar2021e3.pdf

Bank for International Settlements. (2022). Project Dunbar – International settlements using multi-CBDCs. https://www.rba.gov.au/payments-and-infrastructure/central-bank-digital-currency/pdf/project-dunbar-report-2022-03.pdf

BIS Innovation Hub, Banque de France, & Swiss National Bank. (2021). Project Jura – Cross-border settlement using wholesale CBDC. https://www.bis.org/publ/othp44.pdf

Bloomberg. (2022). Central Banks can shape the future of digital finance. Gulf Business. https://gulfbusiness.com/central-banks-can-shape-the-future-of-digital-finance/

Central Bank Digital Currencies Working Group. (2020). Implementing a CBDC: Lessons Learnt and Key Insights – Policy Report. https://www.cemla.org/fintech/docs/2020-Implementing-CBDC.pdf

Christensen, C. (2021). The Role of Digital ID in Advancing CBDC Initiatives. Regulation Asia. https://www.regulationasia.com/the-role-of-digital-id-in-advancing-cbdc-initiatives/

De Galhau, F. V. (2021). Roads for the future: Central Bank Digital Currency (CBDC) and Innovative Payments. The European Monetary and Finance Fourm Policy Note. https://www.suerf.org/policynotes/29965/roads-for-the-future-central-bank-digital-currency-cbdc-and-innovative-payments

Financial Stability Board (FSB). (2021). G20 Roadmap for Enhancing Cross-border Payments (Issue October). https://www.fsb.org/wp-content/uploads/P131021-1.pdf

G7. (2021). Public Policy Principles for Retail Central Bank Digital Currencies. https://www.g8.utoronto.ca/finance/G7_Public_Policy_Principles_for_Retail_CBDC_FINAL.pdf

G7 Finance Ministers and Central Bank Governors. (2021). G7 Finance Ministers and Central Bank Governors’ Statement on Central Bank Digital Currencies (CBDCs) and Digital Payments-13 October 2021. http://www.g7.utoronto.ca/finance/FINAL_G7_Statement_on_Digital_Payments_13.10.21.pdf

Harrison, M., & Xiao, G. (2019). China and Special Drawing Rights—Towards a Better International Monetary System. Journal of Risk and Financial Management, 12(2), 60. https://doi.org/10.3390/jrfm12020060

Hartley, J. (2021). Fnality Global Payments & Multi-CBDC. Fnality. https://www.fnality.org/news-views/fnality-global-payments-multi-cbdc

ISO20022. (n.d.). About ISO 20022. Retrieved April 3, 2022, from https://www.iso20022.org/about-iso-20022

Lam, B., & Wei, Y. (2021). The Case for Multi-CBDC Arrangements. https://doi.org/10.13140/RG.2.2.33913.19043/1

Nolens, B. (2021). Multi-CBDC prototype shows potential for reducing costs and speeding up cross-border payments. In BIS.org. https://www.bis.org/press/p210928.htm

Organisation for Economic Co‑operation and Development. (2021). Digitalisation and Finance in Asia. https://www.oecd.org/finance/financial-markets/Digitalisation-and-finance-in-Asia.pdf

Ozili, P. K. (2021). Can Central Bank Digital Currency Increase Financial Inclusion? Arguments for and Against. SSRN Electronic Journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3963041

Perekaz24. (2021). What Is SWIFT Money Transfer and Its Disadvantages? Perekaz24.Eu. https://perekaz24.eu/en/what-is-swift-money-transfer-and-its-disadvantages

Smith, G. (2021). Green push puts CBDC centre stage. Official Monetary and Financial Institutions Forum. https://www.omfif.org/2021/03/green-push-puts-cbdcs-centre-stage/

Appendix

G7 Finance Ministers and Central Bank Governors Statement (2021):

“Any CBDC ecosystem must be secure and resilient to cyber, fraud and other operational risks, must address illicit finance concerns and be energy efficient. CBDCs must operate in an open, transparent and competitive environment that promotes choice, inclusivity and diversity in payment options. We note the importance of considering interoperability on a cross-border basis given the potential role for CBDCs in enhancing cross-border payments. At the same time, we recognise a shared responsibility to minimise harmful spillovers to the international monetary and financial system” (G7 Finance Ministers and Central Bank Governors, 2021).

G7 Public Policy Principles for Retail CBDCs (2021)

Principle 9 – Digital Economy and Innovation

“CBDCs should contribute to the development of faster, cheaper, more inclusive, convenient and efficient payment solutions including in support of wider trends and innovations (such as ‘open finance’). In this way, CBDCs might bridge fragmentation among regulated ‘end-user’ payment services, alongside adding diversity to, and easing concerns around, concentration within the payments landscape. The design of CBDC may also support interoperability with existing and future regulated payment solutions on both a domestic and cross-border basis” (G7, 2021).

Principle 10 – Financial Inclusion

“CBDC ecosystems should avoid reinforcing barriers to financial access and should not introduce any unintended sources of exclusion. • Countries, in collaboration with international organisations, should work towards developing a wider set of enabling policies, particularly on financial literacy, digital literacy and open and affordable access to digital infrastructure” (G7, 2021).

Principle 12 – Cross Border Functionality

“Facilitating international payments with CBDCs might be achieved through different degrees of integration and cooperation. In the first instance, countries should engage closely with work at CPMI, the BIS Innovation Hub, the FSB the IMF and the World Bank under Building Block 19 of the G20’s roadmap for enhancing cross-border payments adopted in 2020, and factor this work into domestic explorations and design” (G7, 2021).

G20 Roadmap for Enhancing Cross-Border Payments (2021)

“…central banks recognise that the implications of CBDCs go well beyond national borders, highlighting the need for multilateral collaboration on macro-financial questions and the importance of interoperability between CBDCs” (Financial Stability Board (FSB), 2021).