You are currently viewing a placeholder content from Youtube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

We recommend that the G20 target innovative green-technology SMEs as an opportunity to promote financial de-risking while addressing Paris Agreement commitments and UN Sustainable Development Goals. This should be achieved by creating signals for private investors through: (1) a reporting system that can help monitor the scale-up of green-technology SMEs; (2) the use of public funds to signal innovative green-technology SMEs to investors; and (3) the inclusion of SMEs in the design of green finance platforms. By implementing these recommendations, the G20 will ensure that innovative, low-carbon SMEs become attractive, low(er)-risk investment opportunities for the private sector.

Challenge

As the G20/OECD High-Level Principles of SMEs Financing state, Small and Medium-sized Enterprises (SMEs), including micro-enterprises, are important engines of innovation, growth, job creation and social cohesion in high-income/emerging economies, as well as low-income developing countries. In the former, SMEs undertake the majority of private economic activity, and account for more than 60 percent of employment and 50 percent of GDP. In the latter, SMEs contribute on average to more than 50 percent of employment and 40 percent of GDP; furtermore, they contribute significantly to broadening employment opportunities, social inclusion and poverty reduction (G20/OECD 2014). To put this in perspective, in the EU27 the overwhelming majority (some 20.9 million, or 99.8 percent) of enterprises active within non-financial business economy in 2008 were SMEs. These accounted for two out of every three jobs (66.7 percent) and for 58.6 percent of value added within the non-financial business economy (EUROSTAT 2011). SMEs, therefore, are core economic engines for all members of the G20.

In this policy brief, we argue that SMEs, and especially low-carbon technology SMEs, need to be recognized and engaged by G20 countries as key economic actors in the effort toward climate mitigation and sustainable development. Failing to bring them on board, or designing strategies that do not take into account the challenges and barriers they face, would significantly reduce the chances of successfully attaining UN Sustainable Development Goals and the commitments made at the Paris Agreement.

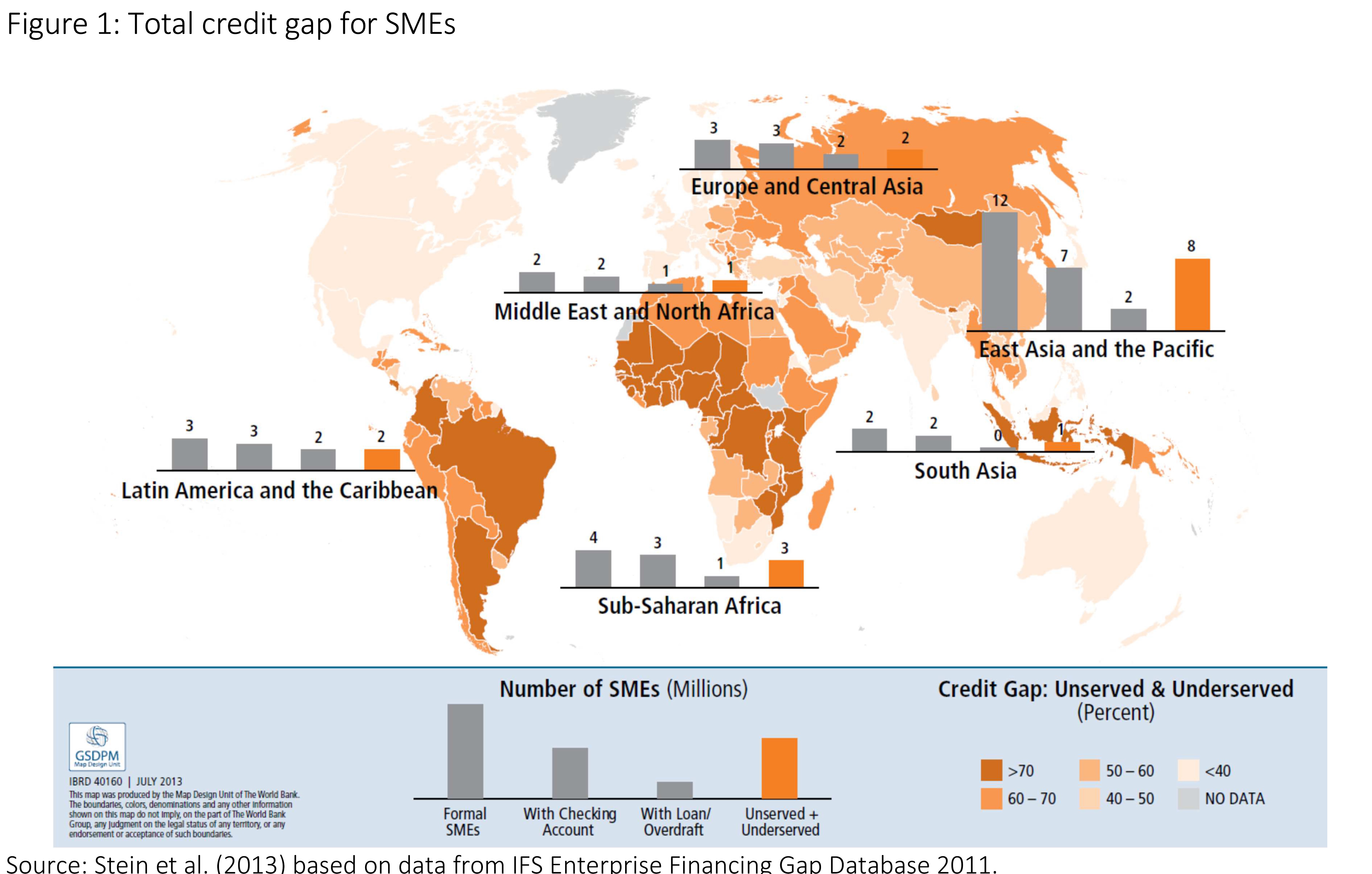

Along-standing hurdle for SMEs has been the lack of appropriate forms of finance, with the severity of financing constraints varying across countries and sectors. A recent World Bank report estimates that the percentage of SMEs unserved or underserved by the formal financial sector is between 19 and 23 percent in developed economies, and rises to 26–32 percent in developing countries (Stein et al. 2013). This amounts to a credit gap of around 1 trillion USD, which rises to over 2 trillion USD if informal SMEs and micro-enteprises are taken into account (Figure 1).

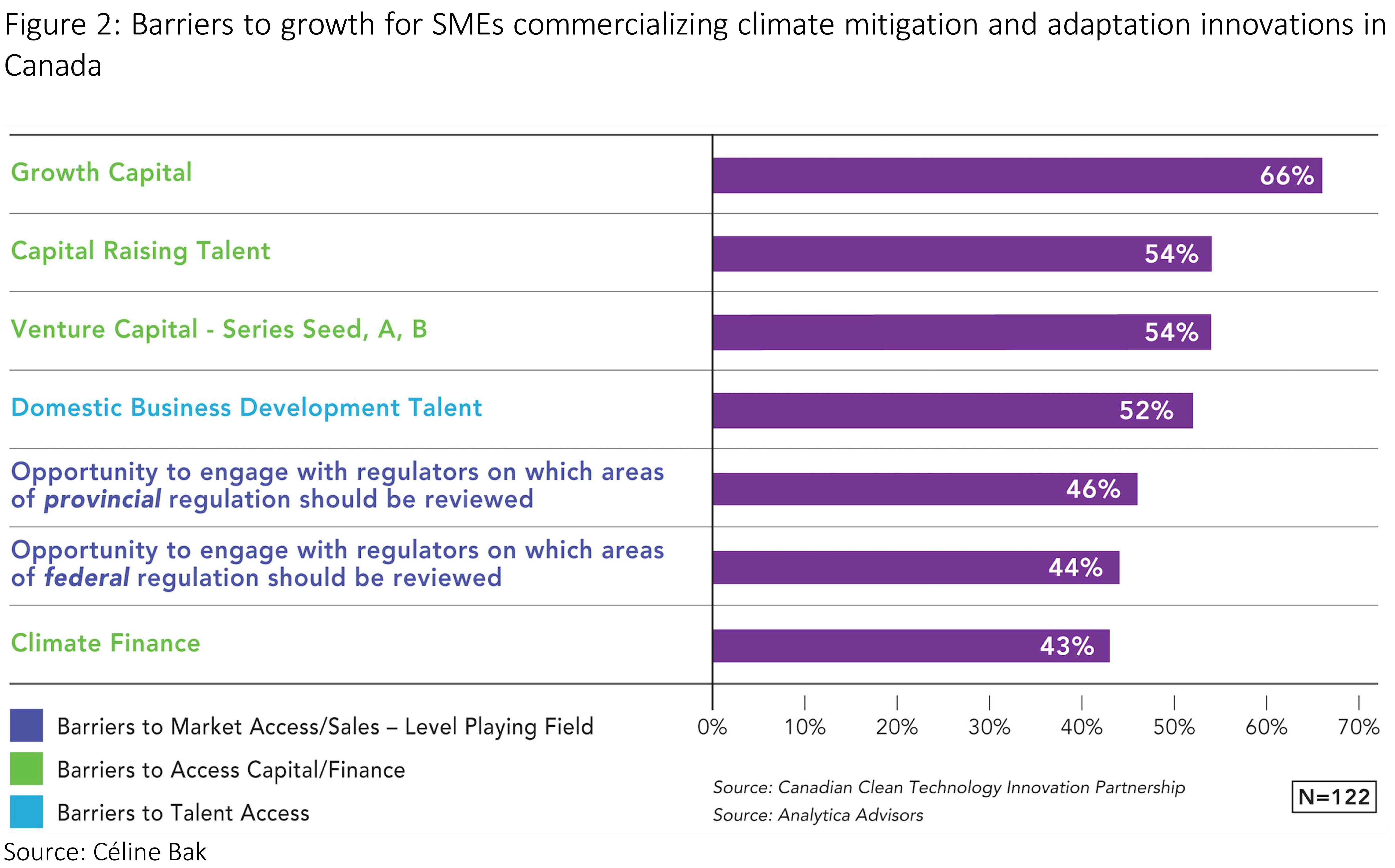

These financing constraints and barriers to private capital have an even more decisive impact on innovative low-carbon SMEs who have developed solutions to mitigate GHG emissions as well as SMEs looking to deploy solutions to reduce their operations’ carbon intensity (Figure 2). SMEs developing low-carbon innovations face issues similar to those of sustainable infrastructure projects: their returns may accrue over a long-term horizon. Similarly, SMEs that can help in the adaptation to climate change must have access to finance with long horizons (Lane 2017). In fact, if we were to imagine emerging firms delivering solutions to climate change in a sports league, they would be a newly established and very talented team of young people playing on a field not yet served by lighting, a stadium or a transportation system for spectators. Their older opponents (incumbent, larger and/or more fossil-intensive firms), on the other hand, are playing on a covered and level field, well lit and well served by public transportation and infrastructure, such as well-established financial markets and engagement mechanism during environmental regulation processes, including for carbon pricing (Bak 2017).

Indeed, many firms now engaged in commercializing solutions to climate change must seek out markets where they can both improve environmental performance and do so at a cost lower than current business baselines. This is because today inefficient fossil fuel subsidies, combined with very low carbon prices, create disincentives to quickly adopt green innovation. G20 countries now provide roughly $444 bilion a year in subsidies for the production of fossil fuels (Bast et al. 2015). In addition to the reccomendations put forward in the Chairs’ Policy Brief of the T20 Task Force on Climate Policy and Finance (which include, for instance, dismantling fossil fuel subsidies and the establishment of a tax on carbon emissions), we focus here on the key challenges for, and role of, innovative, low-carbon SMEs. Note also that SMEs wanting to reduce GHG emissions from their own operations must simultaneously open both the innovation and financing windows. Access to finance is as important as access to technology when it comes to improving eco-efficiency. In this policy brief, we focus specifically on access to finance to commercialize innovation, but it should be noted that accessing finance to adopt innovation should not be forgotten.

In this respect, two other key aspects merit consideration. First, G20 countries must unlock the finance needed to enable the attainment of both Sustainable Development Goals and Paris Agreement commitments. This will require the scale-up of new low-carbon technologies, including promising zero-emission options (i.e., green and blue hydrogen, which offer lower costs and higher performance for sustainable infrastructure projects) as well as carbon capture sequestration and use (CCUS). Indeed, there is currently significant heterogeneity across sectors and countries, and the pace at which low-carbon technologies are developed and deployed. An integrated approach to industrial policy across G20 countries could provide a bridge to accelerate the dissemination of innovation (Ruet 2016).

While carbon pricing and sustainable infrastructure are key to fostering the innovation process, accessing green finance will be a significant challenge for firms developing and commercialzing innovative solutions to climate change as well as SMEs who must adapt to climate change. In many cases, the “technologies of tomorrow“ may very well be developed and commercialized through firms that will start as SMEs.

On the other hand, lack of disclosure and transparency makes it impossible for financial markets to identify investment opportunities to move capital into green investments. As climate-related financial disclosure increases, investors will identify three kinds of risk: (1) Physical risks (i.e., risks of economic and financial losses due to climate-related hazards); (2) Transition risks (i.e., risks of rinancial losses related to regulatory and economic adjustments in a transition to a lower-carbon economy; and (3) Liability risks (i.e., risks that liability insurance providers have to cover claims for losses arising from physical or transition risk from climate change) (Tanaka et al. 2016). If information assymetries are addressed, the solutions that green-technology SMEs can offer for physical risks will attract investment. Their innovations can form the basis of new business models that address transition risks. With access to green finance, SMEs may have a positive impact on liability risks. Indeed, this policy brief identifies financing low-carbon innovative SMEs as one the strategies to kill many birds with one stone. Specifically, we suggest including SMEs in the effort to support sustainable, low-carbon growth as a way to (1) successfully achieve climate targets in G20 countries and beyond; (2) promote sustainable growth for G20 economies; and (3) de-risk private financial investments by ensuring that innovative, low-carbon SMEs are idenfied as high-return, low(er)-risk investments than firms investing in carbon-intensive infrastructure, processes and production.

We put forward three recommendations that will ensure that the G20 can promote the financing of the trasition towards sustainability and resilence by leveraging low-carbon innovation.

Proposal

Promote a reporting system to help monitor the scale-up of green-technology SMEs

There is currently no means for firms to signal innovative projects that lead to reduced GHG emissions, and their commitment to market or adopt low-carbon technologies, processes or business models. However, such signals will increasingly play an important role in a global economy where investments, partnerships and markets extend beyond geographical borders.

G20 countries have the unique opportunity to engage in promoting and designing a monitoring system that can lower financial asymmetries and signal green, innovative SMEs (and firms more generally) to domestic and international investors through low-carbon-related financial disclosure.

To this end, the G20 countries should:

Track the health of emerging green-technology firms as well as the resilience of financial institutions to climate stress-test scenarios. The G20 should invite the OECD and the World Bank to report on the emergence of green innovation firms and the capital they are attracting for demonstration of innovation at scale and for broad-based adoption, as well as their aggregate firm-level financial strength. These indicators should be included as part of monitoring the transition to the low-carbon economy for G20 countries. This measure ought to be paired with informative, non-normative, climate scenarios stress-testing to banks and financial institutions out of these platforms, based on long-term scenarios as an indirect incentive to better capital allocation. This recommandation is in line with recommendation number 5 of Bouzidi et al. (2016)

Promote systematic sharing of IP databases seen not as “protection” but “signaling” of (green and sustainable) innovation. Indeed, beyond granting the owner a monopoly of use, patents can and do play other important roles. Of relevance for firms, and for SMEs in particular, is the fact that patents signal an innovative player in the market. Further, patents can be classfied into specific technology classes, and specifically in green technologies (Hascic and Mingotto 2014). Promoting the sharing of information on the firm’s patent portfolios – for instance, by publicizing what percentage of the firm‘s innovation is “green,” is an important market signal to separate low-carbon innovative SMEs from other economic actors. Note that in this respect SMEs often lack the human resources or training to consult and access such databases, hence that designing focus groups and support strategies would be a crucial aspect of our reccomendation.

Include green-technology firms in green finance platforms

The Taskforce on Financial Risk Disclosure has made recommendations on reporting climate risk for corporations, including banks and pension funds. Given that SMEs represent the backbone of the worldwide economic system, it is crucial that they are included from the start in green finance platforms and in the design of green risk disclosure.

Including SMEs in green finance plaforms, and ensuring that they report on climate impact, will provide a powerful investment signal because it will ensure that investors are able to identify innovative green-technology firms. This in turn will (1) ensure green finance information assymetries are addressed for opportunities presented by green-technology firms; (2) accelerate the formation of capital markets around green technologies to mitigate and adapt to climate change; (3) ensure publically funded R&D returns to society through spillover benefits; and (4) enable green-technology SMEs to become engines of sustainable growth.

To this end, the G20 countries should:

Invite the Financial Stability Board (FSB) to establish a platform to exchange experiences and develop approaches to disclosure on climate-related financial risks (transition, physical and litigation). This platform should be chaired by finance ministries/central banks and involve all relevant stakeholders, including regulators, academia, finance, industry (including SMEs) and relevant international institutions. The proposed platform should develop mandatory climate-related financial risk disclosure as well as its corollary, climate risk reduction from investment in green-technology projects and sustainable infrastructure.

Leverage public funds and public support to signal innovative green-technology SMEs to private investors

Governments and intergovernmental bodies can play a crucial role in mobilizing private capital by levaraging public funds and support to signal innovative, low-carbon SMEs to private investors.

The role of government support and R&D in fostering innovative technologies is undisputed, both in green technologies and overall. Further, given the challenges associated with the diffusion of sustainable technologies, an active role and engagement on the side of government and intergovernmental bodies is a necessary component of a successful transition towards sustainability. However, public investment cannot come close to filling the financing gap for the energy transition, and a significant amount of private money will have to be mobilized to this end. Indeed, access to public funding for SMEs should be designed in such a way as to provide private investors with a clear signal that the SME receiving public support has been selected as one of the most innovative in green technologies.

To this end, the G20 countries should:

Use public funding to de-risk the scale-up of low-carbon innovation by SMEs. There are several examples of how public money and intervention which is meant to support innovative, low-carbon SMEs can be turned into a signal to mobilize private capital to support low-carbon innovation by SMEs. These include:

- Public investment in demonstration projects and proof of concept at commercial scale. Public investment financing should indeed be targeted at low-carbon technologies and away from high-carbon ones. This would ensure that public funding is indeed channelled towards the improvement of energy efficiency, the provision of a healthy, unpolluted environment for the work force, the mitigation of climate change, and more generally the scale-up and diffusion of low-carbon innovation (Anbumozhi et al. 2016). SMEs supported by public financing would then be able to use this as a signal when applying for private credit.

- Public procurement budgets for innovative, low-carbon SMEs and requirements for major government suppliers to develop relationships with them. SMEs participating in public procurement should be able to use such signals as a guarantee of their innovativeness and potential when accessing private funding.

- Dedicated credit lines. These can be established by a public entity such as government agencies and national development banks in cooperation with an international financial institutions such as the World Bank, the Asian Development Bank, or the African Development Bank, to guarantee the performance risk of low-carbon innovative SME projects for project developers and their bankers.

- Risk-Sharing Facilities. Partial risk or partial credit guarantee schemes established by public entities to reduce the risk of SME financing from the private sector, enabling increased private sector lending to SME, low-carbon energy projects.

- Climate Mitigation and Environmental Performance Contracts. Public-sector initiatives, in the form of legislation or regulation, by one or more government agency to facilitate the absorption of required technologies by Energy Service Companies (ESCOs) of performance-based contracts using private-sector financing.

Indeed, many of these instruments are already widely used within G20 countries to target specific groups of entrepreneurs or sectors. For instance, within the EU, entrepreneurs from ethnic minorities and migrant groups benefit from such actions as the “Think Small First” principle, which aims to reduce administrative burdens and make them more competitive, or by the SBA (Small Business Act for Europe), which includes improved access to financing through strengthened loan guarantee schemes (EC 2008). Another example is JEREMIE (Joint European Resources for Small and Medium-sized Enterprises), a joint initiative by the European Commission and the European Investment Fund that promotes the use of financial engineering instruments to improve access to finance for SMEs with EU Structural Fund interventions (OECD/EC 2014).

Designing similar mechanisms specifically targeting innovative, low-carbon SMEs, perhaps leveraging on such existing challenges and institutions, would contribute significantly to the fostering of low-carbon development within the G20. By following the recommendations presented in this brief, G20 countries would strengthen policy signals in support of low-carbon innovation, provide a de-risking strategy for private investors, promote transversality and provide ecosystemic support to safeguard the investments in climate mitigation undertaken by clusters of emerging firms. Indeed, the measures outlined above would go far beyond the universe of innovative, low-carbon SMEs.

Of course, the application of these instruments will very much depend on a number of specific characteristics, including country context, legisilative and regulatory frameworks, existing low-carbon energy innovation systems and service-delivery infrastructure, as well as the maturity of commercial financial markets. Indeed, to the success of the reccomendations will depend on the harmonization of such policies across G20 countries. Such much needed harmonization will not only be beneficial for the G20, but will also promote scale-up and technology diffusion to Asia, Africa and Latin America – not as policy but as a result of investment. To this end, the G20 will need to promote regional, cross-country regulatory packages for investment (Medhora 2016), as well as realign trade and FDI policies towards supporting low-carbon products and processes.

References

- Anbumozhi, V., Kalirajan, K., F Kimura, & Yao X (2016). Investing in Low Carbon Energy Systems: Implications for Regaional Economic Cooperation, Springer, pp 495

- Bak, Céline (2017).

Generating Growth from Innovation for the Low-carbon Economy: Exploring Safeguards in Finance and Regulation. CIGI Paper No. 117. - Bast, E., Doukas A., Pickard S. van der Burg L. and Whitley, S. (2015).

Empty promises. G20 Subsidies to oil, gas and cola production. Overseas development Insitute and Oil Change International. - Bouzidi, A, T. Chalumeau, Camille E., David P., Joël Ruet (2016).

Terra Nova’s brief: Le capital patient Un horizon pour la France et pour l’Europe, 12th May 2016 - European Commission (EC) (2008).

“Entrepreneurial Diversity in a Unified Europe” - Eurostat (2011). Key figures on European business with a special feature on SMEs. 2011 Eurostat pocketbooks 2011. ISSN 1830-9720

- Hascic, I. and M. Mingotto (2014). Measuring Environmental Innovation using Patent Data, Policy relevance. OECD Working Paper ENV/EPOC/WPEI(2014)6/FINAL.

- Lane, T. (2017).

Thermometer Rising—Climate Change and Canada’s Economic Future, Bank of Canada, March 2nd, 2017 - Lehni, M, S. Schmidheiny, B. Stigson (2000). Eco-efficiency: Creating More Value with Less Impact Dedicated to making a difference. World Business Council for Sustainable Development, ISBN 2940240175, 9782940240173

- Medhora, R. P. (2016).

The CGIAR model CGIAR network of research centres, now numbering 15 spread across the world, has conducted research on the science and policy of agriculture, aquaculture and nutrition. CIGI Policy Brief 80. - NRC, Natural Resources Canada (2017).

Clean Technology in Canada’s Natural Resource Sectors: A Discussion Paper, downloaded March 2017. - OECD/The European Commission (2014).

The Missing Entrepreneurs: Policies for Inclusive Entrepreneurship in Europe, OECD Publishing. - Pachouri, A and S. Sharma (2016).

Barriers to Innovation in Indian Small and Medium-Sized Enterprises, Asia Development Bank Working Paper Nr. 588. - Ruet, J. (2016). “Un facteur déterminant de la géopolitique des matières premières : la stratégie industrielle de la Chine”, in RESPONSABILITÉ & ENVIRONNEMENT – AVRIL 2016 – N°82, Paris.

- Schmiemann, M. (2009) .

SMEs were the main drivers of economic growth between 2004 and 2006, Eurostat statistics in focus 71/2009. - Stein, Peer; Ardic, Oya Pinar; Hommes, Martin (2013).

Closing the credit gap for formal and informal micro, small, and medium enterprises. Washington, DC : International Finance Corporation.