Policy-makers and firms can leverage foreign direct investment (FDI) to grow their digital capabilities and competitiveness with a three-part strategy. First, launching Digital FDI enabling projects (DEPs) to create digital friendly investment climates by adopting enabling policies, regulations and measures. Second, using a SMART test as a heuristic before launching a full-fledged DEP, which benchmarks their economy’s digital Skills, Market functioning, Access through connectivity, Restrictions, and Trust (or ‘SMART’), and provides tools to tackle limiting factors. Third, policy-makers can review FDI trends in six sectors that are important to grow the digital economy (two of which are proposed as essential, namely communications and software & IT services), with quantitative evidence that can guide policymakers to prioritize policy reforms and investment promotion where they are relatively weak. Throughout the strategy, particular attention should be paid to growing the digital capacity of SMEs. A G20-initiated Sustainable Technology Board modelled after the Financial Stability Board but oriented to cooperation over new technologies could help address techno-competition and other concerns over Digital FDI.

Challenge

There is broad consensus that digital transformation has been brought forward by years. Since the beginning of the COVID-19 crisis, internet usage has risen by 70%, the use of communication apps has doubled and some video streaming services have seen daily usage rise 20-fold (World Economic Forum, 2020). Digitalization is gradually permeating all economic sectors and functions and is key to COVID-19 economic recovery (McKinsey Digital, 2020).

Yet even before COVID-19 the world was splitting into “digital natives” and “digital laggards”. The former are firms that started their digital transformation early, while the latter are those that were slower to pivot to the new normal. This distinction is creating a growing digital divide, with digital natives experiencing twice the revenue growth of digital laggards (Accenture, 2019). Firms realize they need to invest in digital capacity or risk losing market share or even go out of business (Srinivasan and Eden, 2021).

Countries also are splitting into digital natives and digital laggards and policy-makers also recognize that they need to help their economies stay digitally competitive or risk falling behind. Attracting FDI to grow the digital economy (referred to as ‘Digital FDI’) is one route to increasing capacity and competitiveness, especially for small and medium-sized enterprises (SMEs) (Ciuriak and Ptashkinda, 2019; Eden, 2016; Stephenson, 2020). Digital FDI not only brings capital but also embedded digital knowledge and technology, while creating jobs and boosting productivity (Echandi, Krajcovicova and Qiang, 2015; World Bank Group, 2016).

While some digital service suppliers are relatively “asset-lite” (i.e., they do not require significant FDI to service a market), other digital service suppliers display a similar international asset footprint to traditional multinational enterprises (MNEs). For instance, e-commerce firms (e.g., internet retailers), digital content providers (e.g., those providing digital media, games, information and data) and telecoms firms have a virtually equivalent ratio of foreign assets to foreign revenue when compared to traditional MNEs, indicating that FDI is essential to their business models (see UNCTAD, 2017, p. 171).1 At the same time, some of the fastest growing and most highly valued firms in the world are in the technology sector, creating a huge pool of capital and opportunities for investment that benefit both these firms and recipient economies (PwC, 2020).

However, attracting Digital FDI requires specific policies, regulations and measures. These investments are based on business models that differ from traditional brick-and-mortar businesses. These business activities rely heavily on data and know-how, often involve platform economies, and leverage non-traditional assets.

At the same time, growing techno-nationalism is making Digital FDI more difficult, both inwardly and outwardly: policy-makers may be reluctant for their firms to offshore too much technology and simultaneously reluctant to accept mergers and acquisitions (M&A) in hightech sectors (Lamb, 2019).

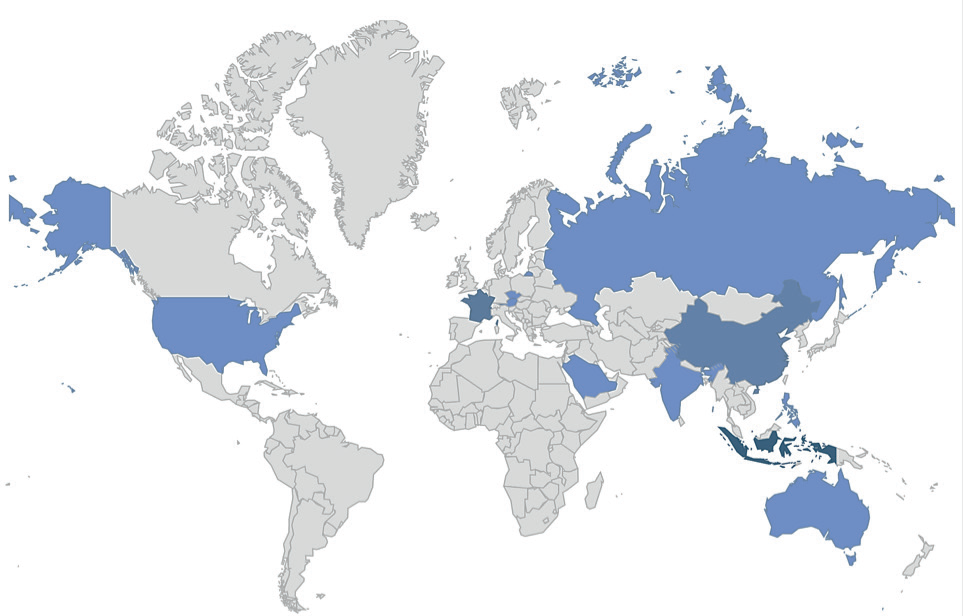

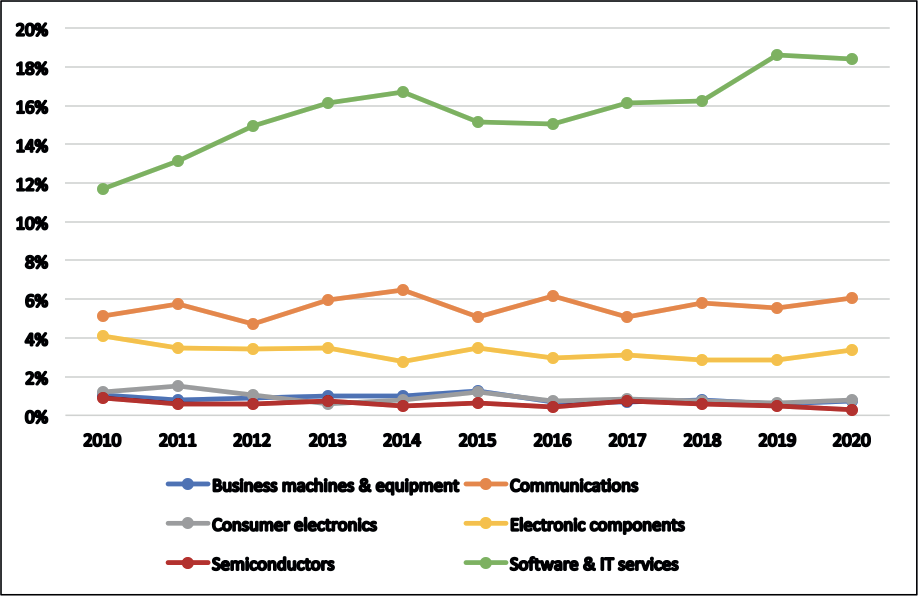

G20 economies have been very active in adopting measures related to Digital FDI (see Figure 1), but are these the right measures? (see Figure 1 for a visual display, and Appendix 1 for a list of the measures).

Figure 1. G20 adoption of thirty-three Digital FDI measures (1 January 2020 to 1 May 2021)

Source: Global Trade Alert (n.d.)

Where should policy-makers focus their attention and efforts to help their firms become digital natives and not digital laggards? What are the policies, regulations and measures needed to create digital friendly investment climates to attract Digital FDI, especially in an era of techno-nationalism? Which sectors are digital enablers but where economies have so far received relatively low levels of FDI? What are some tests to know where to start, and some tools to do so?

This brief will aim to answer these questions by proposing a three-pillar strategy.

Proposal

LAUNCH DIGITAL FDI ENABLING PROJECTS TO CREATE DIGITAL FRIENDLY INVESTMENT CLIMATES

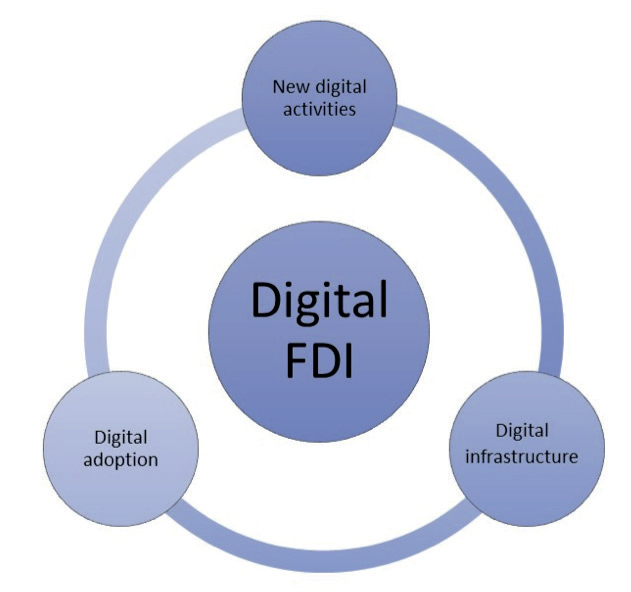

Policy-makers may wish to launch Digital FDI enabling projects (DEPs) to create digital friendly investment climates. Creating a digital friendly investment climate requires firms to identify enabling policies, regulations and measures (known together as “elements”) across three pillars: (1) new digital activities; (2) digital adoption by traditionally non-digital firms; and (3) digital infrastructure (UNCTAD, 2017). Within each of these pillars, there are specific elements that impact and enable a potential investor’s decision to commit capital and other resources (see Figure 2). Once these elements are identified, policy-makers then need to ensure they are present in their economy.

Figure 2. Digital FDI framework

Source: Stephenson (2020), elaborated from UNCTAD (2017)

Pillar 1. Elements that enable investment in new digital activities. The digital economy has generated a variety of new business models, from social media and digital platforms to cloud computing and data centres. Governments can embrace these new business models and actively support such investments. For example, policies, regulations and measures in South-East Asia helped encourage investment in ridesharing apps, such as the billions being invested in Gojek and Grab as they compete for the ridesharing and delivery market in South-East Asia (Lunden, 2019; Lee, 2020).

Why is this a priority? To be successful, new digital activities require digital content oriented to the local market, creating opportunities for SMEs to produce such content and link up with foreign multinationals, with all the positive benefits that digital linkages can bring.

Pillar 2. Elements that enable digital adoption by traditionally non-digital firms. Beyond new business models, the digital economy has the potential to change traditional ways of conducting business. Certain policies, regulations and measures can enable the adoption of new digital approaches by incumbent firms, for instance, through telemedicine, mobile banking and online sales (see IMF, 2018).2 For example, Polish telemedicine firm MedApp invested in the Baltic states, allowing cardiovascular diagnostics to be provided via telemedicine (PMR Healthcare, 2019).

Why is this a priority? Brick-and-mortar firms, both domestic and multinational, view digitalizing their value chains and supply chains as an economic imperative (Srinivasan and Eden, 2021). Digital adoption by domestic firms can help SMEs grow their business by becoming either firstor second-tier suppliers to larger domestic firms. From there, it is a short step for SMEs to start supplying the “going digital” MNEs that are now requiring their first and second tier suppliers to also engage in digital upgrading.

Pillar 3. Elements that enable investment in digital infrastructure, which includes both a physical dimension and a regulatory dimension. Robust and reliable physical infrastructure is key for the development and growth of the digital economy. Attracting FDI in digital infrastructure requires a conducive regulatory framework, for instance, policies and regulations that encourage investment in payment processors. Importantly, infrastructure should aim to connect actors and activities and grow the size of the market (at the national, regional and global level) as investors are often attracted to larger markets (see Stephenson, 2020, p. 14).3 Success in attracting FDI in digital infrastructure will also depend on the level of existing infrastructure. For example, Visa’s investment in Nigeria’s Interswitch, a payment switch and processing company, made Interswitch a unicorn overnight (Bright, 2019).

Why is this a priority? Digital infrastructure is important to help SMEs connect with global market opportunities by plugging into global supply chains and growing e-commerce exports, both of goods and digital services.

What Are the Elements That Need to Be Considered in Each of the Three Pillars?

A recent survey of investors provides the first evidence for how to attract Digital FDI. A total of 314 firms were surveyed across Canada, China, Estonia, India, Japan, the UK and USA. They were asked five principal questions: (1) a big-picture question to understand the relative importance of different elements at the highest level; (2) a question on new digital activities; (3) a question on digital adoption; (4) a question on the physical dimension of digital infrastructure; and (5) a question on the regulatory dimension of digital infrastructure. Full survey results can be found in a white paper (Stephenson, 2020).

The survey found that investors care most about skills and regulations. In terms of the big-picture questions, the top three elements that investors care about when making decisions to invest in the digital economy are: (1) the level of digital skills in the economy; (2) regulatory stability and predictability; and (3) the regulatory framework. This confirms the importance of getting the regulatory framework right if economies are to attract Digital FDI.

However, DEPs need to be tailored to individual economies through country-specific analysis and reforms. Individual economies will be at different starting points in terms of policies, regulations and measures, as well as priority areas for digital development. In addition, investors may be interested in different markets for different reasons, whether because of size, income level, skills, resources, geographic location, etc.

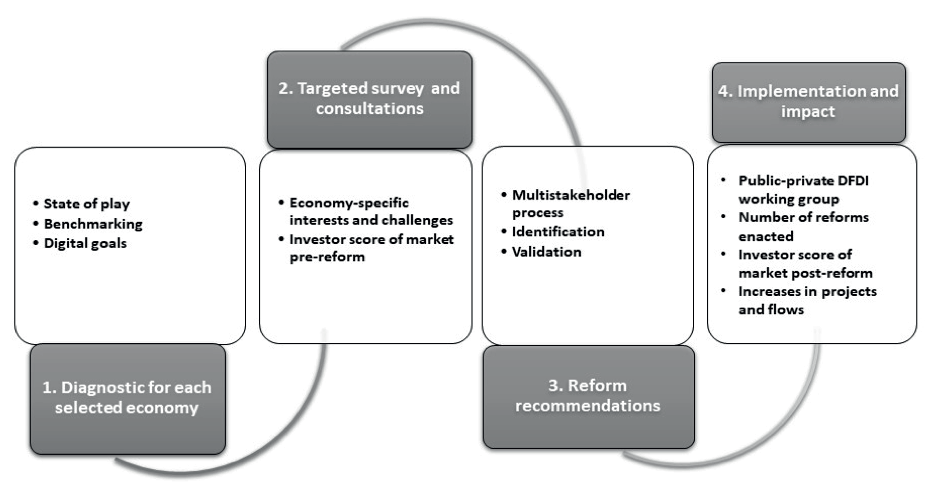

Digital FDI Enabling Projects Can Thus Be Rolled Out in Four Steps

First, a diagnostic step to understand (a) the state of play of relevant policies, regulations and measures, (b) how these are benchmarked against the elements identified as important in the global survey, and (c) the specific digital development goals of the economy.

Second, a targeted survey of and consultations with investors interested in that market, asking them for (a) a perception score of the digital FDI investment climate pre-reform, and (b) the question, “What do you need to see in this country to invest in its digital economy?”

Third, developing reform recommendations through a multistakeholder process to help connect the supply of a digital-friendly investment climate by policy-makers to the demand for such an investment climate by firms.

Fourth, implementing these reforms and tracking impact through the number of reforms carried out, improvement in perception score of the digital FDI investment climate post-reform and increases in actual digital FDI flows investment projects and capital flows.

Figure 3. Digital FDI enabling project (DEP) methodology

Source: Stephenson (2020)

The G20 may wish to create a Sustainable Technology Board (STB) to foster cooperation rather than competition over new technologies, and thus help to address potential concerns over Digital FDI. Some countries may be reluctant to welcome too much Digital FDI given growing competition in a new ‘digital tech’ race. These concerns have led to an increase in FDI screening of technology-related investments (OECD, 2021a). One solution is for the G20 to create an STB, modelled after the Financial Stability Board, which is elaborated in a separate T20 policy brief (see Stephenson et al., 2021)

The STB could have three specific functions that together could help address potential concerns over Digital FDI. First, an STB could provide a platform where policy-makers, firms, experts and civil society would work together to identify needs, share concerns and opportunities over new technologies and their potential contribution to sustainable development, and transparently chart out ways to integrate these in both regulatory frameworks and corporate strategies. Second, an STB could generate analysis on developments in new technologies, and the risks and opportunities that these generate, as well as develop good practices for how authorities and firms have previously addressed risks and seized opportunities. Third, an STB could develop standards and guidelines to facilitate the sustainable adoption of new technologies. While some countries will undoubtedly continue to jockey over technology and remain wary of Digital FDI, an STB creates a mechanism for finding common ground and collaboration where it is feasible, including over inward and outward Digital FDI flows.

If an Individual Economy Wishes to Increase Digital FDI, Where Should It Start?

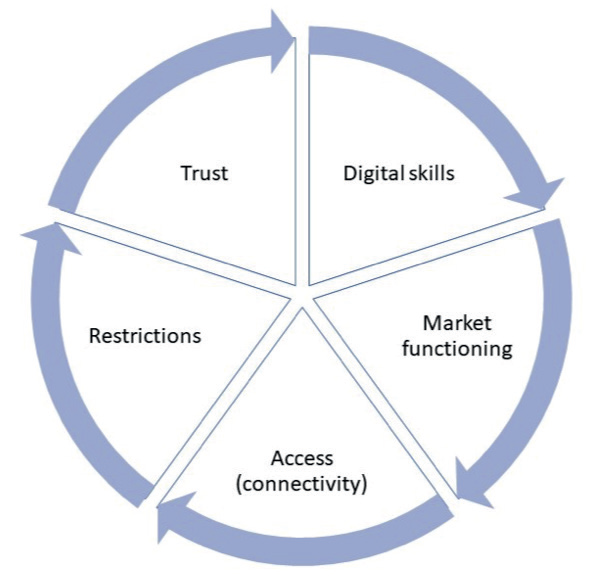

USE “SMART” TEST AND TOOLS

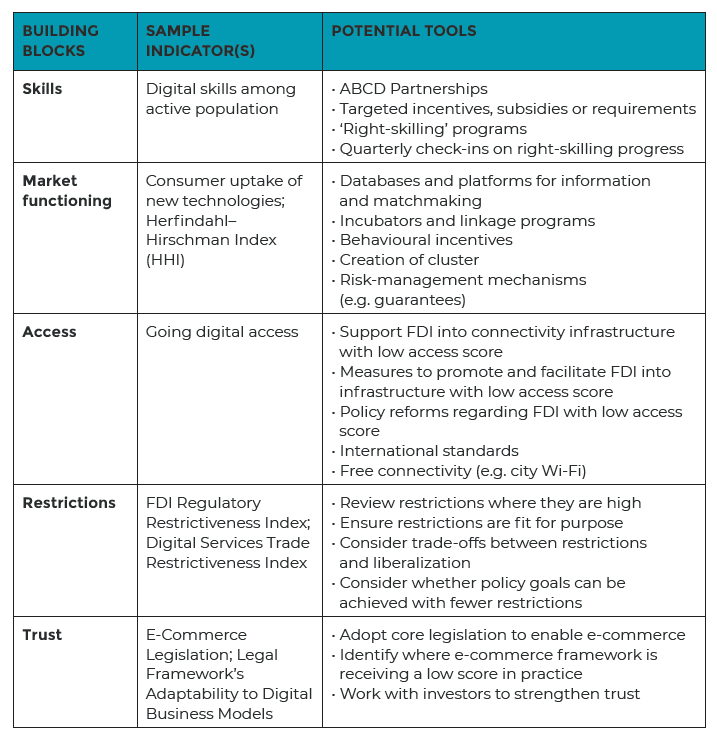

Until a DEP can be launched, policy-makers can use a SMART test and tools to identify and tackle the limiting factors to Digital FDI. Ideally an economy launches a DEP to increase investment by following the methodology outlined above. However, as a “first-response” approach, policy-makers can use a “SMART” test to quickly identify weaknesses that may be holding back Digital FDI. Each of the letters in SMART represent a key building block to a “digital friendly” investment climate: Skills, Markets, Access, Restrictions, and Trust (see Figure 4). Within each of the five building blocks, certain indicators can pinpoint where the problem may lie, and certain tools can help address it.

Figure 4. Five dimensions of the SMART test

Skills

Digital skills can be the most important building block to Digital FDI. Surveys of firms reveal that digital skills are often the most important factor holding back Digital FDI (Stephenson, 2020, p. 11).4 Digital skills are not measured by a diploma or certification, but in terms of practical skills. As such, the best indicator is the perception by existing or potential investors.

Suggested Indicator: Digital Skills Among Active Population

Since 2017, the World Economic Forum’s Global Competitiveness Index has asked a question on digital skills, namely, “In your country, to what extent does the active population possess sufficient digital skills (e.g., computer skills, basic coding, digital reading)?” On average, the digital skills of businesses have decreased by 3.4% among advanced economies and increased by a feeble 1.8% among emerging and developing economies (Schwab and Sahidi, 2020, p. 23).5

WHAT CAN POLICY-MAKERS DO?

The first step may be to identify the required skills through dialogue with industry. Academic-Business Cooperation on Digital (ABCD) partnerships, can then be set up with universities and institutes to provide the skills identified by business. Such ABCD partnerships and the related digital skills can be supported through very targeted incentives, subsidies or requirements. In addition, ‘right-skilling’ programmes need to be launched for those already in the work force. Quarterly check-ins between the public, private and academic groups on progress to ‘right-skilling’ would keep political attention and support on this vital area.

Market functioning

Perhaps even more basic than skills is the need for well-functioning digital markets. This can range from addressing market failure, providing market facilitation or helping to create new markets for Digital FDI. In essence, the incentives, information and opportunities need to be present for such investment to take place. In addition, concerns related to competition need to be addressed because of market concentration and natural monopolies inherent in platform economies and other digital activities. These considerations are difficult to capture in an indicator. One possible proxy can be the degree to which companies and consumers actually use goods and services related to new technologies.

Suggested Indicators: Consumer Uptake of New Technologies; Herfindahl-Hirschman Index

The Global Competitiveness Index has an indicator on the uptake of new technologies, based on a scale of 1-4, which can help determine whether a market is working well for Digital FDI to take place (see Schwab and Sahidi, 2020, p. 71).6 In addition, the HerfindahlHirschman Index (HHI) provides a measure of market concentration through comparing the size of firms to the size of the industry, and can be a starting point to determine the need for stronger competition policy.

WHAT CAN POLICY-MAKERS DO?

If an economy receives a low score, there are number of tools that can help create well-functioning digital markets. Information on opportunities and matchmaking between investors and projects can take place through databases and platforms. Incubators and linkage programmes can help develop domestic firm capacity to connect with foreign investors, which can be supported through behavioural incentives (especially where there may be spillovers, such as in investment into advanced technologies) and the creation of clusters. Risk-management mechanisms, such as guarantees or first-loss equity, can smooth out market functioning.

Access

Underpinning well-functioning markets is connectivity to access the digital economy. Communications infrastructure and services make investment possible in new digital activities and in digital adoption by incumbent firms (see subsection above Launch Digital FDI Enabling Projects to Create Digital Friendly Investment Climates). Without broadband internet and broad mobile network coverage, digital activities cannot flourish as they provide access to data, the ‘lifeblood of technology systems’ (Stephenson et al., 2021, p. 5).

Suggested Indicator: Going Digital Access

The OECD’s Going Digital Toolkit has a policy dimension focused on access which includes seven different indicators (OECD, 2021b).7 Some of these indicators may be relatively more important for certain economies, depending on their particular geographic, economic and societal factors. However, the indicators provide policy-makers with a metric to see on which part of connectivity their economy may be relatively weaker, and to take commensurate action.

WHAT CAN POLICY-MAKERS DO?

Where an economy receives a low indicator score, policy-makers may wish to pay particular attention to supporting Digital FDI into that type of infrastructure. This can take place through the gamut of promotion, facilitation and policy reform. Specific tools can include adopting certain standards regarding infrastructure, which helps connectivity and interoperability between markets and increases investor interest. Policy-makers may even wish to provide free connectivity as an input into digital growth, as a number of cities have done with complementary Wi-Fi. Concerns over Digital FDI into some infrastructure, such as 5G networks, can in part be assuaged and addressed through cooperation at a proposed Sustainable Technology Board (Stephenson et al., 2021). Finally, a future WTO Investment Facilitation for Development Agreement (IFDA) could be designed and implemented to facilitate Digital FDI given its importance both to short-term recovery and long-term growth. While the IFDA is designed to apply horizontally across sectors, measures can be oriented to providing targeted facilitation to priority investments, including Digital FDI. How the WTO IFDA can help “build back better” is addressed in a separate T20 policy brief (Berger et al., 2021).

Restrictions

In addition, Digital FDI is less likely to flow into an economy if market entry restrictions are in place, or if operational regulations are heavy handed. The regulatory framework can be thought of in two ways: restrictions on market entry and regulations on operations once an investor has entered and established a commercial presence. The focus should be on removing market entry restrictions and selecting operating regulations that achieve policy objectives with the lightest regulatory load consistent with those policy objectives, for instance through adopting performance-based regulation (Stephenson et al., 2021).

Importantly, investors are likely to prefer a clear, stable and well-enforced framework that may include some restrictions rather than an unpredictable “Wild West” approach (Stephenson, 2020, p. 11).8 While some large economies may be able to maintain high operating regulations and still enjoy investor interest given their market-seeking motive, most economies are not afforded this luxury. The presence of heavy-handed restrictions will dampen investor interest and the absence of heavy-handed restrictions will increase investor interest, while maintaining a stable, predictable and effective framework. These restrictions matter not only regarding FDI in Digital FDI enabling sectors, but also to digital services trade, given that Digital FDI may be motivated by the provision or export of digital services.

Suggested Indicator: Restrictiveness Indexes

The OECD has two indexes that can be used to measure regulatory restrictions that may impinge on Digital FDI: the FDI Regulatory Restrictiveness Index and the Digital Services Trade Restrictiveness Index. The former includes restrictions on enabling sectors considered below in subsection Target FDI in sectors that are digital enablers (electric, electronics and other instruments; communications; and business services) (OECD, n.d., b). The latter includes restrictions that will limit digital activities (OECD, n.d., a).9

WHAT CAN POLICY-MAKERS DO?

Where there are relatively high restrictions in place that will impinge on Digital FDI, policy-makers may wish to consider reviewing and, if needed, removing them. Restrictions may be outdated and no longer fit-for-purpose. Even if still relevant, it is important to consider and balance trade-offs, for instance national security concerns and communications. It may be that national security may only apply in some parts of communications, and in others lifting certain regulations may kickstart digital growth, for instance by allowing firms to determine the technology that matches the market.

Trust

Underlying all these building blocks must be trust through a fit-for-purpose and effective legal framework. There is core legislation for e-commerce to function well, including e-transactions, consumer protection, data protection and privacy and cybersecurity (UNCTAD, n.d.). In the Digital FDI survey, investors reported that “data security regulations” and “data privacy regulations” were the first and third most important consideration when investing

abroad in new digital activities, and therefore should be a priority to build trust (Stephenson, 2020, p. 11). However, beyond adopting legislation, what matters is how it is applied and enforced in practice. As a result, a perception index can help policy-makers realize whether investors see the legal framework as creating trust in the digital economy, and thus stimulating Digital FDI.

Suggested indicators: Adoption of E-Commerce Legislation; Legal Framework’s Adaptability to Digital Business Models

A further indicator in the Global Competitiveness Index takes the pulse of whether executives feel the legal framework is fit for purpose vis-à-vis the digital economy. They are asked, “In your country, how fast is the legal framework of your country adapting to digital business models (e.g. e-commerce, sharing economy, fintech, etc.)?”10 This supplements a review of the de jure regulatory framework with a sense of how it is being experienced de facto.

WHAT CAN POLICY-MAKERS DO?

Policy-makers can first ensure that core legislation to enable e-commerce is in place. After that, they can use the indicator to get a sense of investors’ perception of how the regulatory framework is effective or not in practice. If they receive a low score, then they can “peel back the onion” to ask investors where policy-makers may need to strengthen implementation.

Box 1. Summary of SMART test and tools

Target FDI in sectors that are digital enablers

In addition to enabling elements, there are also enabling sectors to grow the digital economy.

Policy-makers may wish to ensure their countries are receiving sufficient FDI in sectors that are digital enablers across the economy. While Digital FDI can take place in any sector as digital adoption by incumbent firms can take place in any sector certain sectors can act as digital enablers horizontally across the economy. It may therebefore be particularly important to target investment policy reforms, promotion and facilitation to these sectors.

Two sectors can be considered ‘structural’ digital enablers, and four more ‘supportive’ digital enablers. (1) communications and (2) software & IT services can be seen as structural enablers, while (3) business machines and equipment, (4) consumer electronics, (5) electronic components and (6) semiconductors are considered more supportive enablers.11 Structural enablers are services and therefore often require a physical presence. Even if they do not require a physical presence (e.g., outsourced IT services), having them produced locally can lead to positive externalities and spillovers into other sectors. Supportive digital enablers are goods, and therefore easily imported. However, having them produced locally is again likely to lead to positive externalities. Within the supportive digital enablers, the data will show that (5) electronic components, and (6) semiconductors may be relatively more important in terms of attracting Digital FDI.

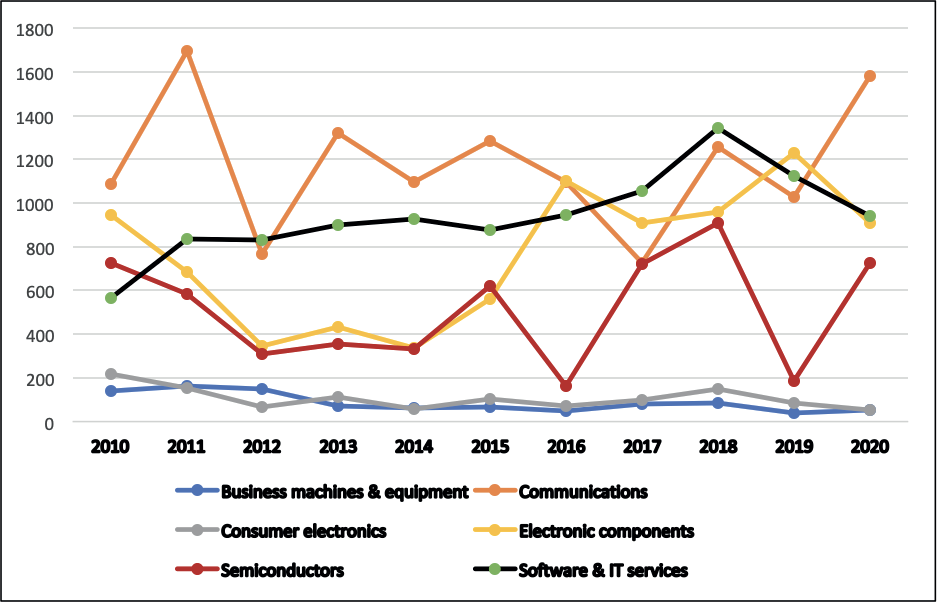

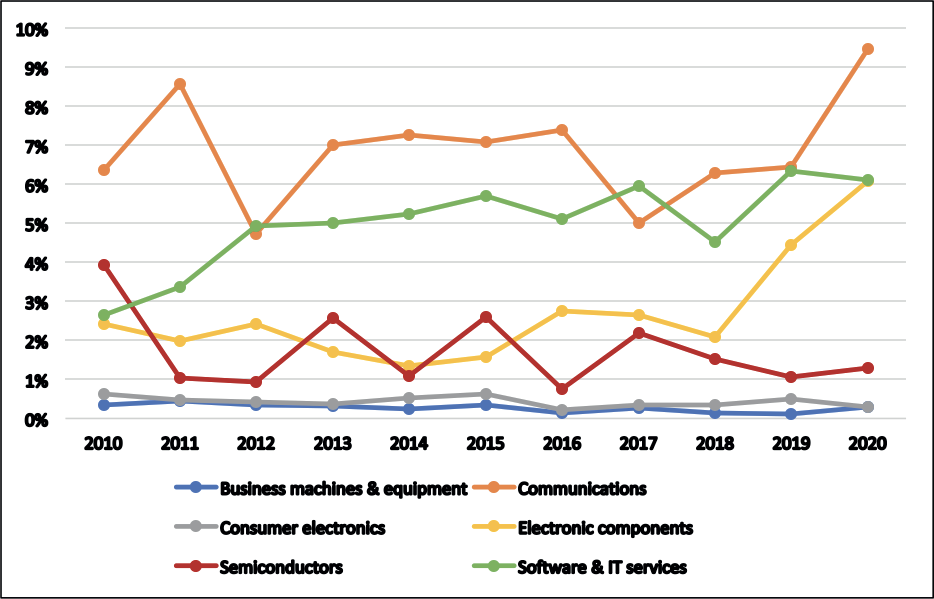

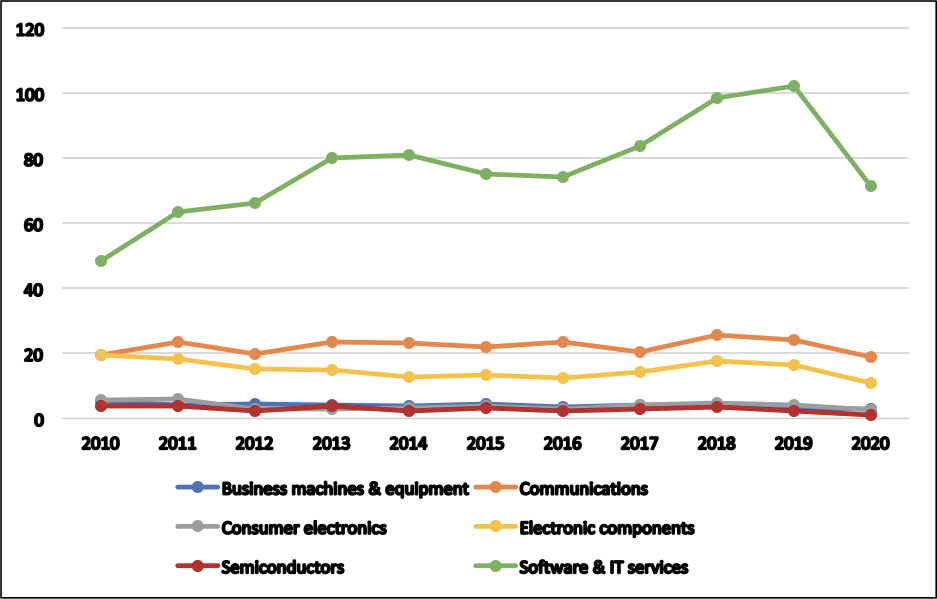

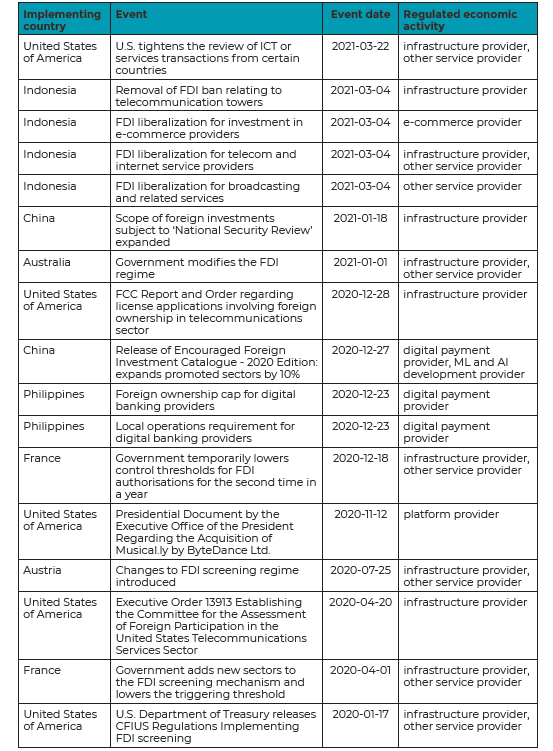

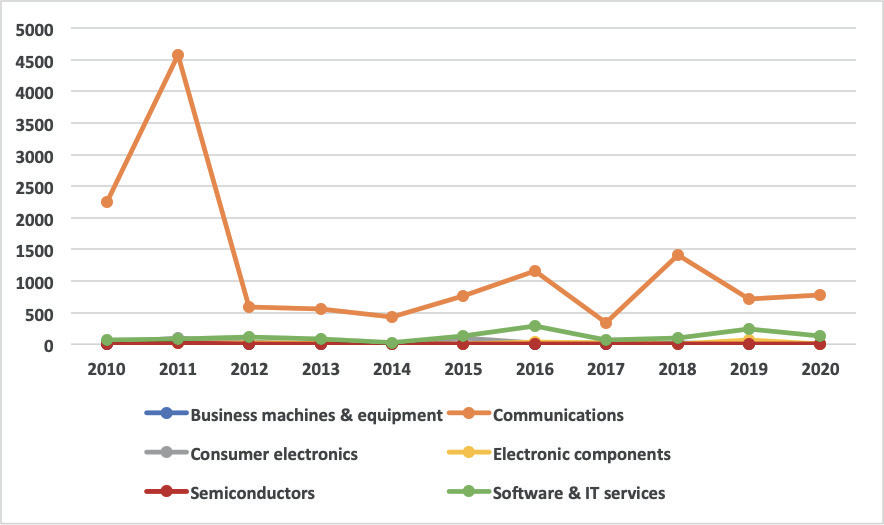

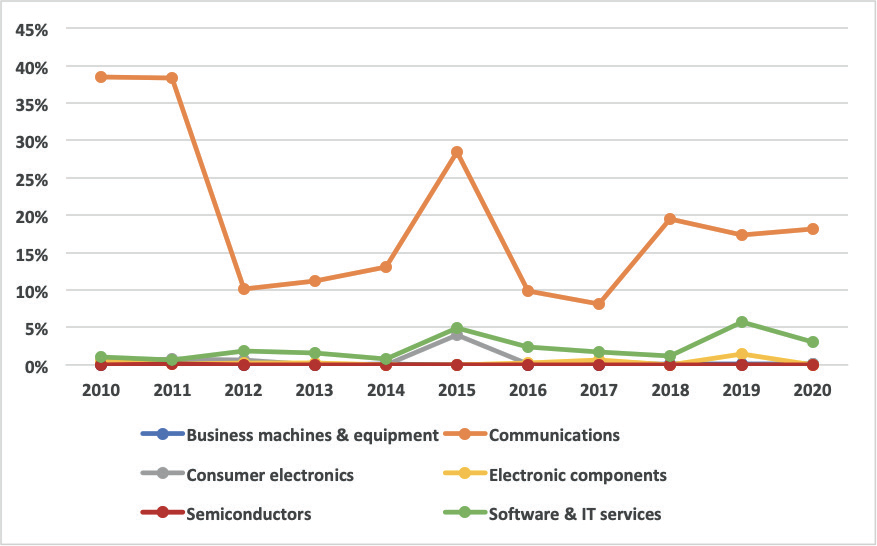

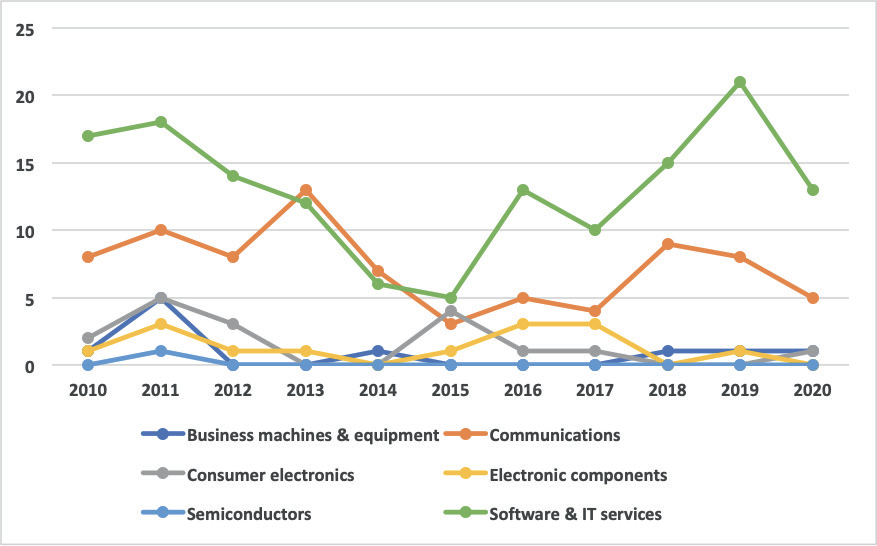

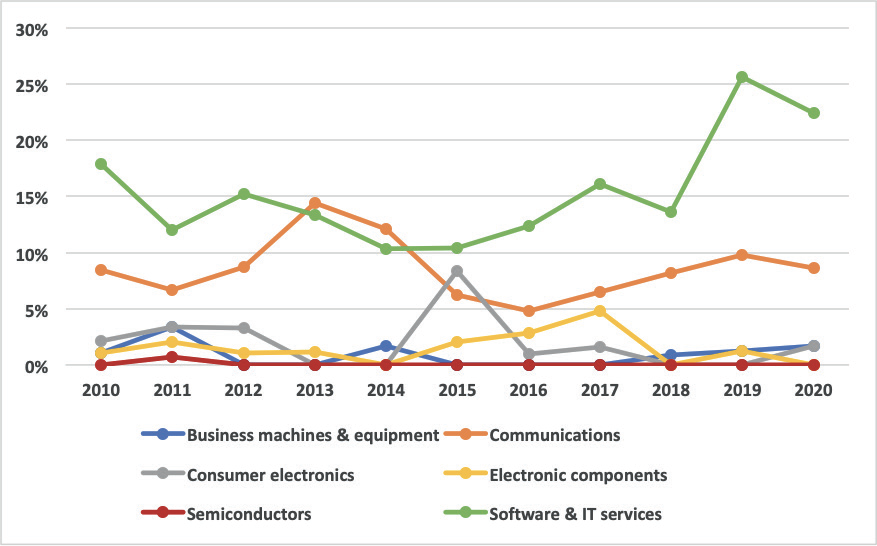

If an economy is receiving relatively low levels of FDI in an enabling sector, it may wish to adopt targeted policies, regulations and measures. In each of the graphs below, the G20 average is presented for the level of inward FDI for each of the six enabling sectors between 2010 and 2020 (see Figures 5-8).12 The information is shown both in terms of capital flows and number of projects as well as the relative share of each. It is important to consider the number of projects, and not just the value of capital, given that some types of investment may not require as large capital expenditures (e.g. those in software & IT services) compared to others (e.g. those in communications). Both capital flows and the number of projects therefore need to be considered together to reach a complete picture.

This brief provides the same information for each individual G20 economy in Appendix 2.13 policy-makers can therefore benchmark how they are doing relative to other G20 economies and G20 averages. They can then consider adopting targeted policies, regulations and measures to increase FDI in the sectors that they wish to strengthen.

Figure 5. G20 average IFDI capital received per digitally enabling sector (USD million)

Figure 6. G20 average share of capital received in digitally enabling sectors (out of total capital received for IFDI projects)

Figure 7. G20 average number of IFDI projects per digitally enabling sector

Figure 8. G20 average share of IFDI projects in digitally enabling sectors (out of total number of IFDI projects)

How should the graphs be read? First, it is worth noting that the two sectors proposed as structural digital enablers (communications and software & IT services) dominate across both capital flows and projects when examining both the G20 average and across most of the component economies. Since these are “core” rather than “nice to have”, this is a good sign, especially the strong trend towards more FDI in software & IT services. On the flip side, some sectors proposed as supportive digital enablers do not receive much FDI at all, notably business machines & equipment and consumer electronics (except for small amounts in China, Mexico, Turkey and Saudi Arabia). The conclusion may be that these two sectors are relatively less important for FDI as they can be easily acquired through trade, and may therefore not be a priority in a DEP. As previewed above, within the supportive digital enablers, it seems that (5) electronic components, and (6) Semiconductors may be relatively more important in terms of attracting digital FDI.

Semiconductors are worth singling out, given the global shortage and their strategic import in the modern economy. China has received significant FDI into this sector, as have the Republic of Korea and Japan, though Japanese levels have fallen significantly in recent years. The USA recently boosted its level of FDI in semiconductors, but other economies have not, prompting some industry leaders, for instance the CEO of Intel, to call for greater FDI in semiconductors in Europe (Gelsinger, 2021).

What kinds of policy implications might these data of Digital FDI reveal? Specific recommendations are beyond the scope of this brief but we hope our work can serve as a starting point for deeper country-specific analysis. Some tentative observations for a few economies can illustrate how policy-makers may wish to use this information. For instance, the data show that China may wish to adopt policies and measures to grow FDI into software & IT services and move away from (what may be) an overreliance on FDI in manufacturing. Indonesia may also wish to develop a targeted strategy to attract FDI in software & IT services, something it may have already started doing with recent reforms (Herbert Smith Freehills, 2021). Italy appears to be doing well, but could perhaps use a little more focus on attracting FDI into software & IT services. India, in contrast, may wish to diversify away from what appears to be an overreliance on Digital FDI in software & IT services. Russia may wish to do the same for communications, as FDI in this sector has collapsed. Canada, Germany and Saudi Arabia appear to be doing quite well and may wish to continue with their approaches.

Having a relatively low level of Digital FDI compared to other countries does not automatically mean the country has a problem but may serve as a red flag or at least as a reason for further investigation. Perhaps the relative lack of Digital FDI reflects underlying economic weakness in that sector or could be due to other causes such as national security concerns or domestic policy objectives that cause an economy to limit FDI in an enabling sector. For instance, 21% of economies have inward FDI restrictions in communications, the fourth-highest sector (UNCTAD, 2017, p. 187). The adoption of new tax policies for the digital economy (e.g., the OECD Pillar One Amount A proposal, the new UN 12B withholding tax on automated digital services, and the digital sales/services taxes being introduced by many countries) should also be examined for their short and long term impacts on Digital FDI. Since FDI restrictions normally lead to lower FDI and potentially reduced competitiveness in a sector, there is a necessary trade-off that should be considered. If an economy is aiming to catch up or strengthen its digital capacity and competitiveness, it may wish to carefully consider such restrictions (see Restrictions).

CONCLUSION

Digital transformation is happening apace. The question, then, is how can policy-makers and firms ride this wave to higher levels of capacity and competitiveness, rather than being crushed by it. This brief has proposed a three-part strategy.

First, launching a DEP to identify and implement enabling policies, regulations and measures to create a digital friendly investment climate. To carry out such projects, policy-makers can draw from a Digital FDI framework, methodology and extant survey data. They can also orient DEPs to boosting the digital capacity of SMEs.

Second, until a DEP can be launched, a SMART test can be used to see where there might be limiting factors holding back Digital FDI. Indicators can pinpoint problems and tools can guide their resolution.

Third, firms should target FDI reform, promotion and facilitation to sectors that are digital enablers across the economy. Six sectors have been proposed, two of which are suggested to be structurally important (communications and software & IT services), and two that are supportive but relatively important (electronic components and semiconductors).

Each country will be at a different starting point in terms of FDI received across these sectors, and so the brief presents G20 economies with the evidence they need to benchmark their performance and thus prioritize reforms (see Appendix 2).

Why should the G20 act? G20 economies represent both the main source of outward Digital FDI and the main destination of inward Digital FDI, and so have an interest in facilitating and promoting these flows. In addition, since targeting Digital FDI is a new concept, G20 economies can play a leadership role in developing the elements needed to target FDI, and thereby accelerate both their recovery and global recovery following COVID-19.

APPENDIX 1

Source: Global Trade Alert (n.d.)

APPENDIX 2

Below are graphs for Argentina to illustrate the information that has been produced for each G20 economy as a resource for policymakers. Information for the other G20 economies can be found at this link: https://www.weforum.org/projects/investment.

Argentina’s IFDI capital received per digitally enabling sector (USD million)

Argentina’s share of capital received in digitally enabling sectors (out of total capital received for IFDI projects)

Argentina’s number of IFDI projects per digitally enabling sector

Argentina’s share of IFDI projects in digitally enabling sectors (out of total number of IFDI projects)

NOTES

1 The relative importance of FDI for a firm can be calculated through the ratio of the share of foreign sales to the share of foreign assets. In other words, does a firm need to undertake significant FDI to generate foreign sales, or can it do so without the need for FDI? Traditional MNEs have, on average, a ratio of 1 between foreign sales and foreign assets. If the ratio is lower than 1, this indicates that FDI is even more important to that type of firm than an average MNE; if more than 1, FDI is relatively less important. According to UNCTAD’s research, internet platforms (e.g. search engines, social networks) have a ratio of 2.6; digital solutions providers (e.g. electronic payments) have a ratio of 1.9; IT firms (e.g. software and services, devices and components) have a ratio of 1.8; digital content providers (e.g. digital media, games, info and data) have a ratio of 1.1; e-commerce firms (e.g. internet retailers) have a ratio of 1.1; and telecom firms have a ratio of 0.9, which reflects the significant investment they must undertake in physical infrastructure. However, it is worth underlining that this ratio captures relative importance: a digital firm that has very significant foreign sales and thus a high ratio could still have undertaken significant FDI in absolute terms.

2 It is worth noting that certain elements can also enable digital adoption by the public sector, which in turn will promote digital adoption by firms and individuals, for instance through exposure, new habits, ensuring skills development, etc. Estonia is a good example of this complementary channel that works through secondary effects, though for the purpose of this brief, the focus is on direct adoption by firms.

3 In the Digital FDI survey, investors reported that international connectivity, national connectivity and urban connectivity were the three most important physical considerations when investing abroad in digital infrastructure.

4 When asked “How important are the following for investing abroad in the digital economy?”, the option ‘Level of digital skills in the economy’ received the top score: 8.05 out of a maximum of 10.

5 The range is 1 = ‘not at all’ to 7 = ‘to a great extent’, with a score reported from 0 to 100.

6 This indicator captures companies/consumers using products and services based on 3D, 4D printing and modelling technology, biotechnology and DNA technology, clean energy (generation, storage, transmission) technology, distributed ledger technology/ blockchain technology, energy efficiency of buildings technology, information processing (artificial intelligence, big data, virtual reality, augmented reality) technology, internet of things and cloud computing technology, network security and encryption protocols technology, new agriculture and food technologies, new materials and composites technology, Quantum computing, robots (air, factory, land, underwater) technology, satellites (data, connectivity) and space technology, smart and energy-efficient transport technology and water, waste and air management technology.

7 These include (a) fixed broadband subscription per 100 inhabitants, (b) SIM cards per 100 inhabitants, (c) mobile broadband subscriptions per 100 inhabitants, (d) share of households with broadband connections, (e) share of businesses with broadband contracted speed of 30 Mbps or more, (f) share of population covered by at least a 4G mobile network and (g) disparity in broadband uptake between urban and rural households.

8 In a Digital FDI survey, investors reported that the second and third most important overall considerations to investing abroad in the digital economy were ‘Regulatory stability and predictability’ and ‘Regulatory framework (national and local)’, providing hard evidence for the importance of getting the regulatory framework right.

9 These include: (a) infrastructure and connectivity, as discussed earlier in the section, (b) electronic transactions, to be discussed next, (c) payment systems, (d) intellectual property rights, and (e) other barriers affecting trade in digitally enabled services.

10 The range is 1 = ‘not fast at all’ to 7 = ‘very fast’.

11 These six were drawn from fDi Markets database out of a total of thirty-seven sectors. fDi Markets was used as a database as it captures greenfield FDI which is likely to produce the most benefits for the host economy. The six were selected as they fit the digital economy architecture proposed in UNCTAD (2017). The exception was ‘Media/Entertainment’, which is part of UNCTAD’s proposed architecture and also featured in fDi Markets, but was not included in this brief as in fDi Markets the category was focused on theme parks, gambling and museums, and therefore lacked a strong digital dimension.

12 In calculating the G20 average, the EU was not included given the challenge of extracting data for each individual EU economy, but the three EU economies that are members of the G20 in their own right were included, namely France, Germany and Italy, in addition to the United Kingdom, a former EU member.

13 Information for Argentina is included in this document for illustration purposes, with the rest of the data available through a link.

REFERENCES

Accenture (2019). Full value. Full stop., https://www.accenture.com/_acnmedia//Thought-Leadership-Assets/PDF/Accenture-Future-Systems-Report.pdf accessed 30 July 2021

Anadon LD, Chan G, Harley AG, Matus K, Moon S, Murthy SL, Clark WC (2016). Making technological innovation work for sustainable development. Proceedings of the National Academy of Sciences, 113(35): 9682-9690, https://www.pnas.org/content/113/35/9682.short accessed 30 July 2021

Berger A, Chi M, Hoekman B, Mbengue MM, Sauvant KP, Stephenson M (2021). Facilitating sustainable investment to build back better. Policy Brief 7, T20 Italy 2021 – Task Force on Trade, Investment and Growth

Bright J (2019). Nigeria’s Interswitch con firms $1B valuation after Visa investment. TechCrunch, 12 November, https://techcrunch.com/2019/11/11/nigerias-interswitch-confirms-1b-valuation-after-visa-investment/ accessed 30 July 2021

Ciuriak D, Ptashkina M (2019). Leveraging the digital transformation for development: a global south strategy for the data-driven economy. Enhanced Integrated Framework Aid for Trade Series, Center for International Governance Innovation (CIGI), https://www.cigionline.org/publications/leveraging-digital-transformation-development-global-south-strategy-data-driven accessed 6 August 2021

Drake-Brockman J, Borchert I, Cory N, Fan Z, Findlay C, Kimura F, Kyvik-Nordås H, Lodefalk M, Peng S-Y, Roelfsema H, Damuri YR, Stephenson S, Xinquan T, Van Der Marel E, Yagci M (2020). Impact of digital technologies and the fourth industrial revolution on trade in services. T20 Policy Brief, https://www.g20-insights.org/policy_briefs/impact-of-digital-technologies-and-the-fourth-industrial-revolution-on-trade-in-services/ accessed 30 July 2021

Echandi R, Krajcovicova J, Qiang CZ (2015) The impact of investment policy in a changing global economy a review of the literature. Policy Research Working Paper 7437, Trade and Competitiveness Global Practice Group, World Bank Group, http://documents1.worldbank.org/curated/en/664491467994693599/pdf/WPS7437.pdf accessed 30 July 2021

Eden L (2016). Multinationals and foreign investment policies in a digital world. The E15 Initiative: Strengthening the Global Trade and Investment System for Sustainable Development, World Economic Forum and the International Centre for Trade and Sustainable Development (ICTSD), http://e15initiative.org/publications/multinationals-and-foreign-investment-policies-in-a-digital-world/ accessed 30 July 2021

Gelsinger P (2021). The EU must play a long game for semiconductor success. Financial Times. 28 April, https://www.ft.com/content/34b07427-6bca-431d8406-62762fc46941 accessed 30 July 2021

Global Trade Alert (n.d.) Digital policy alert. https://www.globaltradealert.org/digital_policy accessed 1 May 2021

Habánik J, Grenčíková A, Karol K (2019). The impact of new technology on sustainable development. Engineering Economics. 30(1): 41-49, https://inzeko.ktu.lt/index.php/EE/article/view/20776 accessed 30 July 2021

Herbert Smith Freehills (2021). Indonesia’s new investment list increases FDI opportunities for foreign investors. 5 March, https://hsfnotes.com/indonesia/2021/03/05/indonesias-new-investment-list-increases-fdi-opportunities-for-foreign-investors/ accessed 30 July 2021

Herweijer C, Combes B, Gawel A, Engtoft Larsen AM, Davies M, Wrigley J, Donnelly M (2020). Unlocking technology for the global goals. World Economic Forum and PwC, http://www3.weforum.org/docs/Unlocking_Technology_for_the_Global_Goals.pdf accessed 30 July 2021

IMF (International Monetary Fund) (2018). Estonia takes off. Finance & Development, 55(1), https://www.imf.org/external/pubs/ft/fandd/2018/03/trenches.htm accessed 30 July 2021

Lamb K (2019). The rise of techno-nationalism – and the paradox at its core. World Economic Forum, 3 July, https://www.weforum.org/agenda/2019/07/the-rise-of-techno-nationalism-and-the-paradox-atits-core/ accessed 30 July 2021

Lee Y (2020). Ride-hailing giant Gojek rais es $1.2 billion for Clash with Grab. Bloomberg, 17 March https://www.bloomberg.com/news/articles/2020-03-17/ride-hailing-giant-gojekraises-1-2-billion-for-clash-with-grab accessed 30 July 2021

Lunden I (2019). SoftBank pumps $2B into Indonesia through Grab investment, putting it head to head with Gojek. TechCrunch, 29 July, https://techcrunch.com/2019/07/29/softbank-pumps-2b-into-indonesia-through-new-grab-investment-putting-it-head-to-head-with-gojek/?guccounter=1 accessed 30 July 2021

McKinsey Digital (2020). The COVID-19 recovery will be digital: a plan for the first 90 days. 14 May, https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-covid-19-recoverywill-be-digital-a-plan-for-the-first-90days accessed 30 July 2021

OECD (Organisation for Economic co-operation and Development) (2021a). Freedom of investment process: investment policy developments in 62 economies between 16 October 2020 and 15 March 2021. https://www.oecd.org/daf/inv/investment-policy/Investment-policy-monitoring-March-2021-ENG.pdf accessed 30 July 2021

OECD (Organisation for Economic co-operation and Development) (2021b). Going digital toolkit. http://goingdigital.oecd.org/ accessed 30 July 2021

OECD (Organisation for Economic co-operation and Development) (n.d., a) Digital services trade restrictiveness index. https://stats.oecd.org/Index.aspx?DataSetCode=STRI_DIGITAL# accessed 30 July 2021

OECD (Organisation for Economic co-operation and Development) (n.d., b) FDI regulatory restrictiveness index. https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX, accessed 30 July 2021

Perea JR, Stephenson M (2018). Outward FDI from developing countries. Global Investment Competitiveness Report 2017/2018, World Bank Group, http://pubdocs.worldbank.org/en/550551508856695853/GICR04.pdf, accessed 30 July 2021

PMR Healthcare (2019). Telemedicine: MedApp enters foreign markets. 2 April, https://healthcaremarketexperts.com/en/news/telemedicine-medapp-enters-foreign-markets/, accessed 30 July 2021

PwC (2020). Global Top 100 companies by market capitalisation. https://www.pwc.com/gx/en/audit-services/publications/assets/global-top-100-companies-2020.pdf, accessed 30 July 2021

Schwab K, Sahidi S (2020). The global competitiveness report: how countries are performing on the road to recovery. World Economic Forum, http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2020.pdf, accessed 30 July 2021

Srinivasan N, Eden L (2021). Going digital multinationals: Navigating economic and social imperatives in a post-pandemic world. Journal of International Business Policy 4, 228-243. https://doi.org/10.1057/s42214-021-00108-7 accessed 6 August 2021

Stephenson M (2020). Digital FDI: policies, regulations and measures to attract FDI in the digital economy. World Economic Forum https://www.weforum.org/whitepapers/digital-fdi-poli cies-regulations-and-measures-to-attract-fdi-in-the-digital-economy, accessed 30 July 2021

Stephenson M (forthcoming). Launching a program for investment partnerships. Columbia FDI Perspectives

Stephenson M, Lejarraga I, Matus K, Mulugetta Y, Yarime M, Zhan J (2021). SusTech Solutions: enabling new technologies to drive sustainable development through value chains. T20 Policy Brief, Task Force on Digital Transformation

UNCTAD (United Nations Conference on Trade and Development) (n.d.). Sum mary of adoption of e-commerce legislation worldwide. https://unctad.org/topic/ecommerce-and-digital-economy/ecommerce-law-reform/summary-adoption-e-commerce-legislation-worldwide, accessed 30 July 2021

UNCTAD (United Nations Conference on Trade and Development) (2017). World investment report 2017: investment and the digital economy. https://investmentpolicy.unctad.org/publications/174/world-investment-report-2017—investment-andthe-digital-economy, accessed 30 July 2021

World Bank Group (2016). World development report 2016: digital dividends. World Bank Publications. https://www.worldbank.org/en/publication/wdr2016, accessed 30 July 2021.

World Economic Forum (2020). Digital transformation: powering the great reset. http://www3.weforum.org/docs/WEF_Digital_Transformation_Powering_the_Great_Reset_2020.pdf, accessed 30 July 2021

Zhan JX (2021). GVC transformation and a Forum, driving forces, directions, and a forward-looking research and policy agenda. Journal of International Business Policy 4, 206-220. https://link.springer.com/article/10.1057/s42214-020-00088-0