Demographic pressures and climate change in Africa are rendering subsistence farming an unviable livelihood strategy for smallholder farmers. However, urbanization and economic growth are creating new markets for fresh and processed foods in the region. To enter this market, African smallholders Need to adopt new production strategies that will increase income and make farming more appealing to the next generation. The G20 can encourage this Transition by supporting the growth of a rural-based food processing sector, the reorientation of smallholder agriculture to commercialization, and the development of infrastructure to link farmers to markets.

Challenge

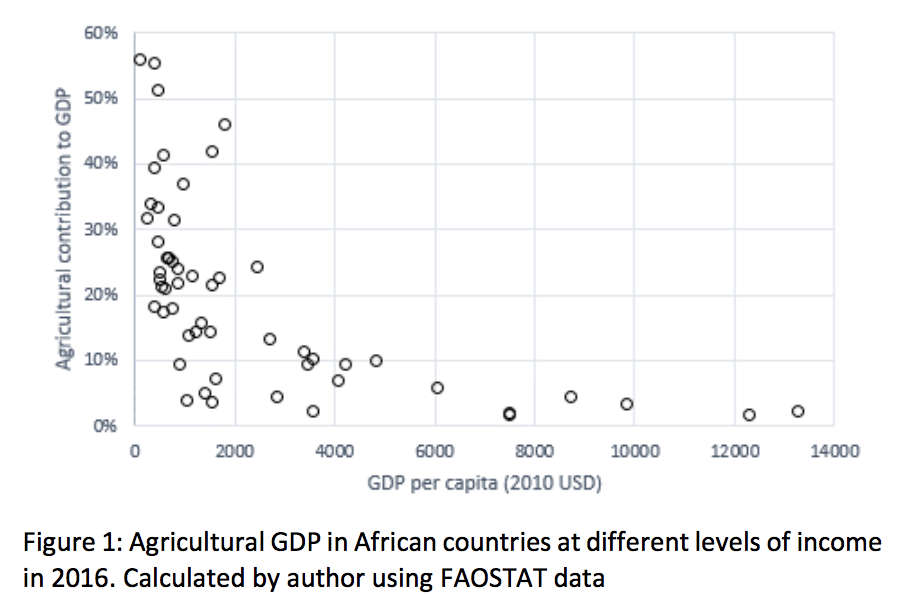

Agriculture is a mainstay of the African economy. Although officially, agricultural production directly accounts for about only 15 percent of GDP in the region (FAO Statistics Division, 2019), this figure understates the importance of agriculture in most countries. As shown in the figure below, countries with high GDP tend to have a lower share of agriculture in their economies. Thus, agriculture is more important in countries with higher poverty rates. Continentally, agriculture is a major source of employment for 70% of the population, and accounts for more than half of total employment (OECD/FAO, 2016). Agriculture is also an important part of regional trade, accounting for 10% of regional exports, although this share has been decreasing in recent decades (Badiane, Odjo, and Collins, 2018).

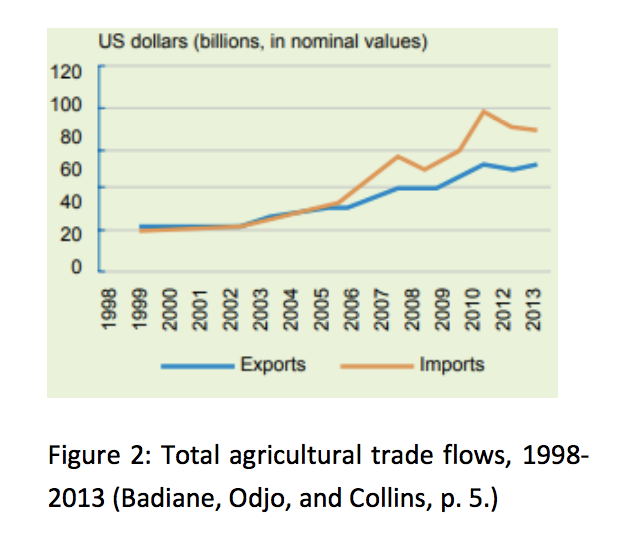

Despite agriculture’s eminence in exports, the regional trade balance of agricultural goods has been negative since 2001. Although agricultural exports have grown at annual rates of 8% in the period of 1998 – 2013, aided by high commodity prices, growth in imports has outpaced exports and increased fivefold in the same period. This is driven by several important megatrends, including high population growth, rapid urbanization, economic growth and changes in diets (Badiane, Odjo, and Collins, p. 4). In urban centers and among middle classes, food consumption has shifted away from staple crops and toward processed and fresh foods, which are increasingly sourced through markets (Tschirley, Reardon, Dolislager, and Snyder, 2015). Unlike in Asia, these megatrends have not been accompanied by substantial investments in infrastructure or the provision of credit for farm technology for domestic agricultural production, in order to fulfill domestic food demand (Reardon, 2015).

On the supply side, African agriculture largely remains characterized by a subsistence-level regime with low levels of inputs, output, and investment. Mixed smallholder farming is the predominant model, constituting 80% of farms and employing 175 million people directly (Alliance for a Green Revolution in Africa, 2014). Smallholder farms are typically smaller than 2 hectares, and only sell surplus production in markets, with the majority of the produce consumed within the household. Production growth has been relatively stagnant, and has not kept pace with the growing demand for food in urban centers and by middle classes. As a result, Africa has become a net importer of food, despite having 60% of the world’s unused arable land (Mulangu, 2015).

Thus, the challenge today is to link rural smallholder farmers to growing markets as a means of improving rural livelihoods and to make farming appealing to the next generation of young entrepreneurs. There is a growing gulf between domestic food production and largely-urban food demand, which is threatening to exclude vast portions of the continent’s population from burgeoning economic growth, prolonging the prevalence of poverty of farming households, and contributing to the exodus of young people to growing cities in search of economic opportunities. According to the FAO, already 90% of citizens living in suburbs are food insecure and these trends are likely to continue in the next decades due to the urbanization trends in particular in small and medium-sized cities.

Proposal

Overcoming the challenges of rural poverty and vulnerability requires transforming smallholder farms from subsistence operations into profitable, commercial-oriented businesses, as well as strengthening their links to growing food markets. The change in food consumption patterns taking place in cities and among growing middle classes presents a major opportunity to add value to domestic production. Moreover, a favorable global food balance means that African farmers can orient their production to align with resource endowments and export opportunities, and are not limited to producing food solely to fulfill domestic food requirements (Alliance for a Green Revolution in Africa, 2017). The objective of agricultural policy in agrarian African countries should be to make domestic agriculture more competitive, both domestically and globally, with the rest of the world, especially in terms of quality.

Agroprocessing

The lack of a robust agroprocessing sector has been identified as an important “missing link” in connecting smallholder producers to high-value markets, both in the context of international trade as well as within country borders (Halvorson, 2017). Currently, in most African countries the food and beverage subsector accounts for 30-50% of the manufacturing industry, and is growing in response to increased domestic demand for processed and fresh foods. Despite this growth, the sector is not generating growth in employment, despite it being more labour-intensive than most other manufacturing sectors (FAO, 2017). This is owing to the fact that most food processors are small-scale, family-based enterprises that are not competitive in processed food markets, while large-scale agroprocessing enterprises are not based in rural areas, are capital-intensive and do not contribute substantially to employment. Thus, policy and interventions are needed to upgrade rural food processing enterprises so that they can be more competitive in food markets while retaining their capacity for rural employment.

In order for this sector to benefit smallholder farmers and have maximal effect on poverty alleviation, it is best for small-scale processing centers to be established close to the productive areas, providing easy access for farmers to market their production as well as being an important source of off-farm employment. Small and medium-sized enterprises (SMEs) located in rural areas have the most potential to generate employment and accrue benefits to low-income families who have limited employment opportunities. While the private sector should bear primary responsibility for the development of these enterprises, they are not likely to emerge through market forces alone. There is significant scope for intervention, by governments and other partners, to facilitate this transformation. These interventions should prioritize SMEs over large agroprocessors, since SMEs have greater potential to become an important source of off-farm employment to rural inhabitants.

The emergence and success of these enterprises is not inevitable. Many entrepreneurs in the agroprocessing industry do not have the business skills or the capital required to establish their own SMEs, and need support to become established in value-added food markets. With the expertise and experience amassed in the food processing industry of some of its members, the G20 can support the integration of the Africa’s agricultural production into global and domestic agro-food value chains by actively promoting the rural-based private food processing sector. Partnerships with successful food processing companies from some G20 members can facilitate this process. Lastly, the G20 can encourage partnerships between African agroprocessors and buyers in the G20 to develop regulatory institutions that ensure the safety and quality of food without being a prohibitive barrier to entry for SMEs. Such support can allow small food processing enterprises to attain experience and establish more robust links both upstream and downstream, allowing them to eventually scale up their operations as farm productivity increases among farmers and the demand for value-added products continues to grow.

As part of the G20’s commitment to developing “integrated, inclusive and equitable development” (G20, 2018) of the global food system, it should promote policies and practices that provide opportunities to smallholder farmers, rural families, women and young people in the agroprocessing industry. The G20 can support the inclusion of smallholder farmers in the following areas:

- Working within the framework of the Comprehensive Africa Agriculture Development Programme (CAADP), the G20 can collaborate with African countries to incorporate programs to improve the prospects of agroprocessing SMEs into National Agricultural Investment Plans (NAIPs), including:

- Disseminating knowledge, promoting technology transfers, and teaching business skills that will allow rural-based food processors to upgrade processes to attain ISO-compliant phytosanitary, technical, and logistical standards, and enabling these SMEs to compete in both domestic and international value-added food markets

- Setting up funding arrangements to allow capital-constrained rural agroprocessors to invest in processing facilities, machinery, transportation, and appropriate storage facilities

- G20 member nations must look closely at their own trade practices, especially subsidies and non-tariff barriers that are inconsistent with WTO regulations, and re-evaluate them in light of stated intentions to promote smallholder farmers’ participation in global value chains. Anticompetitive practices ultimately undermine G20 members’ standing in international trade negotiations. It is in the G20’s interest for member nations to observe the rules that they themselves have set without input from any African nations other than South Africa.

Smallholder Productivity

Ultimately, the productivity of agriculture is the most important factor to harnessing the potential of the non-farm economy in rural areas, because one of the major constraints to the growth of the agroprocessing sector is an unreliable supply of raw materials. It is therefore necessary to support farmers in these areas directly to enable them take advantage of new market opportunities, especially to produce high-quality inputs for the agroprocessing sector. To integrate smallholder farmers into value-added food markets, numerous recent experiences from market-oriented agriculture interventions for small-scale farmers all over the region are tremendously useful. In principle, such projects aim to transform farmers’ orientation from a “produce and then sell” strategy to “producing strategically to sell”. In this process, farmers are expected to become entrepreneurs instead of subsisters.

To be successful actors in globalized food value chains, smallholders need to make decisions directly in response to market opportunities and uncertainties with respect to the climate. Although prices are generally set outside of smallholders’ control and they are therefore price-takers with respect to both input and product markets, farmers can become more strategic actors who mitigate risks and take advantage of market opportunities that appear. Farmers with more accurate and direct information about markets are more involved in marketing, both with middlemen as well as market wholesalers, in response to market demands. The mitigation of information asymmetries improves allocative efficiency in crop production, since farmers that are better informed on price variations and movements are enabled to optimize crop choice, planting timing, and crop marketing. Extension workers are well-positioned to support decisions made by farmers (e.g., crop choice) and improve productivity, rather than forcing farmers to plant crops recommended by the government. Extension workers can also facilitate the dissemination or realtime market information that can help farmers make informed production decisions. Alongside skill trainings, the provision of a package of market information relevant to farmers’ production is a critical role in the smallholder transformation that extension agents could fulfill.

Examples abound of smallholder market interventions led by state and nonstate actors among smallholder farmers in Africa. One example is the Smallholder Horticulture Empowerment and Promotion (SHEP) project, which has been supported by the Japan International Cooperation Agency (JICA). The SHEP model explicitly links farmers and markets to mitigate imperfect information on market prices, chronically faced by farmers. In this program, smallholder farmers are trained to think strategically and to take actions to increase their income from their horticultural produce, and farmers are intrinsically incentivized to decide on best responses to more complete market information. Like this program, the G-20 can play a key role through concerted efforts in supporting smallholders in the continent to access accurate market information and improve their ability to manage and decide on farming practices.

In summary, the G20 can support African smallholder producers by:

• Supporting business development programs like SHEP, in the continent’s horticulture, cereal crop, and livestock sectors.

• Cooperating with African countries to extend the Agricultural Market Information System (AMIS), and engaging in capacity building, with an emphasis on supporting food market transparency and the dissemination of market information, especially to farmers at the very end of GVCs.

• Promoting better climate change adaptive management, including indexed rainfall insurance schemes, water harvesting, drought-resistant crop varieties.

Infrastructure

In addition to the development of agroprocesssing and smallholder farming, investments must continue to be made in strategic infrastructure to connect farming regions to markets. The improvement of roads is necessary to reduce the burden of transport costs within the value chain. Market infrastructure has been significantly improved with the integration of ICTs to facilitate the negotiation of prices between producers and dealers, and such practices should be promoted further. In addition, agroprocessors need stable power supplies in order to run milling machines and other equipment, thus the continued extension of power networks and the upgrading of power supply is imperative.

Since the cost of establishing infrastructure for food processing is prohibitive in some instances, especially in low-income settings, one strategy that has been developed to reduce the user costs of infrastructure is the development of agroprocessing industrial parks. This strategy is currently in development in Ethiopia, and is being scaled up to service 17 regions throughout the country. By developing agro-industrial clusters, enterprises can share the costs of electricity, transportation, water and sewage, workforce training, cold storage, communications and logistics, and other elements. In Ethiopia, these clusters are also served by Rural Transformation Centers, which source agricultural raw materials from farmers as inputs to the agroprocessing sector in the catchment areas of the agro-industrial parks (1). These industrial parks are typically designed to produce at scale, thus making their value-added products more competitive and able to compete in world markets.

To develop market infrastructure in Africa, the G20 can:

• Promote last-mile electrification, telecommunications, and roadway projects as part of CAADP initiatives and other areas of collaboration between the G20 and African countries

• Consider the prospects of agroprocessing industrial parks clusters to reduce costs of storage, sanitation, logistics, and other elements, and integrating them into agricultural development strategies where prospects are favourable.

Conclusion

None of the policies described beforehand will be sufficient to integrate smallholder farmers to burgeoning food markets in isolation. Simply increasing productivity and developing agroprocessing domestically does not guarantee that it will benefit smallholder farmers. In order for this proposed agricultural transformation to be inclusive and conducive to growth, all of the aforementioned policy measures must to be implemented concurrently, which the G20 can support in varying capacities. A coordinated strategy is necessary to address all the issues simultaneously. Strategies in the manufacturing sector need to align with strategies in agriculture, and appropriate infrastructure needs to be established to link these sectors. If executed appropriately, this strategy could provide an effective means of reducing rural poverty, and promoting economic growth.

1 https://isid.unido.org/files/Ethiopia/Integrated-Agro-Industrial-Parks-in-Ethiopiabooklet.pdf

REFERENCES

• Alliance for a Green Revolution in Africa (2014), Africa Agriculture Status Report 2014 (Nairobi, Kenya: Alliance for a Green Revolution in Africa, September 2014) [accessed 17 January 2019].

• Alliance for a Green Revolution in Africa (2017), Africa Agriculture Status Report 2017 (Nairobi, Kenya, 2017), p. 8 [accessed 15 January 2019].

• Badiane, O., Odjo, S., and Collins, J. (2018), Africa Agriculture Trade Monitor 2018 (Washington, DC: International Food Policy Research Institute, 2018) .

• FAO (2017), Leveraging Food Systems for Inclusive Rural Transformation, ed. by FAO, The State of Food and Agriculture, 2017 (Rome: Food and Agriculture Organization of the United Nations, 2017).

• FAO Statistics Division (2019), ‘FAOSTAT’, FAOSTAT, 2019 [accessed 15 January 2019].

• G20 (2018), ‘G20 Agriculture Ministers Declaration 2018’ [accessed 11 February 2019].

• Mulangu, F. (2015), ‘Agroprocessing in Africa: The Low-Hanging Fruits’, Africa Up Close, 2015 [accessed 17 January 2019].

• OECD/FAO (2016), OECD-FAO Agricultural Outlook 2016-2025 (Paris: OECD Publishing, 4 July 2016), p. 136 (p. 65) [accessed 15 January 2019].

• Halvorson, K. (2017), ‘Food Processing as the Missing Link in Africa’s Value Chains’, Business Fights Poverty, 2017 [accessed 24 January 2019].

• Reardon, T. (2015), ‘The Hidden Middle: The Quiet Revolution in the Midstream of Agrifood Value Chains in Developing Countries’, Oxford Review of Economic Policy, 31.1 (2015), 45–63 (p. 50) .

• Tschirley, D., Reardon, T., Dolislager, M., and Snyder, J. (2015), ‘The Rise of a Middle Class in East and Southern Africa: Implications for Food System Transformation’, Journal of International Development, 27.5 (2015), 628–46 (p. 644) .