Climate change can negatively affect macrofinancial stability and amplify sovereign risk. By raising the cost of sovereign borrowing for climate-vulnerable countries, it limits the fiscal space available for scaling up investment in adaptation and resilience to climate change and can threaten debt sustainability. This policy brief proposes actionable policy solutions for mitigating and managing the effects of climate change on macrofinancial stability and the cost of sovereign borrowing.

Challenge

Climate change presents a major threat to macrofinancial stability and amplifies sovereign risk through direct and indirect effects on public finances (Volz et al. 2020a). Countries need to urgently scale up efforts to make their economies, financial systems and public finances more resilient. Many climate-vulnerable developing countries will need international support in mitigating and managing the physical and transition impacts of climate change and the related macrofinancial risks. A coordinated and concerted approach at the global level is needed to enable all countries, especially those most vulnerable to climate change, to invest in adaptation and resilience and climateproof their economies, financial systems and public finances.

For the most climate vulnerable countries, a rapid scaling-up of investment in climate resilience is a matter of survival. Economies with the greatest need for investment in adaptation and resilience are also those who are struggling the most to finance it. Empirical evidence indicates that climate-vulnerable developing countries are already facing a climate risk premium on the cost of capital. Recent work by Beirne et al. (2021a) estimated the effect of climate risk vulnerability and resilience on the cost of sovereign borrowing.

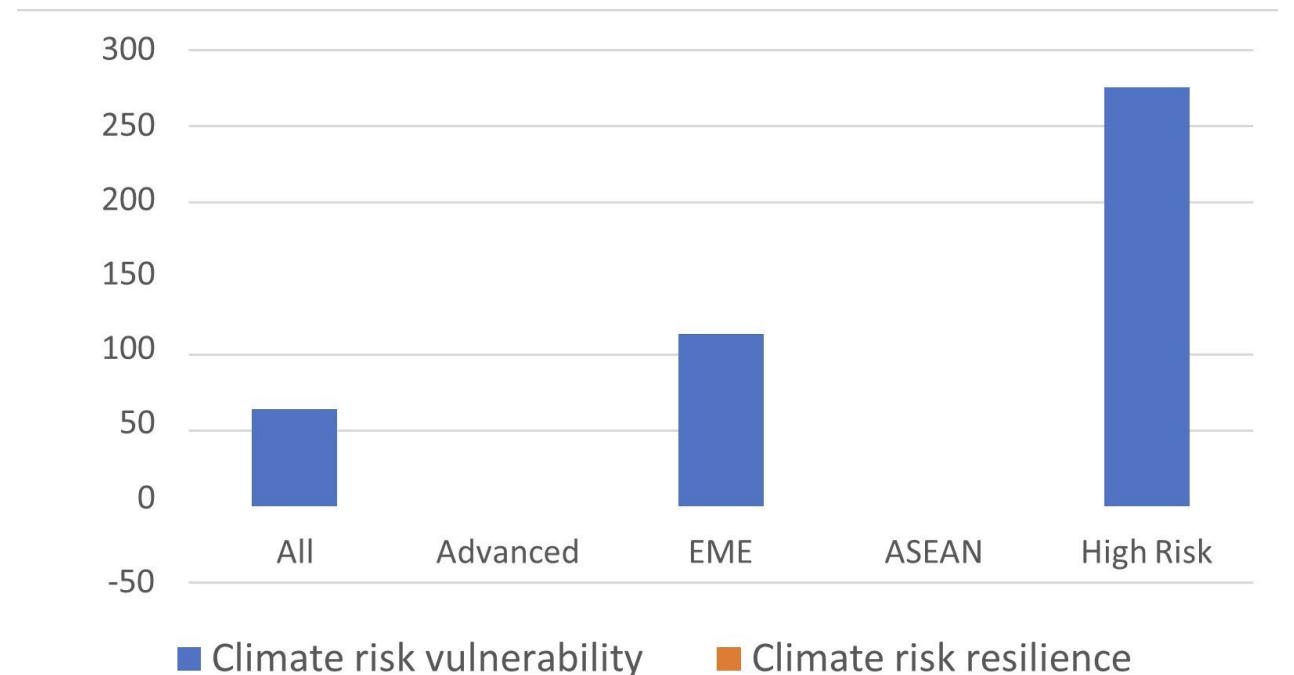

Fig. 1 The impact of climate risk vulnerability and climate risk resilience on the cost of sovereign borrowing

Note: The y-axis refers to the climate risk coefficients from the estimation of a panel regression on the determinants of sovereign bond yields across a sample of 40 economies over the period 2002 to 2018, expressed in basis points. These results also control for a large set of domestic macroeconomic and global financial factors. Source: Computed by authors from estimates in Beirne et al. (2021a).

The main results, which are summarised in Figure 1, show that greater climate vulnerability has a sizable positive effect on sovereign bond yields, while greater resilience to climate change has an offsetting effect, albeit to a lesser extent. The premium on sovereign bond yields from rising climate risk vulnerability is highest for the high-risk group, at 275 basis points, compared to 155 basis points for the member countries of the Association of Southeast Asian Nations (ASEAN) and 113 basis points for other emerging market economies (EMEs). The effect of vulnerability on bond yields for advanced economies is not statistically significant. As regards climate risk resilience, the magnitude of the effect on bond yields is substantially lower than that of climate risk vulnerability, with higher resilience associated with declines in bond yields by fewer than 10 basis points across all country groups.1

The results are striking in two main ways. First, a country’s exposure to the effects of climate change has material implications for public finances, with a sizable and significant impact on the cost of sovereign debt for developing and emerging economies. Improving resilience efforts can help to reduce vulnerability to climate change and hence bring down the cost of sovereign financing. Second, it is clear that the magnitude of the effect on bond yields is notably higher for economies that are more exposed to climate risks. In particular, the effect on bond yields for the high-risk group is higher than for EMEs as a whole by a factor of about three, and higher than for ASEAN by a factor of around two. These findings therefore suggest that those economies that are particularly exposed to climate change and have the greatest need for adaptation and resilience investment face the highest climate risk premium on their sovereign borrowing costs. Given that a significant share of the financing of adaptation and vulnerability reduction measures would have to be borne by the public sector, a higher cost of borrowing could severely hamper these crucial investments and lead to unsustainable debt burdens.

Without sufficient investment in climate resilience, there is a risk that climate-vulnerable countries enter a vicious circle, in which greater climate vulnerability raises the cost of debt and diminishes fiscal space for investment in climate resilience (Volz et al. 2020). As financial markets increasingly price climate risks, and global environmental change accelerates, the already high risk premia of climate-vulnerable countries are likely to increase further. To address the macrofinancial and sovereign risks emanating from climate change, governments face the challenge of climate-proofing their economies and public finances, or potentially facing an ever-worsening spiral of climate vulnerability and unsustainable debt burdens. This is a particularly important policy issue at the current juncture, with public finance positions worsening and debt sustainability threatened in many countries around the world due to COVID-19.

Proposal

This policy brief puts forward five actionable policy recommendations for national governments, monetary and financial authorities and the international community for economies to mitigate and manage risks to macrofinancial stability and debt sustainability caused by exposure to climate change. First, recognition of the scale of the challenge is an important first step, where economies should conduct a comprehensive climate vulnerability assessment and develop a national adaptation plan that addresses macrofinancial risk. Second, economies should mainstream climate risk analysis and adaptation into public budgetary and financial management frameworks. Third, central banks and financial supervisors at the global level have important roles to play in addressing climate-related macrofinancial risks, and monetary and prudential frameworks should be adjusted accordingly to account for climate risks. Fourth, appropriate financial-sector policies should be implemented to scale up investment in climate adaptation and resilience and develop insurance solutions. Fifth, international support is needed, including by international financial institutions, to mitigate and manage climate-related sovereign risk, with a particular focus on strengthening adaptive capacity and enhancing macrofinancial resilience.

DEVELOPMENT OF CLIMATE VULNERABILITY ASSESSMENT AND NATIONAL ADAPTATION PLAN

It is of paramount importance for policymakers to understand the extent of their exposure to the effects of climate change. Governments need to conduct a comprehensive vulnerability assessment and develop national adaptation plans. To address and mitigate climate-related sovereign risk properly, it is important to understand the ways in which climate change can amplify sovereign risk. To this end, a systematic assessment of all sources of vulnerability for the macroeconomy, the financial system and public finances is needed. Along with vulnerability to climate risks, this assessment should include the projected change in the country’s risk exposure. This should include scenario analysis of climatic and socioeconomic change, addressing both physical and transition risks. Such an assessment could be conducted by a dedicated national climate risk board that should include the central bank and supervisor, along with key government departments responsible for finance, economy, planning and agriculture, among others.

While finance ministries have usually been part of national climate change committees and the development of national climate adaptation plans, given the fiscal costs associated with responding to climate change, central banks and financial supervisors have tended not to be involved. The involvement of central banks and financial supervisors is crucial in order to ensure that the macrofinancial risks associated with climate change are appropriately incorporated into vulnerability assessments. Regional bodies such as ASEAN can also play an important role in facilitating the exchange of best practice among member countries, as they seek to understand the scale of their relative climate risk exposure.

MAINSTREAMING OF CLIMATE RISK ADAPTATION INTO PUBLIC BUDGET PLANNING

Based on the vulnerability assessment, governments need to mainstream climate risk analysis into public financial management. This should include appropriate analysis, disclosure and management of risks to public finances, as well as coordination of fiscal decision-making across the public sector. Furthermore, governments need to develop budgetary instruments to account for climate risk, and mainstream and integrate climate framework, policies and laws into national and sectoral budgets. Finance ministries also need to develop public sector funding and debt management strategies, including debt instruments with risk-sharing features, and diversify government revenue streams away from high-risk sectors.

In particular, the focus needs to incorporate climate risk adaptation into longer-term budgeting plans. Previous policy-related work has made similar recommendations in the context of natural disasters (e.g. Cevik and Huang 2018). As well as this, contingency financing for climate-related risk should be built into public budgeting frameworks (e.g. Schuler et al. 2019). On debt management and developing climate-related debt instruments, the management of climate risks in climate-vulnerable countries can be aided through government issuance of public debt instruments with natural disaster clauses, which would allow for repayment deferrals in the event of a natural disaster. The case of Barbados provides an example of such an arrangement whereby natural disaster clauses are integrated into public debt as a means by which to enhance macrofinancial resilience (Anthony, Impavido and van Selm 2020; Shutter 2020). On the diversification away from high-risk sectors, this is an important aspect for climate-proofing the public finances more broadly and reducing the fiscal exposure to climate risks. This is particularly important for economies that are highly dependent on fossil fuels that are likely to be stranded (Cust, Manley and Cecchinato 2017).

ADJUSTMENT OF MONETARY AND PRUDENTIAL FRAMEWORKS FOR CLIMATE RISKS

Central banks and financial supervisors need not only play an important role in supporting governments in analysing macrofinancial risks arising from climate change (Robins, Dikau, and Volz, 2021). They also need to address climate-related risks in their monetary and prudential frameworks and operations. In particular, they should make disclosure of climate and other sustainability risks mandatory and conduct regular climate stress tests of financial institutions, fully integrate climate-related financial risks into prudential supervision, and align monetary and prudential measures with climate goals. Mainstreaming climate-financial risk assessment in financial contracts is crucial for aligning finance flows with a pathway toward low greenhouse gas emissions and climateresilient development. Importantly, supervisors should reconsider the prudential treatment of sovereign exposures in financial regulation.

In particular, central banks and financial supervisors need to ensure that climate-related risks in the financial sector are fully disclosed and that financial institutions are subject to a rigorous set of climate-related stress testing scenarios (Monasterolo and Volz 2020). This can form the basis of an overarching prudential framework by the financial supervising authority. In addition, central banks and financial supervisors can employ a range of monetary, prudential and other policy tools in order to mitigate climate-related risks in the financial sector (Dikau, Robins and Volz 2020). More broadly, given that climate risks can exacerbate sovereign risk and threaten macrofinancial stability, greater efforts are needed on integrating sovereign risk into macroprudential solvency stress testing (Jobst and Oura 2020).

IMPLEMENTATION OF FINANCIAL-SECTOR POLICIES TO SCALE UP INVESTMENT IN CLIMATE ADAPTATION AND RESILIENCE, AND DEVELOP INSURANCE SOLUTIONS

Governments and financial authorities should implement financial-sector policies to scale up investment in climate adaptation and resilience and develop insurance solutions. Especially in developing economies, financial authorities should seek to facilitate the mobilisation of domestic resources for financing climate-resilient, sustainable infrastructure and other adaptation measures. Financial authorities can also help build the infrastructure for insurance services including fintech-based insurance solutions and make them affordable to poorer clients. Developing insurance markets and broadening insurance coverage can help to enhance the financial resilience of households and businesses and take the burden off public finances.

The development of local currency bond markets and reducing the reliance on foreign capital flows is an important consideration in enhancing macrofinancial resilience more broadly (Hofmann, Shim and Shin 2020). The development of these markets needs to progress further, with an important role for monetary and financial authorities. In the context of mitigating and managing climate-related risks, local currency bond markets can be used to finance longterm sustainable infrastructure. Moreover, they can support the development of fintech in mobilising domestic savings and channelling these into sustainable investments (Chen and Volz 2021).

TARGETED SUPPORT BY INTERNATIONAL FINANCIAL INSTITUTIONS, WITH A PARTICULAR FOCUS ON STRENGTHENING ADAPTIVE CAPACITY AND ENHANCING MACROFINANCIAL RESILIENCE

International financial institutions including the IMF, multilateral development banks and regional financing arrangements have a special role to play in supporting vulnerable countries to address climate-related sovereign risks and strengthen adaptive capacity and macrofinancial resilience. Building on their respective strengths, they can provide technical assistance and training, support surveillance and risk monitoring, provide finance for adaptation and resilience investment, support the development of insurance solutions, and provide emergency lending and crisis support. On technical assistance and training, the IMF can provide support to national monetary and financial supervisory authorities in integrating climate risks into public finance management and enhancing the climate risk stress-testing toolkit to help with the design of appropriate prudential policies. As regards surveillance and monitoring, which is a core element of the IMF’s work, climate risks need to be fully integrated into their Article IV consultations, Financial Sector Assessment Programs, and Debt Sustainability Frameworks (Volz and Ahmed 2020; Volz 2021). The IMF should also include climate risk in its stress testing exercises (Adrian, Morsink and Schumacher 2020).

International financial institutions need to provide further support to climate-vulnerable economies, where investment in climate resilience is a matter of urgency. To avoid a vicious circle in which greater climate vulnerability raises the cost of debt and diminishes fiscal space for investment in climate resilience, climate-vulnerable developing countries will need more external support for investment in climate resilience, mostly in the form of grants instead of loans. Moreover, international financial institutions and other development agencies should continue to support climate-vulnerable developing countries, through initiatives such as the InsuResilience Global Partnership for Climate and Disaster Risk Finance and Insurance, in developing insurance and risk transfer solutions (Jarzabkowski et al. 2019). On emergency lending, the IMF currently has two facilities available for catastrophe situations, including climate disasters the Rapid Credit Facility and the Rapid Financing Instrument. Consideration may be given to adjusting these facilities to grants rather than credit (Volz 2020). National and multilateral development banks also have an important role to play in providing countercyclical emergency support in climate-related disaster scenarios. A further role for international financial institutions relates to discussions on the treatment of climate-related debt and possible resolution mechanisms. Such discussions should consider options for adding natural disaster clauses to sovereign debt contracts, developing instruments such as GDPlinked bonds, and developing a new framework for dealing with climate debt, as well as a sovereign debt restructuring mechanism. In the short term, solutions are urgently needed to address the looming debt crisis in the Global South. The G20 needs to move beyond the Common Framework for Debt Treatment adopted in November 2020 and develop an approach that will enable debt relief for a green and inclusive recovery (Volz et al. 2020b; Volz et al. 2021).

NOTES

1 As regards the magnitudes of the effects estimated, while it is difficult to make direct comparisons with other studies due to differences in time periods, sample countries and methodologies, our findings are in alignment with previous studies on the fiscal vulnerabilities of economies highly exposed to climate change (e.g. Buhr et al. 2018). See also Beirne et al. (2021b) and Volz et al. (2020a) for an analysis of the implications of climate change on sovereign risk in the Southeast Asian economies.

REFERENCES

Adrian T., J. Morsink, and L. Schumacher, Stress Testing at the IMF. Monetary and Capital Markets Department, Departmental Paper No. 20/04, Washington DC, International Monetary Fund, 2020

Anthony M., G. Impavido, and B. van Selm, Barbados’ 2018-19 Sovereign Debt Restructuring – A Sea Change, IMF Working Paper No. 20/34, Washington DC, International Monetary Fund, 2020

Beirne J., N. Renzhi, and U. Volz, “Feeling the Heat: Climate Risks and the Cost of Sovereign Borrowing”, International Review of Finance and Economics, 2021a, forthcoming

Beirne J., N. Renzhi, and U. Volz, “Bracing for the Typhoon: Climate Change and Sovereign Risk in Southeast Asia”, Sustainable Development, vol. 29, no. 3, 2021b, pp. 537-51

Buhr B., U. Volz, C. Donovan, G. Kling, Y. Lo, V. Murinde, and N. Pullin, Climate Change and the Cost of Capital in Developing Countries, London and Geneva, Imperial College London, SOAS University of London, UN Environment, 2018

Cevik S. and G. Huang, Fiscal Policy. How to Manage the Fiscal Costs of Natural Disasters, Washington DC, International Monetary Fund, 2018

Chen Y. and U. Volz, “Scaling Up Sustainable Investment through Blockchain-based Project Bonds”, Development Policy Review, 2021 doi:10.1111/dpr.12582

Cust J., D. Manley, and G. Cecchinato, “Unburnable Wealth of Nations”, Finance & Development, vol. 54, no. 1, 2017, pp. 46-49

Dikau S., N. Robins, and U. Volz, A Toolbox for Sustainable Crisis Response Measures for Central Banks and Supervisors, INSPIRE Briefing Paper, London, Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science, SOAS Centre for Sustainable Finance, 2020

Hofmann B., I. Shim, and H.S. Shin, “Emerging Market Economy Exchange Rates and Local Currency Bond Markets Amid the Covid-19 Pandemic”, BIS Bulletin No. 5. Basel, Bank for International Settlements (BIS), 2020

Jarzabkowski P., K. Chalkias, D. Clarke, E. Iyahen, D. Stadtmueller, and A. Zwick, Insurance for Climate Adaptation: Opportunities and Limitations, Rotterdam and Washington DC, Global Commission on Adaptation, 2019

Jobst, A.A. and H. Oura, “Sovereign Risk in Macroprudential Solvency Stress Testing”, in L.L. Ong and A.A. Jobst (eds), Stress Testing Principles, Concepts, and Frameworks, Washington DC, International Monetary Fund, 2020, pp. 183-228

Kling, G., U. Volz, V. Murinde, and S. Ayas, “The Impact of Climate Vulnerability on Firms’ Cost of Capital and Access to Finance”, World Development, vol. 137, Article 105131, 2021

Robins, N., S. Dikau, and U. Volz, Net Zero Central Banking: A New Phase in Greening the Financial System, London, Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science, SOAS Centre for Sustainable Finance, 2021

Monasterolo I. and U. Volz, Addressing Climate-related Financial Risks and Overcoming Barriers to Scaling-up Sustainable Investment, T20 Policy Brief, Riyadh, Think20 Saudi Arabia, 2020

Schuler P., L. Edgard Oliveira, G. Mele, and M. Antonio, “Managing the Fiscal Risks Associated with Natural Disasters”, in M.A. Pigato (ed), Fiscal Policies for Development and Climate Action, Washington DC, World Bank, 2019, pp. 133-54

Shutter A., “Barbados Sovereign Debt Restructuring 2018-2019 – Like the Island, Small but Perfectly Formed”, Capital Markets Law Journal, vol. 15, no. 2, 2020, pp. 250-57

Volz U., Climate-proofing the Global Financial Safety Net, SOAS Centre for Sustainable Finance Working Paper, London, SOAS University of London, 2020

Volz, U., “The IMF and the Macro-Criticality of Climate Change”, in K.P. Gallagher and H. Gao (eds), Building Back a Better Global Financial Safety Net, Boston, MA, Global Development Policy Center, Boston University, 2021, pp. 108-18

Volz U. and S.J. Ahmed, Macrofinancial Risks in Climate Vulnerable Developing Countries and the Role of the IMF – Towards a Joint V20-IMF Action Agenda, London, Rotterdam, and Bonn, SOAS Centre for Sustainable Finance, Global Center on Adaptation, Munich Climate Insurance Initiative, 2020

Volz U., J. Beirne, N. Ambrosio Preudhomme, A. Fenton, E. Mazzacurati, N. Renzhi, and J-. Stampe, Climate Change and Sovereign Risk, London, Tokyo, Singapore, Berkeley, SOAS University of London, Asian Development Bank Institute, World Wide Fund for Nature Singapore, Four Twenty Seven, 2020a

Volz U., S. Akhtar, K.P. Gallagher, S. Griffith-Jones, J. Haas, and M. Kraemer, Debt Relief for a Green and Inclusive Recovery: A Proposal, Berlin, London, and Boston, MA, Heinrich-Böll-Stiftung, SOAS University of London, Boston University, 2020b

Volz U., S. Akhtar, K.P. Gallagher, S. Griffith-Jones, J. Haas, and M. Kraemer, Debt Relief for a Green and Inclusive Recovery: Securing Private-sector Participation and Creating Policy Space for Sustainable Development, Berlin, London, and Boston, MA, Heinrich-Böll-Stiftung, SOAS University of London, Boston University, 2021