In the Riyadh Declaration (G20, 2020), G20 leaders declared they intend to promote “inclusive economic growth including through increased participation of micro-, small-, medium-sized enterprises (MSMEs) in international trade and investment”. MSMEs account for the majority of businesses worldwide and are crucial contributors to job creation. Yet they tend to be less productive and more vulnerable to crises than large enterprises. Being better integrated into global value chains is a potential strategy for these firms to access more markets and improve their productivity. Due to differences in their nature, while partnering with large companies is a potential strategy for small and medium-sized companies (SMEs), micro-enterprises may benefit from linking with SMEs. Member states should, therefore, address the following challenges: a) facilitate the access of MSMEs to information, opportunities, and potential partners, particularly transnational companies; and b) expand trade finance instruments for MSMEs. As a practical solution, we recommend the launch of the Link20 Initiative.

Challenge

Micro-, small-, medium-sized enterprises (MSMEs) play a major role in the global economy, particularly in developing countries. MSMEs represent about 90% of total businesses and more than 50% of employment around the world (UNCTAD, 2020).1 Yet the vast majority of MSMEs tend to be less productive and lucrative than large firms, which is generally attributed to MSME-specific barriers related to scaling up and accessing strategic assets. Recent research showed that the productivity gap between SMEs and large companies is 41% in Germany and 60% in Turkey (McKinsey, 2020).

Improving the productivity of MSMEs can lead to more resilient jobs and faster-growing economies: estimations indicate that halving the global productivity gap between SMEs and large companies would amount to about USD 15 trillion in corresponding value-added, or roughly 7% of global GDP (McKinsey, 2020).

GVCs are a well-established vehicle for generating productivity spillovers to local firms (OECD-UNIDO, 2019). Studies show that the participation of firms in GVCs tends to be associated with higher levels of productivity, technological capacity and competitiveness (Lileeva and Trefler, 2010; Caliendo and Rossi-Hansberg, 2012; Wagner, 2012; Cusmano and Koreen, 2020).

If MSMEs become better integrated into GVCs, they should also be in a stronger position to ask for credit, which is needed to participate in international trade (WTO, 2016).2 However, MSMEs have long struggled to access trade finance due to a combination of factors including creditworthiness, collateral requirements, short-term liquidity, political risk and currency risk.3

Moreover, there is a long-term trade finance gap that tends to be particularly hard on relatively small firms. Even before the pandemic, it was found that the trade finance gap for small companies was around USD 5 trillion every year in the formal sector and the potential demand for finance from developing country-based informal enterprises was USD 2.9 trillion (IFC, 2017)4. 5

There are various reasons for this gap. On the one hand, private banks have been gradually focusing more on lending to large corporates due to Basel III capital reserve norms and other regulatory changes, including those related to Anti-Money Laundering/Combating the financing of Terrorism (AML/CFT) and Know Your Costumers (KYC) (Wass, 2019; IFC/WTO, 2019). On the other, these companies have long struggled to access trade finance due to a combination of factors related to the nature of MSMEs, which include high-risk perception, high transaction costs, lack of financial skills, jurisdictional differences, low short-term liquidity and non-traditional counterparty relationship. As a result, SMEs either tend to face higher interest rates, tighter borrowing terms and are more likely to be credit-rationed, or they have their trade finance applications rejected.

Over time, this has been one of the main reasons for the existence of a global trade finance gap, which has been intensified by the COVID-19 economic crisis (Auboin, 2021). According to ICC (2020), in 2021 the real economy will need an additional USD 2 trillion of trade finance relative to the level of supply to ensure that trade is restored to the levels prior to the global health crisis. Therefore, even though since the outbreak of the pandemic multi-billion-dollar trade finance programmes have been launched by national banks and multilateral development banks (MDBs) to support trade,6 the need for expanding trade finance instruments specifically targeted for smaller companies is a challenge that must be metto ensure that these companies thrive.7

In sum, this policy brief identifies as two major challenges faced by micro firms and SMEs:

1. Difficulties to be strategically linked to global value chains, in order to access markets, be more productive, and have technical capacity gains.

2. The existence of a long-term trade finance gap, which tends to affect MSMEs more than large enterprises.

Proposal

The complex challenges faced by MSMEs described above which entail difficulties in strategically linking themselves to GVCs as well as dealing with a traditional trade finance gap can only be tackled through the adoption of a multidimensional solution to strengthen the links between MSMEs and GVCs and to expand their access to trade finance instruments.

The creation and strengthening of linkages can be an effective strategy to expand the horizon of markets overseas and generate gains in productivity and in technical capabilities for MSMEs.8 But, given the differential nature and needs of micro-enterprises and SMEs, it is not possible to adopt the same strategies to link these companies to value chains. Most micro-enterprises will find it difficult to be part of GVCs due to their constraints in human, technical and capital resources. So, a feasible strategy to better integrate them with GVCs is to first strengthen their links with SMEs. However, while not all SMEs can be directly integrated into GVCs, some of them may make strong candidates if they manage to meet the business, technical and scale requirements.

Fostering linkages between SMEs and transnational corporations (TNCs) are among the most efficient ways to help these firms fulfil these requirements to integrate domestic suppliers into GVCs in a more strategic manner. Learn-by-linking can benefit host economies through direct economic contributions (e.g., jobs, value-added, access to markets), vertical and horizontal linkages or technology spill-overs; market interactions spill-overs, and human-capital spill-overs.

TNCs can also benefit through a TNC-SME linking strategy as they can widen the pool of reliable and efficient suppliers and increase their contribution to socio-economic development in local community. Such a strategy can also be of assistance to SMEs in allowing them to upgrade in the long term as well as in meeting quality and sustainability standards.

Advisory services have a key role to play in removing the barriers that impede the establishment of linkages between MSMEs and TNCs. Business and technical advisory services can help to increase awareness of commercial opportunities and develop the capabilities needed to adopt and apply new technology in order to comply with buyers’ quality, scale, social responsibility and sustainability requirements.

Examples of services that contribute to greater awareness of potential commercial opportunities include matching services to connect MSMEs and TNCs, electronic platforms with information on potential suppliers and buyers, and networking events (OECD-UNIDO, 2019). For instance, the Indonesian Chamber of Commerce and Industry provides business matching services, including a database of verified companies with relevant information and contact details, arranging one-to-one meetings and organizing company visits.9 The Indian Ministry of MSMEs also offers financial assistance through various marketing promotion schemes that help MSMEs take part in international exhibitions and trade fairs, organize overseas buyer-seller meetings and exhibitions and engage in business development and marketing activities.10

The US’ Manufacturing Extension Partnership Program supports small manufacturers through quality management training and assessment, exporting services (market intelligence, logistics, compliance), lean and continuous improvement solutions, technology scouting, environmental management systems compliance, and health and safety training.11 All these initiatives have been supporting local SMEs to become more equipped to be part of GVCs and should serve as role models for other initiatives taken by G20 member states.

In many countries, MSMEs are already suppliers to MNCs, but compete primarily on price rather than innovation. This results in technological dependency and power imbalances and could lead to the relocation of investments. Lead firms demand constant innovation from suppliers that want to remain in the GVCs. The challenge is therefore to leverage the interest shown by MSMEs for participating in GVCs by upgrading the nature and mix of activities they carry out.12

Yet, to become internationalized, SMEs need working capital in the short term and growth capital in the long term (ADB, 2015). Considering that SMEs tend to face greater difficulties than large companies in obtaining financing, it is important to ensure that there are ways to expand their means of financing so that they can truly be integrated into GVCs.

To take forward the commitment made in the Riyadh Declaration of promoting “inclusive economic growth including through increased participation of MSMEs in international trade and investment” (G20, 2020), and building on the G20 Action Plan on MSME financing, we propose the creation of the Link20 Initiative by G20 members.

THE LINK20 INITIATIVE

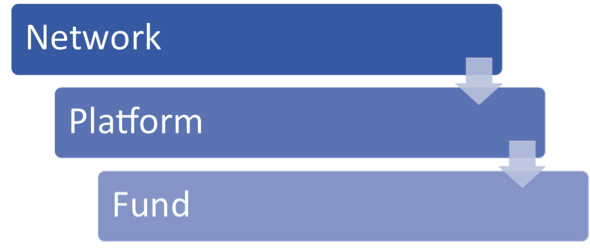

This initiative is a practical strategy to make the envisaged solution a reality. Its objective is threefold: to gather key actors, connect service providers and to boost trade finance. To ensure that these goals can be achieved, we suggest that three interrelated projects to be progressively implemented in the short, medium and long term. The first step is to form a network by bringing together a wide and diverse range of actors to discuss the challenges faced by MSMEs in the context of GVCs. Once the stakeholders are connected, G20 should create a virtual platform, inspired by good practices adopted by some member states, to connect service providers and institutions that can support the Link20 Initiative. Lastly, in order to generate new businesses from these links, G20 should launch a fund for MSMEs wishing to participate in GVCs.

The first step is to form a network by bringing together a wide and diverse range of actors to discuss the challenges faced by MSMEs in the context of GVCs. Once the stakeholders are connected, G20 should create a virtual platform, inspired by good practices adopted by some member states, to connect service providers and institutions that can support the Link20 Initiative. Lastly, in order to generate new businesses from these links, G20 should launch a fund for MSMEs wishing to participate in GVCs.

Link 20 Initiative

Link20 network

The first phase of the implementation of the Link20 Initiative should be the launch of Link20 Network, to be further deliberated during future G20 Presidencies.

This network should be a multilateral attempt to gather key actors involved in the delivery of linkage development policies and business advisory services that facilitates the exchange of knowledge, effective practices and cross-country partnerships among members.13

Its objective would be facilitating the collaboration of stakeholders and the exchange of information, experiences, best practices and policy advice.

The Link20 network should have the participation of representatives from the public, private and third (social enterprises, voluntary organizations, etc.) sectors, as well as from international organizations and academia.14 The network could be linked to existing initiatives such as the G20 Trade and Investment Working Group, which was set up in 2016 to address major issues related to trade and investments as well as to coordinate the action of the G20 countries in these areas.15

Link20 Platform

The launch of the Link20 Platform should be the second phase of the implementation of Link20 Initiative.

Its main objectives would be, in the short term, to connect service providers and institutions that can support linkage development, and in the long term to generate capacity upgrading of policy-makers as well as business and technical advisory service providers, leading to strong sustainable links between TNCs and local MSMEs.

The key components of the Link20 Platform should include:

i. An online platform with the relevant information and a list of business advisory service providers. The online platform can serve as an online directory of members who work with MSMEs. This e-directory can help the interested parties in finding and connecting with others who do similar work in other countries and regions. The platform will provide information on current projects, events, organizations and other initiatives taking place in the field.

ii. An open library of digital toolkits and guidance for MSMEs. The e-library can provide access to knowledge, learning resources and case studies on the design, implementatio, and evaluation of TNC-MSME linkage development policies. As a repository of resources and materials drawn from extensive sources of the organizations from G20 and beyond, the e-library would help users learn about the operation of such linkages, identification of effective practices, ways to conduct firm capability surveys (for matching services) and methods to devise effective policy solutions.

Link20 Fund

This fund would be a specialized G20-facilitated non-sovereign financing mechanism with investments from public and private sectors for inclusive and Environment, Social and Governance (ESG) compliant initiatives in developing countries. The launch of the Link20 Fund should be the third and final phase of the implementation of Link20 Initiative.

This may include the provision of sustainable supply chain finance as it integrates ESG norms into the due diligence processes and the products that are financed by incentivising sustainable practices in GSCs.16 The objective of the fund is to finance employment-generating, productivity-boosting and innovative MSMEs in developing countries and link them to resilient, inclusive, sustainable and transparent GVCs.17

The fund should be a partnership between G20 member states, traditional trade finance institutions, alternative financial institutions as well as MDBs and international organizations.18 The fund could tap into the opportunities arising from the demand for trade finance from developing country-based SMEs, and then attract investments from private players as well as help the formal banking sector as well (Wass, 2019).

To ensure transparency, accountability, professionalism and efficiency, the Link20 Fund should be jointly managed by multilateral public and private sector representatives. The idea is, therefore, not to compete with but to complement existing financing and project preparation assistance facilities being offered by countries and MDBs.19 There should also be a G20-supported evaluation and oversight mechanism.20

NOTES

1 These numbers would be considerably higher if informal firms were included.

2 Up to 80% of global trade is supported by some sort of financing or credit insurance (IFC/WTO, 2019).

3 The trade finance gap refers to the trade finance amount sought by exporters and importers but rejected on account of reasons including the absence of collateral, inadequate information provided in the application, etc.

4 131 million or 41% of developing country-based formal MSMEs have unfulfilled financing requirements. It is estimated that MSME finance gap in developing countries is around USD 5 trillion (or 1.3 times the prevailing level of MSME lending). Significantly, women-owned businesses comprise nearly a fourth of MSMEs and account for around a third of the MSME finance gap (IFC, 2017).

5 For more, visit https://www.smefinanceforum.org/data-sites/msme-finance-gap.

6 For more, visit https://www.wto.org/english/news_e/news20_e/trfin_01jul20_e.pdf.

7 Although alternative financing instruments are increasingly relevant, especially for ‘startups’, the traditional banking system is likely to remain the main source of trade finance for most of the small businesses. Thus, it is important to improve the SME-lending capacity of banks (G20/OECD, 2015).

8 This should be complemented by policy upgradation and long-term capacity building measures. In many countries, MSMEs are already suppliers to multinational companies (MNCs), but compete primarily on price rather than innovation.

9 For more, visit KADIN Business Service Desk, https://www.bsd-kadin.id.

10 For more, visit Ministry of Micro, Small and Medium Enterprises, https://msme.gov.in.

11 For more, visit Manufacturing Extension Partnership, https://www.nist.gov/mep.

12 A prerequisite for increasing MSME participation in GVCs is the availability of capable firms in the national economy. Due to weak absorptive capacity, many MSMEs are unable to update production processes and undertake the development of new products. A gradual improvement in the capability of MSMEs is required to increase the chances of their GVC participation in the long term.

13 An example of international networks founded upon shared mission and goals is the Research and Technology Organisations International Network (RIN). Supported by the European Association of Research and Technology Organisations (EARTO), the network consists of 16 leading RTOs, namely A*STAR Agency for Science Technology and Research (Singapore), AIST National Institute of Advanced Industrial Science and Technology (Japan), CSIRO Commonwealth Scientific and Industrial Research Organisation (Australia), CEA (France), DTI Danish Technological Institute (Denmark), Fraunhofer-Gesellschaft (Germany), IPT (Brazil), ITRI Industrial Technology Research Institute (Taiwan), NRC National Research Council (Canada), NSTDA National Science and Technology Development Agency (Thailand), NST National Research Council of Science and Technology (South Korea), RISE Research Institutes of Sweden AB (Sweden), SINTEF (Norway), TECNALIA (Spain), TNO (The Netherlands), VTT Technical Research Centre of Finland (Finland). It was introduced to strengthen international collaboration on research, development and innovation (RD&I) in the fight against the COVID-19 pandemic (EARTO, 2021).

14 Relevant stakeholders include industry and trade ministries, investment promotion agencies, innovation agencies, technology organizations, universities, industry associations and international organizations such as UNIDO, UNCTAD and the World Bank. TNCs should play an advisory role, given their experience in building corporate supplier development programmes and the importance of public-private partnerships in facilitating effective linkages (UNCTAD, 2010).

15 Working groups are a key part of the G20 decision-making process and are in charge of leading the in-depth analysis of a range of internationally relevant issues. The members are experts from the G20 countries, and they address specific issues linked to the broader G20 agenda, feeding into the ministerial segments and ultimately the summit itself. Each group is coordinated by a representative of the competent Ministry of the country holding the G20 Presidency. For more, please visit: https://www.g20.org/italian-g20-presidency/working-groups.html.

16 As an example, the EBRD has a Green Trade Finance Program (supporting trade transactions for green tech), while IFC has a Climate Smart Trade initiative (for projects and equipment with clearly defined climate resilience or mitigation benefits) (Bancilhon, Karge and Norton, 2018).

17 For other innovative trade finance initiatives among G20 countries, see the initiatives such as UK Export Finance; Trade for development fund of GIZ, Germany, US Office of Trade Finance (ITF), etc.

18 Trade finance suppliers’ professional bodies and other global entities that look at trade and trade finance-related issues, and can be roped in by the proposed Fund to be its partner organisations: International Chamber of Commerce, UNIDO, International Factoring Association, International Trade and Forfaiting Association, International Union of Credit and Investment Insurers (Berne Union), SWIFT, World Trade Organization, World Customs Organization, the Enhanced Integrated Framework (EIF) for Least Developed Countries, the Global Legal Entity Identifier Foundation, Bankers Association for Finance and Trade (BAFT), Financial Stability Board, the Global Partnership for Financial Inclusion (GPFI), World SME Forum (WSF), SME Finance Forum and OECD-BIAC. Also see International Trade Centre’s (ITC) trade finance programme to help developing country-based SMEs as well as the United Nations Conference on Trade and Development’s (UNCTAD) Empretec programme for to help build sustainable, innovative and globally competitive SMEs.

19 The existing financing facilities include Lines of Credit advanced by individual countries for development cooperation as well as the financing facilities (non-sovereign/sovereign-backed finance, and equity investment) and project preparation assistance for trade-related infrastructure being offered by MDBs and international agencies. While there is a substantial demand for infrastructure (including trade-related) in developing countries, they face several challenges as they do not have adequate project preparation facilities. These facilities relate to an end-to-end process from conceptualisation to being awarded the project. This process includes conducting financial, technical, and legal analyses. In this regard, human and technological capacity as well as financial resources are crucial to identify and build a pipeline of viable and ‘bankable’ projects. In developing countries, project preparation costs are estimated to be up to a tenth of the total investment in a project. Developing countries also face difficulties in fulfilling the onerous norms of MDBs. Allocating a portion of the proposed specialised fund for project preparation assistance for developing countries can help them develop ‘project development facilities’ and meet the costs related to structuring viable/bankable trade-related infrastructure projects.

20 The G20 evaluation and oversight mechanism should ensure that the Fund operates in an evidence-based, transparent, and accountable manner.

REFERENCES

ADB (Asian Development Bank) (2015). Integrating SMEs into global value chains: Challenges and policy actions in Asia. Asia Development Institute. Mandaluyong City, Philippines: Asian Development Bank. https://www.adb.org/sites/default/files/publication/175295/smes-global-value-chains.pdf, accessed 26 July 2021

Auboin M (2021). Trade finance, gaps and the COVID-19 pandemic: A review of events and policy responses to date. https://www.wto.org/english/res_e/reser_e/ersd202105_e.pdf, accessed 26 July 2021

Bancilhon C, Karge C, Norton T (2018). Winwin-win: The sustainable supply chain finance opportunity. Report BSR, Paris. https://www.bsr.org/reports/BSR_The_Sustainable_Supply_Chain_Finance_Opportunity.pdf, accessed 26 July 2021

Caliendo L, Rossi-Hansberg E (2012). The impact of trade on organization and productivity. Quarterly Journal of Economics, 127(3):1393-1467. https://academic.oup.com/qje/article-abstract/127/3/1393/1921854?redirectedFrom=fulltext, accessed 26 July 2021

Cusmano L, Koreen M (2017). Fostering greater SME participation in a globally integrated economy. Journal of Management, 22(2):22-45. https://www.global-solutions-initiative.org/wp-content/uploads/g20-insights-uploads/2020/12/fostering-greater-sme-participation-in-a-globally-integrated-economy-1607622343.pdf, accessed 26 July 2021

EARTO (European Association of Research and Technology) (2021). RTOs International Network (RIN) joint statement-RTOs as decisive vehicles to drive international collaboration on RD&I. https://www.earto.eu/wp-content/uploads/RIN-Joint-Statement-on-International-Collaboration-onRDI-Final-10032021.pdf, accessed 26 July 2021

G20/OECD (2015) G20/OECD high-level principles on SME financing. Antalya, Turkey. https://www.oecd.org/finance/G20OECD-High-Level-Principles-on-SME-Financing.pdf, accessed 26 July 2021

G20 (2020). Leader’s declaration – G20 Riyadh summit, 2020. https://www.consilium.europa.eu/media/46883/g20-riyadh-summit-leaders-declaration_en.pdf, accessed 26 July 2021

ICC (International Chamber of Commerce) (2020). Memo to: G20 governments, central banks and international financial institutions. https://iccwbo.org/content/uploads/sites/3/2020/11/memo-g20-recommendations-smes.pdf, accessed 26 July 2021

IFC (International Finance Corporation) (2017) MSME finance gap: Assessment of the shortfalls and opportunities in financing micro, small, and medium enterprises in emerging markets. World Bank. https://www.ifc.org/wps/wcm/connect/03522e90-a13d-4a02-87cd-9ee9a297b311/121264-WP-PUBLIC-MSMEReportFINAL. pdf?MOD=AJPERES&CVID=m5SwAQA, accessed 26 July 2021

International Finance Corporation/World Trade Organization (2019). Trade finance and the compliance challenge: A showcase of international cooperation. Geneva and Washington, DC: WTO/IFC. https://www.wto.org/english/res_e/booksp_e/tradefinnace19_e.pdf, accessed 2 August 2021

Lileeva A, Trefler D (2010). Improved access to foreign markets raises plant-level productivity… for some plants. Quarterly Journal of Economics, 125(3):1051-1099. https://academic.oup.com/qje/article-ab stract/125/3/1051/1903644?redirectedFrom=fulltext, accessed 26 July 2021

McKinsey (2020). Unlocking growth in small and medium-size enterprises. Public and policy sector. https://www.mckinsey.com/industries/public-and-social-sector/our-insights/unlocking-growth-in-smalland-medium-size-enterprises, accessed 26 July 2021

SME Finance Forum (2021). MSME Finance Gap

https://www.smefinanceforum.org/data-sites/msme-finance-gap, accessed 26 July 2021

OECD-UNIDO (2019). Integrating South east Asian SMEs in global value chains enabling linkages with foreign investors

https://www.oecd.org/investment/Integrating-Southeast-Asian-SMEs-in-global-value-chains.pdf, accessed 2 August 2021

UNCTAD (United Nations Conference on Trade and Development) (2010). Integrating developing countries’ SMEs into global value chains. https://unctad.org/system/files/official-document/diaeed20095_en.pdf, accessed 26 July 2021

UNCTAD (United Nations Conference on Trade and Development) (2020). The international day of micro, small and medium enterprises (MSMEs). Statement by Mr. Mukhisa Kituyi. Virtual meeting. https://unctad.org/osgstatement/international-day-micro-small-and-medium-enterprises-msmes, accessed 26 July 2021

Wagner J (2012). International trade and firm performance: A survey of empirical studies since 2006. Review of World Economics, 148(2):235-267. https://link.springer.com/article/10.1007/s10290-011-0116-8, accessed 26 July 2021

Wass S (2019). Trade finance funds grow as investors seek ‘recession-proof’ asset class. S&P Global

https://www.spglobal.com/marketintelligence/en/news-insights/trending/UfTaJgX3uO-L4u8UFjS7WQ2, accessed 2 August 2021

WTO (World Trade Organization) (2016). Trade finance and SMEs: Bridging the gaps in provision. Geneva: WTO. https://www.wto.org/english/res_e/booksp_e/tradefinsme_e.pdf, accessed 26 July 2021