This Policy Brief is offered to the Saudi T20 process, as a recommendation to the G20 in 2020.

Challenge

Infrastructure investment is widely recognized as a crucial driver of economic development as addressed in the Group of 20 principles for quality infrastructure investment (QII). However, the quality, quantity, and accessibility of economic infrastructure in developing countries are considerably lower than expected. Therefore, the scaling up of infrastructure investment is important for boosting global economic growth.

Developed nations, such as Japan, Europe, and the United States, face the challenge of maintaining their existing infrastructure. COVID-19 will increase budget deficits in many advanced countries as spending will increase dramatically for medical care and support for small and medium-sized enterprises (SMEs) and the unemployed. This will make it more difficult for governments to maintain existing infrastructure due a lack of financing.

Revenues for infrastructure maintenance come mainly from user charges. Water supply, electricity, and trains are necessary goods for people. It is not easy to raise user tariffs for water and electricity, etc. COVID19 will lower the revenues of infrastructure operating companies due to the slow growth of the economy. However, infrastructure requires maintenance costs every year. Increased budget deficits will make it difficult for infrastructure operators to receive enough funding to maintain their infrastructure. Spillover tax returns, which will be addressed in the paper, must be developed.

Many implementers of infrastructure projects fail to appropriately calculate the costs and economic benefits of the projects. The appraisal, selection, and construction of infrastructure projects are often initiated with under-estimated costs, over-estimated revenue, under-valued environmental and social impacts, or over-valued economic development or spillover effects in order to win project approval. Most infrastructure investments are either debt financing or tax financing by the government. Therefore, overinvesting in unproductive projects results in the build-up of debt, instability in the budget of the government, and monetary expansion if the debt was purchased by the central bank.

Among the many reasons for these failures, in addition to weak regulatory frameworks, are unconducive institutional environments and limited local capacity. One of the most prominent reasons, and potentially the simplest to resolve, is the low rate of return from infrastructure projects. Other challenges include huge costs paid to acquiring land and anticipating natural disasters that could stop the construction process.

Further shortages of financial resources for infrastructure are expected after the COVID-19 outbreak. Reallocating budget for fiscal interventions to mitigate COVID-19’s negative impacts may lead to huge budget deficits in developing countries. In addition, sudden reversals in capital outflows can worsen the fiscal space. Nevertheless, infrastructure should not be set aside. After the COVID-19 pandemic, infrastructure will aid economic recovery by helping accelerate economic growth back to normal levels and even higher. Therefore, continuous financial support for infrastructure will be definitely needed. It will also help the countries that have suffered to regain confidence from the market by maintaining higher rates of return and lowering the risk associated with infrastructure, which will in turn bring in private sector finance and induce overseas investment.

It proposes new concepts for reducing risk in infrastructure financing, shortening the time in project preparation, and managing the mitigation and adaptation costs of natural disasters related to infrastructure projects. Furthermore, adapting to the current COVID 19 pandemic, this policy brief also provides some policy responses for infrastructure investment to be resilient in this difficult time.

Proposal

1.Quality Infrastructure investment as a response to COVID-19 crisis

The COVID-19 outbreak will bring huge budget deficits and declines in infrastructure investment by governments. Existing infrastructure would be facing with shortage of funds to support of their maintenance. Lack of maintenance will cause accident and mull functioning of infrastructure such as water supply, sewage, electricity, train, road etc. The pandemic has forced many countries to shut down factories, restaurants, and many other businesses for long periods of time. Significant proportions of the manufacturing and services sectors are facing no income for several weeks or even months. These conditions are pushing governments to provide subsidies to those who are forced to close their businesses, leading to increases in government spending. Meanwhile, government revenue from tax collection will decline due to the halt of many business activities. Consequently, significant budget increases are unavoidable in the near future. Although many countries may issue government bonds to be purchased by central banks to finance their emergency spending, the budget deficits will still negatively affect infrastructure financing by governments for the next several years.

In response to these conditions, this paper provides several policy recommendations by amplifying the concept of spillover tax revenue for infrastructure financing as explained above. The policy responses include enhancing private sector involvement, bringing back capital outflows, and SME financing.

2. Enhancing private sector involvement

During many past economic contractions, private sector financing has recovered much faster than government budget deficits. Hence, preparing more attractive instruments for private financing is an effective solution for sustainable infrastructure. If countries rely only on conventional financing concepts, infrastructure construction will halt dramatically. In order to attract private finance into infrastructure investment, governments should prepare the way to ensure that the private sector can attain the higher expected rates of return in the future. This return could be taken from the increase in tax revenue from the positive impacts of infrastructure projects to surrounding region. This policy action would be timely and attractive during the COVID-19 outbreak, considering that in the current situation, tax revenue is in its lowest position, and it will achieve a new peak during the recovery time.

Water supply and electricity supply will bring new residential areas and commercial businesses into the region. Property prices will rise, and many new businesses will start operating after the completion of water supply and sewage services. Property taxes, corporate income taxes, sales taxes, and individual income taxes will rise because of the new increase in business and job opportunities. These tax increases are a result of the new supply of water and electricity, and without construction of these infrastructure, the regional economy would not have developed. However, water and electricity operators rely on user charges as their main source of revenue. User charges are not enough to cover their operation and maintenance costs since water and electricity are necessary goods, and thus the prices of user charges are kept low. Spillover tax revenues created by the water supply and electricity are taken by the government and not returned to infrastructure operating companies.

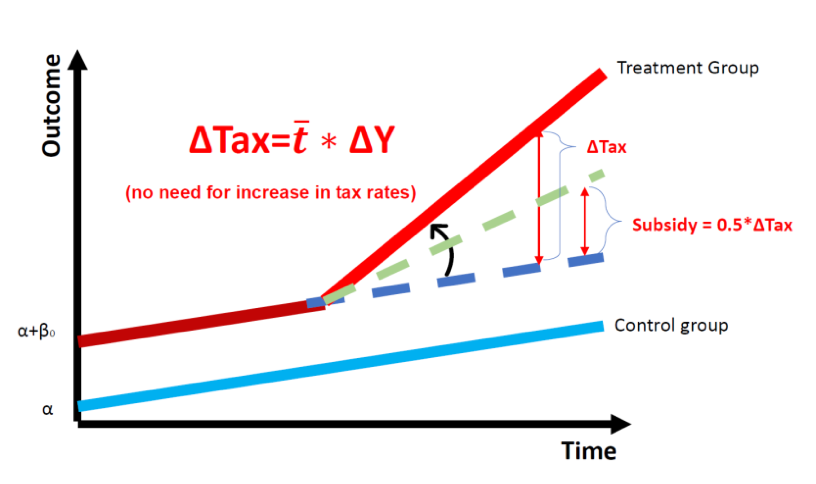

The difference-in-difference method used by Yoshino and Abidhadjaev (2017) can identify how much tax revenue is induced by each infrastructure investment. In practice, the sophisticated econometric methods might not be easy to use. The rule of thumb is to compare the increase in tax revenue from the water and electricity supply compared to the tax revenues with no new utility supply. Taking the difference between the two lines in Figure 1 shows the spillover tax revenue created by the water and electricity supply. If 50% of the tax revenue is shared between the government and infrastructure operators, infrastructure operators can receive user charges plus the spillover tax revenue created by the water and electricity supply. Furthermore, maintenance costs can be collected by spillover tax revenues every year, which will allow infrastructure operators to use them for repair and maintenance costs.

Figure 1. Concept of subsidy based on additional flow of tax revenue due to infrastructure

3. Governance structure to avoid corruption

Substantial benefits can be realized through better governance of public infrastructure. International organizations have provided frameworks, guidance, and tools for countries to follow in order to enhance governance for infrastructure development (OECD and IMF 2019). Multilateral institutions, such as ADB, World Bank, African Development Bank, IBRD, EBRD provide development lending with low interest rates and requirements to countries, sometimes through grants and technical assistance. Through this, multilateral development banks help countries set up their regulation framework and government structure and encourage transparency. Together with country governments, multilateral development banks can identify obstacles in the field and find solutions.

In many developing countries, corruption is associated with infrastructure investment. One delicate step that involves a high risk of corruption is the procurement process, which includes land procurement or land acquisition. These issues can hinder the construction stage of infrastructure development, leading to substantial losses for investors and unpredicted changes in government plans. Meanwhile, land mafias often prevail in developing countries. They act as informal middlemen between governments/construction companies and the landowners. There is no written legal arrangement for them assigned by landowners. However, they ask an extraordinarily high price from construction companies or governments and report substantially low prices to the landowners. They receive large amounts of money as middlemen and leave landowners feeling dissatisfied toward the government for underestimating their land value. Creating a land trust as a legal and independent institution representing the landowners to the government and construction companies can be a solution. As a legal institution, a land trust should fulfil the requirement of good corporate governance and promote transparency. With the assistance of fast-developing technology, land trusts can create a platform that can be accessed by the public for information on the land price in that area. This helps to reduce the existence of land mafias. Furthermore, the main objective of the land trust is to bridge the relationship between the government and landowners in cases where the government rents the land for public infrastructure. For this function, land trust institutions can conduct independent assessments on rent values and collect these for the landowners. Therefore, landowners can still have the benefit of their land and enjoy the spillover effects created by the infrastructure built on their land (Yoshino, Abidhadjaev, and Hendriyetty 2019).

4. Financing for infrastructure maintenance

Policymakers have little incentive to spend on maintenance, which makes it less likely to be a priority for infrastructure investment. In some types of public infrastructure, such as sanitation systems (Hendriyetty, Dey and Kim 2020), funding for the construction of the facilities comes from the central government and the private sector. However, the maintenance costs mostly rely on user charges or tariffs set up by the local government. The collection of the user charge is not sustainable and usually is lower than expected, and hence is not enough to cover the maintenance cost.

Larry Summers argues that poorly maintained infrastructure increases costs, and deferring maintenance makes repairs more expensive later (Brookings Institution 2017). Some infrastructure needs continuous maintenance. A lack of maintenance of railways, subways, and roads, etc. will cause accidents and will issues that hinder the smooth-running transport vehicles. Therefore, maintenance should be prioritized along with the infrastructure project itself. In order to secure maintenance costs, infrastructure operating companies have to be able to receive not only user charges but also spillover tax returns to finance operation costs. A spillover tax return will allow the operating companies of infrastructure to receive continuous revenue sources in addition to user charges.

5. Re-attraction of overseas capital into infrastructure investment

As the crisis hits developing countries, overseas investors will bring their investments back to their home countries. Consequently, infrastructure projects that are receiving financing from abroad will be find it difficult to continue functioning well. Not only infrastructure finance but also other capital investment from abroad will shrink drastically as the crisis impacts developing countries. In order to bring back overseas investors into infrastructure investments, the rate of return must be secured, and governments need to show political will to ensure that projects will still continue regardless of economic turbulence. In this case, the risks associated with infrastructure investment must be kept low through public–private partnerships. Additionally, the attractiveness of infrastructure investment can be enhanced through an increase in the rate of return through the spillover effects of tax revenue.

The composition of the overseas financing of infrastructure projects relies on how fast overseas investors can withdraw their funds compared to domestic investors when economic turbulence occurs. There is a home country bias by domestic investors due to asymmetry of information. If foreign investors move three times quicker than domestic investors, it is better for the ratio of overseas investment to be less than one-third. If foreign investors move 5 times as fast as domestic investors, it is better for the ratio of overseas investors to be less than 20%.

6. Needs for long-term investors

Infrastructure financing requires a long-term duration as projects have long-term horizons. Insurance and pension funds are suitable because of their long-term nature. However, infrastructure investments in developing countries are dominated by domestic savings, such as bank loans with maturities below 5 years.

Some countries issue infrastructure bonds to finance their infrastructure projects. However, the private sector needs deep secondary markets to allow the bonds to be traded easily. In developing countries, secondary markets are shallow and not liquid. Therefore, encouraging people to put their money into insurance and pension funds will deepen the capital market. Furthermore, developing insurance markets and pension fund systems is also important for countries facing aging populations. Financial literacy and education can help citizens to understand how necessary it is to save their money in insurance and pension funds.

7. Easing the requirements and innovative financing for small and medium-sized enterprises (SMEs).

When financial institutions are hit by a crisis, they tend to withdraw risky lending and become reluctant to lend money to SMEs. Worldwide, small businesses have been among the most affected by COVID-19. Many small restaurants, for example, cannot open for long periods and need liquidity to finance their immediate costs, such as rent and overhead costs. Meanwhile, banks often take longer to make decisions on loans for SMEs compared to large businesses due to their risks.

In order to develop the region along various infrastructure, not only large firms but also SMEs must be able to start their business along the station and along new road. If small business can start their own restaurant, small shop at the station and along the road, they can receive constant income which will reduce income inequality and induce job opportunities to many SMEs. Therefore, SMEs play an important role in enhancing the rate of return to infrastructure investors. Infrastructure can allow small restaurants and small businesses to operate along roads and railways. Facilitating SMEs to continue their business will keep regional development going and reduce income inequality in the region.

Three policies are recommended for SME finance.

a. Credit guarantees for SME lending.

Loans to SMEs are needed to enable them to survive in this difficult circumstance. Some liquidity in their balance sheets will help SMEs to cope with the economic slowdown. However, banks are reluctant to provide credit to SMEs due to their lack of credit history and SMEs being categorized as relatively high-risk businesses, especially during the economic turbulence of the COVID-19 outbreak. Credit guarantees for SME lending will make it easier for banks to make loans for SMEs. Governments can increase the credit guarantee ratio to support smooth lending from banks to SMEs (Yoshino and Taghizadeh-Hesary, 2015, 2017). If it remains difficult for SMEs to get loans from banks, then SMEs will have to borrow from local money lenders or loan sharks by paying very high rates of interest, which could force many SMEs into bankruptcy.

Credit guarantees are a good policy that can support private bank loans to SMEs. However, the moral hazard problem should be avoided. Private banks tend to bring risky loans to be supported by credit guarantees. In this case, the credit guarantee system will accumulate large deficits. In order to avoid the moral hazard problem, two policies can be introduced. One is a differentiated credit guarantee ratio. If a bank brings very risky SME loans to the credit guarantee corporation that turn into default losses, the credit guarantee ratio should be lowered. In other words, the credit guarantee ratio can be differentiated by lower default losses and higher default losses. Another policy to avoid moral hazard is to charge higher credit guarantee fees to those banks whose default losses are high (Yoshino and Taghizadeh-Hesary 2019).

b. Government banks can make direct loans to SMEs. Japan’s government bank provided emergency loans to SMEs with a zero interest rate after the outbreak of COVID-19. In the case of crises, SMEs are the first to be affected by shortages of bank loans and shortages of liquidity. Government banks can provide immediate loans to suffering SMEs in the case of a crisis. Some SMEs are temporarily affected by COVID-19. These SMEs will recover when business goes back as normal. However, SMEs who were facing structural problems may not be able to recover their sales even after the pandemic subsides. The former group of SMEs should be rescued by government banks. However, the latter group should be given loans to restructure their businesses rather than temporary assistance loans as they will not be able to recover their sales even after COVID-19.

The government has to avoid the crowding out of private bank loans after COVID-19. When business reverts to normal in time, government emergency bank loans should be shifted to private bank loans to avoid crowding out. Private banks can start their ordinary loan supply after the economy goes back to normal.

c. Hometown crowd funding or hometown investment trust funds (HIT funds) can provide loans to SMEs and startup businesses. COVID-19 will increase business failures, especially for startups and SMEs. This will make banks reluctant to lend money to them. In this situation, hometown crowd funding could offer an alternative source of financing for startups and SMEs. HIT funds collect money from individuals in a region to help local startups and SMEs. People in the region know each other, and the lenders in the community can monitor whether the startups and SMEs in the same region work seriously for their business or not. Investors in the community through hometown crowd funding are often buyers of products. Community-based hometown crowd funding has been developed in Peru, Cambodia, Viet Nam, Japan, and many other Asian countries. Companies that run hometown crowd funding can help startups and SMEs to sell their products by creating platforms for sales expansion. They can do this, for example, by facilitating the sale of products via the internet or at local stations to help the SMEs and startups to increase their sales and stabilize their businesses.

8. The benefits of digital and technological development should be harnessed to address the gap in infrastructure projects.

Digital technology has transformed how human beings live, work, and interact. The benefits of these innovations are indisputable and have become essential. Information technology can be developed by nationwide broadband networks, which can provide digital information even to remote areas through wireless networks and/or satellite technology. By the connection of information, new businesses can be created. Sales of their products can be advertised through the internet which can attract customers from all over the country. New residential areas can be constructed, which can use the internet and other information devices. Corporate tax revenues and income tax revenues will rise. If some of these increases in tax revenues were returned to digital companies, they could expand information networks all over the country. Information technology will allow children to learn remotely by using internet services. Human capital development will bring higher productivity to the country, which will contribute to economic growth and income equality. In order to achieve these benefits, countries need to innovate in three areas: government policies, financing, and technology itself.

Innovation in government policies

The development of technology alone for infrastructure development is not sufficient to achieve the creation of fully functioning markets. It must be complemented by an enabling ecosystem that includes an appropriate level of regulation, while at the same time a competitive environment must be maintained by allowing new entries into the market.

Strict regulations can sometimes hinder the innovation of technology to develop. Therefore, there are two criteria for government policies to support the internet. First, infrastructure policies should be designed with sufficient flexibility to be adaptable to future needs and future technological advancements. As infrastructure projects have very long-life cycles, the demand, the technology, and circumstances will change over time. Second, government policies should be better coordinated and stimulate synergies across sectors to improve efficiency. For example, synergies are needed for road systems, water piping systems, sewage systems, housing developments, and road construction. The combination of various infrastructure, including transport networks, will enhance the spillover effects of infrastructure investments in a region. The development of a station area will induce private businesses and residential areas to be developed nearby.

Innovation in financing and use of land trusts

The main challenge in infrastructure financing is that investors would not tolerate the low rate of return and the high-risk nature of a project itself due to the uncertainty from the long life cycle of the construction, the land acquisition process, political change, and low user charges. Issuing revenue bonds will be one way to guarantee minimum returns and will encourage investors to develop the area alongside the infrastructure, which will increase their rate of return by increased tax revenues created by infrastructure investment.

Governments should also create incentives for businesses to be well-developed in an area. The concept of crowdfunding could be one solution to facilitate start-up businesses to come to a region alongside new infrastructure.

Technology development on Land trusts can create a platform for the transparency on the land price while land trust can manage to transfer the right of use to infrastructure companies without transferring ownership (Yoshino, Abidhadjaev and Hendriyetty, 2019).

Innovation in technology

Breakthrough technologies are rapidly transforming the way infrastructure is built and operated, reshaping the way the infrastructure industry operates, and bring major implications for every participant in the value chain. The utilization of drones, 3D printing, and navigation systems in airports and railways are some examples of technologies that can accelerate the process of infrastructure development and boost the economic impact of infrastructure itself. Tax evasion, for example, can be mitigated by using satellite photos to identify the number of people using a restaurant, or the number of trucks that come to a factory to ship their products each month. These data can help prevent tax evasion, which will increase the spillover taxes returned to infrastructure investments, leading to an increase in bankable infrastructure.

9. Infrastructure project should prepare scenarios to anticipate natural disasters.

Scenario for adaptation policy: Creating reserves or pooling fund for disaster management

As mentioned in proposal 1, infrastructure investment will positively affect the economy of regions. Infrastructure will create new jobs and housing, which impacts the prosperity of the region. The concept proposed for anticipating natural disasters is similar. But here, instead of the positive effect, the negative impact due to natural disasters will be measured with the DID method. With a simple modification of the original DID model to calculate the increase of GDP Y=F(Kp,L,Kg) with the addition of d, Y=F(Kp,L,Kg,d). Here, d stands for disaster that would destroy public infrastructure, then it has negative impacts on companies and the employment. When calculating the impact, we can focus on three channels: infrastructure, private business, and employment. Then to measure the disaster impact, the calculation can be based on other regions where there are no impacts of disaster. Then, we could look at the regions that have been affected by floods or typhoons and how much their GDP has declined, compared to other regions.

For example, we look at the case of the Nagoya flood in Japan in 2000 that affected more than 19 cities. We focus on three cities in this research. First, Iwakura city, which is an agriculture district. We use the impact of the Lehman Brothers’ shock to agriculture in the area as a comparison. The Nagoya flood negatively affected the economy for 3 years, the GDP of Iwakura city declined 35%. On the other hand, the Lehman crisis only negatively affected the economy by around 13%. It is obvious that the Lehman crisis impact was minimal compared to the flood in the agricultural region (Yoshino, 2019).

Second is Nagoya city. It is a business and commercial district. Due to the Nagoya flood, the GDP of this city declined by 23% in four years. The decline is smaller than that of Iwakura City. On the other hand, the impact of the Lehman shock is bigger in this area compared to Iwakura City. The third example is Toyota city, which is a manufacturing city. The impact of the flood was only for 1 year, with only a 13% decline of GDP and very quickly recovered after 1 year. But the Lehman crisis affects were much bigger than the flood (Yoshino, 2019).

Using the data from these three cities, we can summarize that the impacts are different in each area. The agriculture region was affected by –35% in 3 years, the business region –23%, and the manufacturing region, especially Toyota city, was –13%.

These estimations can be used as a basis of calculation for governments to collect financing for disaster management, called “reserves”. There are three financing steps related to this issue: (i) ex ante accumulation of reserves ; ii) fiscal spending when floods or disasters have occurred; and iii) ex post accumulation of reserves. The ex-ante accumulation case occurs before a disaster happens. Governments should create a non-compulsory disaster insurance and a mandatory disaster insurance. In the compulsory type, everyone must join. Mandatory insurance is in addition to compulsory disaster insurance. Governments can assign one insurance company to keep and manage the fund or create a special vehicle for this purpose. The fiscal spending occurs right after the disaster event and the money will be used for rescue and recovery. When the money is not enough, then governments should conduct ex post accumulation of reserves.

Scenario for mitigation policy: levying tax on waste, such as CO2, NOX, or plastics

In the current mechanism, the environmental factor is treated as a separate component when investors consider the allocation of portfolios. However, the current method of measuring the environmental aspect in Sustainable Development Goals (SDGs) based on each consulting company is not leading to optimal portfolio allocation. But each consulting company has a different definition of the environment in the SDGs.

In our proposal, we look into CO2, NOX, and plastic waste as sources for tax levies. This is with the assumption that investors would prefer to look at two parameters: rate of return and risk, rather than consider SDGs and environmental components as separate components. Furthermore, the increase of ocean heat and global sea levels are the major factors of global warming. They are mostly caused by the emission of CO2, NOX, or plastic waste. Therefore, to reach the decrease of temperature by 2°C by 2030, levying taxes on waste, such as CO2, NOX, and plastics will be more feasible (Yoshino, 2020).

In general, many consulting companies have been trying to answer the investors’ question of how to allocate assets to different companies or different sectors. Many criteria have been developed to measure the achievement of their SDGs. KPMG look into SDG indicators as demographics, income growth, technology including renewable energy sources and knowledge sharing cultures, and collaboration among governments, companies, international organizations, and academia. The Nomura Research Institute sets four key performance indicators in investigating business activities: innovation, business opportunity, impact, and cost. Using the example of hydrogen energy, technological growth through innovation is essential to create the hydrogen energy market. PriceWaterhouseCoopers set the SDG indicators to include leadership (business and financial strategies), employee engagement (awareness and bottom-up initiatives), reporting (risk assessment and management), and collaboration (among suppliers, consumers, government, and nongovernment organizations. This variety of models is not effective because of inconsistency and are not in line with the investors’ actual interest, i.e., risk and return.

The optimal portfolio allocation can be achieved by taxing waste products due to these reasons: (i) by taxing waste such as CO2, NOX, or plastics with identical mechanisms or the same rate for each type of waste in international taxation, investors can only look for the rate of return and risk as they were conventionally focused on; and (ii) regional taxation will lead to optimal asset allocation and achieve sustainable growth.

These tax revenues can be given to green sectors to increase their rate of return, which will attract private investors into green energy projects.

Bibliography

Brookings Institution. 2017. “Lawrence Summers: Infrastructure Maintenance.” From Bridges to Education: Best Bets for Public Investment. Washington DC: The Brookings Institution.

Hendriyetty, Nella Sri, Paramita Datta Dey, and Chul Ju Kim. 2020. “Urban sanitation and waste management for all (forthcoming).” Urbanization 20 White Paper.

OECD and IMF. 2019. OECD/IMF Reference Note on the Governance of Quality Infrastructure Investment. Organisation for Economic Co‑operation and Development; International Monetary Fund.

Yoshino, Naoyuki. 2019. “Economic Impact of Disaster to Regional GDP and Portfolio Allocation to Green.” Building Resilient Critical Infrastructure and The Role of Insurance: Sharing Lessons from Japan – ASEAN Collaboration in DRR. Tokyo: United Nations University.

———. 2020. “Estimates of Natural Disaster by use of declined tax revenues and Disaster Bond.” ASEAN High-Level Symposium on Disaster Management 2020. Jakarta, Indonesia: ASEAN Secretariat.

Yoshino, Naoyuki, and Farhad Taghizadeh-Hesary. 2019. “Optimal credit guarantee ratio for small and medium-sized enterprises’ financing: Evidence from Asia.” Economic Analysis and Policy (Elsevier) 62 (2019): 342-356.

Yoshino, Naoyuki and Farhad Taghizadeh-Hesary, 2015, “Analysis of Credit Ratings for Small and Medium-Sized Enterprises: Evidence from Asia.” Asian Development Review, Vol.32, No.2: 18-37.

Yoshino, Naoyuki, and Farhad Taghizadeh-Hesary. 2017. “Solutions for Small and Medium-Sized Enterprises’ Difficulties in Accessing Finance: Asian Experiences.” ADBI Working paper series.

Yoshino, Naoyuki, and Umid Abidhadjaev. 2017. “An impact evaluation of investment in infrastructure: The case of a railway connection in Uzbekistan.” Journal of Asian Economics 49: 1-11. doi:10.1016/j.asieco.2017.02.001.

Yoshino, Naoyuki, and Umid Abidhadjaev. 2017. “Impact of Infrastructure on Tax Revenue: Case study of High-Speed Train in Japan. .” Journal of Infrastructure, Policy and Development 1 (2). doi:doi: 10.24294/jipd.v1i2.69.

Yoshino, Naoyuki, Umid Abidhadjaev, and Nella Hendriyetty. 2019. “Quality Infrastructure Investment and Land Trust.” Global Solutions Journal.