With the strengthened global ambition to address climate issues, the urgency for greening energy sector has rolled up. However, the effort to expedite renewable energy (RE) deployment in Southeast Asia (SEA) remains constrained by financing issues. Such challenges include the limited access to financing sources, high financing costs and underdeveloped project pipelines. To eliminate these obstacles, we propose three major recommendations: 1) establish a regional investment hub; 2) introduce financial de-risking instruments and; 3) promote a favourable enabling environment for renewable investments.

Challenge

Mobilising finance for the energy transition in developing countries was at the forefront of discussions at the 2021 United Nations Climate Change Conference (COP26) in Glasgow. However, public funds have been highly constrained due to the COVID-19 pandemic. While renewable energy (RE) investments have seen steady growth over the last decade, RE projects, especially in developing countries, still face multiple challenges from the institutional, policy and regulatory level to the market and project level, which slow down the development and uptake of RE (IRENA, 2022). These challenges has led to a lack of bankable projects, making it difficult for investors to identify attractive projects, and therefore reducing available capital for those that are ready to be financed. The financing gap for infrastructure (including green infrastructure) in Southeast Asia (SEA) is $3.15 trillion, or 5.7 percent of regional GDP (ADB 2017).

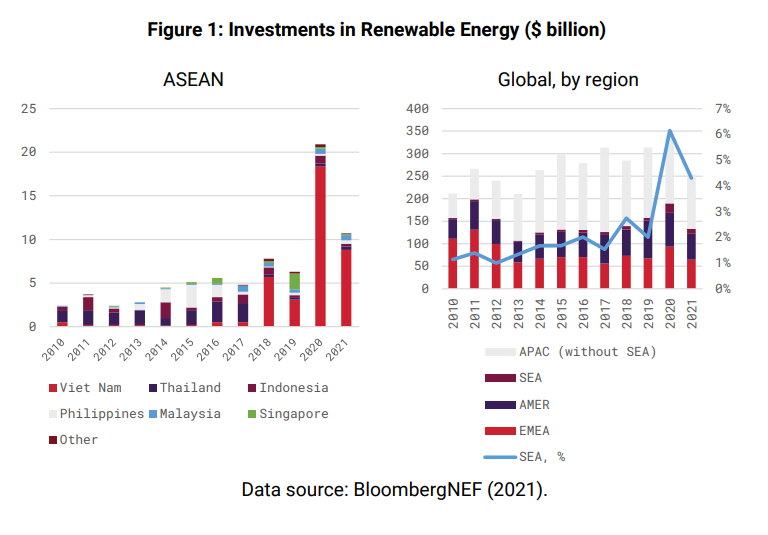

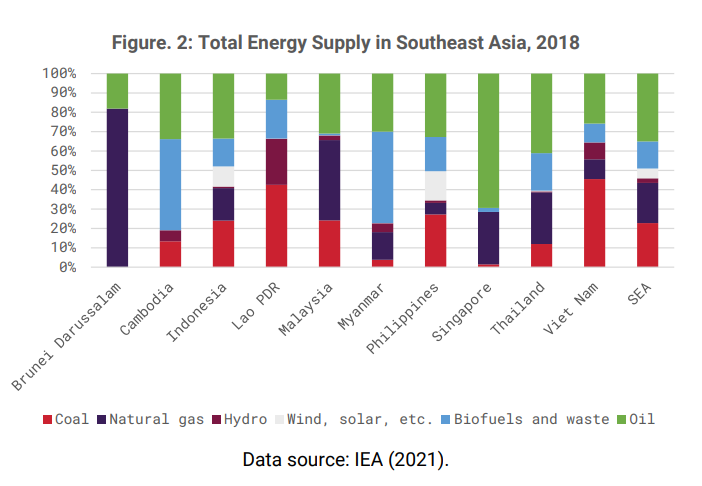

Although, SEA is the sixth-largest economy and third-largest market in the world, its investments in RE account for only 4 percent of global and 8 percent of Asia-Pacific (APAC) investments (BloombergNEF, 2021; Figure 1). The shares of RE in the total primary energy supply in SEA will comprise only about 18 percent and 19 percent by 2025 and 2030, respectively, which is not a large improvement from 2018 (Figure 2). A fundamental hindrance factor to RE development in SEA is financing constraints. We highlight three major aspects of this challenge:

- Limited access to financing sources. A persistent challenge relates to financing upfront expenditures by companies in the RE industry. RE projects in developing countries in general, and small-scale ones in particular, tend to have limited access to credit because of underdeveloped financial markets, as well as a lack of credit rating and project scale. Developers are faced with very limited options for financing sources and instruments, though conventional options through loans from banks and other financial institutions are still the most feasible options.

- Higher project’s risks leading to higher cost of funding. The high cost of financing for RE projects creates a substantial barrier to the growth of such projects. The expected return demanded by investors reflects the risk of the projects. In SEA countries, investing in RE is still considered riskier compared with investing in other sectors. Typical lending interest rates for RE projects in this region, particularly for high-risk countries (e.g. Indonesia, Vietnam, and The Philippines), span around 5-8 percent for United States dollar-denominated loans from local or foreign banks. Meanwhile, in low- risk perceived countries, the typical rate is below 5 percent.1

- Lack of project pipelines. While predictable pipeline for bankable projects is profoundly needed to attract investors, the pipeline of eligible projects has been quite weak in many developing countries, including ASEAN member states. The abundance and paucity of projects in the pipelines creates signal for investment risks. In many cases, government’s incapability to foresee future energy market and political instability place the development of bankable energy projects under-prioritized on one hand. On the other hand, in countries whose abundance of bankable long-term projects in the pipeline is visible, the cost of capital for utility-scale RE has come down strongly (IEA, 2021).

Proposal

Responding to the three major challenges in RE financing three main proposals are formulated as a comprehensive and interrelated bundle through regional cooperation schemes.

PROPOSAL 1: DEVELOP A COMMON PLATFORM AS AN INVESTMENT HUB TO ESCALATE CAPITAL INFLOW FOR RE FINANCING IN SEA

- The creation of an investment hub, as manifestation of regional cooperation in SEA, is expected to accelerate investment and deployment of renewables in the region. The platform would provide services that help developers showcase their projects, to seek desirable financing. Meanwhile, this “one-stop shop” would shed light on the projects’ features and eligibility, crowd-in investment, convey more complete information that helps investors (inc. public and private investors: governments, multilateral banks, private sector investors, philanthropic organisations, and long-term investors) decide where to invest.

- The investment hub could be in form of an investment bank establishment (e.g. ASEAN Renewable Energy Investment Bank). Group of 20 (20) member countries, represented by Indonesia, could deliver assistance in formulating the framework. The initiative could be implemented in cooperation with the Association of Southeast Asian Nations (ASEN) Energy Centre (ACE) as a knowledge partner. ACE has the experience and capacity as a catalyst for providing knowledge and guidance for energy policies among ASEAN nations for the past decades.

- The initiative could also be extended into regional and international multilateral cooperation or treaty establishment. Regional cooperation for RE financing can be elaborated as the purposeful collaboration of SEA countries. It may encompass both cooperation between two or more SEA countries or cooperation among SEA and non- SEA countries. As the existing regional cooperation in the SEA region is non-binding on all countries involved, the novel mechanism is scheduled to be in the form of binding agreement to ensure the implementation of the projects, both for investors and the host countries. G20 countries, through Indonesia for instance, could be the initiators of the agenda, while the other members could provide thorough guidance and monitor the process, particularly during the initial stage. Against the background of each country’s full decision-making power regarding their national energy mixes, regional

cooperation may help bridge gaps in the region, which has different endowments and starting points in RE development.

Rationale:

- As the number of responsible investors grows rapidly around the world, the importance of matching investors and bankable green projects in developing countries is growing.

- Meanwhile, the share of incoming capital to SEA for renewable energy deployment remains paltry, less than 5 percent of global RE investment in 2021 (BloombergNEF, 2021)

- Many organisations have targets for green investments. For example, ADB has increased its ambition to deliver climate financing to its developing member countries (DMCs) to $100 billion from 2019 to 2030 and the World Bank Group committed to increase its climate finance target to 35 percent of total commitments in 2022-2026.

PROPOSAL 2: SUPPORTING FUNDING COST REDUCTION FOR RENEWABLE ENERGY PROJECTS IN ASEAN COUNTRIES :

- It is desirable to establish a guarantee-provision mechanism for RE projects in ASEAN through an independent body to reduce the cost of funding. Guarantee provision could take the form of by chip-in for initial guarantee funds that scale up the guarantee coverage of RE projects. Multilateral development banks and G20 member states could assist ASEAN to develop an independent guarantor body by providing the technical framework, knowledge-sharing and resource mobilisation. This could be integrated with other financial stability mechanisms and frameworks that have been developed by G20 members to ensure the soundness of guarantee facilities for RE projects in ASEAN member states.

- It is also desirable to spur the aggregation of cross-border RE projects within the ASEAN region. While RE projects vary considerably in terms of size, the transaction and due diligence costs are relatively constant regardless of project size, creating a disadvantage to smaller-scale projects. Aggregating smaller-scale RE assets can help scale up the investment volume and reduce due diligence costs per project for institutional investors. Building a replicable aggregation model that can be scaled up requires strong support and commitment from governments, as well as consensus on specific terms of standardisation from industry stakeholders. Producing the commitment through the G20 forum by governments could provide ASEAN countries a necessary aggregation model well-suited to their characteristics and geographic profiles, serving as a standard that could be adopted by industry stakeholders, and a

common regulation framework to enhance the implementation of cross-border RE project aggregation.

- A common framework for standardising assessment mechanisms would ensure the transparency of risk assessment, reducing asymmetric information and monitoring costs, which consequently will lower risk and cost of funding. Given the vast divergency across ASEAN, however, the common framework might not fit every country but put each country at a disadvantage with additional technical burdens. For a good design of the common framework, the cooperation of G20 members is indispensable.

- Building a regional treaty to simplify the regulatory bottleneck on investment would spur RE development in the ASEAN region. G20 leaders could push for a binding agreement in the region to adopt regulatory packages which will ease the RE project investment, development and implementation. Furthermore, the G20 could take a step further by synchronising the common/regional regulatory packages such that they are well-suited to the challenges faced by investors from developed countries to invest more in RE projects, especially in developing countries such as most ASEAN member states.

- Initiate G20 leaders to develop a regional investment pool of funding for RE projects in the ASEAN region. Acting as an independent entity from any governmental body, the entity could manage the funds that are gathered from international financial markets and global institutional investors, such as the World Bank and ADB. The investment entity would operate with the main task of strengthening regional energy security under the principle of sharing risks and common development in ASEAN.

Rationale:

- The number of people gaining access to electricity around the world has increased significantly since the mid-2000s, including in SEA. On average, approximately 50 million people every year gained access to electricity for the first time between 2010 and 2017 (International Energy Agency, 2018). The third important factor is that as household incomes increase, their electricity demand increases as well. This is because of the dramatic increase in the use of household electric appliances, such as air conditioning and water heater appliances (Wolfram et al., 2012). Therefore, since the early 2000s, energy/electricity security has been an important issue in SEA countries (Nurdianto and Resosudarmo, 2016). At the same time, carbon dioxide emissions have also become a concern among SEA countries. Contributing around 7 percent of global CO2, SEA has been among the top CO2 emitters globally (World Resources Institute, 2020). Furthermore, CO2 emissions from SEA countries are still among the largest, even if only emissions from fuel combustion activities are taken into consideration.

- To reach ASEAN’s 2025 goal of increasing the share of RE to 23 percent of its total primary energy supply will require “targeted efforts to accelerate and scale up RE development and exploiting the rapidly evolving market landscape.” ADB (2019) estimates that US$290 billion in investment is needed to achieve regional RE targets.

- The high cost of financing is one of the main barriers to the development of RE in SEA. In most ASEAN countries, due to the perception of RE investments being high risk and technical, investors must be excessively diligent when assessing potential investment opportunities in the sector. Due diligence assessments are costly and even if the results do not prohibit the investment, these high costs are eventually incorporated into the cost of capital (Nexus for Development, 2017).

- According to IRENA, “to reach the region’s aspirational renewable energy target, annual investment would need to be significantly scaled up to an estimated $27 billion.” In context, around $6 billion has been invested cumulatively by development banks in RE between 2009 and 2016. Achieving the required volume of investment is complicated by the high levels of diversity across ASEAN as pointed out by IEA (2021). There is considerable variation in levels of maturity across markets in catalysing renewable energy opportunities, with markets such as Malaysia, the Philippines, Singapore and Thailand being more developed in their efforts to promote clean energy investment. Other countries in the region have access to fewer financial instruments, face greater risks associated with such investments and have comparably fewer vehicles for accessing investment opportunities. One of the most prominent barriers identified by ADB (2021) is related to limited private sector funding. Currently, it estimates 55 percent of clean energy projects still rely on the public sector to ensure bankability.

PROPOSAL 3: PROMOTING REGIONAL ENERGY SECURITY IN THE ASEAN THROUGH ENHANCING ENABLING ENVIRONMENT FOR RE PROJECT DEVELOPMENT:

- Improve the clarity of RE target and policy coherence would help to enhance the enabling environment for RE project development, which would in turn promote regional energy security. The G20 could play a significant role in influencing governments in the ASEAN region to align their RE targets taking into account the differences in starting point of energy transition and resource availability in each country in ASEAN to ensure the RE target will be just. The improvement in RE target clarity should touch upon the role definition, responsibility and involvement of different stakeholders, such as government bodies, developers and financiers. Clear RE targets need to be derived in a coherent manner in each country and related policy and regulations implemented.

- Integrate the regional energy market to reduce the cost of funding. The G20 could lead the discussion to set up the regional energy market integration framework and promote its development by enhancing knowledge sharing, technical expertise sharing and replicate the current establishment of regional market integrations, such as Nord Pool. While there are many aspects that could be replicated from Nord Pool, an electricity trading market among Nordic countries, it needs to incorporate the characteristics of ASEAN countries, including SEA’s natural resource varieties, institutional capacities and geographical differences.

- Enhance RE project feasibility and credibility by facilitating research, project development and capacity building. G20 countries could step in and contribute by making a commitment to assist the establishment of centres for RE research and development (R&D) or support already existing R&D to encourage scientific innovation in the ASEAN region, with the main focus of RE project development at the regional level. Furthermore, considering its influence, G20 countries could also aim to mobilise funding and technical support for R&D activities, including access to public research equipment, instruments and personnel. Also G20 countries could aim at improving research infrastructure, such as providing access to specialised knowledge and supporting the training of scientists and engineers in universities and other institutions of the education sector to enhance the human capital that R&D facilities require.

- Transaction costs could be reduced by developing a common framework for effective and efficient permit and procurement processes. Considering the variability of institutional capacity and regulatory framework across ASEAN countries, adopting a standardised common framework of permit and procurement processes would increase investment and the business climate towards RE projects. The improvement in the investment climate would also be matched by the increase in quality of the regulatory process itself and the RE project itself through its life-cycle. However, it is imperative to ensure that the permit and procurement framework are well-designed, to which G20 countries could contribute by providing technical assistance and resource to increase the technical capacity of related government bodies to design and implement such a framework.

Rationale:

- ASEAN’s RE share of total primary energy supply is expected to only reach 17 percent by 2025 (IRENA, 2016), six percentage points short of the region’s aspirational target of securing 23 percent of its primary energy from modern, sustainable renewable sources by the same year. Even if the more than 800 clean energy projects in the pipeline, as forecast by IRENA, are counted, the proportion of RE to the overall energy in ASEAN would still have much room for improvement.

- Energy insecurity is a potential risk in SEA. Between now and 2040, the region’s energy demand is expected to grow by almost two-thirds, contributing to 12 percent of global demand growth (IEA 2019a). At the same time, the regional economy will more than triple in size, and population will rise by a fifth, with the urban population alone growing by over 150 million people. There are wide disparities in circumstances and energy trends among the 10 ASEAN member states. SEA will change from a net exporting region into a region that will need to import to satisfy its growing energy demand. Oil demand will rise by around 40 percent and natural gas consumption by almost 60 percent, while oil production falls by one-third and gas production remains virtually level. Coal alone accounts for almost 40 percent of the energy demand growth, and has overtaken gas in the electricity mix (IEA, 2019b).

References

Asian Development Bank (ADB). 2017. Meeting Asia’s Infrastructure Needs. Manila: ADB. https://www.adb.org/sites/default/files/publication/227496/special-report- infrastructure.pdf

BloombergNEF. 2021. Bloomberg New Energy Finance Database: Energy Transition Investment, https://www.bnef.com/interactive-datasets/2d5d59acd9000005

International Energy Agency (IEA). 2018. World Energy Outlook 2018. International Energy Agency. https://doi.org/10.1787/weo-2018-en.

International Energy Agency (IEA). 2019a. Southeast Asia Energy Outlook 2019. Paris: International Energy Agency (IEA).

International Energy Agency (IEA). 2019b. Energy Security in ASEAN+6. Paris: International Energy Agency (IEA).

International Energy Agency (IEA). 2021. Financing Clean Energy Transitions in Emerging and Developing Economies. Paris: International Energy Agency (IEA).

International Renewable Energy Agency (IRENA) and ASEAN Centre for Energy (ACE). 2016.

Renewable Energy Outlook for ASEAN: a REmap Analysis. Abu Dhabi and Jakarta: International Renewable Energy Agency and ASEAN Centre for Energy.

International Renewable Energy Agency (IRENA). 2022. NDCs and Renewable Energy Targets in 202. Abu Dhabi: International Renewable Energy Agency (IRENA).

Nexus for Development. 2017. Financing Renewable Energy in South East Asia: Insights from Practitioners.

Resosudarmo, B.P. and Y. Effendi. 2021. “Implications of East Asia electricity market integration on Southeast Asian economies and CO2 emissions”. In A. Mori (ed.), China’s Carbon-energy Policy and Asia’s Energy Transition: Carbon Leakage, Relocation and Halos. London: Routledge

Susantono, B., Zhai, Y., Shrestha, R. M., & Mo, L. 2021. Financing Clean Energy in Developing Asia. Asian Development Bank.

Wolfram, C., Shelef, O. and Gertler, P. (2012). How will energy demand develop in the developing world? Journal of Economic Perspectives 26(1), 119–138.