Is the welfare state jeopardized by demographic and economic pressures (ageing, globalization, technological progress)? In fact, it is even more needed in a globalized economy, and it can be adapted to enhance its effectiveness in promoting more inclusive growth. This involves: developing pre-market and in-market forms of pre-distribution that reduce inequalities in market incomes and lower the need for redistribution; investing in education and health to develop productivity, civic capacities and well-being; seeking more efficient tax bases such as externalities and rents; breaking intergenerational transmissions of inequalities and boosting social mobility by investment in human capital and wealth redistribution; preparing safety nets for large technological waves; developing international cooperation on tax and social norms. These recommendations are equally relevant for developing and emerging economies and should be considered against the broad challenge that such countries face of establishing a sustainable welfare system.

Challenge

The welfare state is considered under pressure due to globalization, ageing, technical progress which disrupts the job structure, and staggering debt in several countries. Actually, data show that the welfare state is not receding and it is arguably a key component of a strategy of global integration. Truly enough, redistribution is under pressure in the globalized economy, as tax rates on corporate profit, wealth, capital income and top earnings have been declining in a general effort by many countries to attract investment and mobile talents. But the welfare state has not been reduced in the size of its operations (public social spending is not being reduced, in most countries), although it has become less redistributive. The composition of tax revenues has shifted toward indirect taxes and income taxes borne by the middle class and the redistributive function of income taxes has diminished under globalization-induced tax competition (Causa, Vindicis et al. 2018). Social spending on cash support for working-age households has gone down, while spending on in-kind support, especially in the area of healthcare, has gone up. Redistribution through cash transfers has therefore declined in the vast majority of advanced countries over the last two decades, driven by less redistributive insurance transfers (i.e. related to disability, unemployment and sickness), in some countries partly compensated by more redistributive (and mostly targeted/means-tested) assistance transfers (Causa and Hermansen, 2017).

A classic argument in international economics is that a key function of welfare states is to insure citizens against the higher risk of income fluctuations in open economies. It is no coincidence that the basic welfare institutions providing social insurance were founded in most countries toward the end of the 19th century, in a period of great international economic integration (Atkinson, 2015; see also IPSP, chapter 8). Empirically, it has been demonstrated that larger governments are associated with more open economies, keeping all other factors constant (Cameron, 1978; Rodrik, 1998). Hence, contrary to the thesis that a state’s action space is reduced in a global economy, the opposite seems to have been the case. It therefore appears paradoxical that, while on the one hand the demand for insurance against the shocks of trade and technical innovation is growing, the support for solidarity mechanisms is eroded.

Social assistance has been the recurrent target of criticism, from all sides of the political spectrum, due to its lack of effectiveness (low take-up rates of targeted income support) and the stigma and discouragement effects of dependence on public stipends. The recent votes in the UK and the US, the growth of Euro-sceptic parties and the shift away from socialist parties in continental Europe, suggest that voters’ response to the recent crisis is more isolationism rather than more insurance through the welfare state. This may be the result of increased cultural, religious or ethnic diversity. Recent migration flows have been used by populist demagogues to arouse divisive sentiments which undermine support for general social assistance programs. It may also be the result of people losing the cooperative ethos that characterized the post-war years, after anti-government narratives became widespread in the 1980s (Atkinson 2015; IPSP 2018 Chapter 8).

We believe that protectionism is not the solution and will damage the very interests of those left behind who demand a system change. We also believe that the welfare state is a valuable actor to address people’s needs, but needs a re-foundation to attract consensus from citizens.

It is important to reaffirm that many forms of redistribution provide essential protection and should be counted not as expenditures but as investments in human and social capital, with very high returns (Heckman and Chasman 2013). Letting individuals and families bear the costs of volatile incomes and health shocks is inefficient because it destroys human potential in the present and the next generations, and generates costly externalities on the productive system, public health, security, social cohesion, and political and social stability.

Along these lines, people often look at the Scandinavian model as a successful formula for the welfare state. This formula displays a coherent architecture of open economies in which centralized wage bargaining, well-designed and efficient active labor market, training and requalification measures, and high levels of universal programs of investment in human capital and redistribution are essential to preserve social cohesion and maintain a good level of cooperation toward high productivity and competitiveness. The open market discipline motivates this high level of cooperation and cohesion, generating a virtuous circle in which efficiency and solidarity reinforce one another (IPSP 2018, ch. 8). The Scandinavian model shows the positive aspects of combining ex-ante investment in human capital and ex-post redistribution.

The future of the welfare state needs rethinking, in many countries, in the light of the increasing challenges. The growing needs for redistributive safety nets, the costs of advanced health care and old-age dependence and related burdens come in conflict with the disaffection for redistribution and the race to the bottom on corporate and top income taxation that many countries are engaged in to attract foreign investment and talent. Can economic security be offered to the population while keeping the economies open and taking care of these new needs? Is the Scandinavian model the only promising option? Can emerging economies adopt models of welfare state which are compatible with their specific constraints on tax revenue? Can global safety nets be useful and viable?

Proposal

Empowering people through pre-market and in-market policies

A narrow view of redistribution as a cost rather than an investment is mistaken, but a narrow view of the welfare state as a redistribution system must also be rejected. The aim of the welfare state should be to minimize its ex-post redistributive branch by maximizing its pre-distributive operations. The latter does not suffer from the economic, political and social limitations of the former, listed in the Challenge section, and can be more effective in reconciling efficiency and social justice.

Investment in human capital and human capacities through education, public health (including environmental policy) and access to basic infrastructure (including digital technology) prepares citizens for their economic activity but also for their civic engagement. While redistribution preserves the basic dignity of individuals by protecting them from the travails of deprivation and begging, this “pre-market” form of pre-distribution empowers them to be full members and full contributors to the economic and social achievements of their community. This appears particularly important in the context of worrisome repercussions of social disruptions on increasing preventable deaths—i.e. suicide, opioid and drug addiction—and diabetes in the US, for instance (Case and Deaton 2015; Graham, 2017).

Another important pre-market form of distribution to foster equality of opportunity involves addressing inheritance-related wealth inequality. While taxing the donors of gifts and bequests is correctly seen as a punitive form of taxation of the successful (charitable donations are actually subsidized in many countries through tax deductions), it is obviously unfair that some individuals become rich with no other merit than being born in particular families. Reconciling the two concerns is possible by taxing gifts and bequests at the recipient level only and encouraging donors to distribute their wealth to the most needy. The proceeds of this tax could feed a fund providing a grant to every young citizen (Atkinson 2015). The G20 countries should build up coordination to enable countries to implement suitable forms of bequest redistribution without fearing capital flight.

There is also “in-market” pre-distribution, which consists in preventing the functioning of various markets from worsening inequalities. For instance, minimum wage and labor contract regulation can force employers to keep a level of productivity and working conditions compatible with giving their workers a good standard of living. Competition policy can prevent the distortions and inequalities due to market power, which can occur both on the supply side (monopolistic power harming customers) and the demand side (monopsonistic power harming workers and small suppliers). Appropriate incentives and regulatory guidance should also induce the modern corporation to broaden its purpose beyond from shareholder value maximization (as enacted in a recent French law) and reform its governance in order to adapt to growing societal demands for a more responsible and inclusive behavior and to workers’ demands for greater autonomy, work-life balance and flexibility. For instance, the European Enterprise formula, which mimics the German co-determination system, could be generalized and made more attractive, including for medium-scale businesses. More generally, businesses must better internalize social and environmental impacts on all relevant stakeholders (workers, suppliers and customers, local communities and local governments). For instance, experience rating can force businesses to internalize the social costs of high turnover in the workforce and medical problems due to unhealthy working conditions, including stressful social relations at work. The Benefit Corporation formula, initiated in the US, could also be generalized to many countries and receive fiscal support to attract more businesses. A renewed welfare state should also ensure that workers in the gig economy are covered by social protection systems. This can be done by developing affordable social insurance mechanisms for poor independent contractors and defining norms to qualify certain platforms as de-facto employers.

The recent increase in inequalities in earnings comes both from inequalities between skill levels and between firms. Reducing both types of inequalities by “in market” interventions can be done either by centralized collective bargaining (as in the Scandinavian model) or by a combination of minimum wage norms and a more democratic governance of the firm leading to a more compressed pay scale.

Seeking new revenues drawn through efficiency-oriented interventions

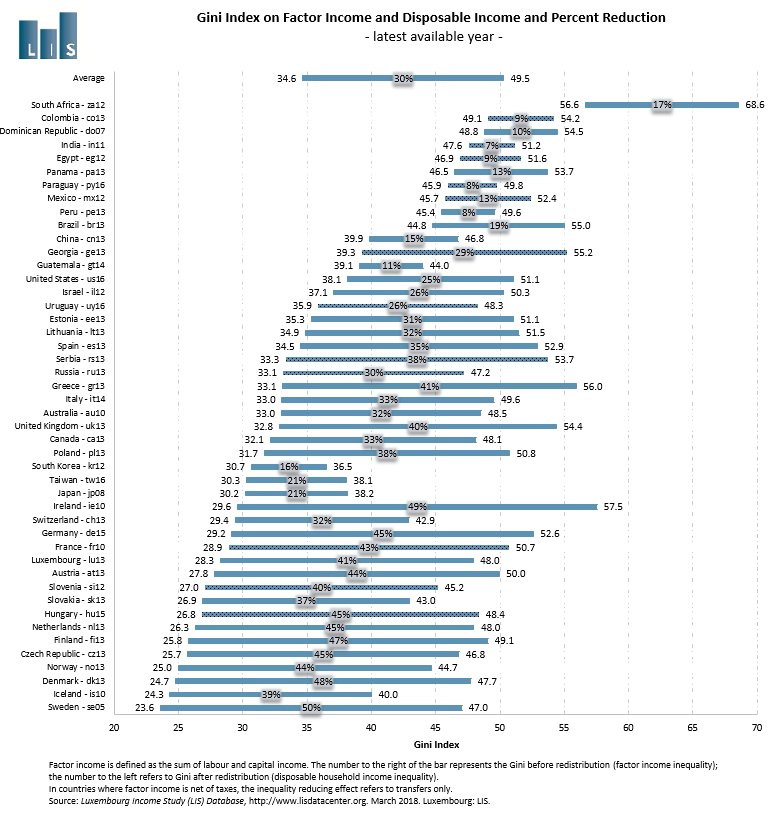

Maximizing pre-distribution should reduce the need for public revenues by two channels. First, investments in human capital have high returns and reduce the need for redistribution and other “repair” programs, as observed in countries with strong education policies, for instance (see Fig. 1 in the appendix). Second, in-market regulation has little direct cost and may have low (or even negative) indirect cost when better managed firms invest more and better treat their human resources.

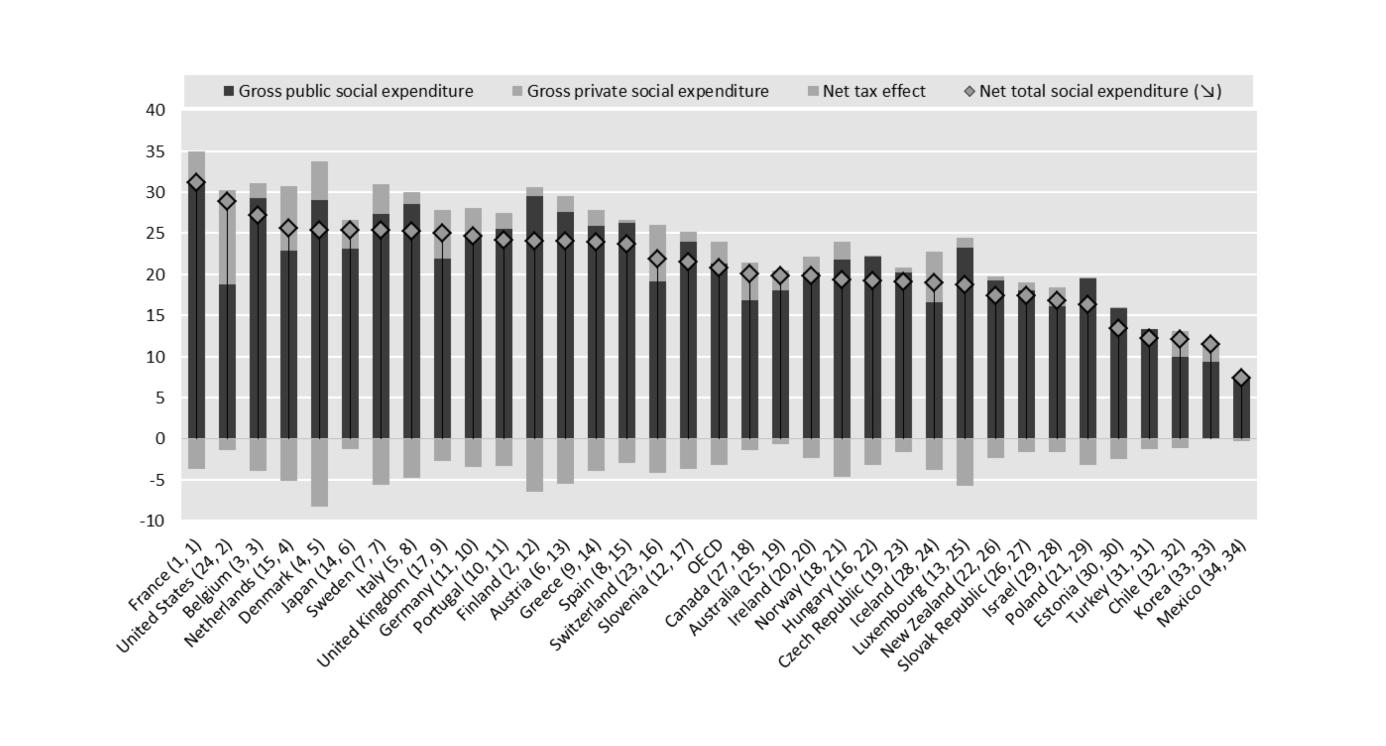

On the other hand, universal programs are very costly and we cannot expect the future welfare state to be able to rely on much less revenue than the current situation. Moreover, while there are important differences between countries in the level of public social expenditures, such differences appear much smaller when private compulsory expenditures are taken into account (OECD 2016, see Fig. 2 in the Appendix).

Nevertheless, there exist more or less distortionary types of taxes and there are opportunities to shift the tax base toward less distortionary or even toward equity and efficiency-enhancing taxes. Reducing taxes on labor earnings at the low-end of the distribution, including by expanding in-work credits and benefits, would reduce both labor supply disincentives among under-represented groups as well as labor demand disincentives by e.g. reducing firms’ capital for labor substitution. Curbing gender bias in taxation would also meet efficiency objectives, by lifting women labor market participation, and equity objectives, by fostering horizontal equity in the tax system.

In principle, rents can be taxed with little distortion and negative externalities can be taxed while making the economy more efficient. Prominent among rents are land rents, which can be taxed by real estate tax, and market power rents, which can be taxed by adjustments of corporate taxation or, as generally practiced, fines on dominant positions or collusion. The tax base of the former is quite inelastic but the tax base of the latter may be elastic for some industries. Evidence suggests that market power has considerably increased in the last decades (De Loecker and Eeckhoudt 2017, Barkai 2017), implying that competition policy is too weak and fines too low. This requires international coordination given the scale of many transnational corporations, and G20 countries should consider defining guidelines to coordinate anti-trust policy.

Taxes on externalities help private agents internalize the effects of their decisions and could also be much more widely used. For instance, a carbon tax could generate a sizeable revenue during the decarbonization transition period. Coordination across countries within the Paris Agreement can be enhanced by setting up a coordinated effort at harmonizing the carbon tax (or price ranges for emission permits) around the levels recommended by Stern and Stiglitz (2017). Evidence also suggests that property taxes are among the least distortive tax bases and can be designed to be progressive, hence addressing efficiency and equity objectives. Most countries have room to rely relatively more on property taxes while ensuring that those are levied on a progressive basis and addressing potential liquidity concerns associated with asset-rich income-poor households (Brys et al 2016).

Breaking intergenerational transmissions and lifetime persistence

A key mission of the welfare state is to give every individual fair chances and possibilities to recover after disruptive events such as unemployment or health shocks. This can be implemented through policies attending to material assets and human capital.

Regarding material assets, an ambitious policy to curb the dynastic transmission of wealth is important, and has already been discussed. As far as lifetime persistence is concerned, unemployment benefits, income support and incentives for savings are needed.

Regarding human capital, it is now understood that initial education, including very early education, but also environmental conditions determining prenatal and neonatal development are important to provide fair initial chances (Heckman and Chasman 2013, Currie 2011). Taxes on pollution can find here an additional rationale, since environmental damage stunting prenatal and neonatal development has very long-term effects. As far as lifetime persistence is concerned, just as health care helps restoring bodily capacities, lifelong education should be developed to retrain workers who need to go into new careers. This is crucial to address the challenges raised by the future of work, not least in ageing societies.

Preparing the welfare state for the fourth industrial revolution

It is very unlikely that the coming artificial intelligence (AI) revolution will drastically reduce the employment of labor, but it will restructure the composition of jobs and its rapid pace may be very disruptive for displaced workers who cannot easily transition to very different jobs (IPSP 2018, ch. 7).

A combination of policies can help reduce the shock. First, better incentives toward employment through reduced payroll taxes and more democratic management can affect the pace and orientation of innovation. Second, income support (unemployment benefits and other forms) and retraining programs can help every affected worker to navigate the transition. Third, pro-competition policy can foster the dynamism of the economy and the creation of new jobs, even if it may also accelerate the innovation wave.

Means-tested and targeted forms of income support may be insufficient if the scale of the disruption of the labor market is large. Also, forms of income and retraining insurance funded by payroll taxes would be undermined if the share of labor in GDP happened to fall dramatically as a consequence of the AI wave. Unconditional forms of support such as a universal basic income (UBI), based on general taxation of all incomes, may be better able to provide a secure safety net, though at a relatively low level. It is often suggested to tie the level of a basic income to a fixed percentage of GDP per capita. It is important to understand that the cost of a UBI is not the level of individual support multiplied by the size of recipients (a staggering amount), because the tax system needs to be adjusted so that no change on net incomes occurs for most taxpayers. The real cost of a UBI is the increase in the take-up of income support by very low income households, and the cost of individualizing income support. G20 countries should consider experimenting with modest levels of universal basic income and test both the economic and political viability of this formula.

One may wonder if unconditional cash support risks disempowering people by making them dependent on the stability of welfare policy instead of relying on their own abilities. The lesson of the Scandinavian model (IPSP 2018, chapter 8) is that universal unconditional forms of support actually make people more resilient to the vagaries of market income and better able to engage in market transactions on favorable terms. However, two conditions are important to make this possible. First, there needs to be some commitment to maintain a stable policy environment fostering people confidence in the capacity of the redistributive system to smooth incomes over the lifecycle hence to prevent hardship during vulnerable lifecycle phases such as youth and old-age. Second, there needs to be supplementary policies that secure people’s rights and prevent the development of an informal sector (e.g., in some form of gig economy) exploiting people’s ability to survive without a decent economic status.

Welfare states in emerging economies

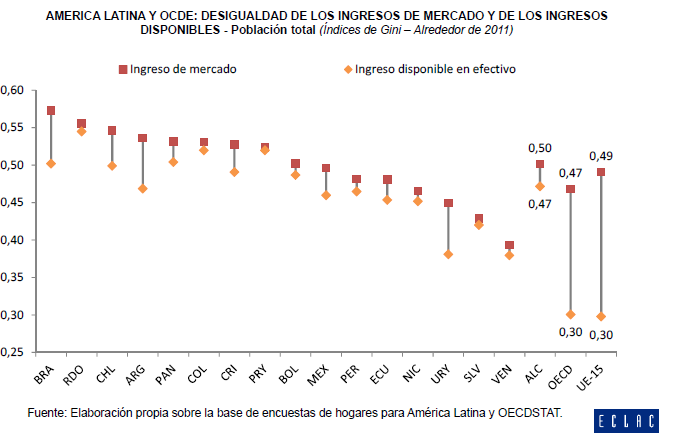

The emerging economies are now as rich, or richer, than the European and American economies when they developed their welfare systems. And indeed, welfare policies are blossoming in the developing world, including in lower middle income countries. However, even in some upper-middle-income countries such as in Latin America (Fig. 3 in the Appendix), the degree of redistribution is low compared to more advanced regions such as the OECD or Europe. While specific opportunities, needs and difficulties occur in countries with large reserves in natural resources or a large informal sector, it appears reasonable to predict that rising demand for social protection will encourage the expansion of the welfare states among emerging economies.

There is no specific model of welfare state for developing countries and a combination of the policies discussed in this note can be adopted in these countries depending on economic and political possibilities. We reiterate that enlarging the access to all levels of education and providing health services as broadly as possible, will generate positive economic and social returns. In fact, such returns should be exceptionally high in low-income countries given their still large education and health gaps with respect to advanced countries. This is an area where official development aid could take new forms directly financing educational and health programs through the provision of loans or unconditional aid. During the scaling-up of a welfare state, targeted social assistance such as conditional cash transfers is usually considered as an effective strategy to tackle inequality and poverty such as testified by the successful experiences of some Latin American countries like Brazil. At the same time, emerging economies need to ensure universal coverage in access to education and health care and several countries have ambitiously started with universal programs in such areas as well as in the area of pensions to ensure minimum standard of livings among the elderly.

International coordination toward a global safety net

The policy brief on the effectiveness of national policy (Causa, Filgueira et al. 2018) argues that the welfare state remains viable and effective in the current state of limited international coordination of social policies. The policies and reforms discussed in this note are meant to be implemented at the national level yet with suitable coordination and harmonization they could form the backbone of a project of universal safety net, defining minimal levels for investment in human capital, social protection and related policies.

Coordination is also needed on the taxation side, and is important to prevent any race to the bottom. Indeed, while the positive effects on the state and human capital of the workforce should attract investment, inheritance taxation may make some wealthy dynasties migrate, while wage compression, centralized bargaining, corporate governance regulation, environmental taxation or even land taxation may discourage foreign investment and trigger offshoring. International coordination may help addressing some of these obstacles and therefore enhance the ability of national governments to deploy ambitious protection for their populations. The most basic form of cooperation should bear on tax evasion and the closure of tax havens (Alonso 2018b). In this sense, a rather simple piece of legislation prescribes individuals to be taxed according to their citizenship rather than their place of residence, as has been practiced by the US (Atkinson, 2015). This would ensure that personal incomes cannot escape taxation by relocation of one’s residence. Since the costs of relinquishing one’s citizenship is much higher than the cost of changing one’s place of residence, there appear to be margins for concrete improvement on this front. The OECD’s efforts (through the Global Forum on Transparency and Exchange of Information for Tax Purposes) at equipping tax authorities with legal, administrative and IT tools, as well as enhancing cooperation through automatic exchange of information have achieved substantial progress in this area. Over the past 8 years, more than 500 000 taxpayers have disclosed offshore assets, and close to 85 billion euros in additional tax revenue has been identified as a result of voluntary compliance mechanisms and offshore investigations (OECD 2017). Such efforts should be pursued and expanded.

Coordination of social (and environmental) norms would also help smooth trade frictions, while conversely trade measures can be used to discourage free riding on such norms (for more details, see the policy brief on trade and social goals, Shaffer and Fleurbaey 2018).

Another potential domain of international cooperation is the introduction of global taxes and global safety nets, or global infrastructure programs. Global taxes such as a carbon tax could be earmarked to pay for infrastructure investment in developing countries and basic safety nets. The Global Partnership for Universal Social Protection launched in 2016 offers an interesting perspective on the development of such initiatives (Alonso 2018a).

Appendix

Figure 1: Redistribution by taxes and transfer in selected countries

Figure 2: Total net spending in the OECD as a percentage of GDP, 2013

Source: OECD (2016, Fig. 4).

Note: Net total social expenditure is ranked differently than gross public social expenditures. For instance, the US ranks 24th for the latter but 2nd for the former, the UK goes from 17th to 9th.

Figure 3: Redistribution in Latin American countries, compared to OECD and Europe-15.

References

- Alonso J.A. 2018a, “Development cooperation to ensure that none be left behind,” UN-CDP working paper.

- Alonso J.A. 2018b, “International tax cooperation and sovereign debt crisis resolution: reforming global governance to ensure no one is left behind,” UN-CDP working paper.

- Atkinson A.B. 2015. Inequality. What Can Be Done? Harvard University Press.

- Barkai S. 2017, “Declining Labor and Capital Shares,” working paper.

- Brys, B., et al. (2016), “Tax Design for Inclusive Economic Growth”, OECD Taxation Working Papers, No. 26, OECD Publishing, Paris, http://dx.doi.org/10.1787/5jlv74ggk0g7-en

- Case, Anne, and Deaton, Angus. 2015. “Rising Morbidity and Mortality in Midlife among White non-Hispanic Americans in the 21st Century.” Proceedings of the National Academy of Sciences, 112/49: 15078–15083.

- Causa O. and M. Hermansen 2017, “Income redistribution through taxes and transfers across OECD countries”, OECD Economics Department Working Papers, No. 1453.

- Causa O., F. Filgueira, M. Fleurbaey, G. Grimalda, U. Sverdrup 2018, “Effective national policies in the globalized era”, T20 Policy Brief Draft.

- Causa O., A. Vindicis, and O. Akgun2018, “An empirical investigation on the drivers of income redistribution across OECD countries,” OECD Economics Department Working Papers, forthcoming.

- Currie J. 2011, “Inequality at Birth: Some Causes and Consequences,” American Economic Review 101(3): 1-22.

- De Loeker J., J. Eeckhoudt 2017, “The Rise of Market Power and the Macroeconomic Implications,” working paper.

- Graham, C. 2017. Happiness for All? Unequal Lives and Hopes in Pursuit of the American Dream, Princeton University Press.

- Heckman J., D. Chasman 2013, Giving Kids A Fair Chance, MIT Press.

- IPSP 2018, Rethinking Society for the 21st Century. Report of the International Panel on Social Progress, Cambridge University Press.

- OECD 2016, “Social spending stays at historically high levels in OECD countries,” Social Expenditure Update, Paris.

- OECD (2017), OECD Secretary-General report to G20 Leaders, Hamburg, Germany, July 2017.

- Shaffer G., M. Fleurbaey 2018, “Adapting trade policy to social, environmental, and development goals”, T20 Policy Brief Draft.

- Stern N., J.E. Stiglitz 2017, Report of the High-Level Commission on Carbon Prices, CPLC.