Low-income consumers in developing economies have limited access and low sustained usage of financial services. Fintech provides an opportunity to promote the financial inclusion of low income households in developing countries, whilst recognising the drivers of financial inclusion. Greater financial inclusion can be a catalyst for eradicating poverty, and for developing the small business sector. Fintech must include both access and usage of financial services focusing on affordability, appropriateness, financial literacy, regulations and fair competition. This policy brief presents findings of a Human Sciences Research Council (HSRC) survey that studied the impact of Fintech for financial inclusion in Sub-Saharan Africa.

Challenge

Financial inclusion statistics at present tend to exclude the key factor of usage, referring instead predominantly to consumers’ access to financial products. In countries such as Kenya or South Africa, the rates of access to financial facilities are amongst the highest in emerging economies, but this betrays the severe challenges experienced by customer’s in these countries, leading to low rates of usage and a dependence on cash (Villasenor, West, & Lewis, 2016). Considering these high rates of access to a banking account or mobile-wallet facility, rates of poverty have remained high, and the expected benefits of financial services for the low-income segment have not materialized.

Further, the drivers of financial inclusion differ depending on the local context requiring policy makers, regulators and innovators to have a clear understanding of the needs of their respective markets. Below are the most significant challenges identified by fintech stakeholders in Southern and East Africa in an HSRC survey :

1. Mobile-wallet transaction costs for low-value transfers are unsustainably high for the low-income segment, in both East and Southern African countries. Given the irregular receipt of income within the informal sectors of these countries and high costs of mobile devices and internet access, the true costs of mobile-transactions are unaffordable for the poor, leading to decreased usage of products.

2. Products are not designed appropriately for the needs of the low-income segment. Various respondents argued that products are designed for the top of the pyramid instead of recognising the unique needs of the poor. Low-income consumers have been unable to transition from mobile-wallet payments to savings, credit, insurance or wealth management.

3. Financial literacy remains a challenge amongst the low-income segment and is compounded by limited capabilities in literacy, numeracy, digital literacy and a general awareness of financial products. Importantly, many respondents agree that policy makers should not mistake the effects of poor product designs, and not catering to the needs of the low-income segment, for low financial literacy. Recognising this caveat, greater support is needed to develop general and financial general education programmes in low-income areas.

4. The regulatory environment has been identified as a challenge within Southern and East Africa. Whilst the regulator works to protect the financial-services ecosystem, improving safety and standardising the industry, restrictive regulations will have an exclusionary effect on innovations. Often the regulation landscape is unclear and innovators are unaware how to develop new technologies aligned to the regulatory needs of the country. Further, this uncertainty inhibits partnerships with foreign large-scale fintech operators, as they are unclear of the medium to longterm prospects of their products in a new a market.

5. Our study’s respondents noted an unequal treatment of small businesses compared to the larger traditional corporates, suggesting that there are unfair competition practices in place. These experiences are noted for a greater extent amongst fintech entrepreneurs discussing how regulations are applied. Such occurrences reduce competition in the sector, and foster conditions for monopolies.

Proposal

The HSRC administered a survey collecting qualitative and quantitative responses describing the challenges and opportunities for the development of financial technologies across Southern and Eastern Africa. In total 85 responses were received from South Africa, Botswana, Mozambique, Zambia, Zimbabwe, Kenya, Rwanda, Tanzania, Uganda and Singapore (a fintech operator, conducting business in the region). In summary, 51 responses were gathered from Southern Africa and 33 responses from Eastern African countries. Inputs were received from academia, think tanks, banks, mobile network operators, fintech entrepreneurs, microfinancing institutions, credit bureaus, regulators, non-governmental organisations and investment managers. The questionnaire concentrated on the interests of the low-income segment, testing support for strategies that may enable financial inclusion in the region. The questionnaire was segmented into sections for financial inclusion factors, appropriate fintech policy, specific technological requirements for the region, support for innovators, data collection and sharing practices, the regulatory environment, the promotion of fair competition and partnerships for growth and development of the fintech sector.

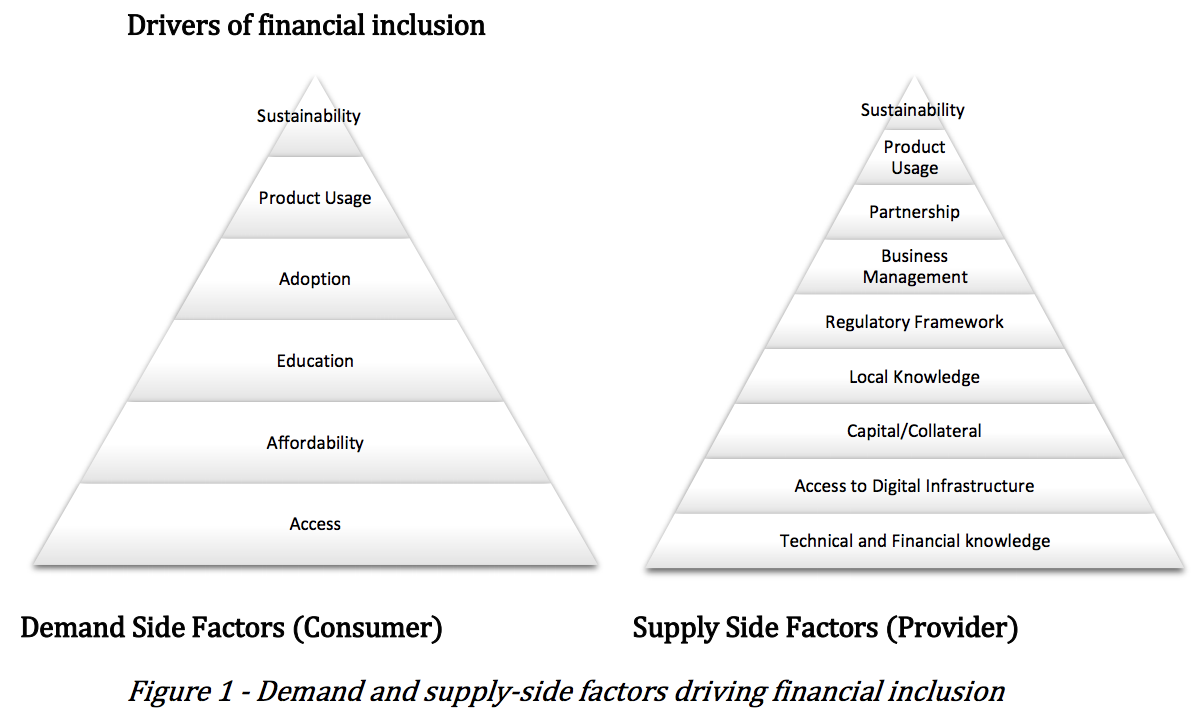

The drivers of financial inclusion must take into account factors from the perspective of the consumer demand for services, and the financial service provider who supplies services to the consumer. In this study, similar factors are recognised from the perspective of both the provider and consumer, but the different contexts have different considerations. For example, issues of usage, and access are referenced on both sides but refer to different issues. Ultimately, both the consumer and financial service provider are interested in a sustainable financial ecosystem promoting continuous innovation and the affordable usage of products.

Recognising the challenges raised by the study’s respondents, to promote financial inclusion, from the consumer’s perspective, the following must be in place:

- Access to a financial product is dependent on a range of factors including: awareness of how and where to access the product, internet access and having sufficient mobile data if required, having an appropriate device to access the product/service and the network infrastructure to which the device operates.

- Affordability refers to the true transaction cost for a consumer which is inclusive of the transaction charge, cost of internet access and cost of transport (if necessary). Further one must be cognisant of the earning patterns of the low-income segment who tend to receive income on an irregular basis.

- Education factors for the consumer must be inclusive of their level of literacy, numeracy, digital skills and financial literacy.

- The choice to adopt a product is influenced by a range of concerns such as awareness, ubiquity of service, trust in the product/service and having the necessary documentation to subscribe to the service.

- Product usage is underpinned by the aforementioned drivers and also promoting a shift of dependency from payments services to a wider range of products such as credit, savings, insurance and wealth-management.

From the perspective of the financial service provider, respondents have argued for the following conditions to be available:

- To provide a service or product, conditions within a country must promote innovative product designs. Innovators are needed, who are aware of the local context and have both technical knowledge and knowledge of the financial service sector. It is recommended that greater support is provided to innovators to access innovation laboratories to build their skills and test their ideas.

- The innovator must be able to access digital infrastructure to develop their business.

- The entrepreneur requires capital or collateral to assist in accessing financing to build a business or scale new products/services.

- For services and products to spread, they need to be designed appropriately, recognising the needs of consumers. Various respondents indicated that this is more crucial than promoting financial literacy programmes, which may promote products which have limited relevance for a poor person.

- The regulatory framework must be conducive to innovation. Finding the balance between innovation and risk is difficult, but is necessary to allow new products/services to gain footing in the market. Further, regulations need to applied consistently.

- The entrepreneur must also possess business management skills. Respondents have indicated that understanding how to traverse the needs of the sector is difficult, and many fintech startups fail, not due to the quality of their product, but due to the management of their business.

- Entering into local and international partnerships are an important mechanism to help scale a product and build a consumer base. However, due to unbalanced power relations, small-scale entrepreneurs become reluctant to share intellectual property. Addressing the concerns of these entrepreneurs, will help scale appropriate products for the low-income segment.

With all the afore-mentioned factors in place, sustainable product usage which benefits both the consumer and financial service provider is possible. The goal is to develop a sustainable fintech ecosystem which meets the financial needs of the consumer whilst also ensuring that innovations are maintained and value continues to be transferred back to the consumer. This must be supported by rich applications and a large base of active users allowing fintech service providers the ability to rapidly test and optimize products, as experienced in advanced fintech markets such as China.

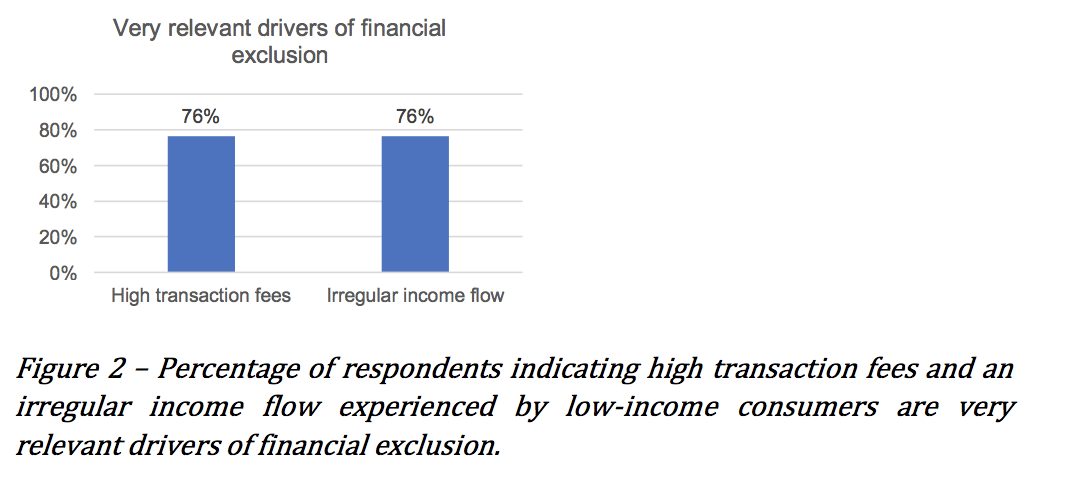

Managing high transaction costs

The affordability of financial products in Southern and Eastern Africa is a primary barrier to usage amongst consumers. For example, a Kenyan MPESA user who chooses to transfer a KSH101 to another user, pays KSH11, which is approximately an 11% transaction fee. Similarly, in South Africa, users of mobile wallets pay between ZAR8.50 and ZAR10.95 when sending ZAR100 to another mobile wallet user, which is between an 8.5% and 10.95% transaction fee. Unfortunately, low-value transactions remain the most expensive and deter low-income consumers from using these products. 76% of respondents to the HSRC survey also indicated that high transaction fees, together with an irregular income flow experienced by low-income consumers, are significant drivers of financial exclusion. GSMA refers to the high transaction costs of mobile money as a reason for the dependence on cash payment in Eastern Africa, despite consumers recognising the safety benefits of electronic payment facilities (GSMA, 2017).

In follow up discussions with survey respondents, the issues of high transaction costs were discussed and possible strategies to counter these challenges were identified. The source of the high costs of mobile-wallet transactions are unclear, but various respondents indicate that a dependence on traditional private payment gateways limit competition in the sector causing prices to stagnate. Respondents argue that greater competition is needed to help lower these prices. Further, several respondents indicate that the notion of what constitutes public infrastructure is changing and must start to include digital services, such as payment gateways, which become bottlenecks, in this case, to the fintech ecosystem. There is a need for the state to provide alternative and neutral payment gateway platforms which will help to reduce transaction fees, by allowing fintech providers to plugin in to these gateways at minimal cost.

In addition to the transaction cost, it is equally important to address challenges of high costs of internet access. Particularly in Southern Africa, it was found that low income users who purchase data in smaller quantities spend the most on average per megabyte (Schumann & Kende, 2013).

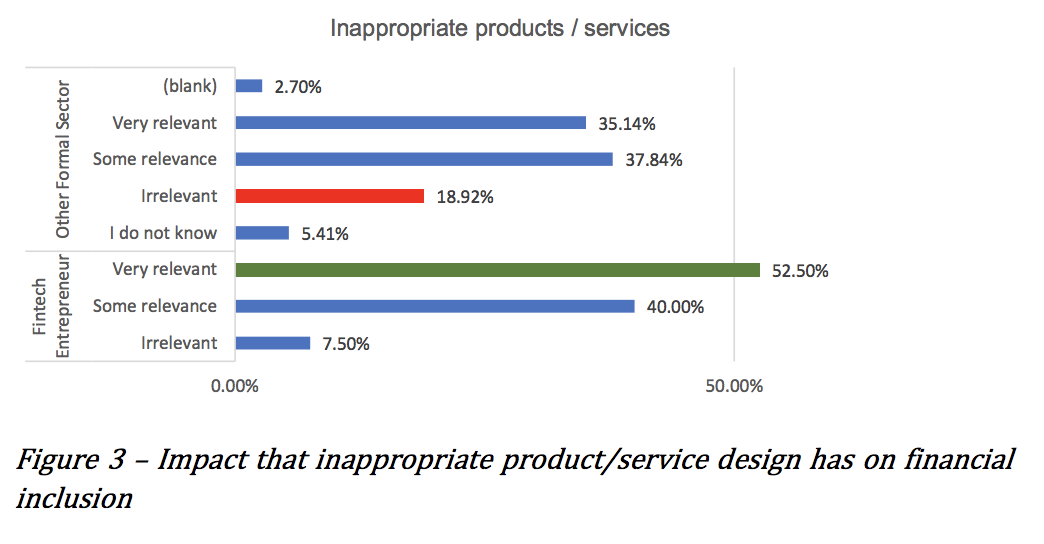

Developing appropriate products for the low-income segment

A key challenge limiting stronger adoption of fintech products is the manner in which they are designed. Appropriately structured financial services are beneficial to those who are underserved by current traditional products, such as women or poor adults (Demirguc-kunt, Asli.; Klapper, Leora.; Singer, 2017). Several respondents to the HSRC survey noted that financial products and services are often not designed for those at the base of the pyramid. When respondents from the formal sector were compared against Fintech Entrepreneurs, 18.9% of those in the formal sector felt that the design of the product was irrelevant as a driver of financial exclusion, whilst 52% of fintech entrepreneurs felt that this issue was very relevant (see figure below). In order to develop appropriate products for the low-income segment, fintech operators must have knowledge about local behaviourial trends and preferences. This becomes challenging, given that there is very little data collected and available which describes the product requirements of poor people in Southern or Eastern Africa. In addition, it is expected that by growing a base of knowledge describing the needs of the low-income segment, fintech operators will be better positioned to develop products helping consumers transition from payments to savings, credit, insurance or wealthmanagement.

Promoting Financial Literacy

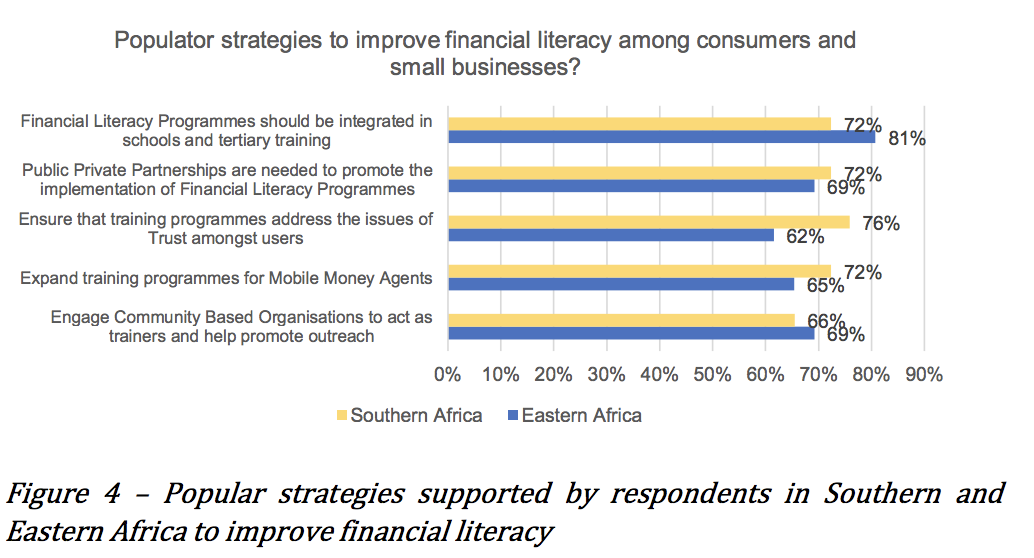

67% of the survey respondents indicated that a lack of financial literacy was a significant impediment to financial inclusion. The OECD has shown that low levels of financial inclusion are closely associated with low levels of financial literacy (Atkinson & Messy, 2013). Recognising the importance of financial literacy in low-income communities, a series of strategies were suggested to respondents. The most popular solutions to improve levels of financial literacy were:

- Integrate financial literacy programmes with schools and tertiary education institutions. By accessing schools, it is expected future generations will better preparted to adopt such tools.

- Promote public-private-partnerships as a mechanism to expand the reach of financial literacy programmes in low-income communities

- Expand training programmes targeted to mobile-money agents, to help spread awareness of products/services. Agents are well-placed to engage consumers and address their concerns directly.

- Engage community based organisations (CBOs) to act as trainers within low-income communities. This requires training the community worker and improving their skills, whilst also developing further opportunities for employment in such areas. CBO’s generally have great understanding of the product requirements of the community and also have a sphere of influence to help educate their peers.

Working with Regulators

Regulatory reforms are found to be a central issue which needs to be addressed to ensure innovative solutions can be developed and adopted. This promotes financial inclusion through potential reductions in transaction costs (Neaime & Gaysset, 2018). In some countries there is a need to introduce enabling regulatory reforms for fintech operators to play a greater role in fostering financial inclusion. The survey participants discussed the need for financial service providers to enter into a healthy relationships with regulators to better understand the needs of both communities. The top strategies supported by the study’s respondents include:

- Regulators to advise fintech startups how to best to navigate the regulatory requirements of the system.

- There is a need to minimise regulation incoherence due to overlapping regulatory environments and mandates.

- Regulators need to be kept abreast of the latest financial technology trends and be aware of the implications for technology advancement, hence the call for training programmes for regulators.

- Ensure transparency in the manner licenses are awarded, given perceptions many have that licenses are awarded unequally.

- Regulators should adopt regulation technologies to promote decisions based on evidence.

- Regulation stringency should reflect the risk associated with the activity.

- Promote a consistent application of regulations for similar functions.

Promoting Fair Competition

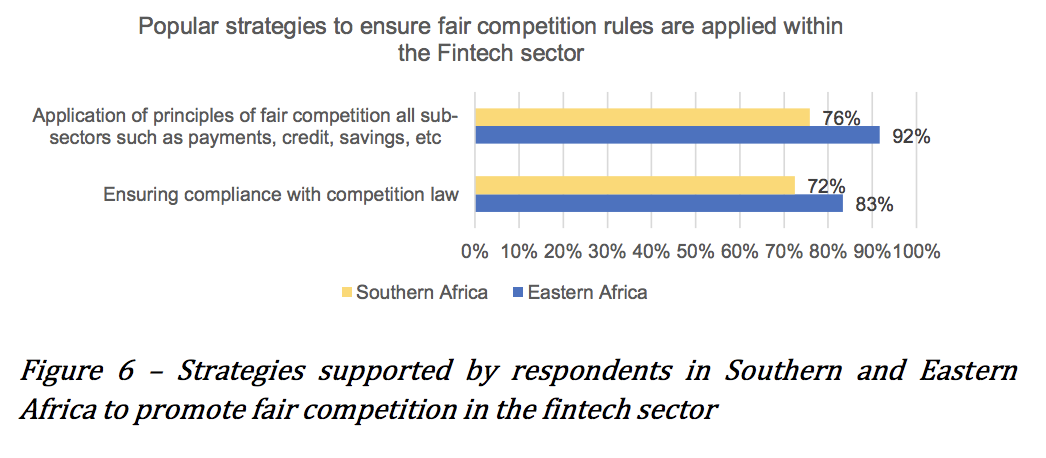

The World Bank currently advocates for greater levels of competition in the banking sector, which would support the proliferaction of digital financial technolgoies (The World Bank, 2018). More competitive environments promote the expansion of product offerings, whilst also promoting the quality and diversity of mobile financial services (Mazer & Rowan, 2016). To ensure that competition is promoted, the survey respondents identified the following strategies:

- Ensuring that that principles of fair competition are applied in all fintech product areas such as payments, credit and savings

- Ensuring that compliance law is applied consistently for all financial service providers

Recommendations

- The G20 should coordinate a feasibility assessment in developing state owned payment gateways, to minimise the costs of payments.

- Accelerate efforts to reduce the cost of internet access, through policy and regulatory frameworks which incentivise competition and the lowering of prices.

- Governments in partnership with financial institutions to conduct representative surveys to determine accurate product/service requirements of the low-income segment

- Governments to promote general literacy and financial programmes in low-income communities. These financial literacy programmes should promote a culture of trust in financial services and savings. In rolling out financial literacy programmes in low-income communities, schools and community-based organisations should be prioritised.

- Regulators to accelerate efforts in adopting RegTech and regulation laboratories to support evidence-based regulatory reforms, to adequately balance risks against the need for innovation, promoting financial inclusion and fintech development in general.

REFERENCES

• Atkinson, A., & Messy, F. (2013). Promoting Financial Inclusion through Financial Education (OECD Working Papers on Finance, Insurance and Private Pensions No. 34). Paris. Retrieved from https://www.oecdilibrary.org/docserver/5k3xz6m88smpen.pdf?expires=1551637859&id=id&accname=guest&checksum=84E68B47EC8E 550D8DB9BC93B486C8C2

• Demirguc-kunt, Asli.; Klapper, Leora.; Singer, D. (2017). Financial inclusion and inclusive growth A review of recent empirical evidence. Policy Research Working Paper.

• GSMA. (2017). State of the Industry Report on Mobile Money. Retrieved from https://www.gsma.com/mobilefordevelopment/wpcontent/uploads/2018/05/GSMA_2017_State_of_the_Industry_Report_on_Mobile_M oney_Full_Report.pdf

• Kessler, K., Ikdal;, A. S., Naidoo;, E., Portafaix;, A., Hendrickson;, J., Boje;, A., & Rabec, D. (2017). How To Create and Sustain Financial Inclusion. Retrieved from http://image-src.bcg.com/Images/BCG-How-to-Create-and-Sustain-FinancialInclusion-Apr-2017_tcm23-146889.pdf

• Mazer, R., & Rowan, P. (2016). Competition in Mobile Financial Services : Lessons from Kenya and. The African Journal of Information and Communication, (17), 39– 59. Retrieved from http://wiredspace.wits.ac.za/bitstream/handle/10539/21629/AJIC-Issue-17-2016- Mazer-Rowan.pdf?sequence=3&isAllowed=y

• Neaime, S., & Gaysset, I. (2018). Financial inclusion and stability in MENA: Evidence from poverty and inequality. Finance Research Letters, 24, 230–237. http://doi.org/10.1016/j.frl.2017.09.007

• Schumann, R., & Kende, M. (2013). Lifting barriers to Internet development in Africa : suggestions for. Retrieved from http://www.analysysmason.com/Research/Custom/Reports/Internetdevelopment-Africa-May2013/

• The World Bank. (2018). Financial Inclusion – Financial inclusion is a key enabler to reducing poverty and boosting prosperity. Retrieved from http://www.worldbank.org/en/topic/financialinclusion/overview

• Villasenor, J. D., West, D. M., & Lewis, R. J. (2016). The 2016 Brookings Financial and Digital Inclusion Project Report: Advancing Equitable Financial Ecosystems. Washington DC. Retrieved from https://www.brookings.edu/wpcontent/uploads/2016/08/fdip_20160816_project_report.pdf