The gender gap in labour force participation (LFP) has been a long-standing issue worldwide. On average, female LFP is currently 25 percentage points below men’s. The impact of the COVID-19 pandemic has widened the gap since women have been hit harder by the crisis. Policy makers often use a myriad of tax expenditures (TEs) to encourage women’s participation in the labour force. Yet, if ill-designed, TEs may be ineffective in reaching their stated goals, or may trigger undesired effects, including exacerbating income and gender inequality. G20 governments should increase their efforts to better design TEs to encourage female LFP, and should eliminate those that discourage it.

Challenge

According to the ILO, “the current global LFP rate for women is just under 47 percent. For men, it is 72 percent. That is a difference of 25 percentage points, with some regions facing a gap of more than 50 percentage points” [1]. The impact of the COVID-19 pandemic has exacerbated this gap since women have been hit harder by the crisis. Women’s employment-to-population ratios declined proportionally more than men’s for all country income level groups, particularly in middle-income countries (ILO, 2021). There are some exceptions. For instance, in Denmark, Norway, and the United Kingdom, the gender gap narrowed, but this was due to LFP for men declining more than that for women (Djankov and Zhang, 2020). In general, the crisis has significantly widened differences in job advancement and wage parity between men and women. The most affected sectors (e.g., social sectors including services industries, retail, tourism, and hospitality) employ more women, and school closures have increased family caregiving responsibilities—the burden of which has, again, disproportionally fallen on mothers (Georgieva et al., 2020).

Women disproportionally bear the burden of long‐term care of children, elderly, and others in the family. This is one of the main causes of women’s lower participation in paid (market) work. Supporting childcare and early childhood education services of high quality can have a significant effect on female LFP and increase their earnings and total income (Brewer et al., 2022). It is also beneficial for children and for the economy as a whole.

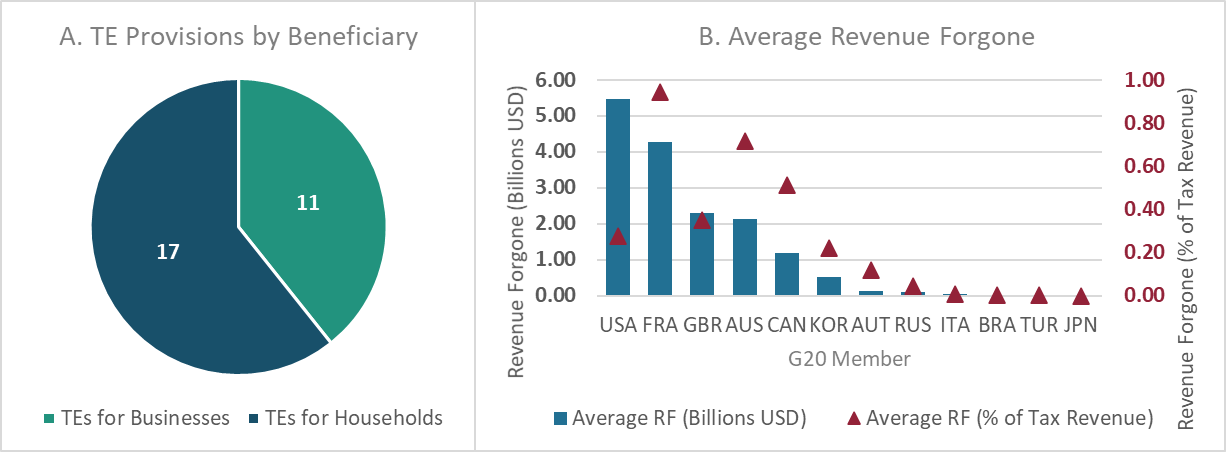

Some TE provisions discourage women’s LFP such as the dependent spouse and pension tax rules in Japan; removing these would have a positive effect on women’s LFP (Kitao and Mikoshiba 2022). Others, such as the US Earned Income Tax Credit (EITC) have a positive effect on women’s LFP, even when they pursue a broader set of policy goals, such as mitigating poverty and income inequality (Bastian and Lochner, 2021). An EITC program in Israel also increased female LFP (Brender and Strawczynski, 2020). Other TEs are explicitly designed to boost female LFP, such as childcare services (ILO and OECD, 2019). Several G20 economies have such TEs for the benefit of businesses and households (Figure 1 – Panel A). Even when this is a small subset of TEs, the revenue forgone triggered by these provisions can be significant, reaching 0.94, 0.71 and 0.51 percent of tax revenue in France, Australia and Canada, respectively (Figure 1 – Panel B).

The economic shock triggered by the pandemic has put additional pressure on the already tight fiscal spaces in many G20 economies and has strengthened the need to increase tax-to-GDP ratios in low-income countries. According to the IMF, deficits as a share of GDP in 2020 reached 11.7 percent for advanced economies, 9.8 percent for emerging market countries, and 5.5 percent for low-income economies, on average (IMF, 2021).

Figure 1. Tax Expenditure Provisions for Childcare, 2016-2020

Note: Figure 1 is based on TE provisions seeking to subsidize childcare. The key words used to extract the relevant data from the GTED are the following ones: childcare, day care, nursery, preschool, kindergarten. The list of the provisions included is provided in Appendix 1.

Source: Global Tax Expenditures Database (GTED), www.GTED.Net.

Besides their fiscal cost, when ill-designed, TEs can be ineffective in reaching their stated objectives, and trigger negative side effects. In Switzerland, a reform package that would have increased the existing general tax deduction for children and the tax deduction for third-party childcare costs was rejected in a referendum based, among others, on the high fiscal cost (roughly CHF 400 million) as well as the regressive impact that such a move would have had (Redonda, 2020).

As is often the case, the devil is in the detail. Design features including the type of TE implemented, whether it is refundable, and whether it is paid to the individual female worker and income-tested on an individual or joint unit (means testing childcare or child subsidy TEs on joint or family income is likely to discourage women’s workforce participation) are vital. Indeed, these features as well as context specific features such as informality in the labour market are crucial determinants of the effectiveness of these provisions as well as of their success in reducing the gender gap in LFP.

Proposal

To ensure evidence-based and gender-equality focused policy making, governments should expand tax expenditures that boost female labour force participation and reform those that have the opposite effect.

Poorly designed TEs are often ineffective and may generate perverse incentives. For instance, tax incentives for investment may be redundant (i.e., the investment project would have taken place without the incentive in place) and trigger windfall gains for businesses (IMF et al., 2015). Pension-related tax expenditures seeking to boost private pension savings have been found to be ineffective in increasing saving, since their effect, if any, is largely explained by reshuffling saving instead of new savings’ creation (Chetty et al., 2014).

TEs can also trigger undesired effects, such as exacerbating income inequality. Again, pension-related TEs are a case in point. In South Africa, pension-related TEs are one of the largest TE provisions and they disproportionally benefit top-income earners, with the top 20 percent of earners capturing more than 80 percent of the benefits (Redonda and Axelson, 2020). The US Mortgage Interest Deduction provides further illustration (Hilber and Turner, 2014).

Governments should seek to achieve the broad goal of increasing women’s LFP. This will assist in generating economic security for women and mitigate the shortage of qualified workers, thus boosting economic growth as well as fiscal revenues. Government support should target female participation, as this is the most under-utilised sector in the economy. In particular, policy should aim to support low- and middle-income households. In South Africa, the Employment Tax Incentive programme is aimed at increasing the employment of young people who have low probabilities of employment. While the programme is targeted to all low-wage young workers, it has been found that there are larger effects on women entering into employment in comparison to men (Ebrahim, 2020). A higher subsidy rate for women in comparison to men would further encourage firms to employ young women.

A crucial aspect of designing a good TE regards the availability of good data. One example is the use of tax data to design TEs and evaluate their effects. The low cost of using tax data makes it an attractive policy choice and should be seen as a low-hanging fruit. In South Africa, researchers are using tax data to credibly evaluate the long-run effects of TEs, or explore changes to policies informed by a better understanding of the levers of impact on female LFP.

To sum up, TEs that are used as part of the support measures to increase female LFP should be carefully designed to achieve this goal and avoid potential undesired side effects. TE evaluation is also vital.

Design features are vital

TEs can be effective policy instruments for income redistribution. Yet, when their benefits are disproportionally captured by the better-off, TEs can be highly regressive and end-up exacerbating inequality. The instrument or type of TE is key.

The use of income tax deductions is usually regressive as they reduce taxable income and, hence, their impact depends on the taxpayer’s marginal tax rate. This is particularly important in a progressive tax system, as the rate increases with income (Humbelin and Farys, 2017). This is relevant for gender equity since men are disproportionally represented among high-income earners. Tax credits are more equitable as they reduce tax directly and do not depend on marginal tax rates. Whereas the revenue forgone from a tax deduction will be disproportionally captured by top-income earners, tax credits are more likely to benefit lower- and middle-income taxpayers. Nhamo and Mudimu (2020) use administrative data from South Africa to assess the distributive effect of switching from medical tax deductions to tax credits, and find that the medical tax credit system has increased the progressivity of the tax system.

Refundability is another crucial design feature when it comes to the effectiveness and distributive impact of TEs. A refundable tax credit, which may be paid as a grant or tax refund to those who do not pay sufficient tax to benefit from the credit, will reach the lowest income individuals and households. Aliu et al. (2022, forthcoming) assess the distributive impact of social TEs (i.e., tax benefits seeking social protection objectives) in the Province of Quebec (Canada). Deductions are proven to be highly regressive, even when only deductions with social objectives are included. The revenue forgone from tax credits, especially refundable tax credits, follows a much more progressive pattern.

The debate around the Child Tax Credit (CTC) in the US is another case in point. Until recently, the CTC was a non-refundable tax credit that primarily benefitted middle-income families (Goldin and Michelmore, 2022). However, the large (albeit temporary) CTC expansion in 2021 made the program fully refundable, decreasing child poverty by a third, and having an especially positive effect on the poorest families (Bastian, 2022). Analysis by the Tax Policy Center shows that full refundability of the CTC is key for low-income families. As explained by Maag (2021), “For families with children and incomes in the bottom one-fifth of the income distribution (income of USD 27.000 or less), keeping the higher credit amounts without full refundability would boost average benefits by only about USD 100 in 2022—from about USD 1.500 to USD 1.600. But if Congress also retains the law’s full refundability, average benefits for those families would almost triple relative to the prior law, to USD 4.600.”

The evidence on the net impact of the CTC on female LFP has been ambiguous. Some commentators argued that the expansion of the CTC would eliminate the strong work incentives under the prior CTC and would end-up discouraging work. [2] However, recent research found no significant differences between the effects of the CTC expansion introduced in July 2021 on the lowest income groups and higher income groups; in some cases, labour supply elasticity estimates for the lowest income groups were more positive than those for other groups (Ananat et al. 2021).

The context in which TE provisions are implemented can be crucial

The share of informal employment in total employment amounts to 90 percent in developing countries, close to 70 percent in emerging markets, and lies under 20 percent in the developed world, with some rich countries showing shares below 5 percent (ILO, 2018). The implications of these differences are significant for the use of TEs for female LFP.

Informality reduces the tax base (i.e., the number of individuals that pay taxes), which further reduces the fiscal space and, at the same time, diminishes the number of people that can be supported through tax reliefs. In general, any measure implemented through the tax system will not reach informal workers. Moreover, women are more exposed to informal employment in most low- and lower-middle income economies, which exacerbates gender inequality (ILO, 2018).

We urge G20 policy makers to increase their efforts to better design, evaluate and—when needed—reform TEs affecting female LFP. This would significantly increase the effectiveness and fairness of TE systems and, at the same time, have a positive impact on economic growth as well as on investment in the human capital of women and children.

Moving in this direction would contribute to the G20’s commitment to reduce the gender gap in LFP by 25 per cent by the year 2025 compared to 2012, as per the 25×25 goal set in Brisbane in 2014. It would also support the G20 in reaching the Sustainability Development Goals (SDGs) including those calling to improve gender equality (SDG 5) and reduce inequality (SDG 10).

References

Ananat, E.; Glasner; B.; Hamilton, C. and Parolin, Z. (2021). Effects of the Expanded Child Tax Credit on Employment Outcomes. Evidence from Real-World Data from April to September 2021. Poverty & Social Policy discussion Paper, https://www.povertycenter.columbia.edu/s/Child-Tax-Credit-Expansion-on-Employment-CPSP-2021.pdf.

Aliu, F.; Gerges, A.; Provencher, Y. and Redonda, A. (2022). Tax Expenditures and Social Protection. The case of Quebec. Mimeo.

Bastian, J. (2022) Investigating the Effects of the 2021 Child Tax Credit Expansion on Poverty and Maternal Employment. Working Paper.

Bastian, J. and Lochner, L. (2022). The EITC and Maternal Time Use: More Time Working and Less Time with Kids? Journal of Labour Economics, (2022, forthcoming).

Brender, A. and Strawczynski, M. (2020). The EITC Program in Israel: Employment Effects and Evidence on the Differential Impacts of Family vs. Individual-Income Based Design. Individual-Income Based Design. Working Paper.

Brewer, M., Cattan, S., Crawford, C. and Rabe, B. (2022). Does More Free Childcare Help Parents Work More? Labour Economics, Vol 74.

Chetty, R. Friedman, J., Leth-Petersen, S; Nielsen, T. and Olsen, T. (2014). Active VS. Passive Decisions and Crowd-out in Retirement Savings Accounts. The Quarterly Journal of Economics Vol. 129, No. 3 (August 2014), pp. 1141-1220.

Djankiv, S and Zhang, E. (2020). COVID-19 Widens Gender Gap in Labor Force Participation in Some but not Other Advanced Economies, Peterson Institute for Economics, Realtime Economic Issues Watch, https://www.piie.com/blogs/realtime-economic-issues-watch/covid-19-widens-gender-gap-labor-force-participation-some-not.

Ebrahim, A. (2020). “A policy for the jobless youth: The Employment Tax Incentive”, chapter 5, pages 112-146. University of Cape Town. PhD Thesis, http://hdl.handle.net/11427/33733.

Georgieva, K., Fabrizio, S., Lim, C. and Tavares, M. (2020). The COVID-19 Gender Gap, IMF Blog, https://blogs.imf.org/2020/07/21/the-covid-19-gender-gap/.

Goldin, J., & Michelmore, K. (2022). Who Benefits from the Child Tax Credit?. National Tax Journal, 75(1), 123-147.

Hilber, C. and Turner, T. (2014). “The Mortgage Interest Deduction and its Impact on Homeownership Decisions”, Review of Economics and Statistics, Vol. 96(4), pp. 618-637.

Humbelin, O., and R. Farys (2017). Income Redistribution Through Taxation: How Deductions Undermine the Effect of Taxes. Journal of Income Distribution, 25(1): 1–35.

Ilo (2018). Women and Men in the Informal Economy: A Statistical Picture. Third Edition. International Labour Office (ILO), https://www.ilo.org/wcmsp5/groups/public/—dgreports/—dcomm/documents/publication/wcms_626831.pdf.

Ilo (2021). An Uneven and Gender-unequal COVID-19 Recovery: Update on Gender and Employment Trends 2021. International Labour Organization (ILO) Policy Brief, https://www.ilo.org/wcmsp5/groups/public/—ed_emp/documents/publication/wcms_824865.pdf

Ilo and OECD (2019). Women at Work in G20 Countries: Progress and Policy Action. Paper prepared under Japan’s G20 Presidency, https://www.oecd.org/g20/summits/osaka/G20-Women-at-Work.pdf.

IMF (2021). Fiscal Monitor April 2021, https://www.imf.org/en/Publications/FM/Issues/2021/03/29/fiscal-monitor-april-2021.

IMF, OECD, UN, World Bank (2015), Options for Low Income Countries’ Effective and Efficient Use of Tax Incentives for Investment, A report to the G-20 Development Working Group, https://www.oecd.org/tax/tax-global/options-for-low-income-countries-effective-and-efficient-use-of-tax-incentives-for-investment.pdf.

Kitao, S. and M. Mikoshiba (2022). Why Women Work the Way They Do in Japan: Roles of Fiscal Policies (CAMA Working Paper 21/2022, Australian National University), https://cama.crawford.anu.edu.au/publication/cama-working-paper-series/20031/why-women-work-way-they-do-japan-roles-fiscal-policies

Maag, E. (2021). Keeping Child Tax Credit Fully Refundable Is Critical To Low-Income Families. Forbes, https://www.forbes.com/sites/elainemaag/2021/09/10/keeping-child-tax-credit-fully-refundable-is-critical-to-low-income-families/?sh=3164f5346445.

Nhamo, S. and Mudimu, E. (2020). Shifting from Deductions to Credits: Unpacking the Distributional Effects of Medical Expenditure Considerations in South Africa. WIDER Working Paper 2020/30, United Nations University World Institute for Development Economics Research (UNU-WIDER), https://www.wider.unu.edu/publication/shifting-deductions-credits.

Redonda, A. and Axelson, C. (2021). Assessing pension-related tax expenditures in South Africa: Evidence from the 2016 retirement reform. WIDER Working Paper 2021/167, United Nations University World Institute for Development Economics Research (UNU-WIDER), https://sa-tied.wider.unu.edu/sites/default/files/SA-TIED-WP167.pdf.

Redonda, A. (2020). Worthy Goals, Flawed Policies – Why Increasing Tax Deductions for Parents Can be Wrong, Council on Economic Policies (CEP) Blog, https://www.cepweb.org/worthy-goals-flawed-policies-why-increasing-tax-deductions-for-parents-can-be-wrong/.

Appendix

Appendix 1: List of Provisions included in Figure 1

| Country | Provision | Tax Base | Type of TE | Beneficiaries | Revenue Forgone (Billions, USD) | |||||

| 2016 | 2017 | 2018 | 2019 | 2020 | ||||||

| Australia | Exemption of Child Care Assistance payments | PIT | Exemption | Households | 1.05 | 1.15 | 1.05 | 1.46 | 1.10 | |

| Goods and Services Tax (GST) – Child care services | VAT | Multiple | Businesses | 0.98 | 1.03 | 1.02 | 0.96 | 0.90 | ||

| Austria | Deductibility of childcare costs | PIT | Deduction | Households | 0.14 | 0.14 | 0.14 | |||

| Brazil | Nurseries and Preschools – Contribution to Financing Social Security | Social Security | Other | Businesses | 0.01 | 0.00 | 0.00 | |||

| Nurseries and Preschools-Social Contribution to PIS-PASEP | Social Security | Other | Businesses | 0.00 | 0.00 | 0.00 | ||||

| Nurseries and Preschools – CIT | CIT | Other | Businesses | 0.01 | 0.00 | 0.00 | ||||

| Canada | Child care expense deduction | PIT | Deduction | Households | 1.00 | 1.02 | 1.05 | 1.07 | 1.08 | |

| Exemption from GST for child care | VAT | Exemption | Households | 0.13 | 0.14 | 0.15 | 0.15 | 0.10 | ||

| Inclusion of the Universal Child Care Benefit in the income of an eligible dependant | PIT | Deduction | Households | 0.00 | ||||||

| Investment Tax Credit for Child Care Spaces – CIT | CIT | Tax Credit | Businesses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Investment Tax Credit for Child Care Spaces – PIT | PIT | Tax Credit | Businesses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| France | Tax credits for childcare of children under 6 | PIT | Tax Credit | Households | 1.36 | 1.36 | 1.40 | 1.38 | ||

| Exemption of family benefits.. home childcare allowance, and childcare benefit | PIT | Exemption | Households | 2.21 | 2.14 | 2.25 | 2.17 | |||

| Exemption from services rendered to individuals by childcare businesses | VAT | Exemption | Businesses | 0.65 | 0.62 | 0.65 | 0.65 | |||

| Exemption from services and closely related goods, made in the context of child care | VAT | Exemption | Businesses | 0.07 | 0.08 | 0.08 | 0.06 | |||

| United Kingdom | Income Tax & NICs, Employer Supported Childcare including workplace nurseries | Multiple | Exemption | Households | 1.13 | 1.16 | 1.24 | 1.21 | 0.96 | |

| Income tax, Employer Supported Childcare including workplace nurseries | PIT | Exemption | Households | 0.62 | 0.63 | 0.69 | 0.66 | 0.57 | ||

| National insurance contributions, Employer Supported Childcare including workplace nurseries | PIT | Exemption | Households | 0.51 | 0.53 | 0.55 | 0.55 | 0.47 | ||

| Italy | 19% deduction for nursery attendance costs | PIT | Deduction | Households | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | |

| Japan | Additional depreciation of assets for company-led childcare facilities | CIT | Deduction | Businesses | ||||||

| South Korea | Child Care Tax Credit System: child care subsidies shall be determined and refunded | PIT | Tax Credit | Households | 0.50 | 0.50 | 0.45 | 0.65 | 0.54 | |

| Russia | Exemption from VAT on the sale of childcare and supervision services in organizations engaged in educational activities | VAT | Exemption | Businesses | 0.09 | 0.10 | 0.09 | 0.12 | 0.09 | |

| Turkey | Exception For Revenues In Kindergartens And Nurseries | PIT | Exemption | Households | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| United States | Employer provided child care exclusion – Individuals | PIT | Exemption | Households | 0.95 | 0.90 | 0.72 | 0.57 | 0.58 | |

| Employer-provided child care credit – Individuals | PIT | Tax Credit | Households | 0.00 | 0.00 | |||||

| Credit for child and dependent care expenses – Individuals | PIT | Tax Credit | Households | 4.57 | 4.60 | 4.56 | 4.26 | 3.19 | ||

| Exclusion of certain foster care payments – Individuals | PIT | Exemption | Households | 0.45 | 0.49 | 0.48 | 0.48 | 0.49 | ||

| Employer-provided child care credit – Corporate | CIT | Tax Credit | Businesses | 0.01 | 0.01 | 0.01 | 0.02 | 0.02 | ||

- https://www.ilo.org/infostories/en-GB/Stories/Employment/barriers-women#intro. ↑

- The expansion temporarily transformed the CTC from a tax credit that would deny benefits to those with no or low earnings and was capped at 2,000 per child per year, into a nearly-universal child allowance capped at USD 3.000 (USD 3.600) for children aged 6–17 (under 6) (Ananat et al. 2021). ↑