Population aging is accelerating worldwide and has significant socioeconomic implications, including a decline in the size of the labour force, an increase in the age-dependency ratio and a redistribution of income and wealth. Hence, the redesign of pension systems has become a priority. Taxation is crucial to influence behaviour and tackle These issues, e.g. tax incentives for pension savings. Yet, whereas some progress has been made, much remains to be done to increase the effectiveness and fairness of pension systems. Thus, we urge G20 governments to take a systemic view of pension systems including socioeconomic aspects such as education, migration, labour force participation and informality. Moreover, governments should take into account the distributional impact of tax policies for pension savings.

Challenge

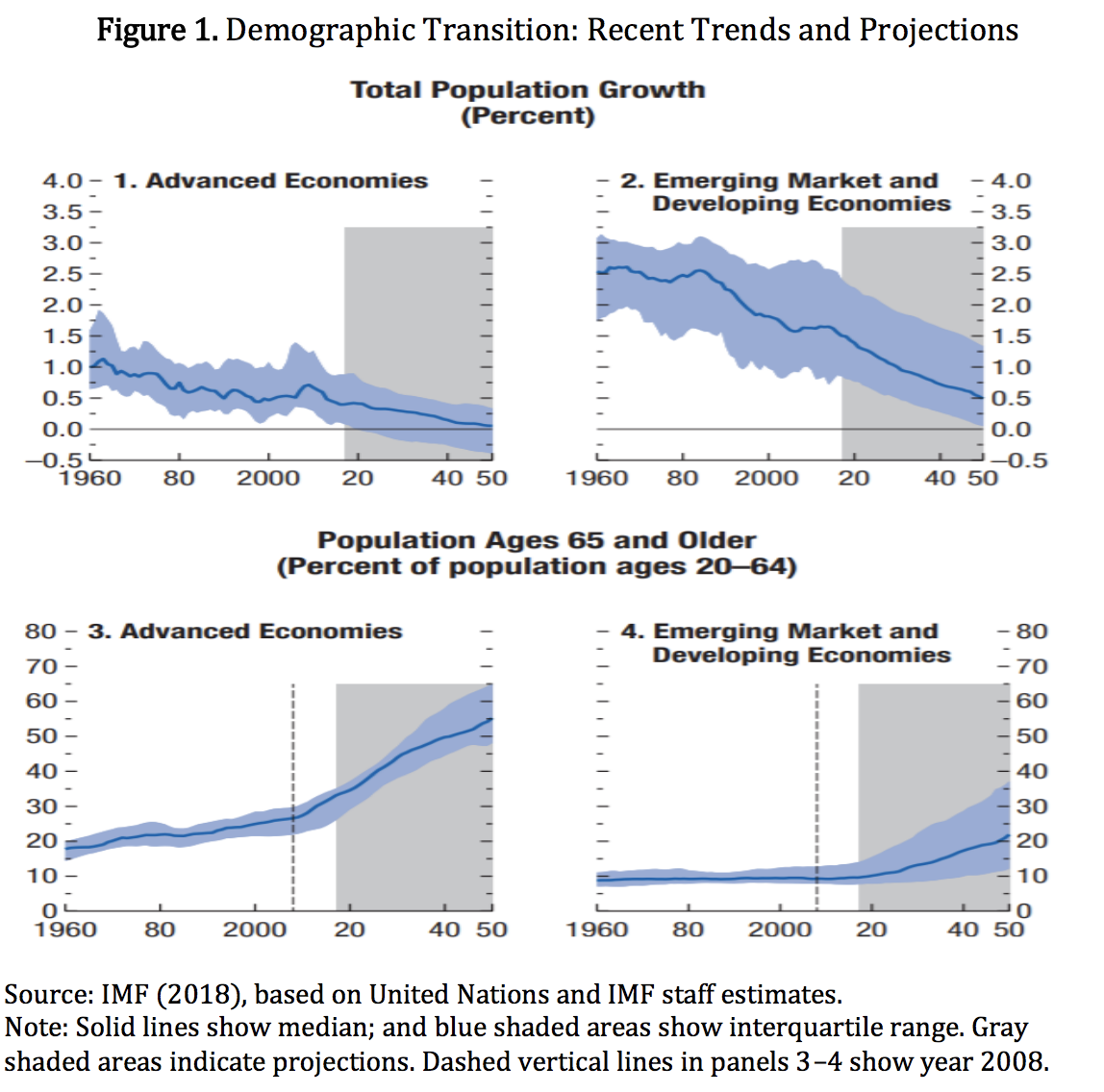

Population aging is accelerating due to a broad range of factors, including rising life expectancy and a decrease in fertility rates. This phenomenon is not new for developed countries but has also recently been spreading in several developing and emerging economies (Figure 1). The region of East Asia and Pacific, for instance, is experiencing aging faster – and on a larger scale – than any other region in history (WB, 2016).

The aging of societies has significant socio-economic implications, including a decline in the size of the labour force, an increase in the age-dependency ratio and a redistribution of income and wealth. Therefore, the redesign of pension systems has become a pressing matter and a challenging issue for governments worldwide.

Guaranteeing adequate retirement income is vital to ensure that the benefits of economic growth are equitably distributed across society. For instance, the latest OECD Survey for Mexico recommends to “raise and broaden the minimum pension to expand the old-age safety net.” (OECD, 2017). At the same time, in many countries public spending on pensions account for a large share of budget deficits. In Argentina, 47% of total federal revenue goes to pensions, and the deficit of the pension system accounts for 4.7% of GDP (Castiñeira, 2018).

Against this background, governments across the world have been trying to shift the burden of providing retirement income out of the public sector by boosting private savings for pensions, e.g. shifting from “pay-as-you-go” (PAYG) systems (where pensions to retired workers are financed by the current contributions of active workers, usually via payroll taxes) to funded systems, where contributions are accumulated in workers’ individual accounts along with earnings on these assets, and the total amount of contribution at retirement is converted into a pension annuity.

Yet neither of these two systems has proven to be the panacea, with both presenting pros and cons. PAYG systems may entail a redistributive component, if pension benefits are not tightly linked to previous contributions (e.g., in a defined benefit system) and provide insurance against the longevity risk, as individuals receive a real annuity, regardless of how many years of retirement they enjoy. Yet, PAYG systems can be subject to economic and demographic shocks. Low economic growth and population aging reduce the financial capacity of the system and require policy measures, such as cuts in pension benefits, increase in retirement age, increase in payroll taxes, or pre-funding. Funded systems are typically less exposed to economic and demographic shocks. However, they face financial market shocks, as the pension benefits depend also on the realized returns on the accumulated contributions. Moreover, these schemes allocate most of the risk to the individuals. In the case of low wages or discontinuous working careers, typically experienced by women, the accumulated contributions and the earnings on these contributions may not be enough to secure a decent pension.

Taxation is one of the key policy instruments used by governments worldwide to influence behaviour and tackle these issues. The myriad of tax incentives to boost pension saving is a case in point. Yet, whereas some countries have managed to improve their pension systems, the overall scenario remains worrisome and much remains to be done.

Dealing with the aging of societies and the reform of pension systems is a complex issue that depends on country-specific factors. Hence, no “one-sizefits-all” solution exists. Yet, population aging is a global phenomenon that affects an increasing number of societies. Moreover, the transversal impact of this issue (e.g. on fiscal sustainability, migration, cross-border investment flows) as well as the ongoing globalization of the economy call for more and better coordination among governments. As the main platform for international economic cooperation, the role of the G20 will be vital to develop sustainable solutions to address issues associated with the aging of societies.

Proposal

Proposal 1: Governments should take a systemic view of pension systems Several countries have already taken concrete steps to deal with the aging of societies and its impact on the sustainability of pension systems. These steps range from the specific (including cutting pension benefits and raising retirement ages 1), to the comprehensive (such as the 2008 pension reform in Chile and the 2012 Fornero reform implemented in Italy).

Yet, in most cases, there is a lack of an overall systemic view. This generates potentially inconsistent policy choices that can jeopardize the overall effectiveness of the reforms. If governments aim to increase the fairness and sustainability of pension systems, they should engage in comprehensive reforms that go beyond the assessment and modification of specific features of the retirement systems, and include broader aspects that are often not part of the policy debate, e.g. education or financial literacy (Lusardi and Mitchel, 2007 and Chetty et al., 2014) and migration (IMF, 2018). The different tax treatment of alternative saving instruments is another case in point. In Australia, for example, retirees rely both on pensions (superannuation) and homeownership as saving instruments. Yet, these instruments are taxed differently, which triggers distortions. In concrete terms, whereas the superannuation tax system is taxed on a TTE basis – i.e. (low) tax on contributions, (low) tax on earnings and exemption for pay-outs, owner-occupied housing benefits from full prepaid expenditure tax treatment or TEE (Ingles and Stewart, 2017).

We discuss the interactions between fiscal policy and two other elements that are crucial for the effectiveness of pension systems: labour force participation and labour market informality.

I. Labour Force Participation

Labour force participation is key for the coverage of pension systems. A recent IMF report shows that, in advanced economies, the evolution of aggregate labour force participation rates has been highly heterogeneous across countries. But similar trends do emerge for specific groups such as women and elderly workers. Among developed countries, the participation of elderly workers has increased since the mid-1990s, particularly among those aged 55- 64. And in the past decade, increases have also been recorded among those aged 65 and over. Likewise, female labour force participation rate has increased by almost ten percentage points over the last three decades. In this regard, Japan stands out. Since the early 2000s, the country’s women labour force participation rate increased 10 percentage points from 66 to 76%, overcoming the US whose rate went down from 76 to 74% (Shambaugh et al., 2017). 2

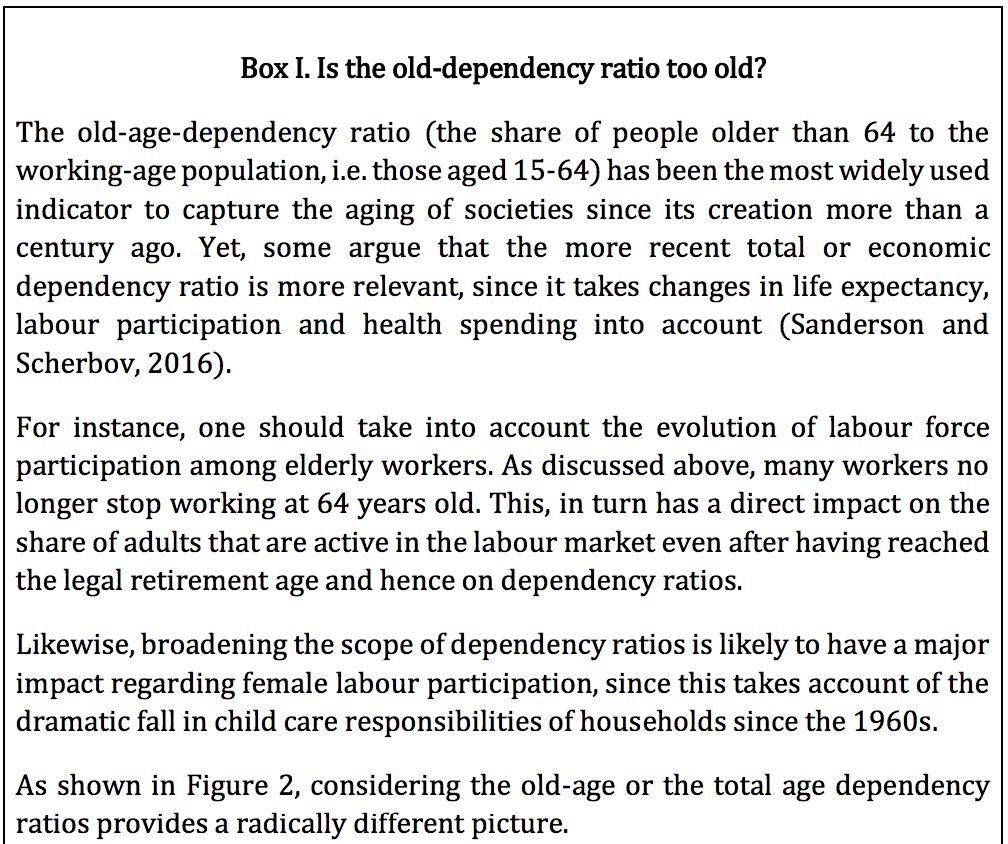

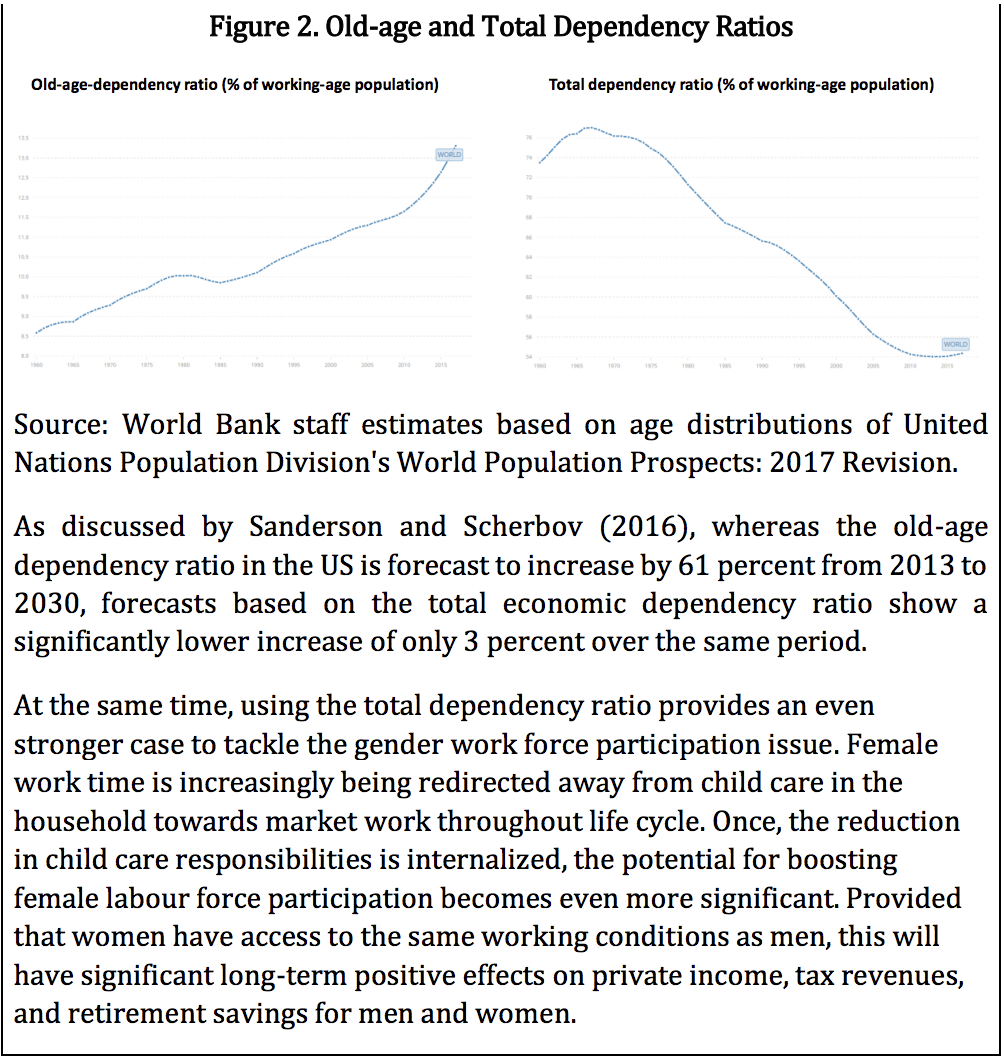

Female and elderly labour force participation tend to increase with economic development. Hence, in some developing and emerging economies, the scope to increase the participation of women and elderly workers is quite significant (see Box I). For instance, female labour force participation is strikingly low in some emerging economies, including in some G20 countries. In India the rate is as low as 28%, in Mexico 43%, in Argentina 46% and in South Africa 49%. Yet, whereas in developed economies the increase in female labour force participation rates is seen as an indicator (and a determinant) of progress and economic growth, in developing countries this is not necessarily the case. Indeed, very often, the participation of women is associated with poverty. That is because women are likely to enter the labour market, even accepting lower wages and worse conditions than men, due to a necessity rather than a choice (Verick, 2018). The same applies to elderly workers. In Korea, for instance, older people are pushed to accept jobs of poor quality, with low job security and wages, and limited access to social insurance. Hence the share of poor aged 50-75 in Korea is significantly higher than in most of the other OECD economies. As suggested by OECD (2018) expanding tax benefits like the Earned Income Tax Credit (EITC) to cover also elderly workers has been a good move and the government should raise EITC payments for people aged 50 and above as well as improve its coverage, particularly when it comes to older selfemployed workers.

Pension reforms have gone a long way into boosting labour force participation among elderly workers. Mandatory increases in the statutory retirement age and in the number of years of contributions required to be eligible for an old age pension have resulted in increased employment rates for workers aged 55 or more. For instance, in Italy, the Fornero reform in 2012 raised the male retirement age to 66, increased to 41 the years of contributions required to access early retirement pension and indexed these two requirements to changes in the expected longevity. While these measures were successful in increasing the effective retirement age and the elderly workers’ participation rate, a demand for more flexibility at retirement emerged. Individual workers seeking to exit the labour market, for health or family reasons, and firms in need of restructuring their labour force demanded measures that allowed early exit. This demand for flexibility is legitimate, but costly – both for individuals and for the public finances. Individuals who retire early should face actuarially fair pension benefit reductions. But even in this case, the short-term public budget deteriorates, as new (early retirement) pensions needed to be financed. Due to the actuarially fair reductions, these pensions are less generous, but the overall effects on the public budget evens out only over a twenty-three year period. An additional rationale often provided is that early exit of elderly workers from the labor market makes room for the entrance of young workers – thereby providing a solution to the youth unemployment problem. However, this argument – known as the “lump of labor fallacy” – has largely been disputed empirically. The recent pension reform in Italy – known as “Quota 100” – allows for early retirement to individuals aged 62 or more with at least 38 years of contributions, but requires no actuarially fair reduction to the pension benefits. Hence, pension spending is set to increase by Euro 22 billion in three years. To allow for early retirement with a fair penalty but with no direct impact on public finances, in 2017, Italy introduced an innovative market mechanism, called APe Volontaria, which allowed individuals to borrow against their future pensions. An individual willing to retire up to three years earlier than his normal retirement age could borrow a monthly amount to be repaid in the next twenty years after retirement with monthly withdrawn on his pension. Tax credits were provided to reduce the cost of the loan. This measure was off a good start in April 2017 – but was largely affected by the discussion about the introduction of Quota 100, which proved more convenient to the retiring workers, albeit much more costly for the public budget. Early retirement is also an issue in Spain. The tax authority (AIREF) has recently published a report calling for a restriction of early retirement by reducing the number of exceptions that allow 40% of the 300.000 active workers that retire every year to stop working before the legal age of retirement (67) and, hence, push down the effective retirement age to the actual 62,4 years. 3

As mentioned, labour force participation can also be influenced by (fiscal) policies that are not directly linked to the pension system. The US EITC is a case in point. The EITC – one of the largest tax expenditures in the US that, in recent years, has distributed around USD 70 billion a year to almost 30 million lowerincome families and lifted more than 6 million people out of poverty – is a refundable tax credit that requires that recipients work. Previous literature assessing this provision has shown that the EITC increases employment (Meyer and Rosenbaum, 2001) and earnings (Dahl et al., 2009) of lower-income mothers. In a recent paper, Bastian and Michemore (2018) assess the longerrun effects of the EITC on educational attainment and employment outcomes of children whose mothers received the EITC. The authors find a positive impact on high school graduation, college graduation as well as employment and earnings when these children grow up. In addition, their results show that these positive effects are largest for children from the poorest households. Hence, the EITC is not only effective in increasing short term (women) and long-term (children) labour force participation, but also has a significant inequalityreducing effect.

II. Labour Market Informality

Informality levels are strikingly high in several regions, particularly in several developing and emerging economies. On average, informal employment is as high as 85.8 percent of total employment in Africa, 68.2% in Asia and the Pacific and 68.6% in the Arab States. Whereas informality rates can be considerably lower in rich countries (e.g., Estonia 6.9%, Norway 7.4% and Slovenia 5%), this is not always the case. In some G20 emerging economies, for instance, informality rates are very high, e.g., India (88.2%), Indonesia (85.6%), China (54.4%) and Mexico (53.4%), but it is also relatively high in a developed country such as Korea, where informal employment accounts for 31.5% of the total (Ilo, 2018).

In general, informality significantly hinders the effectiveness of fiscal policy. For instance, a large informal sector narrows tax bases, and hence generates pressure to increase tax rates. Moreover, since the burden of taxation is shifted to those paying taxes, informality also violates the horizontal equity principle – i.e. two individuals that are identical but for the sector in which they perform their economic activities (formal and informal), receive a different fiscal treatment. Aside from horizontal equity, informality also can exacerbate income inequality since, on average, formal workers have higher wages and work for larger and more productive firms than informal ones.

As discussed by Levy (2017), informality is particularly relevant in the context of aging societies. Since it significantly reduces retirement plan contributions, informality considerably lowers replacement rates (pension entitlements / pre-retirement earnings). In turn, a low coverage rate (as well as informality) disproportionally affect the poor, and hence intensifies inequality.

Chile provides an illustration. The country’s replacement rate stood at 38% in 2012, lagging behind the 63% OECD average (OECD, 2015). Moreover, whereas income distribution is highly skewed – the richest (poorest) 20% captures 54% (5%) of total income – the distribution of pension income is even more unequal – while the bottom quintile gets 2%, the top one receives 63% of the pie.4

In addition, in Chile replacement rates are around 35% (i.e., pensions represent roughly 35 % of the worker’s pre-retirement wage), which is significantly lower than the 70 percent OECD average (Levy, 2017). Although it may not be the only factor, informality is certainly among the main determinants of such a low replacement rate since it reduces the share of the time that workers spend in the formal sector and hence contribute to their pension, relative to the time that they work (either in the formal or informal sectors).

As mentioned, governments worldwide aim to tackle this issue and increase replacement rates through the implementation of different retirement savings’ policies. Some of these measures, e.g. raising social security contributions and raising retirement ages, lift savings automatically. Others, such as tax incentives for savings, rely upon individuals taking action. Using Danish data, Chetty et al. (2014) show that policies which depend on active choices are less effective: 85% of savers do not react to tax subsidies and, of the remaining 15% who do respond, most action takes the form of shifting assets between accounts, leaving overall savings largely unchanged.

Chile’s decision to eliminate the opt-out option for self-employed workers in 2018, and thus to make social security contributions mandatory, seems aligned with this insight since the policy would not require active choices to increase coverage rates. However, Denmark and Chile are different. In Chile, informal workers account for 36% of the total, and 69% of them are self-employed (CIEDES, 2016). Hence, unexpected “rebound-effects” could arise if formal selfemployed individuals that previously opted-out of social security choose to jump to informality instead of start contributing to the pension system, e.g. if contributions were perceived as a tax associated with formality rather than a future benefit.

We urge G20 governments to take concrete actions to tackle the aging of societies and increase the effectiveness and fairness of pension systems. Measures should not be ad-hoc and specific, but rather part of comprehensive reform packages going even beyond retirement systems to include other socioeconomic aspects such as education, migration, labour force participation and informality. Without such a systemic view of pension systems, governments will keep struggling to tackle problems associated with the aging of societies.

Proposal 2: Governments should take into account the distributional impact of tax policies for pension savings

Inequality – both intra- and inter-generational – is one of the main issues triggered by the aging of societies. In PAYG systems, pensions are funded through the contributions of those currently working, who essentially crosssubsidize retired workers. The necessary condition for PAYG systems to work regards the proportion of retired workers relative to those actively working. If the contributions of active workers are not sufficient to cover the pensions of those retired, PAYG systems collapse. Ad-hoc solutions could affect retired individuals (e.g., pension benefits are cut), active workers (e.g., retirement ages are raised) or society as a whole (pension systems’ deficits are funded through taxes). Distributional effects are inevitable since, no matter the strategy implemented, the burden of the adjustment is shifted among different groups of individuals.

More comprehensive solutions also have significant distributional effects that should not be neglected. The shift from PAYG to contributory systems is a case in point. On the one hand, contributory systems can eliminate regressive crosssubsidies. On the other hand, many countries that switched to contributory systems, face replacement rates significantly lower than expected. In many cases, individuals do not even accumulate the minimum required years of contributions to qualify for a pension – again, informality is often one of the main reasons.

Against this backdrop, governments usually try to increase replacement rates by boosting private savings for pensions, e.g., through the implementation of tax incentives (5). Yet, these provisions are costly and often inefficient in reaching their stated goals. Tax incentives for pensions are significant.

The Australian Treasury estimates the revenue foregone from superannuation tax concessions to amount AUD 36 billion, which accounts for more than 9 percent of total tax revenue (Australian Treasury, 2018). Likewise, UK pension tax reliefs cost £ 24 billion in relation to income tax (though this is in part a deferral of tax revenue) and £ 17 billion in National Insurance receipts (HMRC, 2018). The United States Treasury Department estimates that the tax expenditure (roughly revenue foregone) for the favourable tax treatment given to pension contributions and earnings in pension plans approaches USD 200 billion per year (U.S. Department of Treasury, 2018). Recent Chinese efforts to develop a three-pillar pension system provides further illustration. While the Chinese public pillar shows a widespread coverage, benefits have been insufficient (Liu and Sun, 2016). Against this background, the first tax incentive to promote individual savings was announced in June 2018 and three pilot zones were established to test the program.

Besides their fiscal cost, the impact of these provisions in raising pension savings is often marginal and they disproportionally benefit the rich. First, individuals in higher personal income tax brackets are more likely to have the means to save for retirement. In contrast, poorer households struggle to smooth their consumption. To put it another way, saving for retirement is a distant option for many households. Second, pension tax expenditures frequently are “upside down” subsidies since they are granted as deductions or exclusions from taxable income, which exacerbates their negative impact on inequality. As highlighted by Duflo et al. (2006), this design feature entails that the value of these provisions is negligible for families with low marginal income tax rates, and significantly more valuable as income and, thus, marginal tax rates go up. In Switzerland, for instance, a resident of Bern (married, no children, no taxable wealth), with a taxable income of 75,000 CHF who pays 6,000 CHF into her voluntary Pillar 3a account is eligible for a tax incentive that reduces her taxes by 1,400 CHF. If her taxable income doubles to 150,000 CHF, everything else equal, the tax benefit goes up to 2,300 CHF. This is also the case in China, where the recently implemented third-pillar tax incentive is expected to benefit high-income individuals (Insurance Association of China, 2018).

If governments decided to incentivize pensions by the implementation of tax benefits, they should consider better targeting the beneficiaries to mitigate their impact on inequality. For instance, tax credits are often less regressive than deductions since the latter reduce taxable income and, hence, their impact depends on the taxpayer’s marginal tax rate, which is an increasing function of income. As a result, TEs granted as deductions often end-up being “upside down” subsidies that provide larger benefits to high-income families than to low- and middle-income households. Tax credits instead, reduce taxes directly and do not depend on tax rates. Indeed, when the tax reliefs are granted as refundable tax credits, the regressive impact is even lower since those with no enough income to benefit from the tax incentives would still be reached by the provision.

In addition, the tax treatment of pensions could also trigger intergenerational inequality. The UK provides a case in point. Median disposable income (measured after accounting for housing costs) are now higher among UK pensioners than among working-age families, reflecting relatively higher rates of home ownership among recently retiring cohorts. Yet pensioners are exempt from paying National Insurance on any of their income (either earned income or pension income), making them tax-advantaged relative to working-age families recording the same pre-tax income (Corlett et al., 2018).

In recent times, the issue of inequality has been gaining momentum worldwide. The debate around the design of fiscal policy has been moving away from the traditional trade-off between efficiency and equity. The 2016 OECD “Tax Design for Inclusive Economic Growth” as well as the 2017 IMF Fiscal Monitor on “Tackling Inequality” are cases in point. Tax policies implemented in the context of aging societies have significant distributive effects, which should be taken into account by G20 governments to increase the effectiveness and fairness of pension systems.

1 In January 1 2019, Russia started raising the retirement age by six months per year up to 65 years for men and 60 years for women, from the previous 60 and 55 years respectively (Vlasov and Mamedli, 2018).

2 Labour force participation rates usually do not take into account unpaid work such as caregiving. Accounting for unpaid work significantly increases female working hours. On average, women in OECD economies spend almost two times more time in unpaid work than men (264 and 136 minutes per day, respectively). The difference is even larger in emerging and developing countries, e.g. in China, India and South Africa, men (women) spend 91 (234), 59 (352) and 103 (250) minutes on unpaid work, respectively – https://stats.oecd.org/index.aspx?queryid=54757.

3 http://www.airef.es/es/gasto-en-pensiones/ (in Spanish).

4 For more details, see the World Bank’s LAC Equity Lab – http://www.worldbank.org/en/topic/poverty/lac-equity-lab1/incomeinequality/composition-by-quintile.

5 In some cases, considering the pension system as a whole (i.e. both taxes and benefits) the negative impact on inequality is mitigated or even eliminated. In the US, for example, “The Social Security benefit formula is designed to provide beneficiaries who had lower lifetime earnings with monthly benefits that are higher, as a percentage of their lifetime average earnings, than those received by higher-earning beneficiaries. That progressivity in the benefit formula is only partly offset by the fact that higher-earning individuals tend to live longer and thus collect benefits longer” (CBO, 2006). Hence, overall the Social Security is progressive. Yet, the benefits paid to retired workers (the largest component of the benefits) is less progressive than the system overall.

References

• Australian Treasury (2018). “Tax Expenditures Statement 2017”, https://treasury.gov.au/publication/2017-tax-expenditures-statement/.

• Bastian, J. and K. Michelmore (2018). “The long-term impact of the earned income tax credit on children’s education and employment outcomes”, Journal of Labor Economics 36(4), pp. 1127-1163.

• Brys, B., S. Perret, A. Thomas and P. O’Reilly (2016). “Tax design for inclusive economic growth”, Organisation for Economic Co-operation and Development (OECD).

• Castiñeira, R. (2018), “El gasto público en seguridad social”, Econometrica, in Spanish, https://www.econometrica.com.ar/index.php/informes-macro/334-inf-macro2018-02-09.

• Chetty, R., J. Friedman, S. Leth-Petersen, T. Heien Nielsen, and T. Olsen (2014) “Active vs. passive decisions and crowd-out in retirement savings accounts: Evidence from Denmark”, The Quarterly Journal of Economics, 129 (3), pp. 1141-1219

• CIEDES (2016). “Boletín Informalidad Noviembre 2016”, Corporación de Investigación, Estudio y Desarrollo de la Seguridad Social (CIEDES), in Spanish, https://www.ciedess.cl/601/w3-article-1608.html.

• CBO (2016). “Is Social Security Progressive?”, Economic and Budget Issue Brief, Congressional Budget Office (CBO), https://www.cbo.gov/sites/default/files/109thcongress-2005-2006/reports/12-15-progressivity-ss.pdf.

• Corlett A., S. Clarke, C. D’Arcy and J. Wood (2018). “The Living Standards Audit 2018“, Resolution Foundation Report, https://www.resolutionfoundation.org/app/uploads/2018/07/Living-StandardsAudit-2018-3.pdf.

• Dahl, M., T. DeLeire and J. Schwabish (2009). “Stepping Stone or Dead End? The Effect of the EITC on Earnings Growth”, National Tax Journal 62(2), pp. 329–347.

• Duflo, E., W. Gale, J. Liebman, P. Orszag and E. Saez (2006). “Saving incentives for lowand middle-income families: evidence from a field experiment with H&R Block”, The Quarterly Journal of Economics 121(4), pp. 1311-1346.

• HMRC (2018). “Estimated costs of the principal tax reliefs”, UK HM Revenue & Customs, https://www.gov.uk/government/statistics/main-tax-expenditures-andstructural-reliefs.

• ILO (2018). “Women and men in the informal economy: A statistical picture (third edition)”, International Labour Organization (ILO).

• IMF (2017). “IMF Fiscal Monitor: Tackling Inequality, October 2017”, International Monetary Fund (IMF).

• IMF (2018). “World Economic Outlook, April 2018 Cyclical Upswing, Structural Change”, International Monetary Fund (IMF).

• Ingles, D. and M. Stewart (2017). “Reforming Australia’s Superannuation Tax System and the Age Pension to Improve Work and Savings Incentives”, Asia & the Pacific Policy Studies 4(3), pp.417-436.

• Insurance Association of China (2018), “Chinese Pension Third-Pillar Study Report”, China Financial Publishing House. 中国保险行业协会 (2018), “中国养老金第三支柱 研究报告”, 中国金融出版社, in Chinese.

• Levy, S. (2017). “The Great Failure: Retirement Pensions in Latin America”, Vox LACEA.

• Liu, T. and L. Sun, 2016. “Pension Reform in China”. Journal of Aging & Social Policy, 28, pp. 15-28, https://doi.org/10.1080/08959420.2016.1111725.

• Lusardi, A. and O. S. Mitchell (2007). “Baby Boomer retirement security: The roles of planning, financial literacy, and housing wealth”, Journal of Monetary Economics 54 (1), pp. 205-224.

• Meyer, B. and D. Rosenbaum (2001). “Welfare, the Earned Income Tax Credit, and the Labor Supply of Single Mothers”, Quarterly Journal of Economics 116(3), pp. 1063- 1114.

• OECD (2017). “OECD Economic Surveys: Mexico 2017”, Organisation for Economic Co-operation and Development (OECD).

• OECD (2015). “Pensions at a Glance 2015. OECD and G20 Indicators”, Organisation for Economic Co-operation and Development (OECD).

• OECD (2018). “Working Better with Age: Korea, Ageing and Employment Policies”, Organisation for Economic Co-operation and Development (OECD).

• Sanderson, W. and S. Scherbov (2016). “It’s time to measure 21st century aging with 21st century tools”, The Conversation, https://theconversation.com/its-time-tomeasure-21st-century-aging-with-21st-century-tools-53033.

• Shambaugh, J., R. Nunn and B. Portman (2017). “Lessons from the Rise of Women’s Labor Force Participation in Japan”, The Hamilton Project, The Brookings Institution.

• U.S. Department of Treasury (2018). “Tax Expenditures”, https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures.

• Verick, S. (2018). “Female Labor Force Participation and Development”. IZA World of Labor.

• Vlasov, S and M. Mamedli (2018). “Russia’s pension system in the context of world experience and expected trends”, BOFIT Policy Brief 2018 No. 10, Bank of Finland Institute for Economies in Transition (BOFIT).

• WB (2016). “Live Long and Prosper. Aging in East Asia and Pacific”, World Bank East Asia and Pacific Regional Report, World Bank (WB).