Causing substantial declines in output and living standards, the COVID-19 pandemic is having devastating effects on economies and societies. Governments reacted swiftly at the onset of the crisis to enhance public health care capabilities and help workers and firms withstand the shocks and adverse economic effects of confinement. The health emergency now appears to be easing, and confinement measures are gradually being scaled back. This policy brief identifies the main areas where policy support will be needed in the near term to buttress the recovery and address the likely longer-term scars from the crisis arising from business failures and hysteresis in labor markets.

Challenge

The COVID-19 pandemic is taking a substantial toll on economies and societies. At the pandemic’s onset, governments worldwide imposed stringent measures to contain the spread of the virus. These measures resulted in significant short-term economic disruption and job loss, compounded by falling confidence and tighter financial conditions. Emergency measures were put in place in some countries, including health care capacity expansion, preservation of the incomes of workers and companies during confinement, and large-scale guarantees of private debt (see the Appendix for more details). Monetary policy was eased, with interest rate cuts, enhanced asset purchase programs, and targeted interventions in financial market segments under extreme stress. Financial market regulations were eased to support credit provision by financial institutions.

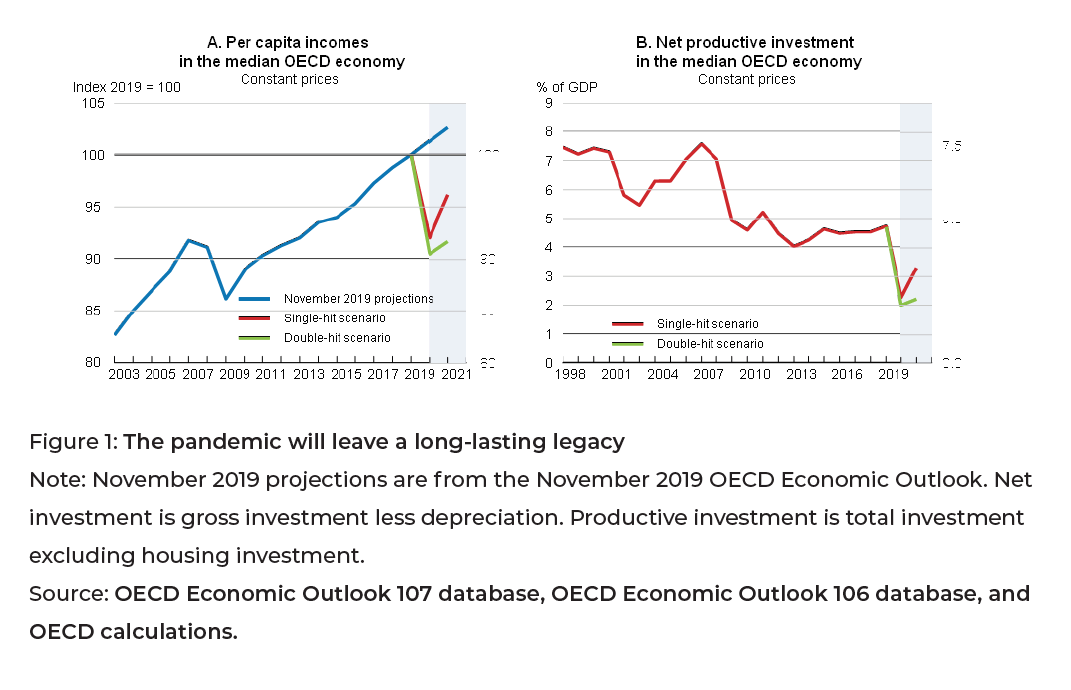

The health emergency is now easing, and confinement measures are being gradually scaled back. Nevertheless, the outlook for the global economy is particularly uncertain. In a “single-hit” scenario (where the spread of the virus is contained), the Organisation for Economic Cooperation and Development (OECD) projects global output to fall by 6% in 2020, with the pre-crisis level almost regained at the end of 2021. Even so, in many advanced economies, the equivalent of five years or more of per capita real income growth could be lost by 2021 (Figure 1).

The recovery could be interrupted by another coronavirus outbreak if targeted containment measures, notably test, track, and trace (TTT) programs, are not implemented or prove ineffective. Should a second outbreak occur toward the end of this year, global GDP is projected to decline by 7.6% in 2020 and remain well below its pre-crisis level at the end of 2021. In this “double-hit” scenario, real per capita income in the median OECD economy would decline in 2020 by 9.5%. Even with some recovery in 2021, real per capita income in the median economy would only reach the 2013 level.

The crisis is also likely to have longer-term economic effects. Unemployment is being pushed well above pre-crisis levels, increasing the risk that many people will become trapped in joblessness for an extended period. The scars from job losses are likely to particularly affect younger workers and lower skilled workers. This direct impact on people’s livelihoods is particularly severe among the most vulnerable groups in society, including workers with low pay or nonstandard contracts and in occupations where teleworking is more difficult (OECD, 2020a, 2020b). Moreover, the pandemic is set to further weaken investment. Even prior to the outbreak, net productive investment was weak; further declines increase the risk that weak output growth will become entrenched. When the global economy eventually recovers, it will be necessary to restore the sustainability of public finances in a way that does not undermine economic growth and other public policy objectives.

Proposal

A. Macroeconomic policies to support the recovery

Policymakers will face macroeconomic challenges to support the recovery. Government budget deficits are currently elevated, and public debt is set to rise to exceptionally high levels in many countries. In the double-hit scenario, 2021 government debt-to-GDP ratios are projected to be around 20 percentage points higher than prior to the crisis. Interest rates have been reduced to zero or below, and central bank balance sheets have expanded dramatically.

Extensive fiscal, monetary and financial policy responses will help underpin household incomes, employment, and firm cash flows and minimize longer lasting economic scars. However, policies will need to be flexible and agile because of differences across sectors in the duration of shutdowns and recoveries, the possibility of additional shutdowns and financial instability, economic uncertainty about structural changes to demand and supply, and the risk that the associated economic costs will be long lasting.

Many emerging market economies and developing countries face particularly acute macroeconomic policy challenges because of the reduction in commodity prices induced by the pandemic, which compounds the negative COVID-19 shock. In addition, many of these economies have become vulnerable in recent years due to the high buildup in private and public debt. Emerging market economies and developing countries with credible macroeconomic policy frameworks, including flexible exchange rate arrangements, strong foreign asset positions, and manageable exposure to foreign-currency-denominated debt, can accommodate the current shocks through a combination of monetary and fiscal policy easing. In contrast, countries with weaker macroeconomic fundamentals may have no choice but to limit macroeconomic policy support, which will have negative implications for domestic demand. Further action may be needed to deal with large capital flow reversals, should they reemerge, including extending OECD central bank swap lines with emerging market economies to relieve global funding pressures and recourse to capital flow management.1 Moreover, while the G20 DSSI is an important achievement, it may not be sufficient to ensure debt sustainability in many developing countries, and further assistance in the form of debt restructuring or relief may be needed.

B. Structural policies for strong post-recovery performance

Policymakers face exceptional challenges in sustaining growth and reducing inequalities after the crisis. In particular, it may have scarring effects related to a permanent reduction in potential output caused by prematurely scrapping capital, which is likely to accompany more bankruptcies and hysteresis in labor markets, as longer unemployment periods may result in higher structural unemployment.

In the aftermath of the pandemic, the scars in labor and product markets, the need to reallocate some workers and capital across sectors, and the significantly adverse impact of the crisis on living standards emphasize the urgent need for renewed and well-targeted structural policy reforms in all economies. In particular:

- Governments are using a broad mix of labor market policies and corporate support schemes to protect the incomes of workers and businesses during the shutdown. Policy responses will need to remain flexible and agile for some time, given the differences in the pace at which various containment measures are being relaxed and the possibility of renewed virus outbreaks. Activity in certain sectors, such as aviation and tourism, may be significantly lower for some time to come. Consumer preferences could also permanently change, accentuating the digital transition toward greater use of e-commerce and digital delivery of services.

- Policymakers will need to find ways to identify and support viable jobs in the near term, while allowing sufficient flexibility for the gradual reallocation needed across sectors to minimize long-term scarring and restore productivity growth. Short-term work schemes are effective for preserving existing jobs but may be less efficient for facilitating post-crisis adjustment across sectors. Gradually raising employers’ financial contributions in these schemes could be one way to identify businesses that expect to remain viable over an extended period (OECD, 2020a, 2020c). In countries where generous unemployment benefits are being used to support incomes, the challenge will be to find ways to restore pre-crisis job matches that become viable again after containment measures have ended and activity starts to recover. This could involve financial incentives for firms to only temporarily layoff employees or rehire former ones. More broadly, active labor market programs and enhanced vocational education and training are needed to create opportunities for all, facilitate possible job reallocation after containment measures are lifted, and prevent erosion of human capital. Providing enhanced childcare and improving the efficiency and targeting of tax and transfer policies must also be integral parts of well-designed policy packages to increase participation and labor market inclusivity.

- Minimizing long-term scarring and paving the way for productivity growth after the crisis also requires reallocation of capital over time to sectors and activities with growing productive potential. Government support for companies through wage subsidies, tax deferrals, and guarantees will need to be gradually phased out as containment measures are eased to ensure that nonviable firms are not supported for an extended period (OECD, 2020a, 2020d). One option is to convert tax deferrals into public equity stakes, although care should be taken to ensure this does not distort competition and that transparent and clearly defined conditional exit strategies exist for such investments (OECD, 2020e). Reforms to streamline insolvency procedures may also be needed in some countries to spur productivity enhancing capital reallocation in the course of the recovery (McGowan, Andrews and Millot 2017).

- In the medium term, reforms to address infrastructure shortages and reduce policy uncertainties about the longer-term challenges of climate change, digitalization, and globalization will also strengthen incentives for businesses to invest. It will be important to balance the need for resilience with the potential reduction in efficiency from policy measures designed to induce businesses to restructure supply chains and reduce inputs from efficient but distant providers (see below).

- Government efforts to support the economic recovery also need to incorporate the necessary actions to limit the long-term threat of climate change. Existing environmental standards should not be rolled back during the recovery, and, where possible, sector specific financial support measures should be conditional on environmental improvements, such as stronger environmental commitments and performance in pollution intense sectors that are particularly affected by the crisis (OECD, 2020f). The potential for an extended period of substantially lower fossil fuel prices than previously expected exacerbates the urgent need to introduce effective incentives for firms’ investments in energy efficient technologies.

Policies are needed to avoid forfeiting the benefits of globalization. In particular:

- To thwart the mounting threat of a reversal in globalization, coordinated action is needed to maintain the free flow of trade and investment. Cooperation in lowering trade tensions and removing tariffs and additional costs for firms and consumers is essential to mitigate the damage to activity and avoid further income losses for households and companies already struck by the crisis. Similarly, governments should refrain from introducing export restrictions on essential goods as this could undermine confidence in global markets, lead to panic buying and price volatility, and harm import dependent countries (OECD, 2020g).

- The current crisis has put a strain on international supply chains, and their resilience should be regularly stress tested to identify weaknesses. Moreover, companies and governments should ensure resilience by developing strategic stocks and upstream agreements to reconvert assembly lines during critical times.

Investment policies should foster broader adoption of digital infrastructure and facilitate transport; this will help bridge distances, reduce trade costs along production chains, and resolve disruptions in face-toface processes. Governments can support upgrades in businesses’ industrial strategies through regulatory flexibility to help promote innovation and supply diversification and through extending credit support programs designed to improve logistic efficiency. - Preserving cross-border trade is particularly important for poor countries that are susceptible to food and medical supply shortages. Therefore, cooperative agreements for regional stockpiling and health emergency assistance in advanced economies should have inclusive designs that also consider the needs of the most vulnerable countries. It is particularly important to ensure that emerging market economies and developing countries are not cut off from the global value chains that improve their growth prospects by providing access to international markets, human capital, and knowledge.

Once economic recovery has been attained, the health of public finance will have to be restored in ways that do not undermine long-term sustainable economic growth, as has often happened in past fiscal consolidations. In particular:

- To ensure public debt sustainability, countries must strengthen their fiscal positions by finding ways to contain public spending pressures and increase tax revenues, while meeting the challenges of digitalization, climate change, and population aging.

- Thorough reviews of all government expenditures will help create room in public budgets for new spending on the high priority areas, such as health, education, and childcare, that positively impact the economy and wellbeing. An early start on such reviews is important given the usual time required to reorient spending levels across government. Well designed fiscal rules and a reformed budget process that strengthens the incentives and provides the information necessary for prudent long-term planning will help shape these decisions.

- Stronger public investment is urgently needed in many countries after the prolonged period of restrained spending following the global financial crisis. With long-term interest rates close to zero in many advanced economies, the social rate of return on public investment is likely to exceed financing costs for many projects. Investment is particularly needed in areas with large positive externalities for the rest of the economy and where underinvestment might otherwise occur due to market failures, including health care, education, and digital and environmental infrastructures.

- Public revenue levels and tax structures may also need to be adapted after the pandemic to support debt sustainability, enhance tax system progressiveness, and help tackle longer term structural challenges (OECD, 2020h). Options include finding new sources of revenue, broadening existing tax bases, and modifying the tax mix. Higher carbon taxes and lower fossil fuel subsidies would raise revenue while helping foster the structural changes required to meet climate change challenges. However, compensating measures will be required to mitigate the impact of these changes on household and small business incomes. Addressing the tax challenges produced by the economy’s digitalization and ensuring that multinational enterprises pay a minimum tax would yield additional revenues and contribute to fair burden sharing. More generally, revenue-raising efforts should focus on enhancing yields from taxes that are the least detrimental to growth, including recurrent immovable property taxes and general consumption taxes.

- International tax cooperation, notably through the G20/OECD Inclusive Framework on Base Erosion and Profit Shifting, will remain an essential part of the efforts to enhance tax transparency, strengthen the fairness of tax systems, and improve dispute resolution and prevention mechanisms. Through a combination of financing and providing expertise and information, international support can also help emerging market economies and developing countries increase their tax revenues and provide new and sustainable sources of financing needed for long-term resilience.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

McGowan, Müge Adalet, Dan Andrews, and Valentine Millot. 2017. “Insolvency Regimes,

Zombie Firms and Capital Reallocation.” OECD Economics Department

Working Papers, No. 1399. Paris: OECD Publishing.

OECD (Organisation for Economic Co-operation and Development). 2020a. OECD

Economic Outlook, Volume 2020, Issue 1. Paris: OECD Publishing.

OECD. 2020b. “Distributional Risks Associated with Non-Standard Work: Stylised

Facts and Policy Considerations”, Tackling Coronavirus Series. Paris: OECD Publishing.

OECD. 2020c. “Flattening the Unemployment Curve? Policies to Limit Social Hardship

and Promote a Speedy Labour Market Recovery.” Tackling Coronavirus Series.

Paris: OECD Publishing.

OECD. 2020d. “Corporate Sector Vulnerabilities during the COVID-19 Outbreak: Assessment

and Policy Responses.” Tackling Coronavirus Series. Paris: OECD Publishing.

OECD. 2020e. “OECD Competition Policy Responses to COVID-19.” Tackling Coronavirus

Series. Paris: OECD Publishing.

OECD. 2020f. “From Containment to Recovery: Environmental Responses to the

COVID-19 Pandemic.” Tackling Coronavirus Series. Paris: OECD Publishing.

OECD. 2020g. “COVID-19 and International Trade: Issues and Actions.” Tackling Coronavirus

Series. Paris: OECD Publishing.

OECD. 2020h. “Tax and Fiscal Policy in Response to the Coronavirus Crisis: Strengthening

Confidence and Resilience.” Tackling Coronavirus Series. Paris: OECD Publishing.

Appendix

[1] . Capital outflow controls may be introduced, especially in countries that exhaust their foreign exchange reserves, but only as a last resort device. There, too, cooperation is important. The OECD assesses the effectiveness of capital flow measures and identifies best practices, including ways to avoid negative spillovers. The OECD encourages G20 countries that have not yet adhered to the Code on capital flows to do so, following the call made in the G20 Finance and Central Bank Governors Communiqué in 2017.