Countries have introduced significant measures to contain the coronavirus pandemic that has severely damaged the tourism economy. The Organisation for Economic Cooperation and Development (OECD) estimates a potential decline of 60 – 80% in the international tourism economy in 2020, depending on the duration of the crisis. Countries are moving beyond immediate, often economy-wide, support measures to develop specific recovery measures for the tourism sector, including lifting travel restrictions, restoring traveler confidence, and rethinking the future of the tourism sector.

Challenge

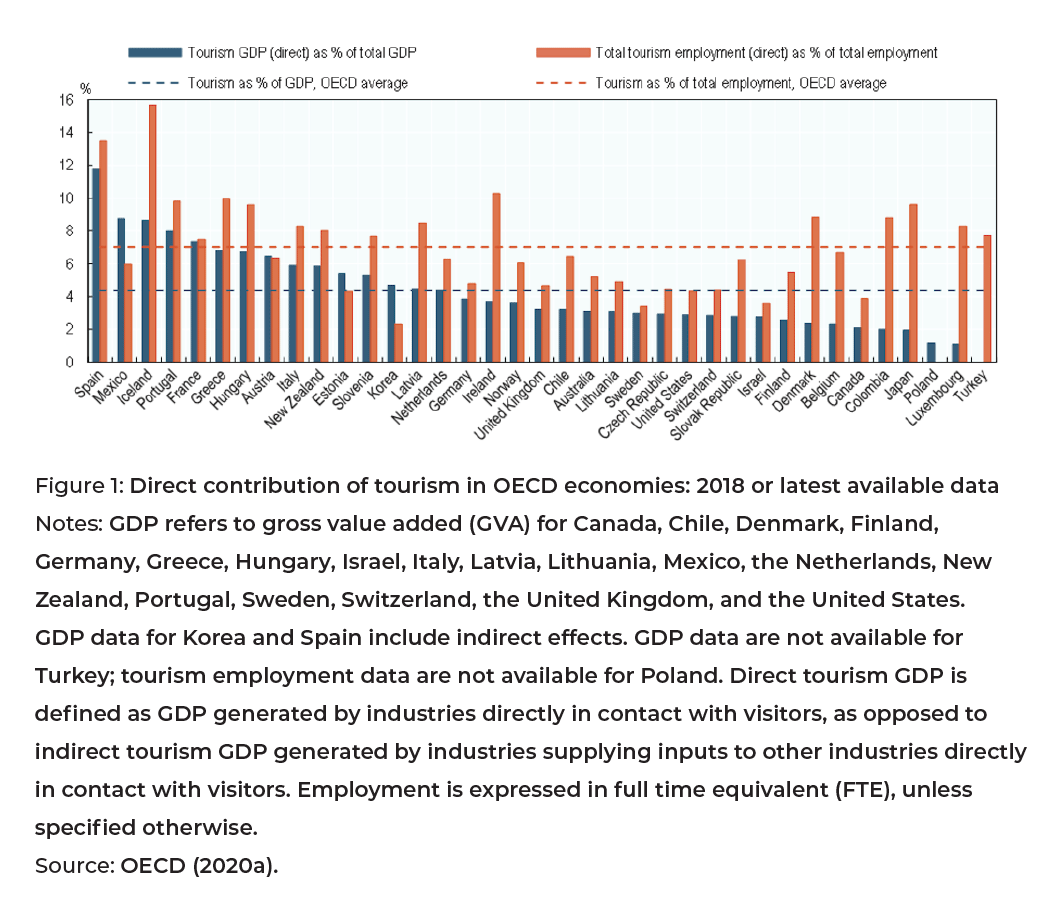

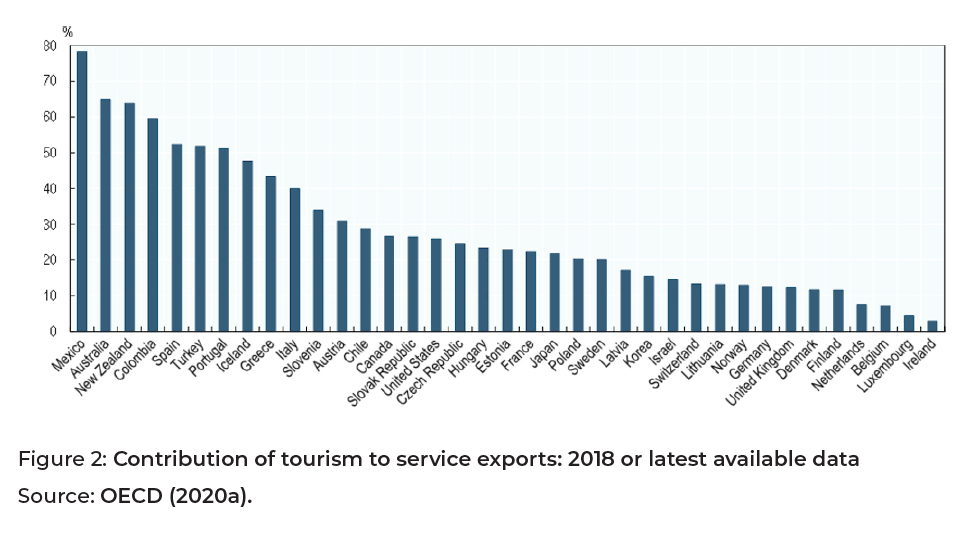

The immediate and immense shock caused by the coronavirus (COVID-19) pandemic to the tourism sector, which is considered a significant element of many national economies, is affecting the wider economy. On average, the tourism sector directly contributes 4.4% of gross domestic product (GDP) (Figure 1), 21.5% of service exports (Figure 2), and 6.9% of employment in OECD countries. Tourism provides a high volume of jobs for low and high skilled workers (Figure 1) and employs many seasonal, part-time, and temporary workers. The national lockdowns have weakened the demand for travel and tourism activities abruptly, causing huge revenue losses and a severe liquidity shock for many businesses (OECD 2020a). Consequently, an International Labour Organization (ILO) sectoral brief indicates an extremely high possibility of drastic job losses in the tourism sector, due to COVID-19 (ILO 2020). With the impact of the crisis expected to extend well into 2021, and the reduced capacity of many industry branches, the World Tourism Organization (UNWTO) estimates that over 100 million jobs are at risk (UNWTO 2020), with significant impact on tourism workers, especially if social protection measures are not in place for individuals who lack coverage.

The effects of COVID-19 on tourism are expected to be asymmetrical and highly localized within countries, exposing some destinations more than others. Under normal circumstances, highly tourism-dependent destinations are disproportionately vulnerable to crises. The immediate and immense shock to the sector due to the pandemic may exacerbate this disparity. OECD analysis indicates that a high percentage of jobs are at risk in European destinations such as the Ionian Islands in Greece, Balearic and Canary Islands in Spain, and Algarve region in Portugal, as tourism is significant to their local economies. Similarly, in Korea, the Jeju-do region is at highest risk, while in North America, Nevada (including Las Vegas) is potentially the most affected state, followed by Hawaii (OECD 2020e).

As governments worldwide introduced unprecedented measures to contain the virus, restrictions on travel, business operations, and interpersonal interactions brought the tourism economy to a standstill. The ministers at an extraordinary virtual meeting of the Group of Twenty (G20) tourism ministers held on April 23, 2020 issued a statement welcoming national efforts to mitigate the economic and social impact of the pandemic, and committing to work jointly toward sustainable and inclusive recovery of the tourism sector (G20 2020).

As opening up the sector will be more challenging than shutting it down, a balanced and measured approach is required to protect people by minimizing job losses and business closures in the short and long term. While tourism has been severely affected by the pandemic and virus containment measures, tourism flows represent a potential vector for spreading the contagion. Although the delay in re-opening and continued uncertainty on the evolution of the pandemic create additional challenges for the sector, hasty actions can further dampen government and consumer confidence in activating the sector in the longer term.

Even when tourism supply chains resume operations, businesses will operate at restricted capacity due to new health protocols. Additionally, with the consequences of the economic and health crises being interlinked, and travel restrictions being lifted progressively, demand will recover gradually. The longer the pandemic continues, the deeper the impact on consumer confidence and travel behavior will be, leading to knock-on implications for many national economies.

Consequently, global tourism will be severely affected throughout 2020 and beyond, even if the contagion is controlled in the months ahead. The OECD estimates a potential decline of 60-80% in the international tourism economy1 in 2020, depending on the duration of the crisis and the sector’s rate of recovery. Originally developed in March and then updated in June 2020, this estimate is based on three scenarios, in which international tourist arrivals begin to recover in either July, September, or December 2020 (OECD 2020a).

- Scenario 1: International tourist arrivals commence recovery in July 2020, strengthening progressively in the second half of the year, at a slower rate than previously foreseen (60% decline in the international tourism economy in 2020).

- Scenario 2: International tourist arrivals commence recovery in September 2020, strengthening progressively in the final quarter of the year, at a slower rate than previously foreseen (75% decline in the international tourism economy in 2020).

- Scenario 3: International tourist arrivals commence recovery in December 2020, considering limited recovery in international tourism before the end of the year (80% decline in the international tourism economy in 2020).

While the impact of the pandemic is still unfolding, the impact on select tourism industry branches is evident (OECD 2020a). However, formulating detailed sector-specific recommendations is challenging due to insufficient evidence on the impact of policy responses on the tourism sector and wider economy. Hence, this paper establishes two broad proposals, and presents examples of the policy responses implemented by different countries to address specific issues.

Proposal

1. Continue extending support to the travel and tourism economy in the shortterm

Until now, government support has focused on immediate response and mitigation efforts to protect visitors and workers, and ensure business continuity following the imposition of containment measures. Efforts have largely aimed to provide financial aid through economy-wide and sector-specific stimulus measures, to maximum workers and businesses possible, as quickly as possible.

As restrictions start to ease, the next steps will be to get travelers moving, tourism businesses operational, and people back to work. Additionally, for a truly inclusive recovery, it is important to ensure that social protection is extended to tourism workers, who frequently lack coverage. Many issues related to seamless travel are and will be critical to the sector’s recovery following the COVID-19 crisis (OECD 2020c). Governments and industry will need to focus their efforts on:

- Promoting access to liquidity support and fiscal relief (e.g., through loans and grants, payment deferrals, tax relief via tax holidays or postponements, and guarantee schemes), often requiring businesses to retain staff for a specified period, and providing specific support to tourism workers (including income support and paid leave).

- Lifting travel restrictions, applying new health protocols for safe travel, and facilitating diversification of markets to avoid over-reliance on international tourism, particularly in long-haul destinations.

- Restoring traveler confidence and stimulating demand using approaches such as “Clean and safe” labels introduced by Turismo de Portugal to distinguish tourism activities that comply with hygiene and cleaning requirements for prevention and control of COVID-19 and other possible infections, information apps for visitors, and domestic tourism promotion campaigns.

- Facilitating travel to enable recovery of the sector and the global economy, simultaneously managing the careful introduction of additional health-related controls and checks on travelers, adhering to accepted international requirements and standards, while minimizing travel disruptions.

To promote access to liquidity support and fiscal relief, Croatia has implemented a set of support measures specifically for tourism businesses, including postponing the payment of fees and tourism taxes, and increasing liquidity. Additionally, the sector is supported through general economy interventions such as inclusion of tourism within the scope of the Export Guarantee Fund to enable issuance of guarantees for loans to banks, for additional liquidity. In France, the government has modified the conditions for cancellation of travel (and similar) bookings, permitting replacement of refunds with a credit note or voucher of an equivalent amount valid on a future service; customers can request a refund after 18 months for un-used vouchers. Thus, businesses can avoid immediate cash outflow, and survive this extremely challenging phase.

As international travel gradually restarts, governments are taking informed decisions on which countries to allow travel to and from, and those that will require mandatory quarantine periods. Moreover, many countries are implementing screening protocols at ports of entry and departure, including temperature checks of travelers on arrival. Coordination within and across countries becomes key to addressing health needs, while enabling tourism to recover in due time. Therefore, some countries with similar coronavirus caseloads and case management processes (e.g., testing and tracing versus quarantine periods) are exploring opportunities to establish travel “corridors” or “bubbles” to initiate the opening up of countries to international tourism. To assist businesses in market diversification, New Zealand has developed the Tourism Transition Programme to provide advice and support to businesses to pivot toward domestic markets, hibernate, or consider other options, while Tourism New Zealand provides customer insights, and views of overseas market conditions.

To restore traveler confidence, the ministry and some local authorities in Israel have developed online virtual tours of sites and attractions across the country, to stimulate a desire for travel and keep postponed tours fresh in people’s memories. From May 5, 2020, businesses, including rural accommodation, hotels and lodges, nature reserves, heritage sites, and national parks, have been permitted to open under strict hygiene regulations. Due to their relative isolation and small number of rooms, rural and urban bed and breakfasts have been the first to open up for tourists. Accommodation facilities have to adhere to high standards of cleaning, training workers according to the new guidelines, upgrading air ventilation, and social distancing. To stimulate demand, Japan introduced an emergency economic package on April 7, 2020 that includes a new subsidy of over USD 10 billion in discounts and vouchers to consumers, thereby supporting tourism, transport, food services, and event businesses, for immediate post-pandemic recovery. After the pandemic ends, the Japan Tourism Agency will spend USD 2.2 billion to attract tourists by making travel destinations appealing, improving the travel environment, and developing promotions for international tourists.

To facilitate travel to allow the sector to recover, the tourism and transport package announced by the European Commission includes an overall strategy for recovery in 2020 and beyond, combining guidance and recommendations on restoring unrestricted movement and reopening within the internal borders of the European Union safely, restoring transport and connectivity safely, and permitting businesses to reopen and resume tourism services safely.

Some countries established coordination mechanisms to monitor the impact of the pandemic on tourism, and respond to a fast-evolving situation. These mechanisms largely aim to identify the sub-sectors in maximum distress requiring immediate assistance, and to develop recovery support roadmaps and action plans for them. Dialogue with industry has been prioritized to ensure targeted and efficient response measures.

Conclusion

The government and industry actions mentioned above are essential. However, to reopen the tourism economy successfully and make businesses operational, industry and governments should persist in reinforcing coordination mechanisms to support workers, destinations, and businesses, particularly the smallest ones. Furthermore, specific focus is required during the recovery phase on the most sensitive/vulnerable destinations, including those heavily dependent on international source markets.

2. Take a forward-looking approach to support long-term sector recovery

Currently, countries are in different phases of COVID-19 crisis management. Rightly focused on protecting workers and visitors, and enabling business survival in recent months, policy makers are now considering the longer-term implications of the crisis on the sector, as well. The crisis presents an opportunity to rethink the tourism system for a more sustainable and resilient future. Policy intervention will be necessary to address structural problems of the sector, avoid a return to tourism management issues including over-tourism, and advance key priorities, such as encouraging new business models, embracing digitalization, and promoting connectivity. The latter assumes key significance in a post-crisis scenario, wherein social distancing remains relevant and tourists seek less crowded destinations. For example, as part of its recovery plans, the Veneto Region in Italy has leveraged lesser known UNESCO heritage sites to shift tourist volumes from Venice to different attractions. Thus, popular destinations may need to reconfigure their development model to attract tourists, and ensure sufficient social distancing (OECD 2020a).

Furthermore, the UNWTO and International Transport Forum (ITF) estimate that in 2016, tourism-related transport emissions represented approximately 22% of the total transport emissions and 5% of the total man-made emissions. Aviation alone accounts for around 50% of the transport-related tourism emissions (UNWTO and ITF 2019). Hence, modifying international tourism patterns after the pandemic could reduce carbon dioxide emissions significantly.

Sustainable growth2 should be a guiding principle in the recovery phase, while limiting tourism as a vector of the pandemic. For example, Tourism New Zealand is “reimagining” how tourism may operate in a post-pandemic world, while examining its governance, its domestic and international marketing, and the management of visitors. Greece has prioritized the transition to a greener and sustainable tourism economy, complemented by digital transformation, to shape the tourism sector better in the post-pandemic context. In the Netherlands, the national destination marketing organization (Holland Marketing) is developing a national recovery strategy with local marketing organizations to stimulate sustainable recovery of the tourism industry (OECD 2020a).

Rebuilding destinations and the tourism system is necessary. Comprehensive support and recovery measures are needed across the sector branches that constitute the tourism experience. Accessibility, connectivity, and transport should be prioritized in rebuilding the tourism system, along with accommodation, restaurants, resorts, events, travel associations, travel technology companies, tour operators, and tourism associations. Years of effort in developing strong and dynamic destinations have been erased; rebuilding them is necessary to support local economies.

In Iceland, the tourism response package includes infrastructure funding to strengthen Iceland as a destination and to prepare for increased tourist numbers. Additionally, the package includes an ISK 15 billion investment acceleration initiative for several projects supporting tourism, such as ISK 650 million for infrastructure in national parks and protected areas including large public tourist sites, and support to accelerate the electrification of the harbors and rental car fleet. Isavia, the public company operating Iceland’s airports, received an ISK 4 billion investment for infrastructure projects including the Keflavik airport. In Hungary, the government support includes HUF 600 billion to priority areas of intervention in the next three years, such as infrastructure development (OECD 2020a).

Innovation in tourism is essential. Governments need to ensure continuous innovation and transformation in the sector, and provide investments to make structural and physical changes for addressing health requirements and visitors’ expectations in the first phase of recovery, and in the long term. Some countries have implemented measures to support innovation in small and medium enterprises, to ensure greater long-term economic resilience. Additionally, tourism businesses and destinations need to adapt their offerings to the modified travel behaviors. This crisis may exert a significant and long-standing impact on consumer behavior, thereby accelerating the transition to digitalization, placing greater emphasis on health and hygiene, and increasing the demand for contactless experiences and payment options.

The Korean government plans to increase usage of its digital application initiatives, transitioning toward more “smart,” “personalized,” and “non-contact” travel. “Non-contact tourism” is a new travel trend of avoiding crowded places and indoor activities, while preferring outdoor attractions with plenty of space. The Tourism Forecast Service is a big data solution providing travel planning assistance, including useful travel information on the local destination, such as real time visitors, transportation and accommodation booking rates, weather information, and more. For those reluctant to tour with a guide, the Digital Storytelling Service substitutes in-person tour guides. As people increasingly avoid busy indoor areas during their travel, the Durunubi (Korea Mobility) system recommends tour routes for trekking, cycling, and driving, thereby aiming to provide utility to the growing number of tourists seeking outdoor activities (OECD 2020a).

Lithuania aims to transform its tourism sector by promoting innovation and digital technologies in the development of tourism services and products. Consequently, the E-Business Model tool seeks to finance new business models by introducing e-business solutions, and the Retraining of Enterprise Workers tool and Innovative Checks tool aims to finance the purchase of publishing, voice reading, translation, photography, film making, design, communication, and other services.

The Tourist Recovery Plan developed in Spain is based on four pillars: health, support, knowledge, and promotion. Under the “health” pillar, the government is working with the private sector to develop socio-sanitary specifications for ensuring that tourist destinations are safe, and perceived to be safe, essential for both domestic and international tourism demand recovery. The “support” pillar includes a new package of measures, developed with other government ministerial departments (including finance, economic affairs, and labor), to provide financial, economic, and social support to tourism businesses and workers, and the destinations particularly affected by this crisis. The “knowledge” pillar focuses on improving the tourism knowledge model, enhancing data processing, creating new indicators, and designing new observation mechanisms. Promotion involves the development of national and international campaigns to activate demand at the appropriate time.

Conclusion

This crisis is an opportunity to rethink the tourism system for the future, as the measures implemented today will shape the tourism of tomorrow. Governments need to consider the longer-term implications of the crisis, and the structural transformation required to build a stronger, more sustainable and resilient tourism economy.

Summary

As the entire tourism ecosystem experiences the impact of the crisis, reopening and rebuilding destinations requires a collaborative approach. Along with economy-wide stimulus packages benefiting tourism businesses and workers, many governments are also introducing tourism-specific measures. Ongoing support to the travel and tourism economy needs to be supplemented with more coordinated efforts, utilizing this crisis as an opportunity to rethink tourism for the future. Specifically, this includes the areas of digitalization, supporting the transition to low carbon, and promoting structural transformation of the tourism sector.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

OECD. 2020a. “Tourism Policy Responses to the Coronavirus (COVID-19).” OECD Policy

Responses. Last Modified June 2, 2020. http://www.oecd.org/coronavirus/policy-responses/tourism-policy-responses-to-the-coronavirus-covid-19-6466aa20.

OECD. 2020b. OECD Economic Outlook, Volume 2020, Issue 1. Paris: OECD Publishing.

https://www.oecd-ilibrary.org/economics/oecd-economic-outlook/volume-2020/issue-1_0d1d1e2e-en;jsessionid=J2Iezw3cXfwzwZzD6-8Z7lOU.ip-10-240-5-121.

OECD, 2020c (forthcoming). Safe and Seamless Travel and Improved Visitor Experience.

Report for the 2020 G20 Tourism Working Group.

OECD. 2020d. OECD Tourism Trends and Policies 2020. Paris: OECD Publishing.

https://www.oecd-ilibrary.org/urban-rural-and-regional-development/oecd-tourism-trends-and-policies-2020_6b47b985-en.

OECD. 2020e. “From Pandemic to Recovery: Local Employment and Economic

Development.” OECD Policy Responses. Last Modified April 27, 2020. http://www.oecd.org/coronavirus/policy-responses/from-pandemic-to-recovery-local-employment-and-economic-development-879d2913.

UNWTO. 2020. “Global Guidelines to Restart Tourism.” Last Modified May 28, 2020.

https://webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2020-05/UNWTO-Global-Guidelines-to-Restart-Tourism.pdf.

UNWTO and ITF. 2019. Transport-Related CO2 Emissions of the Tourism Sector –

Modelling Results. Madrid: UNWTO. https://doi.org/10.18111/9789284416660.

Appendix

[1] . The international tourism economy refers to the economic activity associated with the movement of people across borders for the purposes of tourism.

[2] . Sustainable growth accounts for not only current and future economic, social, and environmental impacts, but also addresses the needs of visitors, the industry, the environment, and host communities (OECD 2020d).