A version of this policy brief was first published by the Centre for International Governance Innovation, copyright 2019.

The modern knowledge-based and data-driven economy features powerful incentives for strategic trade and investment behaviour, modifies the division of labour between the public and private sectors, expands the contribution of economic rents to prosperity, and poses challenges to the effective participation of small open economies given the “winner-take-most” economics that underpins the emergence of superstar firms. These features have contributed to the emergence of trade and technology frictions and also forced the reassessment of traditional views of economic policy. This policy brief speaks to the G20 role in helping sustain global economic cooperation by shedding light on the policy reforms that the new economic conditions demand at the national economy level and thus focussing attention on how these can be accommodated at the international level.

Challenge

Machine Learning and the Acceleration of Change

The evolution of the economy since the industrial revolution has featured three accelerations in the pace of innovation: first, through the knowledge spillovers within industrial districts that, in effect, triggered chain reaction innovation and changed the innovation dynamic from sporadic to continuous, driving the industrial revolution; then, by the industrialization of research and development (R&D), which underpinned the knowledge-based economy as innovation shifted from intuition and inspiration to industrialized exploration of innovation possibilities; and, now, by the industrialization of learning through machine learning.

Acceleration due to machine learning is best illustrated by the experience of first training a computer to play Go based on human strategies and then allowing a computer to learn by playing against itself, telescoping hundreds of years of play into mere days. The second-generation version beat the first version 100–0 in match play. Similar techniques are being applied to much more complex game situations: for example, recently, an artificial intelligence (AI) that trained for 10 months, playing the equivalent of 45,000 years of the video game Dota 2 against versions of itself, beat a champion team of human players (Simonite 2019). Machine learning is also being turned on to optimize the process of selecting algorithms. Accordingly, we can expect to see an accelerated pace of disruptive innovation.

By the same token, investment horizons for private capital are being shortened. This affects the risk/return calculus for firms considering investments that involve longer payback periods or feature greater uncertainty. The rise in uncertainty due to acceleration of change means that the real option value of waiting for more information before committing to investments (Dixit and Pindyck 1994) has risen in the data-driven economy, leaving potentially valuable investments on the table. These investment opportunities will be taken up by either the state, which invests on the basis of low social discount rates, or by the mega-wealthy, for whom the risk concerns shrink into insignificance.

Proposal

Machine Knowledge Capital

AI introduces a new factor of production into the economy — machine knowledge capital, which in the first instance will be narrowly intelligent but hyper-competent AI programs. This enables a significant expansion of income-generating knowledge-based assets.

The competition to capture the rents these assets will generate could redefine the global map of prosperity. This reflects the fact that such AI will be performing functions that currently are the province of “white collar” work. The deployment at scale of machine knowledge capital will thus shock skilled labour in ways that resemble the shock to unskilled labour from the integration of China and India into the global distribution of work and by the advent of robots.

However, there are differences. Whereas workers in export-oriented emerging markets generated demand for imports due to rising incomes, machine knowledge capital generates primarily asset wealth with very little direct linkage to consumption. Moreover, unlike robots, which are expensive to build and to distribute, once the first truly proficient AI is generated in any field, it can be reproduced in arbitrarily large amounts at near zero marginal cost and distributed globally with near frictionless ease. This will give the owner of machine knowledge capital seemingly unprecedented capability to capture rents that presently accrue to human capital.

Adding to this effect, AI embedded in robots will extend the scope of unskilled labour tasks that machines can undertake (for example, agricultural tasks such as picking tomatoes), extending and deepening the shock on unskilled labour market demand and wage bargaining power, and also further expanding the income share captured by machine knowledge capital.

Market Failures and Incentives for Strategic Trade and Investment Behaviour

The data-driven economy features three powerful sources of potential market failure: economies of scale, economies of scope and information asymmetry. In particular industries, network externalities constitute a further powerful source (Ciuriak 2018). The confluence of these features powers the emergence of “superstar” firms that dominate their sectors (Autor et al. 2017). The same factors also give rise to powerful incentives for strategic trade and investment policy as countries compete to capture international rents (Brander and Spencer 1985). Government interventions will thus assuredly play an important role in determining which companies dominate and to what extent, including through industrial policy support (for example, the Made in China 2025 program) and regulatory pushback to curb abuse of dominance, of which there are no shortage of examples (Chen et al. 2019).

Rising Income Share of Knowledge Capital Rents

In the industrial economy, the ability to produce efficiently at scale and to sell at lower prices powers the capture of market share and profit. In the knowledge-based economy, the basis for market share capture shifts to ownership of rent-generating intellectual property (IP). In the data-driven economy the essential asset is data. It enables the capture of value in various ways, including:

- being the source of information asymmetry (already well-established);

- enabling industrialization of learning and creation of IP (mainly forward-looking at this point);

- underpinning the creation of machine knowledge capital (also still mainly forward-looking);

- powering business and industrial process optimization (the Internet of Things [IoT] — currently emerging); and

- enabling extraction of consumer surplus through price discrimination (well-established).

In an asset-based economic model, wealth accrues to owners of rent-generating assets. The path to wealth is thus necessarily the accumulation of assets. An analogy may be drawn to the board game Monopoly. A player who circles the board, collects $200 by passing Go and pays rent to the owners of property eventually goes broke and loses. The winning strategy is to buy property and build rent-generating assets on it, exercising monopoly pricing power. In the data-driven economy, countries will be either rent payers or rent collectors. The latter is likely to be the advantageous position.

Trade Agreements

In the industrial era, trade agreements sought to pry open foreign markets to gain greater access to industrial economies of scale. They could properly be described as “free trade agreements.” In the knowledge-based economy, trade agreements shifted emphasis to protection of IP assets — they became more aptly called “asset value protection agreements” (Ciuriak 2017). US President Barack Obama stated this explicitly: he described his administration’s objectives in negotiating the Trans-Pacific Partnership as the protection of America’s most valuable assets (Obama 2010). In the data-driven economy, the issue becomes access to data (the “new oil”) — under what conditions and at what price? Importantly, the understanding of the conditions and the value proposition is at present rudimentary at best, even in jurisdictions, such as Canada, that have started to study the issues.

Considerations for Canada’s Economic Strategy

The considerations outlined above suggest that, to prosper in the data-driven economy, Canada requires a strategy based not solely on its role in production, but also on asset accumulation and rent capture — more specifically, amassing data assets and related IP. How does this translate into economic, trade and investment policy?

Public Sector Co-investment

Given that the acceleration in the pace of change has necessarily shortened the time horizons for private investors in recovering investment, leaving potentially viable investments on the table, a larger role for public sector capital co-investment is thus mandated. As well, the transition to new technology creates a “coordination” problem — for example, investors in electric vehicles will need complementary investments in charging stations. Mariana Mazzucato (2013) has argued generally for an entrepreneurial role for the state; the data-driven economy places a still-greater onus on public sector risk-taking.

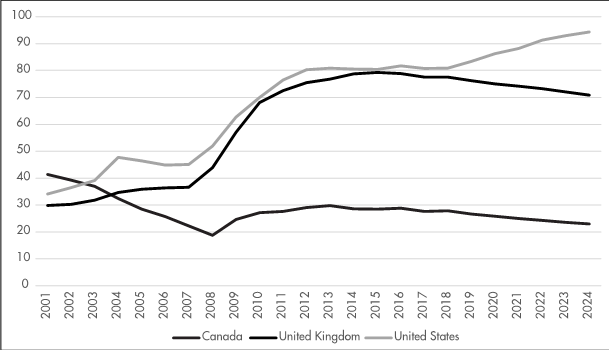

While Canadian policy is moving to take advantage of Canada’s capabilities in the data-driven innovation space, the scale of commitment is arguably orders of magnitude too small and pales in comparison to what other jurisdictions (and even private entities such as Japan’s Softbank) are committing, especially as prudent fiscal policies over the past decades have left Canada with an enviably low net-debt-to-GDP ratio and a solid tax revenue base compared to its peers. Canada’s net government debt as a share of its GDP (which can be thought of as measuring our ability to afford this net debt) is under 30 percent and falling. The United Kingdom is in the 70 percent range and consolidating, while the United States is in the 80 percent range and rising over the forecast period (International Monetary Fund [IMF] 2019).

Figure 1: Net Debt as a Share of GDP

Source: IMF, World Economic Outlook Database, April 2019; author’s calculations.

To provide some idea of the scope for Canada to step up its co-investment in the infrastructure and product development of the data-driven economy, we can consider the implications of Canada simply holding its net-debt-to-GDP ratio constant at the very low 2018 figure of 27.87 percent over the coming half decade. Holding steady at the 2018 level would imply additional borrowing of about CDN$150 billion above what is assumed by the IMF for Canada. CDN$150 billion invested over five years in priming Canada’s technology-generation pump at a time of transformative technological change would put Canada in the same investment league as the major internet firms. For example, it would be about 75 percent of the Uber initial public offering (valued at about US$30 billion in terms of money raised) per year.

The latter observation puts in perspective the scale at which the data-driven economy operates. Canada punches above its weight in generating start-ups with viable technology, but has not succeeded in scaling them up. Borrowing at scale to invest in technology assets or acquire outputs generated by Canada’s innovation ecosystem (for example, in the rollout of fifth-generation [5G] networks to power the IoT or as launch customer for new technologies) would mean deploying serious money to address the single most glaring weakness in Canada’s innovation dynamic.

Borrowing to invest in productive assets is profoundly different from borrowing to support current consumption. In normal times, it is sound policy for governments to leave this function to private capital. But at a time when technological transformation elevates risk and makes returns less certain — and when investment opportunities have public good characteristics — it is both penny foolish and pound foolish for the public sector not to invest.

Data Retention, Scaling and Mobilization

Access to data to drive the development of applications is fundamental to nurturing the development of capabilities in the data-driven economy. Canada has a fair amount of policy leeway given its control over data generated in the exercise of public sector governance functions, ability to set regulatory conditions for use of data generated in Canadian public space (see, for example, Wylie 2018; Girard 2019) and ownership of data generated in public procurement. These data assets can be leveraged for domestic industrial policy purposes and to build IP portfolios surrounding data that resides in Canada. As well, state patent funds have been created to insulate innovative firms from predation. These are now needed, in particular, in the AI/machine learning space, where an IP arms race is under way, especially given that IP can be weaponized for exclusion strategies.

However, a market-based solution would be highly desirable, in part because the ultimate solution must have appeal across the political spectrum. When replicated across many jurisdictions, a market mechanism could, in principle, provide competitive access to data at the scale required to participate in the data-driven economy, which is already available in China or the United States.

One possible mechanism is the data trust (McDonald 2019). This concept involves the creation of intermediaries with fiduciary responsibilities to their data “depositors” and subject to strong disclosure and governance obligations that provide privacy controls yet allow aggregation on a suitably anonymized basis for commercial exploitation. A number of such entities operating on a global basis could provide access to truly big data to firms on a fee basis while providing a dividend to data depositors based on their fee earnings. Commercial banks perform such an aggregation function for household savings, allowing these to power industrial development. The regulatory framework for such entities with fiduciary responsibilities to their clients is well-developed.

Foreign Direct Investment

The international transactions of greatest importance in the data-driven economy involve technology-seeking foreign direct investment (FDI). In the industrial era, inward FDI was associated with knowledge inflows, introduction of advanced management practices and increased R&D. This reflected the fact that firms capable of investing abroad tend to be the dominant, most advanced firms in their home base (see, for example, Helpman, Melitz and Yeaple 2004). They had something to bring to the host economy. However, in the knowledge-based and data-driven economy, inward investment is more typically associated with knowledge extraction and the shift of the IP assets generated by R&D abroad — indeed, it may even involve the exfiltration of the network of skilled personnel generating the knowledge capital. Even locating research facilities in research hubs has the prime intent of extracting knowledge rather than introducing it into the hub: Joel Blit (2017) shows that firms are better able to source knowledge from locations where they have an R&D satellite.

The exfiltration of knowledge assets from a research hub — especially the expatriation of key personnel — has implications for the dynamism of the hub because it reduces knowledge spillovers within the hub. This loss — which is not borne privately — creates the basis for public policy intervention. Based on conventional economic arguments regarding externalities, public policy intervention would be warranted where the appropriable private returns to an individual start-up firm from selling to a foreign firm do not reflect the (positive) externalities that the start-up firm’s presence in a given innovation location generates for the location. In cases where there is a net, uncompensated outflow of wealth from a country, there is public interest in the transaction that goes beyond the private interest.

Authorities worldwide have realized that technology extraction may not be good for their country and have started to apply a new public policy filter for screening inward technology-seeking FDI, in particular, in instances where the inward FDI is from a state-owned enterprise or involves technology that might have security implications. The security aspect of inward investment has been cited by Canada, for example, in turning down the bid by China Communications Construction Company Ltd. International to take over Canada’s Aecon.

However, this filter is also starting to be applied more broadly given the incentives in the knowledge-based and data-driven economy for international rent capture through strategic trade and investment policies. In particular, these types of concerns are part of the backdrop to the emerging trade wars between the United States and China, where the former has moved to restrict inward investment from the latter in technology sectors.

In the data-driven economy, the wealth-generating strategy is outward technology-seeking investment, not promoting and subsidizing inward investment. The key assets are not large mature companies but young, high-growth start-ups. Industrial-era policy rules thus need to be revisited to deliver sound policy.

FTA Strategies for a Post-Free Trade Agreement World

The data-driven economy does not promise to be one that encourages the formation of free trade agreements (FTAs). This reflects a number of factors.

FTAs were the logical response to the economics of the industrial age, which favoured trade to take advantage of firm-level specialization and economies of scale. The postwar revolutions in transportation and communications technology (in particular, containerization and computers) enabled a new depth of unbundling of production processes to take advantage of differential costs and productivity advantages across the global economy. This unbundling gave rise to global value chains (GVCs) and trade in tasks (Baldwin 2016). Tariffs became counterproductive, leading to widespread unilateral liberalization, especially in intermediate goods. Customs agencies rebranded themselves as trade facilitators. FTAs — which rapidly became “deep and comprehensive free trade agreements” — proliferated as countries sought to capture a share of GVC activity.

Unlike the production of industrial goods, data does not evidently lend itself to a fragmentation strategy — quite the opposite, as firms resist data localization rules. Moreover, data was born free — it was initially “data exhaust,” a by-product generated by activity on the internet. Accordingly, there is, for the most part, no legacy of protectionist restrictions to dismantle. The data provisions of FTAs thus primarily seek to lock in the generally open regime for data. This, in turn, tends to entrench powerful first-mover advantages and, arguably, to prevent the spread of participation in data-driven economic activity. Notably, China, the only economy to successfully create world-class rivals to the US internet giants, did so behind a firewall, not through liberalization.

As a corollary of the above point, within any data realm governed by an FTA, there will not tend to be intensified competition; rather, there will tend to be increased market power and, with it, increased potential for market failure and abuse of dominance. Price discrimination, perfected by ever-improved data on individuals, will transform consumer surplus into rents of superstar firms. When this rent extraction is done across borders, it will minimize the value of the FTA in terms of consumer surplus for the country that is being mined.

Further, as economic, social and political interaction moves online, economic, social and political regulation must follow. In particular, as the IoT takes shape, data will become both the intangible infrastructure and the interactive central nervous system of the economy (Balsillie 2018), which will place a priority on security of data flows related to transportation, communications and finance, all areas traditionally subject to ownership restrictions for national security/sovereignty reasons. We are at a very early stage in the development of the IoT, which is registering exponential growth across multiple dimensions (Priceonomics 2019) and there is little experience in the framing of regulation for this economy. The risk for governments is that the hazards that will be encountered will not appear immediately; they will only become evident after data has been assembled into commercial-grade or weapon-grade concentrations.

While FTAs with data provisions also include carve-outs for legitimate regulatory exceptions, the presumption is in favour of free flow, and most countries will find themselves at an information disadvantage vis-à-vis the global leaders regarding the implications of the obligations for regulatory latitude.

The data-driven economy will thus most likely be a post-FTA world in the sense that there will be little incentive for countries to sign on to data provisions given the absence of a strong presumption of reasonably balanced mutual benefits. This outlook may change if there is a multilateral or regional agreement on the trade-related aspects of data exchange that provides well-developed policy guidance, maps out the safe harbours for regulation and addresses the issue of value sharing. Negotiations have been launched under the auspices of the World Trade Organization on the trade-related aspects of electronic commerce. At the same time, Chile, New Zealand and Singapore have launched trilateral talks toward a Digital Economy Partnership Agreement — these three economies, together with Brunei Darussalam, previously started the talks that led to the Trans-Pacific Partnership.

In the meantime, FTAs with data provisions are sources of risk. Canada has already signed on to two FTAs — the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Canada-United States-Mexico Agreement — and will be framing the transposition of its regulation acquis from the analogue to the digital sphere with these constraints.

Concluding Thoughts

Can Canada prosper in the brave and challenging new world being ushered in by the digital transformation? Canada lacks the economic scale of the United States and China, the leading digital economies. This is a significant drawback. But it has other advantages, such as good governance, strong technical competencies in the development of AI and machine learning and even the natural advantage of a cold climate to address cooling requirements of server farms. These stand Canada in good stead to capture international digital activity for itself — especially if it pioneers a sound regulatory architecture to address the various roles of data in the data-driven economy, moves expeditiously to capitalize on the data it already generates and negotiates a path for the small open economies in the emergent data-driven economy.

This policy brief outlines some of the major issues that Canada will have to consider in reframing economic policy to adapt to the economic conditions of the emerging data-driven economy. It underscores that the characteristics of the data-driven economy establish the pre-conditions for pervasive market failure and create powerful incentives for strategic trade and investment policies aimed at capturing international rents. The escalating trade and technology war between the United States and China comes as no surprise given these conditions (see, for example, Ciuriak and Ptashkina 2018), in particular, the moves to block the acquisition of technology assets by strategic rivals as a tactic to achieve dominance in the emerging technologies. These same conditions underpin the rationale for Canadian public policy engagement — at scale.

One final consideration is apposite: in 2009, Canada declined to rescue Nortel, its then-star technology company, during the great recession. With 20/20 hindsight, this was a historic policy error, which simply grows in magnitude in light of the issues that have emerged with the rollout of 5G networks. A financially restructured Nortel, led by new management and retaining its technical abilities and portfolio of IP assets, would have been at the heart of the solution to the security concerns voiced about China’s Huawei, both in Canada and in the United States. The issues with Nortel were not technology-related — they were finances and management. Nortel did not need to die (Sali 2019). Economic development and growth are largely (entirely?) about technology and firms, which are the software of a market economy. Canada faces a new technology moment: it needs to build a herd of unicorns to prosper in this emerging economy.

Works Cited

Autor, David, David Dorn, Lawrence F. Katz, Christina Patterson and John Van Reenen. 2017. “The Fall of the Labor Share and the Rise of Superstar Firms.” National Bureau of Economic Research Working Paper No. 23396.

Baldwin, Richard. 2016. The Great Convergence: Information Technology and the New Globalization. Cambridge, MA: Harvard University Press.

Balsillie, Jim. 2018. “Why We Need a Second Bretton Woods Gathering.” Remarks for keynote presentation at the 6th IMF Statistical Forum, Measuring Economic Welfare in the Digital Age: What and How? Washington, DC, November 20.

Blit, Joel. 2017. “Learning remotely: R&D satellites, intra-firm linkages, and knowledge sourcing.” Journal of Economics and Management Strategy 26: 757–81. https://onlinelibrary.wiley.com/doi/abs/10.1111/jems.12213.

Brander, James A. and Barbara J. Spencer. 1985. “Export Subsidies and Market Share Rivalry.” Journal of International Economics 18: 83–100.

Chen, Lurong, Wallace Cheng, Dan Ciuriak, Fukunari Kimura, Junji Nakagawa, Gabriela Rigoni and Johannes Schwarzer. 2019. “The Digital Economy for Economic Development: Free Flow of Data and Supporting Policies.” Policy Brief No. 4, Task Force 8, T20 Japan.

Ciuriak, Dan. 2017. “A New Name for Modern Trade Deals: Asset Value Protection Agreements.” In New Thinking on Innovation. Special Report. Waterloo, ON: CIGI.

———. 2018. “The Economics of Data: Implications for the Data-driven economy.” In Data Governance in the Digital Age. Special Report. Waterloo, ON: CIGI.

Ciuriak, Dan and Maria Ptashkina. 2018. “Started the Digital Trade Wars Have: Delineating the Regulatory Battlegrounds.” Opinion, RTA Exchange, International Centre for Trade and Sustainable Development. January. https://papers.ssrn.com/abstract=3098982.

Dixit, Avinash K. and Robert S. Pindyck. 1994. Investment under Uncertainty. Princeton, NJ: Princeton University Press.

Girard, Michel. 2019. “Safeguarding Public Data Captured in Public Spaces through Standardization.” CIGI Policy Brief No. 150. Waterloo, ON: CIGI. www.cigionline.org/publications/safeguarding-big-data-captured-public-spaces-through-standardization.

Helpman, Elhanan, Marc J. Melitz and Stephen R. Yeaple. 2004. “Export versus FDI with Heterogeneous Firms.” American Economic Review 94 (1): 300–16.

IMF. 2019. “World Economic Outlook Database — April 2019.” Washington, DC: IMF.

Mazzucato, Mariana. 2013. The Entrepreneurial State: Debunking Public vs. Private Sector Myths. London, UK: Anthem Press.

McDonald, Sean. 2019. “Reclaiming Data Trusts.” Opinion. March 5. www.cigionline.org/

articles/reclaiming-data-trusts.

Obama, Barack. 2010. “Remarks by the President at the Export-Import Bank’s Annual Conference.” March 11. Washington, DC: The White House, Office of the Press Secretary.

Priceonomics Data Studio. 2019. “The IoT Data Explosion: How Big Is the IoT Data Market?” Priceonomics (blog), January 9.

Sali, David. 2019. “‘Nortel did not need to die’: Ten years since the collapse that shook Ottawa’s tech sector.” Ottawa Business Journal, January 14. https://obj.ca/article/nortel-did-not-need-die-ten-years-collapse-shook-ottawas-tech-sector.

Simonite, Tom. 2019. “OpenAI Wants to Make Ultrapowerful AI. But Not in a Bad Way.” Wired, May 1. www.wired.com/story/company-wants-billions-make-ai-safe-humanity/.

Wylie, Bianca. 2018. Open Data Endgame: Countering the Digital Consensus. CIGI Paper No. 186. Waterloo, ON: CIGI. www.cigionline.org/publications/open-data-endgame-countering-digital-consensus.