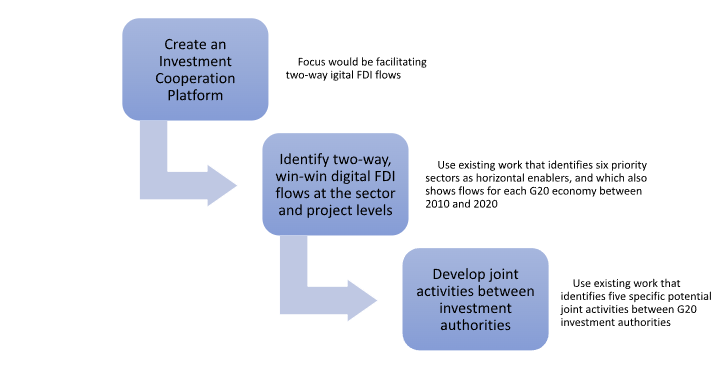

Policymakers and firms are keen to grow digital FDI to increase capacity and competitiveness in the digital economy, but key challenges are in the way, including techno-nationalism, growing digital divides, and lack of regulatory enablers. The policy brief suggests that creating an investment cooperation platform could help address these challenges. In particular, the platform could be structured to match inward and outward digital FDI interest at the sector and project level, building on existing empirical work that has identified the most important sectors for digital FDI flows. Two-way digital FDI flows could be facilitated through joint activities between investment authorities, thereby ensuring that only win-win, mutually beneficial and mutually supported projects are facilitated. Throughout, particular attention should be paid to SMEs as they require relatively more support to benefit from digital FDI.

Challenge

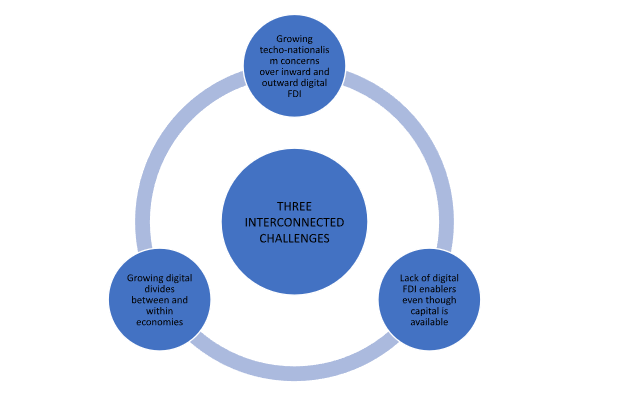

This policy brief aims to help address three separate but interconnected challenges.

First, growing techno-nationalism, which risks G20 economies restricting cross-border investment in the digital economy, known as “digital FDI” (Stephenson, 2020) rather than promoting and facilitating it, notwithstanding huge potential benefits from growing digital FDI flows. Technological competition is at the heart of tensions between certain G20 economies, and so providing a positive agenda for potential digital cooperation on win-win digital FDI flows can help address, and perhaps improve, these tensions.

Second, there is a risk of a growing digital divide, both between and within economies. The lack of sufficient investment in digital capacity risks leaving some economies—and within them firms—behind. These firms have been called “digital laggards”. The challenge is real: digital laggards experience half the revenue growth of firms that have been able to undertake significant digital investment (Accenture, 2019). Targeted efforts are therefore needed to help address the growing digital divide and especially support digital laggards with catching up. Particular attention will need to be paid to small and medium-sized enterprises (SMEs) to ensure they have the capacity to plug into digital economy opportunities.

Third, there are trillions available for digital FDI, but it is not flowing to where it is most needed—productive investments that help with competitiveness and catch up. As such, it is not the lack of capital that is holding back digital FDI flows, as the world has been awash with capital. Rather, these flows are stymied by lack of information, risk, uncertainty, and the absence of adequate enabling environments (Stephenson, 2020; Stephenson, et al., 2021). These are policy challenges that policymakers can help address, including through dialogue facilitated by a mechanism of collaboration and cooperation on digital FDI.

An Investment Cooperation Platform that fosters joint activities to match interests and outcomes can help address all three of these challenges.

Proposal

There is broad consensus that digital transformation has been brought forward by years, and is permeating nearly all economic sectors and functions (McKinsey Digital, 2020). Firms realize they need to invest in digital capacity or risk losing market share or even go out of business (Srinivasan and Eden, 2021). To illustrate the scale of these new investments, JP Morgan Chase announced it would spend a record $12 billion in 2022 on increasing its digital capacity (Franklin and Moise, 2022). Some of these investments will be cross-border, in other words part of foreign direct investment (FDI).

This new wave of FDI in the digital economy—known as “digital FDI”—creates both opportunities and challenges that the G20 is uniquely placed to help address (Stephenson, 2020; Stephenson, et al., 2020; Stephenson, et al. 2021).

In terms of opportunities, we know that FDI not only brings capital but also embedded knowledge and technology, while creating jobs and boosting productivity (Echandi, Krajcovicova and Qiang, 2015; World Bank Group, 2016). Digital FDI has the potential to not only benefit the source firm and its home country, but also the recipient firm and its host country.

The question then becomes, how to facilitate win-win digital FDI flows between economies? This is a challenge, as techno-nationalism is making digital FDI more difficult, both inwardly and outwardly; policymakers may be reluctant for their firms to offshore too much technology and simultaneously reluctant to accept mergers and acquisitions (M&A) in high-tech sectors (Lamb, 2019).

The policy brief sets out three proposals to help address this challenge in order to help seize these opportunities.

Investment Cooperation Platform

Proposal 1: Create an Investment Cooperation Platform with a focus on facilitating two-way digital FDI flows between economies

Rationale

An Investment Cooperation Platform can provide the mechanism for government-to-government (G2G) and government-to-business (G2B) interactions not only to help identify and address necessary policy and regulatory enablers for digital FDI, but also to identify specific, complementary digital FDI interests and projects. Matchmaking has always been an important tool to address information asymmetry and lower risk. It therefore makes sense that this tool be applied in a targeted way to scaling the new area of digital FDI flows.

Example

An Investment Cooperation Platform is in the conceptual stages in the Association of Southeast Asian Nations (ASEAN), which would be a joint effort by the ASEAN Coordinating Committee on Investment (CCI), the UN Economic and Social Commission for Asia and the Pacific (UNESCAP), the World Bank Group (WBG), and the World Economic Forum. There is thus a precedent and useful example on which to build. This ASEAN platform could provide the modalities and proof of concept to broaden the platform to the G20 and beyond. At the same time, the two platforms (G20 and ASEAN) would be complementary, given that ASEAN members are not G20 members except for Indonesia, which could therefore act as a bridge between these two initiatives during its G20 Presidency. The platform could gradually include more and more economies. A similar platform could also be created for Africa in support of the African Continental Free Trade Area (AfCFTA), especially the planned Investment Protocol under Phase 2 of the Agreement. Different platforms could, over time, be connected to create even greater opportunities for two-way investment facilitation.

Benefits

The benefits of such platforms would be both economic and political. On the economic side, information asymmetries and sorting costs could be addressed, addressing market failure and improving market efficiency. Market failure can be taking place in particular for SMEs in that they may not have the knowledge (or requisite skills) to tap into digital economy opportunities, and these need to be addressed. In addition, digital FDI flows would benefit both host and home economies. Host economies would receive the well-documented benefits of job creation, knowledge transfer, upgrading, revenue growth, among others (Echandi, Krajcovicova and Qiang, 2015), but notably in sectors and activities that are understood to be key enablers for future growth. Home economies would likewise accrue development benefits through “home effects” as increasingly demonstrated through empirical work (Knoerich, et al., 2022) but again, notably in digital sectors and activities that will be key enablers for future growth.

On the political side, a platform can create the space to engage between parties that may not otherwise have a space to exchange views and, one hopes, gradually build trust and understanding on these issues. A neutral, technically minded, project-oriented space is therefore a good first step to potentially defuse some of the techno-nationalist tensions that risk blocking growth-generating digital FDI flows.

Two-way Digital FDI flows

Proposal 2: Identify win-win, two-way digital FDI flows by matching digital FDI interests between economies at the sector level

Rationale

G20 investment authorities can leverage a mapping of key sectors and their recent flows across G20 economies, to identify where there are complementarities between their economies and thus the potential for win-win, two-way digital FDI flows (Stephenson, et al., 2021).

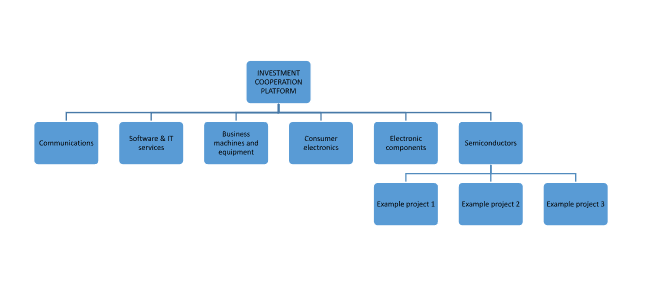

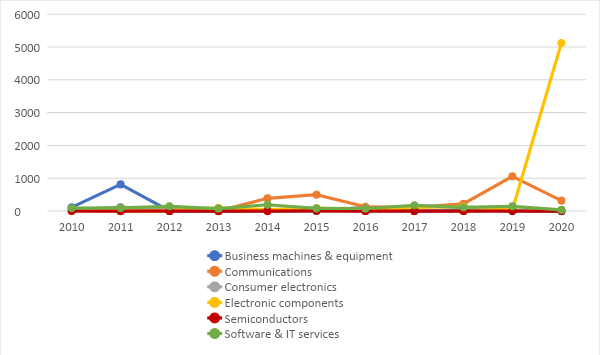

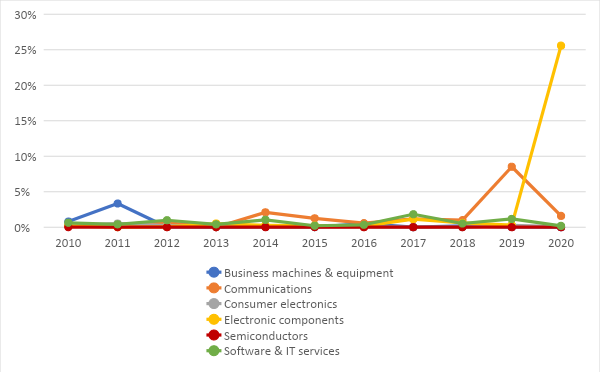

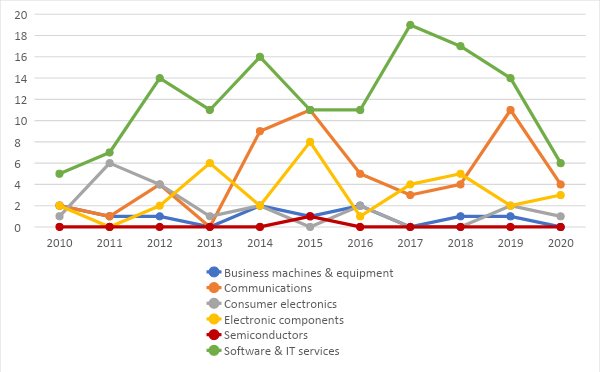

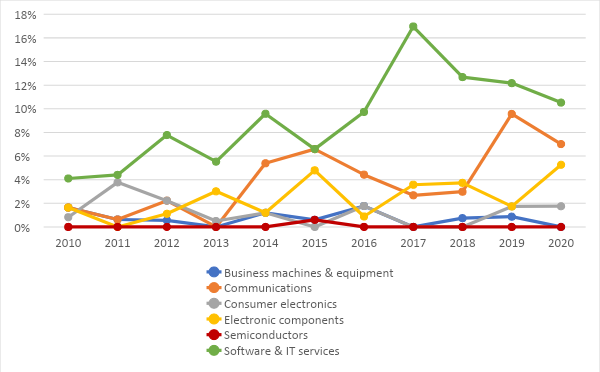

A 2021 T20 policy brief identified, using original empirical work, six sectors that are most important for digital FDI, given their role as digital enablers horizontally across an economy (Stephenson, et al., 2021). Two of the six can be considered “structural” digital enablers (communications; software and IT services), and four more “supportive” digital enablers (business machines and equipment; consumer electronics; electronic components; semiconductors). This 2021 policy brief also presented the digital FDI flows that each G20 economy had received in these six sectors from 2010 to 2020. This data provides a strong starting point for structuring this cooperation through potential matching of interests between G20 economies at the sector and project level (see Figure 1).

Figure 1. Cooperation through an Investment Cooperation Platform structured by sectors and projects within sectors

In particular, G20 economies that are the home (or source) to significant digital FDI flows in certain sectors could be matched with G20 economies that are currently receiving relatively low levels of digital FDI in those sectors. In other words, firms could leverage existing capacity to invest where it is most needed, and in so doing, grow the capacity in those host (or recipient) markets. Given that six sectors are being considered across 20 economies, there are sure to be complementarities and potential mutual interest on both economic and political levels.

Example

Below is the example of Indonesia, selected given its role as G20 President in 2022. From the data, we can see that Indonesia is doing quite well in attracting digital FDI projects in the two sectors that have been identified as “structural” digital enablers, namely communications and software & IT services. Projects in these sectors outnumber projects in any of the other sectors being considered, a very positive sign. At the same time, the level of capital represented by digital FDI projects in software & IT services is relatively low, especially when compared to communications. This may be a function of the relative costs of projects in these two sectors. However, one potential conclusion that could be drawn from the data is that Indonesia may wish to develop a targeted strategy to attract large scale investments in FDI in software & IT services, something it may have already started doing with recent reforms (Herbert Smith Freehills, 2021).

Figure 2. Indonesia’s IFDI capital received per digitally enabling sector (USD million)

Figure 3. Indonesia’s share of capital received in digitally enabling sectors (out of total capital received for IFDI projects)

Figure 4. Indonesia’s number of IFDI projects per digitally enabling sector

Figure 5. Indonesia’s share of IFDI projects in digitally enabling sectors (out of total number of IFDI projects)

To determine which economies to target for investment promotion activities, Indonesia can look at which economies have been significant outward investors in large scale investments in software & IT services. For illustration purposes, India has been a significant outward investor in the area of software & IT services, which is not surprising given how well-developed these sectors are in its domestic economy. For instance, between 2008 and 2018, Indian firms invested over $16 billion abroad in this area (Joseph 2019, p.17). The natural conclusion is that Indonesia may wish to adopt a targeted digital FDI attraction strategy to welcome Indian digital OFDI in this sector.

Benefits

The benefits of sector-level two-day digital FDI facilitation is that it works backwards from the specific need that the economy has identified. In other words, the first step is to identify the need—the gap in the digital FDI flows currently being received—and to proactively seek to address the gap. This helps create a well-balanced digital economy, whereby all relevant sectors receive sufficient digital FDI flows, as opposed to an economic landscape that is lopsided by being focused on only a few sectors, with the vulnerabilities and lack of capabilities that such concentration would risk creating.

Joint activities between investment authorities

Proposal 3: Develop joint activities between investment authorities in different economies to help grow digital FDI at the project level

Rationale

Investment authorities can consider carrying out a series of joint activities with a focus on facilitating two-way digital FDI flows (Stephenson, 2021). By their very nature, joint activities will be win-win or they would not take place.

Joint activities between investment authorities guarantee that these efforts are win-win, given that if they are not, the activities will not take place. Earlier work has identified five specific joint activities that could be considered, which could be applied with a view to facilitating two-way digital FDI flows (Stephenson, 2021).

- Joint business missions, promotion campaigns or roadshows

- Joint standing committees to help with aftercare and policy advocacy

- Joint matchmaking, linkages, and supplier-development programs

- Joint financial support by host and home institutions (e.g., joint equity)

- Jointly developed investment projects

In designing joint activities, particular attention should be paid to how these can benefit SMEs, complementary to larger firms. Understanding the different types of SMEs—and their corresponding needs and potential—could be a first step to folding them into this process.

Examples

The BRICS (Brazil, Russia, India, China, and South Africa) provide an example of a framework to support such joint activities, and is presented here given that all members of BRICS are also members of the G20. The BRICS signed in 2019 a Memorandum of Understanding (MOU) between BRICS Trade and Investment Promotion Agencies (TIPAs). This creates the mechanism, and in some cases specifically encourages, joint activities such as those suggested above.

Another example is an Agreement on Investment Facilitation for Development, currently being negotiated between over 110 economies at the World Trade Organization (WTO). One of the articles covers “Cross-border co-operation on Investment Facilitation”, and encourages cooperation between competent authorities in different jurisdictions on exchange of information and sharing of experiences, exchange of information on investors, and the promotion of facilitation agendas. These are all examples of potential joint activities that can be leveraged to facilitate two-way investment, including two-way digital FDI.

Benefits

The benefits of such joint activities are an amalgam of the earlier economic and political benefits: joint activities build trust and cooperation between parties; they also plug potential needs or areas identified as needing additional investment, thus helping economies become well-rounded and thus grow their digital capacity and competitiveness.

Figure 6. Three proposals to increase two-way, win-win digital FDI flows between economies

Conclusion

This policy brief has suggested how to contribute to digital development cooperation through three practical proposals.

First, policymakers should create an Investment Cooperation Platform to facilitate win-win Digital FDI flows, building on recent developments at the regional level.

Second, G20 investment authorities can leverage a mapping of key sectors and their recent flows across G20 economies, to identify where there are complementarities between their economies and thus the potential for win-win, two-way digital FDI flows (Stephenson, et al., 2021).

Third, investment authorities can consider carrying out a series of joint activities with a focus on facilitating two-way digital FDI flows (Stephenson, 2021). By their very nature, joint activities will be win-win or they would not take place.

There are three reasons why the G20 should take up this issue and these actions.

First, G20 economies represent both the main source of outward digital FDI and the main destination of inward digital FDI, and so have an interest in facilitating these flows.

Second, techno-competition is an issue that is taking place among G20 economies, and so any resolution can also take place within a G20 framework. There is an opportunity for the T20 to suggest a novel—and relatively innocuous—area for an initial first step, namely cooperation over digital FDI flows where there is interest from both sides.

Third, since facilitating digital FDI is a new concept, G20 economies can play a leadership role in developing the platform to do so—along with the elements—and thereby accelerate both their recovery and global recovery following COVID-19. This can, in turn, help open up a new channel for economic growth—namely digital investment flows—not only between G20 economies but also—through replication and spillovers—in other parts of the world.

* The author would like to thank Edgard Carneiro Vieira, Community Engagement Specialist for International Trade and Investment at the World Economic Forum, for research assistance.

References

Accenture, “Full value. Full stop”, 2019, https://www.accenture.com/_acnmedia//Thought-Leadership-Assets/PDF/Accenture-Future-Systems-Report.pdf

Brasília Declaration, 11th BRICS Summit, 2019, http://www.brics.utoronto.ca/docs/191114-Braslia_Declaration.pdf

Echandi Roberto, Jana Krajcovicova and Christine Zhenwei Qiang, “The impact of investment policy in a changing global economy a review of the literature”, Policy Research Working Paper 7437, Trade and Competitiveness Global Practice Group, World Bank Group, 2016, https://openknowledge.worldbank.org/handle/10986/22859?locale-attribute=en

Franklin, Joshua and Imani Moise, “JP Morgan plots ‘astonishing’ $12bn tech spend to beat fintech”, 15 January 2022, Financial Times, https://www.ft.com/content/1828f7a3-97ad-46e2-806f-97987c079b9d

Herbert Smith Freehills, “Indonesia’s New Investment List Increases FDI Opportunities for Foreign Investors”, 5 March 2021, https://hsfnotes.com/indonesia/2021/03/05/indonesias-new-investment-list-increases-fdi-opportunities-for-foreign-investors/

Hodell, Chuck, “5 Types of SMEs”, Association for Talent Development, 16 February 2016, https://www.td.org/newsletters/atd-links/5-types-of-smes#:~:text=For%20our%20purposes%2C%20we%20divide,our%20work%20in%20unique%20ways.

Joseph, Reji K. “Outward FDI from India: Review of Policy and Emerging Trends”, Institute for Studies in Industrial Development (ISID), New Delhi, Working Paper No. 214, November 2019, https://isid.org.in/wp-content/uploads/2020/04/WP214.pdf

Knoerich, Jan, Matthew Stephenson, and Heather Taylor-Strauss. “Outward Foreign Direct Investment Policy Toolkit for Sustainable Development: Highlights”, Bangkok and Geneva: UNESCAP and World Economic Forum, 2022. https://www3.weforum.org/docs/WEF_Outward_FDI_Insight_Report_2022.pdf

Lamb Kate, “The rise of techno-nationalism – and the paradox at its core”, World Economic Forum, 3 July 2019, https://www.weforum.org/agenda/2019/07/the-rise-oftechno-nationalism-and-the-paradox-atits-core/

McKinsey Digital, “The COVID-19 recovery will be digital: a plan for the first 90 days”, 14 May 2020, https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-covid-19-recoverywill-be-digital-a-plan-for-the-first-90-days

Srinivasan Niraja and Lorraine Eden, “Going digital multinationals: Navigating economic and social imperatives in a post-pandemic world”, Journal of International Business Policy 4, 228–243, 2021, https://link.springer.com/article/10.1057/s42214-021-00108-7

Stephenson, Matthew, Mohammed Faiz Shaul Hamid, Augustine Peter, Karl P. Sauvant, Adnan Serič, and Lucia Tajoli. “How the G20 can advance sustainable and digital investment”, T20 policy brief, December 2020,

Stephenson, Matthew. “Digital FDI: Policies, Regulations and Measures to Attract FDI in the Digital Economy.” World Economic Forum White Paper, September 2020. https://www3.weforum.org/docs/WEF_Digital_FDI_2020.pdf

Stephenson, Matthew. “Launching a program for investment partnerships,” Columbia FDI Perspectives No. 319, November 29, 2021, https://ccsi.columbia.edu/sites/default/files/content/docs/fdi%20perspectives/No%20319%20-%20Stephenson%20-%20FINAL.pdf

Stephenson, Matthew, Lorraine Eden, Michael Kende, Fukunari Kimura, Karl P. Sauvant, Niraja Srinivasan, Lucia Tajoli, and James Zhan, “Leveraging Digital FDI for Capacity and Competitiveness: How to be SMART”, T20 policy brief, September 2021, https://www.t20italy.org/2021/09/08/leveraging-digital-fdi-for-capacity-and-competitiveness-how-to-be-smart/

World Bank Group (WBG), “World development report 2016: digital dividends”, 2016, World Bank Publications. https://www.worldbank.org/en/publication/wdr2016

World Economic Forum (WEF), “ASEAN Trade and Investment Recovery Facilitation Package”, ASEAN Cooperation Project Proposal, November 2021.